Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

9 viewsChestnut

Chestnut

Uploaded by

Pratyay MitraThis document contains financial information for several companies in the instrument industry, including debt levels, credit ratings, betas, and calculations of weighted average cost of capital (WACC). It reports the average cost of debt as 3.81% and average unlevered beta as 1.06 for the industry. It then calculates a levered beta of 1.14 for the industry and provides the specific costs of equity and WACC for Chestnut Instrument at 10.16% and 8.6%, respectively.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- AirThreads Valuation SolutionDocument20 pagesAirThreads Valuation SolutionBill JoeNo ratings yet

- Data For Ratio Detective ExerciseDocument1 pageData For Ratio Detective ExercisemaritaputriNo ratings yet

- Pryce Corp V PAGCOR Digest GR 157480Document3 pagesPryce Corp V PAGCOR Digest GR 157480Rav EnNo ratings yet

- CF Murphy Stores CLC DraftDocument12 pagesCF Murphy Stores CLC DraftPavithra TamilNo ratings yet

- Assingment - FM - ChestnutDocument8 pagesAssingment - FM - ChestnutChandra Prakash SNo ratings yet

- Marriot CaseStudyDocument17 pagesMarriot CaseStudySambhav SamNo ratings yet

- Intuit ValuationDocument4 pagesIntuit ValuationcorvettejrwNo ratings yet

- Airthreads Valuation Case Study Excel File PDF FreeDocument18 pagesAirthreads Valuation Case Study Excel File PDF Freegoyalmuskan412No ratings yet

- Cost of Debt Calculation Mariott LodgingDocument4 pagesCost of Debt Calculation Mariott LodgingsmokieremoNo ratings yet

- WACC AnalysisDocument9 pagesWACC AnalysisFadhilNo ratings yet

- Damodaran DataDocument2 pagesDamodaran DataVirginia BalboaNo ratings yet

- BetasDocument10 pagesBetasVilmaCastilloMNo ratings yet

- DCF ModelingDocument8 pagesDCF Modelingramanshekhawat719No ratings yet

- OPTIMAL StructureDocument3 pagesOPTIMAL StructureAnonymous EErmsqjjpNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Question 1: Overall WACCDocument15 pagesQuestion 1: Overall WACCSaadatNo ratings yet

- Corporate Accounting ExcelDocument6 pagesCorporate Accounting ExcelshrishtiNo ratings yet

- Foodtree LBO Deleverage: FinancialsDocument12 pagesFoodtree LBO Deleverage: FinancialsmartinsiklNo ratings yet

- Investments Problem SetDocument5 pagesInvestments Problem Setzer0fxz8209No ratings yet

- Soumya Lokhande 1353 - Manmouth CaseDocument13 pagesSoumya Lokhande 1353 - Manmouth CasednesudhudhNo ratings yet

- Clase 6 de Abril 2021Document12 pagesClase 6 de Abril 2021Wendy Paola Arrieta EscobarNo ratings yet

- BetasDocument7 pagesBetasJulio Cesar ChavezNo ratings yet

- FCF AIRTHREAD 222çbbbbbbDocument18 pagesFCF AIRTHREAD 222çbbbbbbGuillermo DiazNo ratings yet

- Caso Alicorp - WACCDocument243 pagesCaso Alicorp - WACCJesúsNo ratings yet

- Eva GlobalDocument7 pagesEva GlobalRodrigo FedaltoNo ratings yet

- BetterInvesting Weekly Stock Screen 4-15-19Document1 pageBetterInvesting Weekly Stock Screen 4-15-19BetterInvestingNo ratings yet

- BetasDocument19 pagesBetasasesor2009No ratings yet

- CAPM ExamenDocument5 pagesCAPM ExamenDenisse Liliana Melgar ValenzuelaNo ratings yet

- Ibs Abc AnalysisDocument4 pagesIbs Abc Analysishimanshigarg656No ratings yet

- Balance SheetDocument14 pagesBalance SheetIbrahimNo ratings yet

- CVR - Case - Excel FileDocument7 pagesCVR - Case - Excel FileVinay JajuNo ratings yet

- Marriott Cost of Capital DataDocument18 pagesMarriott Cost of Capital DataSaadatNo ratings yet

- Air Thread Case FinalDocument49 pagesAir Thread Case FinalJonathan GranowitzNo ratings yet

- BetasDocument7 pagesBetasWendy FernándezNo ratings yet

- Bottom Up BetaDocument18 pagesBottom Up BetaTimothy NguyenNo ratings yet

- New Items and Escalation Due To Which Estimate Has Been Revised (160 KMPH DHN Division)Document2 pagesNew Items and Escalation Due To Which Estimate Has Been Revised (160 KMPH DHN Division)Abhishek JaiswalNo ratings yet

- Discounted Cash Flow-Model For ValuationDocument9 pagesDiscounted Cash Flow-Model For ValuationPCM StresconNo ratings yet

- Opreration Cycle Time (Normal Time) Sum Avg Rating B.T SAM Capacity Rate Earning 1 2 3 4 5 PC/Mint ValueDocument4 pagesOpreration Cycle Time (Normal Time) Sum Avg Rating B.T SAM Capacity Rate Earning 1 2 3 4 5 PC/Mint ValueUmairIsmailNo ratings yet

- Marriot Corporation Lodging Restaurant Contract ServicesDocument2 pagesMarriot Corporation Lodging Restaurant Contract ServicesFurqanTariqNo ratings yet

- ACF - Capital StructureDocument8 pagesACF - Capital StructureAmit JainNo ratings yet

- Mariott CorporationDocument4 pagesMariott CorporationsmokieremoNo ratings yet

- Tutorial On How To Use The DCF Model. Good Luck!: DateDocument9 pagesTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghNo ratings yet

- DCF ConeDocument37 pagesDCF Conejustinbui85No ratings yet

- Marriott Corp BDocument15 pagesMarriott Corp BEshesh GuptaNo ratings yet

- Tariff RE 2016-17Document14 pagesTariff RE 2016-17Mohnish ManchandaNo ratings yet

- Book1 (AutoRecovered)Document5 pagesBook1 (AutoRecovered)Tayba AwanNo ratings yet

- CNPF Ratio AnalysisDocument8 pagesCNPF Ratio AnalysisSheena Ann Keh LorenzoNo ratings yet

- Solution To ATCDocument17 pagesSolution To ATCGuru Charan ChitikenaNo ratings yet

- Beta Apparel Inc. Always-Glory International Inc. B-II Apparel Group Cambridge Inds. Petty Belly Inc. Avg of Peer GroupDocument21 pagesBeta Apparel Inc. Always-Glory International Inc. B-II Apparel Group Cambridge Inds. Petty Belly Inc. Avg of Peer GroupDamion KenwoodNo ratings yet

- Vardhman Textiles LTD Industry:Textiles - Spinning/Cotton/Blended Yarn - Ring SPGDocument5 pagesVardhman Textiles LTD Industry:Textiles - Spinning/Cotton/Blended Yarn - Ring SPGshyamalmishra1988No ratings yet

- The Unidentified Industries - Residency - CaseDocument4 pagesThe Unidentified Industries - Residency - CaseDBNo ratings yet

- Hero Motocorp EvaDocument1 pageHero Motocorp EvaproNo ratings yet

- RE Tariff 2020Document11 pagesRE Tariff 2020singhalhemesh04No ratings yet

- 0.134 0.1082 Step 1 Cash Flow PV Factor: Problem 21-2Document5 pages0.134 0.1082 Step 1 Cash Flow PV Factor: Problem 21-2alvinNo ratings yet

- Mercury Athletic FootwareDocument12 pagesMercury Athletic FootwareAnandNo ratings yet

- Stock Screener Database - CROICDocument6 pagesStock Screener Database - CROICJay GalvanNo ratings yet

- Microsoft Vs Intuit ValuationDocument4 pagesMicrosoft Vs Intuit ValuationcorvettejrwNo ratings yet

- Bottom-Up BetaDocument15 pagesBottom-Up BetaMihael Od SklavinijeNo ratings yet

- WACCDocument5 pagesWACCWarner Alberto MéridaNo ratings yet

- BetterInvesting Weekly Stock Screen 5-27-19Document1 pageBetterInvesting Weekly Stock Screen 5-27-19BetterInvestingNo ratings yet

- Test Bank Therapeutic Communications For Health Care 3rd Edition TamparoDocument17 pagesTest Bank Therapeutic Communications For Health Care 3rd Edition TamparoMrNicolasGuerraJrtisq100% (40)

- Rib Lake Herald: Annotated Chronology - Volume 1: 1902-1911Document440 pagesRib Lake Herald: Annotated Chronology - Volume 1: 1902-1911Scott RiggsNo ratings yet

- Though, As and HoweverDocument4 pagesThough, As and Howeverlourdes.pereirorodriguezNo ratings yet

- Power of FaithDocument57 pagesPower of Faithssagar_usNo ratings yet

- Auditor's Responsibilities Relating The Subsequent Event in An Audit of The Financial StatementsDocument6 pagesAuditor's Responsibilities Relating The Subsequent Event in An Audit of The Financial StatementsHarutraNo ratings yet

- Mon Tieng Anh - Megabook - de 10 - File Word Co Ma Tran Loi Giai Chi Tiet - (Hoctaivn)Document19 pagesMon Tieng Anh - Megabook - de 10 - File Word Co Ma Tran Loi Giai Chi Tiet - (Hoctaivn)Ngân NguyễnNo ratings yet

- 61 Journal of Chinese Literature and CultureDocument15 pages61 Journal of Chinese Literature and CultureYvonne ChewNo ratings yet

- Fundamental Analysis On Stock MarketDocument6 pagesFundamental Analysis On Stock Marketapi-3755813No ratings yet

- Creating A Diagram of The Film Company LANDocument3 pagesCreating A Diagram of The Film Company LANonlycisco.tkNo ratings yet

- Notice: Human Drugs: Best Pharmaceuticals For Children Act— ALOXIDocument2 pagesNotice: Human Drugs: Best Pharmaceuticals For Children Act— ALOXIJustia.comNo ratings yet

- InvestmentsHull2022 03Document25 pagesInvestmentsHull2022 03Barna OsztermayerNo ratings yet

- Principles of Asset AllocationDocument3 pagesPrinciples of Asset AllocationkypvikasNo ratings yet

- 35-3 Deuteronomy CH 27-34Document113 pages35-3 Deuteronomy CH 27-34zetseatNo ratings yet

- Gmi12 27Document3 pagesGmi12 27ashaik1No ratings yet

- Routing Protocols in Ad-Hoc Networks, Olsr: Jørn Andre BerntzenDocument20 pagesRouting Protocols in Ad-Hoc Networks, Olsr: Jørn Andre BerntzenRycko PareiraNo ratings yet

- People v. Lol-Lo, February 27, 1922 (Hostes Humani Generis)Document3 pagesPeople v. Lol-Lo, February 27, 1922 (Hostes Humani Generis)meerahNo ratings yet

- Chong Wu Ling-Democratisation and Ethnic MinoritiesDocument350 pagesChong Wu Ling-Democratisation and Ethnic MinoritiesHariyadi SajaNo ratings yet

- Important MCQs About Demography of PakistanDocument9 pagesImportant MCQs About Demography of Pakistanabdul rehmanNo ratings yet

- NPC Vs RamoranDocument2 pagesNPC Vs RamoranKhiel CrisostomoNo ratings yet

- S&F ProfileDocument3 pagesS&F ProfileAlfred PatrickNo ratings yet

- Ttheories On PerdevDocument26 pagesTtheories On Perdeveivenej aliugaNo ratings yet

- Section 8.6 - PRFDocument9 pagesSection 8.6 - PRF林義哲No ratings yet

- Northern Valley Regional HS District LawsuitDocument39 pagesNorthern Valley Regional HS District LawsuitDaniel HubbardNo ratings yet

- Importance of The School Science EducationDocument9 pagesImportance of The School Science EducationMaevilyn TurnoNo ratings yet

- Sunday Service - PST - ParkDocument7 pagesSunday Service - PST - ParkDennis ParkNo ratings yet

- Amon Llanca - My Gender Is A (Con) Fusion Experience - Non-Binary Bodies in Fictional NarrativesDocument61 pagesAmon Llanca - My Gender Is A (Con) Fusion Experience - Non-Binary Bodies in Fictional NarrativesvaleriamenaariasNo ratings yet

- Soal Tes Penjajakan Hasil Belajar Sma/Ma TAHUN PELAJARAN 2020/2021Document21 pagesSoal Tes Penjajakan Hasil Belajar Sma/Ma TAHUN PELAJARAN 2020/2021Muhammad AfifNo ratings yet

- Conditionals: Sentence With ConditionsDocument3 pagesConditionals: Sentence With ConditionsSobuz RahmanNo ratings yet

- The Industrial Revolution Slideshow: Questions/Heading Answers/InformationDocument5 pagesThe Industrial Revolution Slideshow: Questions/Heading Answers/InformationMartin BotrosNo ratings yet

Chestnut

Chestnut

Uploaded by

Pratyay Mitra0 ratings0% found this document useful (0 votes)

9 views2 pagesThis document contains financial information for several companies in the instrument industry, including debt levels, credit ratings, betas, and calculations of weighted average cost of capital (WACC). It reports the average cost of debt as 3.81% and average unlevered beta as 1.06 for the industry. It then calculates a levered beta of 1.14 for the industry and provides the specific costs of equity and WACC for Chestnut Instrument at 10.16% and 8.6%, respectively.

Original Description:

finance

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains financial information for several companies in the instrument industry, including debt levels, credit ratings, betas, and calculations of weighted average cost of capital (WACC). It reports the average cost of debt as 3.81% and average unlevered beta as 1.06 for the industry. It then calculates a levered beta of 1.14 for the industry and provides the specific costs of equity and WACC for Chestnut Instrument at 10.16% and 8.6%, respectively.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

9 views2 pagesChestnut

Chestnut

Uploaded by

Pratyay MitraThis document contains financial information for several companies in the instrument industry, including debt levels, credit ratings, betas, and calculations of weighted average cost of capital (WACC). It reports the average cost of debt as 3.81% and average unlevered beta as 1.06 for the industry. It then calculates a levered beta of 1.14 for the industry and provides the specific costs of equity and WACC for Chestnut Instrument at 10.16% and 8.6%, respectively.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 2

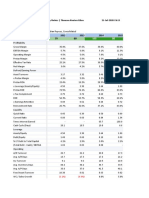

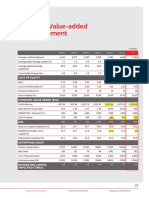

Tax Rate 37%

Risk Free Return (rf) 2.80%

Market Premium (rm -rf) 6%

Company Rating Cost of Equity Beta Debt Total Equity

Debt (rd)

Chestnut (Entire Firm) A- 3.5% 0.9 461 1840

Cost of

Instrument Industry Company Rating Equity Beta Debt Total Equity

Debt (rd)

Badger meter BBB- 4.6% 1.06 89 723

Bresser Rand BB 6.5% 1.4 1287 4549

Flowserve BBB- 4.6% 1.3 1200 10767

Honeywell A 3.3% 1.25 8829 74330

Idex BBB 4.1% 1.15 774 5933

Measurement Specialties BBB 4.1% 1.35 129 944

Mettler-Toledo A 3.3% 1.1 413 7154

Wendell Indtruments NA 0.0% 0.52 0 230

Average 3.81% 1.14 1590 13079

Levered Betaindustry 1.14125

Unlevered Beta industry 1.06

Levered Beta| Chestnut Instrument 1.23

Cost of Equity|Chestnut Instrument 10.16%

Post Tax Cost of Debt|Chestnut Instrument 2.40%

WACC|Chestnut Instrument 8.6%

Debt/ Equity+Debt Post tax Cost of Debt Equity/ Cost of equity (re) E/V x COE WACC

Equity+Debt

0.20034767492395 0.44% 0.80 8.20% 6.56% 7.00%

Equity/

Debt/ Equity+Debt Post tax Cost of Debt Cost of equity (re) E/V x COE WACC

Equity+Debt

0.10960591133005 0.32% 0.89 9.16% 8.16% 8.47%

0.22052775873886 0.90% 0.78 11.20% 8.73% 9.63%

0.10027575833542 0.29% 0.90 10.60% 9.54% 9.83%

0.10617010786566 0.22% 0.89 10.30% 9.21% 9.43%

0.11540181899508 0.30% 0.88 9.70% 8.58% 8.88%

0.12022367194781 0.31% 0.88 10.90% 9.59% 9.90%

0.05457909343201 0.11% 0.95 9.40% 8.89% 9.00%

0 0.00% 1.00 5.92% 5.92% 5.92%

0.10 0.31% 0.90 9.65% 8.58% 8.88%

You might also like

- AirThreads Valuation SolutionDocument20 pagesAirThreads Valuation SolutionBill JoeNo ratings yet

- Data For Ratio Detective ExerciseDocument1 pageData For Ratio Detective ExercisemaritaputriNo ratings yet

- Pryce Corp V PAGCOR Digest GR 157480Document3 pagesPryce Corp V PAGCOR Digest GR 157480Rav EnNo ratings yet

- CF Murphy Stores CLC DraftDocument12 pagesCF Murphy Stores CLC DraftPavithra TamilNo ratings yet

- Assingment - FM - ChestnutDocument8 pagesAssingment - FM - ChestnutChandra Prakash SNo ratings yet

- Marriot CaseStudyDocument17 pagesMarriot CaseStudySambhav SamNo ratings yet

- Intuit ValuationDocument4 pagesIntuit ValuationcorvettejrwNo ratings yet

- Airthreads Valuation Case Study Excel File PDF FreeDocument18 pagesAirthreads Valuation Case Study Excel File PDF Freegoyalmuskan412No ratings yet

- Cost of Debt Calculation Mariott LodgingDocument4 pagesCost of Debt Calculation Mariott LodgingsmokieremoNo ratings yet

- WACC AnalysisDocument9 pagesWACC AnalysisFadhilNo ratings yet

- Damodaran DataDocument2 pagesDamodaran DataVirginia BalboaNo ratings yet

- BetasDocument10 pagesBetasVilmaCastilloMNo ratings yet

- DCF ModelingDocument8 pagesDCF Modelingramanshekhawat719No ratings yet

- OPTIMAL StructureDocument3 pagesOPTIMAL StructureAnonymous EErmsqjjpNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Question 1: Overall WACCDocument15 pagesQuestion 1: Overall WACCSaadatNo ratings yet

- Corporate Accounting ExcelDocument6 pagesCorporate Accounting ExcelshrishtiNo ratings yet

- Foodtree LBO Deleverage: FinancialsDocument12 pagesFoodtree LBO Deleverage: FinancialsmartinsiklNo ratings yet

- Investments Problem SetDocument5 pagesInvestments Problem Setzer0fxz8209No ratings yet

- Soumya Lokhande 1353 - Manmouth CaseDocument13 pagesSoumya Lokhande 1353 - Manmouth CasednesudhudhNo ratings yet

- Clase 6 de Abril 2021Document12 pagesClase 6 de Abril 2021Wendy Paola Arrieta EscobarNo ratings yet

- BetasDocument7 pagesBetasJulio Cesar ChavezNo ratings yet

- FCF AIRTHREAD 222çbbbbbbDocument18 pagesFCF AIRTHREAD 222çbbbbbbGuillermo DiazNo ratings yet

- Caso Alicorp - WACCDocument243 pagesCaso Alicorp - WACCJesúsNo ratings yet

- Eva GlobalDocument7 pagesEva GlobalRodrigo FedaltoNo ratings yet

- BetterInvesting Weekly Stock Screen 4-15-19Document1 pageBetterInvesting Weekly Stock Screen 4-15-19BetterInvestingNo ratings yet

- BetasDocument19 pagesBetasasesor2009No ratings yet

- CAPM ExamenDocument5 pagesCAPM ExamenDenisse Liliana Melgar ValenzuelaNo ratings yet

- Ibs Abc AnalysisDocument4 pagesIbs Abc Analysishimanshigarg656No ratings yet

- Balance SheetDocument14 pagesBalance SheetIbrahimNo ratings yet

- CVR - Case - Excel FileDocument7 pagesCVR - Case - Excel FileVinay JajuNo ratings yet

- Marriott Cost of Capital DataDocument18 pagesMarriott Cost of Capital DataSaadatNo ratings yet

- Air Thread Case FinalDocument49 pagesAir Thread Case FinalJonathan GranowitzNo ratings yet

- BetasDocument7 pagesBetasWendy FernándezNo ratings yet

- Bottom Up BetaDocument18 pagesBottom Up BetaTimothy NguyenNo ratings yet

- New Items and Escalation Due To Which Estimate Has Been Revised (160 KMPH DHN Division)Document2 pagesNew Items and Escalation Due To Which Estimate Has Been Revised (160 KMPH DHN Division)Abhishek JaiswalNo ratings yet

- Discounted Cash Flow-Model For ValuationDocument9 pagesDiscounted Cash Flow-Model For ValuationPCM StresconNo ratings yet

- Opreration Cycle Time (Normal Time) Sum Avg Rating B.T SAM Capacity Rate Earning 1 2 3 4 5 PC/Mint ValueDocument4 pagesOpreration Cycle Time (Normal Time) Sum Avg Rating B.T SAM Capacity Rate Earning 1 2 3 4 5 PC/Mint ValueUmairIsmailNo ratings yet

- Marriot Corporation Lodging Restaurant Contract ServicesDocument2 pagesMarriot Corporation Lodging Restaurant Contract ServicesFurqanTariqNo ratings yet

- ACF - Capital StructureDocument8 pagesACF - Capital StructureAmit JainNo ratings yet

- Mariott CorporationDocument4 pagesMariott CorporationsmokieremoNo ratings yet

- Tutorial On How To Use The DCF Model. Good Luck!: DateDocument9 pagesTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghNo ratings yet

- DCF ConeDocument37 pagesDCF Conejustinbui85No ratings yet

- Marriott Corp BDocument15 pagesMarriott Corp BEshesh GuptaNo ratings yet

- Tariff RE 2016-17Document14 pagesTariff RE 2016-17Mohnish ManchandaNo ratings yet

- Book1 (AutoRecovered)Document5 pagesBook1 (AutoRecovered)Tayba AwanNo ratings yet

- CNPF Ratio AnalysisDocument8 pagesCNPF Ratio AnalysisSheena Ann Keh LorenzoNo ratings yet

- Solution To ATCDocument17 pagesSolution To ATCGuru Charan ChitikenaNo ratings yet

- Beta Apparel Inc. Always-Glory International Inc. B-II Apparel Group Cambridge Inds. Petty Belly Inc. Avg of Peer GroupDocument21 pagesBeta Apparel Inc. Always-Glory International Inc. B-II Apparel Group Cambridge Inds. Petty Belly Inc. Avg of Peer GroupDamion KenwoodNo ratings yet

- Vardhman Textiles LTD Industry:Textiles - Spinning/Cotton/Blended Yarn - Ring SPGDocument5 pagesVardhman Textiles LTD Industry:Textiles - Spinning/Cotton/Blended Yarn - Ring SPGshyamalmishra1988No ratings yet

- The Unidentified Industries - Residency - CaseDocument4 pagesThe Unidentified Industries - Residency - CaseDBNo ratings yet

- Hero Motocorp EvaDocument1 pageHero Motocorp EvaproNo ratings yet

- RE Tariff 2020Document11 pagesRE Tariff 2020singhalhemesh04No ratings yet

- 0.134 0.1082 Step 1 Cash Flow PV Factor: Problem 21-2Document5 pages0.134 0.1082 Step 1 Cash Flow PV Factor: Problem 21-2alvinNo ratings yet

- Mercury Athletic FootwareDocument12 pagesMercury Athletic FootwareAnandNo ratings yet

- Stock Screener Database - CROICDocument6 pagesStock Screener Database - CROICJay GalvanNo ratings yet

- Microsoft Vs Intuit ValuationDocument4 pagesMicrosoft Vs Intuit ValuationcorvettejrwNo ratings yet

- Bottom-Up BetaDocument15 pagesBottom-Up BetaMihael Od SklavinijeNo ratings yet

- WACCDocument5 pagesWACCWarner Alberto MéridaNo ratings yet

- BetterInvesting Weekly Stock Screen 5-27-19Document1 pageBetterInvesting Weekly Stock Screen 5-27-19BetterInvestingNo ratings yet

- Test Bank Therapeutic Communications For Health Care 3rd Edition TamparoDocument17 pagesTest Bank Therapeutic Communications For Health Care 3rd Edition TamparoMrNicolasGuerraJrtisq100% (40)

- Rib Lake Herald: Annotated Chronology - Volume 1: 1902-1911Document440 pagesRib Lake Herald: Annotated Chronology - Volume 1: 1902-1911Scott RiggsNo ratings yet

- Though, As and HoweverDocument4 pagesThough, As and Howeverlourdes.pereirorodriguezNo ratings yet

- Power of FaithDocument57 pagesPower of Faithssagar_usNo ratings yet

- Auditor's Responsibilities Relating The Subsequent Event in An Audit of The Financial StatementsDocument6 pagesAuditor's Responsibilities Relating The Subsequent Event in An Audit of The Financial StatementsHarutraNo ratings yet

- Mon Tieng Anh - Megabook - de 10 - File Word Co Ma Tran Loi Giai Chi Tiet - (Hoctaivn)Document19 pagesMon Tieng Anh - Megabook - de 10 - File Word Co Ma Tran Loi Giai Chi Tiet - (Hoctaivn)Ngân NguyễnNo ratings yet

- 61 Journal of Chinese Literature and CultureDocument15 pages61 Journal of Chinese Literature and CultureYvonne ChewNo ratings yet

- Fundamental Analysis On Stock MarketDocument6 pagesFundamental Analysis On Stock Marketapi-3755813No ratings yet

- Creating A Diagram of The Film Company LANDocument3 pagesCreating A Diagram of The Film Company LANonlycisco.tkNo ratings yet

- Notice: Human Drugs: Best Pharmaceuticals For Children Act— ALOXIDocument2 pagesNotice: Human Drugs: Best Pharmaceuticals For Children Act— ALOXIJustia.comNo ratings yet

- InvestmentsHull2022 03Document25 pagesInvestmentsHull2022 03Barna OsztermayerNo ratings yet

- Principles of Asset AllocationDocument3 pagesPrinciples of Asset AllocationkypvikasNo ratings yet

- 35-3 Deuteronomy CH 27-34Document113 pages35-3 Deuteronomy CH 27-34zetseatNo ratings yet

- Gmi12 27Document3 pagesGmi12 27ashaik1No ratings yet

- Routing Protocols in Ad-Hoc Networks, Olsr: Jørn Andre BerntzenDocument20 pagesRouting Protocols in Ad-Hoc Networks, Olsr: Jørn Andre BerntzenRycko PareiraNo ratings yet

- People v. Lol-Lo, February 27, 1922 (Hostes Humani Generis)Document3 pagesPeople v. Lol-Lo, February 27, 1922 (Hostes Humani Generis)meerahNo ratings yet

- Chong Wu Ling-Democratisation and Ethnic MinoritiesDocument350 pagesChong Wu Ling-Democratisation and Ethnic MinoritiesHariyadi SajaNo ratings yet

- Important MCQs About Demography of PakistanDocument9 pagesImportant MCQs About Demography of Pakistanabdul rehmanNo ratings yet

- NPC Vs RamoranDocument2 pagesNPC Vs RamoranKhiel CrisostomoNo ratings yet

- S&F ProfileDocument3 pagesS&F ProfileAlfred PatrickNo ratings yet

- Ttheories On PerdevDocument26 pagesTtheories On Perdeveivenej aliugaNo ratings yet

- Section 8.6 - PRFDocument9 pagesSection 8.6 - PRF林義哲No ratings yet

- Northern Valley Regional HS District LawsuitDocument39 pagesNorthern Valley Regional HS District LawsuitDaniel HubbardNo ratings yet

- Importance of The School Science EducationDocument9 pagesImportance of The School Science EducationMaevilyn TurnoNo ratings yet

- Sunday Service - PST - ParkDocument7 pagesSunday Service - PST - ParkDennis ParkNo ratings yet

- Amon Llanca - My Gender Is A (Con) Fusion Experience - Non-Binary Bodies in Fictional NarrativesDocument61 pagesAmon Llanca - My Gender Is A (Con) Fusion Experience - Non-Binary Bodies in Fictional NarrativesvaleriamenaariasNo ratings yet

- Soal Tes Penjajakan Hasil Belajar Sma/Ma TAHUN PELAJARAN 2020/2021Document21 pagesSoal Tes Penjajakan Hasil Belajar Sma/Ma TAHUN PELAJARAN 2020/2021Muhammad AfifNo ratings yet

- Conditionals: Sentence With ConditionsDocument3 pagesConditionals: Sentence With ConditionsSobuz RahmanNo ratings yet

- The Industrial Revolution Slideshow: Questions/Heading Answers/InformationDocument5 pagesThe Industrial Revolution Slideshow: Questions/Heading Answers/InformationMartin BotrosNo ratings yet