Professional Documents

Culture Documents

Entrepreneurs Toolkit Write Business Plan

Entrepreneurs Toolkit Write Business Plan

Uploaded by

Roukshana ShanaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Entrepreneurs Toolkit Write Business Plan

Entrepreneurs Toolkit Write Business Plan

Uploaded by

Roukshana ShanaCopyright:

Available Formats

ENTREPRENEURS TOOLKIT

Write a Business Plan

Learn how to write an effective, bankable business plan.

Executive Summary

In two pages, you have to describe what you want to achieve, how you are going to achieve it and

how you are going to fund your plans. It is the first impression you give of your company and a

critical summary.

Marketing and sales projections

In two to three pages, you must describe the market, why any competitors are not answering the

needs of customers, how you are going to meet those needs, how you are going to price your goods

and services and how you are going to reach your identified market.

Management team and SWOT analysis

Provide the profiles of yourself and the key members of your team and outline how your combined

experience is relevant to the new venture. The financial and time commitment of the management

team is important. A SWOT (Strength, Weakness, Opportunity, Threat) analysis is a good tool for

showcasing the potential of a business, while also outlining any risks.

Financial model

Your Financial Plan will include a summary of your main assumptions, a projected income

statement for five years ahead and the sources and uses of funds showing where the money will

come from and how it is going to be spent. Detailed calculations should be in the annex. The

conclusion should focus on what you are asking for: a loan, an equity injection? What amount and

under what terms? Why you consider it to be a safe investment? Again, any details should be in

an appendix.

Entrepreneurs toolkit – Mauritius Trade Easy – Write a business plan

Define your pricing strategy

This document aims to give entrepreneurs some hints to define your pricing strategy

Competitive advantage

Identify clearly your strengths compared to the competition. Your business model has to be

designed around your competitive advantage. Determine your price and your marketing strategy

based on this competitive advantage.

Price strategy and production cost

Carefully establish your pricing strategy by taking into account both your target market and your

production costs. Develop a strategy that will allow you to sell enough of your products/services

to be profitable while satisfying the expectations of your customer. Your production costs will

determine the minimum price you can set.

There are multiple price strategies:

Strategies Characteristic

Premium Establish a price higher than the competitors. It has to be justified by a strong

Pricing competitive advantage that allows you to offer a unique product

Designed to capture market share by entering the market with a low price

Penetration

compare to competition to attract new buyers and then move to a higher market

Pricing

price.

Economy Refers to a low cost approach. Focus on keeping prices as low as you can to

Pricing attract a very price sensitive segment

Price If you have a significant competitive advantage you can enter the market with

Skimming high price to gain maximum revenue before competition comes in the market

Whilst we have taken reasonable steps to ensure the accuracy, currency, availability and

completeness of the information contained on this website, the information provided should not

be considered as advices and is only showing one of many possible approaches. We therefore shall

not be liable for any losses or damages or expenses (including legal costs) whatsoever arising out

of or referable to materials on this website.

Entrepreneurs toolkit – Mauritius Trade Easy – Write a business plan

SWOT Analysis

A SWOT analysis is about defining the Strengths, Weaknesses, Opportunities and Threats of

your business. This is a great tool to identify a businesses' situation regarding its market. This

tool should be regarded as a useful brainstorming that will help you define an efficient and

consistent business' strategy.

Internal and external analysis

The main benefit of the SWOT analysis is that it allows you to bring together in one document,

both internal and external factors that can affect your business. Internal aspects are represented

by your strengths and weaknesses while external factors are the threats and opportunities.

Be realistic and impartial

When using a SWOT analysis, be realistic about the strengths and weaknesses of your

organization. Distinguish between where your organization is today, and where it could be in the

future. Be specific and avoid gray areas.

Maintaining competitive advantage while working on

weaknesses

A SWOT analysis will help you identify areas of your business that are performing well. These

areas are your best assets you must build your business on. These factors can be considered as a

competitive advantage and should be used to grow your business.

On the other hand, weaknesses are the factors that put your business at a disadvantage compared

to others. Conducting a SWOT analysis can help you identify these characteristics and minimize

their impact or improve them before they become a problem.

Be realistic about the weaknesses of your business so you can deal with them adequately.

Strategic decisions

Eventually, a SWOT analysis will help you make strategic decisions. Once you have the

business' big picture you can make smart moves. Seizing opportunities that you have identified

within your market can be one of them. Conducting a SWOT analysis will help you understand

the internal factors that will allow you to seize an opportunity.

Entrepreneurs toolkit – Mauritius Trade Easy – Write a business plan

SWOT Template

SWOT Sample

SCM clothes manufacture

SCM Clothing is a family start-up business that specializes in the fabrication of men's apparel and

that is established in Port Louis. The company will penetrate the clothing sector with high-quality

clothes. Before to elaborate a Marketing Plan, the SCM Clothing team has analysed the business

capacity to succeed thanks to the SWOT tool.

The team had come up with key factors for SCM Clothing business organized as above:

Strengths:

- We have high quality product

Entrepreneurs toolkit – Mauritius Trade Easy – Write a business plan

- We offer innovative products

- Our partnership with a national retailer is a key source of sales and will increase awareness

toward our brand

- Our designer's team shows great creativity skills while understanding customers'

expectations

Weaknesses:

- Our products are expensive in comparison to the competition

- We have a limited budget for promotion

- We are too much dependent on our designer's team

Opportunities:

- The local demand tends to desire fashionable clothes

- We can outsource the production to reduce manufacturing cost

- Casual formats become the rule as companies' dress codes are more flexible and the

population is ageing

Threats:

- A increasing part of the local demand tend to want low-priced clothes

- A highly intensive competition due to the apparition of numerous manufacturers and

retailers over the past years

- We have to avoid being too much dependent on our national retailer partner

- An extremely hot weather can limit our product range

Entrepreneurs toolkit – Mauritius Trade Easy – Write a business plan

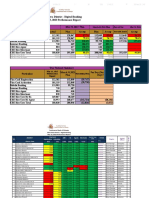

The Financial Plan

The Financial Plan is a key part of your business plan. Its purpose is to forecast future revenues,

expenses and the funding required to set up and develop the company. It includes the

assumptions behind your project and three accounting documents: the balance sheet, the income

statement and the cash flow statement.

A guide to managing your business

The purpose of the plan is to show the profitability of your venture and its financial requirements

for the foreseeable future, in general three to five years. The most important element is to

evaluate carefully how much cash is required for the business to run. No more cash, no more

business! The cash requirements are not only to finance the expenses, fixed or variable, but also

to finance investments and the working capital. Working capital is the amount of cash needed to

finance your inventory and your clients, in case they do not pay upfront, minus the credit terms

you will be able to negotiate from your suppliers. It is important to update the plan with the most

recent results or assumptions. Comparing the actual results with the forecasted ones will allow

you to adjust your plan and take action accordingly.

The reference document for raising funds

Any bank, lender or investor will require a financial plan before committing any money to your

business. Lenders want to understand how and when your business is going to be profitable and

when you will be able to give them their money back! Investors will use it to evaluate the

attractiveness and growth potential of your business.

Be realistic and do not get caught up in too many details

Be realistic about your assumptions! On one hand, overestimating your business will cause you

to lose credibility in front of investors or banks. They have some comparable data and ratios in

mind, so do not try to fool them. On the other hand, being too pessimistic (this isn't usually in an

entrepreneur's DNA!) will not make your project attractive. You should be able to justify every

single assumption. You need to get some help to do the financial modeling if you have never

done it before. Finally, do not get caught up in too many details: show only the important

assumptions and numbers.

Show visuals

Keep in mind that graphs, tables and other visuals are often more effective methods of

highlighting key ideas and figures than just using text. Your visuals will allow you to create an

interaction with your audience during oral presentations and will simplify the readability of your

document.

Entrepreneurs toolkit – Mauritius Trade Easy – Write a business plan

You might also like

- GLCA DA MS Excel HBFC Project Modified-1Document3 pagesGLCA DA MS Excel HBFC Project Modified-1Subhan Ahmad KhanNo ratings yet

- Boots - Management and Marketing Strategy - AnalyseDocument11 pagesBoots - Management and Marketing Strategy - AnalyseandrreiiNo ratings yet

- Godrej InterioDocument15 pagesGodrej InterioAarzu Wadhwa100% (1)

- September 2016 Through October 2016Document456 pagesSeptember 2016 Through October 2016Jen SabellaNo ratings yet

- Portfolio Selection and The Capital Asset Pricing ModelDocument6 pagesPortfolio Selection and The Capital Asset Pricing ModelSana BatoolNo ratings yet

- Haircare Industry ProjectDocument4 pagesHaircare Industry ProjectHelpdeskNo ratings yet

- Final Exam Review: 1. Identify Managers' Three Primary Responsibilities. A. Planning B. Directing C. ControllingDocument4 pagesFinal Exam Review: 1. Identify Managers' Three Primary Responsibilities. A. Planning B. Directing C. ControllingSandip AgarwalNo ratings yet

- Business Plan TemplateDocument14 pagesBusiness Plan TemplateLiviu PăianuNo ratings yet

- PBM - Module 2Document89 pagesPBM - Module 2merinNo ratings yet

- Marketing TipsDocument6 pagesMarketing TipsParas ShahNo ratings yet

- Business Plan: Team Name-Ecofly Team ID - 1064Document9 pagesBusiness Plan: Team Name-Ecofly Team ID - 1064Srijon GgNo ratings yet

- PFSP NO. 1 DoneDocument3 pagesPFSP NO. 1 DoneMacaraeg Joshua ChristoperNo ratings yet

- 4P's of Marketing: Consumer. It Also Identifies Target Markets As Well As Applies Services andDocument3 pages4P's of Marketing: Consumer. It Also Identifies Target Markets As Well As Applies Services andDianne Permejo del PradoNo ratings yet

- Galleria D'arte Business PlanDocument31 pagesGalleria D'arte Business PlanAmnaAnwarNo ratings yet

- Writing The Business Plan IDG VenturesDocument9 pagesWriting The Business Plan IDG VentureswindevilNo ratings yet

- A FOODIE Business PlanDocument13 pagesA FOODIE Business PlanSonal JulumNo ratings yet

- Event Business Plan TemplateDocument4 pagesEvent Business Plan Templatejames reidNo ratings yet

- 3 Entrep Recognize and Understand The Market PDFDocument28 pages3 Entrep Recognize and Understand The Market PDFJuberose GillesaniaNo ratings yet

- ACT1110 Business-Ethics PPTDocument32 pagesACT1110 Business-Ethics PPTJanna BalisacanNo ratings yet

- Business Plan On Hair GelDocument8 pagesBusiness Plan On Hair GelTAYEEB AHMED KHAN100% (2)

- Business PlanDocument11 pagesBusiness PlanLionel DenisNo ratings yet

- 4Ps of Marketing and USPDocument53 pages4Ps of Marketing and USPMonria FernandoNo ratings yet

- Business Plan OutlineDocument2 pagesBusiness Plan OutlineovifinNo ratings yet

- Financial PlanDocument23 pagesFinancial PlanHassan JulkipliNo ratings yet

- How To Do Breakeven AnalysisDocument3 pagesHow To Do Breakeven AnalysisranjankathuriaNo ratings yet

- Franchise Plan Presentation FinalDocument33 pagesFranchise Plan Presentation FinalNicole Eve Pelaez-AbarrientosNo ratings yet

- 15 Logistics Tips For Ecommerce Business - Discover DHLDocument13 pages15 Logistics Tips For Ecommerce Business - Discover DHLmohammadNo ratings yet

- The Entrepreneurial Mind-Set in Individuals: Cognition and EthicsDocument36 pagesThe Entrepreneurial Mind-Set in Individuals: Cognition and Ethicsbuy invitee100% (1)

- Business Plan Example 1Document30 pagesBusiness Plan Example 1Phoenix GriffithNo ratings yet

- A Study On The Sales Promotion ActivitiesDocument14 pagesA Study On The Sales Promotion ActivitiesSagar Paul'gNo ratings yet

- How To Write A Business Plan For Prospective InvestorsDocument10 pagesHow To Write A Business Plan For Prospective InvestorsWilliam BaileyNo ratings yet

- Explain The Concept Development? 2. Describe The Value, Innovation and Unique Selling PropositionDocument29 pagesExplain The Concept Development? 2. Describe The Value, Innovation and Unique Selling PropositionAlexis Joy B. GalicioNo ratings yet

- Corporate EntertainmentDocument36 pagesCorporate EntertainmentPUJAN_CTG100% (1)

- Lulu Bella Report - Brand ReportDocument15 pagesLulu Bella Report - Brand Reportapi-394570019No ratings yet

- Business Strategy December 2009 Exam PaperDocument9 pagesBusiness Strategy December 2009 Exam Paperkarlr9No ratings yet

- Product and Brand Management - SynopsisDocument8 pagesProduct and Brand Management - SynopsisdevakarreddyNo ratings yet

- Week 2 - ENTREPRENEURSHIPDocument16 pagesWeek 2 - ENTREPRENEURSHIPTe Kelly100% (2)

- Thanks For Downloading This Business Plan: All The Financial Tables and Graphs To Go With It. You'll Also Be Able ToDocument35 pagesThanks For Downloading This Business Plan: All The Financial Tables and Graphs To Go With It. You'll Also Be Able Tolalbabu guptaNo ratings yet

- Branding StrategiesDocument5 pagesBranding StrategiesCyrelle PerezNo ratings yet

- Business PLAN Unit 3Document26 pagesBusiness PLAN Unit 3prince100% (1)

- Starting A Business: Click To Edit Master Subtitle StyleDocument27 pagesStarting A Business: Click To Edit Master Subtitle StyleNischup NirobotaNo ratings yet

- Zurich Edition 17 FullDocument4 pagesZurich Edition 17 FullsyedmanNo ratings yet

- Hit 2201 Feasibility Study 2023 - by T.P MushayavanhuDocument22 pagesHit 2201 Feasibility Study 2023 - by T.P MushayavanhuEnjoy Sheshe100% (1)

- Table of Content1Document6 pagesTable of Content1Frenz Reina MabuyoNo ratings yet

- Business Plan Organization & Management Organization: General ManagerDocument12 pagesBusiness Plan Organization & Management Organization: General Managerkelvin orongeNo ratings yet

- Topic 6 - Business Plan NewDocument32 pagesTopic 6 - Business Plan NewAisyNo ratings yet

- Entrepreneurial Process: Here Are The 5 Critical Stages You Will Go Through As An EntrepreneurDocument30 pagesEntrepreneurial Process: Here Are The 5 Critical Stages You Will Go Through As An EntrepreneurDela Rosa ClairielleNo ratings yet

- Business Plan Template CandleDocument4 pagesBusiness Plan Template CandleTrop JeengNo ratings yet

- Business PlanDocument35 pagesBusiness PlanAilyn AmandoronNo ratings yet

- 10 Characteristics of Successful EntrepreneursDocument14 pages10 Characteristics of Successful EntrepreneursKusrianto KurniawanNo ratings yet

- Marketing Management StrategyDocument14 pagesMarketing Management Strategydipanjan banerjeeNo ratings yet

- How To Prepare A Business Plan: Prof K Ramachandran Entrepreneurship & Strategy Indian School of Business HyderabadDocument36 pagesHow To Prepare A Business Plan: Prof K Ramachandran Entrepreneurship & Strategy Indian School of Business HyderabadvanshiiNo ratings yet

- New York Law Lab Business PlanDocument3 pagesNew York Law Lab Business PlanBlake WuNo ratings yet

- Submitted By:: Marketing Strategy Analysis of Bottlers Nepal LTDDocument84 pagesSubmitted By:: Marketing Strategy Analysis of Bottlers Nepal LTDquestion markNo ratings yet

- Entrep Lecture 2Document10 pagesEntrep Lecture 2Rianne ParasNo ratings yet

- Sample Business PlanDocument38 pagesSample Business PlanConsueloNo ratings yet

- B. The Ultimate Business PlanDocument22 pagesB. The Ultimate Business PlanThomas JinduNo ratings yet

- Business Idea 1Document13 pagesBusiness Idea 1Owen BbaleNo ratings yet

- BUSINESS PLAN BY ONAH Jeremiah IjwoDocument9 pagesBUSINESS PLAN BY ONAH Jeremiah IjwoTemiloluwa IbrahimNo ratings yet

- Business Plan PresentationDocument21 pagesBusiness Plan PresentationRoel Jr Pinaroc DolaypanNo ratings yet

- Business Plan For Small Service Firms - 0Document37 pagesBusiness Plan For Small Service Firms - 0MAGSINO, ANGELINE S.No ratings yet

- (Proposed Authorized Dealer of Best-Seller) : Big - Seller Nepal Private LimitedDocument18 pages(Proposed Authorized Dealer of Best-Seller) : Big - Seller Nepal Private LimitedRajan SubediNo ratings yet

- Junsea Perfume Collection: Business PlanDocument9 pagesJunsea Perfume Collection: Business PlanMirasol ManaoatNo ratings yet

- Chapter Four: Market Segmentation, Targeting and PositioningDocument31 pagesChapter Four: Market Segmentation, Targeting and PositioningMohammed HassenNo ratings yet

- Rules and Regulation of The Durgah Khwaja Saheb Ajmer EPFDocument16 pagesRules and Regulation of The Durgah Khwaja Saheb Ajmer EPFLatest Laws TeamNo ratings yet

- NEXT TFD Elder (1) 1Document13 pagesNEXT TFD Elder (1) 1Ruffabbey06No ratings yet

- PWC Miining Taxes and RoyaltiesDocument54 pagesPWC Miining Taxes and RoyaltiesaturcubbNo ratings yet

- Determinants of Bank Selection in Delhi: A Factor Analysis by Sajeevan Rao R.K. SharmaDocument22 pagesDeterminants of Bank Selection in Delhi: A Factor Analysis by Sajeevan Rao R.K. SharmaPooja SinghNo ratings yet

- M. Com. Paper-1 To Paper-5 PDFDocument814 pagesM. Com. Paper-1 To Paper-5 PDFpooja sainiNo ratings yet

- Concall Outcome PDFDocument3 pagesConcall Outcome PDFPanache ZNo ratings yet

- V-Binomial TreeDocument58 pagesV-Binomial TreeHải NhưNo ratings yet

- Mfi 2016 12Document98 pagesMfi 2016 12Subrata ChakrabortyNo ratings yet

- Macroeconomics QuestionsDocument2 pagesMacroeconomics QuestionsBaber AminNo ratings yet

- Ritz Company Had The Following Stock Outstanding and Retained EarningsDocument1 pageRitz Company Had The Following Stock Outstanding and Retained EarningsFreelance WorkerNo ratings yet

- Literature ReviewDocument2 pagesLiterature ReviewParth Panchal50% (2)

- 1 - Error Correction - Final PDFDocument5 pages1 - Error Correction - Final PDFJohn Paul EslerNo ratings yet

- Final Final BlackbookDocument105 pagesFinal Final BlackbookIsha PednekarNo ratings yet

- UpcoverDocument4 pagesUpcoverGet upcoverNo ratings yet

- Metropolitan Bank & Trust Company v. CA, GR No. 88866, February 18, 1961Document8 pagesMetropolitan Bank & Trust Company v. CA, GR No. 88866, February 18, 1961RPSA CPANo ratings yet

- Individual Assignment 2 Managerial AccountingDocument3 pagesIndividual Assignment 2 Managerial AccountingCodyxanssNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-3Document4 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-3Pramod VasudevNo ratings yet

- APLI - Annual Report - 2017 PDFDocument156 pagesAPLI - Annual Report - 2017 PDFMichelle Hartasya SitompulNo ratings yet

- 1 - Introduction To Accountign - Icap - Questions and Answers PDFDocument202 pages1 - Introduction To Accountign - Icap - Questions and Answers PDFM.Abdullah MBIT100% (1)

- Model Question-01.Central ExciseDocument3 pagesModel Question-01.Central ExciseganeshNo ratings yet

- 01209046Document173 pages01209046Ashika AshwinNo ratings yet

- December 2018: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesDecember 2018: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- Mar 23, 2023 DDD Digital Banking ReportDocument23 pagesMar 23, 2023 DDD Digital Banking ReportAschalew FikaduNo ratings yet

- 5-Funds Flow StatementDocument40 pages5-Funds Flow StatementBhagaban DasNo ratings yet

- 62615c75f9babe0b9edf9058 - PF - 2022-04-21 - Master Cryptocurrency Loan AgreementDocument14 pages62615c75f9babe0b9edf9058 - PF - 2022-04-21 - Master Cryptocurrency Loan AgreementContini AndreNo ratings yet