Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

13 viewsAC 1104 Digital Notes

AC 1104 Digital Notes

Uploaded by

Cu, Kathleen Kay M.This document discusses partnerships, including:

1) The definition, characteristics, advantages, and disadvantages of partnerships. It also covers the classification of partnerships based on various factors like contribution, liability, duration, and legality.

2) The steps required to register a partnership business, including requirements to register with regulatory agencies and obtain necessary permits.

3) Key components of a partnership contract and articles of co-partnership, including details about the partners, business purpose, capital contributions, and other terms.

4) Accounting treatments for partnerships, including opening entries, owner's equity accounts, and different methods for dividing profits and losses among partners.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Pre-Quali TQ 2a With Answer KeyDocument10 pagesPre-Quali TQ 2a With Answer KeyJeepee John100% (2)

- AssignmentValuationTemplate v1.0Document46 pagesAssignmentValuationTemplate v1.0HAMMADHRNo ratings yet

- MidTerm Exam, Partnership Formation, Operation and DissolutionDocument3 pagesMidTerm Exam, Partnership Formation, Operation and DissolutionIñego Begdorf100% (5)

- Chapter 1 5 Mylab Homework Exam 1 Fin 4604Document11 pagesChapter 1 5 Mylab Homework Exam 1 Fin 4604Mit DaveNo ratings yet

- Chapter 1 - Part 1Document2 pagesChapter 1 - Part 1clarizaNo ratings yet

- Accounting For Special TransactionDocument2 pagesAccounting For Special TransactionJoresol AlorroNo ratings yet

- Should Always: Exercise 1-1. True or FalseDocument7 pagesShould Always: Exercise 1-1. True or FalseDeanmark RondinaNo ratings yet

- University of Mindanao Panabo College: Items 12-13Document3 pagesUniversity of Mindanao Panabo College: Items 12-13Jessa BeloyNo ratings yet

- Partnership and RCCDocument24 pagesPartnership and RCCJames CantorneNo ratings yet

- Chapter 1 Partnership FormationDocument3 pagesChapter 1 Partnership FormationLyka Mae E. MarianoNo ratings yet

- Far 1 Partnership FormationDocument6 pagesFar 1 Partnership Formationunlocks by xijiNo ratings yet

- Part I Bus LawDocument2 pagesPart I Bus LawShang Bugayong50% (6)

- Far ReviewerDocument43 pagesFar ReviewerAl Robert Angelo LoretoNo ratings yet

- Consensual - Perfected by A Mere ConsentDocument3 pagesConsensual - Perfected by A Mere ConsentRey Joyce AbuelNo ratings yet

- Accounting2 1Document4 pagesAccounting2 1Andrianne MontefalcoNo ratings yet

- Advanced Financial Accounting and Reporting (Partnership)Document5 pagesAdvanced Financial Accounting and Reporting (Partnership)Mike C Buceta100% (1)

- Forms of Business OrganizationDocument2 pagesForms of Business OrganizationJaypee ManiegoNo ratings yet

- LAW 102 (Reviewer)Document15 pagesLAW 102 (Reviewer)Marie GarpiaNo ratings yet

- Far 1 Partnership FormationDocument6 pagesFar 1 Partnership Formationmachelle francisco100% (9)

- ACC 311 ReviewDocument2 pagesACC 311 ReviewMaricar DimayugaNo ratings yet

- 2 - Practical Accounting 2Document2 pages2 - Practical Accounting 2Ruel VicenteNo ratings yet

- Partnership - I: "Your Online Partner To Get Your Title"Document10 pagesPartnership - I: "Your Online Partner To Get Your Title"Arlene Diane OrozcoNo ratings yet

- Module 1 Student Version Partnership Formation Revised 2Document30 pagesModule 1 Student Version Partnership Formation Revised 2Day77No ratings yet

- Bam201 ReviewerDocument7 pagesBam201 Reviewerjireh mallariNo ratings yet

- Prelim Exam, Partnership Formation and Operation PDFDocument2 pagesPrelim Exam, Partnership Formation and Operation PDFIñego BegdorfNo ratings yet

- RFBT Chapter2 OutlineDocument20 pagesRFBT Chapter2 OutlineCheriferDahangCoNo ratings yet

- Chapter 1-Partnership FormationDocument5 pagesChapter 1-Partnership Formationbestinthesis.group11No ratings yet

- The Law On Partnership: Business LawsDocument4 pagesThe Law On Partnership: Business LawsLFGS FinalsNo ratings yet

- 01 - Module 1Document13 pages01 - Module 1Daniel FranciscoNo ratings yet

- UntitledDocument5 pagesUntitledBUENAFE, Randene Marie YohanNo ratings yet

- College of Business Administration Law On Business Organization Part I. IdentificationDocument2 pagesCollege of Business Administration Law On Business Organization Part I. IdentificationGhrace Segundo CocalNo ratings yet

- Partnership - Nature and ConceptDocument8 pagesPartnership - Nature and ConceptRiyah ParasNo ratings yet

- Learning Task No.1Document2 pagesLearning Task No.1Carl Oliver LacanlaleNo ratings yet

- LECTURE NOTES - Law On PartnershipsDocument6 pagesLECTURE NOTES - Law On Partnershipssad nu100% (1)

- Partnership TheoriesDocument5 pagesPartnership TheoriesThomas MarianoNo ratings yet

- General Principles: Lecture Notes in LAW On PARTNERSHIP (BL-09)Document10 pagesGeneral Principles: Lecture Notes in LAW On PARTNERSHIP (BL-09)Francis Louie Allera HumawidNo ratings yet

- Parcoac Prelim Reviewer 2Document5 pagesParcoac Prelim Reviewer 2tokyoescotoNo ratings yet

- BL2 Chap1Document1 pageBL2 Chap1Maria Freyja Darlene CruzNo ratings yet

- 2019 Sqe Reviewer - Fundamentals of Accounting Parts 1 and 2 PDFDocument23 pages2019 Sqe Reviewer - Fundamentals of Accounting Parts 1 and 2 PDFJohn Marfhel PrestadoNo ratings yet

- Chapter 1 - Partnership Formation PDFDocument33 pagesChapter 1 - Partnership Formation PDFAldrin ZolinaNo ratings yet

- Partnership TheoryDocument10 pagesPartnership TheorynikoleNo ratings yet

- Afar PartnershipDocument6 pagesAfar PartnershipSheena Baylosis0% (1)

- Special TransactionsDocument3 pagesSpecial TransactionsTracy AguirreNo ratings yet

- SAN BEDA COLLEGE Mendiola Manila Departm PDFDocument8 pagesSAN BEDA COLLEGE Mendiola Manila Departm PDFAlvaroNo ratings yet

- T 01 PartnershipsDocument5 pagesT 01 PartnershipsCPMNo ratings yet

- Business Law and Regulation Quiz 1Document5 pagesBusiness Law and Regulation Quiz 1Jennica Mae RuizNo ratings yet

- PARTNERSHIP Theories With ExplanationDocument5 pagesPARTNERSHIP Theories With ExplanationNikka PatarataNo ratings yet

- Business Law and Regulation Quiz 2Document6 pagesBusiness Law and Regulation Quiz 2Jennica Mae RuizNo ratings yet

- Partnership-Dissolution ExercisesDocument2 pagesPartnership-Dissolution ExercisesLeenNo ratings yet

- Determining Formation of Partnership: or Agree To Form A PartnershipDocument74 pagesDetermining Formation of Partnership: or Agree To Form A PartnershipAlana Hans-CohenNo ratings yet

- Partnership AccountingDocument3 pagesPartnership Accountingmojii caarrNo ratings yet

- Accounting For Partnership: Part 2Document15 pagesAccounting For Partnership: Part 2Lady Fe DielNo ratings yet

- EH405 ATP WWW - Midterm ExamDocument3 pagesEH405 ATP WWW - Midterm ExamJandi Yang100% (1)

- Chapter 2Document13 pagesChapter 2bartabatoes rerunNo ratings yet

- AFAR 01 - Partnership AccountingDocument7 pagesAFAR 01 - Partnership AccountingcheoreciNo ratings yet

- Booklet 4 PartnershipDocument26 pagesBooklet 4 PartnershipSheldon SyndromeNo ratings yet

- 01 Partnership FormationDocument5 pages01 Partnership FormationJohn Carl TuazonNo ratings yet

- Final Module Summer Review Class A.Y 2018 2019Document57 pagesFinal Module Summer Review Class A.Y 2018 2019Jessie jorgeNo ratings yet

- ACCT102 - Modules 1-3 ReviewerDocument31 pagesACCT102 - Modules 1-3 ReviewerkikoNo ratings yet

- Accounting For Partnership: I. TheoriesDocument10 pagesAccounting For Partnership: I. TheoriesyowatdafrickNo ratings yet

- The Independent Filmmaker's Law and Business Guide: Financing, Shooting, and Distributing Independent Films and SeriesFrom EverandThe Independent Filmmaker's Law and Business Guide: Financing, Shooting, and Distributing Independent Films and SeriesNo ratings yet

- Worksheet ch7 ch8 Without AnswersDocument9 pagesWorksheet ch7 ch8 Without Answerssahar201121999No ratings yet

- 2021 Term 1 Grade 10 Essay QuestionsDocument3 pages2021 Term 1 Grade 10 Essay QuestionsMpilonhle NtuliNo ratings yet

- Ae 18 Financial MarketsDocument6 pagesAe 18 Financial Marketsnglc srzNo ratings yet

- CB Insights - Venture Report 2022Document279 pagesCB Insights - Venture Report 2022TreviNo ratings yet

- Tutorial 7 Chapter 15: Cash Conversion CycleDocument8 pagesTutorial 7 Chapter 15: Cash Conversion CycleAlvaroNo ratings yet

- 3 Capital Market Consequences of Cultural Influences On EarningsDocument14 pages3 Capital Market Consequences of Cultural Influences On EarningsDuwi RiningsihNo ratings yet

- Quizzer 5Document2 pagesQuizzer 5Midas PhiNo ratings yet

- BOBCAPS NPA Conference - Key Takeaways 1mar19 - BOBCAPS ResearchDocument17 pagesBOBCAPS NPA Conference - Key Takeaways 1mar19 - BOBCAPS ResearchPardeep KumarNo ratings yet

- 5th Year Exam APMIDTERMDocument11 pages5th Year Exam APMIDTERMMark Domingo MendozaNo ratings yet

- Initiative and Responsive Activities in The Market Profile - LinkedInDocument1 pageInitiative and Responsive Activities in The Market Profile - LinkedInShahbaz SyedNo ratings yet

- Financial Feasibility - 1Document20 pagesFinancial Feasibility - 1Josie Casquijo BobisNo ratings yet

- Business FailureDocument12 pagesBusiness Failuregoneatlast1985No ratings yet

- Income Taxes: IAS 12: IFRS PrimerDocument35 pagesIncome Taxes: IAS 12: IFRS Primerbrushingman1No ratings yet

- Kasus 1 Analisis Common Size: PT Xyz Balance SheetDocument2 pagesKasus 1 Analisis Common Size: PT Xyz Balance SheetRosmawatiNo ratings yet

- MBFS - 3Document30 pagesMBFS - 3Kaviya KaviNo ratings yet

- A Study On How Derivative Instrument Used As An Effective Tool For Hedging, Speculation & ArbitrageDocument71 pagesA Study On How Derivative Instrument Used As An Effective Tool For Hedging, Speculation & Arbitrageujwaljaiswal100% (1)

- Advanced Liquidity by Elan - @traderslibrary2Document24 pagesAdvanced Liquidity by Elan - @traderslibrary2PrabhasKumarSinghNo ratings yet

- Comparitive Analysis of Mutual Funds With Equity Shares Project ReportDocument83 pagesComparitive Analysis of Mutual Funds With Equity Shares Project ReportRaghavendra yadav KM78% (69)

- Address: Kmps Building Tsinga, Carrefour-Fecafoot, Yaounde. CameroonDocument1 pageAddress: Kmps Building Tsinga, Carrefour-Fecafoot, Yaounde. CameroonSir NDambiNo ratings yet

- What Is Share Capital?: Company Receives Through Their Equity FinancingDocument6 pagesWhat Is Share Capital?: Company Receives Through Their Equity FinancingDominique B. PeronillaNo ratings yet

- Sun Phrma KoreaDocument7 pagesSun Phrma KoreaSiNo ratings yet

- Vouching and VerificationDocument10 pagesVouching and VerificationSaloni AgarwalNo ratings yet

- Final Thesis Report - RaviDocument107 pagesFinal Thesis Report - RavimaneeshpillaiNo ratings yet

- Foreign Investment IbDocument13 pagesForeign Investment Iblakshjan833No ratings yet

- Derringdo Question and AnswerDocument3 pagesDerringdo Question and Answerjustsee100% (2)

- MKT 670 - Chapter 1Document44 pagesMKT 670 - Chapter 1Leo AdamNo ratings yet

- MTI Japanese-Candlesticks - StrategyGuide PDFDocument3 pagesMTI Japanese-Candlesticks - StrategyGuide PDFJean Claude DavidNo ratings yet

- What Is Liquidity in The Forex Market - FX Liquidity - SMCDocument13 pagesWhat Is Liquidity in The Forex Market - FX Liquidity - SMCSebastian Gherman100% (2)

AC 1104 Digital Notes

AC 1104 Digital Notes

Uploaded by

Cu, Kathleen Kay M.0 ratings0% found this document useful (0 votes)

13 views3 pagesThis document discusses partnerships, including:

1) The definition, characteristics, advantages, and disadvantages of partnerships. It also covers the classification of partnerships based on various factors like contribution, liability, duration, and legality.

2) The steps required to register a partnership business, including requirements to register with regulatory agencies and obtain necessary permits.

3) Key components of a partnership contract and articles of co-partnership, including details about the partners, business purpose, capital contributions, and other terms.

4) Accounting treatments for partnerships, including opening entries, owner's equity accounts, and different methods for dividing profits and losses among partners.

Original Description:

midterm notes

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses partnerships, including:

1) The definition, characteristics, advantages, and disadvantages of partnerships. It also covers the classification of partnerships based on various factors like contribution, liability, duration, and legality.

2) The steps required to register a partnership business, including requirements to register with regulatory agencies and obtain necessary permits.

3) Key components of a partnership contract and articles of co-partnership, including details about the partners, business purpose, capital contributions, and other terms.

4) Accounting treatments for partnerships, including opening entries, owner's equity accounts, and different methods for dividing profits and losses among partners.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

13 views3 pagesAC 1104 Digital Notes

AC 1104 Digital Notes

Uploaded by

Cu, Kathleen Kay M.This document discusses partnerships, including:

1) The definition, characteristics, advantages, and disadvantages of partnerships. It also covers the classification of partnerships based on various factors like contribution, liability, duration, and legality.

2) The steps required to register a partnership business, including requirements to register with regulatory agencies and obtain necessary permits.

3) Key components of a partnership contract and articles of co-partnership, including details about the partners, business purpose, capital contributions, and other terms.

4) Accounting treatments for partnerships, including opening entries, owner's equity accounts, and different methods for dividing profits and losses among partners.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

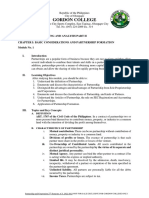

AC 1104: PARTNERSHIP AND CORPORATION

CHAPTER 1: PARTNERSHIP b. Ostensible/by Estoppel

FORMATION

VI. As to Publicity

Definition of Partnership

a. Secret

1. Art. 1767, Civil Code of the Phils. b. Open or Notorious

2. Uniform Partnership Act, Section 6

3. Eastman vs Clark, 52 N.H. 276, 16 Am. VII. As to Purpose

Rep. 192 a. Commercial

4. Mechem, Elements of the Law of b. GPPs

Partnership

5. Words and Phrases, 1957 Ed., page 291- VIII. As to Nature of Business

293 a. Trading

b. Non-trading

General Professional Partnership (GPP)

Classification of Partners

I. Profession

II. Exercise of a Profession I. As to Contribution

a. Capitalist

Characteristics of a Partnership b. Industrial

1. Mutual Contribution c. Capitalist-Industrial

2. Division of Profits or Losses II. As to Liability

3. Mutual Agency a. General

4. Co-Ownership of Contributed Assets b. Limited

5. Limited Life III. Other Classifications

6. Partner’s Equity Accounts a. Nominal

7. Income Taxes b. Secret

c. Silent

Advantages d. Dormant

I. Over Sole Proprietorships e. Managing

II. Over Corporations f. Liquidating

Disadvantages Steps to Register a Partnership Business

I. Over Sole Proprietorships 1. Register the business in the Securities

II. Over Corporations and Exchange Commission (SEC)

2. Get a Barangay Clearance

Classification of Partnership 3. Register the business and employees in

I. As to Object Social Security System (SSS)

a. Particular 4. Obtain a Business or Mayor’s Permit

b. Universal 5. Register the business with the Bureau of

- All present property Internal Revenue (BIR)

- Profits Partnership Contract

II. As to Liability of the partners There is a need for a partnership contract to be

a. General in writing when:

b. Limited a. Capital of the partnership is P3,000 or

more in money or property

III. As to Duration b. Immovable property or real rights are

a. Partnership at will contributed into the partnership

b. Partnership with a fixed term

The same shall also appear in the public

IV. As to Legality of its Existence instrument to be recovered in the SEC.

a. De jure Articles of Co-Partnership

b. De facto

a. Partnership name

V. As to Representation to Others

a. Ordinary or Real

b. Names, nationalities, and residences of the b. Fair Market Value – estimated amount a

partners (indicate if general or limited if willing seller would receive from a

limited partnership) capable buyer for the sale of the asset in

c. Principal office of the partnership a free market

d. Purpose of the partnership

Opening Entries of a Partnership upon

e. Duration of the partnership (term of

Formation

existence)

f. Capital of the Partnership I. Individuals with no existing business

g. Transfer clause form a partnership

h. Undertaking to change partnership name a. Record investment of each partner in

i. Other provisions, conditions, terms, and the partnership books

stipulations

j. Signatures of the partners II. A sole proprietor and another individual

k. Notarial Page forming a partnership

a. Adjust the sole proprietor’s books

Partnership Taxation

b. Close the books of the sole

- GPPs are exempt from income of tax proprietor

- Co-partnership subject to 25% c. Record the opening entries in the

- Partner’s share in GPP is subject to new partnership books

10% tax

- Dividend tax of 10% in co- III. Two sole proprietorships forming a

partnership partnership

- GPP individual income is subject to a. Adjust each proprietor’s capital

individual income tax accounts in accordance with the

- Co-partnership individual partners are agreement

not subject to individual income tax b. Close the books

c. Record the investment of each

CHAPTER 1.1: ACCOUNTING FOR

partner

PARTNERSHIP

CHAPTER 2: PARTNERSHIP

Owner’s Equity Accounts

OPERATIONS

- Credited for initial and additional net

Divisions of Profits and Losses

investments (credit balance)

- Debited for permanent withdrawals If no agreement is made, profits and losses are

(debit balance) divided according to original capital

contributions.

Loans to/from Partners

I. Equally

- If a partner withdraws a substantial

amount of money with the intention

II. In unequal/arbitrary ratio

of repaying it, the debit should be to

a. Multiply profit by ratio

Loans Receivable-Partner.

b. Record the product according to

- A partner may lend amounts to the

each partner

partnership more than his intended

permanent investment, credited to Division of P/L in the Ratio of Partners’ Capital

Loans Payable-Partner Account Balances

- In case of liquidation loans payable to

III. Ratio of Original Capital Balances

partners must be paid after the claims

a. Profit x original investment/total

of outside creditors have been paid in

capital investment of all partners

full

- These loans have priority over

IV. Ratio of Beginning Capital Balances

partners equity.

(is the same with ratio of original

CHAPTER 1.2 PARTNERSHIP capital balances but will differ after

FORMATION next accounting period since the

beginning capital balance refers to

Valuation of Investments by Partners

beginning capital of partner in the

a. Agreed value (upon agreement of accounting period)

partners)

a. Profit x capital balance at end of Balance divided equally

[(350,000)-228750]=121250 60,625 60,625 121,250

the period/total ending capital

balance of all partners

Partners’ Share in Profits 225,450 124,550 350,000

IX. Net profit before allowances for

V. Ratio of Average Capital Balances

salaries and interest but after

a. Calculate capital account balance

deduction of the bonus

x year unchanged = average

capital balances Net profit before

salaries, interest, and

Ex. bonus 300,000 =125%

Net profit after bonus

Capital Portion of the

(300,000/125%) 280,000 =100%

Date Account year

Bonus 70,000 =25%

Balance unchanged

Jan. 1 100,000 3/12 a. Follow standard procedure after

Apr. 1 190,000 6/12

getting the bonus by adding

Oct. 1 150,000 3/12

bonus

b. Add average capital balances of X. Net profit after allowances for

each partner for total average salaries and interest but before bonus

capital balances

c. Profit x average capital balance

Net profit before salaries,

of partner/total ave. capital 350,000

interest, and bonus

balance (Salaries) 100,000

(Interest) 41,250 141,250

VI. Interest allowed on Partners’ Capital Net profit before bonus 208,750

with Remaining Profit and Loss Bonus percentage 25%

Divided in an Agreed Ratio Bonus 52,188

a. Multiply interest with capital

b. Add total interest a. Follow standard procedure by

c. Subtract total interest from net adding bonus as subtrahend

profit = remainder from profit to calculate

d. Remainder divided equally (or remainder

according to agreement) = b. Share profits

partner’s share in profit/loss

e. Subtract/add share from capital XI. Net profit after allowances for

salaries, interest, and bonus

VII. Salary Allowance to Partners with Net profit before salaries,

Remaining Net Profit or Loss interest, and bonus 350,000

Divided in an Agreed Ratio

a. Add salary allowance to get total (Salaries) 100,000

salaries allowance (Interest) 41,250 141,250

b. Remainder = profit – total Net profit before bonus

208,750 =125%

salaries allowance

c. Divide remainder according to Net profit after bonus

167,000 =100%

agreement

Bonus 41,750 =25%

Bonus to Managing Partners Based on Net

Profit a. Follow standard procedure by

adding bonus as subtrahend

VIII. Net profit before allowances for from profit to calculate

salaries, interest, and bonus remainder

b. Share profits

Gomez Cando Total

Bonus x Profit

87,500 - 87,500

Salaries Allowance

60,000 40,000 100,000

Interest on Ave. capital

balances 17,325 23,925 41,250

You might also like

- Pre-Quali TQ 2a With Answer KeyDocument10 pagesPre-Quali TQ 2a With Answer KeyJeepee John100% (2)

- AssignmentValuationTemplate v1.0Document46 pagesAssignmentValuationTemplate v1.0HAMMADHRNo ratings yet

- MidTerm Exam, Partnership Formation, Operation and DissolutionDocument3 pagesMidTerm Exam, Partnership Formation, Operation and DissolutionIñego Begdorf100% (5)

- Chapter 1 5 Mylab Homework Exam 1 Fin 4604Document11 pagesChapter 1 5 Mylab Homework Exam 1 Fin 4604Mit DaveNo ratings yet

- Chapter 1 - Part 1Document2 pagesChapter 1 - Part 1clarizaNo ratings yet

- Accounting For Special TransactionDocument2 pagesAccounting For Special TransactionJoresol AlorroNo ratings yet

- Should Always: Exercise 1-1. True or FalseDocument7 pagesShould Always: Exercise 1-1. True or FalseDeanmark RondinaNo ratings yet

- University of Mindanao Panabo College: Items 12-13Document3 pagesUniversity of Mindanao Panabo College: Items 12-13Jessa BeloyNo ratings yet

- Partnership and RCCDocument24 pagesPartnership and RCCJames CantorneNo ratings yet

- Chapter 1 Partnership FormationDocument3 pagesChapter 1 Partnership FormationLyka Mae E. MarianoNo ratings yet

- Far 1 Partnership FormationDocument6 pagesFar 1 Partnership Formationunlocks by xijiNo ratings yet

- Part I Bus LawDocument2 pagesPart I Bus LawShang Bugayong50% (6)

- Far ReviewerDocument43 pagesFar ReviewerAl Robert Angelo LoretoNo ratings yet

- Consensual - Perfected by A Mere ConsentDocument3 pagesConsensual - Perfected by A Mere ConsentRey Joyce AbuelNo ratings yet

- Accounting2 1Document4 pagesAccounting2 1Andrianne MontefalcoNo ratings yet

- Advanced Financial Accounting and Reporting (Partnership)Document5 pagesAdvanced Financial Accounting and Reporting (Partnership)Mike C Buceta100% (1)

- Forms of Business OrganizationDocument2 pagesForms of Business OrganizationJaypee ManiegoNo ratings yet

- LAW 102 (Reviewer)Document15 pagesLAW 102 (Reviewer)Marie GarpiaNo ratings yet

- Far 1 Partnership FormationDocument6 pagesFar 1 Partnership Formationmachelle francisco100% (9)

- ACC 311 ReviewDocument2 pagesACC 311 ReviewMaricar DimayugaNo ratings yet

- 2 - Practical Accounting 2Document2 pages2 - Practical Accounting 2Ruel VicenteNo ratings yet

- Partnership - I: "Your Online Partner To Get Your Title"Document10 pagesPartnership - I: "Your Online Partner To Get Your Title"Arlene Diane OrozcoNo ratings yet

- Module 1 Student Version Partnership Formation Revised 2Document30 pagesModule 1 Student Version Partnership Formation Revised 2Day77No ratings yet

- Bam201 ReviewerDocument7 pagesBam201 Reviewerjireh mallariNo ratings yet

- Prelim Exam, Partnership Formation and Operation PDFDocument2 pagesPrelim Exam, Partnership Formation and Operation PDFIñego BegdorfNo ratings yet

- RFBT Chapter2 OutlineDocument20 pagesRFBT Chapter2 OutlineCheriferDahangCoNo ratings yet

- Chapter 1-Partnership FormationDocument5 pagesChapter 1-Partnership Formationbestinthesis.group11No ratings yet

- The Law On Partnership: Business LawsDocument4 pagesThe Law On Partnership: Business LawsLFGS FinalsNo ratings yet

- 01 - Module 1Document13 pages01 - Module 1Daniel FranciscoNo ratings yet

- UntitledDocument5 pagesUntitledBUENAFE, Randene Marie YohanNo ratings yet

- College of Business Administration Law On Business Organization Part I. IdentificationDocument2 pagesCollege of Business Administration Law On Business Organization Part I. IdentificationGhrace Segundo CocalNo ratings yet

- Partnership - Nature and ConceptDocument8 pagesPartnership - Nature and ConceptRiyah ParasNo ratings yet

- Learning Task No.1Document2 pagesLearning Task No.1Carl Oliver LacanlaleNo ratings yet

- LECTURE NOTES - Law On PartnershipsDocument6 pagesLECTURE NOTES - Law On Partnershipssad nu100% (1)

- Partnership TheoriesDocument5 pagesPartnership TheoriesThomas MarianoNo ratings yet

- General Principles: Lecture Notes in LAW On PARTNERSHIP (BL-09)Document10 pagesGeneral Principles: Lecture Notes in LAW On PARTNERSHIP (BL-09)Francis Louie Allera HumawidNo ratings yet

- Parcoac Prelim Reviewer 2Document5 pagesParcoac Prelim Reviewer 2tokyoescotoNo ratings yet

- BL2 Chap1Document1 pageBL2 Chap1Maria Freyja Darlene CruzNo ratings yet

- 2019 Sqe Reviewer - Fundamentals of Accounting Parts 1 and 2 PDFDocument23 pages2019 Sqe Reviewer - Fundamentals of Accounting Parts 1 and 2 PDFJohn Marfhel PrestadoNo ratings yet

- Chapter 1 - Partnership Formation PDFDocument33 pagesChapter 1 - Partnership Formation PDFAldrin ZolinaNo ratings yet

- Partnership TheoryDocument10 pagesPartnership TheorynikoleNo ratings yet

- Afar PartnershipDocument6 pagesAfar PartnershipSheena Baylosis0% (1)

- Special TransactionsDocument3 pagesSpecial TransactionsTracy AguirreNo ratings yet

- SAN BEDA COLLEGE Mendiola Manila Departm PDFDocument8 pagesSAN BEDA COLLEGE Mendiola Manila Departm PDFAlvaroNo ratings yet

- T 01 PartnershipsDocument5 pagesT 01 PartnershipsCPMNo ratings yet

- Business Law and Regulation Quiz 1Document5 pagesBusiness Law and Regulation Quiz 1Jennica Mae RuizNo ratings yet

- PARTNERSHIP Theories With ExplanationDocument5 pagesPARTNERSHIP Theories With ExplanationNikka PatarataNo ratings yet

- Business Law and Regulation Quiz 2Document6 pagesBusiness Law and Regulation Quiz 2Jennica Mae RuizNo ratings yet

- Partnership-Dissolution ExercisesDocument2 pagesPartnership-Dissolution ExercisesLeenNo ratings yet

- Determining Formation of Partnership: or Agree To Form A PartnershipDocument74 pagesDetermining Formation of Partnership: or Agree To Form A PartnershipAlana Hans-CohenNo ratings yet

- Partnership AccountingDocument3 pagesPartnership Accountingmojii caarrNo ratings yet

- Accounting For Partnership: Part 2Document15 pagesAccounting For Partnership: Part 2Lady Fe DielNo ratings yet

- EH405 ATP WWW - Midterm ExamDocument3 pagesEH405 ATP WWW - Midterm ExamJandi Yang100% (1)

- Chapter 2Document13 pagesChapter 2bartabatoes rerunNo ratings yet

- AFAR 01 - Partnership AccountingDocument7 pagesAFAR 01 - Partnership AccountingcheoreciNo ratings yet

- Booklet 4 PartnershipDocument26 pagesBooklet 4 PartnershipSheldon SyndromeNo ratings yet

- 01 Partnership FormationDocument5 pages01 Partnership FormationJohn Carl TuazonNo ratings yet

- Final Module Summer Review Class A.Y 2018 2019Document57 pagesFinal Module Summer Review Class A.Y 2018 2019Jessie jorgeNo ratings yet

- ACCT102 - Modules 1-3 ReviewerDocument31 pagesACCT102 - Modules 1-3 ReviewerkikoNo ratings yet

- Accounting For Partnership: I. TheoriesDocument10 pagesAccounting For Partnership: I. TheoriesyowatdafrickNo ratings yet

- The Independent Filmmaker's Law and Business Guide: Financing, Shooting, and Distributing Independent Films and SeriesFrom EverandThe Independent Filmmaker's Law and Business Guide: Financing, Shooting, and Distributing Independent Films and SeriesNo ratings yet

- Worksheet ch7 ch8 Without AnswersDocument9 pagesWorksheet ch7 ch8 Without Answerssahar201121999No ratings yet

- 2021 Term 1 Grade 10 Essay QuestionsDocument3 pages2021 Term 1 Grade 10 Essay QuestionsMpilonhle NtuliNo ratings yet

- Ae 18 Financial MarketsDocument6 pagesAe 18 Financial Marketsnglc srzNo ratings yet

- CB Insights - Venture Report 2022Document279 pagesCB Insights - Venture Report 2022TreviNo ratings yet

- Tutorial 7 Chapter 15: Cash Conversion CycleDocument8 pagesTutorial 7 Chapter 15: Cash Conversion CycleAlvaroNo ratings yet

- 3 Capital Market Consequences of Cultural Influences On EarningsDocument14 pages3 Capital Market Consequences of Cultural Influences On EarningsDuwi RiningsihNo ratings yet

- Quizzer 5Document2 pagesQuizzer 5Midas PhiNo ratings yet

- BOBCAPS NPA Conference - Key Takeaways 1mar19 - BOBCAPS ResearchDocument17 pagesBOBCAPS NPA Conference - Key Takeaways 1mar19 - BOBCAPS ResearchPardeep KumarNo ratings yet

- 5th Year Exam APMIDTERMDocument11 pages5th Year Exam APMIDTERMMark Domingo MendozaNo ratings yet

- Initiative and Responsive Activities in The Market Profile - LinkedInDocument1 pageInitiative and Responsive Activities in The Market Profile - LinkedInShahbaz SyedNo ratings yet

- Financial Feasibility - 1Document20 pagesFinancial Feasibility - 1Josie Casquijo BobisNo ratings yet

- Business FailureDocument12 pagesBusiness Failuregoneatlast1985No ratings yet

- Income Taxes: IAS 12: IFRS PrimerDocument35 pagesIncome Taxes: IAS 12: IFRS Primerbrushingman1No ratings yet

- Kasus 1 Analisis Common Size: PT Xyz Balance SheetDocument2 pagesKasus 1 Analisis Common Size: PT Xyz Balance SheetRosmawatiNo ratings yet

- MBFS - 3Document30 pagesMBFS - 3Kaviya KaviNo ratings yet

- A Study On How Derivative Instrument Used As An Effective Tool For Hedging, Speculation & ArbitrageDocument71 pagesA Study On How Derivative Instrument Used As An Effective Tool For Hedging, Speculation & Arbitrageujwaljaiswal100% (1)

- Advanced Liquidity by Elan - @traderslibrary2Document24 pagesAdvanced Liquidity by Elan - @traderslibrary2PrabhasKumarSinghNo ratings yet

- Comparitive Analysis of Mutual Funds With Equity Shares Project ReportDocument83 pagesComparitive Analysis of Mutual Funds With Equity Shares Project ReportRaghavendra yadav KM78% (69)

- Address: Kmps Building Tsinga, Carrefour-Fecafoot, Yaounde. CameroonDocument1 pageAddress: Kmps Building Tsinga, Carrefour-Fecafoot, Yaounde. CameroonSir NDambiNo ratings yet

- What Is Share Capital?: Company Receives Through Their Equity FinancingDocument6 pagesWhat Is Share Capital?: Company Receives Through Their Equity FinancingDominique B. PeronillaNo ratings yet

- Sun Phrma KoreaDocument7 pagesSun Phrma KoreaSiNo ratings yet

- Vouching and VerificationDocument10 pagesVouching and VerificationSaloni AgarwalNo ratings yet

- Final Thesis Report - RaviDocument107 pagesFinal Thesis Report - RavimaneeshpillaiNo ratings yet

- Foreign Investment IbDocument13 pagesForeign Investment Iblakshjan833No ratings yet

- Derringdo Question and AnswerDocument3 pagesDerringdo Question and Answerjustsee100% (2)

- MKT 670 - Chapter 1Document44 pagesMKT 670 - Chapter 1Leo AdamNo ratings yet

- MTI Japanese-Candlesticks - StrategyGuide PDFDocument3 pagesMTI Japanese-Candlesticks - StrategyGuide PDFJean Claude DavidNo ratings yet

- What Is Liquidity in The Forex Market - FX Liquidity - SMCDocument13 pagesWhat Is Liquidity in The Forex Market - FX Liquidity - SMCSebastian Gherman100% (2)