Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

60 viewsBDO

BDO

Uploaded by

Vince Raphael Miranda- BDO Unibank, Inc. is a Philippines-based bank that provides various banking services including commercial and retail banking.

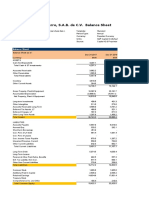

- As of December 2019, BDO had total assets of PHP3.19 trillion, with net loans making up the largest portion at PHP2.28 trillion.

- BDO's main liabilities were total deposits of PHP2.49 trillion and total debt of PHP207 billion.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- Regulatory Framework and Legal Issues in Business Part 1 by Atty. Andrix Domingo 2021edDocument60 pagesRegulatory Framework and Legal Issues in Business Part 1 by Atty. Andrix Domingo 2021edAmethyst Lee100% (3)

- Western Constitutionalism - Andrea BurattiDocument257 pagesWestern Constitutionalism - Andrea BurattiGulrukh SadullayevaNo ratings yet

- Group Case 2 - Playing The Numbers GameDocument33 pagesGroup Case 2 - Playing The Numbers GameHannahPojaFeria0% (1)

- Coaches Guide Re LGU Devolution Transition PlanDocument52 pagesCoaches Guide Re LGU Devolution Transition PlanMajin Bukay75% (8)

- Bidding For Hertz Leveraged Buyout, Spreadsheet SupplementDocument12 pagesBidding For Hertz Leveraged Buyout, Spreadsheet SupplementAmit AdmuneNo ratings yet

- CASE Exhibits - HertzDocument15 pagesCASE Exhibits - HertzSeemaNo ratings yet

- Termination EN2020Document4 pagesTermination EN2020Milos MihajlovicNo ratings yet

- Final Case Study Investment AnalysisDocument4 pagesFinal Case Study Investment AnalysisMuhammad Ahsan MubeenNo ratings yet

- Ermenegildo Zegna N.V. (ZGN)Document2 pagesErmenegildo Zegna N.V. (ZGN)Carlos Suárez MatosNo ratings yet

- Max Healthcare Institute Limited BSE 539981 Financials Balance SheetDocument3 pagesMax Healthcare Institute Limited BSE 539981 Financials Balance Sheetakumar4uNo ratings yet

- Promit Singh Rathore - 20PGPM111Document14 pagesPromit Singh Rathore - 20PGPM111mahiyuvi mahiyuviNo ratings yet

- Adv EnzDocument4 pagesAdv EnzSafwan BhikhaNo ratings yet

- Sample Working Capital Per Dollar of Sales Calculation: Total Sales Income StatementDocument7 pagesSample Working Capital Per Dollar of Sales Calculation: Total Sales Income StatementsanjusarkarNo ratings yet

- PVR LTD (PVRL IN) - StandardizedDocument18 pagesPVR LTD (PVRL IN) - StandardizedSrinidhi SrinathNo ratings yet

- Group AssignmentDocument4 pagesGroup Assignment1954032027cucNo ratings yet

- Financial Statements-Kingsley AkinolaDocument4 pagesFinancial Statements-Kingsley AkinolaKingsley AkinolaNo ratings yet

- Prova Múltiplos Ciclo 2023.1Document14 pagesProva Múltiplos Ciclo 2023.1Jadi MouradNo ratings yet

- Accountingfor Managers Assignment 2 Part-I: Is A Budget?Document9 pagesAccountingfor Managers Assignment 2 Part-I: Is A Budget?Amit SanglikarNo ratings yet

- Prospective Analysis 1Document5 pagesProspective Analysis 1MAYANK JAINNo ratings yet

- Narayana Hrudayalaya Limited NSEI NH Financials Balance SheetDocument2 pagesNarayana Hrudayalaya Limited NSEI NH Financials Balance Sheetakumar4uNo ratings yet

- Nestle Income Statement & Balance SheetDocument10 pagesNestle Income Statement & Balance SheetDristi SinghNo ratings yet

- Shalby Limited BSE 540797 Financials Balance SheetDocument3 pagesShalby Limited BSE 540797 Financials Balance Sheetakumar4uNo ratings yet

- Dabur India LTD: Change 31-Mar-19 31-Mar-18 31-Mar-19 31-Mar-18Document3 pagesDabur India LTD: Change 31-Mar-19 31-Mar-18 31-Mar-19 31-Mar-18VIJAY KUMARNo ratings yet

- Slides Week 8 No AnswerDocument38 pagesSlides Week 8 No Answerchingwen731No ratings yet

- SUEZ 2019 Financial Consolidated Statements ENDocument112 pagesSUEZ 2019 Financial Consolidated Statements ENnhat quangNo ratings yet

- Beyond Meat Inc NasdaqGS BYND FinancialsDocument6 pagesBeyond Meat Inc NasdaqGS BYND FinancialsFabricio Arturo Olalde MacedoNo ratings yet

- Financial Statements For Jollibee Foods CorporationDocument4 pagesFinancial Statements For Jollibee Foods CorporationKevin CeladaNo ratings yet

- Pidilite IndustriesDocument5 pagesPidilite IndustriesPrena JoshiNo ratings yet

- Private Company Financials Balance Sheet: Xchanging Software Europe LimitedDocument1 pagePrivate Company Financials Balance Sheet: Xchanging Software Europe Limitedprabhav2050No ratings yet

- Efrs 2014-2018 Amsa. Ratios-Final-2Document60 pagesEfrs 2014-2018 Amsa. Ratios-Final-2Nicolás Bórquez MonsalveNo ratings yet

- Nestle Financial Statements - 2022Document4 pagesNestle Financial Statements - 2022dpr7033No ratings yet

- Wassim Zhani Starbucks Valuation 2007-2011Document13 pagesWassim Zhani Starbucks Valuation 2007-2011wassim zhaniNo ratings yet

- Adidas AG Consolidated Statement of Financial Position (IFRS)Document6 pagesAdidas AG Consolidated Statement of Financial Position (IFRS)Sanjeev ThadaniNo ratings yet

- Actividad 3.1Document27 pagesActividad 3.1David RiosNo ratings yet

- Housing Development Finance Corp LTD (HDFC IN) - StandardizedDocument4 pagesHousing Development Finance Corp LTD (HDFC IN) - StandardizedAswini Kumar BhuyanNo ratings yet

- Q3 2022 Quarterly Financial Statements VT Group AGDocument6 pagesQ3 2022 Quarterly Financial Statements VT Group AGAmr YehiaNo ratings yet

- Financial Statements For Jollibee Foods CorporationDocument8 pagesFinancial Statements For Jollibee Foods CorporationJ U D YNo ratings yet

- Komatsu LTD (6301 JT) - StandardizedDocument36 pagesKomatsu LTD (6301 JT) - StandardizedIan RiceNo ratings yet

- Tallu Spinning Mills: Particulars 2009 2010 2011 2012 2013Document109 pagesTallu Spinning Mills: Particulars 2009 2010 2011 2012 2013Shovon MustaryNo ratings yet

- Ayush AccountsDocument22 pagesAyush AccountsAyush AnandNo ratings yet

- Traveller Balance SheetDocument4 pagesTraveller Balance SheetMathi Mahi JayanthNo ratings yet

- Cash Flows:: Currency in Millions of U.S. DollarsDocument3 pagesCash Flows:: Currency in Millions of U.S. DollarscutooteddyNo ratings yet

- Acc FCFFDocument25 pagesAcc FCFFArchit PateriaNo ratings yet

- Valuation, Case #KEL790Document40 pagesValuation, Case #KEL790neelakanta srikarNo ratings yet

- Caso HertzDocument32 pagesCaso HertzJORGE PUENTESNo ratings yet

- Siyaram Silk Balance SheetDocument2 pagesSiyaram Silk Balance SheetPAWAN CHANDAKNo ratings yet

- CV Case 3Document40 pagesCV Case 3neelakanta srikarNo ratings yet

- Landmark CaseDocument22 pagesLandmark CaseLauren KlaassenNo ratings yet

- Standalone Balance Sheet - Lupin LTD.: ParticularsDocument26 pagesStandalone Balance Sheet - Lupin LTD.: ParticularsshubhNo ratings yet

- E I D-Parry (India) LTD.: Balance Sheet Summary: Mar 2011 - Mar 2020: Non-Annualised: Rs. CroreDocument15 pagesE I D-Parry (India) LTD.: Balance Sheet Summary: Mar 2011 - Mar 2020: Non-Annualised: Rs. Crorehardik aroraNo ratings yet

- Fortis Healthcare: Previous YearsDocument20 pagesFortis Healthcare: Previous YearsShuBham KanswalNo ratings yet

- Audited Financials Dec 2022Document1 pageAudited Financials Dec 2022EdwinNo ratings yet

- CV Assignment - Group 3Document6 pagesCV Assignment - Group 3HEM BANSALNo ratings yet

- Case ExhibitsDocument7 pagesCase Exhibitsug8No ratings yet

- AMBUJADocument2 pagesAMBUJAAbhay Kumar SinghNo ratings yet

- Ashok Leyland RatioDocument9 pagesAshok Leyland Ratiomudit mohanNo ratings yet

- Financial AnalysisDocument6 pagesFinancial AnalysisRinceNo ratings yet

- Taiwan Semiconductor Manufacturing Company Limited and Subsidiaries Consolidated Condensed Balance SheetDocument4 pagesTaiwan Semiconductor Manufacturing Company Limited and Subsidiaries Consolidated Condensed Balance SheetHarry KilNo ratings yet

- AMBUJA Moneycontrol - Com - Company Info - Print FinancialsDocument2 pagesAMBUJA Moneycontrol - Com - Company Info - Print FinancialsMohammad DishanNo ratings yet

- Hindalco Balance SheetDocument2 pagesHindalco Balance Sheetakhilesh718No ratings yet

- Levi Strauss & Co Fs 2023Document6 pagesLevi Strauss & Co Fs 2023Info Riskma SolutionsNo ratings yet

- Rieter Consolidated Balance Sheet 2020 enDocument1 pageRieter Consolidated Balance Sheet 2020 enMuhammadSiddiqNo ratings yet

- Du Pont AnalysisDocument5 pagesDu Pont Analysisbhavani67% (3)

- Exhibit 1 Horniman Horticulture Projected Horniman Horticulture Financial Summary (In Thousands of Dollars)Document2 pagesExhibit 1 Horniman Horticulture Projected Horniman Horticulture Financial Summary (In Thousands of Dollars)Hằng Dương Thị MinhNo ratings yet

- Robinson's Galleria Vs SanchezDocument9 pagesRobinson's Galleria Vs SanchezChristelle Ayn BaldosNo ratings yet

- 2014-07-21 Monthly Attendance Report Template Format OptionsDocument3 pages2014-07-21 Monthly Attendance Report Template Format OptionsAhmed El AmraniNo ratings yet

- Declaration of Independence (Seacret App)Document2 pagesDeclaration of Independence (Seacret App)api-281934739No ratings yet

- Rights Persons Disabilities Rules 2017 0 PDFDocument70 pagesRights Persons Disabilities Rules 2017 0 PDFParamasiva KumarNo ratings yet

- ID TheftDocument3 pagesID TheftShawn FreemanNo ratings yet

- What Are The Laws That Paved The Way Towards Making Accountancy A Recognized ProfessionDocument3 pagesWhat Are The Laws That Paved The Way Towards Making Accountancy A Recognized ProfessionVirginia PalisukNo ratings yet

- Regional Staff MeetingDocument1 pageRegional Staff MeetingShintara Pagsanjan DimanzanaNo ratings yet

- Azure Devops Security Checklist: 17 Green Lanes, London, England, N16 9BsDocument38 pagesAzure Devops Security Checklist: 17 Green Lanes, London, England, N16 9BsavaldirisNo ratings yet

- Signs of Laylatul QadrDocument2 pagesSigns of Laylatul QadrMountainofknowledgeNo ratings yet

- Issues and Taboo Topics For Debate - Nobody Needs A GunDocument2 pagesIssues and Taboo Topics For Debate - Nobody Needs A GunluciasnmNo ratings yet

- IBM Z CloudDocument18 pagesIBM Z CloudrajeshbabupNo ratings yet

- U.S. Equal Employment Opportunity Commission v. Norfolk Southern Corp.Document33 pagesU.S. Equal Employment Opportunity Commission v. Norfolk Southern Corp.Ryan CaneNo ratings yet

- Grooming and Sexual Offences DataDocument2 pagesGrooming and Sexual Offences DataKash Ahmed100% (1)

- Module 2A PDFDocument13 pagesModule 2A PDFdeepak singhalNo ratings yet

- J Diin 2011 03 002Document6 pagesJ Diin 2011 03 002nanaNo ratings yet

- Extension in PaymentDocument3 pagesExtension in PaymentAbhishek VermaNo ratings yet

- JetDryer JetLite Instruction Manual PDFDocument6 pagesJetDryer JetLite Instruction Manual PDFDylan ParkNo ratings yet

- Final - Writ - Petition - For - Filing-PB Singh vs. State of MaharashtraDocument130 pagesFinal - Writ - Petition - For - Filing-PB Singh vs. State of MaharashtraRepublicNo ratings yet

- Gicely Sarai Flores-Velasquez, A205 277 572 (BIA April 24, 2015)Document8 pagesGicely Sarai Flores-Velasquez, A205 277 572 (BIA April 24, 2015)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Colonial Powers, Nation-States and Kerajaan in Maritime Southeast Asia: Structures, Legalities and PerceptionsDocument14 pagesColonial Powers, Nation-States and Kerajaan in Maritime Southeast Asia: Structures, Legalities and Perceptionsanjangandak2932No ratings yet

- Tendernotice 1Document223 pagesTendernotice 1kaushalkumar085No ratings yet

- Syllabus and Aims and ObjectivesDocument9 pagesSyllabus and Aims and ObjectivesSecretaria OrangeNo ratings yet

- CH 1 - Introduction To Financial ManagementDocument18 pagesCH 1 - Introduction To Financial Managementmaheshbendigeri5945No ratings yet

- List of Certified Workshop SarawakDocument48 pagesList of Certified Workshop SarawakIkhwan Firdausi SazaliNo ratings yet

- Exit & Notice Period PolicyDocument9 pagesExit & Notice Period PolicySarfaraz RahutNo ratings yet

BDO

BDO

Uploaded by

Vince Raphael Miranda0 ratings0% found this document useful (0 votes)

60 views6 pages- BDO Unibank, Inc. is a Philippines-based bank that provides various banking services including commercial and retail banking.

- As of December 2019, BDO had total assets of PHP3.19 trillion, with net loans making up the largest portion at PHP2.28 trillion.

- BDO's main liabilities were total deposits of PHP2.49 trillion and total debt of PHP207 billion.

Original Description:

Original Title

BDO.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document- BDO Unibank, Inc. is a Philippines-based bank that provides various banking services including commercial and retail banking.

- As of December 2019, BDO had total assets of PHP3.19 trillion, with net loans making up the largest portion at PHP2.28 trillion.

- BDO's main liabilities were total deposits of PHP2.49 trillion and total debt of PHP207 billion.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

60 views6 pagesBDO

BDO

Uploaded by

Vince Raphael Miranda- BDO Unibank, Inc. is a Philippines-based bank that provides various banking services including commercial and retail banking.

- As of December 2019, BDO had total assets of PHP3.19 trillion, with net loans making up the largest portion at PHP2.28 trillion.

- BDO's main liabilities were total deposits of PHP2.49 trillion and total debt of PHP207 billion.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 6

BDO Unibank, Inc.

BDO-PH B5VJH76 Philippines Common stock

Source: FactSet Fundamentals

DEC '19 DEC '18 DEC '17 DEC '16

365 Days 365 Days 365 Days 366 Days

Assets

Cash & Due from Banks 354.7 413.1 402.8 363.0

Investments 435.9 407.2 351.2 283.3

Trading Account Securities 27.1 20.3 14.7 14.0

Federal Funds Sold & Securities Purchased - 22.0 18.3 14.3

Securities Bought Under Resale Agreement - 22.0 18.3 14.3

Treasury Securities 293.3 259.2 221.8 168.7

Other Securities 115.5 105.7 96.4 86.4

Other Investments 0.0 0.0 0.0 -

Net Loans 2,279.4 2,097.9 1,814.2 1,571.1

Gross Loans - Net of Unearned Income 2,279.4 2,124.6 1,844.1 1,597.2

Commercial & Industrial Loans 2,048.1 1,010.5 714.7 627.3

Consumer & Installment Loans 161.4 324.3 483.2 374.0

Interbank Loans 101.4 104.6 89.2 115.2

Real Estate Mortgage Loans - 242.8 227.1 205.4

Broker & Financial Institution Loans - 292.9 195.9 150.7

Other/Unspecified Loans -31.6 151.8 135.5 126.0

Unearned Income - -2.2 -1.4 -1.3

Loan Loss Allowances (Reserves) - -26.8 -29.9 -26.2

Investment in Unconsolidated Subs. 5.0 5.1 4.9 4.4

Real Estate Other Than Bank Premises 17.3 20.9 20.4 17.6

Net Property, Plant & Equipment 46.6 33.7 29.3 26.9

Interest Receivables 0.0 0.0 0.0 -

Deferred Tax Assets 9.6 9.0 8.1 7.8

Other Assets 41.1 36.1 37.8 52.3

Other Tangible Assets 21.4 17.3 21.3 36.5

Intangible Assets 9.4 10.0 9.9 9.7

Goodwill 4.5 4.4 4.4 4.4

Other Intangible Assets 4.9 5.6 5.4 5.3

Deferred Charges 10.3 8.9 6.6 6.0

Total Assets 3,189.5 3,022.9 2,668.8 2,326.4

Liabilities & Shareholders' Equity

Total Deposits 2,485.2 2,407.9 2,107.9 1,905.2

Demand Deposits and Other Transaction Accounts 233.0 177.7 133.5 114.3

Savings & Time Deposits 2,252.2 2,230.2 1,974.3 1,790.9

Total Debt 207.0 165.7 153.7 110.6

ST Debt & Curr. Portion LT Debt 107.6 47.9 68.9 60.0

Long-Term Debt 99.4 117.9 84.7 50.6

Long-Term Debt excl Lease Obligations 89.7 117.9 84.7 50.6

Capital and Operating Lease Obligations 9.6 0.0 0.0 0.0

Provision for Risks & Charges 3.3 4.5 2.8 -

Deferred Tax Liabilities 0.7 0.7 0.7 1.4

Other Liabilities 122.8 115.9 105.5 91.6

Other Liabilities (excl. Deferred Income) 122.8 115.9 105.4 91.6

Deferred Income - 0.0 0.0 0.0

Total Liabilities 2,819.0 2,694.8 2,370.5 2,108.9

Preferred Stock (Carrying Value) 5.2 5.2 5.2 5.2

Non-Redeemable Preferred Stock 5.2 5.2 5.2 5.2

Common Equity 363.8 322.2 292.3 211.6

Common Stock Par/Carry Value 43.8 43.7 43.7 36.5

Additional Paid-In Capital/Capital Surplus 124.0 123.4 123.0 70.1

Retained Earnings 192.3 156.3 133.5 109.2

Cumulative Translation Adjustment 0.0 0.0 0.0 0.0

Unrealized Gain/Loss Marketable Securities -1.7 -10.4 -4.0 -3.9

Revaluation Reserves 1.0 1.0 1.0 1.0

Other Appropriated Reserves 7.1 5.9 -3.5 -1.3

Unappropriated Reserves -2.8 2.3 -1.4 0.0

Treasury Stock 0.0 0.0 0.0 0.0

Total Shareholders' Equity 368.9 327.4 297.5 216.8

Accumulated Minority Interest 1.7 0.8 0.9 0.7

Total Equity 370.6 328.1 298.3 217.5

Total Liabilities & Shareholders' Equity 3,189.5 3,022.9 2,668.8 2,326.4

Per Share

Book Value per Share 83.02 73.67 66.91 55.41

Tangible Book Value per Share 80.86 71.38 64.65 52.85

All figures in billions of Philippines Peso except per share items.

DEC '15 DEC '14 DEC '13 DEC '12 DEC '11 DEC '10 DEC '09 DEC '08 DEC '07

365 Days 365 Days 365 Days 366 Days 365 Days 365 Days 365 Days 366 Days 365 Days

323.1 318.5 442.4 150.9 69.0 102.4 95.6 84.9 72.3

295.2 307.7 236.3 238.2 193.4 200.2 171.7 156.2 166.0

13.6 8.8 9.7 4.4 1.1 2.3 2.9 2.6 -

69.5 86.2 8.4 0.9 5.0 2.9 - - -

69.5 86.2 8.4 0.9 5.0 2.9 - - -

137.2 141.6 147.9 165.8 138.5 143.1 134.0 117.3 104.6

75.0 71.2 70.2 62.3 45.1 46.8 29.2 32.0 56.8

- - - 4.8 3.7 5.1 5.6 4.3 4.6

1,329.9 1,145.8 930.5 790.9 772.2 634.2 520.1 440.3 315.1

1,279.4 1,172.5 955.7 817.6 796.5 657.7 542.6 459.5 333.6

514.5 574.0 387.6 357.6 325.1 252.5 193.9 174.0 131.6

298.9 147.2 9.6 - - - - - -

76.8 84.8 46.9 48.7 126.4 116.2 70.0 66.7 36.6

184.8 114.5 147.6 110.5 77.6 55.8 49.7 30.6 23.9

169.1 181.6 131.2 107.7 84.7 79.1 84.1 65.5 36.3

113.5 72.1 235.4 193.1 182.8 154.1 144.9 122.7 105.2

-1.4 -1.7 -2.7 - - - - - -

-26.2 -26.8 -25.2 -26.7 -24.4 -23.5 -22.5 -19.1 -18.5

5.7 5.9 4.8 4.4 4.2 3.9 2.2 1.7 1.7

16.4 16.1 12.7 11.8 13.5 15.4 13.8 15.2 18.2

25.0 21.1 17.9 16.4 15.7 15.1 14.7 14.7 11.4

- - - - - - - - -

7.7 7.7 7.1 7.2 6.7 6.7 5.7 5.8 5.6

29.7 42.6 22.2 26.6 23.9 24.1 38.1 83.2 27.1

18.9 35.1 19.0 19.9 22.2 22.5 36.3 82.0 25.2

9.0 5.8 2.1 2.0 1.4 1.6 1.7 0.7 0.7

4.4 1.5 1.5 1.4 1.2 1.2 1.2 0.7 0.7

4.6 4.3 0.6 0.6 0.1 0.4 0.5 0.0 0.0

1.8 1.7 1.1 4.7 0.3 0.0 0.1 0.5 1.1

2,032.9 1,865.3 1,673.9 1,246.5 1,098.6 1,002.0 862.0 802.0 617.4

1,656.9 1,481.0 1,337.3 928.7 854.0 774.7 694.7 636.8 445.4

102.5 84.7 78.6 48.1 47.7 44.7 42.7 36.3 25.2

1,554.4 1,396.3 1,258.7 880.6 806.3 730.0 652.0 600.4 420.2

114.6 121.7 105.3 103.3 102.3 96.9 54.6 71.6 71.1

59.2 63.5 70.0 45.6 47.4 73.8 31.4 51.4 52.5

55.4 58.2 35.3 57.7 55.0 23.2 23.2 20.1 18.6

55.4 58.2 35.3 57.7 55.0 23.2 23.2 20.1 18.6

0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

- - - - - - - - -

1.7 1.6 1.2 2.1 1.3 1.1 - - -

60.2 81.3 65.8 55.2 44.1 40.5 44.9 35.9 40.4

60.2 81.3 65.5 54.3 43.1 39.4 44.9 35.9 40.4

0.0 0.0 0.3 0.8 1.0 1.1 0.0 0.0 0.0

1,833.3 1,685.6 1,509.6 1,089.2 1,001.6 913.2 794.2 744.3 556.9

5.2 5.2 5.2 5.2 5.0 5.0 0.0 0.0 0.0

5.2 5.2 5.2 5.2 5.0 5.0 0.0 0.0 0.0

193.8 173.9 158.6 151.4 91.3 83.0 67.3 57.1 59.8

36.5 35.8 35.8 35.8 26.1 26.1 28.4 28.0 23.0

69.9 63.9 63.9 63.9 25.2 25.2 16.9 15.9 15.9

88.1 70.2 55.8 41.1 33.3 25.7 19.4 13.9 15.8

-0.1 -0.1 -0.1 -0.4 -0.4 -0.4 0.0 0.0 0.0

-0.7 3.0 2.6 7.6 4.4 3.7 -0.1 -3.5 2.6

1.0 1.0 1.0 1.1 1.1 1.2 1.2 1.3 1.4

-0.9 0.0 -0.4 2.3 1.7 1.6 - 0.1 0.1

0.0 0.0 0.0 0.0 0.0 0.0 1.5 1.3 1.1

0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0 0.0

199.0 179.0 163.7 156.6 96.3 88.0 67.3 57.1 59.8

0.6 0.6 0.6 0.7 0.6 0.7 0.6 0.7 0.7

199.6 179.7 164.4 157.3 97.0 88.7 67.9 57.8 60.5

2,032.9 1,865.3 1,673.9 1,246.5 1,098.6 1,002.0 862.0 802.0 617.4

50.81 46.40 42.31 40.41 30.19 27.44 24.78 21.37 22.41

48.45 44.85 41.76 39.89 29.73 26.91 24.14 21.09 22.13

DEC '06 DEC '05 DEC '04 DEC '03 DEC '02 DEC '01 DEC '00

365 Days 365 Days 366 Days 365 Days 365 Days 365 Days

29.3 9.8 8.5 6.1 5.3 5.5 4.7

119.8 92.4 77.6 52.7 40.3 15.4 11.5

5.5 6.0 19.9 8.3 8.2 1.3 1.6

13.0 4.3 1.3 0.7 - - -

13.0 4.3 1.3 0.7 - - -

75.8 56.6 - - - - -

23.1 24.0 56.4 43.7 32.1 14.0 9.9

2.4 1.5 - - - - -

127.9 102.2 74.5 74.5 61.6 45.7 39.0

133.6 107.1 78.1 77.4 63.6 47.6 40.0

46.0 49.8 30.3 25.3 23.3 0.4 0.1

- - 5.5 4.7 4.2 3.1 2.5

31.5 24.3 14.5 18.3 9.1 36.9 30.3

10.2 8.9 20.2 23.8 21.1 - -

13.6 11.9 - - - - -

32.3 12.3 7.7 5.3 6.0 7.3 7.1

- - -0.1 0.0 0.0 0.0 0.0

-5.7 -4.9 -3.6 -2.9 -2.1 -1.9 -1.0

3.5 3.6 1.6 1.6 1.5 2.9 1.0

5.0 4.9 5.3 4.6 5.1 - -

1.9 1.7 1.2 1.0 0.8 0.8 0.5

- 2.9 2.5 1.8 1.4 - -

1.4 1.4 1.6 1.3 - - 0.3

15.7 15.0 6.3 5.4 4.3 6.6 5.2

14.8 14.2 6.1 5.1 4.1 6.4 5.0

0.7 0.6 0.0 0.0 0.0 0.0 0.0

0.7 0.6 0.0 0.0 0.0 0.0 0.0

0.0 0.0 0.0 0.0 0.0 0.0 0.0

0.3 0.2 0.2 0.3 0.1 0.2 0.2

304.5 233.8 179.1 149.0 120.2 76.9 62.1

229.4 154.3 128.1 102.9 92.4 56.6 47.5

7.1 4.0 3.6 2.7 2.2 1.1 0.8

222.3 150.3 124.4 100.3 90.2 55.5 46.7

40.9 51.3 26.6 26.4 12.3 8.7 7.8

18.1 31.3 12.9 12.3 4.0 8.6 7.4

22.9 19.9 13.7 14.1 8.2 0.1 0.4

22.9 19.9 13.7 14.1 8.2 0.1 0.4

0.0 0.0 0.0 0.0 0.0 0.0 0.0

- - - - - - -

- - - - - - -

9.7 8.0 5.2 4.5 1.8 1.0 1.1

9.7 8.0 5.2 4.5 1.8 1.0 1.1

0.0 0.0 0.0 0.0 0.0 0.0 0.0

280.0 213.5 159.9 133.8 106.5 66.2 56.5

0.0 0.0 0.3 0.0 0.0 0.0 3.3

0.0 0.0 0.3 0.0 0.0 0.0 3.3

24.4 20.3 19.0 14.9 13.6 10.7 2.3

9.6 9.4 9.1 9.1 9.1 7.8 0.1

2.4 2.1 4.4 1.9 1.9 1.3 0.0

9.5 7.3 5.5 3.9 2.7 1.6 2.2

- - 0.0 0.0 - - -

2.6 1.5 0.0 0.0 0.0 0.0 0.0

0.0 0.0 0.0 0.0 0.0 0.0 0.0

0.0 0.0 - - - - -

0.2 0.1 0.1 0.1 0.0 0.0 0.0

0.0 0.0 0.0 0.0 0.0 0.0 0.0

24.4 20.3 19.3 14.9 13.6 10.7 5.6

0.0 -0.1 0.0 0.3 0.0 0.0 0.0

24.4 20.2 19.3 15.1 13.7 10.7 5.6

304.5 233.8 179.1 149.0 120.2 76.9 62.1

21.89 18.63 18.08 14.10 12.93 11.87 2.53

21.30 18.08 18.08 14.10 12.93 11.87 2.53

You might also like

- Regulatory Framework and Legal Issues in Business Part 1 by Atty. Andrix Domingo 2021edDocument60 pagesRegulatory Framework and Legal Issues in Business Part 1 by Atty. Andrix Domingo 2021edAmethyst Lee100% (3)

- Western Constitutionalism - Andrea BurattiDocument257 pagesWestern Constitutionalism - Andrea BurattiGulrukh SadullayevaNo ratings yet

- Group Case 2 - Playing The Numbers GameDocument33 pagesGroup Case 2 - Playing The Numbers GameHannahPojaFeria0% (1)

- Coaches Guide Re LGU Devolution Transition PlanDocument52 pagesCoaches Guide Re LGU Devolution Transition PlanMajin Bukay75% (8)

- Bidding For Hertz Leveraged Buyout, Spreadsheet SupplementDocument12 pagesBidding For Hertz Leveraged Buyout, Spreadsheet SupplementAmit AdmuneNo ratings yet

- CASE Exhibits - HertzDocument15 pagesCASE Exhibits - HertzSeemaNo ratings yet

- Termination EN2020Document4 pagesTermination EN2020Milos MihajlovicNo ratings yet

- Final Case Study Investment AnalysisDocument4 pagesFinal Case Study Investment AnalysisMuhammad Ahsan MubeenNo ratings yet

- Ermenegildo Zegna N.V. (ZGN)Document2 pagesErmenegildo Zegna N.V. (ZGN)Carlos Suárez MatosNo ratings yet

- Max Healthcare Institute Limited BSE 539981 Financials Balance SheetDocument3 pagesMax Healthcare Institute Limited BSE 539981 Financials Balance Sheetakumar4uNo ratings yet

- Promit Singh Rathore - 20PGPM111Document14 pagesPromit Singh Rathore - 20PGPM111mahiyuvi mahiyuviNo ratings yet

- Adv EnzDocument4 pagesAdv EnzSafwan BhikhaNo ratings yet

- Sample Working Capital Per Dollar of Sales Calculation: Total Sales Income StatementDocument7 pagesSample Working Capital Per Dollar of Sales Calculation: Total Sales Income StatementsanjusarkarNo ratings yet

- PVR LTD (PVRL IN) - StandardizedDocument18 pagesPVR LTD (PVRL IN) - StandardizedSrinidhi SrinathNo ratings yet

- Group AssignmentDocument4 pagesGroup Assignment1954032027cucNo ratings yet

- Financial Statements-Kingsley AkinolaDocument4 pagesFinancial Statements-Kingsley AkinolaKingsley AkinolaNo ratings yet

- Prova Múltiplos Ciclo 2023.1Document14 pagesProva Múltiplos Ciclo 2023.1Jadi MouradNo ratings yet

- Accountingfor Managers Assignment 2 Part-I: Is A Budget?Document9 pagesAccountingfor Managers Assignment 2 Part-I: Is A Budget?Amit SanglikarNo ratings yet

- Prospective Analysis 1Document5 pagesProspective Analysis 1MAYANK JAINNo ratings yet

- Narayana Hrudayalaya Limited NSEI NH Financials Balance SheetDocument2 pagesNarayana Hrudayalaya Limited NSEI NH Financials Balance Sheetakumar4uNo ratings yet

- Nestle Income Statement & Balance SheetDocument10 pagesNestle Income Statement & Balance SheetDristi SinghNo ratings yet

- Shalby Limited BSE 540797 Financials Balance SheetDocument3 pagesShalby Limited BSE 540797 Financials Balance Sheetakumar4uNo ratings yet

- Dabur India LTD: Change 31-Mar-19 31-Mar-18 31-Mar-19 31-Mar-18Document3 pagesDabur India LTD: Change 31-Mar-19 31-Mar-18 31-Mar-19 31-Mar-18VIJAY KUMARNo ratings yet

- Slides Week 8 No AnswerDocument38 pagesSlides Week 8 No Answerchingwen731No ratings yet

- SUEZ 2019 Financial Consolidated Statements ENDocument112 pagesSUEZ 2019 Financial Consolidated Statements ENnhat quangNo ratings yet

- Beyond Meat Inc NasdaqGS BYND FinancialsDocument6 pagesBeyond Meat Inc NasdaqGS BYND FinancialsFabricio Arturo Olalde MacedoNo ratings yet

- Financial Statements For Jollibee Foods CorporationDocument4 pagesFinancial Statements For Jollibee Foods CorporationKevin CeladaNo ratings yet

- Pidilite IndustriesDocument5 pagesPidilite IndustriesPrena JoshiNo ratings yet

- Private Company Financials Balance Sheet: Xchanging Software Europe LimitedDocument1 pagePrivate Company Financials Balance Sheet: Xchanging Software Europe Limitedprabhav2050No ratings yet

- Efrs 2014-2018 Amsa. Ratios-Final-2Document60 pagesEfrs 2014-2018 Amsa. Ratios-Final-2Nicolás Bórquez MonsalveNo ratings yet

- Nestle Financial Statements - 2022Document4 pagesNestle Financial Statements - 2022dpr7033No ratings yet

- Wassim Zhani Starbucks Valuation 2007-2011Document13 pagesWassim Zhani Starbucks Valuation 2007-2011wassim zhaniNo ratings yet

- Adidas AG Consolidated Statement of Financial Position (IFRS)Document6 pagesAdidas AG Consolidated Statement of Financial Position (IFRS)Sanjeev ThadaniNo ratings yet

- Actividad 3.1Document27 pagesActividad 3.1David RiosNo ratings yet

- Housing Development Finance Corp LTD (HDFC IN) - StandardizedDocument4 pagesHousing Development Finance Corp LTD (HDFC IN) - StandardizedAswini Kumar BhuyanNo ratings yet

- Q3 2022 Quarterly Financial Statements VT Group AGDocument6 pagesQ3 2022 Quarterly Financial Statements VT Group AGAmr YehiaNo ratings yet

- Financial Statements For Jollibee Foods CorporationDocument8 pagesFinancial Statements For Jollibee Foods CorporationJ U D YNo ratings yet

- Komatsu LTD (6301 JT) - StandardizedDocument36 pagesKomatsu LTD (6301 JT) - StandardizedIan RiceNo ratings yet

- Tallu Spinning Mills: Particulars 2009 2010 2011 2012 2013Document109 pagesTallu Spinning Mills: Particulars 2009 2010 2011 2012 2013Shovon MustaryNo ratings yet

- Ayush AccountsDocument22 pagesAyush AccountsAyush AnandNo ratings yet

- Traveller Balance SheetDocument4 pagesTraveller Balance SheetMathi Mahi JayanthNo ratings yet

- Cash Flows:: Currency in Millions of U.S. DollarsDocument3 pagesCash Flows:: Currency in Millions of U.S. DollarscutooteddyNo ratings yet

- Acc FCFFDocument25 pagesAcc FCFFArchit PateriaNo ratings yet

- Valuation, Case #KEL790Document40 pagesValuation, Case #KEL790neelakanta srikarNo ratings yet

- Caso HertzDocument32 pagesCaso HertzJORGE PUENTESNo ratings yet

- Siyaram Silk Balance SheetDocument2 pagesSiyaram Silk Balance SheetPAWAN CHANDAKNo ratings yet

- CV Case 3Document40 pagesCV Case 3neelakanta srikarNo ratings yet

- Landmark CaseDocument22 pagesLandmark CaseLauren KlaassenNo ratings yet

- Standalone Balance Sheet - Lupin LTD.: ParticularsDocument26 pagesStandalone Balance Sheet - Lupin LTD.: ParticularsshubhNo ratings yet

- E I D-Parry (India) LTD.: Balance Sheet Summary: Mar 2011 - Mar 2020: Non-Annualised: Rs. CroreDocument15 pagesE I D-Parry (India) LTD.: Balance Sheet Summary: Mar 2011 - Mar 2020: Non-Annualised: Rs. Crorehardik aroraNo ratings yet

- Fortis Healthcare: Previous YearsDocument20 pagesFortis Healthcare: Previous YearsShuBham KanswalNo ratings yet

- Audited Financials Dec 2022Document1 pageAudited Financials Dec 2022EdwinNo ratings yet

- CV Assignment - Group 3Document6 pagesCV Assignment - Group 3HEM BANSALNo ratings yet

- Case ExhibitsDocument7 pagesCase Exhibitsug8No ratings yet

- AMBUJADocument2 pagesAMBUJAAbhay Kumar SinghNo ratings yet

- Ashok Leyland RatioDocument9 pagesAshok Leyland Ratiomudit mohanNo ratings yet

- Financial AnalysisDocument6 pagesFinancial AnalysisRinceNo ratings yet

- Taiwan Semiconductor Manufacturing Company Limited and Subsidiaries Consolidated Condensed Balance SheetDocument4 pagesTaiwan Semiconductor Manufacturing Company Limited and Subsidiaries Consolidated Condensed Balance SheetHarry KilNo ratings yet

- AMBUJA Moneycontrol - Com - Company Info - Print FinancialsDocument2 pagesAMBUJA Moneycontrol - Com - Company Info - Print FinancialsMohammad DishanNo ratings yet

- Hindalco Balance SheetDocument2 pagesHindalco Balance Sheetakhilesh718No ratings yet

- Levi Strauss & Co Fs 2023Document6 pagesLevi Strauss & Co Fs 2023Info Riskma SolutionsNo ratings yet

- Rieter Consolidated Balance Sheet 2020 enDocument1 pageRieter Consolidated Balance Sheet 2020 enMuhammadSiddiqNo ratings yet

- Du Pont AnalysisDocument5 pagesDu Pont Analysisbhavani67% (3)

- Exhibit 1 Horniman Horticulture Projected Horniman Horticulture Financial Summary (In Thousands of Dollars)Document2 pagesExhibit 1 Horniman Horticulture Projected Horniman Horticulture Financial Summary (In Thousands of Dollars)Hằng Dương Thị MinhNo ratings yet

- Robinson's Galleria Vs SanchezDocument9 pagesRobinson's Galleria Vs SanchezChristelle Ayn BaldosNo ratings yet

- 2014-07-21 Monthly Attendance Report Template Format OptionsDocument3 pages2014-07-21 Monthly Attendance Report Template Format OptionsAhmed El AmraniNo ratings yet

- Declaration of Independence (Seacret App)Document2 pagesDeclaration of Independence (Seacret App)api-281934739No ratings yet

- Rights Persons Disabilities Rules 2017 0 PDFDocument70 pagesRights Persons Disabilities Rules 2017 0 PDFParamasiva KumarNo ratings yet

- ID TheftDocument3 pagesID TheftShawn FreemanNo ratings yet

- What Are The Laws That Paved The Way Towards Making Accountancy A Recognized ProfessionDocument3 pagesWhat Are The Laws That Paved The Way Towards Making Accountancy A Recognized ProfessionVirginia PalisukNo ratings yet

- Regional Staff MeetingDocument1 pageRegional Staff MeetingShintara Pagsanjan DimanzanaNo ratings yet

- Azure Devops Security Checklist: 17 Green Lanes, London, England, N16 9BsDocument38 pagesAzure Devops Security Checklist: 17 Green Lanes, London, England, N16 9BsavaldirisNo ratings yet

- Signs of Laylatul QadrDocument2 pagesSigns of Laylatul QadrMountainofknowledgeNo ratings yet

- Issues and Taboo Topics For Debate - Nobody Needs A GunDocument2 pagesIssues and Taboo Topics For Debate - Nobody Needs A GunluciasnmNo ratings yet

- IBM Z CloudDocument18 pagesIBM Z CloudrajeshbabupNo ratings yet

- U.S. Equal Employment Opportunity Commission v. Norfolk Southern Corp.Document33 pagesU.S. Equal Employment Opportunity Commission v. Norfolk Southern Corp.Ryan CaneNo ratings yet

- Grooming and Sexual Offences DataDocument2 pagesGrooming and Sexual Offences DataKash Ahmed100% (1)

- Module 2A PDFDocument13 pagesModule 2A PDFdeepak singhalNo ratings yet

- J Diin 2011 03 002Document6 pagesJ Diin 2011 03 002nanaNo ratings yet

- Extension in PaymentDocument3 pagesExtension in PaymentAbhishek VermaNo ratings yet

- JetDryer JetLite Instruction Manual PDFDocument6 pagesJetDryer JetLite Instruction Manual PDFDylan ParkNo ratings yet

- Final - Writ - Petition - For - Filing-PB Singh vs. State of MaharashtraDocument130 pagesFinal - Writ - Petition - For - Filing-PB Singh vs. State of MaharashtraRepublicNo ratings yet

- Gicely Sarai Flores-Velasquez, A205 277 572 (BIA April 24, 2015)Document8 pagesGicely Sarai Flores-Velasquez, A205 277 572 (BIA April 24, 2015)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Colonial Powers, Nation-States and Kerajaan in Maritime Southeast Asia: Structures, Legalities and PerceptionsDocument14 pagesColonial Powers, Nation-States and Kerajaan in Maritime Southeast Asia: Structures, Legalities and Perceptionsanjangandak2932No ratings yet

- Tendernotice 1Document223 pagesTendernotice 1kaushalkumar085No ratings yet

- Syllabus and Aims and ObjectivesDocument9 pagesSyllabus and Aims and ObjectivesSecretaria OrangeNo ratings yet

- CH 1 - Introduction To Financial ManagementDocument18 pagesCH 1 - Introduction To Financial Managementmaheshbendigeri5945No ratings yet

- List of Certified Workshop SarawakDocument48 pagesList of Certified Workshop SarawakIkhwan Firdausi SazaliNo ratings yet

- Exit & Notice Period PolicyDocument9 pagesExit & Notice Period PolicySarfaraz RahutNo ratings yet