Professional Documents

Culture Documents

Statutory Compliance RCM 2022-2023

Statutory Compliance RCM 2022-2023

Uploaded by

Aman ParchaniOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Statutory Compliance RCM 2022-2023

Statutory Compliance RCM 2022-2023

Uploaded by

Aman ParchaniCopyright:

Available Formats

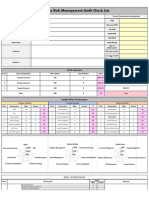

AIROX TECHNOLOGIES PRIVATE LIMITED

Internal Controls Over Financial Reporting (ICOFR)

Risk and Control Matrix - Statutory Compliance

Period April 1, 2022 to March 31, 2023

Key Control Control

Control/ Type Control Type Classification Responsibility

Control Risk Control

Sr. No. Process Sub Process Risks Event Control Objective Existing Control Activities/ Other Controls Assertions* Non (P)reventive (A)utomated (O)perating, (Process Owner &

Reference Category Frequency

Key or or (M)annual (F)inancial, Reviewer)

Control (D)etective (C)ompliance

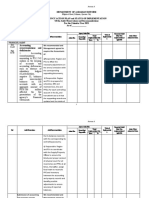

Advance tax liability is calculated by the CFO and reviewed by Tax

To ensure that the Advance Tax liability

Statutory Advance Tax liability is Consultant on the estimated turnover and profits for the current year. Key

1 SC1 Advance Tax is calculated & Paid correctly as per the A, C, V M P Quarterly M F/C CFO

Compliance incorrectly computed or paid After approval from the MD, the F&A Manager makes the payment and Control

Income Tax provisions

records the entry.

1. Final Tax Computation is prepared by CFO, reviewed by Tax

Provision for tax & tax return To ensure provision for current tax are

Statutory Provision for consultant and approved by MD. A, C, R&O, Key

2 SC2 adjustments are not accurate, complete and recorded in the M P Annually M F CFO

Compliance Income Tax 2.F&A Manager post entries in the sytstem which is then reviewed & V and C/O Control

appropriately recorded. correcct period.

approved by CFO

ITC claimed is inappropriate.

Payment of output tax is

Goods and Ensure appropriate claiming of ITC and Manager F&A of GST prepares the workings and reconciliation of

Statutory unauthorized or Key Monthly/

3 SC3 Service Tax payment of liability. Timely filing of GSTR's which is reviewed by GST Consultant and uploaded on portal E,A, C, C/O M P &D M F/C CFO

Compliance inappropriate. GST returns Control Yearly

(GST) returns which is then approved by CFO/MD.

are not filed in a timely

manner

Tax Deducted Tax is not deducted correctly

Statutory To ensure that Tax is deducted correctly TDS on salary is calculated by Manager F&A which is reviewed and Key Manager F&A &

4 SC4 at Source as per the Provisions of A, C, C/O M P Monthly M F/C

Compliance as per the Income Tax Laws. approved by CFO and sent to Sr. HR Manager Control CFO

(TDS) -Salary Income Tax

Tax Deducted

Tax is not deducted correctly Working of TDS (rates, TDS Amount,Category of the payee) other than

Statutory at Source To ensure that Tax is deducted correctly Key

5 SC5 as per the Provisions of salary is calculated by Finance Officer which is then reviewed by A, C, C/O M P Monthly M F/C Manager F&A

Compliance (TDS) - Other as per the Income Tax Laws. Control

Income Tax Manager F&A before payment.

than Salary

Sr. Manager HR will calculate all PF, ESIC,PT and employee related

Provident Incorrect calculation of

To ensure that PF, PT,ESIC is properly calculations which are reviewed by Manager F&A .Statutory

Statutory fund, regulatory payments. Key

6 SC6 deducted and deposited with the compliance tracker is maintained by Finance team for ensuring payment E,A, C, V M P Monthly M F/C Manager F&A

Compliance Professional Delayed deposition of Control

Government within the due date for the statutory liabilities is within due date and non compliance does

Tax & ESIC regulatory payments.

not take place, it is monitored by Manager F&A.

Tax Deducted Finance officer prepares draft return on the basis of approved workings

Statutory at Source Non Filing of returns or which is reviewed and approved by Manager F&A. Finance officer then Non Key Monthly/

7 SC7 Filing of Returns A,C,O,R&O M P &D M C/O Manager F&A

Compliance (TDS) - Other Incorrect returns filed files the return which is once again reviewed by Manager F&A to control Quarterly

than Salary ensure returns are filed correctly.

Deferred tax calculation is considered

Deferred tax working (temporary difference identified, permanent

Deferred taxes are not after considering all the temporary and

difference identified and effective tax reconciliation) is prepared by

Statutory accurately measured, permanenet differences. Preparation of Key Manager F&A and

8 SC8 Deferred Tax Manager F&A which is reveiewed & approved by CFO.Finance officer A,C,V, R&O M P Annually M F

Compliance completely recorded or are effective tax reconciliation to verify that Control CFO

posts the entry in the system which is reviewed & approved by

not appropriately valued the deferred tax is created on all the

Manager F&A.

temporary differecnes.

Open Cases Impact of pending The Manager F&A/CS/Consultant(Related Tax Libility) handled open

Statutory Ensure proper assessment of pending Key

7 SC7 and Pending proceedings is not cases, pending proceedings and all other court related matters on that A, C M P Monthly M F/C CFO & MD

Compliance proceedings Control

Proceedings ascertained appropriately basis MIS for outstanding litigation is reviewed by CFO & MD monthly.

Payment for

Statutory Unauthorised payments to Payments are processed after Asst. Manager F&A takes approval for payment for every payment Key On

9 SC9 Statutory O,C,A M P M F CFO

Compliance Government Authorities appropriate authorizations from CFO and then processes the payment Control Occurrence

Payment

*Assertions impacting IFC

Existence (E) - Assets, liabilities and equity balances exist at the period end.

Accuracy (A) - Assets, liabilities and equity balances are accurately recorded.

Cut off (C/O) - Assets are recorded in a timely manner and proper period.

Completeness (C) - All assets, liabilities and equity balances that were supposed to be recorded have been recognized in the financial statements.

Rights & Obligations (R&O) - Entity has the right to ownership or use of the recognized assets, and the liabilities recognized in the financial statements represent the obligations of the entity.

Valuation (V) - Assets, liabilities and equity balances have been valued appropriately.

You might also like

- Case Study 2 - Alex SharpeDocument3 pagesCase Study 2 - Alex SharpeNell Mizuno100% (3)

- Risk Assessment For MEP Isolation WorksDocument8 pagesRisk Assessment For MEP Isolation WorksAnandu Ashokan100% (6)

- Business Enhancement 2nd Summative TextDocument16 pagesBusiness Enhancement 2nd Summative TextCams DlunaNo ratings yet

- Lbc-110-Internal Audit Manual For Local Government Units (2016)Document160 pagesLbc-110-Internal Audit Manual For Local Government Units (2016)Ryan Socorro Dy100% (2)

- Financial Close Process Controls QuestionnaireDocument8 pagesFinancial Close Process Controls Questionnairesaurabhmjn100% (1)

- Fnce103 Term 2 Annual Year 2014. SMU Study Outline David DingDocument5 pagesFnce103 Term 2 Annual Year 2014. SMU Study Outline David DingAaron GohNo ratings yet

- Treasury RCM 2022-2023Document1 pageTreasury RCM 2022-2023Aman ParchaniNo ratings yet

- Standard Control Matrix UumbalDocument13 pagesStandard Control Matrix UumbalJose Arturo Filigrana de la CruzNo ratings yet

- Action CatalogueDocument1 pageAction CatalogueMarkNo ratings yet

- Control Matrix - A. Sales and ReceivablesDocument23 pagesControl Matrix - A. Sales and Receivablesmehmood.warraichNo ratings yet

- P2P RCM 2022 2023Document1 pageP2P RCM 2022 2023Uddeshya KumarNo ratings yet

- Form 18 Sdi 4 - Recourse Liabilities - Risk of Material Misstatement (Romm) WorksheetDocument17 pagesForm 18 Sdi 4 - Recourse Liabilities - Risk of Material Misstatement (Romm) WorksheetwellawalalasithNo ratings yet

- Banking and Finance - Mortgage Servicing Rights, For The Specified Account. The Substantive Procedures Responsive To The RisksDocument19 pagesBanking and Finance - Mortgage Servicing Rights, For The Specified Account. The Substantive Procedures Responsive To The RiskswellawalalasithNo ratings yet

- Draft RCM - ExpensesDocument9 pagesDraft RCM - ExpensesAbhishek Agrawal100% (1)

- Ipcr - Recio 1st Sem 2022Document2 pagesIpcr - Recio 1st Sem 2022Angelic RecioNo ratings yet

- Doc 05 - 02 Internal Audit Report Core Financial ControlsDocument14 pagesDoc 05 - 02 Internal Audit Report Core Financial Controlsahmed khoudhiryNo ratings yet

- Supplier Risk Management Audit Check ListDocument8 pagesSupplier Risk Management Audit Check ListPrakash kumarTripathiNo ratings yet

- Supplier Risk Management Audit Check ListDocument13 pagesSupplier Risk Management Audit Check ListPrakash kumarTripathiNo ratings yet

- IFC Framework IssueDocument99 pagesIFC Framework IssueAbhishek Agrawal100% (1)

- IT Audit Mind Map chp3Document4 pagesIT Audit Mind Map chp3No IkhNo ratings yet

- IT Audit CH 3Document5 pagesIT Audit CH 3JC MoralesNo ratings yet

- Audit Planning - Analytical ProceduresDocument35 pagesAudit Planning - Analytical ProceduresVenus Lyka LomocsoNo ratings yet

- Worksheet - Income Sheet and Form Series 18 AICPA, AICPA Risk of Material Misstatement WorksheetsDocument20 pagesWorksheet - Income Sheet and Form Series 18 AICPA, AICPA Risk of Material Misstatement WorksheetswellawalalasithNo ratings yet

- Aapsi 2021Document29 pagesAapsi 2021Moda ArgonaNo ratings yet

- Assessment Compliance Audit Action Catalogue: TESDA-OP-CO-06-F48 Rev - No.00-03/08/17Document2 pagesAssessment Compliance Audit Action Catalogue: TESDA-OP-CO-06-F48 Rev - No.00-03/08/17Neja DumapiasNo ratings yet

- SYS Procedure - Internal Quality Audit P1Document1 pageSYS Procedure - Internal Quality Audit P1sumanNo ratings yet

- 5.1 FAPLQSYS001 Internal AuditDocument2 pages5.1 FAPLQSYS001 Internal Auditcghodake1No ratings yet

- Telex: Quality Management System ManualDocument4 pagesTelex: Quality Management System ManualChermaine LacedaNo ratings yet

- Fixed Asset Management - RCMDocument4 pagesFixed Asset Management - RCM1.jayjoshiforchatgptNo ratings yet

- Turtle Diagram TemplateDocument2 pagesTurtle Diagram TemplateMirnes MehanovicNo ratings yet

- National Irrigation Administration: Quality Management SystemDocument2 pagesNational Irrigation Administration: Quality Management SystemKang DanielNo ratings yet

- SA 700 New Nov 18 Elements of Audit Report (Sections) : Independent Auditor'SDocument1 pageSA 700 New Nov 18 Elements of Audit Report (Sections) : Independent Auditor'SApeksha ChilwalNo ratings yet

- Ipcr Accomplishment - Ahig RDocument135 pagesIpcr Accomplishment - Ahig RMA. DIVINA LAPURANo ratings yet

- F8 Summary TopicDocument1 pageF8 Summary TopicChoi HongNo ratings yet

- Sox Internal Control Case Study and Control MatrixDocument4 pagesSox Internal Control Case Study and Control MatrixShaik.jelaniNo ratings yet

- Turtle Diagram - Internal AuditDocument1 pageTurtle Diagram - Internal Auditsyahir etNo ratings yet

- Chapter 9 (3) : Completing The AuditDocument1 pageChapter 9 (3) : Completing The AuditARMIZAWANI BINTI MOHAMED BUANG BMNo ratings yet

- 2022 Quarterly Verification Review Template - AGG v1Document8 pages2022 Quarterly Verification Review Template - AGG v1fernando.burgos0420No ratings yet

- HBC Quarterly Performance Report Q1 2021-22Document23 pagesHBC Quarterly Performance Report Q1 2021-22John KimNo ratings yet

- Action Plan - Open Za Prevođenje - ENG - 5454Document3 pagesAction Plan - Open Za Prevođenje - ENG - 5454MarkoMarjanovicNo ratings yet

- Requirements FOR PAS 701: Key Audit MattersDocument3 pagesRequirements FOR PAS 701: Key Audit MattersRenella Dane H PinedaNo ratings yet

- (UPDATED) Quality Control PlanDocument6 pages(UPDATED) Quality Control PlanAngelic RecioNo ratings yet

- Action Plan Monitoring Tool COA and COMELECDocument7 pagesAction Plan Monitoring Tool COA and COMELECVicky Danila Albano100% (1)

- AS 3101 - The Auditor's Report On An Audit of Financial Statements When The Auditor Expresses An Unqualified OpinionDocument24 pagesAS 3101 - The Auditor's Report On An Audit of Financial Statements When The Auditor Expresses An Unqualified Opinionfaridayusufsaidu13No ratings yet

- Operation Profile: Basic DataDocument13 pagesOperation Profile: Basic DataAlan GarcíaNo ratings yet

- Total Combined File-1Document36 pagesTotal Combined File-1Shefali TailorNo ratings yet

- Basic Data: Operation ProfileDocument11 pagesBasic Data: Operation ProfileAlan GarcíaNo ratings yet

- Audit Evidence and Audit Documentation: Mcgraw-Hill/IrwinDocument30 pagesAudit Evidence and Audit Documentation: Mcgraw-Hill/IrwinyebegashetNo ratings yet

- LB Harrow PG 26 StatementofAccounts20082009Document58 pagesLB Harrow PG 26 StatementofAccounts20082009parkingeconomicsNo ratings yet

- Audit Chart BookDocument209 pagesAudit Chart BookViraj SharmaNo ratings yet

- Item 7aiii Internal Audit Report Is Service DeskDocument6 pagesItem 7aiii Internal Audit Report Is Service DesksamanNo ratings yet

- Procedurestocompletion EXTRADocument5 pagesProcedurestocompletion EXTRAShapan DasNo ratings yet

- Commission On AuditDocument207 pagesCommission On AuditJaniceNo ratings yet

- Form 18 Sdi 2 - Loans - Risk of Material Misstatement (Romm) WorksheetDocument27 pagesForm 18 Sdi 2 - Loans - Risk of Material Misstatement (Romm) WorksheetwellawalalasithNo ratings yet

- OHSAS 18001 2007 Implementation Flow Diagram ENDocument1 pageOHSAS 18001 2007 Implementation Flow Diagram ENoerkulNo ratings yet

- Audit of Insurance CompaniesDocument15 pagesAudit of Insurance CompaniesYoung MetroNo ratings yet

- Week 1 - Introduction and Audit FrameworkDocument20 pagesWeek 1 - Introduction and Audit FrameworkGnanapragasam NavaneethanNo ratings yet

- B S V S S VARMA, EHS Task-1Document16 pagesB S V S S VARMA, EHS Task-1sravan BattulaNo ratings yet

- Form 2 Ipcr Staff CRDDocument12 pagesForm 2 Ipcr Staff CRDVoltaire BernalNo ratings yet

- Audit - Visio-Template Process MapDocument1 pageAudit - Visio-Template Process MapPurushothama Nanje GowdaNo ratings yet

- Assurance Mapping Example SemangatDocument2 pagesAssurance Mapping Example SemangatRiyoHussainMNo ratings yet

- KM Allabksh Gulab Banadar GK9018: Name EMP Code Designation DepartmentDocument1 pageKM Allabksh Gulab Banadar GK9018: Name EMP Code Designation DepartmentallabkshNo ratings yet

- Ejoy A Public Limited Company Has Acquired Two Subsidiaries TheDocument1 pageEjoy A Public Limited Company Has Acquired Two Subsidiaries TheTaimur TechnologistNo ratings yet

- Literature Review of Private Equity in IndiaDocument7 pagesLiterature Review of Private Equity in Indiafvdra0st100% (1)

- HACC215 - Tutorial Questions - 084429Document40 pagesHACC215 - Tutorial Questions - 084429nmutaveniNo ratings yet

- p3 Advanced Auditing & Financial Management Suggested Answers May 2017Document31 pagesp3 Advanced Auditing & Financial Management Suggested Answers May 2017Apeksha ChilwalNo ratings yet

- 9 Stock Market EfficiencyDocument19 pages9 Stock Market EfficiencyVishwas tomarNo ratings yet

- Gonzales - Assignment 4Document18 pagesGonzales - Assignment 4GONZALES, IAN ROGEL L.No ratings yet

- FFM ArticlesDocument16 pagesFFM ArticlesHasniza HashimNo ratings yet

- Cash FlowDocument12 pagesCash FlowalguienNo ratings yet

- Plantilla de Estructuras Organizacionales - HubSpotDocument8 pagesPlantilla de Estructuras Organizacionales - HubSpotAsesor 3GNo ratings yet

- An Inquiry Into The Etf Experiences in American and Indian MarketsDocument11 pagesAn Inquiry Into The Etf Experiences in American and Indian MarketsszaszaszNo ratings yet

- PNB Ratio AnalysisDocument15 pagesPNB Ratio AnalysisNiraj SharmaNo ratings yet

- FR MarchDocument17 pagesFR MarchGenoso OtakuNo ratings yet

- Acct-1 Chap-1-1Document11 pagesAcct-1 Chap-1-1Natnael GetahunNo ratings yet

- Chapter 8 - InventoryDocument26 pagesChapter 8 - Inventorychandel08No ratings yet

- KRDTop100SFM PDFDocument215 pagesKRDTop100SFM PDFNag Sai NarahariNo ratings yet

- Finance Bis Mcqs & Tf5Document1 pageFinance Bis Mcqs & Tf5Souliman MuhammadNo ratings yet

- Mcarthur Highway, Barangay Bulihan, City of Malolos, Bulacan 3000Document4 pagesMcarthur Highway, Barangay Bulihan, City of Malolos, Bulacan 3000Angela Dela PeñaNo ratings yet

- Cybersecurity Market Review Q2 2017Document98 pagesCybersecurity Market Review Q2 2017dattero2k1No ratings yet

- Vodafone Idea Limited: PrintDocument2 pagesVodafone Idea Limited: PrintPrakhar KapoorNo ratings yet

- Template For Eliminating EntriesDocument10 pagesTemplate For Eliminating EntriesAEDRIAN LEE DERECHONo ratings yet

- Bluedart Express: Strategic Investments Continue To Weigh On MarginsDocument9 pagesBluedart Express: Strategic Investments Continue To Weigh On MarginsYash AgarwalNo ratings yet

- ASE20101 Mark-Scheme April-2019Document17 pagesASE20101 Mark-Scheme April-2019YAN YAN TSOINo ratings yet

- Sir Mac Book SolmanDocument10 pagesSir Mac Book SolmanJAY AUBREY PINEDANo ratings yet

- Stock Return 2Document6 pagesStock Return 2Hans Surya Candra DiwiryaNo ratings yet

- Inventory Management: Fin658 - Financial Statement AnalysisDocument6 pagesInventory Management: Fin658 - Financial Statement Analysisamirul baharudinNo ratings yet

- Call With Dividends: Input DataDocument2 pagesCall With Dividends: Input DataCH NAIRNo ratings yet

- 21 Finance Interview Questions and AnswersDocument17 pages21 Finance Interview Questions and Answersdaniel18ct100% (1)