Professional Documents

Culture Documents

Accounting Grade 11 Term 3 Week 4 - 2020

Accounting Grade 11 Term 3 Week 4 - 2020

Uploaded by

adriana espinoza de los monterosOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Grade 11 Term 3 Week 4 - 2020

Accounting Grade 11 Term 3 Week 4 - 2020

Uploaded by

adriana espinoza de los monterosCopyright:

Available Formats

Directorate: Curriculum FET

Gr 11 ACCOUNTING Term 3: Week 4

TOPIC: Inventory systems (Periodic) (Paper 2 topic)

In Gr 10 and 11 you learnt about ... This lesson will enable you to...

• Recordkeeping of the stock on a continuous • Identify the main features of the periodic inventory

(perpetual) basis, e.g. preparing aTrading Stock system

account • Know the advantages and disadvantages of periodic

• Calculating Cost of sales / Sales / Gross profit / inventory system

Mark-up % • Distinguish (identify differences) between perpetual (see

T3, Week 3 lesson) and periodic stock systems

• Analyse transactions using the periodic system

• Calculate in the periodic system:

o cost of sales at the end of a financial period

o gross profit

o mark-up achieved

o number of missing stock items

o financial indicators related to stock

Use your Textbook to read more about Inventories

ALTERNATIVE digital resources:

Via Afrika Gr 11 Study Guide Lucem Publishers Gr 11 Teachers Guide

https://wcedeportal.co.za/eresource/116616 (textbook & answer book in one)

Term 3; Topic 3 (Pg 79 - 85) https://wcedeportal.co.za/eresource/116641

Chapter 10 (pg 265 - 278)

Study & Master PPT lesson (Ch 12) Inventory 2020 Revised Teaching Plan requirements - INVENTORY:

https://wcedeportal.co.za/eresource/127246 - Define / Explain Perpetual & Periodic Stock systems

- Know the advantages / disadvantages of each system

- Focus on calculations of Cost of Sales, Gross Profit,

mark-up%, Sales, etc.

(Although journals & ledgers are not required in 2020, the

understanding of the basic recording of stock in a Trading stock

account will promote deeper understanding of the calculations)

Introduction:

• You have learnt in the lesson for Term 3, Week 3 that the Cost of Sales in the perpetual inventory

system is calculated in EVERY transaction where stock is sold or physically returned by customers.

• This might not be possible for businesses selling large volumes where the cost price of single items

cannot be easily determined, e.g. fresh produce businesses; confectioners, hardware stores, etc.

• These businesses will have to use the periodic inventory system.

What is the Periodic inventory system?

• It is a stock management system that does not require continuous updating of trading stock values.

• The Trading stock account is not updated with the movement of stock, making it difficult to determine

the value of stock at any given time.

• The cost price of stock sold (Cost of sales) is not determined at point of sale, but only when physical

stock take (stock count) is completed

Gr 11 Accounting Term 3, 2020 1

Advantages Disadvantages

• It is cost effective as there is no outlay for • Stock theft/leakages are difficult to identify

expensive equipment, e.g. expensive bar code • Gross profit can only be determined at end of

and scanning systems the month/week when a stock take is done as

• Quick and easy to use with the minimum there is no cost of sales entries and regular

administration required updates of the Trading stock account

• Ideal for smaller businesses where the cost • Value of stock is determined periodically with

price per item cannot be easily determined a physical stock take

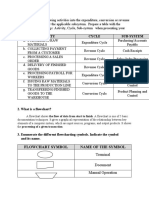

COMPARISON OF THE TWO STOCK SYSTEMS

Perpetual inventory system Periodic inventory system

Stock purchases recorded in Stock purchases recorded in

Trading stock account (asset) Purchases account (expense)

Expenses incurred in purchasing

Expenses incurred in purchasing of goods (e.g. carriage on

of goods (e.g. carriage on purchases) are recorded in

purchases) are charged to the Carriage on purchases account

Trading stock account (expense)

Returns and allowances on stock Returns and allowances on stock

purchased recorded in Trading purchased recorded in

stock account Purchases account

Donations and stock taken by

Donations and stock taken by the the owner are credited to the

owner are credited to the Trading Purchases account

stock account

Physical stock take (periodically)

Balance of Trading stock shows determines stock on hand

value of stock on hand

Cost of sales is calculated on a There is no cost of sales account.

continuous basis, thefore cost of A calculation is required to

sales account will show the total determine the cost of sales.

cost price of goods sold

CALCULATIONS:

COST OF SALES

Opening stock + Purchases + Carriage on Purchases

+ Customs duty – Returns (creditors allowances) – Closing stock

Gr 11 Accounting Term 3, 2020 2

EXAMPLE 1:

The information relates to Meg Stores.

REQUIRED:

Calculate the Cost of sales.

EXTRACT FROM PRE-ADJUSTMENT TRIAL BALANCE ON 30 JUNE 2020

Nominal Accounts Section Debit Credit

Opening stock (1 July 2019) 38 000

Purchases 72 000

Carriage on purchases 13 800

Sales 165 480

Debtors Allowances 9 000

NOTE: The value of stock at end of the financial year as per physical stock count was R26 000.

EXAMPLE 1 SOLUTION:

Opening stock 38 000

Plus: Purchases 72 000

Carriage on Purchases 13 800

Cost of stock available for selling 123 800

Minus: Closing stock (26 000)

COST OF SALES 97 800

NUMBER OF UNITS MISSING

Opening no of units + units purchased – units returned - units sold – closing units

EXAMPLE 2:

UNITS AMOUNTS (R)

Opening stock 890 142 400

Purchases 1 500 240 000

Returns 13 2 080

Carriage on purchases 10 500

Closing stock 190 30 400

Sales 2 157 539 250

EAMPLE 2 SOLUTION:

Opening units + Units purchased – Units returned – Units sold – Closing units

30 units

890 + 1 500 – 13 – 2 157 – 190

Gr 11 Accounting Term 3, 2020 3

ACTIVITY 1

Nalini Stores uses the periodic inventory system. They apply 80% mark-up on their products.

REQUIRED:

Calculate the following for the period ending 28 February 2020:

1.1 Cost of sales

1.2 Gross profit

1.3 Actual mark-up % achieved

INFORMATION:

Totals extracted from the records on 28 February 2020, the end of the financial year.

R

Opening stock 56 000

Purchases (cash and credit) 342 000

Carriage on purchases 12 700

Customs duty 5 500

Cash sales 280 000

Credit sales 425 000

Debtors allowances 21 000

Additional information:

The following have not yet been taken into account:

A. Goods returned to creditors, R900.

B. Carriage on purchases not recorded, R150.

C. A physical stock count after taking all of the above into account, revealed trading stock on

hand, R48 000.

ACTIVITY 1: ANSWER SHEET

CALCULATE: Answers

1.1. Cost of Sales

1.2 Gross Profit

1.3 % Mark-up achieved

Gr 11 Accounting Term 3, 2020 4

ACTIVITY 2

2.1 CONCEPTS

Choose the correct word(s) from those given in brackets. Write only the word(s)

next to the question number (2.1.1 – 2.1.4) on the ANSWER SHEET.

2.1.1 Cost of sales is determined at the point of sale in the (perpetual/periodic inventory system).

2.1.2 In the periodic inventory system, carriage on purchases is recorded as an (asset/expense).

2.1.3 The (perpetual/periodic) system is more suited for low-value goods, purchased in bulk.

2.1.4 Merchandise purchased is recorded as an (asset/ expense) in the perpetual inventory system.

2.2 PERIODIC INVENTORY SYSTEM

The information provided relates to Yummy Stores for the year ended 30 June 2020.

The business is owned by Shiyaam Martin and managed by Jessie George.

REQUIRED:

2.2.1 Calculate the cost of sales on 30 June 2020.

2.2.2 Calculate the average stock turnover rate.

2.2.3 Shiyaam suspects that stock is being stolen despite security cameras being installed.

• Provide a calculation to verify her suspicion.

• What can Shiyaam do to improve the internal control of stock? State TWO points.

INFORMATION:

Units Amount (R)

Sales 3 200 768 000

Opening stock 160 19 200

Purchases 6 300 756 000

Carriage on purchases 75 600

Closing stock 2 800 336 000

ACTIVITY 2: ANSWER SHEET

CONCEPTS

2.1.1

2.1.2

2.1.3

2.1.4

2.2.1 Calculate the Cost of sales on 30 June 2020

2.2.2 Calculate the average stock turnover rate

Gr 11 Accounting Term 3, 2020 5

2.2.3 Shiyaam suspects that stock is being stolen despite security cameras being installed.

Provide a calculation to verify her suspicion.

What can Shiyaam do to improve the internal control of stock? State TWO points

Lesson solution:

https://wcedeportal.co.za/eresource/129786

Gr 11 Accounting Term 3, 2020 6

You might also like

- Xitsonga Novel XimitantsengeleDocument77 pagesXitsonga Novel Ximitantsengelekwetsimohope05100% (2)

- GRADE 9 - Maths - Trace The Concept - Teacher DocumentDocument101 pagesGRADE 9 - Maths - Trace The Concept - Teacher DocumentmariahcopisoNo ratings yet

- Paralysed Child's Parents Demand AnswersDocument7 pagesParalysed Child's Parents Demand AnswersnangamsoNo ratings yet

- SBA Mathematics Teacher Guide EnglishDocument46 pagesSBA Mathematics Teacher Guide EnglishNtsakow Mbekie IINo ratings yet

- Unit 1 MiniMatura - Answer KeyDocument1 pageUnit 1 MiniMatura - Answer KeyŁukasz Gil67% (3)

- UNIT PLAN - Principles of Accounts: Unit Topic: Double EntryDocument10 pagesUNIT PLAN - Principles of Accounts: Unit Topic: Double Entryapi-627345932No ratings yet

- Accounting Self Study Guide - Grade 10 - 12Document155 pagesAccounting Self Study Guide - Grade 10 - 12jgrzadka2No ratings yet

- Michael Ymer Planning DayDocument3 pagesMichael Ymer Planning Dayapi-511483529No ratings yet

- Form 1 PhysicsDocument37 pagesForm 1 PhysicsEng Bahanza80% (5)

- Simple Interest Worksheet 01Document2 pagesSimple Interest Worksheet 01A.Benson0% (1)

- Search For The Graf SpeeDocument5 pagesSearch For The Graf SpeeChristina Chavez Clinton0% (1)

- Home Economics ActivityDocument6 pagesHome Economics ActivityJerwin Arteche DalinaNo ratings yet

- GET Economics & Management Sciences Grades 7 - 9Document107 pagesGET Economics & Management Sciences Grades 7 - 9Goodwill Mahlatse100% (1)

- Grade 12 Learners GuideDocument51 pagesGrade 12 Learners GuidesaneleNo ratings yet

- Grade 10 First Period Physics NotesDocument20 pagesGrade 10 First Period Physics NotesAlphonso Tulay100% (2)

- 2020 BSTD Grade 12 Term 2 Activities According To The New AtpDocument18 pages2020 BSTD Grade 12 Term 2 Activities According To The New AtpAngelinaNo ratings yet

- Syllabus - Grade 8 ScienceDocument32 pagesSyllabus - Grade 8 ScienceArlance Sandra Marie MedinaNo ratings yet

- Math 9 Week 1 Day 2Document7 pagesMath 9 Week 1 Day 2Meleza Joy SaturNo ratings yet

- Grade 11 Exponential Functions ReviewDocument3 pagesGrade 11 Exponential Functions ReviewDangeloNo ratings yet

- 2024 Accounting Grade 10 Learners Notes Session 1-5Document101 pages2024 Accounting Grade 10 Learners Notes Session 1-5tshireletsoseloane2No ratings yet

- Math9 q1 Mod2of8 Illustrationsofquadraticequations v2Document24 pagesMath9 q1 Mod2of8 Illustrationsofquadraticequations v2Layva BahaliNo ratings yet

- April-July 2020 3 Term Primary 3: Scheme of Work For Primary 1, 2 and 3Document2 pagesApril-July 2020 3 Term Primary 3: Scheme of Work For Primary 1, 2 and 3Ashley JosephNo ratings yet

- GRD 7 LO T3 and T4 2018 Learner BookDocument50 pagesGRD 7 LO T3 and T4 2018 Learner BookBotle MakotanyaneNo ratings yet

- Life Sciences Grade 10 Learner Support Document MAFUMANI SECONDARYDocument40 pagesLife Sciences Grade 10 Learner Support Document MAFUMANI SECONDARYdeveloping habit and lifestyle of praise and worshNo ratings yet

- Worksheet 14 5.2 TaxationDocument2 pagesWorksheet 14 5.2 TaxationMuhammad Fareed0% (1)

- Mathsclinic Smartprep GR10 Eng V1.1Document36 pagesMathsclinic Smartprep GR10 Eng V1.1Ebrahim Rayned100% (1)

- Lesson Plan Daily Commerce PD Form 5Document6 pagesLesson Plan Daily Commerce PD Form 5Sweetie Pinkie100% (1)

- Corvs - Grade 7 Lesson Plan Exemplar Term 1 - March2021Document16 pagesCorvs - Grade 7 Lesson Plan Exemplar Term 1 - March2021Africa Maria BernalNo ratings yet

- Business Mathematics Worksheet Week 3Document4 pagesBusiness Mathematics Worksheet Week 3300980 Pitombayog NHS100% (1)

- English Grade 10 Notes 2 - Research IntroductionDocument1 pageEnglish Grade 10 Notes 2 - Research IntroductionaxxNo ratings yet

- 2.1: Use Integers and Rational NumbersDocument3 pages2.1: Use Integers and Rational NumbersPrincess GinezNo ratings yet

- Obe Syllabus in College AlgebraDocument8 pagesObe Syllabus in College AlgebraMichael FigueroaNo ratings yet

- Grade 9 Math - FactoringDocument4 pagesGrade 9 Math - FactoringJerson Yhuwel100% (1)

- Lesson Plan Number and ConversionsDocument10 pagesLesson Plan Number and Conversionsapi-285978629No ratings yet

- G9 - Q1 - Wk.7-LessonEdit Done Na DoneDocument30 pagesG9 - Q1 - Wk.7-LessonEdit Done Na DoneLee C. SorianoNo ratings yet

- Business Studies Grade 12 Notes On Legislation FinalDocument25 pagesBusiness Studies Grade 12 Notes On Legislation Finalrelebogile sekgololoNo ratings yet

- Worksheet On AnnuitiesDocument2 pagesWorksheet On AnnuitiesKurt SoNo ratings yet

- Lesson Plan - Repeating Decimals and Related FractionsDocument3 pagesLesson Plan - Repeating Decimals and Related Fractionsapi-298545735No ratings yet

- Grade 9 Social Studies Textbook CbseDocument3 pagesGrade 9 Social Studies Textbook CbseKurtNo ratings yet

- Samkange and SamkangeDocument9 pagesSamkange and SamkangeAnonymous vaQiOm2No ratings yet

- GRADE 10 Updated Core Notes 2022 Paper 2Document55 pagesGRADE 10 Updated Core Notes 2022 Paper 2cyonela5No ratings yet

- Economic and Management Sciences Grade 9 1.1Document152 pagesEconomic and Management Sciences Grade 9 1.1Blackhawk NetNo ratings yet

- GR 10 Business Studies 3 in 1 Extracts TASDocument16 pagesGR 10 Business Studies 3 in 1 Extracts TASPhumerh NtanzihhNo ratings yet

- E-Mathematics 10: Grade 10. Rex Book Store, Inc. Grade 10. Rex Book Store, IncDocument5 pagesE-Mathematics 10: Grade 10. Rex Book Store, Inc. Grade 10. Rex Book Store, IncEm-jayL.SantelicesNo ratings yet

- Chapter 6 - Ratio and ProportionDocument7 pagesChapter 6 - Ratio and ProportionnbhaNo ratings yet

- Business Studies Self Study-Guide - Forms of OwnershipDocument32 pagesBusiness Studies Self Study-Guide - Forms of Ownershipshreeshail_mp6009No ratings yet

- Grade 7 Mathematics Platinum Navigation PackDocument81 pagesGrade 7 Mathematics Platinum Navigation Packitumeleng senooaneNo ratings yet

- Grade 10 Mathematics Platinum Navigation PackDocument80 pagesGrade 10 Mathematics Platinum Navigation PackNcumo MpanzaNo ratings yet

- OrganisingDocument55 pagesOrganisingskirubaarunNo ratings yet

- Physical Science Teacher GuideDocument28 pagesPhysical Science Teacher GuideJj JjNo ratings yet

- Grade 10 Science (Physics) SchemesDocument3 pagesGrade 10 Science (Physics) SchemesDavies MasumbaNo ratings yet

- S3 - Measures of Central Tendency of Grouped DataDocument24 pagesS3 - Measures of Central Tendency of Grouped DataJoboy FritzNo ratings yet

- Diamond Stone International School IGCSE Weekly Lesson PlanDocument2 pagesDiamond Stone International School IGCSE Weekly Lesson PlanjanithaNo ratings yet

- Function and RelationDocument28 pagesFunction and RelationMarjory GuillemerNo ratings yet

- Tourism Grade 10 2022 Gauteng Compiled BookletsDocument119 pagesTourism Grade 10 2022 Gauteng Compiled BookletsboyteephamoodyNo ratings yet

- Standard Form - Lesson PlanDocument6 pagesStandard Form - Lesson PlangamesNo ratings yet

- Teaching Guide - EMS - 7Document36 pagesTeaching Guide - EMS - 7MIKEMPHALONo ratings yet

- Lesson Plan in Grade 8 MathematicsDocument3 pagesLesson Plan in Grade 8 Mathematicschari cruzmanNo ratings yet

- Business Statistics Session 4Document37 pagesBusiness Statistics Session 4hans100% (1)

- Week Five:: Reporting andDocument38 pagesWeek Five:: Reporting andIzham ShabdeanNo ratings yet

- FABM1 - LAS - 9 - Nature of Transaction of A Mdsg. BusDocument8 pagesFABM1 - LAS - 9 - Nature of Transaction of A Mdsg. BusVenus Ariate100% (1)

- Fabm Module03 File01Document8 pagesFabm Module03 File01PREFIX THAT IS LONG - Lester LoutteNo ratings yet

- Bean GameDocument4 pagesBean Gameadriana espinoza de los monterosNo ratings yet

- Wcms 584176Document41 pagesWcms 584176adriana espinoza de los monterosNo ratings yet

- Key Stage 4 Computing Non GcseDocument14 pagesKey Stage 4 Computing Non Gcseadriana espinoza de los monterosNo ratings yet

- Lesson Plan Project Management - 0Document6 pagesLesson Plan Project Management - 0adriana espinoza de los monterosNo ratings yet

- Shark Tank Project MR Haugers Economics Class HHSDocument6 pagesShark Tank Project MR Haugers Economics Class HHSadriana espinoza de los monterosNo ratings yet

- Academic Calendar 2022-2023Document1 pageAcademic Calendar 2022-2023AssunçãoNo ratings yet

- Ikenberry, John (2014) - The Illusion of Geopolitics.Document9 pagesIkenberry, John (2014) - The Illusion of Geopolitics.David RamírezNo ratings yet

- Smoking During Pregnancy FinalDocument14 pagesSmoking During Pregnancy Finalapi-232728488No ratings yet

- Arabic Diglossia - Jeremy PalmerDocument15 pagesArabic Diglossia - Jeremy PalmerTaliba RoumaniyaNo ratings yet

- FINALLY DTOT Matrix KindergartenDocument3 pagesFINALLY DTOT Matrix KindergartenJaymar Kevin PadayaoNo ratings yet

- Practitioner Guide Georgia English 20130516Document310 pagesPractitioner Guide Georgia English 20130516OSGFNo ratings yet

- Essay 1Document3 pagesEssay 1api-607929863No ratings yet

- 2 The Riseofthe RenaissanceDocument32 pages2 The Riseofthe RenaissanceHoneyGracia BrionesNo ratings yet

- Spouses Guanio V Makati Shangri-LaDocument2 pagesSpouses Guanio V Makati Shangri-LaCinNo ratings yet

- Waimiri Atroari GrammarDocument187 pagesWaimiri Atroari GrammarjjlajomNo ratings yet

- ConsonantsDocument23 pagesConsonantsanna39No ratings yet

- E. S. LYONS vs. C. W. ROSENSTOCKDocument4 pagesE. S. LYONS vs. C. W. ROSENSTOCKMarvin A GamboaNo ratings yet

- Jurisdiction of The Supreme CourtDocument1 pageJurisdiction of The Supreme CourtInnah A Jose Vergara-Huerta100% (1)

- MPA - Policy Paper (R.simbahon)Document80 pagesMPA - Policy Paper (R.simbahon)Robert SimbahonNo ratings yet

- CS615-MidTerm MCQs With Reference Solved by ArslanDocument16 pagesCS615-MidTerm MCQs With Reference Solved by ArslanHabib AhmedNo ratings yet

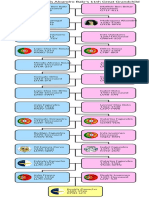

- Activity Cycle Sub-System: Flowchart Symbol Name of The SymbolDocument3 pagesActivity Cycle Sub-System: Flowchart Symbol Name of The SymbolALLIAH CARL MANUELLE PASCASIONo ratings yet

- DOH-HHRDB Healthcare Workers (Physicians)Document41 pagesDOH-HHRDB Healthcare Workers (Physicians)VERA FilesNo ratings yet

- The Romantic Movement As ADocument7 pagesThe Romantic Movement As ATANBIR RAHAMANNo ratings yet

- Optimise B1+ - End of The YearDocument5 pagesOptimise B1+ - End of The YearItsasoAmezaga100% (1)

- Genre Analysis On Racial StereotypeDocument4 pagesGenre Analysis On Racial Stereotypeapi-316855715No ratings yet

- Combined Knitting Conversion TableDocument1 pageCombined Knitting Conversion TableKatarina Ivic-UcovicNo ratings yet

- Introduction e CommerceDocument84 pagesIntroduction e CommerceMohd FirdausNo ratings yet

- 1 Aloandro Ben Bakr - BeatrizDocument1 page1 Aloandro Ben Bakr - BeatrizDavid DayNo ratings yet

- Case Study GoogleplexDocument6 pagesCase Study GoogleplexRoger Madorell100% (1)

- British Yearbook of International Law 1977 Crawford 93 182Document90 pagesBritish Yearbook of International Law 1977 Crawford 93 182irony91No ratings yet

- Ignacy Jan Paderewski A Discography of His European RecordingsDocument9 pagesIgnacy Jan Paderewski A Discography of His European RecordingsCody NguyenNo ratings yet

- What Is Strategic Positioning?Document8 pagesWhat Is Strategic Positioning?Michael YohannesNo ratings yet

- Unit 1. Health, Safety and Welfare in Construction and The Built EnvironmentDocument14 pagesUnit 1. Health, Safety and Welfare in Construction and The Built EnvironmentIhuhwa Marta TauNo ratings yet