Professional Documents

Culture Documents

Answer 4 - "Answers Only For Vaughn Company, Bennett Enterprise"

Answer 4 - "Answers Only For Vaughn Company, Bennett Enterprise"

Uploaded by

Rheu ReyesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answer 4 - "Answers Only For Vaughn Company, Bennett Enterprise"

Answer 4 - "Answers Only For Vaughn Company, Bennett Enterprise"

Uploaded by

Rheu ReyesCopyright:

Available Formats

Answer 4 – “Answers only for Vaughn Company, Bennett Enterprise”

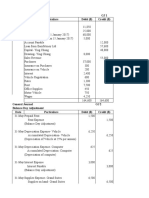

Question No. 1

Vaughn Company

Balance Sheet (Partial)

January 31, 2022

Current Liabilities:

Accounts payable $57,000

Notes Payable 22,500

Sales Taxes Payable* 5,808

Unearned Service Revenue** 5,500

Warranty Liability*** 3,150

Interest payable 50

Total Current Liabilities $94,008

*Sales Taxes Payable = (1,520 + 3,600 + 688) = 5,808

**Unearned service revenue = (16,500 – 10,500) = 6,000

***Warranty Liability = (45,000 x 7%) = 3,150

****Interest payable = (22,500 x 8% x 1/12 x10/30) = 50

S.no. Accounts title and explanations Debit Credit

Journal entries

Jan 5 Cash 20,520

Sales Taxes Payable 1,520

Sales revenue 19,000

(for sales made for cash)

Jan 12 Unearned Service Revenue 10,500

Service Revenue 10,500

(for revenue earned)

Jan 14 Sales Taxes Payable 8,400

Cash 8,400

(for taxes paid)

Jan 20 Accounts Receivable 48,600

Sales Taxes Payable 3,600

Sales Revenue (900*50) 45,000

Jan 21 Cash 22,500

Notes Payable 22,500

(for amount borrowed)

Jan 25 Cash 9,288

Sales Taxes Payable 688

Sales Revenue 8,600

(for sales made for cash)

Adjusting entry

Jan 31 Interest Expense 50

Interest Payable (22500*8%*1/12*10/30) 50

(for interest due)

Jan 31 Warranty Expense (45000 *7%) 3,150

Warranty Liability 3,150

(for warranty expense incurred)

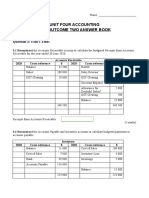

Question No. 2

Entries for notes payable

Bennett Enterprises issues a $528,000, 45-day, 6%, note to Spectrum Industries for

merchandise inventory.

Assume a 360-day year. If required, round your answers to the nearest dollar. If an

amount box does not require an entry, leave it blank.

a. Journalize Bennett Enterprises' entries to record:

Transaction General Journal Debit Credit

1 Inventory $ 528,000

Notes Payable $ 528,000

2 Notes Payable 528,000

Interest expense

3,960

($528,000*6%*45/360)

Cash 531,960

b. Journalize Spectrum Industries' entries to record:

Transaction General Journal Debit Credit

1 Notes Receivable $ 528,000

Sales $ 528,000

2 Cash 531,960

Notes Receivable 528,000

Interest Revenue

3,960

($528,000*6%*45/360)

You might also like

- Advanced Accounting 2:: Home Office, Branch and Agency - General ProceduresDocument37 pagesAdvanced Accounting 2:: Home Office, Branch and Agency - General ProceduresIzzy B94% (16)

- Record Sheet, Year 1: Please Submit These Record Sheets To Your Instructor After Completing The Simulation. Thank You!Document5 pagesRecord Sheet, Year 1: Please Submit These Record Sheets To Your Instructor After Completing The Simulation. Thank You!Randi Kosim SiregarNo ratings yet

- HO&BAccountingDocument27 pagesHO&BAccountingKandiz89% (9)

- Government Accounting Final Examination With Answer and SolutionDocument13 pagesGovernment Accounting Final Examination With Answer and SolutionRheu Reyes100% (7)

- Answer 5 - " Modern Appliances Corporation"Document4 pagesAnswer 5 - " Modern Appliances Corporation"Rheu ReyesNo ratings yet

- Dlp-Triangle CongruenceDocument8 pagesDlp-Triangle CongruenceJoan B. Basco100% (3)

- Workshop 2 Qs As Introduction To A FDocument18 pagesWorkshop 2 Qs As Introduction To A FYeoh Tze ShinNo ratings yet

- (PDF) Download Card Statement PDFDocument4 pages(PDF) Download Card Statement PDFSamNo ratings yet

- Intermediate Accounting 2 Theories Final ExaminationDocument10 pagesIntermediate Accounting 2 Theories Final ExaminationRheu Reyes100% (2)

- Intermediate Accounting 2 Theories Final ExaminationDocument10 pagesIntermediate Accounting 2 Theories Final ExaminationRheu Reyes100% (2)

- Assignment 4 - Financial Accounting - February 11Document4 pagesAssignment 4 - Financial Accounting - February 11Ednalyn PascualNo ratings yet

- Tugas P2-1A Dan P2-2A Peng - AkuntansiDocument5 pagesTugas P2-1A Dan P2-2A Peng - AkuntansiAlche MistNo ratings yet

- CH 8 LiabilitiesDocument10 pagesCH 8 LiabilitiesKrizia Oliva100% (1)

- NumerologyDocument24 pagesNumerologyphani60% (5)

- Jon Thompson Naked Mentalism 3Document100 pagesJon Thompson Naked Mentalism 3AlaaFathey100% (7)

- v3 q1-7 Financial Position QnaDocument26 pagesv3 q1-7 Financial Position Qna5k6kczf2fkNo ratings yet

- BUS 142 - Exercises CH 11Document10 pagesBUS 142 - Exercises CH 11Jess IcaNo ratings yet

- Tugas Latihan Chapter 10 Dan 11Document2 pagesTugas Latihan Chapter 10 Dan 11Arnalistan EkaNo ratings yet

- General Journal GJ1 Date Particulars Debit ($) Credit ($)Document25 pagesGeneral Journal GJ1 Date Particulars Debit ($) Credit ($)Jennifer ChandraNo ratings yet

- mgt101 Questions With AnswersDocument11 pagesmgt101 Questions With AnswersKinza LaiqatNo ratings yet

- Corporate Financial Reporting PDFDocument3 pagesCorporate Financial Reporting PDFIshan SharmaNo ratings yet

- November 2019 Exam Solution Final PaperDocument7 pagesNovember 2019 Exam Solution Final Paper2603803No ratings yet

- Completing The Accounting Cycle: Service Concern: Subject-Descriptive Title Subject - CodeDocument12 pagesCompleting The Accounting Cycle: Service Concern: Subject-Descriptive Title Subject - CodeRose LaureanoNo ratings yet

- CardStatement 2018-01-08Document6 pagesCardStatement 2018-01-08grihit singhNo ratings yet

- CHAPTER 6 JOINT ARRANGEMENTS Soln 2AAC Mar 2023 Copy 2Document11 pagesCHAPTER 6 JOINT ARRANGEMENTS Soln 2AAC Mar 2023 Copy 2Lorifel Antonette Laoreno TejeroNo ratings yet

- Accounting NSC P1 MG Sept 2022 Eng GautengDocument13 pagesAccounting NSC P1 MG Sept 2022 Eng GautengSweetness MakaLuthando LeocardiaNo ratings yet

- MGT 101Document13 pagesMGT 101MuzzamilNo ratings yet

- Question No 1: Journal EntriesDocument3 pagesQuestion No 1: Journal EntriesMUKHTALIFNo ratings yet

- Tugas 2. Proses PencatatanDocument5 pagesTugas 2. Proses Pencatatantheresia betveneNo ratings yet

- Financial Accounting - Tugas 5 - 18 Sep - REVISI 123Document3 pagesFinancial Accounting - Tugas 5 - 18 Sep - REVISI 123AlfiyanNo ratings yet

- BACC 2021 - 22 Sem 2 - MST SolutionsDocument4 pagesBACC 2021 - 22 Sem 2 - MST Solutionsxa. vieNo ratings yet

- Problem 10-8 (Banco)Document7 pagesProblem 10-8 (Banco)Roy Mitz Aggabao Bautista VNo ratings yet

- Questions On Operating ActivityDocument6 pagesQuestions On Operating ActivitypuxvashuklaNo ratings yet

- Interactive Question 4: Acquisition of A Subsidiary: Non-Current AssetsDocument4 pagesInteractive Question 4: Acquisition of A Subsidiary: Non-Current AssetsRiad FaisalNo ratings yet

- KC Toyland WorksheetDocument13 pagesKC Toyland WorksheettakycabrejasNo ratings yet

- Special Journals - Quiz 38Document7 pagesSpecial Journals - Quiz 38Joana TrinidadNo ratings yet

- The Parable of The Talents - 20190714Document6 pagesThe Parable of The Talents - 20190714LynnHanNo ratings yet

- Energy Vending Inc Journal Entries - CompressDocument9 pagesEnergy Vending Inc Journal Entries - Compressadharsh veeraNo ratings yet

- T10 Ans 3Document2 pagesT10 Ans 3PUI TUNG CHONGNo ratings yet

- BDC112 Calculation NOTES For Students BDocument17 pagesBDC112 Calculation NOTES For Students BYogavathany MaihandaranNo ratings yet

- 2019 Unit 4 Budgeting SAC Solution BookDocument3 pages2019 Unit 4 Budgeting SAC Solution BookLachlan McFarlandNo ratings yet

- FDNACCT Unit 3 - Financial Statements - ExampleDocument2 pagesFDNACCT Unit 3 - Financial Statements - ExampleerinlomioNo ratings yet

- Accounting MidtermDocument14 pagesAccounting Midtermazade azamiNo ratings yet

- Exercise 8.1: A Newtown Plumbing: Cash Budget For Month Ending 31 August 2015Document15 pagesExercise 8.1: A Newtown Plumbing: Cash Budget For Month Ending 31 August 2015Doan Chan PhongNo ratings yet

- Chapter6 BuenaventuraDocument11 pagesChapter6 BuenaventuraAnonnNo ratings yet

- Ias 12 QDocument2 pagesIas 12 QPinias ShefikaNo ratings yet

- Fabm 21Document6 pagesFabm 21kristelNo ratings yet

- Viraj Wijeratne 2223 Revised SET ComputationDocument1 pageViraj Wijeratne 2223 Revised SET Computationattackdfg2002No ratings yet

- Accounting II-1Document151 pagesAccounting II-1Adnan KanwalNo ratings yet

- Rise School of Accountancy: Suggested Solution Test 08Document2 pagesRise School of Accountancy: Suggested Solution Test 08iamneonkingNo ratings yet

- 12-Mar Accounts Receivable 11,000 Service Revenue 11,000 20-Mar Cash 10,780 Sales Discount 220 Accounts Receivable 11,000Document6 pages12-Mar Accounts Receivable 11,000 Service Revenue 11,000 20-Mar Cash 10,780 Sales Discount 220 Accounts Receivable 11,000Tess CoaryNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current Amountabhilash eNo ratings yet

- Show Int. Rate: Tax Saving and Misc Earning DeclarationDocument1 pageShow Int. Rate: Tax Saving and Misc Earning DeclarationAK TRIPATHINo ratings yet

- Assignment ACT201 SMR1Document15 pagesAssignment ACT201 SMR1Md.sabir 1831620030No ratings yet

- Midterm Pretest - Cost Model-Partial Goodwill FinalDocument9 pagesMidterm Pretest - Cost Model-Partial Goodwill FinalWinnie LaraNo ratings yet

- Edgar DetoyaDocument16 pagesEdgar DetoyaAngelica EltagonNo ratings yet

- Employee Details Payment & Leave Details: Arrears Amount CurrentDocument2 pagesEmployee Details Payment & Leave Details: Arrears Amount CurrentRamesh yaraboluNo ratings yet

- MRSM 2018 - JawapanDocument14 pagesMRSM 2018 - JawapanbeaveralterNo ratings yet

- 07 Activity 1Document2 pages07 Activity 1Althea NovidaNo ratings yet

- 2021 KZN Acc Step Ahead G11 Solutions-1Document67 pages2021 KZN Acc Step Ahead G11 Solutions-1sanelisomlangeni24No ratings yet

- Dec 2012Document49 pagesDec 2012Saroj ShresthaNo ratings yet

- 2019 Unit 3 Outcome 2 Solution BookDocument10 pages2019 Unit 3 Outcome 2 Solution BookLachlan McFarlandNo ratings yet

- Afe 3582Document6 pagesAfe 3582sarah josephNo ratings yet

- SBM Errata Sheet 2020 - 080920Document11 pagesSBM Errata Sheet 2020 - 080920Hamza AliNo ratings yet

- ACCT 3061 Asignación Cap 4 y 5Document4 pagesACCT 3061 Asignación Cap 4 y 5gpm-81No ratings yet

- Question ADV GMDocument6 pagesQuestion ADV GMsherlockNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- General Accounting 3 - Express Handling and DeliveryDocument9 pagesGeneral Accounting 3 - Express Handling and DeliveryRheu ReyesNo ratings yet

- Answer 4 - Excel For Diff. Acctg.Document42 pagesAnswer 4 - Excel For Diff. Acctg.Rheu ReyesNo ratings yet

- General Accounting 2Document5 pagesGeneral Accounting 2Rheu ReyesNo ratings yet

- Pract 2 Business CombinationDocument3 pagesPract 2 Business CombinationRheu ReyesNo ratings yet

- General Accounting 1 - Indianola Pharmaceutical CompanyDocument7 pagesGeneral Accounting 1 - Indianola Pharmaceutical CompanyRheu ReyesNo ratings yet

- Answer 1 - Blue Bill CorporationDocument2 pagesAnswer 1 - Blue Bill CorporationRheu ReyesNo ratings yet

- Answer 2 - Answers Only For Crane Company, Swifty Company, Pharaoh Company, and Random Accounting QuestionsDocument10 pagesAnswer 2 - Answers Only For Crane Company, Swifty Company, Pharaoh Company, and Random Accounting QuestionsRheu ReyesNo ratings yet

- CRC Ace Afar Tax and RFBTDocument42 pagesCRC Ace Afar Tax and RFBTRheu ReyesNo ratings yet

- Solutions - Auditing Problems Testbank 2Document9 pagesSolutions - Auditing Problems Testbank 2Rheu ReyesNo ratings yet

- Latin Words in Business Law Simplified Explanation - WPS OfficeDocument2 pagesLatin Words in Business Law Simplified Explanation - WPS OfficeRheu Reyes50% (2)

- Business Plan-Feasib Sample Front PageDocument4 pagesBusiness Plan-Feasib Sample Front PageRheu ReyesNo ratings yet

- Nationalized or Partly Nationalized Corporations 1. 100 % FilipinosDocument1 pageNationalized or Partly Nationalized Corporations 1. 100 % FilipinosRheu ReyesNo ratings yet

- Auditing Theory FinalsDocument17 pagesAuditing Theory FinalsRheu ReyesNo ratings yet

- ACCTG-206B-FIRST-PREBOARD Without AnswerDocument16 pagesACCTG-206B-FIRST-PREBOARD Without AnswerRheu ReyesNo ratings yet

- Cash and Cash Equivalents Testbank Fr. BSA-IVDocument48 pagesCash and Cash Equivalents Testbank Fr. BSA-IVRheu ReyesNo ratings yet

- Accounting 204anfinal Exams Compilation Old NotesDocument1 pageAccounting 204anfinal Exams Compilation Old NotesRheu ReyesNo ratings yet

- Business Com - Intercompany TransactionsDocument6 pagesBusiness Com - Intercompany TransactionsRheu ReyesNo ratings yet

- Bank Reconciliation ActivitiesDocument3 pagesBank Reconciliation ActivitiesRheu ReyesNo ratings yet

- Acctg 205A Quiz NOV. 6,2020Document3 pagesAcctg 205A Quiz NOV. 6,2020Rheu ReyesNo ratings yet

- Auditing Problem Final Exam With Answer Only, No SolutionDocument23 pagesAuditing Problem Final Exam With Answer Only, No SolutionRheu Reyes100% (1)

- What Is An NBI Clearance?Document18 pagesWhat Is An NBI Clearance?Rheu ReyesNo ratings yet

- Philhealth ProcessDocument8 pagesPhilhealth ProcessRheu ReyesNo ratings yet

- PMMA Entrance Examination: Basic Qualification RequirementsDocument1 pagePMMA Entrance Examination: Basic Qualification RequirementsRheu Reyes0% (1)

- Sss Requirements and ProcessDocument3 pagesSss Requirements and ProcessRheu ReyesNo ratings yet

- J S Bachs Ornament TableDocument7 pagesJ S Bachs Ornament TableAlmeidaNo ratings yet

- (THAAD) Five Failures and CountingDocument6 pages(THAAD) Five Failures and CountingGuilherme Da Silva CostaNo ratings yet

- Panasonic LCD TH-L32C30Document72 pagesPanasonic LCD TH-L32C30King King0% (1)

- BIOLS102-UOB-Chapter 10Document8 pagesBIOLS102-UOB-Chapter 10Noor JanahiNo ratings yet

- HBR Catalogue Eng KKPCDocument2 pagesHBR Catalogue Eng KKPCIulian Victor MafteiNo ratings yet

- Cases NATRES Batch1Document113 pagesCases NATRES Batch1Leo Mark LongcopNo ratings yet

- Module 6 - Sequential Circuits, Excitation Function, State Table, State DiagramDocument21 pagesModule 6 - Sequential Circuits, Excitation Function, State Table, State DiagramYvanne Esquia CuregNo ratings yet

- UN - HIV and Prison - Policy BriefDocument12 pagesUN - HIV and Prison - Policy BriefParomita2013No ratings yet

- Cutter-Marble - Bosch GDM13-34Document79 pagesCutter-Marble - Bosch GDM13-34tamilmanoharNo ratings yet

- 1884 Journey From Heraut To Khiva Moscow and ST Petersburgh Vol 2 by Abbott S PDFDocument342 pages1884 Journey From Heraut To Khiva Moscow and ST Petersburgh Vol 2 by Abbott S PDFBilal AfridiNo ratings yet

- Santa Cruz Scanner FreqsDocument35 pagesSanta Cruz Scanner FreqsdonsterthemonsterNo ratings yet

- Unit 1: A1 Coursebook AudioscriptsDocument39 pagesUnit 1: A1 Coursebook AudioscriptsRaul GaglieroNo ratings yet

- Essential Tools and Equipment in Organic Agriculture NC II - Jayvee A. RamosDocument7 pagesEssential Tools and Equipment in Organic Agriculture NC II - Jayvee A. RamosRhea Bernabe100% (1)

- EXEMPLAR - 1006HSV - Assessment 1a - Critical Analysis Reflective Essay - Draft Template - T323Document5 pagesEXEMPLAR - 1006HSV - Assessment 1a - Critical Analysis Reflective Essay - Draft Template - T323aryanrana20942No ratings yet

- FM Assignment Booster ChaiDocument26 pagesFM Assignment Booster ChaiAbin ShaNo ratings yet

- Story As World MakingDocument9 pagesStory As World MakingAugusto ChocobarNo ratings yet

- A1 (2 3 4) F./... D 6905 Af/1Document3 pagesA1 (2 3 4) F./... D 6905 Af/1GERALD SIMONNo ratings yet

- Clear Codes List-NokiaDocument8 pagesClear Codes List-NokiaocuavasNo ratings yet

- Body MechanismDocument31 pagesBody MechanismAnnapurna DangetiNo ratings yet

- Ple New Entry Codes 2024Document93 pagesPle New Entry Codes 2024luqmanluqs2No ratings yet

- Book Review For: One Up On Wall StreetDocument22 pagesBook Review For: One Up On Wall StreetSenthil KumarNo ratings yet

- Identifikasi Anak Berbakat (Compatibility Mode)Document23 pagesIdentifikasi Anak Berbakat (Compatibility Mode)Teguh Firman HadiNo ratings yet

- Tender InformationDocument167 pagesTender InformationComments ModeratorNo ratings yet

- FPM Brochur 2016-17Document56 pagesFPM Brochur 2016-17Rithima SinghNo ratings yet

- Study On Effect of Manual Metal Arc Welding Process Parameters On Width of Heat Affected Zone (Haz) For Ms 1005 SteelDocument8 pagesStudy On Effect of Manual Metal Arc Welding Process Parameters On Width of Heat Affected Zone (Haz) For Ms 1005 SteelAngga Pamilu PutraNo ratings yet

- MTM Lab (Metrology Part) - Spring 2021Document12 pagesMTM Lab (Metrology Part) - Spring 2021Rahul Raghunath BodankiNo ratings yet