Professional Documents

Culture Documents

PDF 339277660191018

PDF 339277660191018

Uploaded by

Hasan KhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PDF 339277660191018

PDF 339277660191018

Uploaded by

Hasan KhanCopyright:

Available Formats

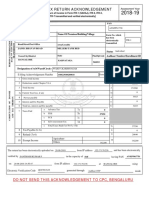

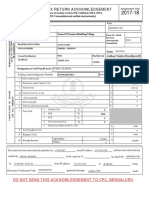

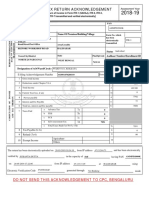

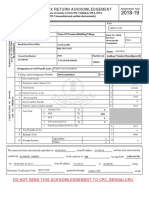

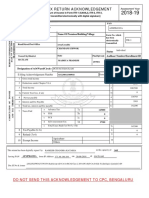

INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year

FORM 2018-19

ITR-V [Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3,

ITR-4(SUGAM), ITR-5, ITR-7 transmitted electronically without digital signature] .

(Please see Rule 12 of the Income-tax Rules, 1962)

Name PAN

BHANWARI KANWAR

PERSONAL INFORMATION AND THE

HPVPK2311P

Form No. which

DATE OF ELECTRONIC

Flat/Door/Block No Name Of Premises/Building/Village

has been ITR-1

TRANSMISSION

1

electronically

transmitted

Road/Street/Post Office Area/Locality

NEAR NAVIN SCHOOL NIMBI JODHAN Individual

Status

Town/City/District State Pin/ZipCode Aadhaar Number/ Enrollment ID

NAGAUR

Rajasthan 341316 XXXX XXXX 5455

Designation of AO (Ward / Circle) ITO, W-1, NAGOUR Original or Revised ORIGINAL

E-filing Acknowledgement Number 339277660191018 Date(DD-MM-YYYY) 19-10-2018

1 Gross Total Income 1 241675

2 Deductions under Chapter-VI-A 2 220

3 Total Income 3 241460

COMPUTATION OF INCOME

a Current Year loss, if any 3a 0

4

AND TAX THEREON

4 Net Tax Payable 0

5 Interest and Fee Payable 5 0

6 Total Tax, Interest and Fee Payable 6 0

7 Taxes Paid

a Advance Tax 7a 0

b TDS 7b 0

c TCS 7c 0

d Self Assessment Tax 7d 0

e Total Taxes Paid (7a+7b+7c +7d) 7e 0

8 Tax Payable (6-7e) 8 0

9 Refund (7e-6) 9 0

10 Exempt Income Agriculture 0

10

Others 0 0

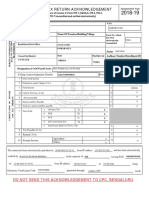

VERIFICATION

I, BHANWARI KANWAR son/ daughter of HULAS SINGH , holding Permanent Account Number HPVPK2311P

solemnly declare to the best of my knowledge and belief, the information given in the return and the schedules thereto which have been transmitted

electronically by me vide acknowledgement number mentioned above is correct and complete and that the amount of total income and other particulars

shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to income-tax for

the previous year relevant to the assessment year 2018-19. I further declare that I am making this return in my capacity as

Self and I am also competent to make this return and verify it.

Sign here Date 19-10-2018 Place NAGAUR

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below:

Identification No. of TRP Name of TRP Counter Signature of TRP

For Office Use Only

Receipt No Filed from IP address 49.36.1.28

Date

Seal and signature of HPVPK2311P01339277660191018B283B06BE0F8DBD41CCDAE71F00F7DB209BAC2CC

receiving official

Please send the duly signed Form ITR-V to “Centralized Processing Centre, Income Tax Department, Bengaluru 560500”, by ORDINARY

POST OR SPEED POST ONLY, within 120 days from date of transmitting the data electronically. Form ITR-V shall not be received in any other

office of the Income-tax Department or in any other manner. The confirmation of receipt of this Form ITR-V at ITD-CPC will be sent to the e-mail

address camp621@gmail.com

You might also like

- KOHO Bank StatementDocument2 pagesKOHO Bank Statementt.biller3No ratings yet

- 2018 Taxation Bar Questions and AnswersDocument14 pages2018 Taxation Bar Questions and AnswersAlexLesle Roble100% (8)

- MD Resident Tax Booklet 2009Document32 pagesMD Resident Tax Booklet 2009galaxianNo ratings yet

- (Answers) 20200915172413prl3 - v1 - 0 - Exercise - Year - End - Federal - 2017 - 0120Document13 pages(Answers) 20200915172413prl3 - v1 - 0 - Exercise - Year - End - Federal - 2017 - 0120Arslan Hafeez100% (1)

- It 18-19Document1 pageIt 18-19mohdmoin0493No ratings yet

- 2018 08 31 18 26 34 022 - 1535720194022 - XXXPB3542X - ItrvDocument1 page2018 08 31 18 26 34 022 - 1535720194022 - XXXPB3542X - Itrvdibyan dasNo ratings yet

- 2020 12 20 20 11 24 733 - 1608475284733 - XXXPP4894X - ItrvDocument1 page2020 12 20 20 11 24 733 - 1608475284733 - XXXPP4894X - ItrvHARI KRISHAN PALNo ratings yet

- Soumyadeep Chanda Itr Ay 2018Document1 pageSoumyadeep Chanda Itr Ay 2018Cajonized Guy DeepNo ratings yet

- Itr5 271352350310818$Document1 pageItr5 271352350310818$Ajay DiwanNo ratings yet

- 2018 08 22 17 18 09 004 - 1534938489004 - XXXPK5111X - ItrvDocument1 page2018 08 22 17 18 09 004 - 1534938489004 - XXXPK5111X - ItrvSooraj KanojiyaNo ratings yet

- 2019 03 29 18 20 50 494 - 1553863850494 - XXXPC3953X - ItrvDocument1 page2019 03 29 18 20 50 494 - 1553863850494 - XXXPC3953X - ItrvIshaan ChawlaNo ratings yet

- 2018 08 08 18 04 19 838 - 1533731659838 - XXXPG1329X - ItrvDocument1 page2018 08 08 18 04 19 838 - 1533731659838 - XXXPG1329X - Itrvdibyan dasNo ratings yet

- 2019 03 31 15 05 10 049 - 1554024910049 - XXXPJ4090X - Itrv PDFDocument1 page2019 03 31 15 05 10 049 - 1554024910049 - XXXPJ4090X - Itrv PDFShivshankar RNo ratings yet

- Sukhjeet Singh 2018-19 (Itr) PDFDocument1 pageSukhjeet Singh 2018-19 (Itr) PDFAnonymous XgLFw9IcQNo ratings yet

- Maadhavan Chandhiran 16-Mar-2018 454072340Document1 pageMaadhavan Chandhiran 16-Mar-2018 454072340samaadhuNo ratings yet

- Ack FY 17-18-Ramesh BDocument1 pageAck FY 17-18-Ramesh BMurthy KarumuriNo ratings yet

- PDF 759518980120718Document1 pagePDF 759518980120718HARDIK BANSALNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)santoshkumarNo ratings yet

- Meghana - 2019 04 10 19 45 08 336 - 1554905708336 - XXXPM8241X - ITRVDocument1 pageMeghana - 2019 04 10 19 45 08 336 - 1554905708336 - XXXPM8241X - ITRVYunusShaikhNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagesanthosh kumarNo ratings yet

- 2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFDocument1 page2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFAkshya BhoiNo ratings yet

- 2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - ItrvDocument1 page2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - Itrvpoluri vinayNo ratings yet

- Itr-V Indian Income Tax Return VerificatDocument1 pageItr-V Indian Income Tax Return VerificatMOHD AslamNo ratings yet

- Itr 2018-19 S B Mishra PDFDocument1 pageItr 2018-19 S B Mishra PDFJITENDRA DUBEBYNo ratings yet

- Edjpb0287g Itrv PDFDocument1 pageEdjpb0287g Itrv PDFArun BhatnagarNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Nida KhanNo ratings yet

- Letsgettin Fraud CompanyDocument1 pageLetsgettin Fraud CompanyAnonymous A3CiCzvNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillagehemakumarsNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document3 pagesItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)srinivas maguluriNo ratings yet

- 17 18 SaleemDocument1 page17 18 Saleembalaji xeroxNo ratings yet

- 102 1500880491102 XXXPP4297X ItrvDocument1 page102 1500880491102 XXXPP4297X Itrvramarao_pandNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)srinivas maguluriNo ratings yet

- Itr-V: Indian Income Tax Return Verification Form - .Document1 pageItr-V: Indian Income Tax Return Verification Form - .KumarNo ratings yet

- MANI SIVASANKAR - 28-Feb-2019 - 427477180Document1 pageMANI SIVASANKAR - 28-Feb-2019 - 427477180samaadhuNo ratings yet

- 2018 07 22 16 36 36 674 - 1532257596674 - XXXPK4739X - Itrv PDFDocument1 page2018 07 22 16 36 36 674 - 1532257596674 - XXXPK4739X - Itrv PDFakshay guptaNo ratings yet

- .Archivetemp2018 10 10 08 02 00 482 - 1539138720482 - XXXPR8391X - ITRVDocument1 page.Archivetemp2018 10 10 08 02 00 482 - 1539138720482 - XXXPR8391X - ITRVUday RayapudiNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagehealth with wealthNo ratings yet

- Itr-V Ajqpy0100n 2017-18 775756550170517Document1 pageItr-V Ajqpy0100n 2017-18 775756550170517Raj RajNo ratings yet

- 2018 12 16 12 25 37 908 - 1544943337908 - XXXPR1749X - Itrv PDFDocument1 page2018 12 16 12 25 37 908 - 1544943337908 - XXXPR1749X - Itrv PDFJayanta Sur RoyNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageARK EXPORT AND IMPORTNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSheila George SorkarNo ratings yet

- 2018 08 08 14 20 22 467 - 1533718222467 - XXXPP1510X - Itrv PDFDocument1 page2018 08 08 14 20 22 467 - 1533718222467 - XXXPP1510X - Itrv PDFKrishnaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageTaiyabaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageApoorva MoonatNo ratings yet

- 2019 03 12 17 56 10 874 - 1552393570874 - XXXPS8275X - ItrvDocument1 page2019 03 12 17 56 10 874 - 1552393570874 - XXXPS8275X - ItrvDhananjay JaiswalNo ratings yet

- 2018 03 04 21 10 37 424 - 1520178037424 - XXXPS9207X - ItrvDocument1 page2018 03 04 21 10 37 424 - 1520178037424 - XXXPS9207X - Itrvrohit sNo ratings yet

- 2018 07 19 12 06 41 640 - 1531982201640 - XXXPS3223X - Acknowledgement PDFDocument1 page2018 07 19 12 06 41 640 - 1531982201640 - XXXPS3223X - Acknowledgement PDFHarshal A ShahNo ratings yet

- 2018 07 20 11 14 23 177 - 1532065463177 - XXXPC3536X - Acknowledgement PDFDocument1 page2018 07 20 11 14 23 177 - 1532065463177 - XXXPC3536X - Acknowledgement PDFGanesh DasaraNo ratings yet

- Itr-V: Indian Income Tax Return Verification Form - .Document1 pageItr-V: Indian Income Tax Return Verification Form - .Balkar BhullerNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageO P TulsyanNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSuraj Dev MahatoNo ratings yet

- 2019-09-12 - XXXPB6273X - ItrvDocument1 page2019-09-12 - XXXPB6273X - ItrvDeb Kumar BhaumikNo ratings yet

- 2019 07 17 12 05 41 184 - 1563345341184 - XXXPG9565X - ItrvDocument1 page2019 07 17 12 05 41 184 - 1563345341184 - XXXPG9565X - ItrvsantoshkumarNo ratings yet

- Sellakkili Ramaiah 31-Jul-2018 969570370Document1 pageSellakkili Ramaiah 31-Jul-2018 969570370samaadhuNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageamitNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageIshani ShahNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagechinna rajaNo ratings yet

- 2018 08 25 21 26 43 822 - 1535212603822 - XXXPV9294X - AcknowledgementDocument1 page2018 08 25 21 26 43 822 - 1535212603822 - XXXPV9294X - Acknowledgementanusha.veldandiNo ratings yet

- 2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFDocument1 page2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFAnupam GauravNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageCA Jitu DashNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSunil PeerojiNo ratings yet

- Ack F.y.2017-18Document1 pageAck F.y.2017-18NishantNo ratings yet

- Maven Minds Budget Brief 2022Document24 pagesMaven Minds Budget Brief 2022Salman AhmedNo ratings yet

- IAS MedTech FEU Fourth Year First Semester Tuition Rates SY2022 2023 - Ver2Document2 pagesIAS MedTech FEU Fourth Year First Semester Tuition Rates SY2022 2023 - Ver2michellemariflor.tutaanNo ratings yet

- CHALLAN FORM No.32 ADocument3 pagesCHALLAN FORM No.32 AMIan Muzamil0% (1)

- Request For A Business Number and Certain Program AccountsDocument13 pagesRequest For A Business Number and Certain Program AccountsDattadharmawardhaneNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearRaveendra MoodithayaNo ratings yet

- Gmail - Madame Tussauds London Booking Confirmation Order NumbeDocument2 pagesGmail - Madame Tussauds London Booking Confirmation Order Numbeapi-75518386No ratings yet

- IUGB TUITION Rev June102017 Rev032218Document2 pagesIUGB TUITION Rev June102017 Rev032218claude BOHOUNo ratings yet

- Payment Acknowledgement Payment Acknowledgement: PrintDocument1 pagePayment Acknowledgement Payment Acknowledgement: PrintS KkNo ratings yet

- UmeshDocument1 pageUmeshAman DubeyNo ratings yet

- Visa Pin Security Program Guide Public PDFDocument33 pagesVisa Pin Security Program Guide Public PDFPutra PutraNo ratings yet

- Income Statement: Case 1: RevenuesDocument3 pagesIncome Statement: Case 1: RevenuesRajivNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)rafeekmek31No ratings yet

- CitiBank-Statement Jan01-Jan30Document2 pagesCitiBank-Statement Jan01-Jan30hzservices70No ratings yet

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiSarang AgrawalNo ratings yet

- Swift GaelDocument1 pageSwift GaelNxckNo ratings yet

- Affirmative: Tax Reform For Acceleration and Inclusion (Train) Law in The PhilippinesDocument10 pagesAffirmative: Tax Reform For Acceleration and Inclusion (Train) Law in The PhilippinesTherese Janine HetutuaNo ratings yet

- SUB: Letter of Intent For Leasing Out Unit No. 1211, 12th Floor, Ocus Quantum, Sector 51, Gurgaon, HaryanaDocument1 pageSUB: Letter of Intent For Leasing Out Unit No. 1211, 12th Floor, Ocus Quantum, Sector 51, Gurgaon, HaryanaHoney ShuklaNo ratings yet

- Frankfinn Franchisee ROI - Moradabad - Jan 2020 - Ver 3.0Document1 pageFrankfinn Franchisee ROI - Moradabad - Jan 2020 - Ver 3.0riyaz9999No ratings yet

- Principles of TaxationDocument25 pagesPrinciples of TaxationceejayeNo ratings yet

- TestbankDocument3 pagesTestbankMarizMatampaleNo ratings yet

- DLCPM00312970000016079 2022Document2 pagesDLCPM00312970000016079 2022Anshul KatiyarNo ratings yet

- Sem-V - Principles of Taxation LawDocument2 pagesSem-V - Principles of Taxation LawNaveen SihareNo ratings yet

- Assign - Trial Balance Answer SheetDocument9 pagesAssign - Trial Balance Answer SheetDing CostaNo ratings yet

- 1 1 2023 Yangon-Singapore TicketDocument6 pages1 1 2023 Yangon-Singapore TicketZin WendyNo ratings yet

- Self Declaration For Tuition FeesDocument1 pageSelf Declaration For Tuition FeesSudha SNo ratings yet

- Principles of Taxation-ReviewerDocument36 pagesPrinciples of Taxation-ReviewerNikki Coleen SantinNo ratings yet