Professional Documents

Culture Documents

Answer 14 Gu January 2013 QUESTION 1

Answer 14 Gu January 2013 QUESTION 1

Uploaded by

skye SCopyright:

Available Formats

You might also like

- Lazar Blue Book Chapter 4 Solution (1 To 14 Only)Document27 pagesLazar Blue Book Chapter 4 Solution (1 To 14 Only)Shuhada Shamsuddin75% (4)

- Financial Accounting IFRS Student Mark Plan June 2019Document16 pagesFinancial Accounting IFRS Student Mark Plan June 2019scottNo ratings yet

- Notes On The Revised Corporation CodeDocument34 pagesNotes On The Revised Corporation CodeZuleira Parra100% (10)

- FMV Magic Timber CaseDocument6 pagesFMV Magic Timber CaseEdward Berbari100% (1)

- Far410 - SS - Feb 2022Document9 pagesFar410 - SS - Feb 2022AFIZA JASMANNo ratings yet

- Answer 29 Mark PLC January 2020Document2 pagesAnswer 29 Mark PLC January 2020skye SNo ratings yet

- Running Head: Financial AccountingDocument9 pagesRunning Head: Financial AccountingKashémNo ratings yet

- Part 1 Examination - Paper 1.1 (INT) Preparing Financial Statements (InternationalDocument8 pagesPart 1 Examination - Paper 1.1 (INT) Preparing Financial Statements (InternationalAUDITOR97No ratings yet

- Accounting 2Document2 pagesAccounting 2reeisha7No ratings yet

- 1-1hkg 2002 Dec ADocument8 pages1-1hkg 2002 Dec AWing Yan KatieNo ratings yet

- ICAEW Mar 2020 - Q4Document4 pagesICAEW Mar 2020 - Q4leejw2810No ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Titles Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Titles Debit Credit Debit Credit Debit Credit Debit CreditVencint LaranNo ratings yet

- MN30315 January 2023 Exam - SOLUTIONSDocument15 pagesMN30315 January 2023 Exam - SOLUTIONSjoshuachan1411No ratings yet

- 20solution Far460 - Jun 2020 - StudentDocument10 pages20solution Far460 - Jun 2020 - StudentRuzaikha razaliNo ratings yet

- A4 PalacioDocument3 pagesA4 PalacioPinky DaisiesNo ratings yet

- Far460 Group Project 2Document4 pagesFar460 Group Project 2NURAMIRA AQILANo ratings yet

- Tutorial Cash FlowDocument18 pagesTutorial Cash FlowmellNo ratings yet

- Final Account (Solution) RainbowDocument4 pagesFinal Account (Solution) RainbowIsteehad RobinNo ratings yet

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- Business Finance Decision Suggested Solution Test # 2: Answer - 1Document4 pagesBusiness Finance Decision Suggested Solution Test # 2: Answer - 1Syed Muhammad Kazim RazaNo ratings yet

- (Chap 26) MaDocument16 pages(Chap 26) MaDuong TrinhNo ratings yet

- Answer 13 Tom and JerryDocument2 pagesAnswer 13 Tom and Jerryskye SNo ratings yet

- Karkits Corporation Excel Copy PasteDocument2 pagesKarkits Corporation Excel Copy PasteCoke Aidenry SaludoNo ratings yet

- 21 FAR460 SS SET 1 Dec21 Kel - StudentDocument9 pages21 FAR460 SS SET 1 Dec21 Kel - StudentRuzaikha razaliNo ratings yet

- Pre Rev Mock Attempt Answers Nov 21Document3 pagesPre Rev Mock Attempt Answers Nov 21RiyaNo ratings yet

- 30 5 To 30 6 Depletion Intermediate Accounting Volume 1 2021 Edition ValixDocument3 pages30 5 To 30 6 Depletion Intermediate Accounting Volume 1 2021 Edition ValixAway To PonderNo ratings yet

- Sol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BDocument15 pagesSol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BChristian James RiveraNo ratings yet

- Far1 Artt Ias 36 Test SolDocument2 pagesFar1 Artt Ias 36 Test SolHassan TanveerNo ratings yet

- CHAPTER 14 - CFS Advance IAS7Document15 pagesCHAPTER 14 - CFS Advance IAS7Hạnh Nguyễn HồngNo ratings yet

- Jawab SS7-27 - Kertas Kerja Konsolidasi Dengan Transfer PersediaanDocument9 pagesJawab SS7-27 - Kertas Kerja Konsolidasi Dengan Transfer PersediaanPuji LestariNo ratings yet

- Latihan P7-4Document6 pagesLatihan P7-4ryuNo ratings yet

- Answer Question 6.6Document3 pagesAnswer Question 6.6Lee Li HengNo ratings yet

- REBYUDocument16 pagesREBYUChi EstrellaNo ratings yet

- Non-Current Assets: Hnda 3 Year - 2 Semester 2016 Advanced Financial Reporting Model AnswersDocument8 pagesNon-Current Assets: Hnda 3 Year - 2 Semester 2016 Advanced Financial Reporting Model Answersrwl s.r.lNo ratings yet

- Solution Comp Acc Soalan 1Document4 pagesSolution Comp Acc Soalan 1maiNo ratings yet

- Material Complementario - Cafes Monte BiancoDocument20 pagesMaterial Complementario - Cafes Monte BiancoGlenda ChiquilloNo ratings yet

- Q1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDDocument8 pagesQ1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDduong duongNo ratings yet

- Chapter 7 Up StreamDocument14 pagesChapter 7 Up StreamAditya Agung SatrioNo ratings yet

- Equity MethodDocument2 pagesEquity MethodJeane Mae BooNo ratings yet

- For Classroom Discussion: SolutionDocument4 pagesFor Classroom Discussion: SolutionMisherene MagpileNo ratings yet

- E5-26A: Cost-Method Consolidation For Majority-Owned SubsidiaryDocument9 pagesE5-26A: Cost-Method Consolidation For Majority-Owned SubsidiaryeryNo ratings yet

- Chapter 3. Solution Exercises Income StatementDocument13 pagesChapter 3. Solution Exercises Income StatementHECTOR ORTEGANo ratings yet

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- Quiz - Single Entry (Answer Key)Document2 pagesQuiz - Single Entry (Answer Key)Gloria BeltranNo ratings yet

- Sukoako Company Statement of Financial Position Current Assets Year 1 Year 2Document5 pagesSukoako Company Statement of Financial Position Current Assets Year 1 Year 2Kevin GarnettNo ratings yet

- JournalDocument8 pagesJournalAmelia AndrianiNo ratings yet

- Unadjusted Trial Balance Adjusting Journal Entries Account Debit Credit Debit CreditDocument5 pagesUnadjusted Trial Balance Adjusting Journal Entries Account Debit Credit Debit CreditChristine RepuldaNo ratings yet

- Published Financial StatementsDocument13 pagesPublished Financial StatementsLoh Jin WenNo ratings yet

- Answer 30 Bridge January 2021Document2 pagesAnswer 30 Bridge January 2021skye SNo ratings yet

- 05 Activity 1 BALADocument3 pages05 Activity 1 BALAPola PolzNo ratings yet

- Jawaban Soal Latihan AKL2 Pertemuan 4Document5 pagesJawaban Soal Latihan AKL2 Pertemuan 4fathan qoriibaNo ratings yet

- Fimd Training Unit 1 - Financial Analysis-ActivitiesDocument8 pagesFimd Training Unit 1 - Financial Analysis-ActivitiesErrol ThompsonNo ratings yet

- LabChapt 4 Meisya Vianqa ADocument7 pagesLabChapt 4 Meisya Vianqa AMeisya VianqaNo ratings yet

- Financial Accounting 3A Assignment 2tendai MakosaDocument5 pagesFinancial Accounting 3A Assignment 2tendai MakosaTendai MakosaNo ratings yet

- Adobe Scan 01-Nov-2022Document5 pagesAdobe Scan 01-Nov-2022Suthersan SoundarrajNo ratings yet

- Ans 03 06Document8 pagesAns 03 06samnan123No ratings yet

- Golden LTD Statement of Profit and Loss and Other Comprehensive Income For The Year Ended 30 September 2018Document10 pagesGolden LTD Statement of Profit and Loss and Other Comprehensive Income For The Year Ended 30 September 2018Sheilla BonsuNo ratings yet

- AC3202 WK2 Exercises SolutionsDocument11 pagesAC3202 WK2 Exercises SolutionsLong LongNo ratings yet

- Lecture 2 Independent Study Exercises - Suggested SolutionsDocument5 pagesLecture 2 Independent Study Exercises - Suggested SolutionsSam TaylorNo ratings yet

- Cash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Document15 pagesCash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Đỗ LinhNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Answer 30 Bridge January 2021Document2 pagesAnswer 30 Bridge January 2021skye SNo ratings yet

- Answer 15 Class Test Leslie 2010Document8 pagesAnswer 15 Class Test Leslie 2010skye SNo ratings yet

- Answer 26 Sophia Test 2017Document2 pagesAnswer 26 Sophia Test 2017skye SNo ratings yet

- Answer 29 Mark PLC January 2020Document2 pagesAnswer 29 Mark PLC January 2020skye SNo ratings yet

- Answer 28 Best PLC Class Test 2019Document6 pagesAnswer 28 Best PLC Class Test 2019skye SNo ratings yet

- Answer 16 Class Test London 0910Document6 pagesAnswer 16 Class Test London 0910skye SNo ratings yet

- Answer 13 Tom and JerryDocument2 pagesAnswer 13 Tom and Jerryskye SNo ratings yet

- Answer 17 Jess Class Test 1 2011Document6 pagesAnswer 17 Jess Class Test 1 2011skye SNo ratings yet

- Topic 2 Thomas Chapter 27Document16 pagesTopic 2 Thomas Chapter 27skye SNo ratings yet

- Topic 1 Wood Bk1 Chapter 32 PartnershipsDocument10 pagesTopic 1 Wood Bk1 Chapter 32 Partnershipsskye SNo ratings yet

- LY283【抽象】视觉层次大气品牌文化总结商务通用模板Document30 pagesLY283【抽象】视觉层次大气品牌文化总结商务通用模板skye SNo ratings yet

- 6小清新 知几许素材Document22 pages6小清新 知几许素材skye SNo ratings yet

- Format For Preparing Cash Flow Statement - Start With PBT: (4) Reclassify Interest Paid Under Financing Activities +Document2 pagesFormat For Preparing Cash Flow Statement - Start With PBT: (4) Reclassify Interest Paid Under Financing Activities +shidupk5 pkNo ratings yet

- FM 211 Preparation of Journal EntriesDocument9 pagesFM 211 Preparation of Journal EntriesJuvy Jane DuarteNo ratings yet

- Summary Group 09Document2 pagesSummary Group 09Resan AhamedNo ratings yet

- 2021 ZA PaperDocument12 pages2021 ZA Papermandy YiuNo ratings yet

- SYNTDocument4 pagesSYNTMervidelle0% (1)

- Capital Structure Ultratech Cement Sahithi Project 111111Document85 pagesCapital Structure Ultratech Cement Sahithi Project 111111Sahithi PNo ratings yet

- AA (F8) - Test (Part I + Part II) - F8 - SolutionDocument12 pagesAA (F8) - Test (Part I + Part II) - F8 - SolutionPham Cam Anh QP0146No ratings yet

- ExP ACCA SBRINT 22 v101 PDFDocument48 pagesExP ACCA SBRINT 22 v101 PDFmeghu87No ratings yet

- Enterprise Group PLC: Unaudited Financial Statements For The Year Ended 31 December 2021Document8 pagesEnterprise Group PLC: Unaudited Financial Statements For The Year Ended 31 December 2021Fuaad DodooNo ratings yet

- CH 10Document47 pagesCH 10Ismadth2918388100% (1)

- PRC4 Vol II MCQs by Sir JahanzaibDocument232 pagesPRC4 Vol II MCQs by Sir JahanzaibAayesha Noor100% (1)

- Kasambahay DeskDocument2 pagesKasambahay DeskJohn Gabriel Pascua RicaforNo ratings yet

- CHKD FABM1 - Q3 - LA 22. Comprehensive Example Using T-AccountsDocument1 pageCHKD FABM1 - Q3 - LA 22. Comprehensive Example Using T-AccountsGladys Angela ValdemoroNo ratings yet

- CH 7 TQDocument15 pagesCH 7 TQManuel Urda Rodriguez0% (1)

- Presentation For AO IIDocument103 pagesPresentation For AO IIClerica Realingo100% (1)

- General Banking UBLDocument61 pagesGeneral Banking UBLaslammalg100% (1)

- Partnership S: 12 - 1 ©2002 Prentice Hall, Inc. Business Publishing Accounting, 5/E Horngren/Harrison/BamberDocument50 pagesPartnership S: 12 - 1 ©2002 Prentice Hall, Inc. Business Publishing Accounting, 5/E Horngren/Harrison/BamberShinji100% (1)

- Chapter-Iii Industry Profile & Company ProfileDocument19 pagesChapter-Iii Industry Profile & Company ProfileKitten KittyNo ratings yet

- Leases, Debt and ValueDocument57 pagesLeases, Debt and ValueGaurav ThakurNo ratings yet

- Shreeji Kosh Overseas Pte. Ltd. FS 31 March 23Document19 pagesShreeji Kosh Overseas Pte. Ltd. FS 31 March 23primestuff09No ratings yet

- 1466060173976Document370 pages1466060173976ChittaNo ratings yet

- Philippine Corporate Law SyllabusDocument102 pagesPhilippine Corporate Law SyllabusRoa Emetrio NicoNo ratings yet

- Buying and Selling Securities Buying and Selling SecuritiesDocument34 pagesBuying and Selling Securities Buying and Selling Securitiesapi-19665156No ratings yet

- FN281 Financial Management QuestionsDocument10 pagesFN281 Financial Management QuestionsRashid JalalNo ratings yet

- IAS 40 - Investment PropertyDocument7 pagesIAS 40 - Investment PropertyEric Agyenim-BoatengNo ratings yet

- Sol. Man. - Chapter 6 - Business Transactions and Their AnalysisDocument18 pagesSol. Man. - Chapter 6 - Business Transactions and Their AnalysisAmie Jane MirandaNo ratings yet

- MF STATEMENT UNLOCKDocument9 pagesMF STATEMENT UNLOCKanilNo ratings yet

- Verano 2022 Q2 SEC FilingDocument64 pagesVerano 2022 Q2 SEC FilingTony LangeNo ratings yet

Answer 14 Gu January 2013 QUESTION 1

Answer 14 Gu January 2013 QUESTION 1

Uploaded by

skye SOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answer 14 Gu January 2013 QUESTION 1

Answer 14 Gu January 2013 QUESTION 1

Uploaded by

skye SCopyright:

Available Formats

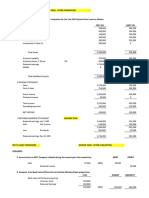

Q 14 Gu (January 2013 QUESTION 1)

Unrealised profit 120*25/125=24,000/2=12,000

Revenue £’000

Gu plc 540,000

Best 346,000

Intercompany trading (120)

885,880

2 marks

Cost of Sales £’000

Gu plc 162,000

Best 172,000

Intercompany trading (120)

Unrealised profit 12

333,892

2 marks

Expenses £’000

Gu 188,000

Best 100,000

Additional depreciation 40 40

Impairment 5,000

293,040

2 marks

NCI - SOCI £’000

Best 40,000

Additional depreciation (40)

39,960

20% 7,992

2 marks

Gu plc

Consolidated Statement of Profit or Loss and Comprehensive Income for year ended

31st December 2011

£’000

Revenue 885,880

Cost of sales 333,892

Gross Profit 551,988

Expenses 293,040

Profit before interest and tax 258,948

Finance costs 68,000

190,948

Share of profit of associate (26000*30%*6/12) 3,900

Profit before tax 194,848

Income tax 92,000

Profit after tax 102,848

Profit attributable to the group 94,856

Profit attributable to NCI 7,992

102,848

2 marks

Goodwill Calculation

In controlling interest £’000 £’000

Consideration 300,000

Share Capital 100,000

Pre- acquisition Retained earnings 228,000

Revaluation 2,000

330,000

80% 264,000

Goodwill 36,000

4 marks

Investment in associate £’000

Cost 50,000

Share of post acq reserves 30%(13000) 3,900

Impairment (5,000)

48,900

3 marks

Consolidated Reserves

£’000

Gu plc 221,000

Best 80% post acquisition reserves 80%(40000) 32,000

Fred 30% (13000) 3,900

Impairment (5,000)

Additional depreciation 80%(40) (32)

Unrealised profit (12)

251,856

5 marks

Reconciliation £’000

Consolidated reserves 1.1.2011 157,000

Consolidated profit for the year 94,856

251,856

1 mark

Non controlling interest

£’000

Share capital 100,000

Reserves 268,000

Revaluation 2,000

Depreciation (40)

369,960

20% 73,992

2 marks

Total Question 1 25 marks

You might also like

- Lazar Blue Book Chapter 4 Solution (1 To 14 Only)Document27 pagesLazar Blue Book Chapter 4 Solution (1 To 14 Only)Shuhada Shamsuddin75% (4)

- Financial Accounting IFRS Student Mark Plan June 2019Document16 pagesFinancial Accounting IFRS Student Mark Plan June 2019scottNo ratings yet

- Notes On The Revised Corporation CodeDocument34 pagesNotes On The Revised Corporation CodeZuleira Parra100% (10)

- FMV Magic Timber CaseDocument6 pagesFMV Magic Timber CaseEdward Berbari100% (1)

- Far410 - SS - Feb 2022Document9 pagesFar410 - SS - Feb 2022AFIZA JASMANNo ratings yet

- Answer 29 Mark PLC January 2020Document2 pagesAnswer 29 Mark PLC January 2020skye SNo ratings yet

- Running Head: Financial AccountingDocument9 pagesRunning Head: Financial AccountingKashémNo ratings yet

- Part 1 Examination - Paper 1.1 (INT) Preparing Financial Statements (InternationalDocument8 pagesPart 1 Examination - Paper 1.1 (INT) Preparing Financial Statements (InternationalAUDITOR97No ratings yet

- Accounting 2Document2 pagesAccounting 2reeisha7No ratings yet

- 1-1hkg 2002 Dec ADocument8 pages1-1hkg 2002 Dec AWing Yan KatieNo ratings yet

- ICAEW Mar 2020 - Q4Document4 pagesICAEW Mar 2020 - Q4leejw2810No ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Titles Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Titles Debit Credit Debit Credit Debit Credit Debit CreditVencint LaranNo ratings yet

- MN30315 January 2023 Exam - SOLUTIONSDocument15 pagesMN30315 January 2023 Exam - SOLUTIONSjoshuachan1411No ratings yet

- 20solution Far460 - Jun 2020 - StudentDocument10 pages20solution Far460 - Jun 2020 - StudentRuzaikha razaliNo ratings yet

- A4 PalacioDocument3 pagesA4 PalacioPinky DaisiesNo ratings yet

- Far460 Group Project 2Document4 pagesFar460 Group Project 2NURAMIRA AQILANo ratings yet

- Tutorial Cash FlowDocument18 pagesTutorial Cash FlowmellNo ratings yet

- Final Account (Solution) RainbowDocument4 pagesFinal Account (Solution) RainbowIsteehad RobinNo ratings yet

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- Business Finance Decision Suggested Solution Test # 2: Answer - 1Document4 pagesBusiness Finance Decision Suggested Solution Test # 2: Answer - 1Syed Muhammad Kazim RazaNo ratings yet

- (Chap 26) MaDocument16 pages(Chap 26) MaDuong TrinhNo ratings yet

- Answer 13 Tom and JerryDocument2 pagesAnswer 13 Tom and Jerryskye SNo ratings yet

- Karkits Corporation Excel Copy PasteDocument2 pagesKarkits Corporation Excel Copy PasteCoke Aidenry SaludoNo ratings yet

- 21 FAR460 SS SET 1 Dec21 Kel - StudentDocument9 pages21 FAR460 SS SET 1 Dec21 Kel - StudentRuzaikha razaliNo ratings yet

- Pre Rev Mock Attempt Answers Nov 21Document3 pagesPre Rev Mock Attempt Answers Nov 21RiyaNo ratings yet

- 30 5 To 30 6 Depletion Intermediate Accounting Volume 1 2021 Edition ValixDocument3 pages30 5 To 30 6 Depletion Intermediate Accounting Volume 1 2021 Edition ValixAway To PonderNo ratings yet

- Sol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BDocument15 pagesSol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BChristian James RiveraNo ratings yet

- Far1 Artt Ias 36 Test SolDocument2 pagesFar1 Artt Ias 36 Test SolHassan TanveerNo ratings yet

- CHAPTER 14 - CFS Advance IAS7Document15 pagesCHAPTER 14 - CFS Advance IAS7Hạnh Nguyễn HồngNo ratings yet

- Jawab SS7-27 - Kertas Kerja Konsolidasi Dengan Transfer PersediaanDocument9 pagesJawab SS7-27 - Kertas Kerja Konsolidasi Dengan Transfer PersediaanPuji LestariNo ratings yet

- Latihan P7-4Document6 pagesLatihan P7-4ryuNo ratings yet

- Answer Question 6.6Document3 pagesAnswer Question 6.6Lee Li HengNo ratings yet

- REBYUDocument16 pagesREBYUChi EstrellaNo ratings yet

- Non-Current Assets: Hnda 3 Year - 2 Semester 2016 Advanced Financial Reporting Model AnswersDocument8 pagesNon-Current Assets: Hnda 3 Year - 2 Semester 2016 Advanced Financial Reporting Model Answersrwl s.r.lNo ratings yet

- Solution Comp Acc Soalan 1Document4 pagesSolution Comp Acc Soalan 1maiNo ratings yet

- Material Complementario - Cafes Monte BiancoDocument20 pagesMaterial Complementario - Cafes Monte BiancoGlenda ChiquilloNo ratings yet

- Q1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDDocument8 pagesQ1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDduong duongNo ratings yet

- Chapter 7 Up StreamDocument14 pagesChapter 7 Up StreamAditya Agung SatrioNo ratings yet

- Equity MethodDocument2 pagesEquity MethodJeane Mae BooNo ratings yet

- For Classroom Discussion: SolutionDocument4 pagesFor Classroom Discussion: SolutionMisherene MagpileNo ratings yet

- E5-26A: Cost-Method Consolidation For Majority-Owned SubsidiaryDocument9 pagesE5-26A: Cost-Method Consolidation For Majority-Owned SubsidiaryeryNo ratings yet

- Chapter 3. Solution Exercises Income StatementDocument13 pagesChapter 3. Solution Exercises Income StatementHECTOR ORTEGANo ratings yet

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- Quiz - Single Entry (Answer Key)Document2 pagesQuiz - Single Entry (Answer Key)Gloria BeltranNo ratings yet

- Sukoako Company Statement of Financial Position Current Assets Year 1 Year 2Document5 pagesSukoako Company Statement of Financial Position Current Assets Year 1 Year 2Kevin GarnettNo ratings yet

- JournalDocument8 pagesJournalAmelia AndrianiNo ratings yet

- Unadjusted Trial Balance Adjusting Journal Entries Account Debit Credit Debit CreditDocument5 pagesUnadjusted Trial Balance Adjusting Journal Entries Account Debit Credit Debit CreditChristine RepuldaNo ratings yet

- Published Financial StatementsDocument13 pagesPublished Financial StatementsLoh Jin WenNo ratings yet

- Answer 30 Bridge January 2021Document2 pagesAnswer 30 Bridge January 2021skye SNo ratings yet

- 05 Activity 1 BALADocument3 pages05 Activity 1 BALAPola PolzNo ratings yet

- Jawaban Soal Latihan AKL2 Pertemuan 4Document5 pagesJawaban Soal Latihan AKL2 Pertemuan 4fathan qoriibaNo ratings yet

- Fimd Training Unit 1 - Financial Analysis-ActivitiesDocument8 pagesFimd Training Unit 1 - Financial Analysis-ActivitiesErrol ThompsonNo ratings yet

- LabChapt 4 Meisya Vianqa ADocument7 pagesLabChapt 4 Meisya Vianqa AMeisya VianqaNo ratings yet

- Financial Accounting 3A Assignment 2tendai MakosaDocument5 pagesFinancial Accounting 3A Assignment 2tendai MakosaTendai MakosaNo ratings yet

- Adobe Scan 01-Nov-2022Document5 pagesAdobe Scan 01-Nov-2022Suthersan SoundarrajNo ratings yet

- Ans 03 06Document8 pagesAns 03 06samnan123No ratings yet

- Golden LTD Statement of Profit and Loss and Other Comprehensive Income For The Year Ended 30 September 2018Document10 pagesGolden LTD Statement of Profit and Loss and Other Comprehensive Income For The Year Ended 30 September 2018Sheilla BonsuNo ratings yet

- AC3202 WK2 Exercises SolutionsDocument11 pagesAC3202 WK2 Exercises SolutionsLong LongNo ratings yet

- Lecture 2 Independent Study Exercises - Suggested SolutionsDocument5 pagesLecture 2 Independent Study Exercises - Suggested SolutionsSam TaylorNo ratings yet

- Cash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Document15 pagesCash Flows Statements Practice Revision - Ias 7 Format: Exercise 1Đỗ LinhNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Answer 30 Bridge January 2021Document2 pagesAnswer 30 Bridge January 2021skye SNo ratings yet

- Answer 15 Class Test Leslie 2010Document8 pagesAnswer 15 Class Test Leslie 2010skye SNo ratings yet

- Answer 26 Sophia Test 2017Document2 pagesAnswer 26 Sophia Test 2017skye SNo ratings yet

- Answer 29 Mark PLC January 2020Document2 pagesAnswer 29 Mark PLC January 2020skye SNo ratings yet

- Answer 28 Best PLC Class Test 2019Document6 pagesAnswer 28 Best PLC Class Test 2019skye SNo ratings yet

- Answer 16 Class Test London 0910Document6 pagesAnswer 16 Class Test London 0910skye SNo ratings yet

- Answer 13 Tom and JerryDocument2 pagesAnswer 13 Tom and Jerryskye SNo ratings yet

- Answer 17 Jess Class Test 1 2011Document6 pagesAnswer 17 Jess Class Test 1 2011skye SNo ratings yet

- Topic 2 Thomas Chapter 27Document16 pagesTopic 2 Thomas Chapter 27skye SNo ratings yet

- Topic 1 Wood Bk1 Chapter 32 PartnershipsDocument10 pagesTopic 1 Wood Bk1 Chapter 32 Partnershipsskye SNo ratings yet

- LY283【抽象】视觉层次大气品牌文化总结商务通用模板Document30 pagesLY283【抽象】视觉层次大气品牌文化总结商务通用模板skye SNo ratings yet

- 6小清新 知几许素材Document22 pages6小清新 知几许素材skye SNo ratings yet

- Format For Preparing Cash Flow Statement - Start With PBT: (4) Reclassify Interest Paid Under Financing Activities +Document2 pagesFormat For Preparing Cash Flow Statement - Start With PBT: (4) Reclassify Interest Paid Under Financing Activities +shidupk5 pkNo ratings yet

- FM 211 Preparation of Journal EntriesDocument9 pagesFM 211 Preparation of Journal EntriesJuvy Jane DuarteNo ratings yet

- Summary Group 09Document2 pagesSummary Group 09Resan AhamedNo ratings yet

- 2021 ZA PaperDocument12 pages2021 ZA Papermandy YiuNo ratings yet

- SYNTDocument4 pagesSYNTMervidelle0% (1)

- Capital Structure Ultratech Cement Sahithi Project 111111Document85 pagesCapital Structure Ultratech Cement Sahithi Project 111111Sahithi PNo ratings yet

- AA (F8) - Test (Part I + Part II) - F8 - SolutionDocument12 pagesAA (F8) - Test (Part I + Part II) - F8 - SolutionPham Cam Anh QP0146No ratings yet

- ExP ACCA SBRINT 22 v101 PDFDocument48 pagesExP ACCA SBRINT 22 v101 PDFmeghu87No ratings yet

- Enterprise Group PLC: Unaudited Financial Statements For The Year Ended 31 December 2021Document8 pagesEnterprise Group PLC: Unaudited Financial Statements For The Year Ended 31 December 2021Fuaad DodooNo ratings yet

- CH 10Document47 pagesCH 10Ismadth2918388100% (1)

- PRC4 Vol II MCQs by Sir JahanzaibDocument232 pagesPRC4 Vol II MCQs by Sir JahanzaibAayesha Noor100% (1)

- Kasambahay DeskDocument2 pagesKasambahay DeskJohn Gabriel Pascua RicaforNo ratings yet

- CHKD FABM1 - Q3 - LA 22. Comprehensive Example Using T-AccountsDocument1 pageCHKD FABM1 - Q3 - LA 22. Comprehensive Example Using T-AccountsGladys Angela ValdemoroNo ratings yet

- CH 7 TQDocument15 pagesCH 7 TQManuel Urda Rodriguez0% (1)

- Presentation For AO IIDocument103 pagesPresentation For AO IIClerica Realingo100% (1)

- General Banking UBLDocument61 pagesGeneral Banking UBLaslammalg100% (1)

- Partnership S: 12 - 1 ©2002 Prentice Hall, Inc. Business Publishing Accounting, 5/E Horngren/Harrison/BamberDocument50 pagesPartnership S: 12 - 1 ©2002 Prentice Hall, Inc. Business Publishing Accounting, 5/E Horngren/Harrison/BamberShinji100% (1)

- Chapter-Iii Industry Profile & Company ProfileDocument19 pagesChapter-Iii Industry Profile & Company ProfileKitten KittyNo ratings yet

- Leases, Debt and ValueDocument57 pagesLeases, Debt and ValueGaurav ThakurNo ratings yet

- Shreeji Kosh Overseas Pte. Ltd. FS 31 March 23Document19 pagesShreeji Kosh Overseas Pte. Ltd. FS 31 March 23primestuff09No ratings yet

- 1466060173976Document370 pages1466060173976ChittaNo ratings yet

- Philippine Corporate Law SyllabusDocument102 pagesPhilippine Corporate Law SyllabusRoa Emetrio NicoNo ratings yet

- Buying and Selling Securities Buying and Selling SecuritiesDocument34 pagesBuying and Selling Securities Buying and Selling Securitiesapi-19665156No ratings yet

- FN281 Financial Management QuestionsDocument10 pagesFN281 Financial Management QuestionsRashid JalalNo ratings yet

- IAS 40 - Investment PropertyDocument7 pagesIAS 40 - Investment PropertyEric Agyenim-BoatengNo ratings yet

- Sol. Man. - Chapter 6 - Business Transactions and Their AnalysisDocument18 pagesSol. Man. - Chapter 6 - Business Transactions and Their AnalysisAmie Jane MirandaNo ratings yet

- MF STATEMENT UNLOCKDocument9 pagesMF STATEMENT UNLOCKanilNo ratings yet

- Verano 2022 Q2 SEC FilingDocument64 pagesVerano 2022 Q2 SEC FilingTony LangeNo ratings yet