Professional Documents

Culture Documents

Non Filer PDF

Non Filer PDF

Uploaded by

Kamal GroverCopyright:

Available Formats

You might also like

- Creative Brief - DoritosDocument6 pagesCreative Brief - Doritosapi-2828939520% (1)

- KIPOD2201 ICM UTP Stage II in Business OfferDocument5 pagesKIPOD2201 ICM UTP Stage II in Business OfferKev SainaNo ratings yet

- Complete Notes On Special Sit Class Joel Greenblatt 2Document311 pagesComplete Notes On Special Sit Class Joel Greenblatt 2eric_stNo ratings yet

- Non-Tax Filer Student 2021 Certification 23-24Document1 pageNon-Tax Filer Student 2021 Certification 23-24Kamal GroverNo ratings yet

- 2023 Unemployed Bursary Application Form PDFDocument4 pages2023 Unemployed Bursary Application Form PDFDL MkhabelaNo ratings yet

- Important Changes For 2022 Payroll: Yeo & YeoDocument2 pagesImportant Changes For 2022 Payroll: Yeo & Yeolarryching_884369919No ratings yet

- Appeal Form 2023-2024Document3 pagesAppeal Form 2023-2024Thushara ThomasNo ratings yet

- For Validation: Not Valid As An Official ReceiptDocument1 pageFor Validation: Not Valid As An Official Receiptalexzandra marie posadasNo ratings yet

- Student Financial Statement: Enrolment and Financial Details For The SemesterDocument3 pagesStudent Financial Statement: Enrolment and Financial Details For The Semesterziyu haoNo ratings yet

- 1st Semester ResultDocument1 page1st Semester ResultManish KumarNo ratings yet

- td1bc 24eDocument2 pagestd1bc 24eprueba.etoroNo ratings yet

- (BW Version) Grad - Financial - Verification - Form 2021-2022Document2 pages(BW Version) Grad - Financial - Verification - Form 2021-2022Pao SuarezNo ratings yet

- ACC Final Exam S1 2022Document9 pagesACC Final Exam S1 2022Vikash PatelNo ratings yet

- SFE Application For Dependants Grants Form 2223 DDDocument7 pagesSFE Application For Dependants Grants Form 2223 DDnahidahcomNo ratings yet

- ACC Final Exam S2 2021Document8 pagesACC Final Exam S2 2021Vikash PatelNo ratings yet

- 2023 Entrance Scholarship Application IHDocument5 pages2023 Entrance Scholarship Application IHĐức Hà Trịnh DươngNo ratings yet

- Adobe Scan 2 Jan 2022Document2 pagesAdobe Scan 2 Jan 2022Nomi Jolie Lamaa (ACS Beirut Student)No ratings yet

- How It WorksDocument1 pageHow It WorksCody DerespinaNo ratings yet

- 2012-13 Graduate Financial Aid ApplicationDocument2 pages2012-13 Graduate Financial Aid ApplicationLufinancial AidNo ratings yet

- Attachment 1Document7 pagesAttachment 1Victor Kiptoo KLNo ratings yet

- Letter of EntitlementDocument4 pagesLetter of EntitlementKialemNo ratings yet

- Form 11Document44 pagesForm 11gilbert.belciugNo ratings yet

- SUMMER 2021 Supplemental Financial Aid Application: Section A: Student InformationDocument2 pagesSUMMER 2021 Supplemental Financial Aid Application: Section A: Student InformationHeidi CherryNo ratings yet

- College Fee Payment RecieptDocument1 pageCollege Fee Payment RecieptSakshi HatkarNo ratings yet

- Scanned From A Xerox Multifunction PrinterDocument4 pagesScanned From A Xerox Multifunction PrinterVincent MpofuNo ratings yet

- TD1 2023 - BCDocument2 pagesTD1 2023 - BCਸੁਖਮਨਪ੍ਰੀਤ ਕੌਰ ਢਿੱਲੋਂNo ratings yet

- Description: Tags: 1125CODProcUpdatesPellDocument4 pagesDescription: Tags: 1125CODProcUpdatesPellanon-536916No ratings yet

- Contrat AEC-DEC - Lopez Sotomayor, SofiaDocument10 pagesContrat AEC-DEC - Lopez Sotomayor, SofiaSolsodumNo ratings yet

- 2012-13 Upperclass Financial Aid ApplicationDocument4 pages2012-13 Upperclass Financial Aid ApplicationLufinancial AidNo ratings yet

- Untitled PageDocument1 pageUntitled PagePriyaNo ratings yet

- Stolt-Nielsen Philippines Inc.: High School Educational Assistance Dependents ListDocument2 pagesStolt-Nielsen Philippines Inc.: High School Educational Assistance Dependents ListAmir Johanz BrosotoNo ratings yet

- Description: Tags: DLB0239AttachDocument1 pageDescription: Tags: DLB0239Attachanon-671674No ratings yet

- Budget Forum For SUCs-FY 2022 Budget Preparation-V1Document12 pagesBudget Forum For SUCs-FY 2022 Budget Preparation-V1BRYAN CHRIST AREVALONo ratings yet

- Taxation Assignment 7 PDFDocument4 pagesTaxation Assignment 7 PDFKNVS Siva KumarNo ratings yet

- Quiz 5 - CHAPTERS 12 13 14: Tax Drill - Refundable and Nonrefundable CreditsDocument9 pagesQuiz 5 - CHAPTERS 12 13 14: Tax Drill - Refundable and Nonrefundable CreditsJoel Christian MascariñaNo ratings yet

- dvf23 24 Form 2Document2 pagesdvf23 24 Form 2Alizjah WilsonNo ratings yet

- B81 VAs - FS AD - ADAS2 BADocument1 pageB81 VAs - FS AD - ADAS2 BANoemi Rosario SanchezNo ratings yet

- Accounting Level II - Third Term Assignement IDocument3 pagesAccounting Level II - Third Term Assignement IEdomNo ratings yet

- 2011-2012 Dependent Verification FormDocument4 pages2011-2012 Dependent Verification FormCoachRich3No ratings yet

- SETC Tax Credit Guide 214276Document2 pagesSETC Tax Credit Guide 214276r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- Conditional Offer Letter - COL - Sumaiya Akter - Shimu - 2023-08-23Document4 pagesConditional Offer Letter - COL - Sumaiya Akter - Shimu - 2023-08-23sumaiyaaktershimuuNo ratings yet

- SETC Tax Credit Guide 130316Document2 pagesSETC Tax Credit Guide 130316r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- Td1on Fill 22eDocument2 pagesTd1on Fill 22eOluwafeyikemi olusogaNo ratings yet

- ACC Final Exam S2 2021 Marking CrieriaDocument10 pagesACC Final Exam S2 2021 Marking CrieriaVikash PatelNo ratings yet

- Monthly Budget Worksheet - Fillable PDF 2022Document3 pagesMonthly Budget Worksheet - Fillable PDF 2022Glaze BoncalesNo ratings yet

- State Level National Talent Search Examination (NTSE) 2021-2022Document25 pagesState Level National Talent Search Examination (NTSE) 2021-2022AsmitNo ratings yet

- SETC Tax Credit Guide 130540Document2 pagesSETC Tax Credit Guide 130540r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- Check List For New F-1 International Students: Welcome To Wayne State University!Document2 pagesCheck List For New F-1 International Students: Welcome To Wayne State University!Kunto Adi WibowoNo ratings yet

- Tax Financial Planning GuideDocument40 pagesTax Financial Planning Guideditoendutojkt75No ratings yet

- DaDA Self Declaration Form 2022-23 FinalDocument3 pagesDaDA Self Declaration Form 2022-23 FinalhNo ratings yet

- 2012-13 Transfer Aid ApplicationDocument4 pages2012-13 Transfer Aid ApplicationLufinancial AidNo ratings yet

- Directorate of Distance Education: Information BrochureDocument4 pagesDirectorate of Distance Education: Information BrochureGOWTHAMNo ratings yet

- Colfuturo Pricing 2020-2021Document1 pageColfuturo Pricing 2020-2021104guerrerostward247No ratings yet

- Tuition Agreement Form: Student Enrolling For2021 Academic YearDocument2 pagesTuition Agreement Form: Student Enrolling For2021 Academic YearIli TuilomaNo ratings yet

- I-20 Document Application: (Certificate of Eligibility For International F-1 Student Status)Document16 pagesI-20 Document Application: (Certificate of Eligibility For International F-1 Student Status)Kata Naresh BabuNo ratings yet

- Virtual Fidelity Bonding SystemDocument55 pagesVirtual Fidelity Bonding SystemLou BaldomarNo ratings yet

- DearDocument5 pagesDearHassan Lamin BarrieNo ratings yet

- Financial Aid Parent Non Tax FilerDocument1 pageFinancial Aid Parent Non Tax FilerDebbieNo ratings yet

- Conditional Offer Letter - COL - Thu Kha - Htun - 2021-09-17Document4 pagesConditional Offer Letter - COL - Thu Kha - Htun - 2021-09-17Thu Kha Ko KoNo ratings yet

- Murdoch Declaration Financial CapacityDocument1 pageMurdoch Declaration Financial CapacityDeki LhadonNo ratings yet

- 27 Fee Collection Notice 2021 1Document1 page27 Fee Collection Notice 2021 1sanjeevmurmu81No ratings yet

- Non-Tax Filer Student 2021 Certification 23-24Document1 pageNon-Tax Filer Student 2021 Certification 23-24Kamal GroverNo ratings yet

- Iss StanfordDocument1 pageIss StanfordKamal GroverNo ratings yet

- Origin of Stoicism and Its Applications in Today's Modern WorldDocument2 pagesOrigin of Stoicism and Its Applications in Today's Modern WorldKamal GroverNo ratings yet

- Svis PyDocument18 pagesSvis PyKamal GroverNo ratings yet

- Princeton PaperDocument4 pagesPrinceton PaperKamal GroverNo ratings yet

- 30 2002 Revenue - Regulations - Implementing - Sections20181220 5466 Ew6q98Document6 pages30 2002 Revenue - Regulations - Implementing - Sections20181220 5466 Ew6q98Milane Anne CunananNo ratings yet

- Learning Ethics From Les MiserablesDocument4 pagesLearning Ethics From Les MiserablesJonas EboraNo ratings yet

- Assignment OF Operation Management-Ii Case: Uber Vs Cabs: Under The Guidance of Prof - Rohit KapoorDocument5 pagesAssignment OF Operation Management-Ii Case: Uber Vs Cabs: Under The Guidance of Prof - Rohit KapoordebojyotiNo ratings yet

- Pinpara Dialog AP MBL-RQ-050998Document1 pagePinpara Dialog AP MBL-RQ-050998dumindu1No ratings yet

- Salus Populi Suprema Lex EstoDocument2 pagesSalus Populi Suprema Lex EstoSaad Ahmed100% (3)

- Contemporary ArtsDocument2 pagesContemporary ArtsKess MontallanaNo ratings yet

- Managing Diversity Toward A Globally Inclusive Workplace 4Th Edition Barak Test Bank Full Chapter PDFDocument36 pagesManaging Diversity Toward A Globally Inclusive Workplace 4Th Edition Barak Test Bank Full Chapter PDFphanagneslr9h55100% (15)

- Ballot Guidelines For General Secretary Election: (Insert Date)Document12 pagesBallot Guidelines For General Secretary Election: (Insert Date)Paul WaughNo ratings yet

- Uef A20e Vominhtri 205044923 Final-Report Sales-ManagenmentDocument39 pagesUef A20e Vominhtri 205044923 Final-Report Sales-ManagenmentTrí Võ MinhNo ratings yet

- James Cameron Research PaperDocument7 pagesJames Cameron Research Paperafnkjdhxlewftq100% (1)

- Chapter 3 - Ethics in Nursing ResearchDocument46 pagesChapter 3 - Ethics in Nursing ResearchIconMaicoNo ratings yet

- Auditing Problems You Can UseDocument51 pagesAuditing Problems You Can UseChinita VirayNo ratings yet

- Case Report UnpriDocument17 pagesCase Report UnpriChandra SusantoNo ratings yet

- UP Diliman Return-to-Work Guidelines: Post-ECQ Guidelines For Administrative ProcessesDocument11 pagesUP Diliman Return-to-Work Guidelines: Post-ECQ Guidelines For Administrative ProcessesTim AcostaNo ratings yet

- Contemporary Issues in Yin Yang TheoryDocument109 pagesContemporary Issues in Yin Yang TheoryRudolph Antony ThomasNo ratings yet

- Gerund or Infinitive Worksheet Templates Layouts 96902Document2 pagesGerund or Infinitive Worksheet Templates Layouts 96902afi54No ratings yet

- John Christman Saving Positive Freedom PDFDocument10 pagesJohn Christman Saving Positive Freedom PDFCristhian VillegasNo ratings yet

- UNIT 1 / Pre-Intermediate Generations: Didn't Go (Go / Not) To A Movie Last Night. I Stayed (Stay) at HomeDocument24 pagesUNIT 1 / Pre-Intermediate Generations: Didn't Go (Go / Not) To A Movie Last Night. I Stayed (Stay) at HomeEren KırıcıNo ratings yet

- Liwanag Vs CA Case DigestDocument1 pageLiwanag Vs CA Case DigestVanityHughNo ratings yet

- Consultancy Services TCSDocument7 pagesConsultancy Services TCSPahulpreetSinghNo ratings yet

- Social Ontology and Research Strategy PDFDocument29 pagesSocial Ontology and Research Strategy PDFFelipe NogueiraNo ratings yet

- Wilbur Smith Books: Yea R Title Timeframe SeriesDocument3 pagesWilbur Smith Books: Yea R Title Timeframe SeriesAamirShabbir100% (2)

- Crimes (Sentencing Procedure) Act 1999 No 92 Section 21ADocument4 pagesCrimes (Sentencing Procedure) Act 1999 No 92 Section 21AReza PatriaNo ratings yet

- LIT 1 EssentialsDocument1 pageLIT 1 Essentialsque zomeNo ratings yet

- M - CV FDocument2 pagesM - CV FYogendra Prawin KumarNo ratings yet

- Math 1050 Mortgage ProjectDocument5 pagesMath 1050 Mortgage Projectapi-2740249620% (1)

- Percieved Social Media Influence On The Choice of National Candidates in 2022 Philippine Elections Senior High School StudentsDocument25 pagesPercieved Social Media Influence On The Choice of National Candidates in 2022 Philippine Elections Senior High School StudentsDan Gela Mæ MaYoNo ratings yet

- Witness Cannot Be Added As An Accused Even If His Statements Are Inculpatory: Supreme CourtDocument36 pagesWitness Cannot Be Added As An Accused Even If His Statements Are Inculpatory: Supreme CourtLive Law100% (1)

Non Filer PDF

Non Filer PDF

Uploaded by

Kamal GroverOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Non Filer PDF

Non Filer PDF

Uploaded by

Kamal GroverCopyright:

Available Formats

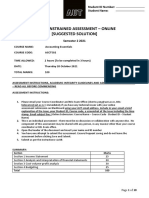

Financial Aid & Educational Financing

OCOLUMBIA UNIVERSITY

IN THE CITY OF NEW YORK

Columbia College &Columbia Engineering

Office Location: 618 Alfred Lerner Hall

Phone: 212-854-3711

Website: http://cc-seas. financlalald.columbia.edu/

Upload to |DOC or email to

2021 Student Tax Non-Filer Certification Form

ugrad-finaid@columbia.edu

Student Name: Wardaan Grover ID #: Cp04722265

Please Note: Students should complete this form only if NOoT FILING a2021 federal income tax return.

Instructions:

FILLABLE form: First save this form to your computer, then type your answers, re-save, print and sign. Please confirm that

your data has been included before submitting.

Icertify that Idid not, willnot and am not required to file a 2021 federal income tax return. (Please refer to IRS Guidelines

to confirm Tax Filing Requirements: https://www.irs.gov/help/ita/do-i-need-to-file-a-tax-return. US Citizens and US

Permanent Residents who are claimed as a dependent on another taxpaver's federal tax return must file their own federal

tax return if earned income exceeds $12,550.)

Indicate source(s) of student income in 2021; do not report any income received by the parent on the student's behalf.

DO NOT LEAVE ANYTHING BLANK. WRITE IN "$O.00" OR "N/A" WHERE APPROPRIATE.

(O)$0 Student Income: Iconfirm that I earned/received no income for 2021

(the student) earned/received income for 2021 (detailed below).

Contributions

Income from work (Federal Work-Study earnings): sO Attach a W-2 form.

toward Retirement:

W-2Box 12 (Code

Income from work (non-Work Study earnings): Attach a W-2 form, if available. D,E,F,G, H, or S)

Social Security Attach Form 1099.

Public Assistance Do not include food stamps or subsidized housing.

Veteran's Affairs Benefits

Untaxed Interest Income Attach a year-end statement from your bank showing the interest received in 2021.

Untaxed Pension Benefits

s0

Other untaxed income

(please explain: support from relatives, disability benefits, etc. )

TOTAL 2021 INCOME

so.00

SPECIAL CIRCUMSTANCES/EXPLANATIONS:

I(we) certify that | (we) did not and will not file a 2021 federal income tax return. The income information listed above is accurate

and complete.

SIGNATURE OF STUDENT DATE o2/17/2023

You might also like

- Creative Brief - DoritosDocument6 pagesCreative Brief - Doritosapi-2828939520% (1)

- KIPOD2201 ICM UTP Stage II in Business OfferDocument5 pagesKIPOD2201 ICM UTP Stage II in Business OfferKev SainaNo ratings yet

- Complete Notes On Special Sit Class Joel Greenblatt 2Document311 pagesComplete Notes On Special Sit Class Joel Greenblatt 2eric_stNo ratings yet

- Non-Tax Filer Student 2021 Certification 23-24Document1 pageNon-Tax Filer Student 2021 Certification 23-24Kamal GroverNo ratings yet

- 2023 Unemployed Bursary Application Form PDFDocument4 pages2023 Unemployed Bursary Application Form PDFDL MkhabelaNo ratings yet

- Important Changes For 2022 Payroll: Yeo & YeoDocument2 pagesImportant Changes For 2022 Payroll: Yeo & Yeolarryching_884369919No ratings yet

- Appeal Form 2023-2024Document3 pagesAppeal Form 2023-2024Thushara ThomasNo ratings yet

- For Validation: Not Valid As An Official ReceiptDocument1 pageFor Validation: Not Valid As An Official Receiptalexzandra marie posadasNo ratings yet

- Student Financial Statement: Enrolment and Financial Details For The SemesterDocument3 pagesStudent Financial Statement: Enrolment and Financial Details For The Semesterziyu haoNo ratings yet

- 1st Semester ResultDocument1 page1st Semester ResultManish KumarNo ratings yet

- td1bc 24eDocument2 pagestd1bc 24eprueba.etoroNo ratings yet

- (BW Version) Grad - Financial - Verification - Form 2021-2022Document2 pages(BW Version) Grad - Financial - Verification - Form 2021-2022Pao SuarezNo ratings yet

- ACC Final Exam S1 2022Document9 pagesACC Final Exam S1 2022Vikash PatelNo ratings yet

- SFE Application For Dependants Grants Form 2223 DDDocument7 pagesSFE Application For Dependants Grants Form 2223 DDnahidahcomNo ratings yet

- ACC Final Exam S2 2021Document8 pagesACC Final Exam S2 2021Vikash PatelNo ratings yet

- 2023 Entrance Scholarship Application IHDocument5 pages2023 Entrance Scholarship Application IHĐức Hà Trịnh DươngNo ratings yet

- Adobe Scan 2 Jan 2022Document2 pagesAdobe Scan 2 Jan 2022Nomi Jolie Lamaa (ACS Beirut Student)No ratings yet

- How It WorksDocument1 pageHow It WorksCody DerespinaNo ratings yet

- 2012-13 Graduate Financial Aid ApplicationDocument2 pages2012-13 Graduate Financial Aid ApplicationLufinancial AidNo ratings yet

- Attachment 1Document7 pagesAttachment 1Victor Kiptoo KLNo ratings yet

- Letter of EntitlementDocument4 pagesLetter of EntitlementKialemNo ratings yet

- Form 11Document44 pagesForm 11gilbert.belciugNo ratings yet

- SUMMER 2021 Supplemental Financial Aid Application: Section A: Student InformationDocument2 pagesSUMMER 2021 Supplemental Financial Aid Application: Section A: Student InformationHeidi CherryNo ratings yet

- College Fee Payment RecieptDocument1 pageCollege Fee Payment RecieptSakshi HatkarNo ratings yet

- Scanned From A Xerox Multifunction PrinterDocument4 pagesScanned From A Xerox Multifunction PrinterVincent MpofuNo ratings yet

- TD1 2023 - BCDocument2 pagesTD1 2023 - BCਸੁਖਮਨਪ੍ਰੀਤ ਕੌਰ ਢਿੱਲੋਂNo ratings yet

- Description: Tags: 1125CODProcUpdatesPellDocument4 pagesDescription: Tags: 1125CODProcUpdatesPellanon-536916No ratings yet

- Contrat AEC-DEC - Lopez Sotomayor, SofiaDocument10 pagesContrat AEC-DEC - Lopez Sotomayor, SofiaSolsodumNo ratings yet

- 2012-13 Upperclass Financial Aid ApplicationDocument4 pages2012-13 Upperclass Financial Aid ApplicationLufinancial AidNo ratings yet

- Untitled PageDocument1 pageUntitled PagePriyaNo ratings yet

- Stolt-Nielsen Philippines Inc.: High School Educational Assistance Dependents ListDocument2 pagesStolt-Nielsen Philippines Inc.: High School Educational Assistance Dependents ListAmir Johanz BrosotoNo ratings yet

- Description: Tags: DLB0239AttachDocument1 pageDescription: Tags: DLB0239Attachanon-671674No ratings yet

- Budget Forum For SUCs-FY 2022 Budget Preparation-V1Document12 pagesBudget Forum For SUCs-FY 2022 Budget Preparation-V1BRYAN CHRIST AREVALONo ratings yet

- Taxation Assignment 7 PDFDocument4 pagesTaxation Assignment 7 PDFKNVS Siva KumarNo ratings yet

- Quiz 5 - CHAPTERS 12 13 14: Tax Drill - Refundable and Nonrefundable CreditsDocument9 pagesQuiz 5 - CHAPTERS 12 13 14: Tax Drill - Refundable and Nonrefundable CreditsJoel Christian MascariñaNo ratings yet

- dvf23 24 Form 2Document2 pagesdvf23 24 Form 2Alizjah WilsonNo ratings yet

- B81 VAs - FS AD - ADAS2 BADocument1 pageB81 VAs - FS AD - ADAS2 BANoemi Rosario SanchezNo ratings yet

- Accounting Level II - Third Term Assignement IDocument3 pagesAccounting Level II - Third Term Assignement IEdomNo ratings yet

- 2011-2012 Dependent Verification FormDocument4 pages2011-2012 Dependent Verification FormCoachRich3No ratings yet

- SETC Tax Credit Guide 214276Document2 pagesSETC Tax Credit Guide 214276r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- Conditional Offer Letter - COL - Sumaiya Akter - Shimu - 2023-08-23Document4 pagesConditional Offer Letter - COL - Sumaiya Akter - Shimu - 2023-08-23sumaiyaaktershimuuNo ratings yet

- SETC Tax Credit Guide 130316Document2 pagesSETC Tax Credit Guide 130316r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- Td1on Fill 22eDocument2 pagesTd1on Fill 22eOluwafeyikemi olusogaNo ratings yet

- ACC Final Exam S2 2021 Marking CrieriaDocument10 pagesACC Final Exam S2 2021 Marking CrieriaVikash PatelNo ratings yet

- Monthly Budget Worksheet - Fillable PDF 2022Document3 pagesMonthly Budget Worksheet - Fillable PDF 2022Glaze BoncalesNo ratings yet

- State Level National Talent Search Examination (NTSE) 2021-2022Document25 pagesState Level National Talent Search Examination (NTSE) 2021-2022AsmitNo ratings yet

- SETC Tax Credit Guide 130540Document2 pagesSETC Tax Credit Guide 130540r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- Check List For New F-1 International Students: Welcome To Wayne State University!Document2 pagesCheck List For New F-1 International Students: Welcome To Wayne State University!Kunto Adi WibowoNo ratings yet

- Tax Financial Planning GuideDocument40 pagesTax Financial Planning Guideditoendutojkt75No ratings yet

- DaDA Self Declaration Form 2022-23 FinalDocument3 pagesDaDA Self Declaration Form 2022-23 FinalhNo ratings yet

- 2012-13 Transfer Aid ApplicationDocument4 pages2012-13 Transfer Aid ApplicationLufinancial AidNo ratings yet

- Directorate of Distance Education: Information BrochureDocument4 pagesDirectorate of Distance Education: Information BrochureGOWTHAMNo ratings yet

- Colfuturo Pricing 2020-2021Document1 pageColfuturo Pricing 2020-2021104guerrerostward247No ratings yet

- Tuition Agreement Form: Student Enrolling For2021 Academic YearDocument2 pagesTuition Agreement Form: Student Enrolling For2021 Academic YearIli TuilomaNo ratings yet

- I-20 Document Application: (Certificate of Eligibility For International F-1 Student Status)Document16 pagesI-20 Document Application: (Certificate of Eligibility For International F-1 Student Status)Kata Naresh BabuNo ratings yet

- Virtual Fidelity Bonding SystemDocument55 pagesVirtual Fidelity Bonding SystemLou BaldomarNo ratings yet

- DearDocument5 pagesDearHassan Lamin BarrieNo ratings yet

- Financial Aid Parent Non Tax FilerDocument1 pageFinancial Aid Parent Non Tax FilerDebbieNo ratings yet

- Conditional Offer Letter - COL - Thu Kha - Htun - 2021-09-17Document4 pagesConditional Offer Letter - COL - Thu Kha - Htun - 2021-09-17Thu Kha Ko KoNo ratings yet

- Murdoch Declaration Financial CapacityDocument1 pageMurdoch Declaration Financial CapacityDeki LhadonNo ratings yet

- 27 Fee Collection Notice 2021 1Document1 page27 Fee Collection Notice 2021 1sanjeevmurmu81No ratings yet

- Non-Tax Filer Student 2021 Certification 23-24Document1 pageNon-Tax Filer Student 2021 Certification 23-24Kamal GroverNo ratings yet

- Iss StanfordDocument1 pageIss StanfordKamal GroverNo ratings yet

- Origin of Stoicism and Its Applications in Today's Modern WorldDocument2 pagesOrigin of Stoicism and Its Applications in Today's Modern WorldKamal GroverNo ratings yet

- Svis PyDocument18 pagesSvis PyKamal GroverNo ratings yet

- Princeton PaperDocument4 pagesPrinceton PaperKamal GroverNo ratings yet

- 30 2002 Revenue - Regulations - Implementing - Sections20181220 5466 Ew6q98Document6 pages30 2002 Revenue - Regulations - Implementing - Sections20181220 5466 Ew6q98Milane Anne CunananNo ratings yet

- Learning Ethics From Les MiserablesDocument4 pagesLearning Ethics From Les MiserablesJonas EboraNo ratings yet

- Assignment OF Operation Management-Ii Case: Uber Vs Cabs: Under The Guidance of Prof - Rohit KapoorDocument5 pagesAssignment OF Operation Management-Ii Case: Uber Vs Cabs: Under The Guidance of Prof - Rohit KapoordebojyotiNo ratings yet

- Pinpara Dialog AP MBL-RQ-050998Document1 pagePinpara Dialog AP MBL-RQ-050998dumindu1No ratings yet

- Salus Populi Suprema Lex EstoDocument2 pagesSalus Populi Suprema Lex EstoSaad Ahmed100% (3)

- Contemporary ArtsDocument2 pagesContemporary ArtsKess MontallanaNo ratings yet

- Managing Diversity Toward A Globally Inclusive Workplace 4Th Edition Barak Test Bank Full Chapter PDFDocument36 pagesManaging Diversity Toward A Globally Inclusive Workplace 4Th Edition Barak Test Bank Full Chapter PDFphanagneslr9h55100% (15)

- Ballot Guidelines For General Secretary Election: (Insert Date)Document12 pagesBallot Guidelines For General Secretary Election: (Insert Date)Paul WaughNo ratings yet

- Uef A20e Vominhtri 205044923 Final-Report Sales-ManagenmentDocument39 pagesUef A20e Vominhtri 205044923 Final-Report Sales-ManagenmentTrí Võ MinhNo ratings yet

- James Cameron Research PaperDocument7 pagesJames Cameron Research Paperafnkjdhxlewftq100% (1)

- Chapter 3 - Ethics in Nursing ResearchDocument46 pagesChapter 3 - Ethics in Nursing ResearchIconMaicoNo ratings yet

- Auditing Problems You Can UseDocument51 pagesAuditing Problems You Can UseChinita VirayNo ratings yet

- Case Report UnpriDocument17 pagesCase Report UnpriChandra SusantoNo ratings yet

- UP Diliman Return-to-Work Guidelines: Post-ECQ Guidelines For Administrative ProcessesDocument11 pagesUP Diliman Return-to-Work Guidelines: Post-ECQ Guidelines For Administrative ProcessesTim AcostaNo ratings yet

- Contemporary Issues in Yin Yang TheoryDocument109 pagesContemporary Issues in Yin Yang TheoryRudolph Antony ThomasNo ratings yet

- Gerund or Infinitive Worksheet Templates Layouts 96902Document2 pagesGerund or Infinitive Worksheet Templates Layouts 96902afi54No ratings yet

- John Christman Saving Positive Freedom PDFDocument10 pagesJohn Christman Saving Positive Freedom PDFCristhian VillegasNo ratings yet

- UNIT 1 / Pre-Intermediate Generations: Didn't Go (Go / Not) To A Movie Last Night. I Stayed (Stay) at HomeDocument24 pagesUNIT 1 / Pre-Intermediate Generations: Didn't Go (Go / Not) To A Movie Last Night. I Stayed (Stay) at HomeEren KırıcıNo ratings yet

- Liwanag Vs CA Case DigestDocument1 pageLiwanag Vs CA Case DigestVanityHughNo ratings yet

- Consultancy Services TCSDocument7 pagesConsultancy Services TCSPahulpreetSinghNo ratings yet

- Social Ontology and Research Strategy PDFDocument29 pagesSocial Ontology and Research Strategy PDFFelipe NogueiraNo ratings yet

- Wilbur Smith Books: Yea R Title Timeframe SeriesDocument3 pagesWilbur Smith Books: Yea R Title Timeframe SeriesAamirShabbir100% (2)

- Crimes (Sentencing Procedure) Act 1999 No 92 Section 21ADocument4 pagesCrimes (Sentencing Procedure) Act 1999 No 92 Section 21AReza PatriaNo ratings yet

- LIT 1 EssentialsDocument1 pageLIT 1 Essentialsque zomeNo ratings yet

- M - CV FDocument2 pagesM - CV FYogendra Prawin KumarNo ratings yet

- Math 1050 Mortgage ProjectDocument5 pagesMath 1050 Mortgage Projectapi-2740249620% (1)

- Percieved Social Media Influence On The Choice of National Candidates in 2022 Philippine Elections Senior High School StudentsDocument25 pagesPercieved Social Media Influence On The Choice of National Candidates in 2022 Philippine Elections Senior High School StudentsDan Gela Mæ MaYoNo ratings yet

- Witness Cannot Be Added As An Accused Even If His Statements Are Inculpatory: Supreme CourtDocument36 pagesWitness Cannot Be Added As An Accused Even If His Statements Are Inculpatory: Supreme CourtLive Law100% (1)