Professional Documents

Culture Documents

Edelweiss Factsheet Bharat Bond ETF April 2023 Fund March MF 2023 13032023 104247 AM

Edelweiss Factsheet Bharat Bond ETF April 2023 Fund March MF 2023 13032023 104247 AM

Uploaded by

S SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Edelweiss Factsheet Bharat Bond ETF April 2023 Fund March MF 2023 13032023 104247 AM

Edelweiss Factsheet Bharat Bond ETF April 2023 Fund March MF 2023 13032023 104247 AM

Uploaded by

S SinghCopyright:

Available Formats

Bharat Bond ETF

An open-ended Target Maturity Exchange Traded Bond Fund

predominately investing in constituents of Nifty BHARAT Bond Index

- April 2023.

APRIL 2023

(As on 28th February, 2023) Inception Date

Investment Objective 26-Dec-19

Fund Managers Details

The investment objective of the scheme is to replicate Nifty BHARAT Bond Index – April 2023 by investing in bonds of

CPSEs/CPSUs/CPFIs and other Government organizations, subject to tracking errors. However, there is no assurance that the investment Fund Managers Experience Managing Since

objective of the Scheme will be realized and the Scheme does not assure or guarantee any returns. Mr. Dhawal Dalal 26 years 26-Dec-19

Mr. Rahul Dedhia 13 years 23-Nov-21

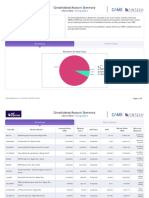

Top Holdings as on February 28, 2023 Asset Allocation (% of total)

Benchmark

Nifty BHARAT Bond Index – April 2023

Name of Instrument Rating % to Net 2.30% 1.05%

Assets 5.13% Fund Size

6.72% NABARD NCD RED 14-04-2023 ICRA AAA 14.21% Month End AUM Monthly Average AUM

6.59% IRFC NCD RED 14-04-2023 CRISIL AAA 13.84% Rs. 7,798.71 Crore Rs. 7,864.17 Crore

6.44% INDIAN OIL CORP NCD RED

14-04-2023 CRISIL AAA 10.78%

NAV (as on February 28, 2023)

6.79% HUDCO NCD RED 14-04-2023 ICRA AAA 10.17% Bharat Bond ETF April 2023 1220.9852

7.04% PFC LTD NCD RED 14-04-2023 CRISIL AAA 10.03%

91.53% Plan/Options:

8.82% REC LTD NCD RED 12-04-23 CARE AAA 8.50%

7.12% REC LTD. NCD RED 31-03-2023 CRISIL AAA 6.01% The Scheme does not offer any Plans/Options for

investment.

6.38% HPCL NCD RED 12-04-2023 CRISIL AAA 4.70% Non Convertible Debentures Commercial Paper

EXIM BANK CP RED 01-03-2023 CRISIL AAA 4.49% Certificate of Deposit Cash & Other Receivables

Minimum Creation Unit Size:

6.64% MANGALORE REF & PET NCD

Through AMC: Rs 25 crs

14-04-2023 CRISIL AAA 4.45% Rating Profile

8.8% POWER GRID CORP NCD RED Through Exchange: 1 unit

13-03-2023 CRISIL AAA 2.78%

1.05% Exit Load NIL

6.35% POWER GRID CORP NCD RED

14-04-2023 CRISIL AAA 1.29%

Total Expense Ratios~:

SIDBI CD RED 23-03-2023 CRISIL AAA 1.28%

Bharat Bond ETF April 2023 0.0005%

8.8% NTPC LTD. NCD RED 04-04-2023 CARE AAA 1.11%

EXIM BANK CD RED 17-03-2023 CRISIL AAA 1.02%

8.56% NPCL NCD RED 15-03-2023 CARE AAA 1.00%

8.80% EXIM BANK NCD RED 15-03-2023 CRISIL AAA 0.83%

8.54% NPCL NCD RED 15-03-2023 CRISIL AAA 0.80% 98.95%

SIDBI CP RED 10-03-2023 CRISIL AAA 0.64%

8.56% NPCL NCD RED 18-03-2023 CARE AAA 0.53%

AAA Cash & Other Receivables

8.84% POWER FIN CORP NCD RED This product is suitable for investors who are seeking*

• Income over the Target Maturity period

04-03-2023 CRISIL AAA 0.14%

• An open ended Target Maturity Exchange Traded Bond

8.73% NTPC LTD. NCD RED 07-03-2023 CRISIL AAA 0.14% Fund that seeks to track the returns provided by Nifty

8.83% INDIAN RLY FIN CORP BHARAT Bond Index - April 2023.

NCD RED 250323 CRISIL AAA 0.14% *Investors should consult their financial advisers if in

8.9% POWER FIN CORP NCD RED doubt about whether the product is suitable for them.

TREPS RED 01.03.2023 1.12%

Cash & Cash Equivalent -0.08%

E

AT

ER

D

MO

LOW

Quantitative indicators as on February 28, 2023

RISKOMETER

0.10

7.60% Modified years Macaulay Investors understand that their

Duration Duration principal will be at Low risk

Yield to Average Benchmark Riskometer: Nifty BHARAT Bond Index – April 2023

maturity (YTM) 0.10 Maturity 0.10

years years

E

AT

ER

D

Fund Performance as on February 28, 2023

MO

Benchmark Additional Benchmark

LOW

Scheme - Bharat Bond ETF April 2023

(Nifty BHARAT Bond Index – April 2023#) (CRISIL 10 year Gilt Index)

Period RISKOMETER

Returns* Value of Rs. 10000 Returns* Value of Rs. 10000 Returns* Value of Rs. 10000

Invested Invested Invested

Potential Risk Class Matrix

1 Year 4.74% 10,474 5.20% 10,520 2.00% 10,200

Credit Risk → Relatively

Low

Moderate Relatively

High

3 Years 6.20% 11,978 6.29% 12,010 2.93% 10,906

Interest Rate Risk

→

(Class A) (Class B) (Class C)

Since Inception 6.48% 12,210 6.58% 12,246 3.60% 11,191

Relatively Low (Class I)

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments.

Moderate (Class II) A-II

* CAGR Return.

Relatively High (Class III)

Notes:

1. The scheme does not offer any plans

2. The scheme is currently managed by Dhawal Dalal (managing this fund from December 26, 2019 ) and Rahul Dedhia (managing this fund

from November 23, 2021 ). Please refer page no. 63-64 for name of the other schemes currently managed by the Fund Managers and

relevant scheme for performance. 3. For SEBI prescribed standard format for disclosure of Portfolio YTM for Debt Schemes please refer

page number 65 & 66 of factsheet.

Disclaimer of NSE: It is to be distinctly understood that the permission given by NSE should not in any way be deemed or construed that the Scheme Information Document has been cleared or approved

by NSE nor does it certify the correctness or completeness of any of the contents of the Scheme Information Document. The investors are advised to refer to the Scheme Information Document for the full

text of the 'Disclaimer Clause of NSE'.

Disclaimer of IISL: The “Product” offered by “the issuer” is not sponsored, endorsed, sold or promoted by India Index Services & Products Limited (IISL). IISL does not make any representation or warranty,

express or implied (including warranties of merchantability or fitness for particular purpose or use) and disclaims all liability to the owners of “the Product” or any member of the public regarding the

advisability of investing in securities generally or in “the Product” linked to Nifty BHARAT Bond Index – April 2023 or particularly in the ability of the Nifty BHARAT Bond Index – April 2023 to track general

stock market performance in India. Please read the full Disclaimers in relation to the Nifty BHARAT Bond Index – April 2023 in the in the Scheme Information Document.

23

You might also like

- Bloomberg Cheat SheetsDocument45 pagesBloomberg Cheat Sheetsuser12182192% (12)

- Bonds Exam Cheat SheetDocument2 pagesBonds Exam Cheat SheetSergi Iglesias CostaNo ratings yet

- This Study Resource Was: Andrea Jasmin D. Nazario October 29, 2020 BSA191A Intermediate Accounting 2Document5 pagesThis Study Resource Was: Andrea Jasmin D. Nazario October 29, 2020 BSA191A Intermediate Accounting 2Nah Hamza67% (3)

- CFA Level 3 2012 Guideline AnswersDocument42 pagesCFA Level 3 2012 Guideline AnswersmerrylmorleyNo ratings yet

- California PizzaDocument4 pagesCalifornia PizzaMaria Fe Callejas0% (1)

- Credit Risk Assessment ReportDocument13 pagesCredit Risk Assessment Reportkitson200100% (1)

- Edelweiss Factsheet Bharat Bond ETF April 2032 Fund May MF 2023 09052023 072214 PMDocument1 pageEdelweiss Factsheet Bharat Bond ETF April 2032 Fund May MF 2023 09052023 072214 PMvishnu cNo ratings yet

- INF090I01569 - Franklin India Smaller Cos FundDocument1 pageINF090I01569 - Franklin India Smaller Cos FundKiran ChilukaNo ratings yet

- Ujaas Energy - Crisil BBB+Document4 pagesUjaas Energy - Crisil BBB+Sidhesh KanadeNo ratings yet

- Sbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFDocument1 pageSbi Magnum Midcap Fund Factsheet (January-2021-34-1) PDFavinash sengarNo ratings yet

- Fund Facts - HDFC Small Cap Fund - March 23Document2 pagesFund Facts - HDFC Small Cap Fund - March 23duttasahil19No ratings yet

- 360 ONE Equity Opportunity Fund - Apr24Document2 pages360 ONE Equity Opportunity Fund - Apr24speedenquiryNo ratings yet

- Sbi Mutual FundDocument1 pageSbi Mutual Fundramana purushothamNo ratings yet

- Invest in Long Term Equity Fund - ELSS Mutual Fund - Edelweiss MFDocument1 pageInvest in Long Term Equity Fund - ELSS Mutual Fund - Edelweiss MFJune RobertNo ratings yet

- SBI Consumption Opportunities Fund Factsheet April 2024Document1 pageSBI Consumption Opportunities Fund Factsheet April 2024Hitesh MiskinNo ratings yet

- Sbi Focused Equity Fund Factsheet (May-2019!25!1)Document1 pageSbi Focused Equity Fund Factsheet (May-2019!25!1)Chandrasekar Attayampatty TamilarasanNo ratings yet

- SBI Small and Mid Cap Fund FactsheetDocument1 pageSBI Small and Mid Cap Fund Factsheetfinal bossuNo ratings yet

- Edelweiss Factsheet Large Cap Fund August MF 2023 10082023 042056 PMDocument1 pageEdelweiss Factsheet Large Cap Fund August MF 2023 10082023 042056 PMall in one videosNo ratings yet

- Morningstarreport 20230812042222Document1 pageMorningstarreport 20230812042222Anal ShahNo ratings yet

- A-1 Facility and Property Managers Private Limited: Rating RationaleDocument5 pagesA-1 Facility and Property Managers Private Limited: Rating RationaleDeepti JajooNo ratings yet

- DariDocument1 pageDarivijay mishraNo ratings yet

- Fund Facts - HDFC Small Cap Fund - May 24Document3 pagesFund Facts - HDFC Small Cap Fund - May 24mk2bmh9sNo ratings yet

- Monthly Corporate Action Tracker: - Dossier of Key Corporate Actions in March, 2019Document17 pagesMonthly Corporate Action Tracker: - Dossier of Key Corporate Actions in March, 2019RajeshNo ratings yet

- Quant Multi Asset FundDocument1 pageQuant Multi Asset Fundarian2026No ratings yet

- SBI Contra FundDocument2 pagesSBI Contra FundScribbydooNo ratings yet

- Factsheet 1705132209349Document2 pagesFactsheet 1705132209349umanarayanvaishnavNo ratings yet

- SBI Long Term Equity Fund Factsheet 62c6e895 82d5 4411 8714 6dfcec432a91Document1 pageSBI Long Term Equity Fund Factsheet 62c6e895 82d5 4411 8714 6dfcec432a91ja3mf29gNo ratings yet

- SBI Bluechip Fund - One PagerDocument1 pageSBI Bluechip Fund - One PagerjoycoolNo ratings yet

- SBI Long Term Equity Fund FactsheetDocument1 pageSBI Long Term Equity Fund FactsheetAwakening with EnlightenmentNo ratings yet

- SABR - Sabre CorporationDocument9 pagesSABR - Sabre Corporationdantulo1234No ratings yet

- Ingenious Nov Dec 2022Document20 pagesIngenious Nov Dec 2022Ankur ShahNo ratings yet

- Inf200k01t28 - Sbi SmallcapDocument1 pageInf200k01t28 - Sbi SmallcapKiran ChilukaNo ratings yet

- KRChoksey Dharmaj Crop Guard IPO NoteDocument13 pagesKRChoksey Dharmaj Crop Guard IPO NoteMohammed Israr ShaikhNo ratings yet

- Sbi Banking and Financial Services Fund Factsheet (August-2021-415-1)Document1 pageSbi Banking and Financial Services Fund Factsheet (August-2021-415-1)charan ThakurNo ratings yet

- Hyderabad Report March-2022-17052022Document1 pageHyderabad Report March-2022-17052022Yakshit JainNo ratings yet

- Subsidy EnquiryDocument3 pagesSubsidy EnquiryGopalakrishnan KNo ratings yet

- HDFC MF Factsheet - July 2021 - 3-55-56Document2 pagesHDFC MF Factsheet - July 2021 - 3-55-56daveNo ratings yet

- SBI Contra Fund FactsheetDocument1 pageSBI Contra Fund FactsheetAkshad KhedkarNo ratings yet

- Atif Raza..Document1 pageAtif Raza..Atif RazaNo ratings yet

- Indicative Quotes 22082022..Document32 pagesIndicative Quotes 22082022..Pravin SinghNo ratings yet

- Fund Facts - HDFC Mid-Cap Opportunities Fund - May 24Document2 pagesFund Facts - HDFC Mid-Cap Opportunities Fund - May 24mk2bmh9sNo ratings yet

- Edelweiss Government Securities Fund August 2021 16092021 030955 PMDocument1 pageEdelweiss Government Securities Fund August 2021 16092021 030955 PMHarsimran SNo ratings yet

- SBI Magnum Income Fund FactsheetDocument1 pageSBI Magnum Income Fund FactsheetKripa Shankar TiwariNo ratings yet

- Shriram Multi Asset Allocation Fund - Regular GDocument4 pagesShriram Multi Asset Allocation Fund - Regular GMarotrao BhiseNo ratings yet

- Cas Summary Report 2022 08 19 123504Document5 pagesCas Summary Report 2022 08 19 123504aman feriadNo ratings yet

- Account Statement (From 12-JAN-2023 To 12-JAN-2023)Document2 pagesAccount Statement (From 12-JAN-2023 To 12-JAN-2023)shekhy123No ratings yet

- Ppfas MF Factsheet For October 2022Document17 pagesPpfas MF Factsheet For October 2022East KailashNo ratings yet

- Ppfas MF Factsheet For October 2022Document17 pagesPpfas MF Factsheet For October 2022Dasari PrabodhNo ratings yet

- Karma - Capital - Domestic Factsheet-November - 2023 FinalDocument18 pagesKarma - Capital - Domestic Factsheet-November - 2023 FinalDeepan KapadiaNo ratings yet

- PR Sheetal Coolproducts 4jul23Document5 pagesPR Sheetal Coolproducts 4jul23jay.futuretecNo ratings yet

- Rating Rationale CampusDocument6 pagesRating Rationale CampusRavi BabuNo ratings yet

- A Guide To Minimum Wage in India - India Briefing NewsDocument14 pagesA Guide To Minimum Wage in India - India Briefing NewsvinaycrNo ratings yet

- Ashv Finance Limited BC Mar2023Document46 pagesAshv Finance Limited BC Mar2023Swarna SinghNo ratings yet

- SBI Contra Fund Factsheet April 2024Document1 pageSBI Contra Fund Factsheet April 2024skbmnnitNo ratings yet

- Mehala Machines India LimitedDocument4 pagesMehala Machines India LimitedKarthikeyan RK SwamyNo ratings yet

- RPR 501-7539692Document1 pageRPR 501-7539692sai vishnu vardhanNo ratings yet

- Figures As On Sep 30,2020: Company/Issuer/Instrument Name Isin Units of Mutual FundsDocument30 pagesFigures As On Sep 30,2020: Company/Issuer/Instrument Name Isin Units of Mutual FundsAryata BhansaliNo ratings yet

- Kogta Financial India LimitedDocument5 pagesKogta Financial India LimitedofficeloginpurposeNo ratings yet

- INF179K01CR2 - HDFC Midcap OpportunitiesDocument1 pageINF179K01CR2 - HDFC Midcap OpportunitiesKiran ChilukaNo ratings yet

- SBI Small Cap PDFDocument1 pageSBI Small Cap PDFJasmeet Singh NagpalNo ratings yet

- Sbi Large and Midcap Fund Factsheet (June-2021!2!1)Document1 pageSbi Large and Midcap Fund Factsheet (June-2021!2!1)Gaurav NagpalNo ratings yet

- Ykfuhrc2qlwoy Sz9o39ugv007dw10g-Qulys5vfqpkDocument3 pagesYkfuhrc2qlwoy Sz9o39ugv007dw10g-Qulys5vfqpkrkchoudhary03012006No ratings yet

- Solutions Oriented Scheme-Children'S Fund: Investment ObjectiveDocument1 pageSolutions Oriented Scheme-Children'S Fund: Investment Objectiveparvinder.singh02No ratings yet

- NPS Transaction Statement For Tier I AccountDocument3 pagesNPS Transaction Statement For Tier I AccountY. T. RNo ratings yet

- Fund Facts - HDFC Tax Saver - August 22.1422969Document3 pagesFund Facts - HDFC Tax Saver - August 22.1422969Jignesh Jagjivanbhai PatelNo ratings yet

- Guidebook for Demand Aggregation: Way Forward for Rooftop Solar in IndiaFrom EverandGuidebook for Demand Aggregation: Way Forward for Rooftop Solar in IndiaNo ratings yet

- Ics Exams 2013 Questions SFDocument2 pagesIcs Exams 2013 Questions SFDeepak Shori100% (1)

- Restructuring Plan GopalDocument3 pagesRestructuring Plan GopalVikas JainNo ratings yet

- In Re: Ralph T. Byrd, Debtor, Platinum Financial Services Corporation, Roger Schlossberg, Chapter 7 Trustee, Trustee-Appellant v. Ralph T. Byrd, 357 F.3d 433, 4th Cir. (2004)Document9 pagesIn Re: Ralph T. Byrd, Debtor, Platinum Financial Services Corporation, Roger Schlossberg, Chapter 7 Trustee, Trustee-Appellant v. Ralph T. Byrd, 357 F.3d 433, 4th Cir. (2004)Scribd Government DocsNo ratings yet

- AC2101 SemGrp4 Team2 UpdatedDocument38 pagesAC2101 SemGrp4 Team2 UpdatedKwang Yi JuinNo ratings yet

- ABnormal Returns With Momentum Contrarian Strategies Using ETFsDocument12 pagesABnormal Returns With Momentum Contrarian Strategies Using ETFsjohan-sNo ratings yet

- Ing NV 2010 PDFDocument296 pagesIng NV 2010 PDFSergiu ToaderNo ratings yet

- 201272163237draft Prospectus - Jointeca Education Solutions Limited - FinalDocument220 pages201272163237draft Prospectus - Jointeca Education Solutions Limited - FinalNimalanNo ratings yet

- A Report On Financial Statement of Hindustan ConstructionDocument18 pagesA Report On Financial Statement of Hindustan ConstructionNaag RajNo ratings yet

- The Influence of Riba and Zakat OnDocument19 pagesThe Influence of Riba and Zakat Onekaitzbengoetxea857No ratings yet

- Review: Letter From The EditorDocument47 pagesReview: Letter From The EditorooteuhNo ratings yet

- Q2 FY22 Financial TablesDocument13 pagesQ2 FY22 Financial TablesDennis AngNo ratings yet

- Mercado, Floriemae S. BSA 2 Exercise 10Document6 pagesMercado, Floriemae S. BSA 2 Exercise 10Floriemae MercadoNo ratings yet

- Hallmark Company Limited: Annual ReportDocument35 pagesHallmark Company Limited: Annual ReportDanial RizviNo ratings yet

- An Analytical Study of Derivatives in Futures Mba ProjectDocument70 pagesAn Analytical Study of Derivatives in Futures Mba ProjectAbhinandan Chougule100% (2)

- JUNE. 2020 G.C Mekelle, Tigray, EthiopiaDocument13 pagesJUNE. 2020 G.C Mekelle, Tigray, EthiopiaAsmelash GideyNo ratings yet

- Activity No. 1. Accounting PracticesDocument3 pagesActivity No. 1. Accounting PracticesNalin SNo ratings yet

- BfsiDocument60 pagesBfsishriya shettiwar0% (1)

- Code of ConductDocument29 pagesCode of ConductKiran GowdaNo ratings yet

- CONNEX ClauseInsights Lock-In Clauses 2023Document5 pagesCONNEX ClauseInsights Lock-In Clauses 2023Investment Promotion Directorate MOIC, AfghanistanNo ratings yet

- Capital Budgeting (Word 2003)Document69 pagesCapital Budgeting (Word 2003)Gangam Sandeep33% (3)

- Critical Analysis of IBC CodeDocument32 pagesCritical Analysis of IBC CodesandeshNo ratings yet

- 3 - Risk & Return - QuestionsDocument2 pages3 - Risk & Return - QuestionsMon Ram0% (1)

- Compliance OfficerDocument2 pagesCompliance Officerapi-121648896No ratings yet

- Diplomat Earnings Release Q3 2019Document10 pagesDiplomat Earnings Release Q3 2019Madeline CiakNo ratings yet