Professional Documents

Culture Documents

Expnses To Be Deductable

Expnses To Be Deductable

Uploaded by

SMTH COriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Expnses To Be Deductable

Expnses To Be Deductable

Uploaded by

SMTH CCopyright:

Available Formats

Representation and Entertainment Expense

Representation and entertainment expense are those incurred by the company in the course of

business relative to entertaining or meeting with guests at a dining place, place of amusement,

sporting events and similar events or places as contemplated under RR No. 10-2002.

These are allowed as deduction because it develops a friendlier atmosphere between the taxpayers

and potential clients, guests or employees in order to develop a better business resulting to a higher

income and eventually more taxes.

However, such expenses are subject to the following limitations on its deductibility:

Sellers of Goods- 0.5% of net sales (net of sales returns, discounts and allowances).

Sellers of Services- 1% of gross receipts.

Note:

For taxpayer engaged in the sale of both goods and services, specific identification or segregation has

to be made. Sellers of service enjoy a higher rate because they are more prone to spending

representation and entertainment in dealings with its guests, clients, or customers

The Bureau of Internal Revenue (BIR) allows businesses to deduct certain

expenses from their taxable income. As a rule of thumb, most of these

allowed expenses should be relevant and necessary to business activities,

while including others such as social security contributions and donations to

charitable institutions.

When applying deductible expenses, you may choose between two options:

itemized deductions and optional standard deductions (OSD). Between the

two, the OSD is simpler to compute because your allowable deduction is set

at 40% of your gross sales or receipts, but only itemized deductions will keep

you from paying income tax if your expenses exceed your income. With

itemized deductions, you’ll also have to present receipts as proof of your

deductible expenses. We discuss this in detail in our article ‘Itemized

Deduction vs. Optional Standard Deduction – Find Out What’s Right for You’.

Meanwhile, we cover everything you need to know about deductible expenses

in the following paragraphs.

WHAT EXPENSES MAY BE

DEDUCTED

Below is a list of the deductible expenses allowed by the BIR. However, to

ensure that a certain business expense is indeed allowed, it is important that

you consult with an accountant or a tax professional.

Advertising and Promotions Amortizations Bad Debts

Charitable Contributions* Commissions Communication, Light,

Water

Depletion Depreciation* Director’s Fees*

Fringe Benefits* Fuel and Oil Insurance Interest*

Janitorial / Messengerial Services* Losses* Management /

Consultancy Fee*

Miscellaneous Office Supplies Other Services

Professional Fees* Rental* Repairs and

Maintenance-Labor

Repairs and Maintenance Representation and Research and

(Materials/Supplies) Entertainment* Development

Royalties* Salaries and Allowances* Security Services*

SSS, GSIS, Philhealth, HDMF and Taxes and Licenses* Tolling Fees

Other Contributions*

Training and Seminars Transportation and Travel Others (case to case

basis)

* See additional notes on mouse-over

CRITERIA FOR ALLOWABLE

DEDUCTIONS

While the list above shows what expenses may be deducted, you must

ensure that these meet the following criteria set by the BIR:

The Expense Must be Business-Related. As we mentioned earlier, majority

of deductible expenses allowed must be relevant and necessary to the

business. These are typical disbursements that your business needs in order

to operate. So if you are running a tarpaulin printing business, for example, a

valid business expense may include your purchase of ink and the

maintenance of your printer. That said, personal expenses are naturally

excluded from allowable deductions.

It Must be Presented with Supporting Documents. This one applies to

itemized deductions. In order for an expense to be deducted, you must show

proof of the said expense such as a receipt or sales invoice. However if you

opt for the OSD, you aren’t required to present any proof to substantiate the

40% deduction.

It Must not be Illegal, Immoral, and not Against Policy and Order. Any

illegal activity is automatically excluded from deductible expenses.

The Amount Deducted Must be Reasonable. There’s a ceiling to certain

expenses such as the Representation and Entertainment expense, which is

capped at 0.5% of net sales for those who sell goods and 1% of revenues for

service providers.

For OSD, the allowable deductible expense is automatically limited to 40% of

your gross sales or receipts.

Withholding Taxes Must Have been Paid

In the above list, you’ll also see certain deductible expenses that are subject

to withholding taxes. You must pay the corresponding tax to the BIR first

before you can claim them as a deductible expense. Withholding taxes must

also be paid whether you choose itemized deductions or the OSD.

HOW TO ENSURE YOUR

COMPLIANCE TO RULES ON

DEDUCTIBLE EXPENSES

Expenses that you can deduct from your gross income and the criteria of what

is considered a deductible expense are fairly clear and straightforward.

However, there may be some instances where exclusions would apply,

creating a potential for confusion and issues with the BIR during tax season.

Because of that, it may be ideal to work with accountants and tax

professionals who can help you navigate through the complexities of the tax

system, so you can pay the right taxes and prevent compliance issues today

and in the future. For more information, contact us today about your services

at Beyond D Numbers, from tax compliance to payroll services.

You might also like

- Direct TaxationDocument2 pagesDirect TaxationSatyam SharmaNo ratings yet

- 2023 Tax Deduction Cheat Sheet and LoopholesDocument24 pages2023 Tax Deduction Cheat Sheet and LoopholesKrisstian AnyaNo ratings yet

- 1589865313232-Invoice 5177188319 PDFDocument1 page1589865313232-Invoice 5177188319 PDFAdnan AhmedNo ratings yet

- Allowable Deductible Expenses in The PhilippinesDocument2 pagesAllowable Deductible Expenses in The PhilippinesmtscoNo ratings yet

- Module 5 Deductions From Gross IncomeDocument3 pagesModule 5 Deductions From Gross Incomekaswabelife16No ratings yet

- FNSACC501 Provide Financial and Business Performance InformationDocument6 pagesFNSACC501 Provide Financial and Business Performance InformationDaranee TrakanchanNo ratings yet

- Taxation of Income From Business or ProfessionDocument5 pagesTaxation of Income From Business or ProfessionKumar NaveenNo ratings yet

- Philippines: Choose A TopicDocument3 pagesPhilippines: Choose A Topicjames luzonNo ratings yet

- Taxation - Allowable Business DeductionsDocument51 pagesTaxation - Allowable Business DeductionsHannah OrosNo ratings yet

- Les On Deductibility of Expenses.04.04.08Document3 pagesLes On Deductibility of Expenses.04.04.08Christine BobisNo ratings yet

- Business Tax DeductionsDocument4 pagesBusiness Tax DeductionsGab VillahermosaNo ratings yet

- Chapter 10 Tabag - Serrano NotesDocument5 pagesChapter 10 Tabag - Serrano NotesNatalie SerranoNo ratings yet

- Chapter 10 Tabag - Serrano NotesDocument5 pagesChapter 10 Tabag - Serrano NotesNatalie SerranoNo ratings yet

- Taxation of Fringe BenefitsDocument5 pagesTaxation of Fringe BenefitsTawanda Tatenda HerbertNo ratings yet

- IncomeTaxation VirreyDocument14 pagesIncomeTaxation VirreyAdilyn Grace VirreyNo ratings yet

- Module 13 Regular Deductions 3Document16 pagesModule 13 Regular Deductions 3Donna Mae FernandezNo ratings yet

- Inland Revenue Department NZ Deductibility of Entertainment ExpenseDocument24 pagesInland Revenue Department NZ Deductibility of Entertainment ExpenseKirsten Marie EximNo ratings yet

- Most CommonDocument6 pagesMost CommonSalah habbiNo ratings yet

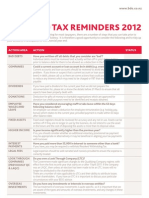

- Year-End Tax Reminders 2012: Action Area Action StatusDocument2 pagesYear-End Tax Reminders 2012: Action Area Action Statusapi-129279783No ratings yet

- Chapter 13 ADocument22 pagesChapter 13 AAdmNo ratings yet

- Tax Tips For Real Estate AgentsDocument13 pagesTax Tips For Real Estate Agentsnikop11422100% (1)

- Chart of AccountDocument9 pagesChart of Accountshankar19744619No ratings yet

- B V R F S: Usiness Aluation Ecasting The Inancial TatementsDocument4 pagesB V R F S: Usiness Aluation Ecasting The Inancial TatementsAaditya JainNo ratings yet

- Analysis Group 4Document5 pagesAnalysis Group 4Clarise DatayloNo ratings yet

- Financial StatementDocument83 pagesFinancial StatementDarkie DrakieNo ratings yet

- Deduction From Gross Income-Deduction Allowed Under Special LawDocument131 pagesDeduction From Gross Income-Deduction Allowed Under Special LawRance Harry Daza0% (2)

- Divers and Diving Supervisors Revenue Expences Under CISDocument5 pagesDivers and Diving Supervisors Revenue Expences Under CISCailean FraserNo ratings yet

- Business Expenses - InvestopediaDocument3 pagesBusiness Expenses - InvestopediaBob KaneNo ratings yet

- Essay On Passive IncomeDocument10 pagesEssay On Passive IncomeJithesh ViswanadhNo ratings yet

- CHAPTER 13 - SummarizeDocument13 pagesCHAPTER 13 - SummarizejsgiganteNo ratings yet

- Compensation Income and Fringe Benefit Tax. ReviewerDocument4 pagesCompensation Income and Fringe Benefit Tax. RevieweryzaNo ratings yet

- 12 of The Biggest Tax Deductions For Real Estate InvestorsDocument6 pages12 of The Biggest Tax Deductions For Real Estate InvestorsdearqivoNo ratings yet

- Business Expenses: Publication 535Document50 pagesBusiness Expenses: Publication 535Birgitte SangermanoNo ratings yet

- Classification of Personal ExemptionsDocument16 pagesClassification of Personal Exemptionswilhelmina romanNo ratings yet

- 05b Concept of Taxable IncomeDocument36 pages05b Concept of Taxable IncomeGolden ChildNo ratings yet

- Special Allowable Itemized DeductionsDocument6 pagesSpecial Allowable Itemized DeductionsChristine RaizNo ratings yet

- Income Statement: Profit and LossDocument7 pagesIncome Statement: Profit and LossNavya NarulaNo ratings yet

- Chapter 13 Principles of DeductionDocument5 pagesChapter 13 Principles of DeductionJason Mables100% (1)

- IPFAS-AdvisoryContract-2023 Revised 4-10-2023 - Blank VersionDocument15 pagesIPFAS-AdvisoryContract-2023 Revised 4-10-2023 - Blank Versionindo 5SNo ratings yet

- EV EBITDA AnalysisDocument25 pagesEV EBITDA AnalysisVaibhav Singh100% (1)

- Tax Midterm ReviewerDocument18 pagesTax Midterm ReviewerAyessa GayamoNo ratings yet

- Solution Advance Taxation Planning and Fiscal Policy Nov 2007Document6 pagesSolution Advance Taxation Planning and Fiscal Policy Nov 2007Samuel DwumfourNo ratings yet

- Deductions From Gross Income Lesson 13Document72 pagesDeductions From Gross Income Lesson 13Mikaela SamonteNo ratings yet

- DanDocument2 pagesDan22-35655No ratings yet

- Nabtrade Financial Services GuideDocument12 pagesNabtrade Financial Services GuideksathsaraNo ratings yet

- Chapter 8 - Deductions From Gross IncomeDocument36 pagesChapter 8 - Deductions From Gross IncomejohnNo ratings yet

- M6 - Deductions P1 Students'Document36 pagesM6 - Deductions P1 Students'micaella pasionNo ratings yet

- Profit and Loss Statement TemplateDocument8 pagesProfit and Loss Statement TemplateJerarudo BoknoyNo ratings yet

- MODULE VIII Financial AnalysisDocument4 pagesMODULE VIII Financial AnalysisInah LataganNo ratings yet

- Deductions Fro Gross IncomeDocument2 pagesDeductions Fro Gross IncomemarjotalaNo ratings yet

- TaxationDocument15 pagesTaxationHani NazrinaNo ratings yet

- How Banks Use Financial Ratios To Measure Your PerformanceDocument4 pagesHow Banks Use Financial Ratios To Measure Your PerformanceEmelyNo ratings yet

- Weak Leaner ActivityDocument5 pagesWeak Leaner ActivityAshwini shenolkarNo ratings yet

- Guidance For Claiming ExpensesDocument5 pagesGuidance For Claiming Expensesrekha_angurajNo ratings yet

- Deductions From Gross Income ShortDocument53 pagesDeductions From Gross Income ShortXander ClockNo ratings yet

- Pay As You Go (Payg) WithholdingDocument70 pagesPay As You Go (Payg) WithholdingliamNo ratings yet

- Lesson 1.2: SciDocument4 pagesLesson 1.2: SciIshi MaxineNo ratings yet

- Basic Things Professionals Need To Consider Tax WiseDocument3 pagesBasic Things Professionals Need To Consider Tax WiseVeraNataaNo ratings yet

- Cash Disbursements Register: Appendix 43Document3 pagesCash Disbursements Register: Appendix 43Cristina D CupatanNo ratings yet

- 49494898268471852-Invoice 9099156993Document1 page49494898268471852-Invoice 9099156993Hemant SharmaNo ratings yet

- 2 BTAC PG OverviewDocument10 pages2 BTAC PG OverviewRommel CabalhinNo ratings yet

- GST Amit Furniture Utopiya TechnologyDocument5 pagesGST Amit Furniture Utopiya TechnologyUtopia Instrumentation AutomationNo ratings yet

- Volume 1Document466 pagesVolume 1DeekshaNo ratings yet

- Train Law Ra 10953Document32 pagesTrain Law Ra 10953IanaNo ratings yet

- ReceiptDocument1 pageReceiptPtesgNo ratings yet

- Refund of Taxes: in GeneralDocument3 pagesRefund of Taxes: in GeneralAileen Love ReyesNo ratings yet

- This Study Resource Was: Cebu Cpar Center Inc. Unit 103, MGA Arcade, A.C. Cortes Ave., Mandaue CityDocument3 pagesThis Study Resource Was: Cebu Cpar Center Inc. Unit 103, MGA Arcade, A.C. Cortes Ave., Mandaue CityNhel AlvaroNo ratings yet

- Thomas Frank's Budget Modeler Template!Document9 pagesThomas Frank's Budget Modeler Template!Norman LefortNo ratings yet

- Debit Note - Cum - Tax Invoice: Sub: Payment of Service TaxDocument1 pageDebit Note - Cum - Tax Invoice: Sub: Payment of Service Taxbha_goNo ratings yet

- MIDTERM Long Quiz - Theories Answer KeyDocument2 pagesMIDTERM Long Quiz - Theories Answer KeyKristine NunagNo ratings yet

- Interview QuestionsDocument12 pagesInterview QuestionsnadeemNo ratings yet

- RMC No 62-16 Tax Treatment of Passed-On GRT PDFDocument3 pagesRMC No 62-16 Tax Treatment of Passed-On GRT PDFGil PinoNo ratings yet

- Chapter 12 QuizDocument5 pagesChapter 12 Quizsaidutt sharma100% (1)

- Perquisites in Indian Tax SystemDocument2 pagesPerquisites in Indian Tax SystemSanni PatelNo ratings yet

- FABM 2 Module 7 Principles of TaxationDocument6 pagesFABM 2 Module 7 Principles of TaxationJOHN PAUL LAGAO50% (2)

- Pad370 Tutorial (Chapter 7 & 8)Document8 pagesPad370 Tutorial (Chapter 7 & 8)justin_styles_7No ratings yet

- Taxation: Definition and Explanation Miss Rabia Asad Iqra University IslamabadDocument18 pagesTaxation: Definition and Explanation Miss Rabia Asad Iqra University IslamabadSaif Ur RehmanNo ratings yet

- TAX 1 Cases (2021)Document488 pagesTAX 1 Cases (2021)SGNo ratings yet

- Washington City Created An Information Technology Department in 2013 To PDFDocument1 pageWashington City Created An Information Technology Department in 2013 To PDFMuhammad ShahidNo ratings yet

- 12 - January 2024 PayslipDocument1 page12 - January 2024 PayslipaigbevascoNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BMCS SBINo ratings yet

- Tuition Statement: This Is Important Tax Information and Is Being Furnished To The Internal Revenue ServiceDocument4 pagesTuition Statement: This Is Important Tax Information and Is Being Furnished To The Internal Revenue ServiceGeozzzyNo ratings yet

- Cir Vs Tours SpecialistDocument1 pageCir Vs Tours SpecialistKim Lorenzo CalatravaNo ratings yet

- Birla Institute of Technology & Science (Bits), PilaniDocument1 pageBirla Institute of Technology & Science (Bits), PilaniSUDIP GORAINo ratings yet

- CIR Vs Toshiba Information EquipmentDocument2 pagesCIR Vs Toshiba Information EquipmentShaneBeriñaImperialNo ratings yet

- Kausar Project PDFDocument93 pagesKausar Project PDFSAMEER NAWABNo ratings yet