Professional Documents

Culture Documents

Fees and Charges Table - 11082022 PDF

Fees and Charges Table - 11082022 PDF

Uploaded by

Jow0 ratings0% found this document useful (0 votes)

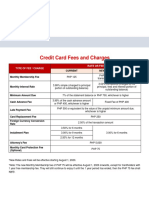

17 views1 pageThis document outlines the various fees and charges for Security Bank credit cards as of November 8, 2022. Fees include annual membership fees ranging from PHP2,000 to PHP5,000 depending on the card type. Other fees include interest of 2% per month on unpaid balances, late payment fees of PHP1,000 or 5% of the unpaid minimum amount due, cash advance fees of PHP200 or USD4 per transaction, and foreign exchange fees of 1-1.5% of converted transaction amounts. Security Bank reserves the right to change fees and charges over time with prior notice.

Original Description:

Original Title

FEES-AND-CHARGES-TABLE_11082022.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the various fees and charges for Security Bank credit cards as of November 8, 2022. Fees include annual membership fees ranging from PHP2,000 to PHP5,000 depending on the card type. Other fees include interest of 2% per month on unpaid balances, late payment fees of PHP1,000 or 5% of the unpaid minimum amount due, cash advance fees of PHP200 or USD4 per transaction, and foreign exchange fees of 1-1.5% of converted transaction amounts. Security Bank reserves the right to change fees and charges over time with prior notice.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

17 views1 pageFees and Charges Table - 11082022 PDF

Fees and Charges Table - 11082022 PDF

Uploaded by

JowThis document outlines the various fees and charges for Security Bank credit cards as of November 8, 2022. Fees include annual membership fees ranging from PHP2,000 to PHP5,000 depending on the card type. Other fees include interest of 2% per month on unpaid balances, late payment fees of PHP1,000 or 5% of the unpaid minimum amount due, cash advance fees of PHP200 or USD4 per transaction, and foreign exchange fees of 1-1.5% of converted transaction amounts. Security Bank reserves the right to change fees and charges over time with prior notice.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Below is the table of fees and charges as of November 8, 2022.

For the latest Security Bank Credit Card Fees and Charges, please visit https://www.securitybank.com/personal/credit-cards/.

CORPORATE CLASSIC COMPLETE GOLD NEXT* PLATINUM WORLD

CASHBACK

Annual Membership Fee Primary PHP2,000 PHP2,000 PHP3,000 PHP2,500 No annual fee PHP4,000 PHP5,000

Annual Membership Fee N/A PHP1,000 PHP1,500 PHP1,500 No annual fee PHP2,500 First supplementary card: waived for life.

Supplementary Succeeding supplementary cards: PHP2,500

Interest 2% per month

Late Payment fee PHP1,000 (USD20) or unpaid minimum amount due5, whichever is lower

Cash Advance fee PHP200 or USD4 per transaction1

Over-the-Counter Processing Fee PHP500 per transaction

ChargeLight Plan Pre-Termination 5% of unbilled portion of the principal amount

Fee

Charge Slip Retrieval Fee PHP400 per sales slip

Lost Card Fee/Card Replacement PHP400 per card

Fee

Card Certification Fee PHP200 for full statement of account Free for the first request

PHP300 for good credit standing PHP150 for succeeding request

Returned Check Fee PHP1,250 for peso per returned check or USD25 for dollar per returned check

Statement of Account Retrieval Fee PHP50 per page if requested billing statement is more than 3 months old

Foreign Exchange Transactions All charges, advances, or amounts in currencies other than Philippine Peso (PHP) shall be converted to PHP. For dual currency, all charges, advances, or amounts in currencies other than

Philippine Peso (PHP) shall be billed in US Dollar (USD). All transactions will be converted using Mastercard’s currency conversion rate at the time of posting. All converted transactions shall be

charged with 1% Mastercard assessment fee and 1.5% service fee, of the rates of which may be adjusted from time to time. The service fee shall likewise apply to transactions involving foreign

currencies converted to PHP at point of sale, whether executed in the Philippines, abroad, or online. Service fees may also be charged to cover costs incurred to discharge the amount(s) due

to Mastercard and/or acquiring bank and/or foreign merchant affiliates.

Minimum Amount Due 3% of total amount due or PHP500 (USD10), whichever is higher

Overlimit Fee3 PHP 500 per occurrence

ADA Fee PHP250 for peso account, if ADA account has insufficient funds.

USD5 for dollar account, if ADA account has insufficient funds.

Account Maintenance Fee PHP250 or amount equivalent to the credit balance whichever is lower will be charged to the accounts with credit balance that are closed or with no activity for the past 12 months.

USD5 or amount equivalent to the credit balance whichever is lower will be charged to the accounts with credit balance that are closed or with no activity for the past 12 months.

Payment Transfer Fee PHP100 if transferring from a peso account

USD2.5 if transferring from a dollar account

Refund Fee PHP500 will be charged for every refund request made to a cardholder’s overpayment amounting to PHP1,000 and above

PHP200 will be charged for every refund request made to a cardholder’s overpayment for amount below PHP1,000

Quasi-cash Fee2 2.5% of transacted amount

Change in credit card statement PHP2,000

cut-off Fee4

Reinstatement Fee6 PHP200

Overseas Card Delivery Fee Amount of fees will vary depending on the market prices of the courier and the destination

1

Cash Advance made overseas shall be subject to the fees of the servicing foreign franchise or bank.

2

Quasi-cash fee will be applied on gaming/gambling transactions and/or transactions made at gaming/gambling establishments, including the placement of wagers, purchase of lottery tickets, gaming chips, as well as any other values in

conjunction with any gaming or gambling activity.

3

Overlimit fee shall be charged for card usage beyond the approved credit limit. Please refer to Credit Cards Terms and Conditions for the full description.

4

Change in credit card statement cut-off fee shall be charged for every request to change your Security Bank Credit Card’s Statement Cut-off.

5

Unpaid minimum amount due refers to the total minimum amount due charged against the client for the latest billing cycle. Partial payment of the minimum amount due as appearing on the SOA will not reduce the “minimum amount due”

to be imposed against the client as late payment fee.

6

A reinstatement fee will be charged to past due accounts and cancelled cards that have been reinstated. Please refer to Credit Cards Terms and Conditions for the full description.

For bills not paid in full, the corresponding interest per card type will be applied to the Total Amount Due in your Statement of Account based on your average daily balance. A corresponding Late Payment Fee per card type will be charged to

your card account if payment is not received on or before the Payment Due Date. Security Bank reserves the right to change said fees and charges from time to time with prior notice.

*Next Mastercard feature is auto-installment. Please refer to Supplemental Terms and Conditions for Next Mastercard for the full description.

This product is not a deposit. This financial product of Security Bank Corporation is not insured by the Philippine Deposit Insurance Corporation (PDIC).

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Dental Starting A Practice WorkbookDocument41 pagesDental Starting A Practice WorkbookD.WorkuNo ratings yet

- AccountingDocument7 pagesAccountingalestingyoNo ratings yet

- AFAR8720 - Government Accounting Manual PDFDocument8 pagesAFAR8720 - Government Accounting Manual PDFSid Tuazon100% (2)

- Fees and Charges PLATINUMDocument1 pageFees and Charges PLATINUMLouise Nichole LogartaNo ratings yet

- Fees and Charges PNB Credit CardsDocument3 pagesFees and Charges PNB Credit CardsbluevaltielNo ratings yet

- Esoa - Azenith M. AustriaDocument6 pagesEsoa - Azenith M. AustriaJourneia AustriaNo ratings yet

- Fees and Charges PNB Credit CardsDocument3 pagesFees and Charges PNB Credit CardsBoss Chris MotovlogNo ratings yet

- Fees Charges Updated 062717Document1 pageFees Charges Updated 062717iammissdNo ratings yet

- Table of Fees and Rates - MB Vantage Card PDFDocument2 pagesTable of Fees and Rates - MB Vantage Card PDFAllanRayEnriquezNo ratings yet

- Business Finance Comparison of Banks in The PhilippinesDocument6 pagesBusiness Finance Comparison of Banks in The PhilippinesPrivate TitaniumNo ratings yet

- CC Products Disclosure SheetDocument13 pagesCC Products Disclosure SheetLoVe YiYiNo ratings yet

- Credit Card Fees and Charges: Type of Fee / Charge Rate or FeeDocument1 pageCredit Card Fees and Charges: Type of Fee / Charge Rate or FeeKram Yer EtentepmocNo ratings yet

- Credit Card Fees and ChargesDocument2 pagesCredit Card Fees and ChargesgwapongkabayoNo ratings yet

- Easy Guide To HSBC Credit Card Fees and ChargesDocument2 pagesEasy Guide To HSBC Credit Card Fees and ChargesboboinksNo ratings yet

- Safari - 17 Aug 2018 at 4:35 PMDocument1 pageSafari - 17 Aug 2018 at 4:35 PMJaybeeBlasBayaniNo ratings yet

- AUB Credit CardDocument18 pagesAUB Credit CardLovely Jennifer Torremonia IINo ratings yet

- En Fair Fees ScheduleDocument3 pagesEn Fair Fees ScheduleHassan AliNo ratings yet

- Money Account Fee Schedule: All Fees Amount DetailsDocument2 pagesMoney Account Fee Schedule: All Fees Amount DetailsCarmen PeñaNo ratings yet

- Private-Banking-Signature-July-Dec-23 JS BankDocument4 pagesPrivate-Banking-Signature-July-Dec-23 JS BankMuhammad Aasim HassanNo ratings yet

- Netspend All-Access AccountDocument35 pagesNetspend All-Access Accountchristopherhowell269100% (1)

- Advance Easy GuideDocument9 pagesAdvance Easy GuideCode JonNo ratings yet

- Corporate Fees and ChargesDocument1 pageCorporate Fees and Chargesabdukiya24No ratings yet

- Schedule of ChargeDocument4 pagesSchedule of Chargebana44244No ratings yet

- 730462222Document20 pages730462222Tank ZillaNo ratings yet

- Consolidated Fillable May 2018Document2 pagesConsolidated Fillable May 2018Alfie FerrariNo ratings yet

- LANDBANK Fees and Charges For Peso, US Dollar and Third Currency Transactions and Deposit Account Information A4-Poster - August 2022Document9 pagesLANDBANK Fees and Charges For Peso, US Dollar and Third Currency Transactions and Deposit Account Information A4-Poster - August 2022Rod LaquintaNo ratings yet

- Netspend All-Access Account: Monthly UsageDocument2 pagesNetspend All-Access Account: Monthly UsageSam BojanglesNo ratings yet

- List of All Fees Associated With Your Paypal Prepaid MastercardDocument1 pageList of All Fees Associated With Your Paypal Prepaid Mastercardmira bucketNo ratings yet

- Fee ScheduleDocument3 pagesFee ScheduleJamesNo ratings yet

- Sproutfi Fee ScheduleDocument4 pagesSproutfi Fee Schedulediego MendesNo ratings yet

- SFLF 730449321 enDocument1 pageSFLF 730449321 enkatyaNo ratings yet

- PSBANKDocument27 pagesPSBANKbackupkuuu10No ratings yet

- Ready Line SOC Jan June 2024Document1 pageReady Line SOC Jan June 2024umarNo ratings yet

- 1 Fees DL English Brand v18 030520 - tcm41 231844Document11 pages1 Fees DL English Brand v18 030520 - tcm41 231844Veera ManiNo ratings yet

- Choose Your Payment Channels:: When Making Credit Card Payments, Please Be Reminded of The FollowingDocument1 pageChoose Your Payment Channels:: When Making Credit Card Payments, Please Be Reminded of The FollowingElibom DnegelNo ratings yet

- Jan 2024 Platinum CC SOCDocument2 pagesJan 2024 Platinum CC SOCAamir JavaidNo ratings yet

- The IslamDocument2 pagesThe Islammuhmmad basharatNo ratings yet

- Metabank Terms and ConditionsDocument17 pagesMetabank Terms and ConditionsMoses MillerNo ratings yet

- Key Fact DocumentDocument2 pagesKey Fact DocumentJagiNo ratings yet

- SOF DL Eng Brand V13 Tcm9 153873Document11 pagesSOF DL Eng Brand V13 Tcm9 153873AlejandroNo ratings yet

- ServePayGo Summary of FeesDocument4 pagesServePayGo Summary of Feeshersheyschwartz1No ratings yet

- Schedule of Fees Personal Banking English - tcm41 375297Document11 pagesSchedule of Fees Personal Banking English - tcm41 375297nagendraNo ratings yet

- BOP Asaan Current AccountDocument2 pagesBOP Asaan Current AccountAhmad CssNo ratings yet

- ICICI Bank Service ChargesDocument7 pagesICICI Bank Service ChargesRanjith MeelaNo ratings yet

- HBL GoldGreen CC SOC Flyer July 23Document2 pagesHBL GoldGreen CC SOC Flyer July 23Usman KhanNo ratings yet

- Understanding Bank of America Interest Checking: An Overview of Key Policies and FeesDocument2 pagesUnderstanding Bank of America Interest Checking: An Overview of Key Policies and FeesGheorghiu GheorgheNo ratings yet

- 5BDF Orientation DeckDocument25 pages5BDF Orientation DeckEralyn OloresNo ratings yet

- Screenshot 2023-11-26 at 12.01.23 AMDocument73 pagesScreenshot 2023-11-26 at 12.01.23 AMqt5tggw8k8No ratings yet

- Pca 14 6Document2 pagesPca 14 6Arora MathewNo ratings yet

- FandC FLYER COREDocument1 pageFandC FLYER COREtech.filnipponNo ratings yet

- Tariff 2022Document1 pageTariff 2022thanesh narendranNo ratings yet

- Account Maintenance and Transaction Fees L BPIDocument4 pagesAccount Maintenance and Transaction Fees L BPISebastian GarciaNo ratings yet

- BlueSnap Fees TableDocument2 pagesBlueSnap Fees Tableemirav2No ratings yet

- AMXACQ2565 Airpoints Platinum Card FeeSheetsDocument1 pageAMXACQ2565 Airpoints Platinum Card FeeSheetsarun_jacobNo ratings yet

- Important Reminders:: Amount May Vary If Purchased Through A PAL Ticket Office or Via PAL Contact CenterDocument1 pageImportant Reminders:: Amount May Vary If Purchased Through A PAL Ticket Office or Via PAL Contact CenterRheneir MoraNo ratings yet

- SFLF 730372319 en PDFDocument1 pageSFLF 730372319 en PDFHenri BlankNo ratings yet

- SOF DL en Brand V15 - tcm41 180545 PDFDocument11 pagesSOF DL en Brand V15 - tcm41 180545 PDFAnkur GargNo ratings yet

- PdfHandler AshxDocument18 pagesPdfHandler AshxphaniNo ratings yet

- Estate: NIRC of 1997 TRAIN Law of 2017Document1 pageEstate: NIRC of 1997 TRAIN Law of 2017Anonymous DJzDBdkRNo ratings yet

- HBL GoldGreen CC SOC Flyer July22Document2 pagesHBL GoldGreen CC SOC Flyer July22iqra maqsoodNo ratings yet

- Contract Management in Construction IndustryDocument3 pagesContract Management in Construction IndustryShubham KesarwaniNo ratings yet

- Business & Corporate Law: PartnershipDocument26 pagesBusiness & Corporate Law: Partnershipinaya khanNo ratings yet

- Chapter Three 2024Document18 pagesChapter Three 2024Romario KhaledNo ratings yet

- AP-09 - "Formato Brief - Campaña Publicitaria en Inglés"Document6 pagesAP-09 - "Formato Brief - Campaña Publicitaria en Inglés"Edisleny Ortiz0% (2)

- UNIQUE SELLING PROPOSITION of Bajaj FinanceDocument7 pagesUNIQUE SELLING PROPOSITION of Bajaj FinanceSANKALP C BCOM LLB HNo ratings yet

- EOQDocument15 pagesEOQPrajaktaNo ratings yet

- PPR MA Economics 1Document41 pagesPPR MA Economics 1raunakyadav009No ratings yet

- Donor S Tax QuizDocument5 pagesDonor S Tax QuizDerick John Palapag100% (1)

- HulDocument349 pagesHulProsenjit RoyNo ratings yet

- Product RED Case Analysis Assignment 1Document8 pagesProduct RED Case Analysis Assignment 1Amit PathakNo ratings yet

- CCIT Module 2 - TAXES, TAX LAWS and TAX ADMINISTRATIONDocument15 pagesCCIT Module 2 - TAXES, TAX LAWS and TAX ADMINISTRATIONAngelo OñedoNo ratings yet

- Chap 5 6 Tutorial ClassDocument7 pagesChap 5 6 Tutorial ClassHonesty GunturNo ratings yet

- Case Study On Consumer Protection ActDocument2 pagesCase Study On Consumer Protection ActNeha Chugh100% (4)

- Accenture 2013 Global Manufacturing Study Full ReportDocument44 pagesAccenture 2013 Global Manufacturing Study Full ReportFerry TriwahyudiNo ratings yet

- More... Social Medias: Home About Us Domestic Banking International Banking E Payment Interest Free Banking FeedbackDocument3 pagesMore... Social Medias: Home About Us Domestic Banking International Banking E Payment Interest Free Banking Feedbacketebark h/michaleNo ratings yet

- Chapter 8Document6 pagesChapter 8Mark Dave SambranoNo ratings yet

- Transportation in Turkey: Country ReportDocument38 pagesTransportation in Turkey: Country ReportDamjan SpasovskiNo ratings yet

- Heizer 12 Invty MGT 7eDocument41 pagesHeizer 12 Invty MGT 7eAndyy Drea LouiseNo ratings yet

- Liza ItineraryDocument23 pagesLiza Itineraryjose randyNo ratings yet

- Transaction Dispute FormDocument1 pageTransaction Dispute FormashokjpNo ratings yet

- Trainning ReportDocument31 pagesTrainning ReportKrishna Murthy ANo ratings yet

- Why ISO 9001Document19 pagesWhy ISO 9001Arun K SharmaNo ratings yet

- IITA Bulletin No. 2192Document3 pagesIITA Bulletin No. 2192International Institute of Tropical AgricultureNo ratings yet

- Pei 135 - Pei300Document13 pagesPei 135 - Pei300Anonymous Rwa38rT8GVNo ratings yet

- Amtb Eft Format SpaDocument7 pagesAmtb Eft Format SpaDavid GómezNo ratings yet

- Consumer RightsDocument2 pagesConsumer RightsVimal RupaniNo ratings yet

- Yyyyyyyyy xxx4046 20221208164508Document38 pagesYyyyyyyyy xxx4046 20221208164508Jeji HirboraNo ratings yet

- National Ecotourism Plan 2016-2025 Executive Summary 24.2.2017Document98 pagesNational Ecotourism Plan 2016-2025 Executive Summary 24.2.2017shahrul rosdiNo ratings yet