Professional Documents

Culture Documents

Mid Semester Exam Accounting Dip in Marketing March 2023

Mid Semester Exam Accounting Dip in Marketing March 2023

Uploaded by

Tawanda Leonard CharumbiraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mid Semester Exam Accounting Dip in Marketing March 2023

Mid Semester Exam Accounting Dip in Marketing March 2023

Uploaded by

Tawanda Leonard CharumbiraCopyright:

Available Formats

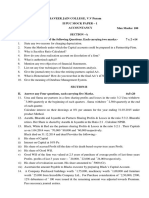

GABORONE UNIVERSITY COLLEGE OF LAW AND PROFESSIONAL STUDIES

DIPLOMA IN MARKETING

LEVEL 1 SEMESTER 1

MID-SEMESTER EXAMINATION

MARCH /APRIL 2023

(FINANCIAL ACCOUNTING)

TIME: 3 HOURS

TOTAL MARKS:100

INSTRUCTIONS TO THE CANDIDATES

Answer any FOUR Questions

Clearly number each question appropriately

Take note of marks allocated to each subsection of a question

All queries should be directed to the invigilator

You can answer questions in any order

Candidates caught cheating will be disqualified.

Q1

1.1. Distinguish between accounting and book-keeping (4)

1.2. State five reasons why a business should keep proper accounting records (5)

1.3. Identify four users of accounting information and give two reason each while they need the

information. (12)

1.4. State four problems a business would experience if it fails to keep proper accounting records

(4)

Q2.Explain

i. “ Double Entry System”. (5)

ii. An account (4)

iii. Ledger (4)

iv. “Debit” (2)

v. “Credit” (4)

vi. State the accounting equation (2)

vii. Use the information below to calculate the assets, liabilities and capital of F Fox

Traders

Land P 280 000, premises P400 000, inventory P30 000, creditors P20 000, loan P300

000 (4)

Q3

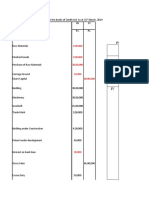

3.1 From the information below, draw up the statement of financial position (balance

sheet) of Bongoman Traders as at 31 March 2022.

P

Premises 300 000

Plant and machinery 120 000

Fixtures and fittings 19 000

Inventory 12 000

Trade receivables (debtors) 13 000

Bank overdraft 80 000

Trade payables (debtors) 30 000

Loan 100 000

Capital ?

15

marks

Show the effects of the transactions on the respective accounts in the table below.

Transaction Assets Capital Liability

1. Owner put P 300 000 in

the bank account of the

business

2. Bought furniture P12 000

by cheque

3. Took P200 inventory for

business use

4. Bought stationery P3000

from XYZ Stationery

Supplies 0n credit

5. Sold inventory P500 to

Lame on credit

2x5=10 marks

Q4

4.1 Enter the following transactions in the appropriate ledger accounts

2022

September 01 Bought motor van P 230 000 by cheque

05 Sold goods P3400 to Mpho on credit

16 Bought inventory P 8000 from B Bat on credit

19 Owner took P300 inventory for own use

22 Paid P2000 cash into the bank account

23 Paid rent P600 by cheque

24 Sold office furniture P2000 to Ben on credit

28 Mpho paid her account after deducting 3% cash discount by cheque

29 Owner took P350 inventory (stock) for personal use

= 19 marks

4.2. Explain

i. Statement of financial position (3)

ii. “Purchases” (3)

Total 100 Marks

You might also like

- MIDTERM LESSON 1 Accounting EquationDocument2 pagesMIDTERM LESSON 1 Accounting EquationJomar Villena100% (3)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Accounts Form 2 - 2021Document40 pagesAccounts Form 2 - 2021Tafaranashe100% (15)

- Session 1 Practice 3Document4 pagesSession 1 Practice 3yimin liuNo ratings yet

- BA (1st) May2020Document3 pagesBA (1st) May2020Manjot KaurNo ratings yet

- Finl Exm Et 2, 2024Document6 pagesFinl Exm Et 2, 2024Vishavpreet SinghNo ratings yet

- Zenith LTD 4 8 2022Document12 pagesZenith LTD 4 8 2022XyzNo ratings yet

- Fundamentals of Accounting 2020Document4 pagesFundamentals of Accounting 2020sreehari dineshNo ratings yet

- Humanities I and II Year MQPDocument108 pagesHumanities I and II Year MQPKishore VNo ratings yet

- Finals 2019Document4 pagesFinals 2019GargiNo ratings yet

- 11 QP Final (2021-22)Document4 pages11 QP Final (2021-22)Flick OPNo ratings yet

- Ugmbcc04 - Business AccountingDocument4 pagesUgmbcc04 - Business AccountingShreya MitraNo ratings yet

- Tutorial 4 Posting To Ledger - Trial Balance (Q)Document2 pagesTutorial 4 Posting To Ledger - Trial Balance (Q)lious liiNo ratings yet

- BMOOlO AccountingDocument5 pagesBMOOlO AccountingSunera MuthukumaranaNo ratings yet

- Accountancy & Auditing Paper - 1-2015Document3 pagesAccountancy & Auditing Paper - 1-2015Qasim IbrarNo ratings yet

- 2019491243256731WHTRateCardupdated09 03 19FinSupSecAmendAct2019Document5 pages2019491243256731WHTRateCardupdated09 03 19FinSupSecAmendAct2019Shoaib AhmedNo ratings yet

- BA7106-Accounting For Management Question Bank - Edited PDFDocument10 pagesBA7106-Accounting For Management Question Bank - Edited PDFDhivyabharathiNo ratings yet

- Acc 111Document10 pagesAcc 111adrian CharlesNo ratings yet

- Karnataka II PUC Accountancy Model Question Paper 17Document6 pagesKarnataka II PUC Accountancy Model Question Paper 17Kishu KishoreNo ratings yet

- Ministry of Education, Heritage and Arts: Strand One Nature of AccountingDocument3 pagesMinistry of Education, Heritage and Arts: Strand One Nature of AccountingShyam murtiNo ratings yet

- A211 CC 1 StudentDocument6 pagesA211 CC 1 StudentWon HaNo ratings yet

- AOR - Paper III Book Keeping Accounts and Professional Ethics ALLDocument27 pagesAOR - Paper III Book Keeping Accounts and Professional Ethics ALLDawood KSNo ratings yet

- Finl Exm Et 1, 2024Document7 pagesFinl Exm Et 1, 2024Vishavpreet SinghNo ratings yet

- SYJC - 16: Book - Keeping & AccountancyDocument8 pagesSYJC - 16: Book - Keeping & Accountancyharesh60% (5)

- Introduction of AccountingDocument4 pagesIntroduction of AccountingBaekhyunee PubbyNo ratings yet

- 201.AFA IP.L II December 2020Document4 pages201.AFA IP.L II December 2020leyaketjnuNo ratings yet

- Accountancy - 2020 - Set - 8Document34 pagesAccountancy - 2020 - Set - 8Saurav PandeyNo ratings yet

- Instant Paper Commerce Paper - IiDocument3 pagesInstant Paper Commerce Paper - IiM JEEVARATHNAM NAIDUNo ratings yet

- Management Accouting Assignment4 Manish Chauhan (09-1128) .Document17 pagesManagement Accouting Assignment4 Manish Chauhan (09-1128) .manishNo ratings yet

- 18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Document3 pages18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Jr.No ratings yet

- Ia3 Midterm QuizDocument11 pagesIa3 Midterm QuizJalyn Jalando-onNo ratings yet

- Accountancy Set BDocument4 pagesAccountancy Set BPatanjal kumarNo ratings yet

- Quiz 1 INTACCDocument13 pagesQuiz 1 INTACCGellie BuenaventuraNo ratings yet

- Financial Accounting and Cost Management and Management Control Paper MBADocument8 pagesFinancial Accounting and Cost Management and Management Control Paper MBAPriyank SaxenaNo ratings yet

- COMPREHENSIVE CASE 1 QuestionDocument4 pagesCOMPREHENSIVE CASE 1 QuestionlurdeparduNo ratings yet

- Quiz SFPDocument2 pagesQuiz SFPMikaella SaduralNo ratings yet

- Second Term Exam-2070 Particulars Debit (RS.) Credit (RS.)Document8 pagesSecond Term Exam-2070 Particulars Debit (RS.) Credit (RS.)ragedskullNo ratings yet

- AssessmentDocument20 pagesAssessmentJenecil JavierNo ratings yet

- Class XI Practice PaperDocument4 pagesClass XI Practice PaperAyush MathiyanNo ratings yet

- Paper 2Document2 pagesPaper 2Raja Mohan RaviNo ratings yet

- ADBM - Financial AccountingDocument10 pagesADBM - Financial AccountingMahima SheromiNo ratings yet

- Institute of Aeronautical Engineering: (Autonomous) Financial Accounting and Analysis (Master of Business Administration)Document5 pagesInstitute of Aeronautical Engineering: (Autonomous) Financial Accounting and Analysis (Master of Business Administration)Mr V. Phaninder ReddyNo ratings yet

- Accountancy: Class: XiDocument8 pagesAccountancy: Class: XiSanskarNo ratings yet

- Lecture No 2Document4 pagesLecture No 2Avia Chelsy DeangNo ratings yet

- APER-1: Fundamental of Accountancy Page No: 9-100: June 2001, FOA/FoundationDocument92 pagesAPER-1: Fundamental of Accountancy Page No: 9-100: June 2001, FOA/FoundationtheabhishekdahalNo ratings yet

- TUTORIAL AccDocument12 pagesTUTORIAL Accizzat ikramNo ratings yet

- Fabm2 Learning-Activity-1Document7 pagesFabm2 Learning-Activity-1Cha Eun WooNo ratings yet

- Sem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201Document5 pagesSem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201ruPAM DeyNo ratings yet

- Lecture No. 2 - Financial Statements & Illustrative ProblemDocument6 pagesLecture No. 2 - Financial Statements & Illustrative ProblemJA LAYUG100% (1)

- Time Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationDocument4 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationKashifNo ratings yet

- 94 Final PB FAR PDFDocument16 pages94 Final PB FAR PDFfanchasticommsNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceDocument4 pagesLoyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceHarish KapoorNo ratings yet

- Far - First Preboard QuestionnaireDocument14 pagesFar - First Preboard QuestionnairewithyouidkNo ratings yet

- Trimester - 1 EMBA Examinations - October 2020Document2 pagesTrimester - 1 EMBA Examinations - October 2020amitabh kumarNo ratings yet

- Fa5 Nov20Document8 pagesFa5 Nov20Ridzuan SharifNo ratings yet

- W4 - SW1 - Statement of Financial PositionDocument2 pagesW4 - SW1 - Statement of Financial PositionJere Mae MarananNo ratings yet

- AFAR 1.3 - Corporate LiquidationDocument5 pagesAFAR 1.3 - Corporate LiquidationKile Rien MonsadaNo ratings yet

- Mock Paper - 2017-18 Class-Xi: General InstructionsDocument6 pagesMock Paper - 2017-18 Class-Xi: General InstructionsMukul YadavNo ratings yet

- Monthly Test October 2019: AccountingDocument7 pagesMonthly Test October 2019: AccountingMohamed MubarakNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Mid-Semester Micro-EconomicsDocument2 pagesMid-Semester Micro-EconomicsTawanda Leonard CharumbiraNo ratings yet

- Communication SkillsDocument3 pagesCommunication SkillsTawanda Leonard CharumbiraNo ratings yet

- Intro To Quantitative MethodsDocument4 pagesIntro To Quantitative MethodsTawanda Leonard CharumbiraNo ratings yet

- Intro To Business MGTDocument2 pagesIntro To Business MGTTawanda Leonard CharumbiraNo ratings yet

- Busisness MathematicsDocument11 pagesBusisness MathematicsTawanda Leonard CharumbiraNo ratings yet

- Business StatisticsDocument9 pagesBusiness StatisticsTawanda Leonard CharumbiraNo ratings yet

- MACROECONOMICSDocument9 pagesMACROECONOMICSTawanda Leonard CharumbiraNo ratings yet

- Record To Report - General Ledger Accounting - 240401 - 004120Document11 pagesRecord To Report - General Ledger Accounting - 240401 - 004120Bharat ChekuriNo ratings yet

- 6881 - Accounting ProcessDocument4 pages6881 - Accounting ProcessMaximusNo ratings yet

- Accounting Notes Module - 1Document16 pagesAccounting Notes Module - 1Bheemeswar ReddyNo ratings yet

- Financial Statemnet Part - ADocument5 pagesFinancial Statemnet Part - AZeba LubabaNo ratings yet

- Botswana General Certificate OF Secondary Education: Teaching SyllabusDocument26 pagesBotswana General Certificate OF Secondary Education: Teaching SyllabusMpaphiNo ratings yet

- Internal Verification of Assessment Decisions - BTEC (RQF) : Higher NationalsDocument37 pagesInternal Verification of Assessment Decisions - BTEC (RQF) : Higher NationalsDINU100% (1)

- Worksheet 1 q2 Acctg. 2Document11 pagesWorksheet 1 q2 Acctg. 2Allan TaripeNo ratings yet

- Intermediate Accounting NotesDocument8 pagesIntermediate Accounting NotesAngela Mae Balanon RafananNo ratings yet

- Senior High School Department: Quarter 3 - Module 5: The Books of AccountsDocument10 pagesSenior High School Department: Quarter 3 - Module 5: The Books of AccountsJaye Ruanto100% (2)

- Individual Learning Monitoring PlanDocument3 pagesIndividual Learning Monitoring PlanLea BantingNo ratings yet

- Fundamentals of Accountancy, Bus Iness and ManagementDocument10 pagesFundamentals of Accountancy, Bus Iness and ManagementzahjNo ratings yet

- PRC4 Vol II MCQs by Sir JahanzaibDocument232 pagesPRC4 Vol II MCQs by Sir JahanzaibAayesha Noor100% (1)

- Double Entry SystemDocument4 pagesDouble Entry Systemsunny sideNo ratings yet

- Comcomputerised Acct Invited LectureDocument7 pagesComcomputerised Acct Invited LectureBenstarkNo ratings yet

- NSSCAS Accounting Syllabus Final Nov 2020Document48 pagesNSSCAS Accounting Syllabus Final Nov 2020jemimanzinu6No ratings yet

- Cape Accounting Unit 1 (Notes 1)Document21 pagesCape Accounting Unit 1 (Notes 1)DWAYNE HARVEYNo ratings yet

- Business Entity ConceptDocument3 pagesBusiness Entity ConceptM. Waasih IqbalNo ratings yet

- Chapter 3 2021Document79 pagesChapter 3 2021Nguyen Cong Tuan AnhNo ratings yet

- Principles of Accounting (DAC1013) : Chapter 3: Business Transaction Recording Process (3 Week)Document21 pagesPrinciples of Accounting (DAC1013) : Chapter 3: Business Transaction Recording Process (3 Week)Nur Ayyen NorminNo ratings yet

- Conecepts and Convention Journal NotesDocument25 pagesConecepts and Convention Journal NotesSWAPNIL BHISE100% (1)

- Fundamentals of Accountancy, Business and Management 1: Quarter 1 - Module 3: Week 3 The Accounting EquationDocument18 pagesFundamentals of Accountancy, Business and Management 1: Quarter 1 - Module 3: Week 3 The Accounting EquationMark Anthony Garcia50% (2)

- 0452 Scheme of Work (For Examination From 2020)Document32 pages0452 Scheme of Work (For Examination From 2020)disha puthranNo ratings yet

- Acc 121 Lecture NoteDocument91 pagesAcc 121 Lecture Noteulomaemeka730No ratings yet

- Accounting - ReviewerDocument89 pagesAccounting - ReviewerRose GonzalesNo ratings yet

- Acctg. Ed 1 - Unit2 Module 5 Books of Accounts and Double-Entry SystemDocument15 pagesAcctg. Ed 1 - Unit2 Module 5 Books of Accounts and Double-Entry SystemAngel Justine BernardoNo ratings yet

- History of AccountingDocument16 pagesHistory of AccountingSai AlviorNo ratings yet

- Accounting - Certificate Level NotesDocument70 pagesAccounting - Certificate Level Notesdiya pNo ratings yet

- CS Executive Corporate and Management AccountingDocument17 pagesCS Executive Corporate and Management AccountingSuraj Srivatsav.SNo ratings yet

- Double-Entry BookkeepingDocument2 pagesDouble-Entry BookkeepingFarmanNo ratings yet