Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

2K viewsUse of Funds Reimbursed by CRF Email Chain

Use of Funds Reimbursed by CRF Email Chain

Uploaded by

WCHS DigitalUse of funds reimbursed by CRF email chain.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

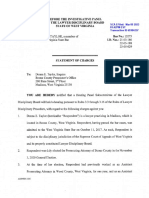

- Lawyer Disciplinary Board Statement of ChargesDocument43 pagesLawyer Disciplinary Board Statement of ChargesWCHS Digital100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Coronavirus Relief Funds Final ReportDocument9 pagesCoronavirus Relief Funds Final ReportWCHS DigitalNo ratings yet

- PSC Fayette County Transmission CaseDocument6 pagesPSC Fayette County Transmission CaseWCHS DigitalNo ratings yet

- Jeff Waybright Email ChainDocument7 pagesJeff Waybright Email ChainWCHS DigitalNo ratings yet

- Governor To Auditor Transfer LetterDocument2 pagesGovernor To Auditor Transfer LetterWCHS DigitalNo ratings yet

- Letter From Senator Tarr To Office of Inspector General LetterDocument3 pagesLetter From Senator Tarr To Office of Inspector General LetterWCHS DigitalNo ratings yet

- Stay DeniedDocument7 pagesStay DeniedWCHS DigitalNo ratings yet

- McDonald's LawsuitDocument8 pagesMcDonald's LawsuitWCHS DigitalNo ratings yet

- PSC Denies Appalachian Power and Wheeling Power IncreaseDocument8 pagesPSC Denies Appalachian Power and Wheeling Power IncreaseWCHS DigitalNo ratings yet

- Paint Creek LawsuitDocument30 pagesPaint Creek LawsuitWCHS DigitalNo ratings yet

- Kanawha Prosecutor's Office LetterDocument1 pageKanawha Prosecutor's Office LetterWCHS DigitalNo ratings yet

- Clay County Report v3 1Document20 pagesClay County Report v3 1WCHS DigitalNo ratings yet

- WVU Student Government ResolutionDocument4 pagesWVU Student Government ResolutionWCHS DigitalNo ratings yet

- Federal Judge Ruling in Transgender Sports LawsuitDocument23 pagesFederal Judge Ruling in Transgender Sports LawsuitWCHS DigitalNo ratings yet

- Letter To Interim Secretary Coben Regarding Child WelfareDocument7 pagesLetter To Interim Secretary Coben Regarding Child WelfareWCHS DigitalNo ratings yet

- Big Sandy Oil Spill LawsuitDocument13 pagesBig Sandy Oil Spill LawsuitWCHS DigitalNo ratings yet

Use of Funds Reimbursed by CRF Email Chain

Use of Funds Reimbursed by CRF Email Chain

Uploaded by

WCHS Digital0 ratings0% found this document useful (0 votes)

2K views6 pagesUse of funds reimbursed by CRF email chain.

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentUse of funds reimbursed by CRF email chain.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

2K views6 pagesUse of Funds Reimbursed by CRF Email Chain

Use of Funds Reimbursed by CRF Email Chain

Uploaded by

WCHS DigitalUse of funds reimbursed by CRF email chain.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 6

nen, 1:17 AM ‘Stoo Woe Vigia Mal - Fwd: Use of nds reimbursed by CRF

é

1

i Bramble, Bonny A

Fwd: Use of funds reimbursed by CRF

1 message

Lipford, Mary M

To: Bonny A Bramble

‘Thu, Sep 15, 2022 at 11:13 AM

Mary Lipford

Office of Governor sim Justice

Office: 304-558-2000 |

‘mary.mlipford@wv.gov | Governorwv.gov

Email correspondence to and from this email address is subject tothe West Virginia Freedom of Information Act and may be disclosed, in whole

‘rin pat, to third partes by an authorized State ofc, It may aso be prilaged or otherwise protected by work product immunity or other

legal rules Unauthorited disclosure of health, legally privileged, or otherwise confidential information, I prohibited by law. ifyou have recelved

‘this emailin error, please notify the sender immediately and delete ofthis eral.

—— Forwarded message ——

From: David Sull

Date: Tue, Sep 13, 2022 at 1:02 PM

Subject: RE: Use of funds reimbursed by CRF

‘To: Uring, Ann V , Kent Hartsog

Ce: Vincent Smith , Mary Lipford@wv.gov , Audiing-ist

Al,

| returned the current IET in order for the additional supporting documentation to be added,

David Sut

Director of Audting - WVSAO

Phone 558-2261 Ext. 2103

Davi sull@vvsao.gov

"This E-mail and any of ts atlachments may contain WV State Auditor's Office proprietary information, which Is privileged,

confidential, or subject to copyright belonging to the WV State Auditor's Office. This E-mail is intended solely for the use

of the individual or entity to which itis addressed. If you are not the intended recipient ofthis E-mail, you are hereby

notified that any dissemination, distribution, copying, or action taken in relation to the contents of and attachments to this

E-mail is stricty prohibited and may be unlawful. I you have received this E-mail in error, please notify the sender

immediately and permanently delete the original and any copy of or printout ofthis E-mail.”

pa vimal google. com!malisO/7k=254-235501& eweptsceareh=allepermihid-ihvoad-1%3A17440460967S6645880%70nsg-MKSAI744048096756... 185

911622, 11:17 AML Stato of Wes! Vigna al - Fd: Use of fr roinbursed by CRE

From: Urling, Ann V

Sent: Tuesday, September 13, 2022 12:56 PM

‘To: Kent Hartsog

Ge: David Sull ; Vincent Smith

‘Subject: Re: Use of funds reimbursed by CRF

External Emai

‘email of containing malicious links or attachments immediately report this email with the report phishing button.

Will do

(On Tue, Sep 13, 2022 at 12:54 PM Kent Hartsog wrote:

‘Ann, on the attached trensaction and similar in the future, could you please attach this email, plus @ memo from

‘counsel stating that this transfer is appropriate and not ‘to legislative appropriation. These two along with the

letter from the Governor.

these would have 3 attachments.

As always, appreciate the help and please let me know if you would like to discuss.

From: Urling, Ann V

Sent: Tuesday, September 13, 2022 8:54 AM

‘To: Kent Hartsog

‘Subject: Fwd: Use of funds reimbursed by CRF

‘External Email: Please use caution when clicking embedded hyperlinks or opening attachments. f you suspect

this email of containing malicious links or attachments immediately report this email wth the report phishing

button.

‘Good moming Kent,

‘As requested, Im sharing the email below from BDO. Let me know if you have any questions or need anything

‘additional.

ipsa. google commattuk=254c7056e |B ow=ptbsearch=allsparmitistvead1%3A17440400067EBS45960%7Cmsg-TK3A174404B088756,

Please use caution wien clicking embedded hyperlinks or opening attachments. if you suspect this

26

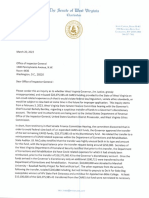

To: File <¢J

From: Berkeley Bentley, General Counsel

‘Samantha Willis, Deputy General Counsel

Re: CARES Act Monies and Legislative Appropriation

is

‘This memorandum summarizes the posture of any monies received from the U.S. Department of Treasury

by the State as Coronavirus Relief Funds (“CRF”) under the federal Coronavirus Aid, Relief, and Economic

Security (“CARES”) Act (2020), with respect to forma] Legislative appropriation.

In short, any CRF monies received by the State under the CARES Act are not subject to Legislative

appropriation and may be expended for any lawful purpose at the direction of the Governor as the chief

executive officer of the State.

“The CARES Act implemented a variety of programs to address issues related to the onset of the COVID-

19 pandemic, and was passed by Congress on March 25, 2020, end signed into law on March 27, 2020. The

Consolidated Appropriations Act (2021) was passed by Congress on December 21, 2020, and signed into

law on December 27, 2020, and made certain changes to provisions relating to CRF funds (e.g, the date by

‘which expenses must have been incurred was extended from December 30, 2020, to December 31, 2021).

‘The CARES Act, as amended, requires that the payments from the Coronavirus Relief Fund only be used

to cover expenses that meet the following criteria:

1. are necessary expenditures incurred due to the public health emergency with respect to the

Coronavirus Disease 2019 (COVID-19);

2. were not accounted for in the budget most recently approved as of March 27, 2020 (the date of

‘enactment of the CARES Act) for the State or government; and

3. were incurred during the period that begins on March 1, 2020, and ends on December 31, 2021.

Chapter 4, Article [1 ofthe West Virginia Code generally requires that federal funds be expended “pursuant

to specific appropriations by the Legislature, except as may be hereinafter provided.” W. Va. Code

§4-11-5(2).

‘The State received CRF funding from the US Department of Treasury on April 20, 2020. At the time this

money was reccived, West Virginia Code § 4 -11-6(3) provided that “fJederal funds made available to the

state for costs and damages resulting from natural disasters, civil disobedience or other occurrences declared

State Capitol | 1900 Kanawha Bivd.,

‘ast, Charleston, WV 25305 | (304) 558-2000

Orrice oF THE Governor

by the Governor asa state of emergency” were excluded from the provisions of Chapter 4, Article 11 of the

‘West Virginia Code.

Govemor Justice declared a state of emergency relating to the COVID-19 pandemic on March 16, 2020,

triggering the exclusion from Legislative appropriation of any federal funds made available to the State to

help respond to the COVID-19 pandemic.

During the 2021 Regular Session ofthe West Virginia Legislature, House Bill 2014 amended West Virginia,

Code § 4-11-6, among other statutory provisions, striking the above-stated absolute exclusion from

Legislative appropriation for federal funding granted in response to a state of emergency.

In place of the absolute exclusion previously existing at West Virginia Code § 4-11-6, the Legislature

amended provisions of West Virginia Code § 4-11-5, relating o appropriation authority when federal funds

become available to a spending unit while the Legislature is not in session. Specifically, the Legislature

provided, in a new subsection (¢), that “no amount of... federal funds . . . made available to the state for

costs and damages resulting from an emergency .... that occur{s] and are received while the Legislature

not in session and that are declared by the Governor as a state of emergency in excess of $150 million . ..

may be expended without appropriation by the Legislature enacted following receipt of the funds.” W. Va.

Code § 4-11-5().

Declared effective from passage on March 31, 2021, House Bill 2014 now mandates federal funds relating

to an emergency, in excess of $150 million, be formally appropriated by the Legislature. During the

development of House Bill 2014, and throughout the Legislative process, its application was consistently

Gescribed to be prospective in nature only. That is, any federal emergency monies received prior to the

effective date, March 31, 2021, were not to be affected and would remain excluded from the necessity of

formal appropriation, but any federal emergency monies received after the effective date of House Bill 2014

‘would be subject to its terms.

Further, the triggering event described in West Virginia Code § 4-11-5(e) for when appropriation is

appropriste for federal funds received for an emergency is the moment of the “receipt of the funds.” As

described above, the State received CRF funds on Apri 20, 2020, and immediately began expending funds

to respond to the COVID-19 pandemic in West Virginia. These monies, having been received prior to the

effective date of House Bill 2014 (March 31, 2021), are subject to the law in existence atthe time of receipt

of the funds. This treatment is consistent with the intent of House Bill 2014, as described during the 2021

Regular Session.

It should also be noted that the Legislature has not attempted to appropriate any CRF funding received by

the State, further evidencing this intent. In contrast, the Governor has submitted several bills to the

Legislature and the Legislature has considered and passed appropriations bills for other federal funds

provided in response to the COVID-19 pandemic that were received by the State afier the effective date of

House Bill 2014 (March 31, 2021)—namely, Coronavirus State and Local Fiscal Recovery funds received

by the State as a part of the American Rescue Plan Act.

‘The fact that the State must continue accounting for expenditures and processing transactions of CRF

‘monies does not change the conclusion that these monies are not subject to Legislative appropriation. As

described herein, the controlling concept relating to the change in law occasioned under House Bill 2014 is

‘when the funds are received by the State from the federal government. The CRF monies were received

April 20, 2020, prior to the effective date of House Bill 2014, and are therefore exempt from Legislative

‘appropriation.

‘Should anyone have questions, please direct them to the Governor's Office of General Counsel.

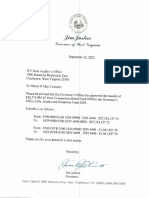

September 22, 2022

WV State Auditor's Office

1900 Kanawha Boulevard, East

Charleston, West Virginia 25305

To Whom It May Concer:

Please be advised that the Governor’ Office has approved the transfer of

$28,375,985.43 from Coronavirus Relief Fund 8700 to the Governor's

Office Gifts, Grants and Donations Fund 1029.

‘Transfer is as follows: |

From: 8700 0000 0100 1824 09900 3285 4440 - $27,334,157.73

To: 1029 0000 0100 GOV 6696 0000 - $27,334,157.73

From: 8700 INTR 0100 1824 09900 3285 4440 - $1,041,827.70

To: 1029 INTR 0100 GOV 6696 3285 4440 - $1,041,827.70

‘Thank you for your attention to this matter.

Sincerely,

SE

Lente EZ

¢ a

Jim Justice

Governor

State Capitol | 1900 Kanawha Bivd., East, Charleston, WV 25305 | (304) 558-2000

wa ai of pect

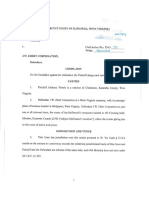

Cash Balance Detail

‘Menu Bats

Fund SubFund CashBalance Adjusted Cash Balance Available Cash Balance

8700 0000 §27,334,157.73, $27,334,157.73 $27,334,157.73,

8700 GEER so.04 s0.04 $0.04

8700 GERZ $0.00 $0.00 $0.00

8700 HOVE $0.00 $0.00 $0.00

8700 INTR $1,041,827.70 $1,041,827:70 $081,827.70

Fist Prev Noxt La

Seatch

Fund: 6700

Cash Balance : §77,934,157.73

Pending Increase Non-Cash : 0.99

Pending Decrease Non-Cash : $0,090

Pending Increase Cath : 50.00

Pending Decrease Cash $000

‘Accepted increase Non-Cash : $0.00

‘Accepted Decreate Non-Cash : 50,00

‘Adjusted Cash Balance : §27,334,157 73

Cash Balance Minimum : $0.00

‘Available Cash Balance : 527,334,187 73

# Cash Balance Detail Maintenance * Cash Balance Summary

ee ee

‘psfprda11 woasis.goviprdin Advantage "

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Lawyer Disciplinary Board Statement of ChargesDocument43 pagesLawyer Disciplinary Board Statement of ChargesWCHS Digital100% (2)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Coronavirus Relief Funds Final ReportDocument9 pagesCoronavirus Relief Funds Final ReportWCHS DigitalNo ratings yet

- PSC Fayette County Transmission CaseDocument6 pagesPSC Fayette County Transmission CaseWCHS DigitalNo ratings yet

- Jeff Waybright Email ChainDocument7 pagesJeff Waybright Email ChainWCHS DigitalNo ratings yet

- Governor To Auditor Transfer LetterDocument2 pagesGovernor To Auditor Transfer LetterWCHS DigitalNo ratings yet

- Letter From Senator Tarr To Office of Inspector General LetterDocument3 pagesLetter From Senator Tarr To Office of Inspector General LetterWCHS DigitalNo ratings yet

- Stay DeniedDocument7 pagesStay DeniedWCHS DigitalNo ratings yet

- McDonald's LawsuitDocument8 pagesMcDonald's LawsuitWCHS DigitalNo ratings yet

- PSC Denies Appalachian Power and Wheeling Power IncreaseDocument8 pagesPSC Denies Appalachian Power and Wheeling Power IncreaseWCHS DigitalNo ratings yet

- Paint Creek LawsuitDocument30 pagesPaint Creek LawsuitWCHS DigitalNo ratings yet

- Kanawha Prosecutor's Office LetterDocument1 pageKanawha Prosecutor's Office LetterWCHS DigitalNo ratings yet

- Clay County Report v3 1Document20 pagesClay County Report v3 1WCHS DigitalNo ratings yet

- WVU Student Government ResolutionDocument4 pagesWVU Student Government ResolutionWCHS DigitalNo ratings yet

- Federal Judge Ruling in Transgender Sports LawsuitDocument23 pagesFederal Judge Ruling in Transgender Sports LawsuitWCHS DigitalNo ratings yet

- Letter To Interim Secretary Coben Regarding Child WelfareDocument7 pagesLetter To Interim Secretary Coben Regarding Child WelfareWCHS DigitalNo ratings yet

- Big Sandy Oil Spill LawsuitDocument13 pagesBig Sandy Oil Spill LawsuitWCHS DigitalNo ratings yet