Professional Documents

Culture Documents

PAMB Medical Revision-00446241 2 PDF

PAMB Medical Revision-00446241 2 PDF

Uploaded by

Jojo YongCopyright:

Available Formats

You might also like

- Syllabus - Legal Principles and PracticesDocument4 pagesSyllabus - Legal Principles and PracticesJeremy ChangNo ratings yet

- Medical Repricing-96105332Document14 pagesMedical Repricing-96105332Mazlynn AmirNo ratings yet

- Proposed Belle Isle LeaseDocument15 pagesProposed Belle Isle LeaseCharlesPughNo ratings yet

- GCAAR Form 1316Document2 pagesGCAAR Form 1316Federal Title & Escrow CompanyNo ratings yet

- PAMB Medical Revision-00421602Document10 pagesPAMB Medical Revision-00421602WONG CHEE SIANG MoeNo ratings yet

- PAMB Medical Revision-35376814 PDFDocument9 pagesPAMB Medical Revision-35376814 PDFSoon SoonNo ratings yet

- PAMB Medical Revision-33430362Document9 pagesPAMB Medical Revision-33430362ts.liza76No ratings yet

- PAMB Medical Revision-33551087 4Document9 pagesPAMB Medical Revision-33551087 4zairizaNo ratings yet

- PAMB Medical Revision-34618558Document9 pagesPAMB Medical Revision-34618558Miracle BongNo ratings yet

- PAMB Medical Revision-34247081Document9 pagesPAMB Medical Revision-34247081mlcheong65.mcNo ratings yet

- PAMB Medical Revision-35383988Document10 pagesPAMB Medical Revision-35383988Daniel HarunNo ratings yet

- PAMB Medical Revision-34146670Document9 pagesPAMB Medical Revision-34146670DG.SARMILA BT SIDEK KPM-GuruNo ratings yet

- PAMB Medical Revision-00746590Document10 pagesPAMB Medical Revision-00746590anasallin8383No ratings yet

- PAMB Medical Revision-32819828Document10 pagesPAMB Medical Revision-32819828patrickng794No ratings yet

- PAMB Medical Revision-00454212Document10 pagesPAMB Medical Revision-00454212Ann ShahNo ratings yet

- PAMB Medical Revision-34552971Document9 pagesPAMB Medical Revision-34552971zubairzn595No ratings yet

- PAMB Medical Revision-00347214 2Document10 pagesPAMB Medical Revision-00347214 2fannysuekfunNo ratings yet

- PAMB Medical Revision-34760696 3Document10 pagesPAMB Medical Revision-34760696 3lizhaney53No ratings yet

- PAMB Medical Revision 34875081 1Document12 pagesPAMB Medical Revision 34875081 1anis264No ratings yet

- PAMB Medical Revision-32959392 2Document8 pagesPAMB Medical Revision-32959392 2yewyngNo ratings yet

- PAMB Medical Revision-33330006 2Document9 pagesPAMB Medical Revision-33330006 2Ai xuanNo ratings yet

- PAMB Medical Revision-33046806 3Document8 pagesPAMB Medical Revision-33046806 3NoØr FatiӍah MaƦdiahNo ratings yet

- Medical Repricing 95673366Document12 pagesMedical Repricing 95673366pudinlegacyNo ratings yet

- Medical Repricing-95891560Document10 pagesMedical Repricing-95891560Anonymous yGwMIPJRawNo ratings yet

- Medical Repricing 95683993Document7 pagesMedical Repricing 95683993Maznah Binti MassiNo ratings yet

- Medical Repricing-96466896Document10 pagesMedical Repricing-96466896amar rusydiNo ratings yet

- Medical Repricing 96345683Document10 pagesMedical Repricing 96345683jannatulajilah6256No ratings yet

- Medical Repricing 95925429Document10 pagesMedical Repricing 95925429Jason MaldonadoNo ratings yet

- Medical Repricing 96360695Document10 pagesMedical Repricing 96360695b687fmbbzjNo ratings yet

- Medical Repricing-96050809Document10 pagesMedical Repricing-96050809Sakinah Mhd ShukreeNo ratings yet

- Medical Repricing-95664702Document12 pagesMedical Repricing-95664702NurSyahirahMohdTaharNo ratings yet

- Scan Here For FaqsDocument10 pagesScan Here For Faqspnh_aaNo ratings yet

- Medical Repricing 96620334Document10 pagesMedical Repricing 96620334Nur Hana Qaisara MichaelNo ratings yet

- Medical Repricing 95624156Document12 pagesMedical Repricing 95624156Azwa ZahaRiNo ratings yet

- PAMB Medical Revision-33617303 2Document8 pagesPAMB Medical Revision-33617303 2SangarNo ratings yet

- Reprice Eumcr 20231025 22-35-16-135Document21 pagesReprice Eumcr 20231025 22-35-16-135Izzatt TazaliNo ratings yet

- 00883311-Endt Pandemic OfferDocument6 pages00883311-Endt Pandemic OfferDesmond KhorNo ratings yet

- Medical Repricing-95943501Document14 pagesMedical Repricing-95943501Fikri RaisNo ratings yet

- Incomeshield - Notice of Payment (Renewal) : Income Insurance LimitedDocument36 pagesIncomeshield - Notice of Payment (Renewal) : Income Insurance LimitedPhan QuanNo ratings yet

- Frequently Asked Questions FAQs For BancassuranceDocument7 pagesFrequently Asked Questions FAQs For BancassuranceAzeem AnwarNo ratings yet

- Medical Repricing 96473463 1Document14 pagesMedical Repricing 96473463 1Mohamad Raziff RamliNo ratings yet

- Product Disclosure Sheet HSBC Bank Malaysia Berhad: PublicDocument3 pagesProduct Disclosure Sheet HSBC Bank Malaysia Berhad: PublicsyanakimNo ratings yet

- Medical Repricing 96283330Document14 pagesMedical Repricing 96283330farahlianaNo ratings yet

- Revision in Exclusion Clause For Your Medical Plan(s)Document10 pagesRevision in Exclusion Clause For Your Medical Plan(s)thilaNo ratings yet

- Payment Alteration FormDocument3 pagesPayment Alteration FormTan KM0% (1)

- Corona Kavach Policy, Max Bupa Health Insurance Co. Ltd. - Policy Schedule Policy ScheduleDocument17 pagesCorona Kavach Policy, Max Bupa Health Insurance Co. Ltd. - Policy Schedule Policy ScheduleGlobal College of Engineering TechnologyNo ratings yet

- Renewal Intimation: Insured Name Chronic Condition Member ID Date of Birth Cumulative Bonus Existing Sum InsuredDocument2 pagesRenewal Intimation: Insured Name Chronic Condition Member ID Date of Birth Cumulative Bonus Existing Sum InsuredZakirKhanNo ratings yet

- Ilp AlterationDocument3 pagesIlp AlterationJasper LeeNo ratings yet

- 20102700-Endt Rider Exp Conf LTRDocument2 pages20102700-Endt Rider Exp Conf LTRbakiroosly859No ratings yet

- Product Disclosure SheetDocument10 pagesProduct Disclosure SheetIzzudin Nur Syahmie Shahrol AffendiNo ratings yet

- BA BCP - Covid 19 FAQ - CSD - For Posting On WeLearnDocument3 pagesBA BCP - Covid 19 FAQ - CSD - For Posting On WeLearnChi CkEnNo ratings yet

- Policy Surrender FormDocument2 pagesPolicy Surrender Formaife.ocubilloNo ratings yet

- Medical Repricing RevisionDocument6 pagesMedical Repricing RevisionSarveshrau SarveshNo ratings yet

- 96437186-Endt Pandemic Offer 2Document10 pages96437186-Endt Pandemic Offer 2Nik HafizNo ratings yet

- DownloadDocument4 pagesDownloadloredanachelu61No ratings yet

- Hayat Diinsuranskan Pemunya Polisi: Prudential Assurance Malaysia BerhadDocument2 pagesHayat Diinsuranskan Pemunya Polisi: Prudential Assurance Malaysia BerhadWinnie TickminNo ratings yet

- ASB Fin PDS ENG June 2020-2Document4 pagesASB Fin PDS ENG June 2020-2holaNo ratings yet

- Terms of BusinessDocument9 pagesTerms of Businessksenos.ukNo ratings yet

- 96380154-Endt Pandemic Offer 2Document6 pages96380154-Endt Pandemic Offer 2azieNo ratings yet

- Pai Proposal Form-1Document2 pagesPai Proposal Form-1praveenaNo ratings yet

- HeathGuard BrochureDocument2 pagesHeathGuard BrochureKumud GandhiNo ratings yet

- Credit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsFrom EverandCredit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsNo ratings yet

- Modes of Extinguishment of Obligation PDF FreeDocument6 pagesModes of Extinguishment of Obligation PDF FreeRUBY JAN CASASNo ratings yet

- Kenya Sale of Goods LawDocument17 pagesKenya Sale of Goods LawowinohNo ratings yet

- PIA vs. OpleDocument2 pagesPIA vs. OpleKristine ChavezNo ratings yet

- Atp Cases Digest 1001Document65 pagesAtp Cases Digest 1001Radel LlagasNo ratings yet

- Chapter 19 Real PropertyDocument17 pagesChapter 19 Real Propertyshazada shakirNo ratings yet

- Topic: Actions That Survive Doctrine: in Case of Unreasonable Delay in The Appointment of An Executor or Administrator of TheDocument57 pagesTopic: Actions That Survive Doctrine: in Case of Unreasonable Delay in The Appointment of An Executor or Administrator of TheJimi SolomonNo ratings yet

- Liability in Construction Contract LawDocument8 pagesLiability in Construction Contract Lawmulabbi brianNo ratings yet

- Full Download Test Bank For Cengage Advantage Books Fundamentals of Business Law Summarized Cases 9th Edition PDF Full ChapterDocument23 pagesFull Download Test Bank For Cengage Advantage Books Fundamentals of Business Law Summarized Cases 9th Edition PDF Full Chapterbowgebachelorqcja6100% (18)

- Contract of Lease - ApartmentDocument4 pagesContract of Lease - ApartmentMasnar KamaludinNo ratings yet

- THE LANDLORD GAME & PROSPERITY - Raw Extraction VODocument9 pagesTHE LANDLORD GAME & PROSPERITY - Raw Extraction VOElias GreemNo ratings yet

- House Rental Agreement FormatDocument4 pagesHouse Rental Agreement FormatsravanNo ratings yet

- Twerski TortsDocument23 pagesTwerski Tortslegale13No ratings yet

- Case StudyDocument3 pagesCase StudyAshish KumarNo ratings yet

- GST HS TradersDocument3 pagesGST HS TradersNihasNo ratings yet

- ReplevinDocument1 pageReplevingeoraw9588No ratings yet

- AJ&K Enlistment ChecklistDocument2 pagesAJ&K Enlistment ChecklistMuhammad Rafaqat GakharNo ratings yet

- ALFREDO N. AGUILA, JR, Petitioner, vs.Document3 pagesALFREDO N. AGUILA, JR, Petitioner, vs.Marvin A GamboaNo ratings yet

- Finman Digest OwnDocument5 pagesFinman Digest OwnTooMUCHcandyNo ratings yet

- Estate Tax Problems 2Document5 pagesEstate Tax Problems 2howaanNo ratings yet

- Managerial Prerogatice, Property Rights, and Labor Control in Employment Status DisputesDocument26 pagesManagerial Prerogatice, Property Rights, and Labor Control in Employment Status DisputesAnnieNo ratings yet

- Grotjahn GMBH Vs InansiDocument3 pagesGrotjahn GMBH Vs InansiStephanie ValentineNo ratings yet

- Nejmoa2302892 DisclosuresDocument8 pagesNejmoa2302892 Disclosuresalu0100537680No ratings yet

- Philippine Commercial and Industrial Bank V EscolinDocument157 pagesPhilippine Commercial and Industrial Bank V EscolinAaron James PuasoNo ratings yet

- LIGHT RAIL TRANSIT AUTHORITY & RODOLFO ROMAN vs. MARJORIE NAVIDADDocument2 pagesLIGHT RAIL TRANSIT AUTHORITY & RODOLFO ROMAN vs. MARJORIE NAVIDADCharles Roger RayaNo ratings yet

- Civ Rev 2 Preference of CreditsDocument23 pagesCiv Rev 2 Preference of CreditsShirley Marie Cada - CaraanNo ratings yet

- Sales of Goods ActDocument2 pagesSales of Goods ActvijaiNo ratings yet

PAMB Medical Revision-00446241 2 PDF

PAMB Medical Revision-00446241 2 PDF

Uploaded by

Jojo YongOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PAMB Medical Revision-00446241 2 PDF

PAMB Medical Revision-00446241 2 PDF

Uploaded by

Jojo YongCopyright:

Available Formats

YONG PAIK CHEW

4-1-1 LEBUH BATU MAUNG 8

BATU MAUNG

11960 BAYAN LEPAS PULAU PINANG

MALAYSIA

Date : 18-07-2022

Ref : ILPRPRC_0001_001/NL01

Dear Sir/Madam,

Policy Number : 00446241

Life Assured : TEH YU HEN

Assured : YONG PAIK CHEW

Subject : PRUValue Med New Insurance Charges and Premium

Thank you for choosing PRUValue Med as your health and medical

protection solution. Payment Arrangement

Healthcare costs have been consistently rising with the increasing Cash/e-Banking

demand for better healthcare services and increases in the Please remit the new premium

medical treatment costs along with advancement in technology. upon revision effective date.

Market studies further show that medical inflation has

registered double digit increases in recent years. Credit Card Auto-debit

New premium will be deducted

As your long-term medical protection is important, we regularly upon revision effective date.

review our medical plans to ensure you are protected when you

need it. Having carefully considered the rise in healthcare costs, Direct-Debit (with

we will be revising the insurance charges of your medical plan transaction amount limit)

effective 01-10-2022*. If you are currently on this

arrangement, please submit

With this revision of the insurance charges, your premium will the attached Direct Debit

also be revised as below: Enrolment Form, with a copy

of the account holder’s

Current Identification Card or Passport.

New Premium** Effective Date

Premium This will enable us to deduct

RM 150.00 RM 162.00 the new premiums from your

01-10-2022 bank account. Do note that if

Monthly Monthly your account is with Bank

Note: The increase in premiums is to cater for the increase in medical insurance Simpanan Nasional, CIMB

charges. Payor coverage (if applicable) will increase correspondingly and Bank, Public Bank or RHB

additional insurance charges will be deducted from your policy account value. We Bank, you will also need to

advise you to refer to your annual statement and discuss with your agent or perform a signature

Bank/Prudential Representative to review your policy sustainability regularly to verification at the bank before

ensure continuity of your coverage. submitting the form to

Prudential.

DOC ID 12201009

Prudential Assurance Malaysia Berhad 198301012262 (107655-U) Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala Lumpur, Malaysia.

P.O. Box 10025, 50700 Kuala Lumpur. Tel (603) 2778 3888 www.prudential.com.my

Customer Service Tel (603) 2771 0228 Email: customer.mys@prudential.com.my

Part of Prudential plc (United Kingdom)

P1

To help you better understand the changes in your insurance charges and premium, we have

enclosed the Supplementary Schedule with details of the revision as part of your policy, including

the changes in payor benefits (if applicable), as well as some Frequently Asked Questions (FAQs).

You may also visit www.askprudential.com.my or scan the above QR Code for further information.

If you would like to review your existing coverage or consider other options that may better meet

your protection and financial needs, please do not hesitate to reach out to your Prudential Agent or

Bank/Prudential Representative.

Should you have any enquiries, you may contact us at 03-2771 2450 (Monday-Friday, 8.30am -

5.15pm, excluding Public Holidays) or email us at customer.mys@prudential.com.my.

Once again, thank you for your support and trust in Prudential. We look forward to continue serving

you in the future.

Yours sincerely,

Lim Eng Seong

Chief Executive Officer

Note:

* The content of this notification letter does not consider any alteration made to this policy after 05-07-2022.

** Premium is inclusive of applicable taxes (if any).

DOC ID 12201009

Prudential Assurance Malaysia Berhad 198301012262 (107655-U) Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala Lumpur, Malaysia.

P.O. Box 10025, 50700 Kuala Lumpur. Tel (603) 2778 3888 www.prudential.com.my

Customer Service Tel (603) 2771 0228 Email: customer.mys@prudential.com.my

Part of Prudential plc (United Kingdom)

P1

YONG PAIK CHEW

4-1-1 LEBUH BATU MAUNG 8

BATU MAUNG

11960 BAYAN LEPAS PULAU PINANG

MALAYSIA

日期 : 18-07-2022

参考 : ILPRPRC_0001_001/NL01

尊敬的先生/女士,

保单号码 : 00446241

受保人 : TEH YU HEN

保单持有人 : YONG PAIK CHEW

主旨 : PRUValue Med 最新保险费和保费

感谢您选择 PRUValue Med 作为您的健康和医疗保障方案。

付费安排

随着人们不断追求更好的医疗服务,以及医药成本日益增加的情况,医疗保

健成本随之提升。市场研究显示医疗成本通货膨胀,近年来更呈现双位数的 现金/电子银行

上升率。 请在生效日期依据调整保费汇款。

由于您的长期医疗保障需被优先考量,因此我们时刻审查我们的医疗保健计 信用卡自动缴费

划,以确保您在需要的时候,时刻都受到保障。在经过审慎考虑后,我们将 新调整的保费在生效日期将被扣

在 01-10-2022* 起根据您的医疗保险计划调整保险费。 除。

随着此次保险费调整,您的保费也将如下所示开始调整:

直接付款(转账限额)

现有的保费 新的保费** 生效日期 如果您目前是通过此安排付费,请

提交随函附上的直接付款登记表

每月 RM 150.00 每月 RM 162.00 01-10-2022 格,并附上帐户持有人的身份证或

护照的副本。这意味着您授权我们

注释:保费的增加是为了迎合医疗保险费用的上涨。缴费人保障(如适用)将随之增加,同时额外 从您的帐户直接扣取新保费。请注

的保险费也将会从您的保单账户价值中扣除。我们建议您参考您的年度报表和定期与您的保险 意,如果您的帐户是国家储蓄银

代理或银行/保诚专员讨论并评估您的保单持续性,以便确保您的保障延续性。

行、联昌国际(CIMB)银行、大众银

为了帮助您充分了解此调整保险费和保费事宜,随函除了附上一份含此调整 行或RHB银行,您依然需要去银行

的细节保单附录,也包括缴费人利益的更新(如适用)以及一些常见问答 进行验证签名核实检查,然后才提

(FAQ)供您参考。您亦可浏览 www.askprudential.com.my 或扫描以上 交该表格给保诚。

的QR码以了解更多相关信息。

如果您想要重新评估和检讨您目前的保单,或根据您的经济需求并酌情选择

适合您的其他保险保障选项,请随时联系您的保诚代理员或银行/保诚代

表。

DOC ID 12201009

Prudential Assurance Malaysia Berhad 198301012262 (107655-U) Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala Lumpur, Malaysia.

P.O. Box 10025, 50700 Kuala Lumpur. Tel (603) 2778 3888 www.prudential.com.my

Customer Service Tel (603) 2771 0228 Email: customer.mys@prudential.com.my

Part of Prudential plc (United Kingdom)

P1

如有任何疑问,您可拨打 03-2771 2450 (周一至周五,上午8时30分至下午5时15分,公共假期除外) 或电邮至

customer.mys@prudential.com.my 。

再次感谢您对保诚的支持和信任。我们期待着将来能继续为您服务。

至诚敬上,

林永祥

首席执行员

注意事项:

* 此通知书内容未纳入任何 05-07-2022 后的保单内容更改。

** 保费包括相关税收(如有)。

DOC ID 12201009

Prudential Assurance Malaysia Berhad 198301012262 (107655-U) Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala Lumpur, Malaysia.

P.O. Box 10025, 50700 Kuala Lumpur. Tel (603) 2778 3888 www.prudential.com.my

Customer Service Tel (603) 2771 0228 Email: customer.mys@prudential.com.my

Part of Prudential plc (United Kingdom)

P1

SUPPLEMENTARY SCHEDULE TO POLICY NUMBER: 00446241

JADUAL TAMBAHAN KEPADA POLISI NOMBOR

Date / Tarikh: 05-07-2022

The provisions in this Supplementary Schedule shall form part of your Policy upon the effective date as shown in this

Supplementary Schedule. To the extent any of the provisions in this Supplementary Schedule conflict with any provisions

of the existing content of your Policy, the provisions in this Supplementary Schedule shall prevail and replace those

provisions of the existing content. Peruntukan dalam Jadual Tambahan ini adalah sebahagian daripada Polisi anda

pada tarikh berkuatkuasa seperti yang ditunjukkan dalam Jadual Tambahan ini. Setakat mana-mana bahagian dalam

Jadual Tambahan ini bercanggah dengan mana-mana peruntukan dalam Polisi anda yang sedia ada, peruntukan dalam

Jadual Tambahan ini akan diutamakan dan menggantikan peruntukan dalam Polisi anda yang sedia ada tersebut.

Revised Insurance Charges for PRUValue Med

Caj Insurans yang diubahsuai bagi PRUValue Med

• Effective Date / Tarikh Berkuatkuasa: 01-10-2022

• Projected Insurance Charges / Unjuran Caj Insurans: As Attached / Seperti yang dilampirkan

Revised Payor Related Benefit(s) / Manfaat (-Manfaat) Payor yang Diubahsuai

Effective from / Amount of Benefit /

Benefit Type / Jenis Manfaat

Berkuatkuasa daripada Jumlah Manfaat

01-10-2022 Payor Basic RM 1,944.00 (p.a. / setahun)

01-10-2022 Parent Payor Basic RM 1,944.00 (p.a. / setahun)

Revised Premium plus Taxes (if any) / Premium Diubahsuai tambah dengan Cukai (jika ada)

Monthly Premium plus Taxes (if any) of RM 162.00* effective 01-10-2022, payable by Cash/Cheque. / Bulanan

Premium tambah dengan Cukai (jika ada) RM 162.00*, berkuatkuasa 01-10-2022 yang dibayar secara Tunai/Cek.

*Increase in the amount of RM 12.00 on the Insurance Premium, with 95.00% as the allocation rate set for each

Premium Year. / Peningkatan sebanyak RM 12.00 bagi Premium Insurans, dengan 95.00% sebagai kadar

peruntukan untuk setiap Tahun Premium.

Notes / Nota:

• “Insurance Premium” shown above refers to “Insurance Premium”, “Optional Benefit(s) Premium” and “Add-On

Benefit(s) Premium”, whichever is applicable, that appears in your Policy. / “Premium Insurans” yang ditunjukkan di

atas, merujuk kepada “Premium Insurans”, “Premium Manfaat(-manfaat) Opsyenal” dan “Premium Manfaat(-

manfaat) Add-On”, yang mana terpakai dan ditunjukkan di dalam Polisi anda.

• “Amount of Benefit” shown above refers to “Amount of Benefit”, “Amount” and “Sum Assured”, whichever is

applicable, that appears in your Policy. / “Amaun Manfaat” yang ditunjukkan di atas merujuk kepada “Amaun

Manfaat”, “Amaun” dan “Jumlah Diinsuranskan”, yang mana terpakai dan ditunjukkan di dalam Polisi anda.

DOC ID 12201009

Prudential Assurance Malaysia Berhad 198301012262 (107655-U) Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala Lumpur, Malaysia.

P.O. Box 10025, 50700 Kuala Lumpur. Tel (603) 2778 3888 www.prudential.com.my

Customer Service Tel (603) 2771 0228 Email: customer.mys@prudential.com.my

Part of Prudential plc (United Kingdom)

P1

If any part of your Policy in connection with the provisions above is varied after the date of this Supplementary Schedule

but before 01-10-2022, the provisions in this Supplementary Schedule shall not apply. If you require further assistance,

please do not hesitate to get in touch with your Prudential representative. You may also contact our Customer Service

Representatives at 03-2771 0228 (Monday-Friday from 8.30am to 5.15pm, excluding Public Holidays) or email us at

customer.mys@prudential.com.my. Jika mana-mana bahagian Polisi anda yang berkenaan dengan peruntukan-

peruntukan di atas diubah selepas tarikh Jadual Tambahan ini tetapi sebelum 01-10-2022, peruntukan-peruntukan

dalam Jadual Tambahan ini tidak akan terpakai. Jika anda memerlukan bantuan selanjutnya, sila berhubung dengan

wakil Prudential anda. Anda juga boleh menghubungi Wakil Khidmat Pelanggan kami di talian 03-2771 0228 (Isnin-

Jumaat 8:30 pagi-5:15 petang, selain daripada cuti umum) atau emel kami di customer.mys@prudential.com.my.

DOC ID 12201009

Prudential Assurance Malaysia Berhad 198301012262 (107655-U) Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala Lumpur, Malaysia.

P.O. Box 10025, 50700 Kuala Lumpur. Tel (603) 2778 3888 www.prudential.com.my

Customer Service Tel (603) 2771 0228 Email: customer.mys@prudential.com.my

Part of Prudential plc (United Kingdom)

P1

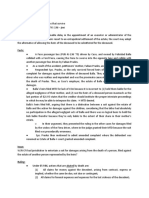

Summary of Projected Insurance Charges of / Ringkasan Unjuran Caj Insurans untuk PRUValue Med:

Age Next Insurance Age Next Insurance Age Next Insurance Age Next Insurance

Birthday / Charges / Birthday / Charges / Birthday / Charges / Birthday / Charges /

Umur Pada Caj Insurans Umur Pada Caj Insurans Umur Pada Caj Insurans Umur Pada Caj Insurans

Hari Jadi Akan (RM) Hari Jadi Akan (RM) Hari Jadi Akan (RM) Hari Jadi Akan (RM)

Datang Datang Datang Datang

15 490.64 40 888.20 65 3,202.65 90 18,179.24

16 633.92 41 1,063.16 66 4,463.78 91 21,924.14

17 633.92 42 1,063.16 67 4,463.78 92 21,924.14

18 633.92 43 1,063.16 68 4,463.78 93 21,924.14

19 633.92 44 1,063.16 69 4,463.78 94 21,924.14

20 633.92 45 1,063.16 70 4,463.78 95 21,924.14

21 675.13 46 1,350.26 71 6,781.47 96 25,832.15

22 675.13 47 1,350.26 72 6,781.47 97 25,832.15

23 675.13 48 1,350.26 73 6,781.47 98 25,832.15

24 675.13 49 1,350.26 74 6,781.47 99 25,832.15

25 675.13 50 1,350.26 75 6,781.47 100 25,832.15

26 704.57 51 1,731.74 76 10,183.34

27 704.57 52 1,731.74 77 10,183.34

28 704.57 53 1,731.74 78 10,183.34

29 704.57 54 1,731.74 79 10,183.34

30 704.57 55 1,731.74 80 10,183.34

31 764.85 56 2,370.70 81 14,256.47

32 764.85 57 2,370.70 82 14,256.47

33 764.85 58 2,370.70 83 14,256.47

34 764.85 59 2,370.70 84 14,256.47

35 764.85 60 2,370.70 85 14,256.47

36 888.20 61 3,202.65 86 18,179.24

37 888.20 62 3,202.65 87 18,179.24

38 888.20 63 3,202.65 88 18,179.24

39 888.20 64 3,202.65 89 18,179.24

Note / Nota:

1. The projected Insurance Charges shown above are based on our current scales of charges and we shall deduct them from

your Policy in future when the Life Assured reaches that age on the Life Assured’s next birthday, until the expiry of this

benefit. / Caj Insurans yang diunjurkan di atas adalah berdasarkan pada skala caj semasa kami dan akan ditolak

daripada Polisi anda pada masa hadapan apabila Hayat Yang Diinsuranskan mencapai umur tersebut pada hari jadi

Hayat Yang Diinsuranskan yang akan datang, sehingga tamat tempoh manfaat.

2. These rates are annual rates and based on standard risk (“Annual Insurance Rate”). We will deduct Insurance Charges,

amongst others based on any underwriting-based loading imposed for sub-standard risk. / Kadar-kadar ini adalah kadar

tahunan dan berdasarkan risiko standard (“Kadar Tahunan Insurans”). Kami akan menolak Caj Insurans, antara lain

berdasarkan sebarang loading tambahan yang dikenakan mengikut dasar pengunderaitan untuk risiko sub-standard.

DOC ID 12201009

Prudential Assurance Malaysia Berhad 198301012262 (107655-U) Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala Lumpur, Malaysia.

P.O. Box 10025, 50700 Kuala Lumpur. Tel (603) 2778 3888 www.prudential.com.my

Customer Service Tel (603) 2771 0228 Email: customer.mys@prudential.com.my

Part of Prudential plc (United Kingdom)

P1

Frequently asked questions (FAQ)

1. Why are my insurance charges and/or premium being revised?

To ensure you are always adequately protected, Prudential regularly reviews our medical plans against the current

healthcare costs. As you might be aware, the cost of healthcare has been consistently rising due to various factors.

These include increase in hospital and doctor charges, advancement in medical treatments and drugs, as well as

increasing demand for better healthcare services. Having carefully considered the relevant factors above, Prudential

undertakes this revision to help ensure your long-term medical protection will be there for you when you need it. You

will be notified accordingly if there is a need for revision in the future as well.

2. What is the difference between premium and insurance charges?

Premium is the amount that you pay to Prudential in return for the insurance coverage provided. For an investment-

linked insurance policy, part or all the premiums paid are used to purchase units in the investment-linked fund(s) while

the remaining is used to pay upfront charges for insurance expenses and direct distribution costs. Insurance charges

are deducted monthly from the value of your investment-linked funds to pay for your insurance coverage. Generally, the

insurance charges will increase as you grow older.

3. Why do I need to pay the additional premium/recommended top-up?

The additional premium/top-up is required to cover the increased insurance charges. With the increase in insurance

charges, more units will be deducted from your policy account value to pay for the higher insurance charges. If you

continue to pay the same amount of premium after the new premium effective date or do not top-up your policy after

this revision, it is possible that your policy may lapse earlier than expected.

4. I have not made any claim. Why are my insurance charges and/or premium being revised?

How insurance works and is calculated, is by pooling and spreading the risks among all those who are insured in the

portfolio. Health/medical insurance is no different. When you purchase health insurance, you join a group of other

customers who have similar risk characteristics (such as age group, plan type, gender etc.). We (the insurance

company) cover the entire group rather than individuals. Similarly, when we review our medical portfolio, it is conducted

across the board.

5. Is the rate of increase in insurance charges/premium fixed across all policies?

The rate of increase in premium and insurance charges is not fixed across all policies as it varies depending on factors

such as age, gender and type of medical plan.

Prudential Assurance Malaysia Berhad 198301012262 (107655-U) Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala Lumpur, Malaysia.

P.O. Box 10025, 50700 Kuala Lumpur. Tel (603) 2778 3888 www.prudential.com.my

Customer Service Tel (603) 2771 0228 Email: customer.mys@prudential.com.my

Part of Prudential plc (United Kingdom)

P1

6. Arising from this revision, what are the options available to me?

There are a variety of options that may apply to your specific situation. Listed below are some of the options you may

wish to consider in reviewing your current policy coverage and affordability: -

Option(s) Details

Review current benefit(s) You may review and alter your policy benefits to suit your needs, subject

to the terms and conditions of the policy.

If you change your medical plan to a lower plan within the same medical

rider for a more affordable premium within 1 January 2021 to 30 June

2022, we will accept your application to switch back to the original medical

plan in the same policy within 12 months period from the medical plan

endorsement, without underwriting assessment.

However, we wish to remind you that any changes to your coverage will

have an impact to your protection.

Change premium payment You may consider changing your premium payment frequency to lower

frequency down lump sum financial commitment (if applicable).

If you would like to review your existing coverage or consider other options that may better meet your protection and

financial needs, please do not hesitate to reach out to your Prudential Agent or Bank/Prudential Representative.

Please visit www.askprudential.com.my or scan the below QR Code for more details.

Prudential Assurance Malaysia Berhad 198301012262 (107655-U) Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala Lumpur, Malaysia.

P.O. Box 10025, 50700 Kuala Lumpur. Tel (603) 2778 3888 www.prudential.com.my

Customer Service Tel (603) 2771 0228 Email: customer.mys@prudential.com.my

Part of Prudential plc (United Kingdom)

P1

常见问题(FAQ)

1. 为什么我的保险费和/或保费被调整?

为了确保您得到充分的保障,保诚不时根据当前医疗保健成本为其医疗保健保险进行评估及审查。如您所知,由于各种因

素,医疗费用一直不断上涨,其中包括医院和医生诊费的上涨,先进医疗与药物处方费用及人们要求更好的医疗服务不断激

增等等。在经过审慎考虑上述相关因素之后,保诚将作出此调整以确保您长期在需要的时刻受到医疗保障。如将来需要再次

进行调整,您将也会相应地收到通知。

2. 保费和保险费有哪些区别?

保费是您缴付保诚以获取保障利益的投保金额。投资联结保单把部分或全部保费投资于购买联结基金单位上,余额则用来支

付保险开销的预付收费和直接分销费用。保险费则每个月从您投资联结保单的单位价值的金额所扣除并用来缴付您的保单。

一般,保险费将随着您的年龄逐年增加。

3. 为何我需要缴付额外的保费/建议推荐加额?

额外的保费/加额是用来支付保险费的增加。由于保险费的增加,相对的从您的保单账户价值扣除来缴付保险费的单位也随

之增加。随着新调整保费生效日期后,如果您继续以同样的费缴付或没随着此调整而加额您的保单,您的保单将可能比预期

更早失效。

4. 我未曾做出任何索赔。为何调整我的保险收费和/或保费?

保险是基于该投保群组的风险分享基础原理营运与计算。因此,健康/医疗保险也不例外。当您购买保健保险时,也意味着

您参与具有相似风险特征的客户群(例如年龄层、保单类型、性别等等)。本公司覆盖整个客户群而不是个人的风险。因此,

本公司是进行全面评估及审查我们的医疗群组的,而非依据个人风险。

5. 所有保单的保费/保险收费增长率是否固定的?

保费和保险费取决于年龄、性别和医疗计划类型等等因素,所以并非所有保费和保险费增长率是固定的。

6. 按此调整后,我还有什么选项?

其中还有很多的选项供您按个别情形做出选择。如果您想要重新审查您目前的保单并按您的负担酌情考虑进行评估,请参阅

下述提供的一些选项:-

选项 细节

评估目前的利益 在符合有关保单协议与条款之下,您可按您的需要进行评估您目前的保单及

在其利益上作出更改。

如果您在 2021 年 1 月 1 日至 2022 年 6 月 30 日期间以更实惠的保

费将您的医疗计划更改为同一医疗附加险中的较低计划,我们将接受您在 12

个月内转换回同一保单中的原始医疗计划的申请,无需核保。

我们谨此提醒您,该保单的任何更改将影响您的保障。

更改保费缴付频率 您可以考虑更改您的保费支付频率以降低一次性支付的财务承担(如果适

用)。

如果您想要重新评估及审查讨您目前的保单,或者根据您的经济需求并酌情选择适合您的其他保险保障选项,请随时联系您

的保诚代理员或银行/保诚代表。

请游览www.askprudential.com.my或扫描以下QR码查阅常见问题。

Prudential Assurance Malaysia Berhad 198301012262 (107655-U) Level 20, Menara Prudential, Persiaran TRX Barat, 55188 Tun Razak Exchange, Kuala Lumpur, Malaysia.

P.O. Box 10025, 50700 Kuala Lumpur. Tel (603) 2778 3888 www.prudential.com.my

Customer Service Tel (603) 2771 0228 Email: customer.mys@prudential.com.my

Part of Prudential plc (United Kingdom)

P1

You might also like

- Syllabus - Legal Principles and PracticesDocument4 pagesSyllabus - Legal Principles and PracticesJeremy ChangNo ratings yet

- Medical Repricing-96105332Document14 pagesMedical Repricing-96105332Mazlynn AmirNo ratings yet

- Proposed Belle Isle LeaseDocument15 pagesProposed Belle Isle LeaseCharlesPughNo ratings yet

- GCAAR Form 1316Document2 pagesGCAAR Form 1316Federal Title & Escrow CompanyNo ratings yet

- PAMB Medical Revision-00421602Document10 pagesPAMB Medical Revision-00421602WONG CHEE SIANG MoeNo ratings yet

- PAMB Medical Revision-35376814 PDFDocument9 pagesPAMB Medical Revision-35376814 PDFSoon SoonNo ratings yet

- PAMB Medical Revision-33430362Document9 pagesPAMB Medical Revision-33430362ts.liza76No ratings yet

- PAMB Medical Revision-33551087 4Document9 pagesPAMB Medical Revision-33551087 4zairizaNo ratings yet

- PAMB Medical Revision-34618558Document9 pagesPAMB Medical Revision-34618558Miracle BongNo ratings yet

- PAMB Medical Revision-34247081Document9 pagesPAMB Medical Revision-34247081mlcheong65.mcNo ratings yet

- PAMB Medical Revision-35383988Document10 pagesPAMB Medical Revision-35383988Daniel HarunNo ratings yet

- PAMB Medical Revision-34146670Document9 pagesPAMB Medical Revision-34146670DG.SARMILA BT SIDEK KPM-GuruNo ratings yet

- PAMB Medical Revision-00746590Document10 pagesPAMB Medical Revision-00746590anasallin8383No ratings yet

- PAMB Medical Revision-32819828Document10 pagesPAMB Medical Revision-32819828patrickng794No ratings yet

- PAMB Medical Revision-00454212Document10 pagesPAMB Medical Revision-00454212Ann ShahNo ratings yet

- PAMB Medical Revision-34552971Document9 pagesPAMB Medical Revision-34552971zubairzn595No ratings yet

- PAMB Medical Revision-00347214 2Document10 pagesPAMB Medical Revision-00347214 2fannysuekfunNo ratings yet

- PAMB Medical Revision-34760696 3Document10 pagesPAMB Medical Revision-34760696 3lizhaney53No ratings yet

- PAMB Medical Revision 34875081 1Document12 pagesPAMB Medical Revision 34875081 1anis264No ratings yet

- PAMB Medical Revision-32959392 2Document8 pagesPAMB Medical Revision-32959392 2yewyngNo ratings yet

- PAMB Medical Revision-33330006 2Document9 pagesPAMB Medical Revision-33330006 2Ai xuanNo ratings yet

- PAMB Medical Revision-33046806 3Document8 pagesPAMB Medical Revision-33046806 3NoØr FatiӍah MaƦdiahNo ratings yet

- Medical Repricing 95673366Document12 pagesMedical Repricing 95673366pudinlegacyNo ratings yet

- Medical Repricing-95891560Document10 pagesMedical Repricing-95891560Anonymous yGwMIPJRawNo ratings yet

- Medical Repricing 95683993Document7 pagesMedical Repricing 95683993Maznah Binti MassiNo ratings yet

- Medical Repricing-96466896Document10 pagesMedical Repricing-96466896amar rusydiNo ratings yet

- Medical Repricing 96345683Document10 pagesMedical Repricing 96345683jannatulajilah6256No ratings yet

- Medical Repricing 95925429Document10 pagesMedical Repricing 95925429Jason MaldonadoNo ratings yet

- Medical Repricing 96360695Document10 pagesMedical Repricing 96360695b687fmbbzjNo ratings yet

- Medical Repricing-96050809Document10 pagesMedical Repricing-96050809Sakinah Mhd ShukreeNo ratings yet

- Medical Repricing-95664702Document12 pagesMedical Repricing-95664702NurSyahirahMohdTaharNo ratings yet

- Scan Here For FaqsDocument10 pagesScan Here For Faqspnh_aaNo ratings yet

- Medical Repricing 96620334Document10 pagesMedical Repricing 96620334Nur Hana Qaisara MichaelNo ratings yet

- Medical Repricing 95624156Document12 pagesMedical Repricing 95624156Azwa ZahaRiNo ratings yet

- PAMB Medical Revision-33617303 2Document8 pagesPAMB Medical Revision-33617303 2SangarNo ratings yet

- Reprice Eumcr 20231025 22-35-16-135Document21 pagesReprice Eumcr 20231025 22-35-16-135Izzatt TazaliNo ratings yet

- 00883311-Endt Pandemic OfferDocument6 pages00883311-Endt Pandemic OfferDesmond KhorNo ratings yet

- Medical Repricing-95943501Document14 pagesMedical Repricing-95943501Fikri RaisNo ratings yet

- Incomeshield - Notice of Payment (Renewal) : Income Insurance LimitedDocument36 pagesIncomeshield - Notice of Payment (Renewal) : Income Insurance LimitedPhan QuanNo ratings yet

- Frequently Asked Questions FAQs For BancassuranceDocument7 pagesFrequently Asked Questions FAQs For BancassuranceAzeem AnwarNo ratings yet

- Medical Repricing 96473463 1Document14 pagesMedical Repricing 96473463 1Mohamad Raziff RamliNo ratings yet

- Product Disclosure Sheet HSBC Bank Malaysia Berhad: PublicDocument3 pagesProduct Disclosure Sheet HSBC Bank Malaysia Berhad: PublicsyanakimNo ratings yet

- Medical Repricing 96283330Document14 pagesMedical Repricing 96283330farahlianaNo ratings yet

- Revision in Exclusion Clause For Your Medical Plan(s)Document10 pagesRevision in Exclusion Clause For Your Medical Plan(s)thilaNo ratings yet

- Payment Alteration FormDocument3 pagesPayment Alteration FormTan KM0% (1)

- Corona Kavach Policy, Max Bupa Health Insurance Co. Ltd. - Policy Schedule Policy ScheduleDocument17 pagesCorona Kavach Policy, Max Bupa Health Insurance Co. Ltd. - Policy Schedule Policy ScheduleGlobal College of Engineering TechnologyNo ratings yet

- Renewal Intimation: Insured Name Chronic Condition Member ID Date of Birth Cumulative Bonus Existing Sum InsuredDocument2 pagesRenewal Intimation: Insured Name Chronic Condition Member ID Date of Birth Cumulative Bonus Existing Sum InsuredZakirKhanNo ratings yet

- Ilp AlterationDocument3 pagesIlp AlterationJasper LeeNo ratings yet

- 20102700-Endt Rider Exp Conf LTRDocument2 pages20102700-Endt Rider Exp Conf LTRbakiroosly859No ratings yet

- Product Disclosure SheetDocument10 pagesProduct Disclosure SheetIzzudin Nur Syahmie Shahrol AffendiNo ratings yet

- BA BCP - Covid 19 FAQ - CSD - For Posting On WeLearnDocument3 pagesBA BCP - Covid 19 FAQ - CSD - For Posting On WeLearnChi CkEnNo ratings yet

- Policy Surrender FormDocument2 pagesPolicy Surrender Formaife.ocubilloNo ratings yet

- Medical Repricing RevisionDocument6 pagesMedical Repricing RevisionSarveshrau SarveshNo ratings yet

- 96437186-Endt Pandemic Offer 2Document10 pages96437186-Endt Pandemic Offer 2Nik HafizNo ratings yet

- DownloadDocument4 pagesDownloadloredanachelu61No ratings yet

- Hayat Diinsuranskan Pemunya Polisi: Prudential Assurance Malaysia BerhadDocument2 pagesHayat Diinsuranskan Pemunya Polisi: Prudential Assurance Malaysia BerhadWinnie TickminNo ratings yet

- ASB Fin PDS ENG June 2020-2Document4 pagesASB Fin PDS ENG June 2020-2holaNo ratings yet

- Terms of BusinessDocument9 pagesTerms of Businessksenos.ukNo ratings yet

- 96380154-Endt Pandemic Offer 2Document6 pages96380154-Endt Pandemic Offer 2azieNo ratings yet

- Pai Proposal Form-1Document2 pagesPai Proposal Form-1praveenaNo ratings yet

- HeathGuard BrochureDocument2 pagesHeathGuard BrochureKumud GandhiNo ratings yet

- Credit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsFrom EverandCredit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsNo ratings yet

- Modes of Extinguishment of Obligation PDF FreeDocument6 pagesModes of Extinguishment of Obligation PDF FreeRUBY JAN CASASNo ratings yet

- Kenya Sale of Goods LawDocument17 pagesKenya Sale of Goods LawowinohNo ratings yet

- PIA vs. OpleDocument2 pagesPIA vs. OpleKristine ChavezNo ratings yet

- Atp Cases Digest 1001Document65 pagesAtp Cases Digest 1001Radel LlagasNo ratings yet

- Chapter 19 Real PropertyDocument17 pagesChapter 19 Real Propertyshazada shakirNo ratings yet

- Topic: Actions That Survive Doctrine: in Case of Unreasonable Delay in The Appointment of An Executor or Administrator of TheDocument57 pagesTopic: Actions That Survive Doctrine: in Case of Unreasonable Delay in The Appointment of An Executor or Administrator of TheJimi SolomonNo ratings yet

- Liability in Construction Contract LawDocument8 pagesLiability in Construction Contract Lawmulabbi brianNo ratings yet

- Full Download Test Bank For Cengage Advantage Books Fundamentals of Business Law Summarized Cases 9th Edition PDF Full ChapterDocument23 pagesFull Download Test Bank For Cengage Advantage Books Fundamentals of Business Law Summarized Cases 9th Edition PDF Full Chapterbowgebachelorqcja6100% (18)

- Contract of Lease - ApartmentDocument4 pagesContract of Lease - ApartmentMasnar KamaludinNo ratings yet

- THE LANDLORD GAME & PROSPERITY - Raw Extraction VODocument9 pagesTHE LANDLORD GAME & PROSPERITY - Raw Extraction VOElias GreemNo ratings yet

- House Rental Agreement FormatDocument4 pagesHouse Rental Agreement FormatsravanNo ratings yet

- Twerski TortsDocument23 pagesTwerski Tortslegale13No ratings yet

- Case StudyDocument3 pagesCase StudyAshish KumarNo ratings yet

- GST HS TradersDocument3 pagesGST HS TradersNihasNo ratings yet

- ReplevinDocument1 pageReplevingeoraw9588No ratings yet

- AJ&K Enlistment ChecklistDocument2 pagesAJ&K Enlistment ChecklistMuhammad Rafaqat GakharNo ratings yet

- ALFREDO N. AGUILA, JR, Petitioner, vs.Document3 pagesALFREDO N. AGUILA, JR, Petitioner, vs.Marvin A GamboaNo ratings yet

- Finman Digest OwnDocument5 pagesFinman Digest OwnTooMUCHcandyNo ratings yet

- Estate Tax Problems 2Document5 pagesEstate Tax Problems 2howaanNo ratings yet

- Managerial Prerogatice, Property Rights, and Labor Control in Employment Status DisputesDocument26 pagesManagerial Prerogatice, Property Rights, and Labor Control in Employment Status DisputesAnnieNo ratings yet

- Grotjahn GMBH Vs InansiDocument3 pagesGrotjahn GMBH Vs InansiStephanie ValentineNo ratings yet

- Nejmoa2302892 DisclosuresDocument8 pagesNejmoa2302892 Disclosuresalu0100537680No ratings yet

- Philippine Commercial and Industrial Bank V EscolinDocument157 pagesPhilippine Commercial and Industrial Bank V EscolinAaron James PuasoNo ratings yet

- LIGHT RAIL TRANSIT AUTHORITY & RODOLFO ROMAN vs. MARJORIE NAVIDADDocument2 pagesLIGHT RAIL TRANSIT AUTHORITY & RODOLFO ROMAN vs. MARJORIE NAVIDADCharles Roger RayaNo ratings yet

- Civ Rev 2 Preference of CreditsDocument23 pagesCiv Rev 2 Preference of CreditsShirley Marie Cada - CaraanNo ratings yet

- Sales of Goods ActDocument2 pagesSales of Goods ActvijaiNo ratings yet