Professional Documents

Culture Documents

Parents Policy Mother PDF

Parents Policy Mother PDF

Uploaded by

shamsehrOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Parents Policy Mother PDF

Parents Policy Mother PDF

Uploaded by

shamsehrCopyright:

Available Formats

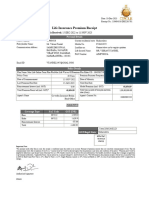

Date: 12-Dec-2022

Receipt No.: 17RB634247

Health Insurance Premium Receipt

Duration For Which the Premium is Received: 12-DEC-2022 to 11-DEC-2023

Personal Details

Policy Number: 179184330 Current residential state: Rohtak

Policyholder Name: Mrs. Ashraf Siddique Mobile No. 8860653606

Commuinication Address: House no-20, Ward No-5 Landline no. Please inform us for regular updates

Near Ganpati Tent House Health Insured Name: MR. ASHRAF

Camp Area, PAN Number: CHAPA7628B

GANDHI NAGAR Camp

Rohtak - 124001

Email ID: tech.shanu786@GMAIL.COM

Policy Details

Plan Name: Max Life Online Term Plan PlusMax Life Waiver Of Premium Plus Rider CO - 104N092V02

Health Policy Term 1Year Premium Payment Frequency Yearly

Date of Commencement 12-DEC-2022 Date of Maturity Till 11-Jan-2027

Last Premium Due Date 12-DEC-2022 Next Due Date 12-Jan-2024

Reinstatement Interest (incl. GST) ` 0.00 Model Premium (incl. GST) 103,744.60

Total Premium Received (incl. GST)* 103,744.60 Total Sum Assured of base plan and term 5,00,00,0.00

rider (if any)

Agent's Name Coverfox Insurance Brokin Agent's Contact No.

18002005522

Head Office

GST Details

Coverage Type SAC Code GST (INR) GSTIN 27AACCM3201E1Z3

Base 997132 ` 194.83 GST Regd. State Delhi

Rider 997132 ` 10.28 Affix

Reinstatement Interest ` 0.00 Re1

revenue

Total ` 205.11

stamp

Important Note:

*For payment mode other than in cash, this receipt is conditional upon the credit in our account. Payment of premium amount does not constitute commencement of risk. The risk

commencement starts after acceptance of risk by us. *Amount received would be adjusted against the due premium as per terms and conditions of the policy. *Premium paid would be

eligible for deduction as per the provision of Income Tax Act, 1961. Kindly consult your tax advisor for more information. Tax benefits are liable to change due to changes in legislation

or government notification. *Applicable Taxes, Cesses and Levies, as per prevailing laws, shall be borne by you. *For GST purposes,this premium receipt is Tax Invoice.Assessable

Value in GST for Endowment First Year is 25%, Renewal Year is 12.5%; Single Premium Annuity is 10%; Term and Health is 100%. In case of unit linked product GST is applicable

on charges.

Authorised signatory

PRM20

You might also like

- Max Life Total Premium ReceiptDocument1 pageMax Life Total Premium ReceiptBhavik Thaker100% (1)

- Premium ReceiptsDocument1 pagePremium Receiptsmanojsh88870% (1)

- ICAB Manual - Tax Planning & Compliance (2020)Document584 pagesICAB Manual - Tax Planning & Compliance (2020)Tasmia Binte Habib100% (5)

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsRITIKANo ratings yet

- Ads653 Case StudyDocument14 pagesAds653 Case StudyAnis NajwaNo ratings yet

- Max Life InsuranceDocument1 pageMax Life InsuranceLohith Labhala100% (1)

- Taxation First Preboard 93 - QuestionnaireDocument16 pagesTaxation First Preboard 93 - QuestionnaireAmeroden AbdullahNo ratings yet

- (INCOME TAX-BUSINESS TAX) AnswersDocument37 pages(INCOME TAX-BUSINESS TAX) AnswersAeyjay Manangaran100% (1)

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailssatish varmaNo ratings yet

- Health Insurance Premium Receipt: Personal DetailsDocument1 pageHealth Insurance Premium Receipt: Personal DetailsRanjith BNo ratings yet

- Parents Policy Father PDFDocument1 pageParents Policy Father PDFshamsehrNo ratings yet

- Term Insurance Premium Receipt: Personal DetailsDocument1 pageTerm Insurance Premium Receipt: Personal DetailsRanjith BNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailsnitish rohiraNo ratings yet

- Life Insurance Premium ReceiptDocument1 pageLife Insurance Premium ReceiptChandPari AkulNo ratings yet

- 2018032388Document1 page2018032388Vengal reddyNo ratings yet

- Old LIC PremiumDocument2 pagesOld LIC PremiumVikrantTandelNo ratings yet

- Circi: InsuranceDocument1 pageCirci: InsuranceapplerajivNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsRanjith BNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailschanam bedantaNo ratings yet

- Life Insurance Premium Receipt: Duration For Which The Premium Is Received: 12-DEC-2017 To 11-JAN-2018 Personal DetailsDocument2 pagesLife Insurance Premium Receipt: Duration For Which The Premium Is Received: 12-DEC-2017 To 11-JAN-2018 Personal Detailsnitish rohiraNo ratings yet

- Policydownload 230207 000615-43Document1 pagePolicydownload 230207 000615-43Anindya SundarNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsHarsh Gandhi0% (1)

- Consolidated Premium Receipt (Chosen Policy)Document1 pageConsolidated Premium Receipt (Chosen Policy)sreeleoenterprisesNo ratings yet

- Life Insurance Premium ReceiptDocument1 pageLife Insurance Premium ReceiptVijayNo ratings yet

- Premium Receipt: ' 50,00,000.00 ' 853.78 13-DEC-2020 To 12-JAN-2021 13-JAN-2021Document1 pagePremium Receipt: ' 50,00,000.00 ' 853.78 13-DEC-2020 To 12-JAN-2021 13-JAN-2021ceogaursNo ratings yet

- Premium Receipts2Document1 pagePremium Receipts2sudhir_gsrcNo ratings yet

- Zprmrnot - 22303149 - 12926353 2Document1 pageZprmrnot - 22303149 - 12926353 2RKGUPTANo ratings yet

- Personal Details: Duration For Which The Premium Is Received: 01/04/2023Document1 pagePersonal Details: Duration For Which The Premium Is Received: 01/04/2023bbarle69No ratings yet

- Mh43av0575 Utkarsha SharmaDocument2 pagesMh43av0575 Utkarsha SharmaJainam AjmeraNo ratings yet

- Personal Details: Duration For Which The Premium Is Received: 28/07/2021Document1 pagePersonal Details: Duration For Which The Premium Is Received: 28/07/2021ravi kumarNo ratings yet

- 118921519_20240205T184254Document1 page118921519_20240205T184254Venkey DemattiNo ratings yet

- Zprmrnot 20927762 24235025 231002 181434Document2 pagesZprmrnot 20927762 24235025 231002 181434aanandaman1098No ratings yet

- Premium Receipts PDFDocument1 pagePremium Receipts PDFAJAY JAISWALNo ratings yet

- Max Life Term PlanDocument1 pageMax Life Term PlanShreya JadhavNo ratings yet

- GPA PolicyDocument10 pagesGPA Policyparas INSURANCENo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsUttam kumar chintuNo ratings yet

- Saw G Payment ReceiptDocument1 pageSaw G Payment ReceiptrinkukjanNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsVijay PendurthiNo ratings yet

- Zprmrnot - 22442221 - 9000233 2Document1 pageZprmrnot - 22442221 - 9000233 2Manju SinghalNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsNeeraj TyagiNo ratings yet

- Zprmrnot 23345535 17208239Document1 pageZprmrnot 23345535 17208239bharat4u04No ratings yet

- Life Insurance 47KDocument1 pageLife Insurance 47KRaghupathi PaindlaNo ratings yet

- Consolidated Premium ReceiptDocument1 pageConsolidated Premium ReceiptBhavik ThakerNo ratings yet

- Premium Paid Certificate: Personal DetailsDocument1 pagePremium Paid Certificate: Personal Detailsravikumar281287No ratings yet

- Medical InsuranceDocument1 pageMedical InsuranceMasood Ahmad100% (1)

- Life Insurance InvoiceDocument1 pageLife Insurance InvoiceAkash DesaiNo ratings yet

- Premium ReceiptDocument1 pagePremium Receiptsvruma2No ratings yet

- eRRS 01962015 22092022162212 1Document2 pageseRRS 01962015 22092022162212 1Prakash GadadNo ratings yet

- Medical InsuranceDocument1 pageMedical Insurancesunil dinodiyaNo ratings yet

- Zprmrnot - 22253699 - 17202314 2Document1 pageZprmrnot - 22253699 - 17202314 2Inder Raj GuptaNo ratings yet

- Zprmrnot 23614257 14778150Document1 pageZprmrnot 23614257 14778150c97rvkkyfrNo ratings yet

- Ap09cn9438 Krishna HydDocument2 pagesAp09cn9438 Krishna Hydsarath potnuriNo ratings yet

- All Risk PolicyDocument25 pagesAll Risk PolicyPlanning DAPLNo ratings yet

- Premium Receipts1Document1 pagePremium Receipts1sudhir_gsrcNo ratings yet

- Consolidated ReceiptDocument1 pageConsolidated ReceiptSaket TiwariNo ratings yet

- Premium Paid Certificate: 11,27,500.00 1,04,806.26 07-MAR-2024 To 06-MAR-2025 07-MAR-2025Document1 pagePremium Paid Certificate: 11,27,500.00 1,04,806.26 07-MAR-2024 To 06-MAR-2025 07-MAR-2025tomarneptuneNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal Detailskathik MNo ratings yet

- UnlockedDocument1 pageUnlockedAshish NaikNo ratings yet

- Medical InsuranceDocument1 pageMedical InsuranceMasood AhmadNo ratings yet

- PolicyDocument2 pagesPolicypinki gNo ratings yet

- Renewal Notice - Tw-AnilagrDocument2 pagesRenewal Notice - Tw-AnilagrRakesh VermaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Booking Details - OYODocument2 pagesBooking Details - OYOshamsehrNo ratings yet

- Yashika Vohra CV.Document4 pagesYashika Vohra CV.shamsehrNo ratings yet

- CRN7931628646Document3 pagesCRN7931628646shamsehrNo ratings yet

- Prateek Sharma DevOpsDocument3 pagesPrateek Sharma DevOpsshamsehrNo ratings yet

- DevOps CVDocument1 pageDevOps CVshamsehrNo ratings yet

- Kishore Kumar 914266114Document5 pagesKishore Kumar 914266114shamsehrNo ratings yet

- Sample Coding Test - V1Document2 pagesSample Coding Test - V1shamsehrNo ratings yet

- Digesh Gathani 767297802Document4 pagesDigesh Gathani 767297802shamsehrNo ratings yet

- Alok Singh ResumeDocument3 pagesAlok Singh ResumeshamsehrNo ratings yet

- Rajesh Rawool 914266114 PDFDocument5 pagesRajesh Rawool 914266114 PDFshamsehrNo ratings yet

- Sreeja Kurup 905888970 PDFDocument5 pagesSreeja Kurup 905888970 PDFshamsehrNo ratings yet

- CV Ashish DangiDocument2 pagesCV Ashish DangishamsehrNo ratings yet

- Prasad's Resume PDFDocument1 pagePrasad's Resume PDFshamsehrNo ratings yet

- Mobile Bill MarchDocument1 pageMobile Bill MarchshamsehrNo ratings yet

- Hritik MahirraoDocument2 pagesHritik MahirraoshamsehrNo ratings yet

- Parents Policy Father PDFDocument1 pageParents Policy Father PDFshamsehrNo ratings yet

- PaymentReceipt PDFDocument1 pagePaymentReceipt PDFshamsehrNo ratings yet

- Rent Receipt PDFDocument6 pagesRent Receipt PDFshamsehrNo ratings yet

- Treasury Presentation To TBAC ChartsDocument47 pagesTreasury Presentation To TBAC Chartsrichardck61No ratings yet

- Fnsacc411 Process Business Tax RequirementsDocument14 pagesFnsacc411 Process Business Tax RequirementsStephanie NGNo ratings yet

- Condition TypeDocument18 pagesCondition TypeDeepak SangramsinghNo ratings yet

- Hdfcslic: Preferred Partner in Your Financial PlanningDocument17 pagesHdfcslic: Preferred Partner in Your Financial PlanningSandeep BorseNo ratings yet

- Lesson 4 Final Income Taxation PDFDocument4 pagesLesson 4 Final Income Taxation PDFErika ApitaNo ratings yet

- Bhupendar 02 AprDocument1 pageBhupendar 02 AprVikram JoshiNo ratings yet

- Commission Rates For All Plans-1Document1 pageCommission Rates For All Plans-1Gaurav KumarNo ratings yet

- Revenue Memorandum Circular (RMC) No. 44-2005 Taxation of Payments For SoftwareDocument10 pagesRevenue Memorandum Circular (RMC) No. 44-2005 Taxation of Payments For SoftwareKriszanFrancoManiponNo ratings yet

- CIR vs. Eastern Telecommunications PhilippinesDocument3 pagesCIR vs. Eastern Telecommunications PhilippinesNathalie YapNo ratings yet

- Work Contract Under West Bengal Vat ActDocument3 pagesWork Contract Under West Bengal Vat Actraj2404No ratings yet

- IRAS E-Tax Guide: Deductibility of "Keyman" Insurance PremiumsDocument8 pagesIRAS E-Tax Guide: Deductibility of "Keyman" Insurance PremiumsSampath VimalaNo ratings yet

- Corporation As A TaxpayerDocument27 pagesCorporation As A TaxpayerBSA-2C John Dominic Mia100% (1)

- 61a38d5c7b74a - INcome Tax and ETA HandwrittenDocument15 pages61a38d5c7b74a - INcome Tax and ETA HandwrittenAnuska ThapaNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: COBPS9708EDocument2 pagesIndian Income Tax Return Acknowledgement 2021-22: COBPS9708Evikas guptaNo ratings yet

- Types of Finance DeficitDocument8 pagesTypes of Finance DeficitRezel FuntilarNo ratings yet

- Lectures of Atty. Japar B. Dimampao: Tax Notes (Legal Ground)Document106 pagesLectures of Atty. Japar B. Dimampao: Tax Notes (Legal Ground)Zaira Gem GonzalesNo ratings yet

- The Head Office of North Central LTD Has Operated in PDFDocument2 pagesThe Head Office of North Central LTD Has Operated in PDFTaimur TechnologistNo ratings yet

- Tax Receipt Transport Department, Government of West Bengal Registration Authority UTTAR DINAJPUR RTO, West BengalDocument1 pageTax Receipt Transport Department, Government of West Bengal Registration Authority UTTAR DINAJPUR RTO, West BengalSiwam ChoudharyNo ratings yet

- Payroll Accounting 2018 28th Edition Bieg Test BankDocument15 pagesPayroll Accounting 2018 28th Edition Bieg Test Bankloanazura7k6bl100% (30)

- Tan vs. Del RosarioDocument1 pageTan vs. Del RosarioFaustina del RosarioNo ratings yet

- Invoice No.1197Document2 pagesInvoice No.1197LL Lawwise Consultech India Pvt LtdNo ratings yet

- Rev SKBPP Forms1 3Document3 pagesRev SKBPP Forms1 3Naka Ng TetengNo ratings yet

- (Reviewer) TaxDocument13 pages(Reviewer) TaxchxrlttxNo ratings yet

- B2C QuotationDocument5 pagesB2C QuotationSANSKAR AGRAWALNo ratings yet

- BIR Certificate of Donation (2322)Document2 pagesBIR Certificate of Donation (2322)Bogee RomeroNo ratings yet

- Invoices 2022Document42 pagesInvoices 2022Awais Ahmed NiaziNo ratings yet