Professional Documents

Culture Documents

BTG Pactual - Dividend Tax PDF

BTG Pactual - Dividend Tax PDF

Uploaded by

Thais Viana FerreiraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BTG Pactual - Dividend Tax PDF

BTG Pactual - Dividend Tax PDF

Uploaded by

Thais Viana FerreiraCopyright:

Available Formats

BTG Pactual Global Research

Banco BTG Pactual S.A.

Strategy Note

Brazil Strategy 13 December 2022

Analysts

Corporate impact of dividend tax and end of IoE

Carlos Sequeira, CFA

New York – BTG Pactual US Capital LLC

Taxing dividends and ending IoE could increase government income carlos.sequeira@btgpactual.com

With the end of the electoral cycle, the newly elected Lula administration began +1 646 924 2479

discussions to adjust the 2023 budget and propose a new fiscal framework in order to

substitute the spending cap rule, approved back in 2016. With the new government Osni Carfi

Brazil – Banco BTG Pactual S.A.

indicating it plans to materially increase expenses, especially to beef up social osni.carfi@btgpactual.com

programs, discussions on how to fund them should be on top of the policy agenda. +55 11 3383 2634

One way to increase government income would be taxing dividends and ending the

tax break generated by interest on equity (IoE) payments. Guilherme Guttilla

Brazil – Banco BTG Pactual S.A.

guilherme.guttilla@btgpactual.com

Impact on corporates and their shareholders could be relevant +55 11 3383 9684

We ran two exercises with 140 Brazilian companies to better understand the impacts

of these potential changes on the companies we cover: i) 15% tax on dividends, end

of IoE, and no reduction in corporate income tax; and ii) same hypotheses as the

previous scenario, but with a 5p.p. reduction in corporate income tax. We also

assume companies won’t change their current dividend payouts or capital structures.

We ran both scenarios for 2023 and 2024 expected earnings, but we consider it

extremely unlikely that the potential reform would take effect in 2023 (more on that

below).

Banks, Telecoms and Ambev to suffer most

Companies that are heavy IoE payers, like banks and telcos, would suffer the most. In

the first scenario (15% dividend tax, end of IoE, without any offset), both sectors

would experience a 17% drop in their 2024 earnings. Meanwhile, the second scenario

(15% dividend tax, end of IoE and 5p.p. reduction in tax rate) would drive down

earnings by 10%. Ambev, also a heavy payer of IoE, would suffer from this type of

legislation. Stocks that are seen by investors as bond proxies may also be penalized,

as dividends would lose competitiveness vs. bond yields – Utilities could fall into this

group.

Earnings would grow for those not paying IoE, but dividends would fall

In general, companies that don’t make IoE payments should see their earnings

increase if the government reduces the tax rate. Considering our second scenario

(incl. a tax cut of 5p.p.), we estimate earnings for general retail, internet providers

(ISPs) and food companies would increase 6-7% in 2024. Still, even though some

companies will see their earnings go up, their shareholders will probably receive fewer

dividends.

Side effects: Increased stock buybacks and leverage; more earnings

reinvested

One side effect of the potential legislation is that companies may choose to prioritize

share buybacks instead of cash distribution. We could also see companies, especially

those with inefficient capital structures, leveraging up their balance sheets in order to

reduce their taxable income. Finally, a dividend tax could lead companies to reduce

their dividend payouts and re-invest bigger chunks of their earnings (or maybe

increase their appetites for M&As).

ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 10

Banco BTG Pactual S.A. does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could

affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Any U.S. person receiving this report and wishing to effect any

transaction in a security discussed in this report should do so with BTG Pactual US Capital, LLC at 212-293-4600, 601 Lexington Avenue. 57th Floor, New York NY 10022

Document copied by arlindo.carvalho@btgpactual.com

Brazil Strategy BTG Pactual Global Research

Strategy Note - 13 December 2022 Banco BTG Pactual S.A.

Corporate impact of dividend tax and end of IoE

With the end of the electoral cycle, the newly elected Lula administration began

discussions to adjust the 2023 budget and propose a new fiscal framework in order to

substitute the spending cap rule, approved back in 2016. With the new government

indicating it plans to materially increase expenses, especially to beef up social

programs, discussions on how to fund them should be on top of the policy agenda.

The proposed 2023 spending cap “waiver” currently being discussed in Congress is

likely to total 1.6-2.0% of GDP and lead to a sizable primary deficit next year (down

from a 1.3% surplus forecasted for 2022, see our December 10SIM). If the draft bill

voted and approved in the Senate is also approved in the Lower House, debt-to-GDP

simulations are likely to point to a significant increase over the next few years, with

gross debt reaching 89% of GDP at the end of the new government’s mandate (up

from 74% at YE22).

To avoid deterioration in risk premia, an increase in real interest rates, and a worse

growth/inflation combo, not to mention potential credit-rating downgrades along the

way, the new administration will likely need to find offsets to finance more spending,

making revenue measures a must.

One way to increase government income would be taxing dividends (something

discussed for years) and ending the tax breaks generated by interest on equity (IoE)

payments. BTG Pactual's macroeconomics team estimates that a potential 15% tax

on corporate dividends combined with the end of IoE would increase government

revenues by R$47-61bn in 2023 and R$50-65bn in 2024. The range relates to the

fact that the amount of dividends distributed by companies would probably decrease

if a tax were created.

It is important to highlight that higher revenues will not fix the breach of the spending

cap and open up room for more social programs, as under the current legislation, this

would only be possible by reducing expenses (at least while the spending cap rule is

in place). However, with the growing demand to increase expenditures, higher taxes

would be the most likely way for the government to counteract the upward trajectory

of Brazil’s debt-to-GDP ratio.

To minimize the negative market reaction related to taxing dividends and ending IoE,

the government could potentially propose an offset in the new legislation. Throughout

the report, we will analyze the impact on companies in two possible scenarios, with

the first considering only dividend taxation and the end of IoE, and the second adding

an offset via a 5p.p. reduction in corporate income tax (falling from 25% to 20%, or

34% to 29% considering the CSLL tax).

Interestingly, if the decrease in corporate income tax is in effect implemented, even if

only 5p.p., the impact on government revenues of the described changes to taxation

would be negative, according to our conservative estimates (-R$5.0bn in 2023 and -

R$5.4bn in 2024). In our more optimistic scenario, the combined impact of a 15%

dividend tax, end of IoE and a 5p.p. reduction in corporate taxes, would be of

increasing government revenues +R$9.3bn in 2023 and +R$9.8bn in 2024.

In our view, with the deterioration in fiscal policy, scenarios in which the increase in

the tax burden is neutral will probably not work. So, to finance these extra expenses

and slow the trajectory of public debt, the tax burden will likely have to rise.

Brazil Strategy Page 2

Document copied by arlindo.carvalho@btgpactual.com

Brazil Strategy BTG Pactual Global Research

Strategy Note - 13 December 2022 Banco BTG Pactual S.A.

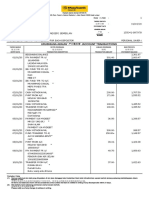

Table 1: Fiscal space created by taxing dividends and Table 2: Fiscal space created by taxing dividends and

ending IoE (for 2023) ending IoE (for 2024)

Conservative assumptions Optimistic assumptions Conservative assumptions Optimistic assumptions

Dividends (15%) 32.1 46.4 Dividends (15%) 34.2 49.4

IoE (ending) 14.5 14.5 IoE (ending) 15.4 15.4

Total 46.6 60.9 Total 49.6 64.8

Income tax (-5%) (51.6) (51.6) Income tax (-5%) (55.0) (55.0)

Total (5.0) 9.3 Total (5.4) 9.8

Source: BTG Pactual estimates Source: BTG Pactual estimates

Impact of lower corporate income tax, no IoE, and dividend

taxation

We ran two exercises with 140 Brazilian companies to better understand the impacts

of these changes on the companies we cover.

Since we don't know exactly what reform the new government will seek, we decided

to run the analysis considering two possible scenarios:

i. Worst case scenario: 15% tax on dividends, end of IoE, and no reduction in

corporate income tax.

ii. Same hypotheses as the previous scenario, but with an offset via a 5p.p.

reduction in income tax.

We also assume companies won’t change their current dividend payout policies (i.e.,

companies paying 100% of net income in dividends will continue doing so) or capital

structures. We then compared our earnings estimates pre- and post-tax changes.

We ran both scenarios for 2023 and 2024 expected earnings, but we consider it

extremely unlikely that the potential reform would take effect in 2023.

According to the Federal Constitution, the government cannot levy taxes in the same

financial year in which the law that created them was enacted. Thus, for a tax on

dividends and the end of IoE to be implemented next year, the government would

have to pass the new law in both houses of Congress by December of this year,

something we consider very unlikely, if not impossible.

Banks, telecoms, and Ambev to suffer most

Companies that are heavy IoE payers, like banks and telcos, would suffer the most.

Their effective tax rates would go up, and their earnings would fall. In the first

scenario (15% tax on dividends, end of IoE without any offset), both sectors would

experience a drop of 17% in their 2024 consolidated earnings. Meanwhile, the

second scenario (15% tax on dividends, 5p.p. reduction in corporate income tax and

end of IoE) would drive down earnings by 10%.

Ambev is another heavy IoE payer that would suffer from this kind of legislation.

Assuming the company doesn’t change its capital structure, the negative impact on

2024E earnings could reach 23% in the worst-case scenario and 18% considering

a tax cut of 5p.p.

Interestingly, our estimates point to consolidated earnings barely changing in the

second scenario (down only 1%). The negative impact of the end of the IoE tax break

Brazil Strategy Page 3

Document copied by arlindo.carvalho@btgpactual.com

Brazil Strategy BTG Pactual Global Research

Strategy Note - 13 December 2022 Banco BTG Pactual S.A.

would be almost entirely offset by the lower corporate income tax rate (naturally, the

impact varies significantly across sectors). On the other hand, in our worst-case

scenario, consolidated earnings would drop 8%.

Chart 1: Scenario 1 (end of IoE and same tax rate) – Chart 2: Scenario 2 (5p.p. tax cut + end of IoE) -

Negatively impacted sectors Negatively impacted sectors

Source: BTG Pactual estimates Source: BTG Pactual estimates

It is important to highlight that investors in companies that are big IoE payers are

already taxed at 15% when they receive these proceeds. So, the final impact of the

new legislation on investors’ proceeds from high IoE payers is not as high as it may

seem at first glance.

Earnings would grow for those not paying IoE, but post-tax dividends

would fall

On the other hand, in general, companies that do not make IoE payments should see

their earnings increase if the government reduces the corporate tax rate. Obviously,

no company would increase earnings in our worst-case scenario, as there is no offset

for the end of IoE.

Considering our second scenario (15% tax on dividends, tax cut of 5p.p. and end of

IoE), we estimate that earnings of general retail, internet providers (ISPs) and food

companies would increase 6-7% in 2024.

Chart 3: Scenario 2 (5p.p. tax cut + end of IoE) - Positively impacted

sectors

Source: BTG Pactual estimates

Brazil Strategy Page 4

Document copied by arlindo.carvalho@btgpactual.com

Brazil Strategy BTG Pactual Global Research

Strategy Note - 13 December 2022 Banco BTG Pactual S.A.

Still, even though some companies will see their earnings increase, their

shareholders will probably receive fewer dividends (assuming payouts don’t change).

This is because the increase in earnings for those not paying IoE would not be

enough to offset the taxation of dividends.

Bond-like stocks may suffer, as they will lose competitiveness vs. bonds

Stocks that are seen by investors as bond proxies would also suffer more. Dividends

would be taxed, reducing their competitiveness vs. bond yields. We believe utilities

stocks, some telecom stocks, and Ambev, among others, may fall into this group.

Side effects: Increased stock buybacks and leverage; more

earnings reinvested

One possible side effect of this kind of new legislation is that companies may choose

to prioritize share buybacks instead of cash distributions. The acquired shares could

be cancelled and the share buyback would produce virtually the same effect to

shareholders as dividends would – except that some investors, especially those

looking for bond-like stocks, are really after the cash distributions.

Capital reductions could also be an option, as they work like dividend payments, but

with no taxes (although the government could also start taxing these).

We could also see companies, which in some cases operate with what some may

consider inefficient capital structures, leveraging up their balance sheets in a way to

take advantage of increased financial expenses to reduce their taxable income.

Finally, a dividend tax could lead companies to reduce their dividend payouts and re-

invest a bigger chunk of their earnings (or maybe increase their appetite for M&As).

Brazil Strategy Page 5

Document copied by arlindo.carvalho@btgpactual.com

Brazil Strategy BTG Pactual Global Research

Strategy Note - 13 December 2022 Banco BTG Pactual S.A.

Appendix: Impact by sector and company

Table 3: Scenario 1 (end of IoE) – Summary by sector Table 4: Scenario 2 (5p.p. tax cut + end of IoE) -

Summary by sector

Effective tax rate (%) Net income (R$mn) Effective tax rate (%) Net income (R$mn)

2023 2024 2023 2024 2023 2024 2023 2024

Agribusiness +0.0 p.p. +0.0 p.p. 0.0% 0.0% Agribusiness (2.7)p.p. (2.7)p.p. 3.7% 3.7%

Apparel +0.0 p.p. +0.0 p.p. -8.0% -8.0% Apparel (1.0)p.p. (1.0)p.p. -3.2% -2.4%

Banks +11.4 p.p. +11.1 p.p. -17.6% -16.9% Banks +6.4 p.p. +6.1 p.p. -10.4% -9.5%

Beverages +24.8 p.p. +20.3 p.p. -26.3% -22.8% Beverages +20.8 p.p. +16.1 p.p. -22.1% -18.1%

Capital Goods +6.3 p.p. +6.2 p.p. -8.2% -8.4% Capital Goods +0.9 p.p. +1.2 p.p. -1.4% -1.4%

E-commerce +6.0 p.p. +6.0 p.p. -8.0% -9.0% E-commerce +1.0 p.p. +1.0 p.p. -1.3% -2.3%

Financials ex-Banks +0.0 p.p. +0.0 p.p. -4.7% -4.2% Financials ex-Banks (3.2)p.p. (3.3)p.p. 2.8% 3.4%

Food +0.0 p.p. +0.0 p.p. -0.3% -0.5% Food (3.7)p.p. (3.7)p.p. 6.3% 6.1%

Food Retail +0.7 p.p. +0.7 p.p. -4.0% -4.0% Food Retail (3.8)p.p. (3.8)p.p. 1.6% 1.8%

General Retail +0.0 p.p. +0.0 p.p. -0.1% -0.1% General Retail (5.0)p.p. (5.0)p.p. 6.6% 6.7%

Healthcare +5.5 p.p. +3.8 p.p. -6.7% -5.0% Healthcare +0.6 p.p. (0.6)p.p. -1.2% 0.8%

Infrastructure +0.0 p.p. +0.0 p.p. -1.1% -0.9% Infrastructure (5.0)p.p. (5.0)p.p. 7.0% 7.3%

ISPs +0.0 p.p. +0.0 p.p. 0.0% 0.0% ISPs (4.1)p.p. (5.0)p.p. 5.6% 6.3%

Logistics +3.5 p.p. +2.9 p.p. -4.9% -4.7% Logistics (1.5)p.p. (2.1)p.p. 2.2% 2.5%

Metals & Mining +0.0 p.p. +0.0 p.p. -7.4% -9.2% Metals & Mining (5.0)p.p. (5.0)p.p. -0.6% -2.0%

Oil & Gas +0.0 p.p. +1.0 p.p. -2.9% -3.0% Oil & Gas (4.0)p.p. (4.0)p.p. 4.6% 4.6%

Pharma +10.0 p.p. +10.0 p.p. -10.4% -9.6% Pharma +5.0 p.p. +5.0 p.p. -4.2% -3.1%

Pulp & Paper +0.0 p.p. +0.0 p.p. -2.9% -9.4% Pulp & Paper (5.0)p.p. (5.0)p.p. 4.7% -3.1%

Real Estate +0.0 p.p. +0.0 p.p. -2.7% -2.7% Real Estate (5.0)p.p. (4.7)p.p. 2.3% 2.7%

Rental +6.0 p.p. +6.0 p.p. -9.8% -9.3% Rental +0.9 p.p. +0.9 p.p. -2.9% -2.4%

Technology +5.0 p.p. +5.7 p.p. -8.6% -8.1% Technology +4.3 p.p. +3.9 p.p. -4.7% -3.6%

Telecom +15.8 p.p. +12.4 p.p. -18.4% -17.0% Telecom +10.8 p.p. +7.4 p.p. -12.1% -10.2%

Utilities +0.0 p.p. +0.0 p.p. -2.4% -1.7% Utilities (5.0)p.p. (3.0)p.p. 3.3% 3.3%

Consolidated -7.9% -8.0% Consolidated -0.9% -1.1%

Source: BTG Pactual estimates Source: BTG Pactual estimates

Brazil Strategy Page 6

Document copied by arlindo.carvalho@btgpactual.com

Brazil Strategy BTG Pactual Global Research

Strategy Note - 13 December 2022 Banco BTG Pactual S.A.

Table 5: Impact by company (1/3)

5p.p. tax cut and no IoE Same tax rate and no IoE

Effective tax rate (%) Net income (R$mn) Effective tax rate (%) Net income (R$mn)

Company Ticker Sector 2023 2024 2023 2024 2023 2024 2023 2024

Bradesco BBDC4 Banks +9.1 p.p. +8.1 p.p. -12.9% -11.6% +14.1 p.p. +13.1 p.p. -20.0% -18.8%

Itau ITUB4 Banks +5.1 p.p. +5.0 p.p. -7.8% -7.7% +10.1 p.p. +10.0 p.p. -15.4% -15.4%

Banco do Brasil BBAS3 Banks +7.8 p.p. +7.6 p.p. -10.9% -10.9% +12.8 p.p. +12.6 p.p. -17.9% -18.0%

Santander SANB11 Banks +9.1 p.p. +7.1 p.p. -12.7% -10.5% +14.1 p.p. +12.1 p.p. -19.7% -17.9%

Banco ABC ABCB4 Banks +3.3 p.p. +4.5 p.p. -6.3% -8.6% +8.3 p.p. +9.5 p.p. -15.8% -18.0%

Banrisul BRSR6 Banks +8.5 p.p. +8.0 p.p. -11.3% -11.1% +13.5 p.p. +13.0 p.p. -18.0% -18.0%

Inter INBR32 Banks +3.1 p.p. +3.1 p.p. -4.3% -4.3% +8.1 p.p. +8.1 p.p. -11.3% -11.3%

Nubank NU Banks (5.0)p.p. (5.0)p.p. 6.6% 6.6% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Banks +6.4 p.p. +6.1 p.p. -10.4% -9.5% +11.4 p.p. +11.1 p.p. -17.6% -16.9%

Porto Seguro PSSA3 Financials ex-Banks +3.0 p.p. +2.7 p.p. -5.5% -4.9% +8.0 p.p. +7.7 p.p. -14.5% -13.9%

BB Seguridade BBSE3 Financials ex-Banks (3.2)p.p. (3.3)p.p. 7.7% 7.8% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

B3 B3SA3 Financials ex-Banks (0.0)p.p. (0.8)p.p. 0.1% 1.2% +5.0 p.p. +4.2 p.p. -7.0% -6.0%

BR Partners BRBI11 Financials ex-Banks (5.0)p.p. (5.0)p.p. 7.9% 7.8% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Cielo CIEL3 Financials ex-Banks +5.0 p.p. +5.0 p.p. -7.1% -7.1% +10.0 p.p. +10.0 p.p. -14.3% -14.3%

PagSeguro PAGS Financials ex-Banks (5.0)p.p. (5.0)p.p. 7.4% 7.5% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Stone STNE Financials ex-Banks (5.0)p.p. (5.0)p.p. 6.7% 7.3% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Financials ex-Banks (3.2)p.p. (3.3)p.p. 2.8% 3.4% +0.0 p.p. +0.0 p.p. -4.7% -4.2%

Telefônica Brasil VIVT3 Telecom +6.8 p.p. +7.3 p.p. -9.1% -10.1% +11.8 p.p. +12.3 p.p. -15.6% -17.0%

TIM Participações TIMS3 Telecom +14.8 p.p. +7.6 p.p. -17.8% -10.4% +19.8 p.p. +12.6 p.p. -23.7% -17.0%

Telecom +10.8 p.p. +7.4 p.p. -12.1% -10.2% +15.8 p.p. +12.4 p.p. -18.4% -17.0%

Brisanet BRIT3 ISPs (4.1)p.p. (5.0)p.p. 6.3% 8.3% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Unifique FIQE3 ISPs (5.0)p.p. (5.0)p.p. 7.9% 8.1% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Desktop DESK3 ISPs (2.7)p.p. (3.5)p.p. 3.4% 4.8% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

ISPs (4.1)p.p. (5.0)p.p. 5.6% 6.3% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Totvs TOTV3 Technology +5.3 p.p. +3.9 p.p. -7.4% -5.3% +10.0 p.p. +8.6 p.p. -13.5% -11.9%

Locaweb LWSA3 Technology (5.0)p.p. (5.0)p.p. 6.4% 6.9% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Intelbras INTB3 Technology +4.3 p.p. +4.4 p.p. -4.3% -4.8% +5.0 p.p. +5.7 p.p. -5.0% -6.1%

Technology +4.3 p.p. +3.9 p.p. -4.7% -3.6% +5.0 p.p. +5.7 p.p. -8.6% -8.1%

Vale VALE3 Metals & Mining (5.0)p.p. (5.0)p.p. 0.3% -1.2% +0.0 p.p. +0.0 p.p. -6.7% -8.6%

Gerdau GGBR4 Metals & Mining (5.0)p.p. (5.0)p.p. -4.3% -7.7% +0.0 p.p. +0.0 p.p. -10.9% -14.4%

CSN CSNA3 Metals & Mining (5.0)p.p. (5.0)p.p. -2.8% -1.7% +0.0 p.p. +0.0 p.p. -8.5% -8.5%

CMIN CMIN3 Metals & Mining (5.0)p.p. (5.0)p.p. -0.5% 0.1% +0.0 p.p. +0.0 p.p. -8.0% -7.5%

USIM USIM5 Metals & Mining (5.0)p.p. (5.0)p.p. -6.6% -8.3% +0.0 p.p. +0.0 p.p. -10.2% -10.2%

CBA CBAV3 Metals & Mining (5.0)p.p. (5.0)p.p. -0.6% -0.5% +0.0 p.p. +0.0 p.p. -8.5% -8.5%

Aura AURA33 Metals & Mining (5.0)p.p. (5.0)p.p. -0.6% -0.2% +0.0 p.p. +0.0 p.p. -6.8% -6.8%

Metals & Mining (5.0)p.p. (5.0)p.p. -0.6% -2.0% +0.0 p.p. +0.0 p.p. -7.4% -9.2%

Irani RANI3 Pulp & Paper (5.0)p.p. (5.0)p.p. -3.2% -5.3% +0.0 p.p. +0.0 p.p. -10.2% -12.9%

Klabin KLBN11 Pulp & Paper (5.0)p.p. (5.0)p.p. -1.5% -5.8% +0.0 p.p. +0.0 p.p. -10.0% -13.4%

Dexco DXCO3 Pulp & Paper (5.0)p.p. (5.0)p.p. -4.0% -3.7% +0.0 p.p. +0.0 p.p. -10.2% -10.2%

Suzano SUZB3 Pulp & Paper (5.0)p.p. (5.0)p.p. 5.9% -2.5% +0.0 p.p. +0.0 p.p. -1.5% -8.5%

Pulp & Paper (5.0)p.p. (5.0)p.p. 4.7% -3.1% +0.0 p.p. +0.0 p.p. -2.9% -9.4%

Multiplan MULT3 Real Estate +3.5 p.p. +2.9 p.p. -3.6% -3.2% +8.2 p.p. +7.4 p.p. -8.4% -8.4%

Aliansce Sonae ALSO3 Real Estate (3.8)p.p. (4.3)p.p. 3.5% 4.4% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

BR Malls BRML3 Real Estate (5.0)p.p. (6.4)p.p. 6.0% 8.4% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Iguatemi IGTI11 Real Estate (5.0)p.p. (3.3)p.p. 3.6% 2.8% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

SYN SYNE3 Real Estate n.a. (6.9)p.p. 14.4% 8.5% n.a. +0.0 p.p. 0.0% 0.0%

BR Properties BRPR3 Real Estate (5.1)p.p. (5.0)p.p. 6.3% 7.2% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

HBR HBRE3 Real Estate (5.0)p.p. (5.1)p.p. 6.8% 6.8% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

LOG LOGG3 Real Estate (3.9)p.p. (3.0)p.p. 5.8% 4.2% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Real Estate (5.0)p.p. (4.7)p.p. 2.3% 2.7% +0.0 p.p. +0.0 p.p. -2.7% -2.7%

Source: BTG Pactual estimates

Brazil Strategy Page 7

Document copied by arlindo.carvalho@btgpactual.com

Brazil Strategy BTG Pactual Global Research

Strategy Note - 13 December 2022 Banco BTG Pactual S.A.

Table 6: Impact by company (2/3)

5p.p. tax cut and no IoE Same tax rate and no IoE

Effective tax rate (%) Net income (R$mn) Effective tax rate (%) Net income (R$mn)

Company Ticker Sector 2023 2024 2023 2024 2023 2024 2023 2024

AES Brasil AESB3 Utilities (5.0)p.p. (5.0)p.p. 7.4% 7.7% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Alupar ALUP11 Utilities +0.0 p.p. +0.0 p.p. 0.0% 0.0% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Ambipar AMBP3 Utilities (5.0)p.p. (5.0)p.p. 8.1% 8.3% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Auren AURE3 Utilities (5.0)p.p. (5.0)p.p. 2.9% 3.1% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Copasa CSMG3 Utilities (1.0)p.p. (1.0)p.p. 1.5% 1.5% +4.0 p.p. +4.0 p.p. -5.8% -5.9%

CPFL CPFE3 Utilities (5.0)p.p. (5.0)p.p. 7.4% 7.4% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

EDP do Brasil ENBR3 Utilities (0.0)p.p. +0.1 p.p. 0.3% 0.0% +5.0 p.p. +5.1 p.p. -8.1% -8.2%

Eletrobras ELET3 Utilities (5.0)p.p. (5.0)p.p. 5.1% 3.7% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Energisa ENGI11 Utilities (5.0)p.p. (5.0)p.p. 7.9% 8.0% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Eneva ENEV3 Utilities (5.0)p.p. (5.0)p.p. 6.1% 6.3% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Engie brasil EGIE3 Utilities +1.8 p.p. +1.8 p.p. -1.8% -1.8% +6.8 p.p. +6.8 p.p. -6.9% -6.7%

Equatorial EQTL3 Utilities (5.0)p.p. (5.0)p.p. 6.1% 6.3% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

ISA Cteep TRPL4 Utilities +0.0 p.p. +0.0 p.p. 0.0% 0.0% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Light LIGT3 Utilities (5.0)p.p. (5.0)p.p. 5.2% 5.3% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Neoenergia NEOE3 Utilities +1.0 p.p. +1.0 p.p. -1.5% -1.6% +6.0 p.p. +6.0 p.p. -9.2% -9.8%

Omega MEGA3 Utilities +0.0 p.p. 0.0% 0.0% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Orizon ORVR3 Utilities (5.0)p.p. (5.0)p.p. 3.0% 4.7% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Sabesp SBSP3 Utilities (1.0)p.p. (1.0)p.p. 1.6% 1.7% +4.0 p.p. +4.0 p.p. -5.7% -5.9%

Sanepar SAPR11 Utilities +0.8 p.p. +0.8 p.p. -1.2% -1.2% +5.8 p.p. +5.8 p.p. -8.4% -8.6%

Taesa TAEE11 Utilities +0.0 p.p. +0.0 p.p. 0.0% 0.0% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Utilities (5.0)p.p. (3.0)p.p. 3.3% 3.3% +0.0 p.p. +0.0 p.p. -2.4% -1.7%

Panvel PNVL3 Pharma +5.0 p.p. +5.0 p.p. -6.1% -6.1% +10.0 p.p. +10.0 p.p. -12.0% -12.2%

Hypera HYPE3 Pharma +8.7 p.p. +8.6 p.p. -9.5% -8.2% +13.7 p.p. +13.6 p.p. -15.0% -14.1%

Raia Drogasil RADL3 Pharma (2.9)p.p. (2.9)p.p. 4.3% 4.3% +2.1 p.p. +2.1 p.p. -3.1% -3.1%

Pharma +5.0 p.p. +5.0 p.p. -4.2% -3.1% +10.0 p.p. +10.0 p.p. -10.4% -9.6%

Renner LREN3 Apparel +7.8 p.p. +7.8 p.p. -8.8% -9.3% +12.8 p.p. +12.8 p.p. -14.5% -15.2%

Arezzo ARZZ3 Apparel +0.2 p.p. (0.9)p.p. 3.4% 1.8% +5.2 p.p. +4.1 p.p. -6.0% -6.0%

C&A CEAB3 Apparel (5.0)p.p. (5.0)p.p. 7.6% 2.0% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Grupo SBF SBFG3 Apparel (5.0)p.p. (5.0)p.p. 1.9% 4.7% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Grupo Soma SOMA3 Apparel +0.0 p.p. (0.5)p.p. 0.0% 0.0% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Track&Field TFCO4 Apparel (1.0)p.p. (1.0)p.p. 1.3% 1.5% +4.0 p.p. +4.0 p.p. -5.5% -5.9%

Vulcabras VULC3 Apparel (3.4)p.p. (5.0)p.p. 3.5% 9.7% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Apparel (1.0)p.p. (1.0)p.p. -3.2% -2.4% +0.0 p.p. +0.0 p.p. -8.0% -8.0%

Magazine Luiza MGLU3 E-commerce +4.0 p.p. +4.0 p.p. -5.1% -5.1% +9.0 p.p. +9.0 p.p. -11.5% -11.6%

Americanas AMER3 E-commerce (1.0)p.p. (1.0)p.p. 1.4% 1.4% +4.0 p.p. +4.0 p.p. -5.7% -5.7%

Allied ALLD3 E-commerce +1.0 p.p. +1.0 p.p. -1.2% -1.3% +6.0 p.p. +6.0 p.p. -7.2% -7.7%

E-commerce +1.0 p.p. +1.0 p.p. -1.3% -2.3% +6.0 p.p. +6.0 p.p. -8.0% -9.0%

Carrefour CRFB3 Food Retail +0.8 p.p. +0.8 p.p. -1.3% -1.3% +4.8 p.p. +5.0 p.p. -7.7% -8.0%

Assaí ASAI3 Food Retail (3.5)p.p. (3.5)p.p. 4.1% 4.1% +1.5 p.p. +1.5 p.p. -1.7% -1.8%

Grupo Mateus GMAT3 Food Retail (4.0)p.p. (4.0)p.p. 4.2% 4.5% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Zamp ZAMP3 Food Retail (5.0)p.p. (5.0)p.p. 6.7% 6.8% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Food Retail (3.8)p.p. (3.8)p.p. 1.6% 1.8% +0.7 p.p. +0.7 p.p. -4.0% -4.0%

Lojas Quero-Quero LJQQ3 General Retail (3.1)p.p. (0.7)p.p. 4.5% 1.0% +1.9 p.p. +4.3 p.p. -2.8% -6.2%

Natura NTCO3 General Retail (5.0)p.p. (5.0)p.p. 6.7% 6.9% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Petz PETZ3 General Retail (5.0)p.p. (5.0)p.p. 7.2% 7.5% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

CVC CVCB3 General Retail (5.0)p.p. (5.0)p.p. 5.3% 4.9% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

EspaçoLaser ESPA3 General Retail (5.0)p.p. (5.0)p.p. 7.2% 7.3% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

SmartFit SMFT3 General Retail (5.0)p.p. (5.0)p.p. 6.9% 7.1% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Positivo POSI3 General Retail (5.0)p.p. (5.0)p.p. 5.6% 5.9% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

General Retail (5.0)p.p. (5.0)p.p. 6.6% 6.7% +0.0 p.p. +0.0 p.p. -0.1% -0.1%

Rede D'Or RDOR3 Healthcare +0.5 p.p. (0.7)p.p. -0.6% 0.8% +3.8 p.p. +2.7 p.p. -4.7% -3.7%

Fleury FLRY3 Healthcare +0.4 p.p. +0.7 p.p. -0.3% -1.2% +6.4 p.p. +5.7 p.p. -8.8% -8.5%

Qualicorp QUAL3 Healthcare +0.9 p.p. +0.8 p.p. -1.3% -1.2% +5.9 p.p. +5.8 p.p. -8.5% -8.3%

Odontoprev ODPV3 Healthcare (1.2)p.p. (1.1)p.p. 1.8% 1.6% +3.8 p.p. +3.9 p.p. -5.4% -5.6%

SulAmérica SULA11 Healthcare +2.3 p.p. (1.2)p.p. -3.3% 1.8% +7.3 p.p. +3.8 p.p. -10.8% -6.2%

Mater Dei MATD3 Healthcare (0.6)p.p. (1.8)p.p. 0.6% 1.9% +4.4 p.p. +3.2 p.p. -4.1% -3.6%

Viveo VVEO3 Healthcare +4.3 p.p. (0.5)p.p. -4.2% 0.3% +7.3 p.p. +3.0 p.p. -7.1% -3.7%

Blau BLAU3 Healthcare +0.8 p.p. +0.5 p.p. -1.0% -0.7% +5.2 p.p. +3.9 p.p. -7.1% -5.8%

Healthcare +0.6 p.p. (0.6)p.p. -1.2% 0.8% +5.5 p.p. +3.8 p.p. -6.7% -5.0%

Source: BTG Pactual estimates

Brazil Strategy Page 8

Document copied by arlindo.carvalho@btgpactual.com

Brazil Strategy BTG Pactual Global Research

Strategy Note - 13 December 2022 Banco BTG Pactual S.A.

Table 7: Impact by company (3/3)

5p.p. tax cut and no IoE Same tax rate and no IoE

Effective tax rate (%) Net income (R$mn) Effective tax rate (%) Net income (R$mn)

Company Ticker Sector 2023 2024 2023 2024 2023 2024 2023 2024

Ambev ABEV3 Beverages +20.8 p.p. +16.1 p.p. -22.1% -18.1% +24.8 p.p. +20.3 p.p. -26.3% -22.8%

Beverages +20.8 p.p. +16.1 p.p. -22.1% -18.1% +24.8 p.p. +20.3 p.p. -26.3% -22.8%

M. Dias Branco MDIA3 Food +1.4 p.p. +1.6 p.p. -1.5% -1.9% +3.8 p.p. +4.4 p.p. -4.1% -5.1%

JBS JBSS3 Food (4.6)p.p. (4.6)p.p. 7.3% 7.3% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Minerva BEEF3 Food (3.7)p.p. (3.7)p.p. 4.9% 4.9% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

BRF BRFS3 Food (3.7)p.p. (3.7)p.p. 5.2% 5.0% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Marfrig MRFG3 Food (3.7)p.p. (3.7)p.p. 8.1% 9.6% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Food (3.7)p.p. (3.7)p.p. 6.3% 6.1% +0.0 p.p. +0.0 p.p. -0.3% -0.5%

SLC Agrícola SLCE3 Agribusiness (3.8)p.p. (3.8)p.p. 5.2% 5.5% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

BrasilAgro AGRO3 Agribusiness (2.6)p.p. (2.6)p.p. 3.3% 3.4% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

São Martinho SMTO3 Agribusiness (3.7)p.p. (3.7)p.p. 4.3% 4.2% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Jalles Machado JALL3 Agribusiness (2.7)p.p. (2.8)p.p. 3.4% 3.6% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

3tentos TTEN3 Agribusiness (0.6)p.p. (1.2)p.p. 0.6% 1.0% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

AgroGalaxy AGXY3 Agribusiness +0.0 p.p. +0.0 p.p. 0.0% 0.0% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Agribusiness (2.7)p.p. (2.7)p.p. 3.7% 3.7% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Localiza RENT3 Rental +4.2 p.p. +3.6 p.p. -5.6% -4.8% +9.2 p.p. +8.6 p.p. -12.3% -11.4%

Movida MOVI3 Rental +0.9 p.p. +1.1 p.p. -1.3% -1.5% +5.9 p.p. +6.1 p.p. -8.3% -8.5%

Mils MILS3 Rental +1.0 p.p. +0.9 p.p. -1.3% -1.2% +6.0 p.p. +5.9 p.p. -8.3% -8.2%

Armac ARML3 Rental (0.5)p.p. (1.2)p.p. 0.7% 1.7% +4.5 p.p. +4.5 p.p. -6.4% -5.4%

Vamos VAMO3 Rental +0.9 p.p. +0.9 p.p. -1.3% -1.3% +6.0 p.p. +6.0 p.p. -8.3% -8.3%

Rental +0.9 p.p. +0.9 p.p. -2.9% -2.4% +6.0 p.p. +6.0 p.p. -9.8% -9.3%

Simpar SIMH3 Logistics (1.3)p.p. (1.4)p.p. 1.8% 2.0% +3.7 p.p. +3.6 p.p. -5.3% -5.1%

Sequoia SEQL3 Logistics (5.0)p.p. (5.0)p.p. 7.2% 7.4% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

JSL JSLG3 Logistics +1.4 p.p. +1.4 p.p. -1.8% -1.8% +6.4 p.p. +6.4 p.p. -8.5% -8.5%

Tegma TGMA3 Logistics (1.5)p.p. (2.1)p.p. -3.0% -1.8% +3.5 p.p. +2.9 p.p. -9.4% -8.3%

GPS GGPS3 Logistics (5.0)p.p. (5.0)p.p. 7.6% 7.6% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Logistics (1.5)p.p. (2.1)p.p. 2.2% 2.5% +3.5 p.p. +2.9 p.p. -4.9% -4.7%

Aeris AERI3 Capital Goods (5.0)p.p. (5.0)p.p. 5.9% 5.9% +0.0 p.p. (0.0)p.p. 0.0% 0.0%

Embraer EMBR3 Capital Goods +6.8 p.p. +6.9 p.p. -8.2% -8.3% +11.8 p.p. +11.9 p.p. -14.2% -14.3%

Randon RAPT4 Capital Goods +1.1 p.p. +1.1 p.p. -1.7% -1.7% +6.1 p.p. +6.1 p.p. -9.3% -9.3%

Fras-le FRAS3 Capital Goods +0.8 p.p. +3.3 p.p. -1.0% -4.3% (5.0)p.p. (5.0)p.p. -7.6% -10.9%

Marcopolo POMO4 Capital Goods +6.9 p.p. +6.1 p.p. -8.8% -7.8% +11.9 p.p. +11.1 p.p. -15.3% -14.3%

Iochpe-Maxion MYPK3 Capital Goods (0.9)p.p. (0.7)p.p. 1.5% 1.2% +6.9 p.p. +7.1 p.p. -11.7% -11.8%

Tupy TUPY3 Capital Goods +0.8 p.p. +0.8 p.p. -1.1% -1.1% +5.8 p.p. +5.8 p.p. -8.0% -8.0%

WEG WEGE3 Capital Goods +1.5 p.p. +1.3 p.p. -0.4% -0.1% +6.5 p.p. +6.3 p.p. -6.5% -6.5%

Capital Goods +0.9 p.p. +1.2 p.p. -1.4% -1.4% +6.3 p.p. +6.2 p.p. -8.2% -8.4%

Rumo RAIL3 Infrastructure (5.0)p.p. (5.0)p.p. 6.8% 7.6% +0.0 p.p. (0.0)p.p. 0.0% 0.0%

CCR CCRO3 Infrastructure (5.0)p.p. (5.0)p.p. 9.9% 9.4% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Ecorodovias ECOR3 Infrastructure (5.0)p.p. (5.0)p.p. 8.3% 8.3% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Santos Brasil STBP3 Infrastructure (0.0)p.p. +0.8 p.p. 0.0% -1.1% +5.0 p.p. +5.0 p.p. -6.9% -8.0%

Wilson Sons PORT3 Infrastructure (5.0)p.p. (5.0)p.p. 7.6% 7.6% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Hidrovias do Brasil HBSA3 Infrastructure (5.0)p.p. (5.0)p.p. 7.1% 7.1% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Infrastructure (5.0)p.p. (5.0)p.p. 7.0% 7.3% +0.0 p.p. +0.0 p.p. -1.1% -0.9%

Petrobras PETR4 Oil & Gas (3.0)p.p. (3.0)p.p. 4.5% 4.6% +2.0 p.p. +2.0 p.p. -3.0% -3.1%

Ultrapar UGPA3 Oil & Gas (3.0)p.p. (3.0)p.p. 4.4% 4.6% +2.0 p.p. +2.0 p.p. -3.0% -3.0%

Vibra VBBR3 Oil & Gas +1.0 p.p. +1.0 p.p. -1.4% -1.5% +6.0 p.p. +6.0 p.p. -8.3% -8.8%

Raízen RAIZ4 Oil & Gas (1.0)p.p. (1.0)p.p. 1.4% 1.5% +4.0 p.p. +4.0 p.p. -5.7% -6.0%

Cosan CSAN3 Oil & Gas +0.0 p.p. (1.0)p.p. n.a. 1.3% +0.0 p.p. +4.0 p.p. n.a. -5.1%

PetroRio PRIO3 Oil & Gas (5.0)p.p. (5.0)p.p. 7.6% 8.0% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

3R Petroleum RRRP3 Oil & Gas (5.0)p.p. (5.0)p.p. 6.3% 6.5% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

PetroReconcavo RECV3 Oil & Gas (5.0)p.p. (5.0)p.p. 5.9% 6.2% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Braskem BRKM5 Oil & Gas (5.0)p.p. (5.0)p.p. 7.3% 7.5% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Dexxos DEXP3 Oil & Gas (5.0)p.p. (5.0)p.p. 7.1% 7.4% +0.0 p.p. +0.0 p.p. 0.0% 0.0%

Oil & Gas (4.0)p.p. (4.0)p.p. 4.6% 4.6% +0.0 p.p. +1.0 p.p. -2.9% -3.0%

Consolidated -0.9% -1.1% -7.9% -8.0%

Source: BTG Pactual estimates

Brazil Strategy Page 9

Document copied by arlindo.carvalho@btgpactual.com

Brazil Strategy BTG Pactual Global Research

Strategy Note - 13 December 2022 Banco BTG Pactual S.A.

Disclosures

Required Disclosure

This report has been prepared by Banco BTG Pactual S.A.

The figures contained in performance charts refer to the past; past performance is not a reliable indicator of future results.

Analyst Certificate

Each research analyst primarily responsible for the content of this investment research report, in whole or in part, certifies that:

(i) all of the views expressed accurately reflect his or her personal views about those securities or issuers, and such recommendations were elaborated independently, including

in relation to Banco BTG Pactual S.A. and/or its affiliates, as the case may be;

(ii) no part of his or her compensation was, is, or will be, directly or indirectly, related to any specific recommendations or views contained herein or linked to the price of any of

the securities discussed herein.

Research analysts contributing to this report who are employed by a non-US Broker dealer are not registered/qualified as research analysts with FINRA and therefore are not

subject to the restrictions contained in the FINRA rules on communications with a subject company, public appearances, and trading securities held by a research analyst

account.

Part of the analyst compensation comes from the profits of Banco BTG Pactual S.A. as a whole and/or its affiliates and, consequently, revenues arisen from transactions held by

Banco BTG Pactual S.A. and/or its affiliates.

Where applicable, the analyst responsible for this report and certified pursuant to Brazilian regulations will be identified in bold on the first page of this report and will be the first

name on the signature list.

Global Disclaimer

This report has been prepared by Banco BTG Pactual S.A. (“BTG Pactual S.A.”), a Brazilian regulated bank. BTG Pactual S.A. is the responsible for the distribution of this report

in Brazil. BTG Pactual US Capital LLC (“BTG Pactual US”), a broker-dealer registered with the U.S. Securities and Exchange Commission and a member of the Financial

Industry Regulatory Authority and the Securities Investor Protection Corporation is distributing this report in the United States. BTG Pactual US is an affiliate of BTG Pactual S.A.

BTG Pactual US assumes responsibility for this research for purposes of U.S. law. Any U.S. person receiving this report and wishing to effect any transaction in a security

discussed in this report should do so with BTG Pactual US at 212-293-4600, 601 Lexington Ave. 57th Floor, New York, NY 10022.

This report is being distributed in the United Kingdom and elsewhere in the European Economic Area (“EEA”) by BTG Pactual (UK) Limited (“BTG Pactual UK”), which is

authorized and regulated by the Financial Conduct Authority of the United Kingdom. BTG Pactual UK has not: (i) produced this report, (ii) substantially altered its contents, (iii)

changed the direction of the recommendation, or (iv) disseminated this report prior to its issue by BTG Pactual US. BTG Pactual UK does not distribute summaries of research

produced by BTG Pactual US.

BTG Pactual Chile S.A. Corredores de Bolsa (“BTG Pactual Chile”), formerly known as Celfin Capital S.A. Corredores de Bolsa, is a Chilean broker dealer registered with

Comisión para el Mercado Financiero (CMF) in Chile and responsible for the distribution of this report in Chile and BTG Pactual Perú S.A. Sociedad Agente de Bolsa (“BTG

Pactual Peru”), formerly known as Celfin Capital S.A. Sociedad Agente e Bolsa, registered with Superintendencia de Mercado de Valores (SMV) de Peru is responsible for the

distribution of this report in Peru. BTG Pactual Chile and BTG Pactual Peru acquisition by BTG Pactual S.A. was approved by the Brazilian Central Bank on November 14th,

2012.

BTG Pactual S.A. Comisionista de Bolsa (“BTG Pactual Colombia”) formerly known as Bolsa y Renta S.A. Comisionista de Bolsa, is a Colombian broker dealer register with the

Superintendencia Financeira de Colombia and is responsible for the distribution of this report in Colombia. BTG Pactual Colombia acquisition by BTG Pactual S.A. was approved

by Brazilian Central Bank on December 21st, 2012.

BTG Pactual Argentina is a broker dealer (Agente de Liquidación y Compensación y Agente de Negociación Integral ) organized and regulated by Argentinean law, registered

with the Exchange Commission of Argentina (Comisión Nacional de Valores) under license Nro. 720 and responsible for the distribution of this report in Argentina. Additionally,

the Brazilian Central Bank approved the indirect controlling participation of Banco BTG Pactual S.A. in BTG Pactual Argentina on September 1st, 2017.

References herein to BTG Pactual include BTG Pactual S.A., BTG Pactual US Capital LLC, BTG Pactual UK, BTG Pactual Chile and BTG Pactual Peru and BTG Pactual

Colombia and BTG Pactual Argentina as applicable. This report is for distribution only under such circumstances as may be permitted by applicable law. This report is not

directed at you if BTG Pactual is prohibited or restricted by any legislation or regulation in any jurisdiction from making it available to you. You should satisfy yourself before

reading it that BTG Pactual is permitted to provide research material concerning investments to you under relevant legislation and regulations. Nothing in this report constitutes a

representation that any investment strategy or recommendation contained herein is suitable or appropriate to a recipient’s individual circumstances or otherwise constitutes a

personal recommendation. It is published solely for information purposes, it does not constitute an advertisement and is not to be construed as a solicitation, offer, invitation or

inducement to buy or sell any securities or related financial instruments in any jurisdiction. Prices in this report are believed to be reliable as of the date on which this report was

issued and are derived from one or more of the following: (i) sources as expressly specified alongside the relevant data; (ii) the quoted price on the main regulated market for the

security in question; (iii) other public sources believed to be reliable; or (iv) BTG Pactual's proprietary data or data available to BTG Pactual. All other information herein is

believed to be reliable as of the date on which this report was issued and has been obtained from public sources believed to be reliable. No representation or warranty, either

express or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, except with respect to information concerning Banco

BTG Pactual S.A., its subsidiaries and affiliates, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in the report. In

all cases, investors should conduct their own investigation and analysis of such information before taking or omitting to take any action in relation to securities or markets that are

analyzed in this report. BTG Pactual does not undertake that investors will obtain profits, nor will it share with investors any investment profits nor accept any liability for any

investment losses. Investments involve risks and investors should exercise prudence in making their investment decisions. BTG Pactual accepts no fiduciary duties to recipients

of this report and in communicating this report is not acting in a fiduciary capacity. The report should not be regarded by recipients as a substitute for the exercise of their own

judgment. Opinions, estimates, and projections expressed herein constitute the current judgment of the analyst responsible for the substance of this report as of the date on

which the report was issued and are therefore subject to change without notice and may differ or be contrary to opinions expressed by other business areas or groups of BTG

Pactual as a result of using different assumptions and criteria. Because the personal views of analysts may differ from one another, Banco BTG Pactual S.A., its subsidiaries and

affiliates may have issued or may issue reports that are inconsistent with, and/or reach different conclusions from, the information presented herein. Any such opinions,

estimates, and projections must not be construed as a representation that the matters referred to therein will occur. Prices and availability of financial instruments are indicative

only and subject to change without notice. Research will initiate, update and cease coverage solely at the discretion of BTG Pactual Investment Bank Research Management.

The analysis contained herein is based on numerous assumptions. Different assumptions could result in materially different results. The analyst(s) responsible for the preparation

of this report may interact with trading desk personnel, sales personnel and other constituencies for the purpose of gathering, synthesizing and interpreting market information.

BTG Pactual is under no obligation to update or keep current the information contained herein, except when terminating coverage of the companies discussed in the report. BTG

Pactual relies on information barriers to control the flow of information contained in one or more areas within BTG Pactual, into other areas, units, groups or affiliates of BTG

Pactual. The compensation of the analyst who prepared this report is determined by research management and senior management (not including investment banking). Analyst

compensation is not based on investment banking revenues, however, compensation may relate to the revenues of BTG Pactual Investment Bank as a whole, of which

investment banking, sales and trading are a part. The securities described herein may not be eligible for sale in all jurisdictions or to certain categories of investors. Options,

derivative products and futures are not suitable for all investors, and trading in these instruments is considered risky. Mortgage and asset-backed securities may involve a high

degree of risk and may be highly volatile in response to fluctuations in interest rates and other market conditions. Past performance is not necessarily indicative of future results.

If a financial instrument is denominated in a currency other than an investor’s currency, a change in rates of exchange may adversely affect the value or price of or the income

derived from any security or related instrument mentioned in this report, and the reader of this report assumes any currency risk. This report does not take into account the

investment objectives, financial situation or particular needs of any particular investor. Investors should obtain independent financial advice based on their own particular

circumstances before making an investment decision on the basis of the information contained herein. For investment advice, trade execution or other enquiries, clients should

contact their local sales representative. Neither BTG Pactual nor any of its affiliates, nor any of their respective directors, employees or agents, accepts any liability for any loss or

damage arising out of the use of all or any part of this report. Notwithstanding any other statement in this report, BTG Pactual UK does not seek to exclude or restrict any duty or

liability that it may have to a client under the “regulatory system” in the UK (as such term is defined in the rules of the Financial Conduct Authority). Any prices stated in this report

are for information purposes only and do not represent valuations for individual securities or other instruments. There is no representation that any transaction can or could have

been effected at those prices and any prices do not necessarily reflect BTG Pactual internal books and records or theoretical model-based valuations and may be based on

certain assumptions. Different assumptions, by BTG Pactual S.A., BTG Pactual US, BTG Pactual UK, BTG Pactual Chile and BTG Pactual Peru and BTG Pactual Colombia and

BTG Pactual Argentina or any other source, may yield substantially different results. This report may not be reproduced or redistributed to any other person, in whole or in part,

for any purpose, without the prior written consent of BTG Pactual and BTG Pactual accepts no liability whatsoever for the actions of third parties in this respect.

Brazil Strategy Page 10

Document copied by arlindo.carvalho@btgpactual.com

Brazil Strategy BTG Pactual Global Research

Strategy Note - 13 December 2022 Banco BTG Pactual S.A.

Additional information relating to the financial instruments discussed in this report is available upon request. BTG Pactual and its affiliates have in place arrangements to manage

conflicts of interest that may arise between them and their respective clients and among their different clients. BTG Pactual and its affiliates are involved in a full range of financial

and related services including banking, investment banking and the provision of investment services. As such, any of BTG Pactual or its affiliates may have a material interest or

a conflict of interest in any services provided to clients by BTG Pactual or such affiliate. Business areas within BTG Pactual and among its affiliates operate independently of

each other and restrict access by the particular individual(s) responsible for handling client affairs to certain areas of information where this is necessary in order to manage

conflicts of interest or material interests. Any of BTG Pactual and its affiliates may: (a) have disclosed this report to companies that are analyzed herein and subsequently

amended this report prior to publication; (b) give investment advice or provide other services to another person about or concerning any securities that are discussed in this

report, which advice may not necessarily be consistent with or similar to the information in this report; (c) trade (or have traded) for its own account (or for or on behalf of clients),

have either a long or short position in the securities that are discussed in this report (and may buy or sell such securities), with the securities that are discussed in this report;

and/or (d) buy and sell units in a collective investment scheme where it is the trustee or operator (or an adviser) to the scheme, which units may reference securities that are

discussed in this report.

United Kingdom and EEA: Where this report is disseminated in the United Kingdom or elsewhere in the EEA by BTG Pactual UK, this report is issued by BTG Pactual UK only

to, and is directed by BTG Pactual UK at, those who are the intended recipients of this report. This report has been classified as investment research and should not be

considered a form of advertisement or financial promotion under the provisions of FSMA 2000 (Sect. 21(8)).This communication may constitute an investment recommendation

under the Market Abuse Regulation 2016 (“MAR”) and, as required by MAR, the investment recommendations of BTG Pactual personnel over the past 12 months can be found

by clicking on https://www.btgpactual.com/research/. Please also consult our website for all relevant disclosures of conflicts of interests relating to instruments covered by this

report. While all reasonable effort has been made to ensure that the information contained is not untrue or misleading at the time of publication, no representation is made as to

its accuracy or completeness and it should not be relied upon as such. Past performances offer no guarantee as to future performances. All opinions expressed in the present

document reflect the current context and which is subject to change without notice.

Dubai: This research report does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe for or purchase, any securities or investment

products in the UAE (including the Dubai International Financial Centre) and accordingly should not be construed as such. Furthermore, this information is being made available

on the basis that the recipient acknowledges and understands that the entities and securities to which it may relate have not been approved, licensed by or registered with the

UAE Central Bank, Emirates Securities and Commodities Authority or the Dubai Financial Services Authority or any other relevant licensing authority or governmental agency in

the UAE. The content of this report has not been approved by or filed with the UAE Central Bank or Dubai Financial Services Authority.

United Arab Emirates Residents: This research report, and the information contained herein, does not constitute, and is not intended to constitute, a public offer of securities in

the United Arab Emirates and accordingly should not be construed as such. The securities are only being offered to a limited number of sophisticated investors in the UAE who

(a) are willing and able to conduct an independent investigation of the risks involved in an investment in such securities, and (b) upon their specific request. The securities have

not been approved by or licensed or registered with the UAE Central Bank or any other relevant licensing authorities or governmental agencies in the UAE. This research report

is for the use of the named addressee only and should not be given or shown to any other person (other than employees, agents or consultants in connection with the

addressee's consideration thereof). No transaction will be concluded in the UAE and any enquiries regarding the securities should be made with BTG Pactual CTVM S.A. at +55

11 3383-2638, Avenida Brigadeiro Faria Lima, 3477, 14th floor, São Paulo, SP, Brazil, 04538-133.

Brazil Strategy Page 11

Document copied by arlindo.carvalho@btgpactual.com

You might also like

- Bank StatementDocument10 pagesBank StatementMuhammad Danial100% (1)

- Muzaffarpur Jio Fibre Dec-Jan 2022 PostpaidDocument9 pagesMuzaffarpur Jio Fibre Dec-Jan 2022 PostpaidHappy Singh0% (1)

- BSBFIN501 Contingency Plan TASK 3 Assessment 1Document2 pagesBSBFIN501 Contingency Plan TASK 3 Assessment 1Ivson SilvaNo ratings yet

- The Ecommerce HandbookDocument43 pagesThe Ecommerce HandbookTiago SoaresNo ratings yet

- Module Title: International Finance: Module Handbook 2020/21 Module Code: BMG704 (86966)Document16 pagesModule Title: International Finance: Module Handbook 2020/21 Module Code: BMG704 (86966)Osman Iqbal100% (1)

- Penyata Akaun: Tarikh Date Keterangan Description Terminal ID ID Terminal Amaun (RM) Amount (RM) Baki (RM) Balance (RM)Document2 pagesPenyata Akaun: Tarikh Date Keterangan Description Terminal ID ID Terminal Amaun (RM) Amount (RM) Baki (RM) Balance (RM)mainem izzanNo ratings yet

- Reporte EstrategiaDocument15 pagesReporte EstrategiaCarolina GialdiNo ratings yet

- Brazil Retail & Consumer Goods: Black Friday 2020 - Not A Door-Busting Crowd, But Still A Huge EventDocument6 pagesBrazil Retail & Consumer Goods: Black Friday 2020 - Not A Door-Busting Crowd, But Still A Huge EventRodrigo PereiraNo ratings yet

- Brazil Small Caps PortfolioDocument8 pagesBrazil Small Caps PortfolioElidiel BarrosoNo ratings yet

- Exam19 20 SolutionsDocument3 pagesExam19 20 SolutionsHenri De sloovereNo ratings yet

- ABM TextDocument6 pagesABM TextPauline TayabanNo ratings yet

- CITIRA Bill (Senate Version)Document9 pagesCITIRA Bill (Senate Version)Tan GonzalesNo ratings yet

- BTG Pactual Research HealthcareDocument8 pagesBTG Pactual Research HealthcareBruno LimaNo ratings yet

- Transfer Pricing Implications of BP Pillar TwoDocument5 pagesTransfer Pricing Implications of BP Pillar Twowhatsmyname3789No ratings yet

- PWCDocument47 pagesPWCDefimediagroup Ldmg100% (1)

- THE BOSTON CONSULTING GROUP Vs GAMESTOP CORPORATIONDocument12 pagesTHE BOSTON CONSULTING GROUP Vs GAMESTOP CORPORATIONEdmund TadrosNo ratings yet

- 2022-CRS - Global Minimum Tax Could Lead To Higher Multinational Taxes - Tax NotesDocument16 pages2022-CRS - Global Minimum Tax Could Lead To Higher Multinational Taxes - Tax Noteswedsrvn599No ratings yet

- Equity Strategy Brazil 20210526Document4 pagesEquity Strategy Brazil 20210526Renan Dantas SantosNo ratings yet

- The Effect of Liquidity, Leverage and Determined Tax Load On Profitability With Profit Management As Moderating VariablesDocument13 pagesThe Effect of Liquidity, Leverage and Determined Tax Load On Profitability With Profit Management As Moderating VariablesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Thematic Report - Chinese Cars in Brazil - The Year of The DragonDocument94 pagesThematic Report - Chinese Cars in Brazil - The Year of The Dragonamota1977No ratings yet

- Concept Paper - Mandanas Ruling and The Lgu's Bigger Budget This Fy 2022Document3 pagesConcept Paper - Mandanas Ruling and The Lgu's Bigger Budget This Fy 2022Analou Agustin Villeza100% (2)

- BTG Pactual WizDocument4 pagesBTG Pactual Wizrgoliveira3No ratings yet

- CREATE Bill Salient PointsDocument2 pagesCREATE Bill Salient PointsMats Lucero100% (1)

- Investigacion Final MacroDocument12 pagesInvestigacion Final Macrodaniel servellonNo ratings yet

- Nigeria Taxation Post Covid - What To ExpectDocument3 pagesNigeria Taxation Post Covid - What To ExpectOmotayo AlabiNo ratings yet

- Tax Glimpses 2019Document97 pagesTax Glimpses 2019DarshanaNo ratings yet

- Vision 360 Edition 6 1614142642Document43 pagesVision 360 Edition 6 1614142642Swapnil PatilNo ratings yet

- 2010 Budget Perspective: The Real Deficit Effect of The Health BillDocument5 pages2010 Budget Perspective: The Real Deficit Effect of The Health BillWashington ExaminerNo ratings yet

- CBOSSApressrelease 61404Document1 pageCBOSSApressrelease 61404Committee For a Responsible Federal BudgetNo ratings yet

- International FinanceDocument18 pagesInternational FinanceehikhioyaodionNo ratings yet

- Carta de La Junta de Control Fiscal Al Gobernador Ricardo RossellóDocument5 pagesCarta de La Junta de Control Fiscal Al Gobernador Ricardo RossellóManuel NatalNo ratings yet

- 59134-MBR (Cbo)Document8 pages59134-MBR (Cbo)Verónica SilveriNo ratings yet

- 2Q13 Press Release 83cdDocument16 pages2Q13 Press Release 83cdeconomics6969No ratings yet

- Do You Know?: What Is Fiscal Responsibility and Budget Management Act ?Document1 pageDo You Know?: What Is Fiscal Responsibility and Budget Management Act ?Rakesh KumarNo ratings yet

- GOOG 4Q06 Earnings JSDocument8 pagesGOOG 4Q06 Earnings JSBrian BolanNo ratings yet

- Brazilian Homebuilders: 2021 Guidance Suggests A Great YearDocument5 pagesBrazilian Homebuilders: 2021 Guidance Suggests A Great YearJorge EchanizNo ratings yet

- A K Bhattacharya: Subir GokarnDocument3 pagesA K Bhattacharya: Subir GokarnramunagatiNo ratings yet

- Brazil Copom Watch 11jan17 BTGPDocument5 pagesBrazil Copom Watch 11jan17 BTGPbenjah2No ratings yet

- MODULE 3 UNIT 2 TRAIN SUPPLEMENTAL READING 1 Aki - Policy - Brief - Volume - Xii - No. - 4 - 2019Document6 pagesMODULE 3 UNIT 2 TRAIN SUPPLEMENTAL READING 1 Aki - Policy - Brief - Volume - Xii - No. - 4 - 2019Isabella AlfonsoNo ratings yet

- Federal Budget Summary - 1Document23 pagesFederal Budget Summary - 1Osama AtifNo ratings yet

- Argentina 20231220 1404Document6 pagesArgentina 20231220 1404Mateo SapiaNo ratings yet

- IT Return Extension Expected Till 15 DecemberDocument8 pagesIT Return Extension Expected Till 15 DecemberMuhammad Wisal AhmedNo ratings yet

- India: Populist Not ReformistDocument9 pagesIndia: Populist Not Reformistapi-14664192No ratings yet

- Finance Act 2023 - Analysis by Grant ThorntonDocument39 pagesFinance Act 2023 - Analysis by Grant ThorntonoogafelixNo ratings yet

- CreditSights Kantar New Issue Operations in Focus PDFDocument14 pagesCreditSights Kantar New Issue Operations in Focus PDFZain HussainNo ratings yet

- Tax and Business Strategy - Impact of New Ghanaian Tax LawsDocument6 pagesTax and Business Strategy - Impact of New Ghanaian Tax LawsM ArmahNo ratings yet

- Philippine Interpretations Committee (Pic) Questions and Answers (Q&As)Document8 pagesPhilippine Interpretations Committee (Pic) Questions and Answers (Q&As)Hanee Ruth BlueNo ratings yet

- Market Strategy: February 2021Document19 pagesMarket Strategy: February 2021Harshvardhan SurekaNo ratings yet

- Shareholder Letter Q3 2022 11.8.22 FINALDocument36 pagesShareholder Letter Q3 2022 11.8.22 FINALAlexNo ratings yet

- Budget Update March 142006Document10 pagesBudget Update March 142006Committee For a Responsible Federal BudgetNo ratings yet

- IF12572Document3 pagesIF12572chichponkli24No ratings yet

- Impact of GST FMCG and Retail SectorDocument11 pagesImpact of GST FMCG and Retail SectorSunoop BalaramanNo ratings yet

- Cares Act Impacts On Net Operating Losses: Frequently Asked QuestionsDocument1 pageCares Act Impacts On Net Operating Losses: Frequently Asked QuestionsAllenNo ratings yet

- 5yr of GSTDocument8 pages5yr of GSTSuraj PawarNo ratings yet

- Black Friday - BTGDocument7 pagesBlack Friday - BTGRenan Dantas SantosNo ratings yet

- Gati Q1 Result UpdateDocument7 pagesGati Q1 Result UpdateAryan SharmaNo ratings yet

- PWC: A Shower of Social MeasuresDocument49 pagesPWC: A Shower of Social MeasuresDefimediaNo ratings yet

- Compensation System For GOCCs Approved - Official Gazette of The Republic of The PhilippinesDocument6 pagesCompensation System For GOCCs Approved - Official Gazette of The Republic of The PhilippinesmilecordNo ratings yet

- Brazilian Broadband MarketDocument6 pagesBrazilian Broadband Marketbenjah2No ratings yet

- Inflation Reduction Act: Preliminary Estimates of Budgetary and Macroeconomic EffectsDocument5 pagesInflation Reduction Act: Preliminary Estimates of Budgetary and Macroeconomic EffectsJohn SmithNo ratings yet

- GM Test Series: Advanced AccountingDocument4 pagesGM Test Series: Advanced AccountingAryanAroraNo ratings yet

- Macro Effects of IRADocument21 pagesMacro Effects of IRAmuhammad.nm.abidNo ratings yet

- Build Tax-Free Wealth: How to Permanently Lower Your Taxes and Build More WealthFrom EverandBuild Tax-Free Wealth: How to Permanently Lower Your Taxes and Build More WealthNo ratings yet

- Final Group Summative AssessmentDocument7 pagesFinal Group Summative AssessmentAMG 2001No ratings yet

- Deposit Invoice-20210611072147Document1 pageDeposit Invoice-20210611072147Malik Sheraz IqbalNo ratings yet

- UNIT III Lesson 1 (Communication and Globalization)Document4 pagesUNIT III Lesson 1 (Communication and Globalization)Photz Bayangan KatabNo ratings yet

- Obligation and ContractDocument3 pagesObligation and ContractAllan RejanoNo ratings yet

- Tax Multiplier in Keynesian Model of Macroeconomics Derive The Expression For Tax MultiplierDocument7 pagesTax Multiplier in Keynesian Model of Macroeconomics Derive The Expression For Tax Multiplierniloy100% (1)

- Chapter 9 - Interim Financial ReportingDocument17 pagesChapter 9 - Interim Financial Reportingarlynajero.ckcNo ratings yet

- Mayor Adams Meeting RequestDocument3 pagesMayor Adams Meeting RequestGersh KuntzmanNo ratings yet

- The French RevolutionDocument10 pagesThe French Revolutiontapas mishraNo ratings yet

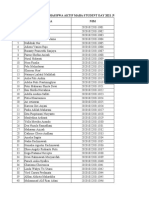

- Daftar Hadir Peserta Maba Student Day 2021 Minggu Ke-5Document55 pagesDaftar Hadir Peserta Maba Student Day 2021 Minggu Ke-5Tiara Arana MaudyNo ratings yet

- Mint Kolkata 23-05-2024Document20 pagesMint Kolkata 23-05-2024Internet knowledgeNo ratings yet

- Vansh Course Prospectous 12 Feb 2021Document8 pagesVansh Course Prospectous 12 Feb 2021Komal S.No ratings yet

- 5-The Purchasing Power Parity PrincipleDocument9 pages5-The Purchasing Power Parity Principleyaseenjaved466No ratings yet

- Need of ProjectDocument5 pagesNeed of ProjectnirajsaruNo ratings yet

- Quotation 30Document1 pageQuotation 30Hytech Pvt. Ltd.No ratings yet

- A Study On Financial Analysis of Balaji BuildersDocument46 pagesA Study On Financial Analysis of Balaji BuildersSurendra SkNo ratings yet

- Globalisation and The Indian EconomyDocument2 pagesGlobalisation and The Indian EconomyEmelyn StanicaNo ratings yet

- Summer Training Project Report ON: "A Study On Consumer Buying Behaviour Towards Amul in Lucknow City"Document115 pagesSummer Training Project Report ON: "A Study On Consumer Buying Behaviour Towards Amul in Lucknow City"Master PrintersNo ratings yet

- Additional Solved Problems and MinicasesDocument155 pagesAdditional Solved Problems and MinicasesMera Birthday 2021No ratings yet

- Volatile: Strategies For Volatile ViewDocument12 pagesVolatile: Strategies For Volatile ViewAshutosh ChauhanNo ratings yet

- Poverty Free Bangladesh: Social Security Work PlanDocument3 pagesPoverty Free Bangladesh: Social Security Work Planxfile123No ratings yet

- RegionalizationDocument8 pagesRegionalizationBethwen Eliza CDichosoNo ratings yet

- What Is The Keynesian MultiplierDocument17 pagesWhat Is The Keynesian MultiplierjamesNo ratings yet

- Strategic Swing Trading (PDFDrive)Document98 pagesStrategic Swing Trading (PDFDrive)geokennyNo ratings yet

- CH 14 Country and Political RiskDocument32 pagesCH 14 Country and Political Riskklm klmNo ratings yet

- Corr Case StudiesDocument5 pagesCorr Case StudiesPrashant ChavanNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument11 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balanceavnish sharmaNo ratings yet