Professional Documents

Culture Documents

2 - CW France - Residential Invest Market 2020 - VA PDF

2 - CW France - Residential Invest Market 2020 - VA PDF

Uploaded by

liuCopyright:

Available Formats

You might also like

- Dobank Business PlanDocument7 pagesDobank Business PlanSankary CarollNo ratings yet

- Sharpe RatioDocument13 pagesSharpe RatioArimas FirasNo ratings yet

- Q2 2020 Sales H1 2020 Results: July 28, 2020Document42 pagesQ2 2020 Sales H1 2020 Results: July 28, 2020José Manuel EstebanNo ratings yet

- Inditex Finance Report 2020Document18 pagesInditex Finance Report 2020david juNo ratings yet

- Avolta Partners VC MA Tech Trends France Q2 2022Document21 pagesAvolta Partners VC MA Tech Trends France Q2 2022David GoubetNo ratings yet

- Presentation - Growth For Impact 2024 - 0Document82 pagesPresentation - Growth For Impact 2024 - 0vicente.granizoNo ratings yet

- Hotel Transactions: 2019 EuropeanDocument16 pagesHotel Transactions: 2019 EuropeanMarco PoloNo ratings yet

- BASF in Korea Report 2020Document26 pagesBASF in Korea Report 2020Amit MirgeNo ratings yet

- Httpscorporate - Bpost.be mediaFilesBBpostannual Reportsannual Report 2020 PDFDocument172 pagesHttpscorporate - Bpost.be mediaFilesBBpostannual Reportsannual Report 2020 PDFKristien BessemansNo ratings yet

- Avolta Partners VC France 2021Document33 pagesAvolta Partners VC France 2021jackNo ratings yet

- Deal Drivers - France - Q1-2020 - FINAL - 18may2020Document7 pagesDeal Drivers - France - Q1-2020 - FINAL - 18may2020PierreNo ratings yet

- 2019 Q1 2019.06.21 Vingroup Earnings Presentation 1Q 2019Document43 pages2019 Q1 2019.06.21 Vingroup Earnings Presentation 1Q 2019MNo ratings yet

- 2018 Q4 Jakarta Retail Market Report ColliersDocument10 pages2018 Q4 Jakarta Retail Market Report ColliersNovia PutriNo ratings yet

- Colliers Davao 2022 ResidentialDocument4 pagesColliers Davao 2022 Residentialbhandari_raviNo ratings yet

- Etude Avolta-VC-MA-Tech-Trends-France-2022Document26 pagesEtude Avolta-VC-MA-Tech-Trends-France-2022Thibaud CombeNo ratings yet

- How To Web Romanian Venture Report 2021Document20 pagesHow To Web Romanian Venture Report 2021start-up.roNo ratings yet

- Fy2019 Results: 1 February 2019 To 31 January 2020Document16 pagesFy2019 Results: 1 February 2019 To 31 January 2020david juNo ratings yet

- MGBT1BNE Business EnvironmentDocument6 pagesMGBT1BNE Business EnvironmentIffath JahanNo ratings yet

- Spain 2019-2020: Flash - Property Market inDocument6 pagesSpain 2019-2020: Flash - Property Market inChemaNo ratings yet

- Fnac Darty PR q1 2024Document4 pagesFnac Darty PR q1 2024sadfqNo ratings yet

- Glo Ir2020Document378 pagesGlo Ir2020akosimawilynNo ratings yet

- 2019 Q2 2019.07.31 Vingroup Earnings Presentation 2Q2019Document44 pages2019 Q2 2019.07.31 Vingroup Earnings Presentation 2Q2019MNo ratings yet

- Beiersdorf Completes Successful Fiscal Year 2021Document5 pagesBeiersdorf Completes Successful Fiscal Year 2021Pancho Ahumada RojasNo ratings yet

- En Randco 2021 Agm Slideshow 20210520Document65 pagesEn Randco 2021 Agm Slideshow 20210520Xolani Radebe RadebeNo ratings yet

- Distrab SAS LBO: Marc Harik David Brandao Jimmy Moreau Avaidh Sudhakaran Jean-Victor ChambardDocument15 pagesDistrab SAS LBO: Marc Harik David Brandao Jimmy Moreau Avaidh Sudhakaran Jean-Victor ChambardchambardNo ratings yet

- Arçelik Yatırımcı SunumuDocument32 pagesArçelik Yatırımcı SunumuOnur YamukNo ratings yet

- Presentation 2020 EssilorDocument19 pagesPresentation 2020 EssilorMustapha OUHADDANo ratings yet

- BASF Report 2020Document324 pagesBASF Report 2020Rafael FalconNo ratings yet

- Romanian Venture Report 2020Document11 pagesRomanian Venture Report 2020ClaudiuNo ratings yet

- 2022 Treasurer Report PublicDocument11 pages2022 Treasurer Report PublicJoa PintoNo ratings yet

- LBS February 2020Document114 pagesLBS February 2020Adebowale OyedejiNo ratings yet

- Adyen Shareholder Letter H2 2019Document43 pagesAdyen Shareholder Letter H2 2019simplyvenNo ratings yet

- ING Direct StrategyDocument16 pagesING Direct Strategyalice376No ratings yet

- Ratio Analysis and GraphsDocument23 pagesRatio Analysis and GraphsAbhishek Gaming YTNo ratings yet

- Press Release Carrefour Q4+FY 2023 - 0Document25 pagesPress Release Carrefour Q4+FY 2023 - 0dumitruadriana369No ratings yet

- Annual Report 2018Document190 pagesAnnual Report 2018Abdul Ghaffar BhattiNo ratings yet

- Handset Leasing ReportDocument9 pagesHandset Leasing ReportGerardus BanyuNo ratings yet

- SOK 2020 Annual ReportDocument158 pagesSOK 2020 Annual Reporttarikerkut44No ratings yet

- Carrefour Q1 2023 Presentation 1Document16 pagesCarrefour Q1 2023 Presentation 1FaIIen0nENo ratings yet

- Colliers Manila Q3 2022 Residential v2Document4 pagesColliers Manila Q3 2022 Residential v2bhandari_raviNo ratings yet

- Investor Presentation 29 October 2020: 1 © 2020 NokiaDocument35 pagesInvestor Presentation 29 October 2020: 1 © 2020 NokiaMocanu CatalinNo ratings yet

- 1902 14 - Nexans FY 2018 - Final2 PublicationDocument35 pages1902 14 - Nexans FY 2018 - Final2 PublicationSaifa KhalidNo ratings yet

- Gtal 2020 DealtrackerDocument52 pagesGtal 2020 Dealtrackeryinjara.buyerNo ratings yet

- M&A Advisor of The WeekDocument7 pagesM&A Advisor of The Weekstephyl0722No ratings yet

- Preliminary Announcement Aug 2022 COMBINED FINALDocument56 pagesPreliminary Announcement Aug 2022 COMBINED FINALartismmgNo ratings yet

- AR Ali 89Document1 pageAR Ali 89Lieder CLNo ratings yet

- Distrib SASDocument11 pagesDistrib SASShubham KumarNo ratings yet

- Spanish Economy 23-24 Exercises 2Document3 pagesSpanish Economy 23-24 Exercises 2paocabrerad19No ratings yet

- Brochure Istituz enDocument29 pagesBrochure Istituz enhuppan.gaborNo ratings yet

- Financial Results - First Half 2021: Investors' and Analysts' PresentationDocument24 pagesFinancial Results - First Half 2021: Investors' and Analysts' PresentationMiguel Couto RamosNo ratings yet

- Orange Essential 2020Document57 pagesOrange Essential 2020kentmultanNo ratings yet

- Carrefour - H1 - 2022 - Results - Analysts Presentation (1) - 2Document31 pagesCarrefour - H1 - 2022 - Results - Analysts Presentation (1) - 2FaIIen0nENo ratings yet

- 2021 European Hotel TransactionsDocument10 pages2021 European Hotel TransactionsLeonardo NociNo ratings yet

- Ytd October 2021 Performance Report: Net RevenueDocument3 pagesYtd October 2021 Performance Report: Net RevenueQuynh NguyenNo ratings yet

- Telenor Q4 2018 Presentation PDFDocument44 pagesTelenor Q4 2018 Presentation PDFAliNo ratings yet

- Societe Generale Group Results: 4 Quarter and Full Year 2020 - 10.02.2021Document74 pagesSociete Generale Group Results: 4 Quarter and Full Year 2020 - 10.02.2021EvgeniyNo ratings yet

- Backing OUR Customers: Annual Financial ReportDocument375 pagesBacking OUR Customers: Annual Financial ReportKiran NaiduNo ratings yet

- Solid Revenue Growth in 2020 and Objectives Confirmed: Paris, February 18, 2021Document9 pagesSolid Revenue Growth in 2020 and Objectives Confirmed: Paris, February 18, 2021pharssNo ratings yet

- Lafargeholcim: The Global Leader in Sustainable and Innovative Building Materials and SolutionsDocument12 pagesLafargeholcim: The Global Leader in Sustainable and Innovative Building Materials and SolutionsSibouss NNo ratings yet

- Repsol LubeDocument46 pagesRepsol LubeDharshan MylvaganamNo ratings yet

- A New Dawn for Global Value Chain Participation in the PhilippinesFrom EverandA New Dawn for Global Value Chain Participation in the PhilippinesNo ratings yet

- Erajaya Swasembada TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesErajaya Swasembada TBK.: Company Report: January 2019 As of 31 January 2019Aldo EriandaNo ratings yet

- Freelance ProjectDocument62 pagesFreelance ProjectamoghvkiniNo ratings yet

- MC 1215Document28 pagesMC 1215mcchronicleNo ratings yet

- Financial Statements: For The Year Ended 31 December 2019Document11 pagesFinancial Statements: For The Year Ended 31 December 2019RajithWNNo ratings yet

- Financial-Forecast AFN FinMgmt 13e BrighamDocument19 pagesFinancial-Forecast AFN FinMgmt 13e BrighamRimpy SondhNo ratings yet

- Master of Finance: Derivatives Lecture 2: Introduction To DerivativesDocument36 pagesMaster of Finance: Derivatives Lecture 2: Introduction To DerivativesYassine ZenaguiNo ratings yet

- HW Assignment For Week 8Document2 pagesHW Assignment For Week 8Lưu Gia BảoNo ratings yet

- CH 14Document80 pagesCH 14Michael Fine100% (1)

- Babasaheb Bhimrao Ambedkar University: Karan Shukla 194120 B.B.A. 5 Managing Personal FinanceDocument8 pagesBabasaheb Bhimrao Ambedkar University: Karan Shukla 194120 B.B.A. 5 Managing Personal FinanceShivani ShuklaNo ratings yet

- Binary Option Book Strategies PDDocument16 pagesBinary Option Book Strategies PDAsad Khalif Omar100% (1)

- Pertemuan 14 Bu There Chapter 10Document49 pagesPertemuan 14 Bu There Chapter 10CYNTHIA ARYA PRANATANo ratings yet

- Minutes of Board of Directors' MeetingsDocument3 pagesMinutes of Board of Directors' MeetingsMultiplan RINo ratings yet

- Topic 1 Enterprenership ChallengesDocument32 pagesTopic 1 Enterprenership ChallengesMasumHasanNo ratings yet

- 4 Audit of InvestmentsDocument11 pages4 Audit of InvestmentsMarcus MonocayNo ratings yet

- Ahmed Fine Weaving LTDDocument5 pagesAhmed Fine Weaving LTDHamza AsifNo ratings yet

- Fundamental Analysis PresentationDocument28 pagesFundamental Analysis Presentation354Prakriti SharmaNo ratings yet

- Executive SummaryDocument41 pagesExecutive SummaryArchana SinghNo ratings yet

- Case Study - BCVE and Preacquistion EntriesDocument3 pagesCase Study - BCVE and Preacquistion EntriesHuỳnh Minh Gia HàoNo ratings yet

- Bhupendra Imrt B School Lucknow Difference Between Eps N DpsDocument15 pagesBhupendra Imrt B School Lucknow Difference Between Eps N Dpsbhupendra pt singhNo ratings yet

- Bond ValuationDocument20 pagesBond Valuationsona25% (4)

- Three Essays On Mutual FundsDocument181 pagesThree Essays On Mutual FundsIGift WattanatornNo ratings yet

- Practice Problems - Capital Budgeting PDFDocument2 pagesPractice Problems - Capital Budgeting PDFRamainne RonquilloNo ratings yet

- Trade PlanDocument6 pagesTrade PlanFazri Ashari RomadhonNo ratings yet

- Dr. Kumar Financial Market & Inst1Document40 pagesDr. Kumar Financial Market & Inst1Aderajew MequanintNo ratings yet

- Office Fund: Tishman SpeyerDocument101 pagesOffice Fund: Tishman SpeyerjozefpatelniaNo ratings yet

- Al-Noor Sugar Mills Limited: Balance Sheet As at 31St December, 2006Document6 pagesAl-Noor Sugar Mills Limited: Balance Sheet As at 31St December, 2006Umair KhanNo ratings yet

- Stock Market TrendsDocument11 pagesStock Market TrendsPhilonious PhunkNo ratings yet

- RRL Financial ManagementDocument12 pagesRRL Financial ManagementAriel Barcelona100% (6)

- 1 Financial Management IntroductionDocument12 pages1 Financial Management IntroductionJeremyCervantesNo ratings yet

2 - CW France - Residential Invest Market 2020 - VA PDF

2 - CW France - Residential Invest Market 2020 - VA PDF

Uploaded by

liuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2 - CW France - Residential Invest Market 2020 - VA PDF

2 - CW France - Residential Invest Market 2020 - VA PDF

Uploaded by

liuCopyright:

Available Formats

FLASH INVEST

Residential Market France

2020 Overview

Record level for the residential investment market in 2020

• €7.1 billion (+82% in one year) through 223 transactions

• The traditional segment (free and intermediate housing) has increased by 150%, while serviced

residences (student, senior and coliving) have fallen by 33%, returning to a volume of nearly €954 million

after the €1.4 billion recorded in 2019.

• The outlook for 2021 is positive given the appetite of investors for this asset class whose acquisition

activity has exceeded for the first time that of retail (€4.3 billion) and logistics warehouses (€3.4 billion).

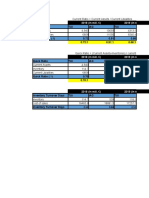

INVESTMENT VOLUME IN FRANCE

Investment volume (Classic & with services, i n € millions)

Classic Serviced Total

• An strong acceleration of residential asset acquisitions in 2020 with a record level of 2020 6,157 954 7,111

around €7.1 billion, mainly driven by the traditional segment (free or intermediate 2019 2,461 1,420 3,881

housing units) 2018 2,819 826 3,645

2017 3,817 168 3,984

• The number of transactions also illustrates this rise in the residential segment: 223

deals in 2020 compared to 199 a year earlier (+12%). It also shows the increase in NUMBER OF DEALS

average unit amounts, which rose significantly from one year to the next thanks to (Classic & with services)

the sales of several portfolios: CDC with developers NEXITY, ALTAREA

Classic Serviced Total

COGEDIM, CAPELLI, REALITES PROMOTION and WOODEUM, and IN'LI with

2020 181 42 223

EIFFAGE-COFFIM. Forward sales (Ventes en Etat Futur d'Achèvement) were

2019 151 48 199

therefore at the heart of the residential investment market in 2020, accounting for

2018 78 5 83

almost 70% of the total volume committed. 2017 90 41 131

Residential asset types

• Classic: The exceptional support plan decided by CDC HABITAT- AMPERE INVESTMENT VOLUME IN FRANCE

(Classic, Serviced, i n € million)

GESTION has given a strong boost to the traditional residential segment with more

than €3.5 billion euros invested in 2020 in operations under development. €6.2

billion spread over more than 180 transactions, i.e. more than a doubling of Classic Serviced Total

2020 6,157 954 7,111

volumes from one year to the next.

2019 2,461 1,420 3,881

2018 2,819 826 3,645

• Student housing : After an exceptional year in 2019 in terms of volumes 2017 3,817 168 3,984

(acquisition of the KLEY portfolio by AXA REIM), the volume of investments

returns to a more usual level with 232 million euros committed in 2020. Most INVESTMENT VOLUME IN FRANCE

acquisitions are concentrated in the €10-20 million segment. (Classic, with services, i n € million)

Students Seniors Coliving

• Seniors housing : The investment volume increased to reach €687 million in 2020 2020 232 687 35

(compared to €523 million in 2019). Once again, forward sales reign supreme with 2019 860 523 37

a market share of 77%, demonstrating the emergence of a new residential supply

for seniors, which differs from retirement homes and other EHPADs.

• Coliving : This still nascent market segment is consolidating its volumes around a

handful of transactions (4 in 2020) targeting the heart of the main conurbations. It

is expected to grow significantly in 2021 given investor appetite for this new asset

class and the opening pipeline of operators.

Sources : Cushman & Wakefield / Immostat pour l’Ile-de-France

FLASH INVEST

Résidentiel France

Bilan 2020

Investors

• The panel of investors active on the buy-side of the residential market continues to expand: alongside the traditional players in this

segment (mainly insurance companies and SCPI-OPCI), investment funds are gaining in importance and are showing a desire to

increase their exposure to this resilient asset class, which is less subject to a disrupted use linked to the Covid 19 health crisis. This

expansion is reflected in the diversity of residential assets, candidates for real estate investment, with a particular appetite for serviced

residential property, which makes it possible to develop a long-term strategy to support the development of operators in the sector.

• There are therefore a few heavyweights in the sector, first and foremost CDC HABITAT AMPERE GESTION, a specialist in the sector,

but also IN'LI. They are in direct competition with more generalist investors such as PRIMONIAL, SWISS LIFE, AEW EUROPE and LA

FRANCAISE, all of whom manage SCPI/OPCI or act for pension funds, as well as with French and foreign investment funds that

intend to rapidly increase their activity in this asset class.

• Investment intentions for 2021 clearly show a willingness on the part of new entrants to join this pro-residential trend which should

support market activity this year, subject to identifying investment opportunities in both the new and existing asset segments.

PRIME YIELDS FRANCE

(*latest update in 1st January 2021)

Q4 2020

Office – Paris CBD 2.80%

High Street Shops - Paris 3.10%

Shopping Centres 4.25%

Retail parks 5.00%

Logistics France 3.70%

Residential (Paris & Tier 1 Urban cities) 1.50 – 3.50%

Student housing (Greater Paris Region – Tier 2 regions) 3.00 – 4.30%

Seniors housing (Greater Paris Region – Tier 2 regions) 3.00 – 4.75%

TRACK RECORD – CUSHMAN & WAKEFIELD

Rue de Tocqueville Rue Garnier Paris 20ème

75017 Paris 92200 Neuilly-s-Seine

• SURFACE : 2,350 sq m • SURFACE : 2,825 sq m • SURFACE : 6,700 sq m

• VENDOR : PRIVE • VENDOR : Developer • VENDOR : INSTITUTIONNAL FUND

• BUYER : INVESTMENT FUND • BUYER : Nue pro /Usufruit • BUYER : VILLE DE PARIS

• USAGE : RESIDENTIAL • USAGE : RESIDENTIAL • USAGE : RESIDENTIAL / OFFICE

Cushman & Wakefield FRANCE

21 rue Balzac 75008 PARIS Cushman & Wakefield LLP. All rights reserved. This report has been

produced by Cushman & Wakefield LLP for use by those with an interest

in commercial property solely for information purposes. The report uses

For more information, please contact : information obtained from public sources which Cushman & Wakefield

CHRYSTELE VILLOTTE Magali MARTON, MRICS LLP believe to be reliable. No warranty or representation, express or

implied, is made as to the accuracy or completeness of any of the

Head of Residential & Healthcare Head of Research information contained herein and Cushman & Wakefield LLP shall not be

Capital Markets France France liable to any reader of this report or any third party in any way whatsoever.

Tel: +33 (0)1 86 46 11 07 Tel: +33 (0)1 86 46 10 95 Our prior written consent is required before this report can be reproduced

in whole or in part.

chrystele.villotte@cushwake.com magali.marton@cushwake.com

You might also like

- Dobank Business PlanDocument7 pagesDobank Business PlanSankary CarollNo ratings yet

- Sharpe RatioDocument13 pagesSharpe RatioArimas FirasNo ratings yet

- Q2 2020 Sales H1 2020 Results: July 28, 2020Document42 pagesQ2 2020 Sales H1 2020 Results: July 28, 2020José Manuel EstebanNo ratings yet

- Inditex Finance Report 2020Document18 pagesInditex Finance Report 2020david juNo ratings yet

- Avolta Partners VC MA Tech Trends France Q2 2022Document21 pagesAvolta Partners VC MA Tech Trends France Q2 2022David GoubetNo ratings yet

- Presentation - Growth For Impact 2024 - 0Document82 pagesPresentation - Growth For Impact 2024 - 0vicente.granizoNo ratings yet

- Hotel Transactions: 2019 EuropeanDocument16 pagesHotel Transactions: 2019 EuropeanMarco PoloNo ratings yet

- BASF in Korea Report 2020Document26 pagesBASF in Korea Report 2020Amit MirgeNo ratings yet

- Httpscorporate - Bpost.be mediaFilesBBpostannual Reportsannual Report 2020 PDFDocument172 pagesHttpscorporate - Bpost.be mediaFilesBBpostannual Reportsannual Report 2020 PDFKristien BessemansNo ratings yet

- Avolta Partners VC France 2021Document33 pagesAvolta Partners VC France 2021jackNo ratings yet

- Deal Drivers - France - Q1-2020 - FINAL - 18may2020Document7 pagesDeal Drivers - France - Q1-2020 - FINAL - 18may2020PierreNo ratings yet

- 2019 Q1 2019.06.21 Vingroup Earnings Presentation 1Q 2019Document43 pages2019 Q1 2019.06.21 Vingroup Earnings Presentation 1Q 2019MNo ratings yet

- 2018 Q4 Jakarta Retail Market Report ColliersDocument10 pages2018 Q4 Jakarta Retail Market Report ColliersNovia PutriNo ratings yet

- Colliers Davao 2022 ResidentialDocument4 pagesColliers Davao 2022 Residentialbhandari_raviNo ratings yet

- Etude Avolta-VC-MA-Tech-Trends-France-2022Document26 pagesEtude Avolta-VC-MA-Tech-Trends-France-2022Thibaud CombeNo ratings yet

- How To Web Romanian Venture Report 2021Document20 pagesHow To Web Romanian Venture Report 2021start-up.roNo ratings yet

- Fy2019 Results: 1 February 2019 To 31 January 2020Document16 pagesFy2019 Results: 1 February 2019 To 31 January 2020david juNo ratings yet

- MGBT1BNE Business EnvironmentDocument6 pagesMGBT1BNE Business EnvironmentIffath JahanNo ratings yet

- Spain 2019-2020: Flash - Property Market inDocument6 pagesSpain 2019-2020: Flash - Property Market inChemaNo ratings yet

- Fnac Darty PR q1 2024Document4 pagesFnac Darty PR q1 2024sadfqNo ratings yet

- Glo Ir2020Document378 pagesGlo Ir2020akosimawilynNo ratings yet

- 2019 Q2 2019.07.31 Vingroup Earnings Presentation 2Q2019Document44 pages2019 Q2 2019.07.31 Vingroup Earnings Presentation 2Q2019MNo ratings yet

- Beiersdorf Completes Successful Fiscal Year 2021Document5 pagesBeiersdorf Completes Successful Fiscal Year 2021Pancho Ahumada RojasNo ratings yet

- En Randco 2021 Agm Slideshow 20210520Document65 pagesEn Randco 2021 Agm Slideshow 20210520Xolani Radebe RadebeNo ratings yet

- Distrab SAS LBO: Marc Harik David Brandao Jimmy Moreau Avaidh Sudhakaran Jean-Victor ChambardDocument15 pagesDistrab SAS LBO: Marc Harik David Brandao Jimmy Moreau Avaidh Sudhakaran Jean-Victor ChambardchambardNo ratings yet

- Arçelik Yatırımcı SunumuDocument32 pagesArçelik Yatırımcı SunumuOnur YamukNo ratings yet

- Presentation 2020 EssilorDocument19 pagesPresentation 2020 EssilorMustapha OUHADDANo ratings yet

- BASF Report 2020Document324 pagesBASF Report 2020Rafael FalconNo ratings yet

- Romanian Venture Report 2020Document11 pagesRomanian Venture Report 2020ClaudiuNo ratings yet

- 2022 Treasurer Report PublicDocument11 pages2022 Treasurer Report PublicJoa PintoNo ratings yet

- LBS February 2020Document114 pagesLBS February 2020Adebowale OyedejiNo ratings yet

- Adyen Shareholder Letter H2 2019Document43 pagesAdyen Shareholder Letter H2 2019simplyvenNo ratings yet

- ING Direct StrategyDocument16 pagesING Direct Strategyalice376No ratings yet

- Ratio Analysis and GraphsDocument23 pagesRatio Analysis and GraphsAbhishek Gaming YTNo ratings yet

- Press Release Carrefour Q4+FY 2023 - 0Document25 pagesPress Release Carrefour Q4+FY 2023 - 0dumitruadriana369No ratings yet

- Annual Report 2018Document190 pagesAnnual Report 2018Abdul Ghaffar BhattiNo ratings yet

- Handset Leasing ReportDocument9 pagesHandset Leasing ReportGerardus BanyuNo ratings yet

- SOK 2020 Annual ReportDocument158 pagesSOK 2020 Annual Reporttarikerkut44No ratings yet

- Carrefour Q1 2023 Presentation 1Document16 pagesCarrefour Q1 2023 Presentation 1FaIIen0nENo ratings yet

- Colliers Manila Q3 2022 Residential v2Document4 pagesColliers Manila Q3 2022 Residential v2bhandari_raviNo ratings yet

- Investor Presentation 29 October 2020: 1 © 2020 NokiaDocument35 pagesInvestor Presentation 29 October 2020: 1 © 2020 NokiaMocanu CatalinNo ratings yet

- 1902 14 - Nexans FY 2018 - Final2 PublicationDocument35 pages1902 14 - Nexans FY 2018 - Final2 PublicationSaifa KhalidNo ratings yet

- Gtal 2020 DealtrackerDocument52 pagesGtal 2020 Dealtrackeryinjara.buyerNo ratings yet

- M&A Advisor of The WeekDocument7 pagesM&A Advisor of The Weekstephyl0722No ratings yet

- Preliminary Announcement Aug 2022 COMBINED FINALDocument56 pagesPreliminary Announcement Aug 2022 COMBINED FINALartismmgNo ratings yet

- AR Ali 89Document1 pageAR Ali 89Lieder CLNo ratings yet

- Distrib SASDocument11 pagesDistrib SASShubham KumarNo ratings yet

- Spanish Economy 23-24 Exercises 2Document3 pagesSpanish Economy 23-24 Exercises 2paocabrerad19No ratings yet

- Brochure Istituz enDocument29 pagesBrochure Istituz enhuppan.gaborNo ratings yet

- Financial Results - First Half 2021: Investors' and Analysts' PresentationDocument24 pagesFinancial Results - First Half 2021: Investors' and Analysts' PresentationMiguel Couto RamosNo ratings yet

- Orange Essential 2020Document57 pagesOrange Essential 2020kentmultanNo ratings yet

- Carrefour - H1 - 2022 - Results - Analysts Presentation (1) - 2Document31 pagesCarrefour - H1 - 2022 - Results - Analysts Presentation (1) - 2FaIIen0nENo ratings yet

- 2021 European Hotel TransactionsDocument10 pages2021 European Hotel TransactionsLeonardo NociNo ratings yet

- Ytd October 2021 Performance Report: Net RevenueDocument3 pagesYtd October 2021 Performance Report: Net RevenueQuynh NguyenNo ratings yet

- Telenor Q4 2018 Presentation PDFDocument44 pagesTelenor Q4 2018 Presentation PDFAliNo ratings yet

- Societe Generale Group Results: 4 Quarter and Full Year 2020 - 10.02.2021Document74 pagesSociete Generale Group Results: 4 Quarter and Full Year 2020 - 10.02.2021EvgeniyNo ratings yet

- Backing OUR Customers: Annual Financial ReportDocument375 pagesBacking OUR Customers: Annual Financial ReportKiran NaiduNo ratings yet

- Solid Revenue Growth in 2020 and Objectives Confirmed: Paris, February 18, 2021Document9 pagesSolid Revenue Growth in 2020 and Objectives Confirmed: Paris, February 18, 2021pharssNo ratings yet

- Lafargeholcim: The Global Leader in Sustainable and Innovative Building Materials and SolutionsDocument12 pagesLafargeholcim: The Global Leader in Sustainable and Innovative Building Materials and SolutionsSibouss NNo ratings yet

- Repsol LubeDocument46 pagesRepsol LubeDharshan MylvaganamNo ratings yet

- A New Dawn for Global Value Chain Participation in the PhilippinesFrom EverandA New Dawn for Global Value Chain Participation in the PhilippinesNo ratings yet

- Erajaya Swasembada TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesErajaya Swasembada TBK.: Company Report: January 2019 As of 31 January 2019Aldo EriandaNo ratings yet

- Freelance ProjectDocument62 pagesFreelance ProjectamoghvkiniNo ratings yet

- MC 1215Document28 pagesMC 1215mcchronicleNo ratings yet

- Financial Statements: For The Year Ended 31 December 2019Document11 pagesFinancial Statements: For The Year Ended 31 December 2019RajithWNNo ratings yet

- Financial-Forecast AFN FinMgmt 13e BrighamDocument19 pagesFinancial-Forecast AFN FinMgmt 13e BrighamRimpy SondhNo ratings yet

- Master of Finance: Derivatives Lecture 2: Introduction To DerivativesDocument36 pagesMaster of Finance: Derivatives Lecture 2: Introduction To DerivativesYassine ZenaguiNo ratings yet

- HW Assignment For Week 8Document2 pagesHW Assignment For Week 8Lưu Gia BảoNo ratings yet

- CH 14Document80 pagesCH 14Michael Fine100% (1)

- Babasaheb Bhimrao Ambedkar University: Karan Shukla 194120 B.B.A. 5 Managing Personal FinanceDocument8 pagesBabasaheb Bhimrao Ambedkar University: Karan Shukla 194120 B.B.A. 5 Managing Personal FinanceShivani ShuklaNo ratings yet

- Binary Option Book Strategies PDDocument16 pagesBinary Option Book Strategies PDAsad Khalif Omar100% (1)

- Pertemuan 14 Bu There Chapter 10Document49 pagesPertemuan 14 Bu There Chapter 10CYNTHIA ARYA PRANATANo ratings yet

- Minutes of Board of Directors' MeetingsDocument3 pagesMinutes of Board of Directors' MeetingsMultiplan RINo ratings yet

- Topic 1 Enterprenership ChallengesDocument32 pagesTopic 1 Enterprenership ChallengesMasumHasanNo ratings yet

- 4 Audit of InvestmentsDocument11 pages4 Audit of InvestmentsMarcus MonocayNo ratings yet

- Ahmed Fine Weaving LTDDocument5 pagesAhmed Fine Weaving LTDHamza AsifNo ratings yet

- Fundamental Analysis PresentationDocument28 pagesFundamental Analysis Presentation354Prakriti SharmaNo ratings yet

- Executive SummaryDocument41 pagesExecutive SummaryArchana SinghNo ratings yet

- Case Study - BCVE and Preacquistion EntriesDocument3 pagesCase Study - BCVE and Preacquistion EntriesHuỳnh Minh Gia HàoNo ratings yet

- Bhupendra Imrt B School Lucknow Difference Between Eps N DpsDocument15 pagesBhupendra Imrt B School Lucknow Difference Between Eps N Dpsbhupendra pt singhNo ratings yet

- Bond ValuationDocument20 pagesBond Valuationsona25% (4)

- Three Essays On Mutual FundsDocument181 pagesThree Essays On Mutual FundsIGift WattanatornNo ratings yet

- Practice Problems - Capital Budgeting PDFDocument2 pagesPractice Problems - Capital Budgeting PDFRamainne RonquilloNo ratings yet

- Trade PlanDocument6 pagesTrade PlanFazri Ashari RomadhonNo ratings yet

- Dr. Kumar Financial Market & Inst1Document40 pagesDr. Kumar Financial Market & Inst1Aderajew MequanintNo ratings yet

- Office Fund: Tishman SpeyerDocument101 pagesOffice Fund: Tishman SpeyerjozefpatelniaNo ratings yet

- Al-Noor Sugar Mills Limited: Balance Sheet As at 31St December, 2006Document6 pagesAl-Noor Sugar Mills Limited: Balance Sheet As at 31St December, 2006Umair KhanNo ratings yet

- Stock Market TrendsDocument11 pagesStock Market TrendsPhilonious PhunkNo ratings yet

- RRL Financial ManagementDocument12 pagesRRL Financial ManagementAriel Barcelona100% (6)

- 1 Financial Management IntroductionDocument12 pages1 Financial Management IntroductionJeremyCervantesNo ratings yet