Professional Documents

Culture Documents

Lesson 5 Quiz-1

Lesson 5 Quiz-1

Uploaded by

Jay LloydOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lesson 5 Quiz-1

Lesson 5 Quiz-1

Uploaded by

Jay LloydCopyright:

Available Formats

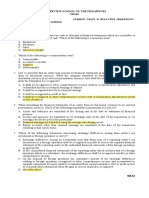

LESSON 5

EVALUATION

1. Jeep Corporation imported a machine for US $ 50,000 from the United States on

January 10, 2022. A corresponding letter of credit (LC) was opened with Metro

Bank to cover importation. Shipment was effected on March 24, 2022 at which time

the exporter collected the proceeds of the LC when the exchange rate was P

58.000 to US$ 1. On April 1, 2022 Jeep paid the LC when the exchange rate was

P 59.45.

What is the forex gain or loss to be recognized by Jeep from the fluctuations of the

exchange rate:

2. On January 1, 2022, the Makati Corporation established a branch in Hongkong.

On February 15, 2022, the branch purchased inventory for HK$200,000. On

December 31, 2022, HK $35,000 of the inventory purchased on February 15, 2022

made up the entire inventory. The exchange rates were as follows:

January 1 to June 30, 2022 HK $0.139= P 1

December 31, 2022 HK$0.132=P 1

The December 31, 2022 inventory balance for Makati’s branch should be

translated into Philippines pesos in the amount of:

3. The subsidiary in Japan of Manila Company, a Philippine enterprise has plant

assets with a cost of 4,000,000 yen on December 31, 2022. Of this amount, plant

assets with a cost of 2,400,000 yen were acquired in 2018 when the exchange rate

was 1 yen= P 0.635; plant assets with a cost of 1,600,000 yen were acquired in

2021 when the exchange rate was 1 yen= P 0.510, and the weighted average rate

for 2021 was 1 yen= P 0.522. The Japanese subsidiary depreciates plant assets

by the straight-line method over a 10-year economic life with no residual value.

What is the 2022 depreciation expense for the Japanese subsidiary in Philippine

peso for the translated statement of comprehensive income?

4. On July 1, 2022, Manila Company purchased raw materials from a Japanese

supplier for 3,000,000 yen and opens the corresponding Letter of Credit (LC) with

City Bank to cover its importation. The company’s year-end is December 31. The

spot rate issued by the bank for Japanese yen at various dates is as follows:

July 1, 2022 (date of arrival of goods) P 0.60

December 31, 2022 P 0.65

July 1, 2023 (date of settlement) P 0.62

In its statement of comprehensive income for 2023, what amount should Manila

Company include as a foreign exchange gain (loss)?

5. If one (1) Euro can be exchanged for P 75.50 Philippine peso, the indirect

exchange rate of Euro per Philippine peso is:

A subsidiary of Jolly, Inc. located in a foreign country whose functional currency is the

foreign currency (which is not the currency of a hyperinflationary economy). The

subsidiary acquires inventory on credit on November 1, 2021, for 120,000 foreign

currencies (FC) that is sold on January 17, 2022 for 140,000 foreign currencies (FC). The

subsidiary pays for the inventory on January 31, 2022. Currency exchange rates for 1

foreign currency (FC) are as follows:

November 1, 2021 P 0.16 = 1 FC

December 31, 2021 0.18 = 1

January 17, 2022 0.20 = 1

January 31, 2022 0.22 = 1

Average for 2022 0.24 = 1

6. What amount does Jolly’s consolidated balance sheet report for this inventory at

December 31, 2021?

7. What amount does Jolly’s consolidated income statement report for cost of goods

sold for the year ending December 31, 2022?

8. What amount does Jolly’s consolidated income statement report for cost of goods

sold for the year ending December 31, 2022?

Jolly Company is a Thailand subsidiary of a Philippine Company. Jolly’s functional

currency is LCU. The following exchange rates were in effect during 2021:

January 1 P 1 = .615 baht

June 30 1 = .625 baht

December 31 1 = .635 baht

Weighted average rate for the year 1 = .627 baht

9. Jolly Company sales of 2,000,000 during 2021. What amount would have been

included for this subsidiary in calculating consolidated sales?

10. Jolly had accounts receivable of 280,000 on December 31, 202`. What amount

would have been included for this subsidiary in calculating consolidated accounts

receivable?

You might also like

- FOREXQUIZ2021Document6 pagesFOREXQUIZ2021rodell pabloNo ratings yet

- Apr 4/accounting For Business Combinations: General InstructionDocument8 pagesApr 4/accounting For Business Combinations: General InstructionJoannah maeNo ratings yet

- Bus 322 Tutorial 5-SolutionDocument20 pagesBus 322 Tutorial 5-Solutionbvni50% (2)

- Fund 4e Chap07 PbmsDocument14 pagesFund 4e Chap07 Pbmsjordi92500100% (1)

- Forex ProbsDocument1 pageForex ProbsJULLIE CARMELLE H. CHATTONo ratings yet

- Module 07.5 - Foreign Currency Accounting PSDocument5 pagesModule 07.5 - Foreign Currency Accounting PSFiona Morales100% (2)

- ForexDocument1 pageForexArceeNo ratings yet

- Afar FC 2Document5 pagesAfar FC 2Ann MagsipocNo ratings yet

- Foreign Currency Transactions2021 3Document6 pagesForeign Currency Transactions2021 3Sheira Mae GuzmanNo ratings yet

- Practical Accounting 1Document6 pagesPractical Accounting 1Myiel AngelNo ratings yet

- 17 Questions Investment in Associate 1Document2 pages17 Questions Investment in Associate 1bernadeth.lorzanoNo ratings yet

- Assignment 7 Financial Statements Translation..Document2 pagesAssignment 7 Financial Statements Translation..Aivan De LeonNo ratings yet

- INVESTMENTS IN DEBT SECURITIES-ExercisesDocument4 pagesINVESTMENTS IN DEBT SECURITIES-ExercisesJazmine Arianne DalayNo ratings yet

- FS Translation and Hedging Asynchronous ActivityDocument2 pagesFS Translation and Hedging Asynchronous ActivityRalph Lawrence Francisco BatangasNo ratings yet

- 9022 - Financial Statements TranslationDocument3 pages9022 - Financial Statements TranslationAljur SalamedaNo ratings yet

- Earnings+Per+Share+ +finacc5Document3 pagesEarnings+Per+Share+ +finacc5Miladanica Barcelona BarracaNo ratings yet

- EarningsperShare Finacc5Document3 pagesEarningsperShare Finacc5Miladanica Barcelona BarracaNo ratings yet

- QuizDocument6 pagesQuizKathrine YapNo ratings yet

- Finals Bcacc MQCDocument12 pagesFinals Bcacc MQCLaurence BacaniNo ratings yet

- Homework 6 - Long-Term Financial LiabilitiesDocument2 pagesHomework 6 - Long-Term Financial LiabilitiesCha PampolinaNo ratings yet

- MFRS 121 Tutorial Ques - 62022 UploadDocument4 pagesMFRS 121 Tutorial Ques - 62022 UploadZhaoYing TanNo ratings yet

- 5 6145300324501422422 PDFDocument3 pages5 6145300324501422422 PDFBeverly MindoroNo ratings yet

- Practice Set - Foreign Exchange - AfarDocument3 pagesPractice Set - Foreign Exchange - AfarFannie GailNo ratings yet

- Intermediate Accounting 1 - InvestmentsDocument5 pagesIntermediate Accounting 1 - InvestmentsAmber FordNo ratings yet

- Quiz-11 (Investment in Associate)Document2 pagesQuiz-11 (Investment in Associate)Panda ErarNo ratings yet

- 5 6079864208529295481Document4 pages5 6079864208529295481Razel MhinNo ratings yet

- Pas 21 The Effects of Changes in Foreign Exchange RatesDocument2 pagesPas 21 The Effects of Changes in Foreign Exchange RatesRaven BermalNo ratings yet

- (ACC124) Investment QuizDocument6 pages(ACC124) Investment QuizKloie SanoriaNo ratings yet

- A Owns Majority of The Outstanding Ordinary SharesDocument2 pagesA Owns Majority of The Outstanding Ordinary Sharesasdfghjkl zxcvbnmNo ratings yet

- A Owns Majority of The Outstanding Ordinary SharesDocument2 pagesA Owns Majority of The Outstanding Ordinary Sharesasdfghjkl zxcvbnm100% (1)

- Effective Interest Method and Reclassification of Financial AssetsDocument1 pageEffective Interest Method and Reclassification of Financial Assetsbarneyaguilar8732No ratings yet

- Audit of InvestmentsDocument4 pagesAudit of InvestmentsLloydNo ratings yet

- Foreign Currency Transactions2019Document6 pagesForeign Currency Transactions2019Jeann MuycoNo ratings yet

- Drills Notes Receivable To Discounting of ReceivableDocument3 pagesDrills Notes Receivable To Discounting of ReceivableVincent AbellaNo ratings yet

- Quiz-8 (Securities)Document1 pageQuiz-8 (Securities)Panda ErarNo ratings yet

- Module 33 Retained Earnings ProblemDocument1 pageModule 33 Retained Earnings ProblemThalia UyNo ratings yet

- Module 1 Problems and Exercises 1 QuestionsDocument2 pagesModule 1 Problems and Exercises 1 QuestionsRafael Capunpon VallejosNo ratings yet

- Assignment Dilutive SecuritiesDocument2 pagesAssignment Dilutive SecuritiesJohanaNo ratings yet

- Universitas Indonesia Fakultas Ekonomi Dan BisnisDocument2 pagesUniversitas Indonesia Fakultas Ekonomi Dan BisnisGamesnEntertainment OnlyNo ratings yet

- Earnings Per Share DiscussionDocument2 pagesEarnings Per Share DiscussionSpongebob SquarepantsNo ratings yet

- Financial Accounting and Reporting (Accounting 15) InvestmentsDocument10 pagesFinancial Accounting and Reporting (Accounting 15) InvestmentsJoel Christian MascariñaNo ratings yet

- Financial Assets at Amortized CostDocument1 pageFinancial Assets at Amortized Costbarneyaguilar8732No ratings yet

- FAR-06 Earnings Per ShareDocument4 pagesFAR-06 Earnings Per ShareKim Cristian Maaño50% (2)

- Buscom 2Document5 pagesBuscom 2Janice AbonalesNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaAljur SalamedaNo ratings yet

- Practice Questions (Mar 5, 2024)Document3 pagesPractice Questions (Mar 5, 2024)Waqas Younas BandukdaNo ratings yet

- Assignment 6 - Foreign Currency Transactions and Derivatives PDFDocument8 pagesAssignment 6 - Foreign Currency Transactions and Derivatives PDFKurt Russel AduvisoNo ratings yet

- THEORY InventoryDocument1 pageTHEORY InventoryJohnallenson DacosinNo ratings yet

- Intermediate Accounting I - Investment Part 1Document3 pagesIntermediate Accounting I - Investment Part 1Joovs Joovho0% (3)

- Audit Problem Investments Part 1Document3 pagesAudit Problem Investments Part 1Rio Cyrel CelleroNo ratings yet

- Module 5 - Assessment ActivitiesDocument4 pagesModule 5 - Assessment Activitiesaj dumpNo ratings yet

- SDOADocument2 pagesSDOAassoc.uls2324No ratings yet

- INS3017-22-23-Code 2Document8 pagesINS3017-22-23-Code 2Ha Thu ĐinhNo ratings yet

- Ae121 Activity InvinbondsDocument1 pageAe121 Activity InvinbondsMary Ann Clarice YmanaNo ratings yet

- FAR JA-2023 QuestionDocument4 pagesFAR JA-2023 QuestionMd HasanNo ratings yet

- ACC 101 - NR Assignment SolutionDocument6 pagesACC 101 - NR Assignment SolutionAdyangNo ratings yet

- Quiz 3 With Correct AnswersDocument10 pagesQuiz 3 With Correct AnswersmarietorianoNo ratings yet

- 17 Questions Investment in Associate 2Document1 page17 Questions Investment in Associate 2bernadeth.lorzanoNo ratings yet

- Debt Securities PDFDocument7 pagesDebt Securities PDFChin-Chin Alvarez SabinianoNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- Ge 10 PretestDocument3 pagesGe 10 PretestJay LloydNo ratings yet

- AUD of PPE Problem 2Document11 pagesAUD of PPE Problem 2Jay LloydNo ratings yet

- Audit of ReceivablesDocument30 pagesAudit of ReceivablesJay LloydNo ratings yet

- GlobalizationDocument19 pagesGlobalizationJay LloydNo ratings yet

- Securities Regulation CodeDocument81 pagesSecurities Regulation CodeJay LloydNo ratings yet

- Chapter 3 Auditors ResponsibilityDocument17 pagesChapter 3 Auditors ResponsibilityJay LloydNo ratings yet

- NSTP 1 - QuestionnairesDocument3 pagesNSTP 1 - QuestionnairesJay LloydNo ratings yet

- Partnership Formation ProblemsDocument1 pagePartnership Formation ProblemsJay LloydNo ratings yet

- Headline WritingDocument8 pagesHeadline WritingJay LloydNo ratings yet

- Accounting 109 - Case Study - SambogDocument3 pagesAccounting 109 - Case Study - SambogJay LloydNo ratings yet

- Chapter 2 - UacsDocument31 pagesChapter 2 - UacsJay LloydNo ratings yet

- CORRELATIONDocument5 pagesCORRELATIONJay LloydNo ratings yet

- Chapter 11 THE AUDITORS REPORT ON FINANCIALDocument95 pagesChapter 11 THE AUDITORS REPORT ON FINANCIALJay Lloyd100% (1)

- Chapter 27 Aud 5Document24 pagesChapter 27 Aud 5Jay LloydNo ratings yet

- Accounting 109 SummaryDocument12 pagesAccounting 109 SummaryJay LloydNo ratings yet

- Coupon Accounting AbuseDocument2 pagesCoupon Accounting AbuseJay LloydNo ratings yet

- Liabilities Part 2Document4 pagesLiabilities Part 2Jay LloydNo ratings yet

- Aud5 Chapter-26Document27 pagesAud5 Chapter-26Jay LloydNo ratings yet

- MODULE 4 WACC Assignment MaterialDocument2 pagesMODULE 4 WACC Assignment MaterialJay LloydNo ratings yet

- 01B Forex QuestionDocument48 pages01B Forex QuestionrishavNo ratings yet

- Type Euro Symbol, Pound Symbol, Yen Symbol, and Other Currency Symbols OnlineDocument3 pagesType Euro Symbol, Pound Symbol, Yen Symbol, and Other Currency Symbols OnlineGabriel PereiraNo ratings yet

- Chapter 15 HW SolutionDocument5 pagesChapter 15 HW SolutionZarifah FasihahNo ratings yet

- Chapter 11 Foreign ExchangeDocument17 pagesChapter 11 Foreign Exchangebuzov_dNo ratings yet

- Solution Manual Chapter 2Document4 pagesSolution Manual Chapter 2Firda AziziaNo ratings yet

- Term 2 Foreign Exchange Week 6Document10 pagesTerm 2 Foreign Exchange Week 6Siphumeze TitiNo ratings yet

- NSSMC en Ar 2013 All V Nippon SteelDocument56 pagesNSSMC en Ar 2013 All V Nippon SteelJatin KaushikNo ratings yet

- Wksheet 05Document18 pagesWksheet 05venkeeeeeNo ratings yet

- IMF and World BankDocument100 pagesIMF and World BankMohsen SirajNo ratings yet

- 听见英国 AnswerDocument23 pages听见英国 Answer彭昱翔No ratings yet

- CH 02 SolsDocument2 pagesCH 02 SolsHạng VũNo ratings yet

- Full Download Multinational Financial Management 10th Edition Shapiro Solutions Manual PDF Full ChapterDocument36 pagesFull Download Multinational Financial Management 10th Edition Shapiro Solutions Manual PDF Full Chaptertightlybeak.xwf5100% (21)

- BrittonDocument26 pagesBrittonNidhin NalinamNo ratings yet

- Bank Resona Company Profile 2022 Ina Eng 230530 FinalDocument20 pagesBank Resona Company Profile 2022 Ina Eng 230530 FinalRamadan SiagianNo ratings yet

- Open-Economy Macroeconomics: Basic ConceptsDocument44 pagesOpen-Economy Macroeconomics: Basic ConceptsEricka Joy FranciscoNo ratings yet

- Indian Rupee Vs US Dollar Exchange RatesDocument3 pagesIndian Rupee Vs US Dollar Exchange RatesGanaie AhmadNo ratings yet

- Currency Fluctuations - How They Effect The Economy - InvestopediaDocument5 pagesCurrency Fluctuations - How They Effect The Economy - InvestopediaYagya RajawatNo ratings yet

- International Parity Conditions: (Or Chapter 4)Document28 pagesInternational Parity Conditions: (Or Chapter 4)masa michiyoshiokaNo ratings yet

- Sparse and Low-Rank Representation Lecture I: Motivation and TheoryDocument78 pagesSparse and Low-Rank Representation Lecture I: Motivation and TheoryMaz Har UlNo ratings yet

- Chapter 32 Exchange Rates Balance of Payments and International DebtDocument18 pagesChapter 32 Exchange Rates Balance of Payments and International DebtMary Chrisdel Obinque GarciaNo ratings yet

- Tut 4 SolutionsDocument2 pagesTut 4 SolutionsTriet NguyenNo ratings yet

- All in One Source For Grade 11 (2nd Sem)Document1,561 pagesAll in One Source For Grade 11 (2nd Sem)Jo Ash BiongNo ratings yet

- Trichy Full PaperDocument13 pagesTrichy Full PaperSwetha Sree RajagopalNo ratings yet

- Free Download Chapter 26 Solution Manual Financial Management by Brigham Chapter 26 Multinational Financial Management ANSWERS TO END-OF-CHAPTER QUESTIONSDocument4 pagesFree Download Chapter 26 Solution Manual Financial Management by Brigham Chapter 26 Multinational Financial Management ANSWERS TO END-OF-CHAPTER QUESTIONSSolutionz Manual0% (2)

- KomatsuDocument11 pagesKomatsuAmit AhujaNo ratings yet

- Grammar Notes For Lesson 9: 1. More Diverse Ways of ExpressionDocument19 pagesGrammar Notes For Lesson 9: 1. More Diverse Ways of ExpressionGab ServacioNo ratings yet

- 2.2 Sunchem Temp PrasadDocument8 pages2.2 Sunchem Temp PrasadaaidanrathiNo ratings yet

- SEB Report: New FX Scorecard Sees Swedish Currency StrengtheningDocument44 pagesSEB Report: New FX Scorecard Sees Swedish Currency StrengtheningSEB GroupNo ratings yet