Professional Documents

Culture Documents

Meby MMW

Meby MMW

Uploaded by

celsa empronOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Meby MMW

Meby MMW

Uploaded by

celsa empronCopyright:

Available Formats

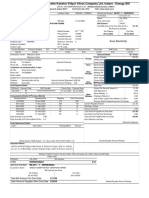

Name: Meby P.

Lamoste Section: MMW-J2

Advantages of Credit Card

1. A credit card is safer than carrying cash. While there’s only a small chance of having lost or

stolen cash returned, a credit card can quickly be cancelled if you lose your wallet. Most

financial institutions also have security processes in place to protect you if your card has been

lost or stolen or if you suspect your account has been used for a fraudulent transaction. If you’re

in any of these situations, make sure to contact your bank to report the issue as soon as

possible.

2. A credit card can build your credit rating. Your credit card account details and payment history

make up a key part of your credit score. If you keep your account in good standing, this

information will help you build up a good credit score, which could increase your chances of

approval for other products such as car loans or a mortgage.

3. You can get interest-free days. If you pay your balance in full before the statement period ends,

you can be rewarded with interest-free days on future purchases for a set period.

4. Earn rewards points when you spend. Rewards and airline credit cards allow you to earn

reward points on every dollar you spend on eligible purchases, such as the groceries and gas

costs. Earn reward points to redeem with the bank’s rewards programs for perks including

flights with partner airlines, products from the rewards store or cash back with rewards credit

cards. On the other hand, airline credit cards let you earn flights with specific airline loyalty

programs.

5. Request a chargeback if you’re unhappy with a product or service. Ask for a chargeback

through your credit card company if you have a dispute with a merchant, either in-store or

online.

6. Credit cards work in any currency. Although currency conversion fees usually apply, you can use

your credit card overseas to make purchases in a foreign currency. There are even credit cards

that waive fees for international purchases, which could be useful if you often shop at overseas

online stores or have an international holiday coming up.

7. Credit cards give you an emergency line of credit. Credit cards can be a financial safety net if

you don’t have enough cash or savings to cover any unexpected costs that arise. Remember that

you have to repay everything you owe, though.

8. Credit cards often have complimentary extras. Credit card features such as travel insurance,

purchase protection and extended warranty insurance can save you money and give you peace

of mind. Other value-adding features include complimentary flight offers, passes to some of the

best airline lounges and even free checked bags.

9. Travel reservations and insurance. In today’s Internet age, reserving your flight or booking your

hotel stay often requires a credit card to complete. If you don’t have one, you may find it hard to

make your travel itinerary. Also, most travel credit cards come with a variety of insurance and

coverage options, including travel accident insurance, lost luggage coverage, car rental collision

damage waiver, trip cancelation and more.

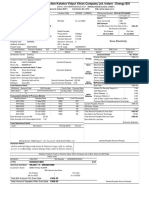

Disadvantages of Credit Card

1. Paying high rates of interest. If you carry a balance from month-to-month, you’ll pay interest

charges. Purchase and cash advance interest rates can be as high as 22% APR, so you can end up

paying hundreds or thousands more than you initially charged in interest if you’re unable to

make repayments each month.

2. Credit damage. Missed credit card repayments and ongoing debts are recorded on your credit

file and can impact your chances of getting a loan down the track. See our guide on how to

improve your credit score for some tips.

3. Credit card fraud. There are a range of fraud schemes that target credit cards. While you can be

compensated for illegal transactions on your account, dealing with credit card fraud can still be a

time-consuming and stressful experience. Scammers could use skimming devices, phishing

techniques and other tricks to steal your credit card information and your hard-earned money.

4. Cash advance fees and rates. Financial institutions make it very expensive to use your credit

card to get cash out or make other “cash equivalent” transactions, such as buying foreign

currency or gambling. Using a credit card for a cash withdrawal will attract a cash advance fee

worth around 3% of the total transaction amount. It also typically attracts an interest rate of 19–

22% right away.

5. Annual fees. While you can often get debit cards without annual fees, most credit cards have

them. These can cost as little as $25 per year, or as much as $1,200 depending on the card that

you choose. Generally, the more perks you want, the higher the cost of the annual fee. If you

want to avoid this charge, you can consider a no-annual-fee credit card — but make sure you

look at all the other features to help find a card that works for you.

6. Credit card surcharges. Businesses often apply a surcharge when you pay with a credit card. For

Mastercard and Visa products, this fee is usually 0.5–2% of the total transaction cost, while for

Amex cards it could be closer to 3%. Whatever the case, this is an extra cost for the convenience

of paying with plastic.

7. Other fees can quickly add up. Depending on your card, you could be charged fees when you

miss a payment, fees if you spend past your credit limit, fees for overseas transactions, balance

transfer fees and even some rewards programs fees. If you carry a balance or don’t have access

to interest-free days, there’s also a good chance interest will be applied to these charges.

8. Overspending. When talking about the pros and cons of credit cards, this is the classic

downside. Some individuals can get easily carried away with their credit card, creating a debt

that is beyond their means to pay off.

You might also like

- The Credit Card GuidebookDocument161 pagesThe Credit Card GuidebookRea MayNo ratings yet

- NON-TOD Bill Preview PDFDocument1 pageNON-TOD Bill Preview PDFAkash Singh0% (1)

- Debit Card Issued by A Bank Allowing The Holder To Transfer Money Electronically To Another Bank Account When Making A PurchaseDocument9 pagesDebit Card Issued by A Bank Allowing The Holder To Transfer Money Electronically To Another Bank Account When Making A PurchaseShovan ChowdhuryNo ratings yet

- Plastic MoneyDocument105 pagesPlastic Moneygkmrmanish100% (3)

- Owing WorksheetDocument7 pagesOwing Worksheetapi-273999449No ratings yet

- What Is A Credit CardDocument6 pagesWhat Is A Credit CardPrince AschwellNo ratings yet

- Document 6Document6 pagesDocument 6Yasiru PandigamaNo ratings yet

- Understanding The Background of Credit CardDocument17 pagesUnderstanding The Background of Credit CarddeepanshuNo ratings yet

- An Introduction To Credit CardDocument58 pagesAn Introduction To Credit CardAsefNo ratings yet

- Debit VS Credit11Document3 pagesDebit VS Credit11For YoutubeNo ratings yet

- Personal Finacial Literacy NotesDocument64 pagesPersonal Finacial Literacy Notesmpontier123100% (1)

- Is Credit Wealth: Negative Aspects of CreditDocument4 pagesIs Credit Wealth: Negative Aspects of CreditFrederick PatacsilNo ratings yet

- Credit Card BusinessDocument51 pagesCredit Card BusinessAsefNo ratings yet

- Introduction To Consumer CreditDocument21 pagesIntroduction To Consumer Credittreasure ROTYNo ratings yet

- Define and Explain Thoroughly What Is CREDITDocument4 pagesDefine and Explain Thoroughly What Is CREDITAngelika SinguranNo ratings yet

- Banking Practice Unit 5 What Is A 'Credit Card'Document6 pagesBanking Practice Unit 5 What Is A 'Credit Card'Nandhini VirgoNo ratings yet

- Banking Practice Unit 5 What Is A 'Credit Card'Document6 pagesBanking Practice Unit 5 What Is A 'Credit Card'Nandhini VirgoNo ratings yet

- Module 1Document16 pagesModule 1Hyacinth FNo ratings yet

- Credit Cards InformationDocument15 pagesCredit Cards InformationShekar Kurakula0% (1)

- Literature Review On The Credit Card IndustryDocument4 pagesLiterature Review On The Credit Card IndustryKhushbooNo ratings yet

- Ecommerce Unit 4Document12 pagesEcommerce Unit 4jhanviNo ratings yet

- Credit DebtDocument41 pagesCredit Debtbns.publishing12100% (1)

- Credit Card Bill Would Do More Harm Than GoodDocument13 pagesCredit Card Bill Would Do More Harm Than GoodJhon Piter MNo ratings yet

- The Importance of Credit CardsDocument2 pagesThe Importance of Credit Cardsdevendra meenaNo ratings yet

- Different Types of Credit Cards PDFDocument2 pagesDifferent Types of Credit Cards PDFJosé BurgeiroNo ratings yet

- Plastic Money: Defination of Plastic Money:-Term: A Slang Phrase For Credit Cards, Especially When Such CardsDocument6 pagesPlastic Money: Defination of Plastic Money:-Term: A Slang Phrase For Credit Cards, Especially When Such CardsEvans VasavanNo ratings yet

- 5 Easy Ways To Save MoneyDocument2 pages5 Easy Ways To Save MoneyReuben EscarlanNo ratings yet

- Unit 5Document16 pagesUnit 5rishavNo ratings yet

- AmexDocument12 pagesAmexMohammad BilalNo ratings yet

- H/W Topic 6 4/11/19Document4 pagesH/W Topic 6 4/11/19sssda fffdfNo ratings yet

- Safari - Oct 13, 2020 at 6:15 PMDocument1 pageSafari - Oct 13, 2020 at 6:15 PMJaboris JohnNo ratings yet

- Electronic Funds TransferDocument14 pagesElectronic Funds TransferRaj KumarNo ratings yet

- H H H H H: #2 Your Bank Account #3 Home Equity Line of CreditDocument2 pagesH H H H H: #2 Your Bank Account #3 Home Equity Line of CreditFlaviub23No ratings yet

- Credit Card: Dr. Yamini Sharma D.M.SDocument31 pagesCredit Card: Dr. Yamini Sharma D.M.SJames RossNo ratings yet

- Prepared by HilmiDocument3 pagesPrepared by HilmiMuhammad Hilmi BundleNo ratings yet

- Consumer Credit: Submitted By: Aayush Behal Shashank Singh Manik MittalDocument61 pagesConsumer Credit: Submitted By: Aayush Behal Shashank Singh Manik Mittalmanik_mittal30% (1)

- Mukkessshhh 23Document65 pagesMukkessshhh 23Satinder ShindaNo ratings yet

- Credit Card : Classifcations, Types, Charges/Fees and Business ModelsDocument14 pagesCredit Card : Classifcations, Types, Charges/Fees and Business ModelsAsef KhademiNo ratings yet

- International Journal of Contemporary PracticesDocument8 pagesInternational Journal of Contemporary Practiceskhushnuma20No ratings yet

- FMS ProjectDocument16 pagesFMS ProjectVinod KumarNo ratings yet

- Advantages and Disadvantages of Credit CardsDocument3 pagesAdvantages and Disadvantages of Credit CardsAsif AliNo ratings yet

- Lovely Professionaluniversity: Personal Financial PlanningDocument12 pagesLovely Professionaluniversity: Personal Financial Planningaadi642No ratings yet

- Thesis About Debit CardsDocument8 pagesThesis About Debit Cardsafkodpexy100% (2)

- The Advantages of Credit CardDocument1 pageThe Advantages of Credit CardYuda SetiawanNo ratings yet

- Frauds in Plastic MoneyDocument60 pagesFrauds in Plastic MoneyChitra Salian0% (1)

- Financial Literacy CourseDocument29 pagesFinancial Literacy CourseAsfandyar KhanNo ratings yet

- Credit, Collection and Compliance Application # 3 - Managing CreditDocument3 pagesCredit, Collection and Compliance Application # 3 - Managing CreditGabriel Matthew Lanzarfel GabudNo ratings yet

- Credit DisputeDocument15 pagesCredit Disputeedward julius67% (3)

- Bank CardsDocument2 pagesBank Cardsalex_212No ratings yet

- Mcgill Personal Finance Essentials Transcript Module 2: Debt and Borrowing, Part 1Document7 pagesMcgill Personal Finance Essentials Transcript Module 2: Debt and Borrowing, Part 1shourav2113No ratings yet

- Secured Credit CardsDocument4 pagesSecured Credit Cardsjeremyyu2003No ratings yet

- 10 Ways To Increase Your Chances of Getting A Credit Card ApprovedDocument1 page10 Ways To Increase Your Chances of Getting A Credit Card ApprovedBhanuka SamarakoonNo ratings yet

- Chapter 7 Choosing A Source of Credit The Costs of Credit AlternativesDocument40 pagesChapter 7 Choosing A Source of Credit The Costs of Credit Alternativesgyanprakashdeb302No ratings yet

- l5 - Credit and Debt 4Document14 pagesl5 - Credit and Debt 4api-290878974No ratings yet

- Credit CardDocument51 pagesCredit CardSmita JainNo ratings yet

- Module 6B CreditDocument41 pagesModule 6B CreditLorejhen VillanuevaNo ratings yet

- Students and Credit Cards MiniDocument32 pagesStudents and Credit Cards MiniVikram SinghNo ratings yet

- Credit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsFrom EverandCredit Secrets: Learn the concepts of Credit Scores, How to Boost them and Take Advantages from Your Credit CardsNo ratings yet

- World Lit Report-Biag Ni Lam-AngDocument5 pagesWorld Lit Report-Biag Ni Lam-Angcelsa empronNo ratings yet

- World Lit AssigntmentDocument2 pagesWorld Lit Assigntmentcelsa empronNo ratings yet

- The Dancers World LitDocument10 pagesThe Dancers World Litcelsa empronNo ratings yet

- IS106 - FinalExam - B Nescel John PerpasDocument5 pagesIS106 - FinalExam - B Nescel John Perpascelsa empron0% (1)

- Makemytrip Icici Bank Platinum Credit Card Membership GuideDocument11 pagesMakemytrip Icici Bank Platinum Credit Card Membership GuideKon ArvaNo ratings yet

- Chase Sapphire Preferred With Ultimate Rewards Program AgreementDocument5 pagesChase Sapphire Preferred With Ultimate Rewards Program AgreementBen WuNo ratings yet

- Save Electricity: LV1 N3962038232 MLZ91 - 1 - 3962038232Document1 pageSave Electricity: LV1 N3962038232 MLZ91 - 1 - 3962038232santosh_325No ratings yet

- Reservation Confirmed: Tel: +971 6 558 0000, Fax: +971 6 558 0008Document3 pagesReservation Confirmed: Tel: +971 6 558 0000, Fax: +971 6 558 0008Shubham SinghNo ratings yet

- Products Distributed by Worldwide Sporting GoodsDocument4 pagesProducts Distributed by Worldwide Sporting GoodsGeorge KariukiNo ratings yet

- Airtel Bill October PytDocument1 pageAirtel Bill October PytKevin DsouzaNo ratings yet

- Receiver Paid - MyDHL+Document28 pagesReceiver Paid - MyDHL+Đen LêNo ratings yet

- Excalibur CatalogDocument16 pagesExcalibur Catalogchevy-usa-1No ratings yet

- Madhyanchal Vidyut Vitran Nigam Limited: Powered by Fluentgrid Ltd. (Formerly Phoenix It Solutions LTD.) - Mpower™ CssDocument1 pageMadhyanchal Vidyut Vitran Nigam Limited: Powered by Fluentgrid Ltd. (Formerly Phoenix It Solutions LTD.) - Mpower™ CssInder Kumar100% (1)

- Zen Signature Credit Card: INR 1500 INR 1500Document3 pagesZen Signature Credit Card: INR 1500 INR 1500Saksham GoelNo ratings yet

- 2GO Travel - Itinerary ReceiptDocument3 pages2GO Travel - Itinerary ReceiptAnthony CarolloNo ratings yet

- 24 02 2018 - ElectricityBillDocument1 page24 02 2018 - ElectricityBillAditya TiwariNo ratings yet

- A Brief Study On Value Added Services Offered by HDFC BankDocument90 pagesA Brief Study On Value Added Services Offered by HDFC BankShashank RanaNo ratings yet

- Christopher Doll DissertationDocument5 pagesChristopher Doll DissertationEnglishPaperHelpUK100% (1)

- Save Electricity: LV1 N3963001896 SKZ40 - 9 - 3963001896Document1 pageSave Electricity: LV1 N3963001896 SKZ40 - 9 - 3963001896lahotishreyanshNo ratings yet

- Umali v. Miclat 105 Phil 1109 Oblicon AjeDocument1 pageUmali v. Miclat 105 Phil 1109 Oblicon AjeAje EmpaniaNo ratings yet

- Indusind Bank Legend Credit Card Benefit GuideDocument32 pagesIndusind Bank Legend Credit Card Benefit Guidevamshi vNo ratings yet

- Language ExplorerDocument16 pagesLanguage ExplorerDulguun Enkhtaivan100% (2)

- Kristin Domestic Fee Schedule 2024Document1 pageKristin Domestic Fee Schedule 2024Smile PrincessNo ratings yet

- Tariff and Associated Terms and Conditions For 2021-22Document4 pagesTariff and Associated Terms and Conditions For 2021-22Rahul DuttaNo ratings yet

- ProductDocument7 pagesProductmemomohitNo ratings yet

- Payments Card Includes Credit Cards and Debit CardsDocument6 pagesPayments Card Includes Credit Cards and Debit CardsdivyavishalNo ratings yet

- ItineraryDocument2 pagesItinerarynashiksccsNo ratings yet

- 2023 TemplateDocument2 pages2023 TemplateAfrith Rahim100% (1)

- Booking Confirmation: I. Customer InformationDocument2 pagesBooking Confirmation: I. Customer Informationlam HàNo ratings yet

- PDFDocument4 pagesPDFAce MereriaNo ratings yet

- Domestic: SMT Supriya ChowdhuryDocument2 pagesDomestic: SMT Supriya ChowdhurySujay HalderNo ratings yet

- Channels Television Ad RatesDocument11 pagesChannels Television Ad RatesfolaodetNo ratings yet

- EzeePay DistributorDocument19 pagesEzeePay Distributorpavan bNo ratings yet