Professional Documents

Culture Documents

Ofc Ad9 Mid - Quiz 1

Ofc Ad9 Mid - Quiz 1

Uploaded by

dindo monilOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ofc Ad9 Mid - Quiz 1

Ofc Ad9 Mid - Quiz 1

Uploaded by

dindo monilCopyright:

Available Formats

MIDTERM QUIZ.

1

OFFICE Ad 9

1. It is tax imposed on gift or the transfer without consideration of property between two or more persons who are

living at the time the transfer is made.

2. The total amount of gifts less the allowable deductions and specific exemptions.

3. What do you call a person who is not a brother, sister, spouse, ancestor and lineal descendant or a relative by

consanguinity in the collateral line, not within the 4th degree of relationship?

4. It is the excess of the output tax on sale, etc. of goods, properties or services over the input tax on important and

local purchases.

5. These are taxes measured by a certain percentage of the gross selling price or gross value in money of goods sold,

bartered, exchange, or imported or gross receipts or earnings derived by any person engaged in the sale of

services.

6. It means all amounts received by the prime or principal contractor and diminished by any amount paid to any

subcontractor under a subcontract arrangement.

7. It is a kind of excise tax imposed based on weight or volume capacity or any other physical unit of measurement

8. How is petroleum product computed based on excise stocks?

9. It is a tax on documents, instruments and papers evidencing the acceptance, assignment, sale or transfer of an

obligation, rights or property incident there too.

10. These are taxes levied by a government on goods exported from or imported into the country.

11. It means a book of rates, a schedule of fees imposed on goods exported from or imported into a country.

12. The offices charged with administration and enforcement of the law are the ______ and ____

13. It is the duty imposed on imported articles or their containers, which have not been properly marked in any

official language of the Philippines, as to indicate the name of the country or origin of the article.

14. These are fees imposed on vessels entering into or departing from a port of entry of the Philippines.

15. What do you call the charges assessed on articles for storage in customs premises, cargo sheds and warehouses of

the government?

16. It refers to any drug which produces insensibility, stupor, melancholy or dullness of mind with delusions and

which may be habit forming and includes opium, opium derivatives and synthetic opiates.

17. It is no longer required for purposes of travel.

18. What does MV UC means?

19. What does LTO stands for?

20. It is an act of liberality whereby a person disposes gratuitously a thing, or right in favor of another who accepts it.

21. It refers to the total amount of gifts, less the allowable deductions and specific exemptions.

22. It means the value added tax due on the sale or lease of taxable goods, properties or services by a VAT registered

person or person required to register under the law.

23. Define EF PS.

24. Give the meaning of BSP.

25. These products are taxed based on the net retail price per bottle for sparkling wines and proof for still wines.

26. These are fees assessed against a vessel for mooring or birthing at a pier, wharf or river at any port in the

Philippines.

27. These are charges imposed on all imported and exported articles and baggages of passengers for their handling,

receiving and custody.

28. These are tax imposed upon producers and importers of narcotic drugs.

29. What does the DOTC means?

30. The travel tax shall be collected by the carriers or their agents issuing the tickets, and the carriers shall remit their

collection to the___________.

You might also like

- Crim Exam Judge ArtDocument5 pagesCrim Exam Judge ArtNashiba Dida-AgunNo ratings yet

- Business TaxesDocument50 pagesBusiness TaxesSunny DaeNo ratings yet

- Business TaxesDocument50 pagesBusiness TaxesMacatol KristineNo ratings yet

- Lesson 15: TaxationDocument15 pagesLesson 15: TaxationRheanne OseaNo ratings yet

- Course SynthesisDocument7 pagesCourse SynthesisZiyeon SongNo ratings yet

- Bustax ReviewerDocument7 pagesBustax ReviewerJeremy JimenezNo ratings yet

- PDF DocumentDocument8 pagesPDF DocumentNinaNo ratings yet

- PDF DocumentDocument8 pagesPDF DocumentNinaNo ratings yet

- LawDocument43 pagesLawMARIANo ratings yet

- Taxiation Group 8Document15 pagesTaxiation Group 8rheamae2bernalesNo ratings yet

- VAT Group 3Document39 pagesVAT Group 3Andrea GranilNo ratings yet

- Taxing Powers, Scope and Limitations of Nga and LguDocument7 pagesTaxing Powers, Scope and Limitations of Nga and LguArthur MericoNo ratings yet

- Module 4 Lesson 10 Taxation Read... in Phil. His.Document5 pagesModule 4 Lesson 10 Taxation Read... in Phil. His.John Mark Candeluna EreniaNo ratings yet

- VALUE Added TaxDocument20 pagesVALUE Added TaxMadz Rj MangorobongNo ratings yet

- Local Revenue GenerationDocument9 pagesLocal Revenue GenerationIsnihaya I. AbubacarNo ratings yet

- Comparison VAT.Document11 pagesComparison VAT.Francis Ian BirondoNo ratings yet

- Other Percentage Taxes: Prof. Jeanefer Reyes CPA, MPADocument29 pagesOther Percentage Taxes: Prof. Jeanefer Reyes CPA, MPAmark anthony espirituNo ratings yet

- Felipe, Emmyrose N. BSA-3 (Tax 2 MW 8:30-10:00am)Document5 pagesFelipe, Emmyrose N. BSA-3 (Tax 2 MW 8:30-10:00am)AustinNo ratings yet

- Activi: Taxation 219Document14 pagesActivi: Taxation 219Block escapeNo ratings yet

- Business Tax - Chapter 5Document37 pagesBusiness Tax - Chapter 5Anie MartinezNo ratings yet

- Value Added TaxDocument32 pagesValue Added Taxsei1davidNo ratings yet

- Taxation Value-Added Tax: Lecture NotesDocument23 pagesTaxation Value-Added Tax: Lecture Notestherezzzz0% (1)

- Review Business and Transfer TaxDocument201 pagesReview Business and Transfer TaxReginald ValenciaNo ratings yet

- VALUE-ADDED TAX NOTES-WPS OfficeDocument14 pagesVALUE-ADDED TAX NOTES-WPS Officeyasser lucmanNo ratings yet

- GR No. 188497 Dated February 19, 2014: Separate Opinion of Justice Bersamin in CIR vs. Pilipinas ShellDocument19 pagesGR No. 188497 Dated February 19, 2014: Separate Opinion of Justice Bersamin in CIR vs. Pilipinas ShellPaul Joshua SubaNo ratings yet

- MODULE 2 Value Added TaxDocument21 pagesMODULE 2 Value Added TaxLenson NatividadNo ratings yet

- Reviewer BTTDocument14 pagesReviewer BTTAlthea Frances VasalloNo ratings yet

- PT, Excise and DST NotesDocument10 pagesPT, Excise and DST NotesFayie De LunaNo ratings yet

- OtesvatDocument18 pagesOtesvatRichelle Joy Reyes BenitoNo ratings yet

- Application For VAT Zero RatingDocument9 pagesApplication For VAT Zero RatingHanabishi RekkaNo ratings yet

- I. Basic Concepts in Income TaxationDocument79 pagesI. Basic Concepts in Income Taxationcmv mendoza100% (1)

- Air Canada vs. Cir, G. R. No. 169507 (2016 J. Leonen)Document1 pageAir Canada vs. Cir, G. R. No. 169507 (2016 J. Leonen)Y P Dela PeñaNo ratings yet

- Tax 2 AssignmentDocument6 pagesTax 2 AssignmentKim EcarmaNo ratings yet

- Vat On Sale of Goods or PropertiesDocument7 pagesVat On Sale of Goods or Propertiesnohair100% (3)

- Local Taxation: Taxing Power of LGU'sDocument5 pagesLocal Taxation: Taxing Power of LGU'sJaymark FernandoNo ratings yet

- CARL ANDREW Assignment Tax 102Document7 pagesCARL ANDREW Assignment Tax 102Carl Andrew Aborquez Arcinal0% (1)

- Value Added TaxDocument7 pagesValue Added Taxalbert agnesNo ratings yet

- TaxationDocument5 pagesTaxationThonieroce Apryle Jey Morelos100% (1)

- E. Other Percentage TaxesDocument49 pagesE. Other Percentage TaxesNatalie SerranoNo ratings yet

- Revenue Regulations No. 16-2005 (Digest)Document19 pagesRevenue Regulations No. 16-2005 (Digest)JERepaldoNo ratings yet

- Taxation IIDocument3 pagesTaxation IIAnonymous BNrz1arNo ratings yet

- Accounting Ed.04 (Business & Transfer Taxes) Ma. Daria N. Labalan, Cpa, Mba TF-7:20-8:55Document3 pagesAccounting Ed.04 (Business & Transfer Taxes) Ma. Daria N. Labalan, Cpa, Mba TF-7:20-8:55Jerbert JesalvaNo ratings yet

- Income Tax Part IIIDocument6 pagesIncome Tax Part IIImary jhoyNo ratings yet

- Taxation 1Document11 pagesTaxation 1graciaNo ratings yet

- Tax LawsDocument19 pagesTax LawsJoshua CastilloNo ratings yet

- Vat TaxDocument6 pagesVat TaxJunivenReyUmadhayNo ratings yet

- Value Added Tax - Sale of GoodsDocument8 pagesValue Added Tax - Sale of Goods2071275No ratings yet

- STAGES ASPECTS WPS OfficeDocument20 pagesSTAGES ASPECTS WPS OfficesimpatheticoNo ratings yet

- VatDocument70 pagesVatPETERWILLE CHUANo ratings yet

- Princples of Taxation: Janet G. Taojo-Matuguinas, Cpa, Mba PresenterDocument43 pagesPrincples of Taxation: Janet G. Taojo-Matuguinas, Cpa, Mba PresenterMae NamocNo ratings yet

- DAY 22-Philippine Government, Taxation, and Agrarian Reform (Part 2)Document34 pagesDAY 22-Philippine Government, Taxation, and Agrarian Reform (Part 2)Starilazation KDNo ratings yet

- Value Added TaxDocument4 pagesValue Added TaxJune Romeo ObiasNo ratings yet

- BUSTAXADocument9 pagesBUSTAXATitania ErzaNo ratings yet

- Tax - PDF of Prof. Mamalateo'sDocument18 pagesTax - PDF of Prof. Mamalateo'sRenante Rodrigo100% (1)

- Percentage Tax Excise Tax Documentary Stamp: Taxation LawDocument23 pagesPercentage Tax Excise Tax Documentary Stamp: Taxation LawB-an Javelosa100% (1)

- Taxation: Paula R. Morota BS Midwifery IDocument37 pagesTaxation: Paula R. Morota BS Midwifery INano KaNo ratings yet

- TAX Midterm ReviewerDocument10 pagesTAX Midterm ReviewerCookie MasterNo ratings yet

- Types of Taxes in The PhilippinesDocument4 pagesTypes of Taxes in The PhilippinesRieva Jean Pacina100% (1)

- VAT NotesDocument8 pagesVAT NotesFayie De LunaNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- General Instructions for the Guidance of Post Office Inspectors in the Dominion of CanadaFrom EverandGeneral Instructions for the Guidance of Post Office Inspectors in the Dominion of CanadaNo ratings yet

- Advertising Chapter 5Document37 pagesAdvertising Chapter 5dindo monilNo ratings yet

- Advertising Chapter 4Document22 pagesAdvertising Chapter 4dindo monilNo ratings yet

- Advertising Chapter 3Document40 pagesAdvertising Chapter 3dindo monilNo ratings yet

- RCI 103 Advertising Principles and PracticesDocument7 pagesRCI 103 Advertising Principles and Practicesdindo monilNo ratings yet

- Taxation PrelimDocument3 pagesTaxation Prelimdindo monilNo ratings yet

- Activities No. 1Document1 pageActivities No. 1dindo monilNo ratings yet

- RCI Prelim Exam Set ADocument3 pagesRCI Prelim Exam Set Adindo monilNo ratings yet

- Ofc Ad 9 - Quiz 1Document2 pagesOfc Ad 9 - Quiz 1dindo monilNo ratings yet

- Poli 1Document125 pagesPoli 1Veah CaabayNo ratings yet

- NC 410t Addendum 112019Document4 pagesNC 410t Addendum 112019rahulqtpNo ratings yet

- Previous Year Question Paper 2024 GSTDocument6 pagesPrevious Year Question Paper 2024 GSTsangeetha3508No ratings yet

- Final Audit - MCQ (For Nov. 2023 Exams)Document94 pagesFinal Audit - MCQ (For Nov. 2023 Exams)bhallavishal1996No ratings yet

- Construction Progress Report: ST STDocument3 pagesConstruction Progress Report: ST STCashmere AbutanNo ratings yet

- Number System 4Document2 pagesNumber System 4Zainab Thasneem BadurdeenNo ratings yet

- TST WU ExpandedDocument18 pagesTST WU ExpandedLucas Quaio BelanzuoliNo ratings yet

- (COPY) Effects of The Black Death - Source Response - Trong Son TranDocument12 pages(COPY) Effects of The Black Death - Source Response - Trong Son Tranphammaithuy76No ratings yet

- Bagatellesforhar 1941 Gran 1Document6 pagesBagatellesforhar 1941 Gran 1wongyinlaiNo ratings yet

- Maruti Suzuki Arena Salem Price List W.E.F 20 JUN 2019Document2 pagesMaruti Suzuki Arena Salem Price List W.E.F 20 JUN 2019KARTHIKEYANNo ratings yet

- 10 Phil-Nippon vs. Gudelosao (796 SCRA 508)Document2 pages10 Phil-Nippon vs. Gudelosao (796 SCRA 508)Marco CervantesNo ratings yet

- Espina v. ZamoraDocument6 pagesEspina v. ZamoraChristine Joy PamaNo ratings yet

- Case LawDocument4 pagesCase LawSabrinaAmirNo ratings yet

- GDocument4 pagesGKimberly Sheen Quisado TabadaNo ratings yet

- PartF Vol1 2017Document240 pagesPartF Vol1 2017Anonymous v7XdaQuNo ratings yet

- Top-Rated Personal Injury Lawyers in Carson City - Benson & BinghamDocument7 pagesTop-Rated Personal Injury Lawyers in Carson City - Benson & BinghamBenson & Bingham Accident Injury Lawyers, LLCNo ratings yet

- Supplied by Billed ToDocument2 pagesSupplied by Billed TogadNo ratings yet

- Ra 7691Document23 pagesRa 7691Elenita OrdaNo ratings yet

- Increment - Information DocumentDocument5 pagesIncrement - Information DocumentRavi Rai MarwahNo ratings yet

- Terms and ConditionsDocument4 pagesTerms and ConditionsDhvanit JoshiNo ratings yet

- Parents Sue District Over Alleged Racism Against StudentDocument21 pagesParents Sue District Over Alleged Racism Against Studentbrandon carrNo ratings yet

- Sen Sec Exam Guide NoaDocument6 pagesSen Sec Exam Guide NoaDenzel MusaNo ratings yet

- Supreme Court Verdict On Election DateDocument13 pagesSupreme Court Verdict On Election DateWasif ShakilNo ratings yet

- Part A & BDocument6 pagesPart A & BRiya PrajapatiNo ratings yet

- Law Making Process in NigeriaDocument6 pagesLaw Making Process in Nigeriashaba samsonNo ratings yet

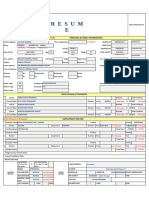

- Eq - 040422 Fill Up Biodata FormDocument1 pageEq - 040422 Fill Up Biodata Formnjbxhycn4bNo ratings yet

- CLJ 1 ReviewerDocument4 pagesCLJ 1 RevieweratienzajisangNo ratings yet

- Your Text Here Your Text Here: Chanakya National LAW University PatnaDocument3 pagesYour Text Here Your Text Here: Chanakya National LAW University PatnaNikhil BhartiNo ratings yet

- Heirs of Doronio Vs Hrs of DoronioDocument11 pagesHeirs of Doronio Vs Hrs of DoronioSamantha BaricauaNo ratings yet