Professional Documents

Culture Documents

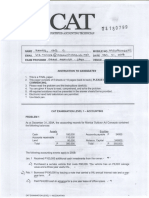

2023 01 12 16 03

2023 01 12 16 03

Uploaded by

Dev Joshi0 ratings0% found this document useful (0 votes)

5 views42 pagesOriginal Title

2023-01-12-16-03

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

5 views42 pages2023 01 12 16 03

2023 01 12 16 03

Uploaded by

Dev JoshiCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 42

Nawanagar Bank is a private sector bank

in India. It was founded in 1943 and is

headquartered in Jamnagar, Gujarat. The

bank offers a variety of banking and

financial services to individuals and

businesses, including deposit accounts,

loans, and investment services.

Nawanagar Bank Limited, also known as

the "Princely Bank", is a private sector

bank in India. It was founded in 1943 by

the late Maharaja Jam Sahib of Nawanagar

and was headquartered in Jamnagar,

Gujarat. The bank has a network of

branches across the country and offers a

variety of banking and financial services to

individuals and businesses, including

deposit accounts, loans, and investment

services. In 2019, the Bank was merged

with and into Bank of Baroda.

The bank's main products and services

included personal banking, corporate

banking, NRI banking, agricultural banking,

and SME banking. In personal banking, the

bank offered a range of deposit accounts,

loans, and investment options to meet the

diverse needs of its customers. In

corporate banking, the bank provided

services such as working capital financing,

term loans, and trade finance.

The bank also had a strong presence in the

agricultural sector and offered a range of

products and services to farmers and rural

customers.The merger was aimed at

enhancing the customer experience,

increasing operational efficiency, and

expanding the bank's reach and scale.

The bank has the reserve of 150 crores

however, it's important to note that Reserve

refers to the portion of a bank's funds that

are kept aside to meet unexpected losses

and to ensure that the bank can meet its

obligations to its depositors and other

creditors. Reserve is a crucial part of a

bank's balance sheet, and it is an indicator

of the bank's financial health and stability.

Nawanagar bank provides various loan

facilities such as:-

* Cash Credit against Hypo.

* Term Loan for Machinery / Equipments /

Comm. vehicles

* Loans to Professionals

* Consumer Loan

* Housing Loan

Services provided by the bank are as

follows:-

* RuPay Debit-cum-ATM-Card

* Stamp Franking

* PGVCL Bill Collection

* Life Insurance

* RTGS / NEFT

The Nawanagar Co-operative Bank Ltd. ,

registered under Gujarat Co-operative

Societies Act 1961, popularly known as

Nawanagar Bank commenced its banking

business with a small capital of Rs. 1.36

lakh at Jamnagar in the year 1980. The

Reserve Bank of India has issued Bank

License No. ACD/GJ/196-P dt. 2/4/1980.

The idea of establishing of Bank was the

dream of young and dedicated like-minded

persons like Shri Jaysukhbhai Hathi, Shri

Gulabbhai Shah, Shri Jayantilal Anjaria,

Shri Ramnikbhai Shah and many

dignitaries of Jamnagar

Since then the Bank has never looked

back. As on today the Bank has 11

branches in the City plus 1 extension

counter at Haria School.

Technological Up-gradation :-

All the 12 branches of the Bank are

connected under CBS platform. Customers

receive SMS alerts for their transactions.

Bank has already launched ATM Cum

Debit Cards and on-site ATMs at various

places. Bank has also opened E-Lobby in

ground floor of Head Office premises

wherein ATM, Passbook Printer, Cash

Deposit Machine and Coin vending

machine have been installed for the

general public.

SAGA of Successful Growth: -

Business Figures

(Rs. In Lacs)

Sr. No. Particulars 30-06-1981 30-06-1991

31-03-2001 31-03-2011 31-3-2022

1 Share Capital 5.35 20.00 200.00 568.48

1,336.42

2 Reserves 0.21 49.51 2,210.00 7,882.53

16,257.68

3 Deposits 25.37 677.66 12,874.63

27,712.93 90,259.75

4 Advances 10.59 380.44 4,905.42

11,509.55 35,713.39

5 Profit -0.32 26.47 465.43 465.57

1,101.00

6 Working Funds 32.76 793.66 16,547.42

37,391.39 1,09,655.15

Bank has also tie-up arrangement

with M/s. HDFC Life Insurance Company

Ltd. and Reliance Nippon Life Insurance

Company Ltd., for insurance business.

Social Responsibilities:-

Bank has launched several schemes

for the benefit of its stake holders,

shareholders and customers. Bank has

taken unique steps that if all the owners of

the unit are female, special concession in

rate of interest is granted. If there is regular

repayment in Housing Loan additional

benefit in rate of interest is passed on to

the Borrowers.

All Share Holders have facility to

receive amount up to Rs. 12,500/- in case

of hospitalization expenses. In case of

Death of a shareholder Rs. 11,000/- are

given to the bereaved family.

Atmanirbhar Gujarat Sahay Yojana

Scheme Details

As per RBI guidelines, Nawanagar

Co-operative Bank Ltd. will be pleased to

grant you a moratorium on your

loan/CC/OD facilities. However, if you

chose not to avail the moratorium, contact

your Branch immediately through email /

letter.

Bank offers 3.25% interest p.a. on savings

bank account.

Know Your Customer Have you heard of a

small account? Even without proof of

identity and address, open a Basic Savings

Bank Deposit Account by submitting a

recent photograph and a signature. Enjoy

account balance of up to Rs. 50,000/- and

total credits of up to Rs. 1 lakh per financial

year

Pradhan Mantri Jivan Jyoti Bima Yojana

Get Rs. 2 lakhs Insurance at affordable

premiums

Scope of coverage:

Age should be between 18 to 50 years

Should be account holder of the bank. In

case of multiple savings accounts held by

an individual in or different banks, the

person shall be eligible to join the scheme

through one savings bank account only.

Enrolment modality:

Cover shall be for one year period

stretching from 1st June to 31st May

Premium: 330/- p.a. It will be deducted

from the account holder s savings bank

account through auto debit facility in one

instalment

Benefits: 2.0 lacs in case of death due to

any reason. Cover will be provided by Life

Insurance Corporation of Indi

Annual report of the year 2109-20

the accompanying financial statement of

The Nawanagar Co-operative Bank Limited

(he

Bank) as at 31 March 2020, which

comprise the Balance Sheet as at 31"

March 2020, and the Profit and

Loss Account, and the Cash Flow

Statement for the year then ended, and a

summary of significant

accounting policies and other explanatory

information. The returns of 11 branches

audited by us are

incorporated in these financial statements.

Management's Responsibility for the

financial statement.

2. Management is responsible for the

preparation of these financial statement

that gives a true and fair view of

the financial position, financial performance

and cash low of the Bank in accordance

with Banking

Regulation Act 1949 (as applicable to

co-operative societies), the guidelines

issued by the Reserve Bank of

India and The Registrar of Co-Operative

Societies, Gujarat, The Gujarat

Co-Operative Societies Act, 1961

and the Gujarat Co-Operative Societies

Rules, 1965 and generally accepted

accounting principles in India so

far as applicable to the Bank. This

responsibility includes design,

implementation and maintenance of

internal control relevant to the financial

statement that are free from material

misstatement, whether due to

fraud or error.

Auditor's Responsibility

3.Our responsibility is to expres an opinion

on these financial statement based on our

audit. We conducted our

audit in accordance with standards on

Auditing issued by the lnstitute of

Chartered Accountants of India.

Those standards require that we comply

with ethical requirements and plan and

perform the audit to obtain

reasonable assurance about whether the

financial statement are free from material

misstatements.

4. An audit involves perfoming procedures

to obtain audit evidence about the amounts

and disclosures in the

financial statements. The procedures

selected depend on the auditor's judgment,

including the assessment of

the risks of material misstatements of the

financial statements, whether due to fraud

or error, In making those

risk assessments, the auditor considers

internal control relevant to the Bank's

preparation and fair

presentation of the finaneial statements in

order to design audit procedures that are

appropriate in the

circumstances, but not for the purpose of

expressing an opinion on eftectiveness of

the entity's internal

control. An audit also includes evaluating

the appropriateness of accounting policies

used and the

reasonableness of the accounting

estimates made by management, as well

as evaluating the overall

presentation ofthe statements.

5.We believe that the audit evidence we

have obtained is sufficient and appropriate

to provide a basis for our

audit opinion.

Opinion

6. In our opinion and to the best of our

information and according to the

explanations given to us, the financial

Statements togther wih the notes thereon

give the infomation requireod by the

Banking Regulation Act.

1989 (25 plicable so CoOperative

Societies). the Gujarat Co-Operative

Societies Act 196l and

idelines d by Reserve Bunk of ndia and

Registrar of Co-Operative Societies in the

manner so

Togied and give a true and fair viewin

conformity with the accoumting principles

generally accepted in

Indiac

a)bthccasc ofthe Balance Shect, of statcof

affairs of the Bank as at 3 1"March 2020:

b)athe case ofthe Profitand Loss Account.

ofthe profit/ loss for the year ended on that

date, and

(c) In the case of the Cash Flow Statement.

ofthe cash flows for the year ended on that

date.

Repert on other Legal & Regulatory

Requirements

7The Balance Shect and the Profit and

Loss Account have been drawn up in

Form"A and"B respectively of

the thind Schodule to the Bnking

Regulation Act. 1949 and provisions of The

Gujarat Co-Operative Societics

Act, 1961 and Gujarat Co-Operative

Socities Rules, 1965.

&Wereport that

a)We have obainod all the infomation and

eplanations, which to the best of our

knowicdge and belief

were nccessary for the purpose ofour audit

and have found to be satisfactory

b) In our opinion proper books of account

as required by lasw have been kept by the

Bank so far as it

ppears from our euminaion of those books

and proper returns adequate for the

purposes of our audit

havc becm received from the

branchesoffices.

(c)The transactionofthe Bank which have

come to our notice are within the powers of

the Bank

a The Balance Sheet and Profit and Loss

Account dealt with by this report, are in

agreement with the

bocks ofaccount and the returns.

(c) The acoounting standards adopted by

the Bank are consistent with those laid

down by accounting

principles generally accepted in India so far

as applicable to Banks

9. We further report that for the year under

audit, the Bank has been awarded"A grade

and "85.5 marks

Saving Deposits

Savings accounts are a great way to

establish a rainy day fund in the event of

emergencies. The best saving accounts

are from banks that offer good interest

rates and friendly customer service. By

establishing a saving bank account , you

can rest assured that you will have money

in case of emergency.

* Easy Account Opening Procedure.

Account can alos open with "zero" ablance.

* Facility of Computerised passbook

* No extra charges for passbook.

* Free of cost personalized MICR cheque

book upto 3 cheque book ( 1 cheque book

15 leag)

* SMS Alert beyond Specified limit for Debit

entries without any charges.

* 24 hours banking through ATM Centres.

* Nomination facility available

* No minimum average balance charge

* Rate of interest is 4% and it calculated on

daily basis and accounting oh half yearly

basis.

Current Deposit

The bank offers the facility of Current A/c

with personalized services to meet the

business requirement of the customers.

The facility of Current A/c is available to

proprietorship firm, partnership firms,

company, HUF, Trust, co op soc,

association etc and individual customers

having the daily transactions in the

account.

* Easy procedure for account opening.

* 24 hours banking facility through our ATM

centres to individual account holder.

* Personalized services.

* SMS Alert beyond Specified limit for

Debit entries without any charges

* Six monthly average balance should be

maintained only of Rs. 2000/-

Recurring Deposit

To encourage the saving habit of the public

at large on monthly basis the bank offers

the facility of Recurring Deposits. The

product is especially designed for the

customers who compulsorily like to save

the small amount of their income on

monthly basis.

* Easy & Simple A/c Opening procedure.

* Speedy and timely services.

* A/c can be opened at your convenient

amount.

* Special benefits to Small savers.

* Attractive rate of interest on maturity of

the deposits.

* Flexible maturity periods.

Fixed Deposit

* Fix deposit scheme is an attractive

scheme to deposit your savings for fix

period for 30 days to 05 years as per your

future requirements.

* We provide attractive Interest Rates to

our Customers from time to time.

* We offer 0.50% extra Interest Rate to

Senior Citizens(Age upto 60 or above)on

fix deposits of more than 180 days period

and above.

* Guardian can open Minor s Fix deposit

A/c. When minor turns major then at

maturity he/she can withdraw the amount

with his/her signature, after providing valid

age proof.

* We offer nomination facility for all deposit

accounts.

* We provide montly, quarterly, half yearly,

yearly Interest payment to our customers

on their existing Fix Deposits as per their

instruction.

* Loan and Overdraft facility is available

against Fix deposit receipt.

* The maturity date of Loan and Overdraft

Account against Fix Deposit is maturity

date of Fix Deposit Receipt.

* TDS on Interest income will be deducted

as per Income Tax Act.

* We are member of Deposit Insurance and

Credit Guarantee Scheme [DICGC] in

which customers deposit are insured up to

Rs. 1 Lac.

* The rate of interest of tne term deposit is

as under

No. Duration Rate for Public Rate for

Senior Citizen

1 30 days to 45 days 4.50% 4.50%

2 46 days to 90 days 4.75% 4.75%

3 91 days to 179 days 6.25% 6.25%

4 180 days to 1 year 7.25% 7.75%

5 More than 1 year and up to 2 years

8.25% 8.75%

6 More than 2 years and up to 5 years

8.00% 8.50%

Parivar Bachat

* It is our daily dore to dore collecton

deposit schme

* Deposits are colliction in minimum of Rs.

50/- and above in multiple amount of Rs.

10 .

* The maturity period is of one year

* Bank is giving intereset at the rate of 4%

and it is counting on daily basis but

accounting at tne end of the year.

* If deposit is withdrawan prematured than

no interest will be given

* Bank is collecting deposits throgh agent

* Bank has given deposit collection

machine to all agents and receipt of

deposit is issued by the agent on the place.

* Presently we are this deposit facility is

available at our Ranjitsagar Road Branch

only.

Financial Indicators

Financial Indicators (Rs in Lakhs.)

Financial Year Paid Up Capital Reserves

Deposits Advances Net Profit Working

Capital

1980-1981 5.35 0.21 25.37 10.59 -0.32

32.76

1989-1990 16.44 30.12 521.86 292.59

17.52 603.55

1999-2000 148.16 1810.20 11874.24

5261.67 406.46 14515.67

2000-2001 200.00 2210.00 12874.63

4905.42 465.43 16547.42

2001-2002 200.00 2680.94 12848.46

4546.96 491.09 16661.68

2002-2003 228.76 3195.43 13690.12

4081.62 501.80 17317.46

2003-2004 237.52 3692.04 14241.42

4139.99 523.71 17190.76

2004-2005 245.54 4348.30 13820.35

4167.51 363.65 18245.47

2005-2006 251.33 4947.22 14346.13

3922.17 341.31 19528.59

2006-2007 269.71 5301.78 15368.35

3780.10 322.47 21949.36

2007-2008 316.61 5842.16 18872.77

5551.21 438.37 26505.82

2008-2009 414.32 6828.19 22119.88

8435.52 416.86 31236.41

2009-2010 453.74 7243.77 25142.29

9571.48 449.92 34383.61

2010-2011 568.48 7882.53 27712.93

11509.55 465.57 37391.39

2011-2012 662.37 8549.64 30297.48

14261.40 486.13 40311.55

2012-2013 738.83 9137.42 33986.16

16082.64 512.41 44636.17

2013-2014 842.49 9825.69 37698.73

18205.68 506.60 49350.94

2014-2015 923.97 10286.99 43858.27

18577.89 567.97 56283.95

2015-2016 989.53 10818.75 51190.53

20190.78 633.51 64765.87

2016-2017 1197.81 11304.94 62036.91

23036.47 631.65 75784.53

2017-2018 1371.47 11896.15 62859.98

29657.76 753.77 78217.20

2018-2019 1605.85 12511.86 66897.95

36221.48 990.59 83661.23

2019-2020 1708.75 14,330.87 74,102.00

37,664.94 1028.02 91,713.15

2020-2021 1471.32 14,051.80 89,828.86

39783.94 1630.34 107979.89

2021-2022 1336.42 16,257.68 90,259.75

35,713.39 1101.00 1,09,655.15

Terms and Conditions for RuPay

PaySecure® platform

RuPay PaySecure authentication service is

powered by National Payments

Corporation of India(NPCI). All web based

transactions on cards enabled for this

service are guided by the Terms and

Conditions ("T&Cs") mentioned herein.

Please read these T&Cs carefully before

using your electronic payment card on the

RuPay PaySecure solution for online

transactions.

Definitions

"Card(s)" shall mean RuPay Debit/Prepaid

or Credit cards as issued by the Issuing

Bank.

Cardholder shall mean the owner

authorized to perform transaction on the

card issued by an Issuing bank

The words "we", "us" and "our" refer to

NPCI / RuPay PaySecure solution as the

case may be. Registration information/

data shall mean the information shared by

the cardholder during the registration

transaction viz. Image, Personalized

phrase and PIN.

Bank shall mean the customer s bank

which has issued RuPay Debit/Prepaid or

Credit Card.

About RuPay PaySecure:

RuPay PaySecure provides you an

additional level of security for all online

transactions done using your RuPay cards.

Registering your card for RuPay

PaySecure involves providing information

to NPCI, which is then used to confirm your

identity during future online transactions

which use RuPay PaySecure. The platform

uses a combination of image & phrase

selection and PIN entry to secure your

online experience using the card. Your

registration information (image, phrase),

and other personal information is not

shared with the merchant or Bank.

1. ACCEPTANCE OF TERMS

* Usage of RuPay PaySecure is subject to

the T&Cs governing the card transactions

as well as Terms and Conditions applicable

to the Bank Account. Use of PaySecure

abides you to the terms of the solution. The

T&Cs can also be viewed on the

mentioned URL: xxx. In addition, when

using RuPay PaySecure, you will be

subject to all guidelines or rules applicable

to RuPay cards and PaySecure that may

be posted from time to time at the (Bank

and/or NPCI) web site.

* Selection of Image, phrase & PIN entry

using RuPay PaySecure, will confirm

acceptance of RuPay PaySecure T&Cs

and the revised versions, enhancements,

modifications of the same.

* The cardholder is entirely responsible for

ensuring secure usage/storage of the

PaySecure registration information (image,

personalized phrase and PIN). Cardholder

is liable for misuse/ unwarranted disclosure

of sensitive information such as the

registration data. NPCI shall not be

responsible for interception/ misuse of

PIN/image/phrase using RuPay PaySecure

service. NPCI is not liable if the registration

information is misused due to any reason

whatsoever and or if the terms and

conditions relating to use of this information

are not complied with.

2. CUSTOMER OBLIGATIONS

Customer to provide complete, correct,

honest and current information as required

by RuPay PaySecure in the registration

page. If you provide any personal Data that

is untrue, inaccurate, not current or

incomplete, or if there are reasonable

grounds to suspect that the information

provided by you is untrue, inaccurate, not

current or incomplete, NPCI reserves the

right to suspend, terminate, or refuse your

current or future use of RuPay PaySecure

service.

3. REGISTRATION

* The cardholder is required to register

his/her card to be able to use RuPay

PaySecure. Card holder must provide the

requested information, to the Bank/NPCI to

validate their identity and have

authorization for the usage of the Card(s)

for transactions on RuPay PaySecure.

* RuPay PaySecure reserves the right to

disallow the customer from

registration/usage of the service in case

the information provided by the customer is

incorrect/false. The cardholder assures that

every information entered in the PaySecure

system is true and that they are legally

entitled to use the cards that they register

on the RuPay PaySecure system.

* RuPay PaySecure unregistered cards will

be disallowed from being used at any

online Merchant entities.

* For all queries related to RuPay

PaySecure, refer to the following URL:

xxxx or call your bank s customer service

numbers.

* NPCI may enhance the security features

etc. of the RuPay PaySecure solution from

time to time. The T&Cs may be modified

for revised features in the future.

Acceptance of these T&Cs will abide the

cardholder for any future versions of the

RuPay PaySecure T&Cs.

4. AUTHENTICATION

* During registration in RuPay PaySecure

service, you may be required to select an

authentication method viz. OTP (One Time

Password) or Internet ID & password, or

challenge question/answer etc. for

authenticating with your bank. Along with

that, you would be required to select an

image & enter a phrase when engaging in

an online transaction or registration/other

transaction for which RuPay PaySecure is

used. You may be asked to select the

image and approve the phrase that you

had selected during your registration

process before the merchant accepts your

Card in payment for the transaction. If you

are unable to select the correct image or if

the authentication through RuPay

PaySecure otherwise fails, the merchant

may not accept your RuPay Card for

payment in that transaction.

* You are successfully registered for

RuPay PaySecure service only after you

successfully complete the entire online

transaction for the first time.

* By registering for RuPay PaySecure, you

agree to the use of RuPay PaySecure to

evidence your identity, including the

authorization of transactions authorized in

advance to recur at substantially regular

intervals.

* Certain merchant establishments/ Banks

at a later date may provide for any

additional authentication in addition to what

has been requested for. Cardholder will be

required to provide the same accordingly.

5. CONFIDENTIALITY AND SECURITY

OF REGISTRATION INFORMATION

Cardholder is liable entirely for maintaining

the confidentiality of the registration

information viz. image, phrase, PIN and

other verification information used on the

RuPay PaySecure solution. All activities

that occur using the Registration

information or other verification information

supplied to or established by Cardholder

with respect to PaySecure will be the sole

responsibility of the cardholder. Cardholder

is responsible not to share information

which enables access/ usage of RuPay

PaySecure to any third party. Customer

should immediately notify the bank of any

unauthorized use of their RuPay

PaySecure verification information, or any

other breach of security. The cardholder

agrees that NPCI will not be liable for any

loss or damage arising from failure of

Cardholder to comply with these T&Cs.

6. CONFIDENTIALITY OF CUSTOMER

INFORMATION

* Cardholder Registration information will

not be shared with any online merchant

establishments for which RuPay

PaySecure is used.

* Cardholder agrees to permit the

Bank/NPCI to store the Registration

information in their databases and are

permitted to disclose it if required to do so

by Applicable Law, in good faith believing

that such preservation or disclosure is

permitted by Applicable Law, or as

reasonably necessary to (i) comply with

legal process or (ii) enforce these T&Cs.

7. CARDHOLDER RESPONSIBILITIES

As a RuPay PaySecure user, the

cardholder acknowledges and agrees to

the following: The cardholder will -

* Ensure confidentiality of PIN and not

reveal it to any third party.

* Keep the image & phrase confidential and

not share with any third party

* Keep the OTP; internet ID & Password or

challenge questions used during

registration process, totally confidential and

not reveal it to any third party

* Ensure the phrase entered during

registration must not be related to any

readily accessible personal data such as

name, address, telephone number, driver

license, etc.

* Ensure the Image, Phrase & PIN should

not be written or stored physically or in soft

form. The same should be memorized

* Take necessary precautions to ensure

that the computer device or other device

accessing RuPay PaySecure during

transactions is guarded from all

unauthorized access.

The cardholder will NEVER-

* access RuPay PaySecure with false/fake

id or attempt impersonation of any kind;

* hamper the functioning of the RuPay

PaySecure module in any manner of

hardware or software malfunction by use of

software viruses or any other programs or

applications;

* intentionally overload the RuPay

PaySecure platform to hamper the service;

* infringe upon the Intellectual Property

rights of the PaySecure solution by

attempting to re-create or re-engineer the

solution or any part of it or the softwares

used in connection with RuPay PaySecure;

* remove any copyright, trademark, or

other proprietary rights notices contained in

RuPay PaySecure;

* re-create or use any part of the RuPay

PaySecure service without NPCI's prior

written authorization;

* attempt to data mine, unlawfully obtain

information specific to the RuPay

PaySecure solution using any application,

or other manual or automatic device or in

any way and re-engineer or duplicate the

user experience similar to PaySecure

service;

* interfere with the functioning of

PaySecure or its associated hardware/

software by any means; or

* fail adherence to any applicable

governing law, regulation, guidelines or any

Terms and Conditions advised by

Bank/NPCI in connection with use of

RuPay PaySecure.

8. Rules of Liability

* NPCI has no liability for cardholder s

internet access device or password

obtaining device (such as computer or

mobile phones etc.) or proper functioning

of its hardware or software before, during

or after the use of RuPay PaySecure.

* NPCI will in its best efforts make the web

service secure from all aspects possible.

However, NPCI will not take liability for any

viruses or unlawful downloads that the

cardholder s system may be exposed to

while he accesses the internet for using

RuPay PaySecure.

* NPCI does not take liability of failed

transactions which are incomplete due to

any reason

9. MERCHANTS

The RuPay PaySecure solution merely

offers card holders an additional level of

security for their card transactions on their

online merchants. RuPay PaySecure by no

means intends to endorse any Merchant

over others. Additionally, NPCI does not

guarantee the cardholder experience with

the merchant in terms of delivery of

product, quality etc. NPCI does not validate

the Merchant s services or offering.

Cardholder s interaction with the merchant

is independent of governance of RuPay

PaySecure rules. Merchant s terms of

business with the cardholder with regards

to service/ product quality, delivery,

payment, guarantees / warrantees,

promotions, discounts etc. is an

understanding between the cardholder and

merchant alone even if the customer used

RuPay PaySecure for authorizing the

transaction. In no event will NPCI be liable

for any loss or damage including without

limitation, indirect or consequential loss or

damage, or any loss or damage

whatsoever arising from loss of data or

profits arising out of, or in connection with,

the use of this website.

10. Internet Frauds:

The Internet per se is susceptible to a

number of frauds, misuses, hacking and

other actions which could affect use of

RuPay PaySecure. Whilst the Bank and/or

NPCI shall aim to provide security to

prevent the same, there cannot be any

guarantee from such Internet frauds,

hacking and other actions which could

affect the use of the RuPay PaySecure.

You shall separately evaluate all risks

arising out of the same.

11. Operational Issues :

Every effort is made to keep the website up

and running smoothly. However, NPCI

takes no responsibility for, and will not be

liable for, the website being temporarily

unavailable due to operational issues

beyond control of NPCI.

12. NPCI Indemnity:

NPCI should be indemnified against all

losses and damages that may be caused

as a consequence of breach of any of the

RuPay PaySecure T&Cs.

13. Discontinuation of RuPay PaySecure:

NPCI reserves the right to discontinue the

above service at any time whatsoever.

Service Charges

Sr.No. Details Charges

Transfer Cash

1 1.1 UTI/HDFC/ICICI (Cheque Issued for

above mentioned Banks)

Up to Rs 1.00 Lacs 0.07 Paisa 0.10

Paisa

Above Rs 1.00 Lacs 0.05 Paisa 0.10

Paisa

Minimum Exchange 10/- 15/-

2 Bills Commission

2.1 O.B.C. Cheque (As per RBI

guidelines)

Up to Rs 1,000/- Rs 20/-

Rs 1,001/- to Rs 10,000/- Rs 50/-

Rs 10,001/- to Rs 1,00,000/- Rs 100/-

Above Rs 1,00,000/- Rs 150/-

2.2 I.B.C Cheque(As per RBI guidelines)

Up to Rs 1,000/- Rs 20/-

Up to Rs 10,000/- Rs 50/-

Rs 10,001/- to Rs 1,00,000/- Rs 100/-

Above Rs 1,00,000/- Rs 150/-

2.3 O.B.C Bills

Up to Rs 10,000/- Rs 100/- (Postal

Charges Rs 30/-)

Rs 10,001/- to Rs 1,00,000/- Above Rs

1,00,001/- Rs 0.25/- Rs 100/- + Rs 30/-

(Min- Rs 100/- Max- Rs 5,000/-)

2.4 I.B.C Bills

Up to Rs 10,000/- Rs 100/- (Postal

charges Rs. 30/-)

Rs 10,001/- to Rs 1,00,000/- Above Rs

1,00,001/- Rs 0.25/- Rs 100/-+ Rs 30 (Min

Rs100/- Max Rs 5000/-)

Parcel Handling charges Rs 30/-

2.5 Purchase/ Discount Cheques/ Bills

1 Cheques: Out of Fund interest +

Cheque collection charges

1 Bills: Out of Fund interest + Bill

collection charges

1 L.C Bills : Interest will be applied from

the date of purchase till the date of receipt

+ Rs. 100/- out of pocket expenses per bill

L.C. Charge: Rs 250/-

The above charges are excluding Service

Tax

3 Cheque Return Charges

Inward (Debit Clearing) Rs. 30/-

Inward (Debit Clearing) Minimum

balance Not maintained Rs. 50/-

Inward (Debit Clearing) Repayment to

Finance company Rs 100/-

Outward ( Credit Clearing) Rs 25/-

4 Stop Payment Charges

General case Rs 50/-

Repayment to Finance company Rs 100/-

5 Cheque Book Issue Charges

Savings A/c (Per Cheque Book - 15

cheque leaves First 4 cheque books free

per financial year) Rs 30/-

Current / CC / Overdraft (Per Cheque

Book-60 cheque leaves) Rs 125/-

6 Ledger Folio Charges (Incidental

Charges)

6.1 Current A/c, OD, CC 1 Page(30

Entries) Rs 30/-

Current A/c / OD A/c Minimum Charges

Rs. 100/-

Cash Credit A/c Minimum Charges Rs.

150/-

Rebate in above charge

Average Minimum Balance

Rs 50,000/- to Rs 99,999/- 5 Pages Free

Rs 1,00,000/- to Rs 1,99,999/- 7 Pages

Free

Above Rs 2,00,000/- Free

6.2 Incidental Charges in Savings A/c

Up to 20 entries( half yearly) only Debit

entries Free

Above 20 entries (per entry) only Debit

Entries Free

Rebate

Average Minimum Balance Rs 50,000/-

only Free

If minimum balance is not preserved

Current A/c (Average Minimum Balance

Rs 2,000/-) Rs 150/-

Savings A/c (Average Minimum Balance

Rs 500/-) Rs 25/-

7 Proposal Processing Charges (Limit

Processing Charges)

CC/ Hypothecation(Against Stock/ book

Debt) Limit Renew

Up to Rs. 1.00 Lacs Rs 250/-

Rs 1.00 Lacs to Rs 1.99 Lacs Rs 500/-

Rs 2.00 Lacs to Rs 2.99 Lacs Rs 1,500/-

Rs 3.00 Lacs to Rs 4.99 Lacs Rs 2,000/-

Rs 5.00 Lacs to Rs 7.50 Lacs Rs 3,000/-

Rs 7.51 Lacs to Rs 9.99 Lacs Rs 4,500/-

Rs 10.00 Lacs to Rs 24.99 Lacs Rs

6,500/-

Rs 25.00 Lacs to Rs 49.99 Lacs Rs

10,000/-

Rs 50.00 Lacs to Rs 74.99 Lacs Rs

15,000/-

Rs 75.00 Lacs to Rs 100.00 Lacs Rs

20,000/-

Term Loan( Except Staff Loan)

Up to Rs 1.00 Lacs Rs 250/-

Rs 1.00 Lacs to Rs 5.00 Lacs Rs 2,500/-

Rs 5.01 Lacs to Rs 10.00 Lacs Rs

5,000/-

Rs 10.00 Lacs to Rs 24.99 Lacs Rs

8,000/-

Rs 25.00 Lacs to Rs 49.99 Lacs Rs

12,000/-

Rs 50.00 Lacs to Rs 100.00 Lacs Rs

25,000/-

Adhoc Sanction

Up to Rs 1.00 lacs Rs 300/-

Rs 1.00 lacs to Rs 5.00 Lacs Rs 750/-

Above Rs 5.00 Lacs Rs 1,500/-

8 Inspection Charges (Annually)

8.1 Cash Credit

Up to Rs 1.99 lacs Rs 200/- per

inspection irrespective of limit sanctioned

Rs 2.00 lacs to Rs 4.99 Lacs

Rs 5.00 Lacs to Rs 10.00 lacs

Above Rs 10.00 lacs

8.2 Term Loan

Every Term Loan Account (Except

Education loan, Staff Loan) Rs 200/-(Per

Financial Year

Financial Position

(Rs. in Lakhs)

Year Paid Up Capital Reserves Deposits

Advances Net Profit Working Capital Audit

Class

2005-2006 251.33 4,947.22 14,346.13

3,922.17 341.31 19,528.59 A

2006-2007 269.71 5,301.78 15,368.35

3,780.10 322.47 21,949.36 A

2007-2008 316.61 5,842.16 18,872.77

5,551.21 438.37 26,505.82 A

2008-2009 414.32 6,828.19 22,119.88

8,435.52 416.86 31,236.41 A

2009-2010 453.74 7,243.77 25,142.29

9,571.48 449.92 34,383.61 A

2010-2011 568.48 7,882.53 27,712.93

11,509.55 465.57 37,391.39 A

2011-2012 662.37 8,549.64 30,297.48

14,261.40 486.13 40,311.55 A

2012-2013 738.83 9,137.42 33,986.16

16,082.64 512.41 44,636.17 A

2013-2014 842.49 9,825.69 37,698.73

18,205.68 506.60 49,350.94 A

2014-2015 923.97 10,286.99 43,858.27

18,577.89 567.97 56,283.95 A

2015-2016 989.53 10,818.75 51,190.53

20,190.78 633.51 64,765.87 A

2016-2017 1197.81 11,304.94 62,036.91

23,036.47 631.65 75,784.53 A

2017-2018 1371.47 11,896.15 62,859.98

29,657.76 753.77 78,217.20 A

2018-2019 1605.85 12,511.86 66,897.95

36,221.48 990.59 83,661.23 A

2019-2020 1708.75 14,330.87 74,102.00

37,664.94 1028.02 91,713.15 A

2020-2021 1471.32 14,051.80 89,828.86

39,783.94 1630.34 1,07,979.89 A

2021-2022 1336.42 16,257.68 90,259.75

35,713.39 1101.00 1,09,655.15

Know Your Customer (KYC)

The bank is under statutory obligation to

comply with the provisions of the

Prevention of Money Laundering Act, 2002

and the rules made thereunder and also

the guidelines issued by the Reserve Bank

of India on Know Your Customer (KYC)

policy from time to time

You might also like

- Capitec Statement NewDocument4 pagesCapitec Statement NewCindyNo ratings yet

- Non-Performing AssestDocument56 pagesNon-Performing AssestKhalid HussainNo ratings yet

- BAJAJ Statement of AccountDocument1 pageBAJAJ Statement of AccountSurya Prakash100% (1)

- The Federation of Universities: SBI LTDDocument26 pagesThe Federation of Universities: SBI LTDkohinoor_roy5447No ratings yet

- Summer Internship Project On BankDocument76 pagesSummer Internship Project On BankReema Negi100% (3)

- History of Payment BanksDocument4 pagesHistory of Payment Banksanshul4clNo ratings yet

- Sarswat Bank in ShortDocument22 pagesSarswat Bank in ShortKrishan BhagwaniNo ratings yet

- Punjab and Sind Bank Services of Risk ManagementDocument12 pagesPunjab and Sind Bank Services of Risk Managementiyaps427100% (1)

- E-Internship Report 1Document13 pagesE-Internship Report 1Avani TomarNo ratings yet

- JETIR1806472Document9 pagesJETIR1806472Nirvana CélesteNo ratings yet

- A Study On Credit Risk ManagementDocument44 pagesA Study On Credit Risk ManagementShabreen Sultana100% (1)

- Fundamental of BankingDocument55 pagesFundamental of BankingSubodh RoyNo ratings yet

- Gaurav Choudhari Project ReportDocument59 pagesGaurav Choudhari Project ReportSoluion RajNo ratings yet

- Document 1Document67 pagesDocument 1editorialfreelancers19No ratings yet

- AKASh 4545Document73 pagesAKASh 4545Akash KatkdhondNo ratings yet

- Introduction of IDBI BankDocument58 pagesIntroduction of IDBI BankHarshada Patil67% (3)

- Main Objects of The BankDocument23 pagesMain Objects of The BankNishant GroverNo ratings yet

- Foreign Banks and GuidelinesDocument7 pagesForeign Banks and GuidelinesprasannarbNo ratings yet

- SBI Assignment 1Document12 pagesSBI Assignment 1DeveshMittalNo ratings yet

- Report On Sutex BankDocument55 pagesReport On Sutex Bankjkpatel221No ratings yet

- Gurleen Internship Report-6Document74 pagesGurleen Internship Report-6Joshua LoyalNo ratings yet

- Organisational Setup and Management of The State Bank of IndiaDocument6 pagesOrganisational Setup and Management of The State Bank of IndiapandisivaNo ratings yet

- Short Term Structure Has Three LevelsDocument4 pagesShort Term Structure Has Three LevelsSachin AntonyNo ratings yet

- Syndicate BankDocument28 pagesSyndicate BankPriya MoorthyNo ratings yet

- Ibps Clerk Mains Capsule 2015 16Document73 pagesIbps Clerk Mains Capsule 2015 16Anonymous lt2LFZHNo ratings yet

- Darshan Black Book 180917 FinalDocument91 pagesDarshan Black Book 180917 Finaladitya desaiNo ratings yet

- Financial Statment Analysis of SiblDocument30 pagesFinancial Statment Analysis of SiblShafiur Ratul100% (1)

- BanksDocument48 pagesBanksmNo ratings yet

- MBA Finance Project On Credit Schemes of State Bank of India (SBI) and Other Banks in IndiaDocument13 pagesMBA Finance Project On Credit Schemes of State Bank of India (SBI) and Other Banks in IndiaDiwakar BandarlaNo ratings yet

- Bhavin kkkkkkkkk38Document87 pagesBhavin kkkkkkkkk38Sandip ChovatiyaNo ratings yet

- Beepedia Weekly Current Affairs (Beepedia) 9th-15th June 2023Document46 pagesBeepedia Weekly Current Affairs (Beepedia) 9th-15th June 2023Sahil KalerNo ratings yet

- Working Management of Axis BankDocument61 pagesWorking Management of Axis BankNiki PatelNo ratings yet

- July GA RefresherDocument29 pagesJuly GA RefresherKi RuNo ratings yet

- Legal Framework Regulating The Banking Sector in IndiaDocument7 pagesLegal Framework Regulating The Banking Sector in IndiaRiya SharmaNo ratings yet

- History of State Bank of IndiaDocument5 pagesHistory of State Bank of IndiaanilllllNo ratings yet

- Banking Today Nov 15Document22 pagesBanking Today Nov 15Apurva JhaNo ratings yet

- Credit Appraisal Techniques in State Bank of India in Dharwad District - A Case StudyDocument12 pagesCredit Appraisal Techniques in State Bank of India in Dharwad District - A Case StudyakshayNo ratings yet

- Credit Appraisal SystemDocument58 pagesCredit Appraisal Systemsatapathy_smruti12100% (10)

- Bank of MaharashtraDocument9 pagesBank of MaharashtraKaviya KaviNo ratings yet

- B BB Bbanking Anking Anking Anking Anking: U Uu Uupdate Pdate Pdate Pdate PdateDocument20 pagesB BB Bbanking Anking Anking Anking Anking: U Uu Uupdate Pdate Pdate Pdate PdateGuruswami PrakashNo ratings yet

- 180 Sample-Chapter PDFDocument15 pages180 Sample-Chapter PDFhanumanthaiahgowdaNo ratings yet

- Literature Review of Sbi BankDocument6 pagesLiterature Review of Sbi Bankeowcnerke100% (1)

- Indian Banking SystemDocument11 pagesIndian Banking SystemRahul TandonNo ratings yet

- AttachmentDocument60 pagesAttachmentTahseen banuNo ratings yet

- Synopsis On Differentiated Banking: Name: Pragti Bhargava Roll No: 2 Branch: PGDM-RuralDocument3 pagesSynopsis On Differentiated Banking: Name: Pragti Bhargava Roll No: 2 Branch: PGDM-RuralPardeep Singh SainiNo ratings yet

- PIB 2-14 MarchDocument122 pagesPIB 2-14 MarchgaganNo ratings yet

- Bank of IndiaDocument22 pagesBank of IndiaLeeladhar Nagar100% (1)

- Interim Union Budget Proposals: 2014-15Document8 pagesInterim Union Budget Proposals: 2014-15Mohit AnandNo ratings yet

- Syndicate BankDocument46 pagesSyndicate Bankabhijitnaik1818No ratings yet

- Banking Sector: Madhurima Mitra 11712303911Document43 pagesBanking Sector: Madhurima Mitra 11712303911mollymitraNo ratings yet

- Para-Banking and ActivitiesDocument13 pagesPara-Banking and ActivitiesKiran Kapoor100% (1)

- B&i M-1Document33 pagesB&i M-1LolsNo ratings yet

- A Report OnDocument26 pagesA Report OnNihar HindochaNo ratings yet

- Iftm University, Moradabad: "The Study of Recruitment & Selection Procedure of Insurance Advisor/Agent" ATDocument72 pagesIftm University, Moradabad: "The Study of Recruitment & Selection Procedure of Insurance Advisor/Agent" ATCrystal GarciaNo ratings yet

- Executive SummaryDocument36 pagesExecutive SummaryPooja NirmalNo ratings yet

- Winter ProjectDocument25 pagesWinter ProjectKishan gotiNo ratings yet

- Pacs Fin PerformanceDocument13 pagesPacs Fin PerformancegimsonNo ratings yet

- General Banking Activities of Banking System in Bangladesh.: 1. Account Opening SectionDocument7 pagesGeneral Banking Activities of Banking System in Bangladesh.: 1. Account Opening SectionFozle Rabby 182-11-5893No ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- ECONOMÍA UNIT 5 NDocument6 pagesECONOMÍA UNIT 5 NANDREA SERRANO GARCÍANo ratings yet

- No. 279 December 2014: Please NoteDocument6 pagesNo. 279 December 2014: Please NoteCornwall and Isles of Scilly LMCNo ratings yet

- HDFC BankDocument98 pagesHDFC BankAjay SethiNo ratings yet

- E-Ticket Receipt & Itinerary: Passenger and Ticket DetailsDocument2 pagesE-Ticket Receipt & Itinerary: Passenger and Ticket DetailsgaweshajeewaniNo ratings yet

- Peach Payments Master Agreement (1) (1) - 13-17Document5 pagesPeach Payments Master Agreement (1) (1) - 13-17HerbertNo ratings yet

- Aes Annual Report 2018 2019Document20 pagesAes Annual Report 2018 2019AMRIT ANANDNo ratings yet

- HMWSSB Account Statement 20190821Document7 pagesHMWSSB Account Statement 20190821Venkata AlluriNo ratings yet

- Screenshot 2023-11-26 at 12.01.23 AMDocument73 pagesScreenshot 2023-11-26 at 12.01.23 AMqt5tggw8k8No ratings yet

- Internetworking Model: Open System Interconnection Model (Osi Model)Document16 pagesInternetworking Model: Open System Interconnection Model (Osi Model)PaschalNo ratings yet

- Greater KL Retail Sector q1 2022Document9 pagesGreater KL Retail Sector q1 2022Huda OsmanNo ratings yet

- History of AmazonDocument48 pagesHistory of Amazonraj0402mishraNo ratings yet

- AWS Cloud Practioner Certification Preparation GuideDocument12 pagesAWS Cloud Practioner Certification Preparation GuideDavid JosephNo ratings yet

- Banking Finals Samplex Sample Answers (Ver.2)Document2 pagesBanking Finals Samplex Sample Answers (Ver.2)Florence RoseteNo ratings yet

- Pre Bid Conference Attendance Contact List 0Document4 pagesPre Bid Conference Attendance Contact List 0NassimNo ratings yet

- Sales & Distribution ManagementDocument119 pagesSales & Distribution ManagementPriyanka SinghaniaNo ratings yet

- ATT Chat Transcript July28th2022Document6 pagesATT Chat Transcript July28th2022asaNo ratings yet

- 50 Journal EntriesDocument8 pages50 Journal EntriesAshish GuptaNo ratings yet

- Alexander Symonds Case StudyDocument3 pagesAlexander Symonds Case StudyezyCollectNo ratings yet

- 5G NetStratOp Survey 2023Document25 pages5G NetStratOp Survey 2023RastislavNo ratings yet

- About 100 Practice QuestionsDocument12 pagesAbout 100 Practice QuestionsDelenzy CinoNo ratings yet

- Accommodation in ThessalonikiDocument1 pageAccommodation in ThessalonikiThings and StuffNo ratings yet

- Appendix C: Templates For Traffic Management PlansDocument26 pagesAppendix C: Templates For Traffic Management PlansHamdy KarNo ratings yet

- Sample Exam CAT Level 1 - Dec 2018Document10 pagesSample Exam CAT Level 1 - Dec 2018April Joy InductaNo ratings yet

- Accounting Ch-5 Cash & ReceivablesDocument97 pagesAccounting Ch-5 Cash & ReceivablesFeda EtefaNo ratings yet

- EdelDocument12 pagesEdelelyas mustefaNo ratings yet

- French Tour OperatorsDocument13 pagesFrench Tour OperatorsEkaterina Varkopulo100% (1)

- Case Study Network Monitoring SystemDocument8 pagesCase Study Network Monitoring SystemDITE 4A NUR SYAFIQAH RAFIENo ratings yet

- ShuchiDocument2 pagesShuchiAlkaNo ratings yet