Professional Documents

Culture Documents

Taxes Completing A 1040ez NGPF

Taxes Completing A 1040ez NGPF

Uploaded by

Shahnawaz DolaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxes Completing A 1040ez NGPF

Taxes Completing A 1040ez NGPF

Uploaded by

Shahnawaz DolaniCopyright:

Available Formats

NGPF Activity Bank

Taxes #1

CALCULATE: Completing a 1040EZ

The 1040 is the form that Americans use to complete their federal income tax returns. It’s also long and complicated,

and lots of it doesn’t apply to most people. To simplify, the government created a simpler version: the 1040EZ!

The 1040EZ is much simpler, but to use it filers need to meet a number of requirements, including:

● Your filing status is single or ● You claim no dependents ● You are under 65

married filing jointly

● Your taxable income is less ● You did not earn dividends or ● You are not claiming

than $100,000 interest from investments adjustments to income, or

credits

To see the full list of requirements, visit the IRS website. For teens, college students and adults in their 20s, the 1040EZ is

the way to go.

Part I: Scenarios

To illustrate how different circumstances affect your tax return, we’ll explore the case of four different individuals:

Name Personal Info Employment Info W-2 Form

1. Edgar Flores ● Age 16 ● Works around 10 hours/week cleaning

Edgar’s W-2

● Lives with his parents pools for $15/hour

2. Melinda ● Age 18 ● Worked around 10 hours/week during

● Melinda’s

Flowers Lives with her parents, will be senior year at a local ice cream shop,

W-2

heading to college in the fall and 40 hours/week during the summer

3. Angela Li ● Age 22 ● Worked 20 hours/week during the school

● Is at college, which she is year at a local plant nursery

Angela’s

paying for herself using a full

W-2

merit scholarship *Note: her job provides MORE than half of

her support

4. Marcus ● Age 24 ● Is on salary as a sales representative at a

● Marcus’s

Roberts Recent college graduate, living shoe store, working full-time

W-2

by himself

www.ngpf.org Last updated: 7/6/18

1

Part II: Completing the 1040EZ

To complete a tax return, use the 1040EZ. This PDF comes directly from the IRS website. Just print and fill out manually.

Follow the directions on every line of the 1040EZ.

● For certain lines, you may need additional information. Consult the table below:

Lines 2/3 Assume no taxable interest or unemployment income

Line 5 Determine if the individual is/is not a dependent by reading the “Who qualifies as a dependent?” and

“Qualifying Child” sections of this article. Then, follow the directions below:

● If you are NOT a dependent, you can deduct $10,400 from your gross income ($6,350+$4,050)

● In 2017, the standard deduction is $6,350 if single

● In 2017, the exemption amount is $4,050 per person.

Line 8 Assume no Earned Income Credit or nontaxable combat pay

Line 10 Use this link instead: https://www.irs.gov/pub/irs-pdf/i1040tt.pdf

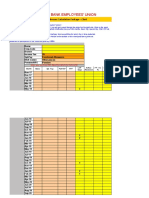

Here is the 2017 Tax Table for Single Filers (all examples in this activity are single filers)

Line 11 Assume none of these jobs provide health care coverage

Line 13 - Ignore entering bank information if the individual received a refund

b,c,d

Third Part Leave these sections blank

Designee

& Paid

Preparer

Use Only

Sign Here Complete signature, date (remember, taxes for 2017 must be completed between 1/1/18 and 4/15/18),

and occupation. Leave everything else blank.

www.ngpf.org Last updated: 7/6/18

2

Part III: Results

1. In the chart below, enter the results of each person’s 1040EZ. Specifically, are they going to receive a refund or

owe taxes? In what amount?

Edgar Melinda Angela Marcus

Refund?

Owed More?

How Much?

2. If anyone had an extremely high refund amount (or amount owed), how could they change their W-4 to spread

their tax burden more evenly throughout the year?

Part IV: Audit a classmate

When you submit your taxes, you’re not always done with your taxes. The IRS conducts audits, or reviews/examinations

of an organization's or individual's accounts and financial information to ensure information is being reported correctly.

Only about 1% of people get audited, but it’s a very serious thing so you want to make sure you complete your taxes

honestly and accurately. If you’d like, you can learn more about audits here.

3. Audit a teammate’s 1040EZ and note any potential errors you see so you can discuss them with the person who

filed that report.

List the errors you see Explain why you believe it might be an error. Use specific information

from the return in your explanation.

www.ngpf.org Last updated: 7/6/18

3

You might also like

- CALCULATE - Completing A 1040Document3 pagesCALCULATE - Completing A 1040Giselle Ubieta Salas50% (8)

- New CPN Guide 2023 - 230628 - 180320Document32 pagesNew CPN Guide 2023 - 230628 - 180320enrique.deleon7410No ratings yet

- Guarding Against Pandemics 2022 Tax FilingDocument30 pagesGuarding Against Pandemics 2022 Tax FilingTeddy SchleiferNo ratings yet

- Forte 2023Document3 pagesForte 2023abhishek cjNo ratings yet

- PLAY - Should They File A Tax ReturnDocument9 pagesPLAY - Should They File A Tax ReturnAlanna100% (1)

- Calculate Completing A 1040 1Document3 pagesCalculate Completing A 1040 1api-581728153No ratings yet

- A Single Father's Tax Situation ResponseDocument2 pagesA Single Father's Tax Situation ResponseJenn4459No ratings yet

- Internet Access Human Right AssignmentDocument2 pagesInternet Access Human Right Assignmentapi-357464401No ratings yet

- Food StampsDocument1 pageFood StampsbkdizzleNo ratings yet

- Blot v. WIS International and Washington InventoryDocument5 pagesBlot v. WIS International and Washington InventoryMatthew Seth SarelsonNo ratings yet

- Tax Invoice Deccan Sales & Service PVT - Ltd. (Division Deccan Earthmovers)Document1 pageTax Invoice Deccan Sales & Service PVT - Ltd. (Division Deccan Earthmovers)Jonathan KaleNo ratings yet

- SalarySlip 1Document1 pageSalarySlip 1Siva KumarNo ratings yet

- How To Do A Self Employed Tax ReturnDocument9 pagesHow To Do A Self Employed Tax ReturnHarvey PotterNo ratings yet

- MR D.I.Y. Group (M) Berhad - MITI Instruction LetterDocument5 pagesMR D.I.Y. Group (M) Berhad - MITI Instruction LetterRead Do WanNo ratings yet

- Online SecretsDocument31 pagesOnline Secretsajm5335No ratings yet

- Credit Card Debt AssignmentDocument4 pagesCredit Card Debt Assignmentapi-525829885No ratings yet

- Introduction To Accounting Transcript 0Document9 pagesIntroduction To Accounting Transcript 0mohsrourNo ratings yet

- Buy SSN NumberDocument7 pagesBuy SSN NumberKoester FabianNo ratings yet

- Banking Code V20152Document25 pagesBanking Code V20152dacoda204No ratings yet

- 3 "C'S" of Credit: Personal FinanceDocument43 pages3 "C'S" of Credit: Personal FinanceJack RichardsonNo ratings yet

- Sec - gov-EIN Formation BylawsDocument4 pagesSec - gov-EIN Formation BylawsДмитрий КалиненкоNo ratings yet

- Economic Impact Payments For Social Security and Ssi RecipientsDocument7 pagesEconomic Impact Payments For Social Security and Ssi RecipientsLeanne Joy RumbaoaNo ratings yet

- Salem 2012-13 Budget Final in Depth Proposed 12-13Document14 pagesSalem 2012-13 Budget Final in Depth Proposed 12-13Statesman JournalNo ratings yet

- The I.D. Master - Identity Change Insider Secrets - John Q. Newman - Paladin Press - 2002Document133 pagesThe I.D. Master - Identity Change Insider Secrets - John Q. Newman - Paladin Press - 2002dioni456No ratings yet

- Care Credit AppDocument7 pagesCare Credit AppwvhvetNo ratings yet

- SEC Form 17-QDocument20 pagesSEC Form 17-QnnovNo ratings yet

- Access To Unemployment Insurance Benefits For Family CaregiversDocument29 pagesAccess To Unemployment Insurance Benefits For Family CaregiversElaine ManceNo ratings yet

- Food Stamps FormDocument9 pagesFood Stamps FormValentin ParraNo ratings yet

- Quick Tips For Managing Your MoneyDocument12 pagesQuick Tips For Managing Your MoneyRazvanNo ratings yet

- PUA Overpayment Waiver RequestDocument5 pagesPUA Overpayment Waiver RequestOlegNo ratings yet

- COVID Positive Sept. 28, 2021Document3 pagesCOVID Positive Sept. 28, 2021NBC 10 WJARNo ratings yet

- Definition of FinanceDocument9 pagesDefinition of FinanceIni IchiiiNo ratings yet

- Taxation NotesDocument36 pagesTaxation NotesJM CamalonNo ratings yet

- Chapter-15 Tax CreditsDocument18 pagesChapter-15 Tax CreditsakhtarNo ratings yet

- Apple 424B2 For International BondDocument70 pagesApple 424B2 For International BondMike WuertheleNo ratings yet

- Can I Use This Form?: U.S. Passport Renewal Application For Eligible IndividualsDocument6 pagesCan I Use This Form?: U.S. Passport Renewal Application For Eligible Individuals1tonsilsNo ratings yet

- eDiplomaFreeDocument3 pageseDiplomaFreeWaii Moe AungNo ratings yet

- SF86 - 2011 (Short)Document63 pagesSF86 - 2011 (Short)Touba SadatNo ratings yet

- Steps Followed in Establishing A Home Furnishing Unit/ Design StudioDocument5 pagesSteps Followed in Establishing A Home Furnishing Unit/ Design StudioshashikantshankerNo ratings yet

- Banking&Security UpdateDocument19 pagesBanking&Security Updateseunnuga93No ratings yet

- PFSADocument84 pagesPFSAAkinlabi HendricksNo ratings yet

- Rent Supplement: Application Form ForDocument8 pagesRent Supplement: Application Form ForVasile E. UrsNo ratings yet

- Times Leader 05-30-2013Document38 pagesTimes Leader 05-30-2013The Times LeaderNo ratings yet

- XII STD - Economics EM Combined 11.03.2019 PDFDocument296 pagesXII STD - Economics EM Combined 11.03.2019 PDFMonika AnnaduraiNo ratings yet

- Times Leader 08-04-2013Document73 pagesTimes Leader 08-04-2013The Times LeaderNo ratings yet

- Understanding Credit: 5 Do's and Don'ts To Getting A Better ScoreDocument2 pagesUnderstanding Credit: 5 Do's and Don'ts To Getting A Better ScoreSean Patrick SmithNo ratings yet

- Income Tax Filing For Self-Employed IndividualsDocument2 pagesIncome Tax Filing For Self-Employed IndividualsJefferson AlingasaNo ratings yet

- SF182 - Authorization, Agreement and Certification of TrainingDocument14 pagesSF182 - Authorization, Agreement and Certification of TrainingnevdullNo ratings yet

- Application For Social Security Card - Ss-5Document1 pageApplication For Social Security Card - Ss-5Casey Orvis100% (1)

- US Internal Revenue Service: p967 - 1996Document5 pagesUS Internal Revenue Service: p967 - 1996IRSNo ratings yet

- Concept of Asessment Year, Previous Year, Income, Capital and Revenue Receipts, Capital and Revenue ExpenditureDocument15 pagesConcept of Asessment Year, Previous Year, Income, Capital and Revenue Receipts, Capital and Revenue ExpenditureAnany UpadhyayNo ratings yet

- Start Up Loans Business Plan TemplateDocument18 pagesStart Up Loans Business Plan TemplateFilip CiobanuNo ratings yet

- BUSN115 Final Exam Study Guide: TCO 1 Chapters 1, 2, 3, 5, 6, 13 and 15 Weeks 1, 2, 4 and 5Document26 pagesBUSN115 Final Exam Study Guide: TCO 1 Chapters 1, 2, 3, 5, 6, 13 and 15 Weeks 1, 2, 4 and 5acadia15No ratings yet

- Business Plan TemplateDocument5 pagesBusiness Plan TemplateRola OnrNo ratings yet

- IC Simple Fill in The Blank Business Plan 10809 - PDFDocument7 pagesIC Simple Fill in The Blank Business Plan 10809 - PDFNguyễn Minh HuyềnNo ratings yet

- Businessregulatoryframeworkmcqsslideshare 230524162337 E3eb4ba7Document33 pagesBusinessregulatoryframeworkmcqsslideshare 230524162337 E3eb4ba7jack jackNo ratings yet

- Summer Training Project Report: Prabath Financial Services LimitedDocument66 pagesSummer Training Project Report: Prabath Financial Services Limitedrahuljajoo100% (1)

- The Military Credit Blueprint: The Step-By-Step Guide for Military Credit RepairFrom EverandThe Military Credit Blueprint: The Step-By-Step Guide for Military Credit RepairNo ratings yet

- Batul Almasri Calculate Completing A 1040Document3 pagesBatul Almasri Calculate Completing A 1040api-711253108No ratings yet

- Invoice 408 4521932 Balaji Book House Madhu Kumar KetteDocument2 pagesInvoice 408 4521932 Balaji Book House Madhu Kumar Kettemr pirateNo ratings yet

- GST Invoice 14.11..2019 Schott Kaisha - Hepa - 85Document2 pagesGST Invoice 14.11..2019 Schott Kaisha - Hepa - 85Ray Leo guptaNo ratings yet

- Aryan Sports Industries: Mr. RaynazDocument1 pageAryan Sports Industries: Mr. RaynazNaNo ratings yet

- TAXATION ON CORPORATIONS Lecture NotesDocument5 pagesTAXATION ON CORPORATIONS Lecture NotesLucille Rose MamburaoNo ratings yet

- OTB Notice 2020 08 20 19 15 50 186683Document3 pagesOTB Notice 2020 08 20 19 15 50 18668369j8mpp2sc0% (1)

- KMUT - NEW - POST CRA LetterDocument12 pagesKMUT - NEW - POST CRA LetterdineshmarginalNo ratings yet

- Railwire BillingDocument1 pageRailwire BillingVikash KunwarNo ratings yet

- 05-2022, CI - Assam - Form IV-A, MW ActDocument1 page05-2022, CI - Assam - Form IV-A, MW ActPragnaa ShreeNo ratings yet

- Erroneous Foreign Earned Income Exclusion ClaimsDocument40 pagesErroneous Foreign Earned Income Exclusion ClaimstaxesforexpatsNo ratings yet

- 5.roshan Kumar-Payslip - Sep-2022Document1 page5.roshan Kumar-Payslip - Sep-2022Burning to ShineNo ratings yet

- Proviso PPP DatabaseDocument8 pagesProviso PPP DatabaseMichaelRomainNo ratings yet

- Chapter 4 Payroll Acct.Document54 pagesChapter 4 Payroll Acct.Yang XuanNo ratings yet

- HTAX230-1-Week1-Unit1-Chapters 1&2Document3 pagesHTAX230-1-Week1-Unit1-Chapters 1&2kashmeerpunwasiNo ratings yet

- Income Tax Form 2020 IDocument1 pageIncome Tax Form 2020 ISuvashreePradhanNo ratings yet

- TAX.3503 Sources of IncomeDocument4 pagesTAX.3503 Sources of IncomeMarinoNo ratings yet

- Why O'Connor For Property Tax Reduction?Document7 pagesWhy O'Connor For Property Tax Reduction?O'Connor AssociateNo ratings yet

- Minimum Corporate Income Tax 3Document5 pagesMinimum Corporate Income Tax 3NaikNo ratings yet

- CHAPTER 8. NICsDocument32 pagesCHAPTER 8. NICsAmanda RuseirNo ratings yet

- Purchase of Immovable Property (NIN01)Document4 pagesPurchase of Immovable Property (NIN01)Phil MatizNo ratings yet

- Apfpm0726b 2019-20 (1527)Document2 pagesApfpm0726b 2019-20 (1527)Basant Kumar MishraNo ratings yet

- InvoiceDocument1 pageInvoiceShahil Kumar ShawNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Manogya SharmaNo ratings yet

- Karur Vysya Bank Employees' Union: 11th Bipartite Arrears Calculation Package - ClerkDocument10 pagesKarur Vysya Bank Employees' Union: 11th Bipartite Arrears Calculation Package - ClerkDeepa ManianNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Jaideep SinghNo ratings yet

- BIR Ruling No. 206-90Document2 pagesBIR Ruling No. 206-90Raiya Angela100% (2)

- Tax InvoiceDocument3 pagesTax InvoiceKrishNo ratings yet

- Donor's Tax Return BIR Form No. 1800Document2 pagesDonor's Tax Return BIR Form No. 1800May DinagaNo ratings yet