Professional Documents

Culture Documents

2 Salary - Control Sheet - SirTariqTunio - ARTT

2 Salary - Control Sheet - SirTariqTunio - ARTT

Uploaded by

Zari MaviOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2 Salary - Control Sheet - SirTariqTunio - ARTT

2 Salary - Control Sheet - SirTariqTunio - ARTT

Uploaded by

Zari MaviCopyright:

Available Formats

SALARY (CONTROL SHEET) PREPARED BY SIR TARIQ TUNIO THE TAXMAN 2nd EDITION FOR MARCH 2023 ATTEMPT

2nd EDITION FOR MARCH 2023 ATTEMPT ONLY

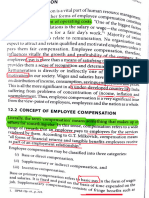

GENERAL POINTS CORE AMOUNTS REIMBURSEMENT OF EXPENDITURE

Charge of Any salary received by an employee in a tax Pay, wages or other remuneration provided to employee, leave pay,

Fully Expenditure incurred for employee’s own benefit Fully Taxable

Tax on Salary year, other thanexempt, is chargeable to tax in payment in lieu of leave, overtime payment, bonus, commission, fees, work Expenditure incurred in performance of duties of employment Not Taxable

Taxable

that year under the head “Salary” conditions supplement (e.g unpleasant or dangerous working conditions)

Revenue/ Capital Salary means any amount received by an SPECIAL AMOUNTS

Nature employee from anyemployment, whether of a

revenue or capital nature

ALLOWANCES Golden handshake Taxable in the year of receipt at current tax rates, or

Amount of allowance provided by employer to employee including (or amounts given Taxable at the average rate of three preceding tax years

Basis of Charge Received basis on termination Option to be filed with CIR by the due date for filing of

cost of living, dearness allowance, subsistence, rent, utilities,

Receipt of (a) actually received by the person; Fully of employment) return ofthe tax year in which salary in arrears is received.

education, entertainment or travel allowance. Note: any

Income (b) applied on behalf of the person, at the Mere right or option is not taxable

allowance solely expended in the performance of the employee’s Taxable

instruction of the personor under any law; or Benefit from mere right/option is taxable if it is disposed, as

(c) made available to the person. duties of employment is not included in employee’s Salary.

follows: Consideration received –Cost= Gain

When is Salary An amount or perquisite is treated as paid if it is Explanation: The allowance solely expended in the performance of

Value of shares (Without Restriction): FMV of shares

Treated as Paid? paid or provided: employee’s duty does not include (i) allowance which is paid in

determinedat date of issue reduced by consideration given

by employer, an associate of the employer, or by monthly salary on fixed basis or %age of salary; or (ii) allowance Taxable Employee Share for the shares and right/option by employee

3rd party underan arrangement with employer which is not wholly, exclusively, necessarily or actually spent on

Scheme Value of shares (With Restriction): FMV of shares determined

or associate of the employer. behalf of the employer. [Example: Special Allowance]

to employee, or an associate of employee or

3rd party under anagreement with employee or

Medical Allowance: Medical allowance received by employee, if

free medical treatment or hospitalization or reimbursement of Exempt upto S atearlier of:

time when employee has free right to transfer the shares

time of disposal of shares

medical or hospitalization charges are NOT provided for in the 10% of Basic

Deductions

an associate of the employee.

by past or prospective employer

No deductions are allowed for any expenditure

terms of employment. Salary

A reduced by consideration given for the shares and right/option

byemployee

Amount of any profit given to employee instead of salary

Profits

Definitions Employee means any individual engaged in

employment

Employer means any person who engages and

PERQUISITES

Accommodat- Amount that would have been paid if accommodation was not

L Agreement to enter

into employment

or inaddition to salary is taxable.

Amounts received as consideration for agreement to enter

intoemployment are taxable

remunerates an employee

Employment includes (a) a directorship or any

other office involved in the management of a

ion provided (i.e. alternative amount)

Minimum value to be taken at 45% of MTS/Basic Salary.

Conveyance Partial personal use:

A Agreement to

Conditions

Amounts received as consideration for conditions of

employmentor changes thereof is taxable.

Amounts received as consideration for agreement to

Restrictive

company; (b) a position entitling the holder to a

fixed or ascertainable remuneration; or (c) the

holding or acting in any public office

5% of Cost of vehicle (owned case) or FMV of vehicle at thetime

of commencement of lease (lease case).

Full personal use:

R covenant

restrictive covenant for past, present or prospective

employment.

Taxable in the year of receipt at current tax rates;

EXEMPTIONS

Domestic

10% of Cost of vehicle (owned) or FMV of vehicle at the time of

commencement of lease agreement (lease case).

Where services of house keeper, driver, gardener or other

Y Salary in arrears

Taxable at the tax rates of the relevant tax year if opted;

Option to be filed with CIR by the due date for filing of

return ofthe tax year in which salary in arrears is received.

Free medical MEDICAL BENEFITS: Benefit representing free servant domestic assistant are provided: Total salary paid to such servant in Tax on tax Amount of tax paid by employer is to be grossed up.

Treatment, medical treatment, hospitalization or both, or the year for services rendered to employee as reduced by

Hospitalization reimbursement of medical charges/hospital payment made by employee to employer for such services.

or Both

Reimbursement

charges or both are provided by employer is

exempt subject to following conditions:

Utilities FMV of the utilities provided reduced by payment made by RETIREMENT BENEFITS

employee for the utilities. Provident (1) Statutory Provident Fund (for Govt Employee) → Employee’s &

of Medical Benefit is provided in employee’s terms of Waiver Waiver/Payment: Amount paid/waived by employer Fund Employer’s annual contribution and Annual accretion of Interest are

Charges, employment

Transfer of FMV of property determined at the time of transfer, as reduced byany not taxable → Payment of accumulated balance Exempt

Hospital NTN of the hospital or clinic is given &

property payment made by employee for the property (2) Recognized Provident Fund →Employee’s annual contribution is

Charges, or employer certifies and attests the medical/

Services FMV of services provided by employer determined at the time not taxable → Employer’s annual contribution: Amount exceeding

Both hospital bills

services are provided as reduced by payment made by employee lower of 1/10th of basic salary & dearness allowance or Rs. 150,000

Exemption for following perquisites received by an employee are

for the services is taxed on annual basis. →Annual accretion of interest: Amount

Food, exempt:

Concessional Amount equal to bench mark rate (in case no interest is charged by exceeding higher of 1/3 of basic salary & dearness allowance or

Education, free or subsidized food provided by hotels and

/ employer) interest amount calculated @ 16% of accumulated amount is taxed

Medical restaurants toits employees during duty hours;

Interest- free Difference between interest charged by employer and the interest annually →Payment of accumulated balance is exempt

Treatments, etc. free or subsidized education provided by an

Loan computed at bench mark rate e.g. 10% (in case interest is charged (3) Unrecognized Provident Fund →Employee’s & employer’s annual

educationalinstitution to the children of its

by employer) contribution and annual accretion of interest are not taxable

employees;

No amount is to be added to salary in following situations: →Payment of accumulated balance is fully taxable (except repayment

free or subsidized medical treatment provided

If employer has charged interest ≥ bench mark rate. of employee’s own contribution)

by a hospital ora clinic to its employees; and

If employee has waived interest on his account maintained Pension Pension received by citizen of Pk from former employer is

any other perquisite or benefit for which the

by the employer. exempt

employer does nothave to bear any marginal If loan amount does not exceed Rs. 1,000,000/- Pension is not exempt if employee continues to work for same

cost, as notified by the Board.

Residual Residual perquisites (i.e. other perquisites not mentioned above) employer or associate of employer

Foreign-Source FS salary received by resident individual is FMV of the perquisites determined at the time they are provided by More than one pensions: Only higher pension is exempt

Salary exempt if he paid foreign income tax on salary. employer reduced by any payment made by employee to employer Leave → Taxable

Foreign Inc.tax is treated as paid if tax has been for the perquisite Encashment →Exempt for employees of Federal Govt., Provincial Govt., or Armed

withheld from salary by employer and paid to the Forces when it is received preparatory to retirement.

revenue authority of foreign country in which the

employment was exercised.

Gratuity or Govt. employees: Exempt if received by employee of Govt. (Federal/Provincial/Local), Statutory body, or Govt. corporations in accordance with rules & condition

Full-Time 25% reduction in tax payable on salary if employed

Commutation of of employee’s service Approved Gratuity Fund: Fully exempt Approved Gratuity Scheme: Exempt upto Rs. 300,000/- Others: Lower of 50% of the

pension on amount or Rs. 75,000/- is exempt (This exemption is not available if gratuity is (a) received outside Pakistan, (b) received by a NR individual, (c) received by an

Teacher / in non-profit education or research institution

retirement employee who has already received a gratuity previously from same or any other employer, & (d) received by a director who is not a regular employee of Co.)

Researcher recognized by HEC, Board of Education, University

recognized by HEC, Govt Training or research

institution.

You might also like

- Standard Chart of Accounts For Manufacturing OperationsDocument31 pagesStandard Chart of Accounts For Manufacturing Operationswpentinio67% (15)

- Case 5Document12 pagesCase 5JIAXUAN WANGNo ratings yet

- Rajpur Garments and Textiles Limited: Indian Institute of Management Ahmedabad IIMA/F&A0400Document4 pagesRajpur Garments and Textiles Limited: Indian Institute of Management Ahmedabad IIMA/F&A04002073 - Ajay Pratap Singh BhatiNo ratings yet

- Salary-Chp 3Document38 pagesSalary-Chp 3Rozina TabassumNo ratings yet

- Workshop On Simple BookkeepingDocument8 pagesWorkshop On Simple BookkeepingInternal Audit ServicesNo ratings yet

- PARTNERSHIP Questions Problems With AnswersDocument11 pagesPARTNERSHIP Questions Problems With AnswersFlor Danielle Querubin100% (5)

- ACC601 Xero Assignment S2 2019Document11 pagesACC601 Xero Assignment S2 2019awazNo ratings yet

- Basic Farm Accounting and Record Keeping Templates: If You Are or Plan To Be Certified OrganicDocument11 pagesBasic Farm Accounting and Record Keeping Templates: If You Are or Plan To Be Certified OrganicGeros dienosNo ratings yet

- 1 Control Sheet - Salary DemoDocument3 pages1 Control Sheet - Salary DemoArman KhanNo ratings yet

- Smart Summary - Salary (IQ School)Document7 pagesSmart Summary - Salary (IQ School)Usama FattahNo ratings yet

- Salary and Its TaxationDocument12 pagesSalary and Its TaxationBasit BandayNo ratings yet

- Unit - Ii - : Income Under The Head Salaries Definition of The Head 'SalariesDocument36 pagesUnit - Ii - : Income Under The Head Salaries Definition of The Head 'SalariesVENKATESWARLUMCOMNo ratings yet

- IncomeTax Valuation PerquisitesDocument19 pagesIncomeTax Valuation PerquisitesSanjeevNo ratings yet

- Fringe Benefits Tax and de MinimisDocument6 pagesFringe Benefits Tax and de MinimisL.ShinNo ratings yet

- Salary PDFDocument14 pagesSalary PDFNITESH SINGHNo ratings yet

- Chapter 5Document5 pagesChapter 5Shafaq Hamid RazaNo ratings yet

- Chapter 4 - ReviewerDocument11 pagesChapter 4 - Reviewerdevy mar topiaNo ratings yet

- Title Ii Wages Preliminary Matters ARTICLE 97. Definitions. - As Used in This TitleDocument12 pagesTitle Ii Wages Preliminary Matters ARTICLE 97. Definitions. - As Used in This Titlemitsudayo_No ratings yet

- Ange - Chapter 4 Reviewer TaxationDocument11 pagesAnge - Chapter 4 Reviewer Taxationdevy mar topiaNo ratings yet

- Ange - Chapter 4 Reviewer TaxationDocument11 pagesAnge - Chapter 4 Reviewer Taxationdevy mar topiaNo ratings yet

- Income Tax Inclusion From Gross IncomeDocument5 pagesIncome Tax Inclusion From Gross IncomeSharmaine Clemencio0No ratings yet

- Income Tax Inclusion From Gross IncomeDocument5 pagesIncome Tax Inclusion From Gross IncomeHeinie Joy PauleNo ratings yet

- My Sip 2021-22Document28 pagesMy Sip 2021-22Xenqiyj XyenttukNo ratings yet

- Income From SalaryDocument28 pagesIncome From SalarykumarNo ratings yet

- Computation Income From SalaryDocument14 pagesComputation Income From SalaryHajra MalikNo ratings yet

- Computation Income From SalaryDocument15 pagesComputation Income From SalaryIzma HussainNo ratings yet

- Chapter 6Document38 pagesChapter 6assadrafaqNo ratings yet

- Forms of Compensation IncomeDocument6 pagesForms of Compensation IncomeMariaHannahKristenRamirezNo ratings yet

- Salary, HPDocument21 pagesSalary, HPNickyta UpadhyayNo ratings yet

- Tax - Notes - Inclusions and ExclusionsDocument11 pagesTax - Notes - Inclusions and ExclusionsCamille Danielle BarbadoNo ratings yet

- Fringe and de Minimis BenefitsDocument14 pagesFringe and de Minimis BenefitsIrish D DagmilNo ratings yet

- Pagatpat, Aischelle Mhae RDocument4 pagesPagatpat, Aischelle Mhae RElleNo ratings yet

- CHAPTER 11 - IncomeTaxDocument2 pagesCHAPTER 11 - IncomeTaxVicente, Liza Mae C.No ratings yet

- Fringe BenefitsDocument3 pagesFringe BenefitsNoroNo ratings yet

- Gross IncomeDocument5 pagesGross IncomeNavarro Cristine C.No ratings yet

- Fringe Benefits TaxDocument39 pagesFringe Benefits TaxGet BurnNo ratings yet

- Income Under The Head "Salary"Document15 pagesIncome Under The Head "Salary"NITESH SINGHNo ratings yet

- The Labour Code 2019 Part 2 - Deduction, Payment of BonusDocument26 pagesThe Labour Code 2019 Part 2 - Deduction, Payment of BonusDr.poonamNo ratings yet

- Summary of IAS 19_ Employee BenefitsDocument8 pagesSummary of IAS 19_ Employee BenefitsMohammad KashirNo ratings yet

- TX TSNDocument55 pagesTX TSN유니스No ratings yet

- Salary Part 1Document4 pagesSalary Part 1887 shivam guptaNo ratings yet

- Income Under Head SalariesDocument8 pagesIncome Under Head Salaries887 shivam guptaNo ratings yet

- Business Ethics PrelimDocument2 pagesBusiness Ethics Prelimdumboo371No ratings yet

- Salary PDF New 1Document20 pagesSalary PDF New 1NITESH SINGHNo ratings yet

- Salary PDFDocument12 pagesSalary PDFNITESH SINGHNo ratings yet

- Salary PDF New 2Document20 pagesSalary PDF New 2NITESH SINGHNo ratings yet

- CHAPTER 11 Flashcards - QuizletDocument11 pagesCHAPTER 11 Flashcards - QuizletTokis SabaNo ratings yet

- Fringe and de Minimis BenefitsDocument21 pagesFringe and de Minimis BenefitsMaureen Joy Esguerra ZamudioNo ratings yet

- Linear RelationshipDocument63 pagesLinear RelationshipJohn FloresNo ratings yet

- Gross Income: Definition Means All Gains, Profits, and IncomeDocument19 pagesGross Income: Definition Means All Gains, Profits, and IncomeKathNo ratings yet

- Labor Reviewer - WagesDocument22 pagesLabor Reviewer - WagesMikaela Pamatmat100% (1)

- Friinge Benifit Tax-18Document9 pagesFriinge Benifit Tax-18s4sahithNo ratings yet

- Part 3 - Beda NotesDocument6 pagesPart 3 - Beda NotesNoelle SanidadNo ratings yet

- CompensationDocument4 pagesCompensationjasbirkaurNo ratings yet

- 1 IAS 19 EMPLOYEE BENEFITS With Suggested Answers As of 11 10Document13 pages1 IAS 19 EMPLOYEE BENEFITS With Suggested Answers As of 11 10Kimberly IgnacioNo ratings yet

- In Addition To Basic Salaries, To An Individual Employee, Other Than A Rank and File EmployeeDocument13 pagesIn Addition To Basic Salaries, To An Individual Employee, Other Than A Rank and File EmployeeNOW BIENo ratings yet

- W6 Module 5 - Fringe Benefits and Dealings in PropertyDocument13 pagesW6 Module 5 - Fringe Benefits and Dealings in PropertyElmeerajh JudavarNo ratings yet

- IAS 19 - SummaryDocument8 pagesIAS 19 - SummaryZubair MalikNo ratings yet

- Chapter 11Document2 pagesChapter 11Alyssa BerangberangNo ratings yet

- INCLUSIONS (Gross Income For Individuals) 1. Compensation IncomeDocument4 pagesINCLUSIONS (Gross Income For Individuals) 1. Compensation IncomeJoAiza DiazNo ratings yet

- Gross Income: Income Earned Through The Actual, Direct, Personal Effort of The TaxpayerDocument9 pagesGross Income: Income Earned Through The Actual, Direct, Personal Effort of The TaxpayerKen RaquinioNo ratings yet

- Ia2 Employee BenefitsDocument5 pagesIa2 Employee BenefitsnishioyukihimeNo ratings yet

- Ast TX 901 Fringe Benefits Tax (Batch 22)Document6 pagesAst TX 901 Fringe Benefits Tax (Batch 22)Shining LightNo ratings yet

- 8,9 Employee Compensation PackageDocument37 pages8,9 Employee Compensation PackageAMITESH RANJANNo ratings yet

- Module 10 - Fringe Benefit TaxDocument27 pagesModule 10 - Fringe Benefit Taxairwaller rNo ratings yet

- AC 501 (Pre-Mid)Document3 pagesAC 501 (Pre-Mid)RodNo ratings yet

- Free Printable Financial Affidavit FormDocument3 pagesFree Printable Financial Affidavit FormfatinNo ratings yet

- Adv - IT Project Cost - FinalDocument10 pagesAdv - IT Project Cost - FinalAdamNo ratings yet

- Maths Year 11A CH 3 - Maths Quest Maths A Year 11 For QueenslandDocument40 pagesMaths Year 11A CH 3 - Maths Quest Maths A Year 11 For QueenslandJason TaylorNo ratings yet

- Journal EntryDocument4 pagesJournal EntryRhio venus LacsamanaNo ratings yet

- Minor Operating Department Medha Singh (127) Muskan AgarwalaDocument3 pagesMinor Operating Department Medha Singh (127) Muskan AgarwalaMedha SinghNo ratings yet

- Consolidated Balance Sheet of Mahindra and Mahindra - in Rs. Cr.Document10 pagesConsolidated Balance Sheet of Mahindra and Mahindra - in Rs. Cr.bhagathnagarNo ratings yet

- Healthcare Deal Multiples (Select Transactions) - Part 1Document10 pagesHealthcare Deal Multiples (Select Transactions) - Part 1Reevolv Advisory Services Private LimitedNo ratings yet

- 21decentralized Operations and Segment ReportingDocument130 pages21decentralized Operations and Segment ReportingAilene QuintoNo ratings yet

- COBA Newsletter 0408 (GH-31)Document16 pagesCOBA Newsletter 0408 (GH-31)Albany Times UnionNo ratings yet

- PLDTDocument163 pagesPLDTAlyssa E. FrigillanaNo ratings yet

- L3-L4 CostsheetDocument30 pagesL3-L4 CostsheetDhawal RajNo ratings yet

- Advanced Financial Accounting: 2 Year ExaminationDocument27 pagesAdvanced Financial Accounting: 2 Year ExaminationEdson Jorge MandlateNo ratings yet

- Aat Level 3 Fapr 1-2Document29 pagesAat Level 3 Fapr 1-2Ira CașuNo ratings yet

- Auditing Concepts and Application SolManDocument20 pagesAuditing Concepts and Application SolManPenryu LeeNo ratings yet

- HumanResourceAccountingACaseStudyWithSpecialReferenceToVisakhapatnamPortTrust (72 77)Document6 pagesHumanResourceAccountingACaseStudyWithSpecialReferenceToVisakhapatnamPortTrust (72 77)bablooNo ratings yet

- 02 Acme Example and T Accounts - HandoutsDocument33 pages02 Acme Example and T Accounts - HandoutsTony DilleenNo ratings yet

- Accounting Notes For EE SubjectDocument32 pagesAccounting Notes For EE SubjectSanjay YadavNo ratings yet

- Honda Atlas Cars Pakistan) LimitedDocument43 pagesHonda Atlas Cars Pakistan) Limitedzee412No ratings yet

- Auditing Problems Final Term Exam 3.14.2013Document10 pagesAuditing Problems Final Term Exam 3.14.2013Vel JuneNo ratings yet

- Sustainable Housing Project ProposDocument41 pagesSustainable Housing Project ProposRizqillaahi NaufalNo ratings yet

- PSG Institute of Technology and Applied Research, Coimbatore - 641 062 Department of Electrical and Electronics Engineering Comprehension Test - 1Document3 pagesPSG Institute of Technology and Applied Research, Coimbatore - 641 062 Department of Electrical and Electronics Engineering Comprehension Test - 1Divya VigneshbabuNo ratings yet

- Nep 2022 Volume 2Document1,478 pagesNep 2022 Volume 2Roldz LariosNo ratings yet