Professional Documents

Culture Documents

Form PDF 301906800310714

Form PDF 301906800310714

Uploaded by

deepkaryan1988Copyright:

Available Formats

You might also like

- Pay Slip - 473995 - Apr-21Document1 pagePay Slip - 473995 - Apr-21Siva RamakrishnaNo ratings yet

- TaxReturn PDFDocument24 pagesTaxReturn PDFga83% (6)

- Deductions Under Chapter VI A (Section)Document2 pagesDeductions Under Chapter VI A (Section)Dharmendra SinghNo ratings yet

- Deductions Under Chapter VI A (Section)Document2 pagesDeductions Under Chapter VI A (Section)ashim kumar PramanickNo ratings yet

- Deductions Under Chapter VI A (Section)Document2 pagesDeductions Under Chapter VI A (Section)Vikas KumarNo ratings yet

- Deductions Under Chapter VI A (Section) : Date of Filing of Original ReturnDocument2 pagesDeductions Under Chapter VI A (Section) : Date of Filing of Original Returnismailkhan.dbaNo ratings yet

- Form PDF 860011410060114Document2 pagesForm PDF 860011410060114prakashdebleyNo ratings yet

- Form PDF 692100430280713Document2 pagesForm PDF 692100430280713sunilNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnசிவா நடராஜன்No ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnDr-Firoz ShaikhNo ratings yet

- Itr-4 Sugam Presumptive Business or Profession Income Tax ReturnDocument7 pagesItr-4 Sugam Presumptive Business or Profession Income Tax ReturnShivam DixitNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnSiddhant SwainNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnsky2flyboy@gmail.comNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnpavanNo ratings yet

- 2019-01-24-Amit Swaroop 1 - Atgps5835e - 2017Document6 pages2019-01-24-Amit Swaroop 1 - Atgps5835e - 2017ApoorvNo ratings yet

- 2018 03 31 12 23 14 702 - 1958189601Document5 pages2018 03 31 12 23 14 702 - 1958189601Kethavarapu RamjiNo ratings yet

- Form PDF 378544500300118Document7 pagesForm PDF 378544500300118raodinesh0001No ratings yet

- Itr 1Document2 pagesItr 1zakirhusssainNo ratings yet

- Itr-4 Sugam Presumptive Business or Profession Income Tax ReturnDocument6 pagesItr-4 Sugam Presumptive Business or Profession Income Tax ReturnMANOJNo ratings yet

- Itr-4 Sugam Presumptive Business or Profession Income Tax ReturnDocument7 pagesItr-4 Sugam Presumptive Business or Profession Income Tax ReturnShivam JainNo ratings yet

- 2019 09 18 18 03 50 397 - Ehbps8472n - 2016Document5 pages2019 09 18 18 03 50 397 - Ehbps8472n - 2016Darvesh mishraNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnValesh MonisNo ratings yet

- (DD/MM/YYYY) : (Please See Rule 12 of The Income-Tax Rules, 1962) (Also See Attached Instructions)Document3 pages(DD/MM/YYYY) : (Please See Rule 12 of The Income-Tax Rules, 1962) (Also See Attached Instructions)nilihitaNo ratings yet

- 12 Itr1 10 11Document6 pages12 Itr1 10 11ramanwweNo ratings yet

- Sahaj Individual Income Tax Return Assessment Year 2 0 15 - 1 6Document9 pagesSahaj Individual Income Tax Return Assessment Year 2 0 15 - 1 6Prince BalaNo ratings yet

- 2018 11 12 09 56 17 498 - Cinpm3915m - 2018 - PDFDocument5 pages2018 11 12 09 56 17 498 - Cinpm3915m - 2018 - PDFMohammed MaazNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnSijo Kaviyil JosephNo ratings yet

- Indian Income Tax Return Itr-1Document10 pagesIndian Income Tax Return Itr-1bharatmitnaNo ratings yet

- Form ITR-1Document2 pagesForm ITR-1vinay.bpNo ratings yet

- For Individuals and Hufs Not Carrying Out Business or Profession Under Any ProprietorshipDocument25 pagesFor Individuals and Hufs Not Carrying Out Business or Profession Under Any ProprietorshipSahil GuptaNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnram4a5No ratings yet

- NotificationDocument7 pagesNotificationapi-25886395No ratings yet

- 2017 07 16 14 13 28 351 - 970124135Document5 pages2017 07 16 14 13 28 351 - 970124135Ganesh DasaraNo ratings yet

- Final Itr PDFDocument8 pagesFinal Itr PDFharish1000No ratings yet

- Itr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 994254410070818 Assessment Year: 2018-19Document5 pagesItr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 994254410070818 Assessment Year: 2018-19Prashant GuptaNo ratings yet

- Form PDF 358979100180620Document10 pagesForm PDF 358979100180620Sajan JhaNo ratings yet

- I T R-1-Ver1 (2pages)Document4 pagesI T R-1-Ver1 (2pages)mohan6789No ratings yet

- Form ITR-1-2009-10Document7 pagesForm ITR-1-2009-10vikram_enercon3941No ratings yet

- 2017 09 18 16 47 37 050 - 118817245Document5 pages2017 09 18 16 47 37 050 - 118817245Nitin KumarNo ratings yet

- (DD/MM/YYYY) : (Please See Rule 12 of The Income-Tax Rules, 1962) (Also See Attached Instructions)Document5 pages(DD/MM/YYYY) : (Please See Rule 12 of The Income-Tax Rules, 1962) (Also See Attached Instructions)anon-928287100% (1)

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnchinna rajaNo ratings yet

- Itr 4 - Indian Income Tax ReturnDocument9 pagesItr 4 - Indian Income Tax ReturnArun AssociatesNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnhavejsnjNo ratings yet

- Income Tax Return Form-1 Sahaj - Excel FormatDocument9 pagesIncome Tax Return Form-1 Sahaj - Excel Formatswapnil007salunkeNo ratings yet

- Itr 4 Sugam - Indian Income Tax Return: Acknowledgement Number: 986260850020121 Assessment Year: 2020-21Document10 pagesItr 4 Sugam - Indian Income Tax Return: Acknowledgement Number: 986260850020121 Assessment Year: 2020-21PANKAJ KOTHARINo ratings yet

- Receipt No/ Date Seal and Signature of Receiving OfficialDocument10 pagesReceipt No/ Date Seal and Signature of Receiving OfficialRAMAPPA100% (2)

- UntitlramedDocument22 pagesUntitlramedKrrishnachaithanya bukka ThantriswamyNo ratings yet

- Receipt No/ Date Seal and Signature of Receiving OfficialDocument4 pagesReceipt No/ Date Seal and Signature of Receiving Officialtsrahod@yahoo.comNo ratings yet

- 2019 09 18 22 09 59 689 - Aovpb3846g - 2018Document5 pages2019 09 18 22 09 59 689 - Aovpb3846g - 2018varahalutulugu1980No ratings yet

- Form PDF 925169910281220Document12 pagesForm PDF 925169910281220itr hmpNo ratings yet

- SahajDocument6 pagesSahajtrash.promosNo ratings yet

- 2019 08 05 19 29 34 024 - Eopps2520g - 2019 - PDFDocument5 pages2019 08 05 19 29 34 024 - Eopps2520g - 2019 - PDFselvaprpcNo ratings yet

- Form PDF 658202480080622Document6 pagesForm PDF 658202480080622Chandrasekhar NandigamNo ratings yet

- 2011 ITR1 r2Document3 pages2011 ITR1 r2notybhardwajNo ratings yet

- 2019 10 20 11 11 26 114 - Cixpm4133k - 2019Document8 pages2019 10 20 11 11 26 114 - Cixpm4133k - 2019tarun mathurNo ratings yet

- Itr 4 Sugam - Indian Income Tax Return: Acknowledgement Number: 406506330200720 Assessment Year: 2020-21Document10 pagesItr 4 Sugam - Indian Income Tax Return: Acknowledgement Number: 406506330200720 Assessment Year: 2020-21A2a PancardNo ratings yet

- Coi Ay 22-23Document2 pagesCoi Ay 22-23vikash pandeyNo ratings yet

- Medi Classic Individual BrochureDocument3 pagesMedi Classic Individual BrochureAmir ShaNo ratings yet

- BOSCHDocument1 pageBOSCHKolkata Jyote MotorsNo ratings yet

- Instructions For Form 990-C: Internal Revenue ServiceDocument12 pagesInstructions For Form 990-C: Internal Revenue ServiceIRSNo ratings yet

- Bar ExamDocument29 pagesBar ExamRica Kathrine Reyes AustriaNo ratings yet

- Partnership Agreement TemplateDocument12 pagesPartnership Agreement TemplateNaymul AlamNo ratings yet

- Cir v. PalDocument54 pagesCir v. PalTzarleneNo ratings yet

- GR No. L-30642, Apr 30, 1985) Floresca V. Philex Mining Corporation FactsDocument24 pagesGR No. L-30642, Apr 30, 1985) Floresca V. Philex Mining Corporation FactskerovinmaguigadNo ratings yet

- The Institute of Chartered Accountants of PakistanDocument6 pagesThe Institute of Chartered Accountants of PakistanWajahat GhafoorNo ratings yet

- PALE Position PaperDocument10 pagesPALE Position PaperCindy-chan DelfinNo ratings yet

- Covering The IRSDocument31 pagesCovering The IRSNational Press FoundationNo ratings yet

- Ontario Drug Benefit Act (1/2)Document2 pagesOntario Drug Benefit Act (1/2)HerodotusNo ratings yet

- Conwi vs. CTADocument4 pagesConwi vs. CTAAnonymous sMqziwneNo ratings yet

- 3rd MeetingDocument15 pages3rd MeetingCarlos JamesNo ratings yet

- Utah Form TC-20 Tax Return and InstructionsDocument26 pagesUtah Form TC-20 Tax Return and InstructionsBrandonNo ratings yet

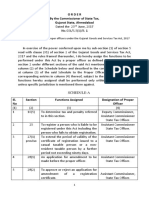

- Order by The Commissioner of State Tax, Gujarat State, AhmedabadDocument10 pagesOrder by The Commissioner of State Tax, Gujarat State, Ahmedabadarpit85No ratings yet

- Scoot Fees Chart - For Travel Out of SINGAPORE (In SGD) : If Purchased After Booking Is TicketedDocument16 pagesScoot Fees Chart - For Travel Out of SINGAPORE (In SGD) : If Purchased After Booking Is TicketedpriyoNo ratings yet

- PDF 2007 2013 Taxation Law Philippine Bar Examination Questions and Suggested Answers JayarhsalsampladotDocument125 pagesPDF 2007 2013 Taxation Law Philippine Bar Examination Questions and Suggested Answers JayarhsalsampladotIrin200No ratings yet

- US Internal Revenue Service: I1040 - 2001Document123 pagesUS Internal Revenue Service: I1040 - 2001IRS100% (1)

- Income Tax Declaration Form (09-010)Document2 pagesIncome Tax Declaration Form (09-010)tanilshuklaNo ratings yet

- HCM US Balance Adjustments White PaperDocument184 pagesHCM US Balance Adjustments White Paperajay kumarNo ratings yet

- GST PresentationDocument66 pagesGST PresentationkapuNo ratings yet

- Case Digest Incomplete TaxDocument135 pagesCase Digest Incomplete TaxHencel GumabayNo ratings yet

- Direct Tax ProjectDocument18 pagesDirect Tax ProjectShivani Singh ChandelNo ratings yet

- CT 3911Document1 pageCT 3911Kizito MarowaNo ratings yet

- 2018 540instructions PDFDocument96 pages2018 540instructions PDFEric1201No ratings yet

- 17 12 04 Tax Administration Proclamation Explanatory Notes 1 1Document145 pages17 12 04 Tax Administration Proclamation Explanatory Notes 1 1Dame WordofaNo ratings yet

- Chapter 10 - TAXDocument11 pagesChapter 10 - TAXJkjkMlmlNo ratings yet

Form PDF 301906800310714

Form PDF 301906800310714

Uploaded by

deepkaryan1988Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form PDF 301906800310714

Form PDF 301906800310714

Uploaded by

deepkaryan1988Copyright:

Available Formats

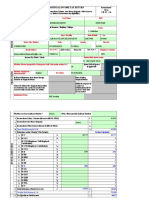

First Name Middle Name Last Name PAN

DEEPAK KUMAR CENPK7126J

Flat / Door / Building Name Of Premises / Building / Village Status

HOUSE NO.-198/SECTOR -30 NEAR SHIVAM HOSPTIAL I

INFORMATION

Road/Street Area/Locality Date of Birth (YYYY/MM/DD)

PERSONAL

GURGAON, DELHI NCR 1988-12-28

Town/City/District State Pincode Sex

GURGAON, DELHI NCR HARYANA 122001 M

Country

91- INDIA Employer Category

Email Address Residential/Office Phone Mobile No.

No. with STD Code

deepakaryan1988@gmail.com ( )- 7042079239 OTH

,

Income Tax Ward/Circle Return filed under Section 11

Whether Original or Revised return? O

If revised, Original Ack no Date of filing of Original Return

FILING STATUS

If u/s 139(9)-defective return ,

Original Ack No

If u/s 139(9)-defective return , Notice If u/s 139(9)-defective return , Date

No of Filing of Original Return

Residential Status RES Tax Status TR

Whether Person governed by N If A22 is applicable, PAN of the

Portuguese Civil Code under Sec 5A ? Spouse

If filed in response to notice u/s

139(9)/142(1)/148/153(A)/153(C), date

of such notice

1 Income from Salary / Pension (Ensure to fill Sch TDS1) 1 334537

Type of House Property

2 Income from one House Property 0

3 Income from Other Sources (Ensure to fill Sch TDS2) 0

4 Gross Total Income (1+2+3) 4 334537

5 Deductions under chapter VI A (Section)

a 80C 5178 5178 i 80G 0 0

b 80CCC 0 0j 80GG 0 0

c 80CCD(1) 0 0k 80GGA 0 0

INCOME & DEDUCTIONS

(i) (Employers

Contribution)

c 80CCD(2) 0 0l 80GGC 0 0

(ii) (Employees /

Self Employed

Contribution)

d 80D 0 0m 80U 0 0

e 80DD 0 0n 80CCG 0 0

f 80DDB 0 0o 80RRB 0 0

g 80E 0 0p 80QQB 0 0

h 80EE 0 0q 80TTA 0 0

6 Total Deductions (Total of 5a to 5q) 6 5178

7 Taxable Total Income (4-6) 7 329360

8 Tax Payable on Total Income 8 12936

COMPUTATION

9 Rebate u/s 87A 9 2000

10 Tax Payable After Rebate(8-9) 10 10936

11 Surcharge, if (7) exceeds 1 crore 11 0

TAX

12 Cess on (10+11) 12 328

13 Total Tax, Surcharge and Cess (Payable)(10+11+12) 13 11264

14 Relief u/s 89 14 0

15 Balance Tax After Relief (13-14) 15 11264

16 (i) Total Interest u/s 234A 16i 0

(ii) Total Interest u/s 234B 16ii 0

(iii) Total Interest u/s 234C 16iii 0

17 Total Interest Payable (16(i) + 16(ii) + 16(iii)) 17 0

18 Total Tax and Interest (15+17) 18 11264

19 Taxes Paid

TAXES PAID

a Total Advance Tax Paid (from item 26) 19a 0

b Total TDS Claimed (Total from item 24 + item 25) 19b 21470

c Total Self Assessment Tax Paid (item 26) 19c 0

Total Taxes Paid(19a + 19b + 19c) 20 21470

20

21 Total Tax Payable (18-20) (if 18 is greater than 20) 21 0

REFUND

22 Refund (20-18) (if 20 is greater than 18) 22 10210

23 Bank Account Number 187801501234

24 IFSC Code ICIC0001878

25 Type of Account SAV

26 SCH TDS1-Details of Tax Deducted at Source from Salary [As per Form 16 issued by Employer(s)]

SI.NO Tax Deduction Name of the Employer Income Tax Deducted

Account Number Under Salary

(TAN) of the

Employer

1 PNED08602G DIPEN CHAUDHARY 0 9120

2 PNEQ00279G QED42 ENGINEERING PVT LTD 0 12350

29 Exempt income for reporting purposes only

VERIFICATION

xyz

I, DEEPAK KUMAR son/daughter of SUBHASH PRASAD solemnly declare that to the best of my knowledge and belief, the information

given in the return is correct and complete and that the amount of total income and other particulars shown therein are truly stated and

are in accordance with the provisions of the Income- tax Act 1961, in respect of income chargeable to Income-tax for the previous year

relevant to the Assessment Year 2014-15.

Place GURGAON, DELHI NCR Date 2014-07-31 PAN CENPK7126J

30 If the return has been prepared by a Tax Return Preparer (TRP) give further details as below:

TRP PIN [10 Digit] Name of the TRP TRP Signature

31 Amount to be paid to TRP

You might also like

- Pay Slip - 473995 - Apr-21Document1 pagePay Slip - 473995 - Apr-21Siva RamakrishnaNo ratings yet

- TaxReturn PDFDocument24 pagesTaxReturn PDFga83% (6)

- Deductions Under Chapter VI A (Section)Document2 pagesDeductions Under Chapter VI A (Section)Dharmendra SinghNo ratings yet

- Deductions Under Chapter VI A (Section)Document2 pagesDeductions Under Chapter VI A (Section)ashim kumar PramanickNo ratings yet

- Deductions Under Chapter VI A (Section)Document2 pagesDeductions Under Chapter VI A (Section)Vikas KumarNo ratings yet

- Deductions Under Chapter VI A (Section) : Date of Filing of Original ReturnDocument2 pagesDeductions Under Chapter VI A (Section) : Date of Filing of Original Returnismailkhan.dbaNo ratings yet

- Form PDF 860011410060114Document2 pagesForm PDF 860011410060114prakashdebleyNo ratings yet

- Form PDF 692100430280713Document2 pagesForm PDF 692100430280713sunilNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnசிவா நடராஜன்No ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnDr-Firoz ShaikhNo ratings yet

- Itr-4 Sugam Presumptive Business or Profession Income Tax ReturnDocument7 pagesItr-4 Sugam Presumptive Business or Profession Income Tax ReturnShivam DixitNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnSiddhant SwainNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnsky2flyboy@gmail.comNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnpavanNo ratings yet

- 2019-01-24-Amit Swaroop 1 - Atgps5835e - 2017Document6 pages2019-01-24-Amit Swaroop 1 - Atgps5835e - 2017ApoorvNo ratings yet

- 2018 03 31 12 23 14 702 - 1958189601Document5 pages2018 03 31 12 23 14 702 - 1958189601Kethavarapu RamjiNo ratings yet

- Form PDF 378544500300118Document7 pagesForm PDF 378544500300118raodinesh0001No ratings yet

- Itr 1Document2 pagesItr 1zakirhusssainNo ratings yet

- Itr-4 Sugam Presumptive Business or Profession Income Tax ReturnDocument6 pagesItr-4 Sugam Presumptive Business or Profession Income Tax ReturnMANOJNo ratings yet

- Itr-4 Sugam Presumptive Business or Profession Income Tax ReturnDocument7 pagesItr-4 Sugam Presumptive Business or Profession Income Tax ReturnShivam JainNo ratings yet

- 2019 09 18 18 03 50 397 - Ehbps8472n - 2016Document5 pages2019 09 18 18 03 50 397 - Ehbps8472n - 2016Darvesh mishraNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnValesh MonisNo ratings yet

- (DD/MM/YYYY) : (Please See Rule 12 of The Income-Tax Rules, 1962) (Also See Attached Instructions)Document3 pages(DD/MM/YYYY) : (Please See Rule 12 of The Income-Tax Rules, 1962) (Also See Attached Instructions)nilihitaNo ratings yet

- 12 Itr1 10 11Document6 pages12 Itr1 10 11ramanwweNo ratings yet

- Sahaj Individual Income Tax Return Assessment Year 2 0 15 - 1 6Document9 pagesSahaj Individual Income Tax Return Assessment Year 2 0 15 - 1 6Prince BalaNo ratings yet

- 2018 11 12 09 56 17 498 - Cinpm3915m - 2018 - PDFDocument5 pages2018 11 12 09 56 17 498 - Cinpm3915m - 2018 - PDFMohammed MaazNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnSijo Kaviyil JosephNo ratings yet

- Indian Income Tax Return Itr-1Document10 pagesIndian Income Tax Return Itr-1bharatmitnaNo ratings yet

- Form ITR-1Document2 pagesForm ITR-1vinay.bpNo ratings yet

- For Individuals and Hufs Not Carrying Out Business or Profession Under Any ProprietorshipDocument25 pagesFor Individuals and Hufs Not Carrying Out Business or Profession Under Any ProprietorshipSahil GuptaNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnram4a5No ratings yet

- NotificationDocument7 pagesNotificationapi-25886395No ratings yet

- 2017 07 16 14 13 28 351 - 970124135Document5 pages2017 07 16 14 13 28 351 - 970124135Ganesh DasaraNo ratings yet

- Final Itr PDFDocument8 pagesFinal Itr PDFharish1000No ratings yet

- Itr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 994254410070818 Assessment Year: 2018-19Document5 pagesItr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 994254410070818 Assessment Year: 2018-19Prashant GuptaNo ratings yet

- Form PDF 358979100180620Document10 pagesForm PDF 358979100180620Sajan JhaNo ratings yet

- I T R-1-Ver1 (2pages)Document4 pagesI T R-1-Ver1 (2pages)mohan6789No ratings yet

- Form ITR-1-2009-10Document7 pagesForm ITR-1-2009-10vikram_enercon3941No ratings yet

- 2017 09 18 16 47 37 050 - 118817245Document5 pages2017 09 18 16 47 37 050 - 118817245Nitin KumarNo ratings yet

- (DD/MM/YYYY) : (Please See Rule 12 of The Income-Tax Rules, 1962) (Also See Attached Instructions)Document5 pages(DD/MM/YYYY) : (Please See Rule 12 of The Income-Tax Rules, 1962) (Also See Attached Instructions)anon-928287100% (1)

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnchinna rajaNo ratings yet

- Itr 4 - Indian Income Tax ReturnDocument9 pagesItr 4 - Indian Income Tax ReturnArun AssociatesNo ratings yet

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax ReturnhavejsnjNo ratings yet

- Income Tax Return Form-1 Sahaj - Excel FormatDocument9 pagesIncome Tax Return Form-1 Sahaj - Excel Formatswapnil007salunkeNo ratings yet

- Itr 4 Sugam - Indian Income Tax Return: Acknowledgement Number: 986260850020121 Assessment Year: 2020-21Document10 pagesItr 4 Sugam - Indian Income Tax Return: Acknowledgement Number: 986260850020121 Assessment Year: 2020-21PANKAJ KOTHARINo ratings yet

- Receipt No/ Date Seal and Signature of Receiving OfficialDocument10 pagesReceipt No/ Date Seal and Signature of Receiving OfficialRAMAPPA100% (2)

- UntitlramedDocument22 pagesUntitlramedKrrishnachaithanya bukka ThantriswamyNo ratings yet

- Receipt No/ Date Seal and Signature of Receiving OfficialDocument4 pagesReceipt No/ Date Seal and Signature of Receiving Officialtsrahod@yahoo.comNo ratings yet

- 2019 09 18 22 09 59 689 - Aovpb3846g - 2018Document5 pages2019 09 18 22 09 59 689 - Aovpb3846g - 2018varahalutulugu1980No ratings yet

- Form PDF 925169910281220Document12 pagesForm PDF 925169910281220itr hmpNo ratings yet

- SahajDocument6 pagesSahajtrash.promosNo ratings yet

- 2019 08 05 19 29 34 024 - Eopps2520g - 2019 - PDFDocument5 pages2019 08 05 19 29 34 024 - Eopps2520g - 2019 - PDFselvaprpcNo ratings yet

- Form PDF 658202480080622Document6 pagesForm PDF 658202480080622Chandrasekhar NandigamNo ratings yet

- 2011 ITR1 r2Document3 pages2011 ITR1 r2notybhardwajNo ratings yet

- 2019 10 20 11 11 26 114 - Cixpm4133k - 2019Document8 pages2019 10 20 11 11 26 114 - Cixpm4133k - 2019tarun mathurNo ratings yet

- Itr 4 Sugam - Indian Income Tax Return: Acknowledgement Number: 406506330200720 Assessment Year: 2020-21Document10 pagesItr 4 Sugam - Indian Income Tax Return: Acknowledgement Number: 406506330200720 Assessment Year: 2020-21A2a PancardNo ratings yet

- Coi Ay 22-23Document2 pagesCoi Ay 22-23vikash pandeyNo ratings yet

- Medi Classic Individual BrochureDocument3 pagesMedi Classic Individual BrochureAmir ShaNo ratings yet

- BOSCHDocument1 pageBOSCHKolkata Jyote MotorsNo ratings yet

- Instructions For Form 990-C: Internal Revenue ServiceDocument12 pagesInstructions For Form 990-C: Internal Revenue ServiceIRSNo ratings yet

- Bar ExamDocument29 pagesBar ExamRica Kathrine Reyes AustriaNo ratings yet

- Partnership Agreement TemplateDocument12 pagesPartnership Agreement TemplateNaymul AlamNo ratings yet

- Cir v. PalDocument54 pagesCir v. PalTzarleneNo ratings yet

- GR No. L-30642, Apr 30, 1985) Floresca V. Philex Mining Corporation FactsDocument24 pagesGR No. L-30642, Apr 30, 1985) Floresca V. Philex Mining Corporation FactskerovinmaguigadNo ratings yet

- The Institute of Chartered Accountants of PakistanDocument6 pagesThe Institute of Chartered Accountants of PakistanWajahat GhafoorNo ratings yet

- PALE Position PaperDocument10 pagesPALE Position PaperCindy-chan DelfinNo ratings yet

- Covering The IRSDocument31 pagesCovering The IRSNational Press FoundationNo ratings yet

- Ontario Drug Benefit Act (1/2)Document2 pagesOntario Drug Benefit Act (1/2)HerodotusNo ratings yet

- Conwi vs. CTADocument4 pagesConwi vs. CTAAnonymous sMqziwneNo ratings yet

- 3rd MeetingDocument15 pages3rd MeetingCarlos JamesNo ratings yet

- Utah Form TC-20 Tax Return and InstructionsDocument26 pagesUtah Form TC-20 Tax Return and InstructionsBrandonNo ratings yet

- Order by The Commissioner of State Tax, Gujarat State, AhmedabadDocument10 pagesOrder by The Commissioner of State Tax, Gujarat State, Ahmedabadarpit85No ratings yet

- Scoot Fees Chart - For Travel Out of SINGAPORE (In SGD) : If Purchased After Booking Is TicketedDocument16 pagesScoot Fees Chart - For Travel Out of SINGAPORE (In SGD) : If Purchased After Booking Is TicketedpriyoNo ratings yet

- PDF 2007 2013 Taxation Law Philippine Bar Examination Questions and Suggested Answers JayarhsalsampladotDocument125 pagesPDF 2007 2013 Taxation Law Philippine Bar Examination Questions and Suggested Answers JayarhsalsampladotIrin200No ratings yet

- US Internal Revenue Service: I1040 - 2001Document123 pagesUS Internal Revenue Service: I1040 - 2001IRS100% (1)

- Income Tax Declaration Form (09-010)Document2 pagesIncome Tax Declaration Form (09-010)tanilshuklaNo ratings yet

- HCM US Balance Adjustments White PaperDocument184 pagesHCM US Balance Adjustments White Paperajay kumarNo ratings yet

- GST PresentationDocument66 pagesGST PresentationkapuNo ratings yet

- Case Digest Incomplete TaxDocument135 pagesCase Digest Incomplete TaxHencel GumabayNo ratings yet

- Direct Tax ProjectDocument18 pagesDirect Tax ProjectShivani Singh ChandelNo ratings yet

- CT 3911Document1 pageCT 3911Kizito MarowaNo ratings yet

- 2018 540instructions PDFDocument96 pages2018 540instructions PDFEric1201No ratings yet

- 17 12 04 Tax Administration Proclamation Explanatory Notes 1 1Document145 pages17 12 04 Tax Administration Proclamation Explanatory Notes 1 1Dame WordofaNo ratings yet

- Chapter 10 - TAXDocument11 pagesChapter 10 - TAXJkjkMlmlNo ratings yet