Professional Documents

Culture Documents

Bull Put Spread - Varsity by Zerodha

Bull Put Spread - Varsity by Zerodha

Uploaded by

option 360Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bull Put Spread - Varsity by Zerodha

Bull Put Spread - Varsity by Zerodha

Uploaded by

option 360Copyright:

Available Formats

≡

Module 6 Option Strategies → Chapter 3

Bull Put Spread

← Hide

1 Orientation

2 Bull Call Spread

3 Bull Put Spread

4 Call Ratio Back Spread

5 Bear Call Ladder

6 Synthetic Long & Arbitrage

7 Bear Put Spread

8 Bear Call Spread

9 Put Ratio Back spread

10 The Long Straddle

11 The Short Straddle

12 The Long & Short Strangle

13 Max Pain & PCR Ratio

3.1 Why Bull Put Spread?

14 Iron Condor

Similar to the Bull Call Spread, the Bull Put Spread is a two leg option strategy invoked

when the view on the market is ‘moderately bullish’. The Bull Put Spread is similar to the

Bull Call Spread in terms of the payoff structure; however there are a few differences in

terms of strategy execution and strike selection. The bull put spread involves creating a

spread by employing ‘Put options’ rather than ‘Call options’ (as is the case in bull call

spread).

You may have a fundamental question at this stage – when the payoffs from both Bull call

spread and Bull Put spread are similar, why should one choose a certain strategy over the

other?

Well, this really depends on how attractive the premiums are. While the Bull Call spread is

executed for a debit, the bull put spread is executed for a credit. So if you are at a point in

the market where –

The markets have declined considerably (therefore PUT premiums have swelled)

The volatility is on the higher side

There is plenty of time to expiry

And you have a moderately bullish outlook looking ahead, then it makes sense to invoke a

Bull Put Spread for a net credit as opposed to invoking a Bull Call Spread for a net debit.

Personally I do prefer strategies which offer net credit rather than strategies which offer

net debit.

3.2 Strategy Notes

The bull put spread is a two leg spread strategy traditionally involving ITM and OTM Put

options. However you can create the spread using other strikes as well.

To implement the bull put spread –

Buy 1 OTM Put option (leg 1

Sell 1 ITM Put option (leg 2

When you do this ensure –

All strikes belong to the same underlying

Belong to the same expiry series

Each leg involves the same number of options

For example –

Date 7th December 2015

Outlook Moderately bullish (expect the market to go higher)

Nifty Spot 7805

Bull Put Spread, trade set up –

Buy 7700 PE by paying Rs.72/- as premium; do note this is an OTM option. Since

money is going out of my account this is a debit transaction

Sell 7900 PE and receive Rs.163/- as premium, do note this is an ITM option. Since I

receive money, this is a credit transaction

The net cash flow is the difference between the debit and credit i.e 163 72 91,

since this is a positive cashflow, there is a net credit to my account.

Generally speaking in a bull put spread there is always a ‘net credit’, hence the bull put

spread is also called referred to as a ‘Credit spread’.

After we initiate the trade, the market can move in any direction and expiry at any level.

Therefore let us take up a few scenarios to get a sense of what would happen to the bull

put spread for different levels of expiry.

Scenario 1 Market expires at 7600 (below the lower strike price i.e OTM option)

The value of the Put options at expiry depends upon its intrinsic value. If you recall from

the previous module, the intrinsic value of a put option upon expiry is –

Max Strike-Spot, o]

In case of 7700 PE, the intrinsic value would be –

Max 7700 7600 0

Max 100, 0

100

Since we are long on the 7700 PE by paying a premium of Rs.72, we would make

Intrinsic Value Premium Paid

100 72

28

Likewise, in case of the 7900 PE option it has an intrinsic value of 300, but since we have

sold/written this option at Rs.163

Payoff from 7900 PE this would be –

163 300

= – 137

Overall strategy payoff would be –

28 137

= 109

Scenario 2 Market expires at 7700 (at the lower strike price i.e the OTM option)

The 7700 PE will not have any intrinsic value, hence we will lose all the premium that we

have paid i.e Rs.72.

The 7900 PE’s intrinsic value will be Rs.200.

Net Payoff from the strategy would be –

Premium received from selling 7900PE Intrinsic value of 7900 PE Premium lost on

7700 PE

163 200 72

= 109

Scenario 3 Market expires at 7900 (at the higher strike price, i.e ITM option)

The intrinsic value of both 7700 PE and 7900 PE would be 0, hence both the potions

would expire worthless.

Net Payoff from the strategy would be –

Premium received for 7900 PE Premium Paid for 7700 PE

163 72

= 91

Scenario 4 Market expires at 8000 (above the higher strike price, i.e the ITM option)

Both the options i.e 7700 PE and 7900 PE would expire worthless, hence the total

strategy payoff would be

Premium received for 7900 PE Premium Paid for 7700 PE

163 72

= 91

To summarize –

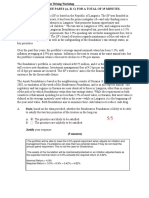

Market Expiry 7700 PE (intrinsic value) 7900 PE (intrinsic value) Net pay off

7600 100 300 109

7700 0 200 109

7900 0 0 91

8000 0 0 91

From this analysis, 3 things should be clear to you –

The strategy is profitable as and when the market moves higher

Irrespective of the down move in the market, the loss is restricted to Rs.109, the

maximum loss also happens to be the difference between “Spread and net credit’ of the

strategy

The maximum profit is capped to 91. This also happens to be the net credit of the

strategy.

We can define the ‘Spread’ as –

Spread Difference between the higher and lower strike price

We can calculate the overall profitability of the strategy for any given expiry value. Here is

screenshot of the calculations that I made on the excel sheet –

LS IV Lower Strike Intrinsic value 7700 PE, OTM

PP Premium Paid

LS Payoff Lower Strike Payoff

HS IV Higher strike Intrinsic Value 7900 PE, ITM

PR Premium Received

HS Payoff Higher Strike Payoff

As you can notice, the loss is restricted to Rs.109, and the profit is capped to Rs.91. Given

this, we can generalize the Bull Put Spread to identify the Max loss and Max profit levels

as –

Bull PUT Spread Max loss Spread Net Credit

Net Credit Premium Received for higher strike Premium Paid for lower strike

Bull Put Spread Max Profit Net Credit

This is how the pay off diagram of the Bull Put Spread looks like –

There are three important points to note from the payoff diagram –

The strategy makes a loss if Nifty expires below 7700. However, the loss is restricted to

Rs.109.

The breakeven point (where the strategy neither makes a profit or loss) is achieved

when the market expires at 7809. Therefore we can generalize the breakeven point for a

Bull Put spread as Higher Strike Net Credit

The strategy makes money if the market moves above 7809, however the maximum

profit achievable is Rs.91 i.e the difference between the Premium Received for ITM PE and

the Premium Paid for the OTM PE

Premium Paid for 7700 PE 72

Premium Received for 7900 PE 163

Net Credit 163 72 91

3.3 Other Strike combinations

Remember the spread is defined as the difference between the two strike prices. The Bull

Put Spread is always created with 1 OTM Put and 1 ITM Put option, however, the strikes

that you choose can be any OTM and any ITM strike. The further these strikes are the

larger the spread, the larger the spread the larger is the possible reward.

Let us take some examples considering spot is at 7612

Bull Put spread with 7500 PE OTM and 7700 PE ITM

Lower Strike OTM, Long) 7500

Higher Strike ITM, short) 7700

Spread 7700 7500 200

Lower Strike Premium Paid 62

Higher Strike Premium Received 137

Net Credit 137 62 75

Max Loss Spread Net Credit) 200 75 125

Max Profit Net Credit) 75

Breakeven Higher Strike Net Credit) 7700 75 7625

Bull Put spread with 7400 PE OTM and 7800 PE ITM

Lower Strike OTM, Long) 7400

Higher Strike ITM, short) 7800

Spread 7800 7400 400

Lower Strike Premium Paid 40

Higher Strike Premium Received 198

Net Credit 198 40 158

Max Loss Spread Net Credit) 400 158 242

Max Profit Net Credit) 158

Breakeven Higher Strike Net Credit) 7800 158 7642

Bull Put spread with 7500 PE OTM and 7800 PE ITM

Lower Strike OTM, Long) 7500

Higher Strike ITM, short) 7800

Spread 7800 7500 300

Lower Strike Premium Paid 62

Higher Strike Premium Received 198

Net Credit 198 62 136

Max Loss Spread Net Credit) 300 136 164

Max Profit Net Credit) 136

Breakeven Higher Strike Net Credit) 7800 136 7664

So the point here is that, you can create the spread with any combination of OTM and ITM

option. However based on the strikes that you choose (and therefore the spread you

create), the risk reward ratio changes. In general, if you have a high conviction on a

‘moderately bullish’ view then go ahead and create a larger spread; else stick to a smaller

spread.

Key takeaways from this chapter

The Bull Put Spread is an alternative to the Bull Call Spread. Its best executed when the

outlook on the market is ‘moderately bullish’

Bull Put Spread results in a net credit

The Bull Put Spread is best executed when the market has cracked, put premiums are

high, the volatility is on the higher side, and you expect the market to hold up (without

cracking further)

The Bull Put strategy involves simultaneously buying an OTM Put option and selling an

ITM Put option

Maximum profit is limited to the extent of the net credit

Maximum loss is limited to the Spread minus Net credit

Breakeven is calculated as Higher Strike Net Credit

One can create the spread by employing any OTM and ITM strikes

Higher the spread, higher the profit potential, and higher the breakeven point.

D OW N LOA D B U L L P U T S P R E A D E XC E L S H E E T

277 comments

View all comments →

abhijeet says:

December 11, 2015 at 2 39 pm

hey,

consider if today i formed bull put spread at 7500 and 7600 pe then it means i m buying 7500pe and selling 7600 pe .Is it right?

Reply

Karthik Rangappa says:

December 13, 2015 at 12 47 pm

Yes, thats right. You always buy OTM PE and sell ITM PE for a net credit.

Reply

ishwar karankot says:

December 11, 2015 at 3 10 pm

How to sell a stock in cash market? When we have don’t particular stock dilevery

Reply

Karthik Rangappa says:

December 13, 2015 at 12 48 pm

Check this Ishwar, the concept of shorting is explained in this chapter – http://zerodha.com/varsity/chapter/commonly-used-jargons/

Reply

harshakabra says:

December 13, 2015 at 12 28 pm

Dear Karthik Sir,

Want to say Thank You and appreciate your efforts for all wonderful, knowledge packed modules you have written so far.

Have read your all modules and at present at Module of Options Theory.

Your clear n crisp writing style, Way to approach any topic, Beautiful gist/summary at the end, Re-connection old knowledge with new one, and on the top of all-Your real

life example which you present as Analogy are superb..

Pl keep sharing..

Many thanks

Reply

Karthik Rangappa says:

December 13, 2015 at 1 02 pm

Harsha – thank you so much for the kind words, this is certainly encouraging

Please stay tuned as there is some really nice content coming up.

Reply

R P HANS says:

December 14, 2015 at 6 48 am

Hi, Karthik,

As one option is short and another is long, will it be that the time decay will nullify at expiry. My general question is that in option strategy (one leg short and another

long) whether the time decay will affect the pay-off or not?

Reply

Karthik Rangappa says:

December 14, 2015 at 10 04 am

It kind of gets nullified…as time decay is a negative for the long OTM option, it is considered positive for the short ITM option.

Reply

Sandeep says:

December 14, 2015 at 8 37 am

Hi Karthik,

Thanks for your articles on Bull Call and Put spread strategy. What should be the ideal Risk to Reward ratio in case if I look for near future expiry (say expiry within next 20

days).

Reply

Karthik Rangappa says:

December 14, 2015 at 10 06 am

There is nothing like ideal RRR, it really depends on the trader’s risk appetite. For me personally I look for 1.2 RRR for Bull Call Spread and for Bull Put spread I guess

around 1.0 should be ok.

Reply

View all comments →

Post a comment

Name (required)

Mail (will not be published) (required)

Comment

POST COMMENT

Varsity by Zerodha © 2015 2023. All rights reserved. Reproduction of

the Varsity materials, text and images, is not permitted. For media

queries, contact press@zerodha.com

You might also like

- Lotus MMXM Trading Model 1.2Document13 pagesLotus MMXM Trading Model 1.2MUDDASSIR RAJA100% (1)

- Advanced Leverage StrategiesDocument23 pagesAdvanced Leverage Strategieskrum topuzovNo ratings yet

- Novice HedgeDocument130 pagesNovice HedgeAnujit Kumar100% (6)

- Philippe Laffont Coatue Presentation 05 09Document20 pagesPhilippe Laffont Coatue Presentation 05 09marketfolly.com100% (3)

- Lotusxbt Trading ModelDocument8 pagesLotusxbt Trading ModelNassim Alami MessaoudiNo ratings yet

- Bull Spread Spread: Montréal ExchangeDocument2 pagesBull Spread Spread: Montréal ExchangepkkothariNo ratings yet

- BFM Numericals .10Document10 pagesBFM Numericals .10Sribharath SekarNo ratings yet

- Apache Case StudyDocument15 pagesApache Case Studyadrian_lozano_zNo ratings yet

- Bull Call Spread - Varsity by ZerodhaDocument1 pageBull Call Spread - Varsity by Zerodhaoption 360No ratings yet

- Bear Put Spread: Montréal ExchangeDocument2 pagesBear Put Spread: Montréal ExchangepkkothariNo ratings yet

- Short Put VerticalsDocument12 pagesShort Put VerticalsConstantino L. Ramirez IIINo ratings yet

- IG - Module 1Document30 pagesIG - Module 1James NortholtNo ratings yet

- Lotusxbt Trading Model 1.1Document9 pagesLotusxbt Trading Model 1.1edi abdulm100% (1)

- Short Straddle Option Strategy - The Options PlaybookDocument3 pagesShort Straddle Option Strategy - The Options PlaybookdanNo ratings yet

- CH 4 Hedging and DerivativesDocument31 pagesCH 4 Hedging and DerivativesAbdii DhufeeraNo ratings yet

- ISE Volatility Options Skew Nov 2010Document77 pagesISE Volatility Options Skew Nov 2010Smilie ChawlaNo ratings yet

- What Is A SpreadDocument7 pagesWhat Is A SpreadpkkothariNo ratings yet

- Diagonal Put SpreadsDocument6 pagesDiagonal Put Spreadsprivatelogic100% (1)

- Cheat Sheet CFIN 2Document2 pagesCheat Sheet CFIN 2nupurNo ratings yet

- Put Ratio Spread: Limited Profit PotentialDocument4 pagesPut Ratio Spread: Limited Profit PotentialAbhijit SenguptaNo ratings yet

- Slides Aymeric KALIFE - Vanilla StrategiesDocument38 pagesSlides Aymeric KALIFE - Vanilla StrategiesSlakeNo ratings yet

- Bull Put SpreadDocument3 pagesBull Put SpreadpkkothariNo ratings yet

- Bull Call SpreadDocument3 pagesBull Call SpreadpkkothariNo ratings yet

- Bull Call SpreadDocument3 pagesBull Call SpreadpkkothariNo ratings yet

- Long StraddleDocument2 pagesLong StraddlepkkothariNo ratings yet

- ArbitrageDocument3 pagesArbitragebhavnesh_muthaNo ratings yet

- Long Put & Short PutDocument17 pagesLong Put & Short Putharsh agarwalNo ratings yet

- Introduction To Spread TradingDocument18 pagesIntroduction To Spread TradingelisaNo ratings yet

- Using Historical Probabilities To Trade The Opening Gap: Scott AndrewsDocument32 pagesUsing Historical Probabilities To Trade The Opening Gap: Scott Andrewsjosecsantos83No ratings yet

- 7.MFINA6003 Tutorial 3Document9 pages7.MFINA6003 Tutorial 3liujinxinljxNo ratings yet

- Long Ratio Put SpreadDocument3 pagesLong Ratio Put SpreadpkkothariNo ratings yet

- Bear Spread Spread: Montréal ExchangeDocument2 pagesBear Spread Spread: Montréal ExchangepkkothariNo ratings yet

- Long Put CondorDocument2 pagesLong Put CondorpkkothariNo ratings yet

- Long Combination - Synthetic Long Stock - The Options PlaybookDocument3 pagesLong Combination - Synthetic Long Stock - The Options PlaybookdanNo ratings yet

- Stp2 Step 3 Strategy TooDocument60 pagesStp2 Step 3 Strategy TooshivamNo ratings yet

- Lesson 17 PDFDocument36 pagesLesson 17 PDFNelwan NatanaelNo ratings yet

- PassarelliAdvancedTime Spreads - Webinar PDFDocument19 pagesPassarelliAdvancedTime Spreads - Webinar PDFaasdadNo ratings yet

- Splitted-Fibonacci For The Active Trader by Derrik S Hobbs-147-203 - 3Document25 pagesSplitted-Fibonacci For The Active Trader by Derrik S Hobbs-147-203 - 3Vinh PhanNo ratings yet

- Short Put - Naked (Uncovered) Put Strategies - The Options PlaybookDocument3 pagesShort Put - Naked (Uncovered) Put Strategies - The Options PlaybookdanNo ratings yet

- Basics of TradingDocument6 pagesBasics of Tradingfor SaleNo ratings yet

- SOS Options Cheat Sheet v2.2Document14 pagesSOS Options Cheat Sheet v2.2Yash Raj KumarNo ratings yet

- Short Combination - Synthetic Short Stock - The Options PlaybookDocument3 pagesShort Combination - Synthetic Short Stock - The Options PlaybookdanNo ratings yet

- Yield Curve Spread Trades PDFDocument12 pagesYield Curve Spread Trades PDFNicoLaza100% (1)

- Sarang SoodDocument20 pagesSarang SoodStockmarket StrategiesNo ratings yet

- Adjusting The Bull PutDocument9 pagesAdjusting The Bull PutS LeeNo ratings yet

- Bull or Bear, We Don'T Care !: Resource Guide For Trading Without Predicting Market DirectionDocument7 pagesBull or Bear, We Don'T Care !: Resource Guide For Trading Without Predicting Market DirectionRuler ForGood2No ratings yet

- Long Put Calendar SpreadDocument3 pagesLong Put Calendar SpreadpkkothariNo ratings yet

- Short Strangle Option Strategy - The Options PlaybookDocument3 pagesShort Strangle Option Strategy - The Options PlaybookdanNo ratings yet

- Covered PutDocument3 pagesCovered PutpkkothariNo ratings yet

- Shariah Compliant Principal Protected NotesDocument3 pagesShariah Compliant Principal Protected Notesprofinvest786No ratings yet

- Derivatives Chapter 4aDocument65 pagesDerivatives Chapter 4ahardikvibhakarNo ratings yet

- Raghu Iyer 27 Oct 2012 Derivative Accounting Notes PDFDocument17 pagesRaghu Iyer 27 Oct 2012 Derivative Accounting Notes PDFaradhana avinashNo ratings yet

- SQN - Market Regimes Strategy - The Prop TraderDocument6 pagesSQN - Market Regimes Strategy - The Prop Traderyoussner327No ratings yet

- IntraDay TradingDocument73 pagesIntraDay TradingIssaka Ouedraogo100% (1)

- Investment Analysis and Portfolio Management: Lecture 7Document59 pagesInvestment Analysis and Portfolio Management: Lecture 7jovvy24No ratings yet

- Swing Trade Pro 2.0 (068 134)Document67 pagesSwing Trade Pro 2.0 (068 134)Wenceslas wouedjeNo ratings yet

- S1 - Introduction To DerivativesDocument12 pagesS1 - Introduction To Derivativesmiku hrshNo ratings yet

- Racing Ahead - Trading - Swing Trading-Peter WebbDocument2 pagesRacing Ahead - Trading - Swing Trading-Peter WebbkwasNo ratings yet

- 2011sep30 Class056 Week1 UpdateDocument16 pages2011sep30 Class056 Week1 UpdateMario Javier PakgoizNo ratings yet

- Covered Calls Are The Same As Cash-Secured PutsDocument4 pagesCovered Calls Are The Same As Cash-Secured PutspkkothariNo ratings yet

- F&O Strategies-The MasterclassDocument45 pagesF&O Strategies-The Masterclasssandeepsak533No ratings yet

- Basics of Derivatives - Options, Greeks & SwapsDocument35 pagesBasics of Derivatives - Options, Greeks & SwapsVenkat SaiNo ratings yet

- Make the Profits Now: A Comprehensive Guide for Dummies On Proven Strategies for Profiting in Cryptocurrency DipFrom EverandMake the Profits Now: A Comprehensive Guide for Dummies On Proven Strategies for Profiting in Cryptocurrency DipNo ratings yet

- Question - Define Adaptive Radiation With Suitable Example. Explian Darwin's FinchesDocument1 pageQuestion - Define Adaptive Radiation With Suitable Example. Explian Darwin's Finchesoption 360No ratings yet

- Question 1 - Write Short Note On Hardy-Weinberg PrincipleDocument1 pageQuestion 1 - Write Short Note On Hardy-Weinberg Principleoption 360No ratings yet

- NEET Chapter - Anatomy of Flowering PlantsDocument27 pagesNEET Chapter - Anatomy of Flowering Plantsoption 360No ratings yet

- Plant Tissues & AnatomyDocument25 pagesPlant Tissues & Anatomyoption 360No ratings yet

- Revision Notes - Reproduction in OrganismsDocument7 pagesRevision Notes - Reproduction in Organismsoption 360No ratings yet

- Bull Call Spread - Varsity by ZerodhaDocument1 pageBull Call Spread - Varsity by Zerodhaoption 360No ratings yet

- Elite Investment Advisory Services Equity Derivative Daily Reports - 20 NovDocument4 pagesElite Investment Advisory Services Equity Derivative Daily Reports - 20 NovElite Investment Advisory ServicesNo ratings yet

- DERIVATIVESDocument30 pagesDERIVATIVESDeepak ParidaNo ratings yet

- Chapter 1Document20 pagesChapter 1Sheri DeanNo ratings yet

- Option Trading Guide - Introduction PDFDocument65 pagesOption Trading Guide - Introduction PDFRAHUL RAI100% (1)

- Paper14 SolutionDocument20 pagesPaper14 Solutionஜெயமுருகன் மருதுபாண்டியன்No ratings yet

- Intro To Options Webinar NotesDocument26 pagesIntro To Options Webinar NotesMallikarjun Reddy ChagamreddyNo ratings yet

- CHP 10Document50 pagesCHP 10SUBA NANTINI A/P M.SUBRAMANIAMNo ratings yet

- IFM EXAM1 - MaduraDocument22 pagesIFM EXAM1 - MaduraLe Thuy Duong100% (5)

- 466 8Document9 pages466 8Prathap H GowdaNo ratings yet

- Chapter 7Document25 pagesChapter 7Cynthia AdiantiNo ratings yet

- FDRMDocument41 pagesFDRMARUNSANKAR NNo ratings yet

- Foreign Exchange and Risk ManagementDocument86 pagesForeign Exchange and Risk ManagementKrunal Patel100% (2)

- Topic 55 Binomial TreesDocument6 pagesTopic 55 Binomial TreesSoumava PalNo ratings yet

- Chapter 9 - Mechanics of Options MarketsDocument28 pagesChapter 9 - Mechanics of Options MarketsRanil FernandoNo ratings yet

- A Practical Handbook On Stock Market TradingDocument105 pagesA Practical Handbook On Stock Market TradingSudhanshu SinghNo ratings yet

- Currency Futures, Options and Swaps PDFDocument22 pagesCurrency Futures, Options and Swaps PDFHemanth Kumar86% (7)

- 7 Steps To Sucess Trading OptionsDocument146 pages7 Steps To Sucess Trading Optionsdrvaibhav24100% (1)

- Math 361Document312 pagesMath 361eeeeewwwwwwwwssssssssssNo ratings yet

- How To Not-To Lose Money in Stock Market-V2.0Document21 pagesHow To Not-To Lose Money in Stock Market-V2.0Vikas Jain0% (1)

- Sol. Man. - Chapter 13 - Basic Derivatives - Ia Part 1aDocument21 pagesSol. Man. - Chapter 13 - Basic Derivatives - Ia Part 1aJamie Rose Aragones100% (1)

- Summary Sheet Derivatives-Options: 27 Final Selections in RBI Grade B 2017 Final Results Awaited For RBI Grade B 2018Document13 pagesSummary Sheet Derivatives-Options: 27 Final Selections in RBI Grade B 2017 Final Results Awaited For RBI Grade B 2018devesh chaudharyNo ratings yet

- Cisi Cmsa Derivatives Chapter 6 19 April 2021Document61 pagesCisi Cmsa Derivatives Chapter 6 19 April 2021Lulu KatimaNo ratings yet

- Option Profit AcceleratorDocument129 pagesOption Profit AcceleratorlordNo ratings yet

- Derivatives Problem SetDocument6 pagesDerivatives Problem SetNiyati ShahNo ratings yet

- 3I0-008Document102 pages3I0-008dafes danielNo ratings yet

- CR Workshop Q11-20 Ryan Ebner SDDocument26 pagesCR Workshop Q11-20 Ryan Ebner SDRyan EbnerNo ratings yet

- Long Put & Short PutDocument17 pagesLong Put & Short Putharsh agarwalNo ratings yet