Professional Documents

Culture Documents

Tata Steel Future Projections

Tata Steel Future Projections

Uploaded by

Roshan JambheOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tata Steel Future Projections

Tata Steel Future Projections

Uploaded by

Roshan JambheCopyright:

Available Formats

INDIA DAILY

February 16, 2011

India

15-Feb 1-day1-mo 3-mo

Sensex

18,274

Nifty

Contents

Tata Steel: Solid operational performance

0.5

(3.1) (10.5)

Global/Regional indices

Dow Jones

Results

5,481

0.4 (3.1) (10.0)

12,227

(0.3)

3.7

9.1

2,804

(0.5)

1.8

11.6

Nasdaq Composite

FTSE

6,037

(0.4)

0.6

3.7

Nikkie

10,782

0.3

2.7

10.1

IVRCL Infrastructures: Revenue and EBITDA gains nullified by interest cost and

depreciation

Hang Seng

22,900

Jubilant Lifesciences: Disappointing quarter

Value traded India

Reliance Power: Expensive despite recent correction

KOSPI

2,009

(1.0) (5.7) (3.3)

(0.1) (4.7)

5.8

Cash (NSE+BSE)

171

Derivatives (NSE)

1,507

2,105 1,429

163

82

Deri. open interest

1,547

1,524 1,716

News Round-up

` India's textile, pharmaceuticals & services sectors could expect greater market

openings & automobile parts companies may face stiffer competition after the

country signs a trade agreement with Japan. (ECNT)

` Oil PSUs to hike jet fuel price 4.1% in metros. Oil marketing companies will hike

prices by an average of INR 2,204.48 a kilo litre. (THBL)

Forex/money market

Change, basis points

15-Feb 1-day

Rs/US$

10yr govt bond, %

1-mo

3-mo

45.5

29

8.1

(2)

(12)

Net investment (US$mn)

` Oil minister S Jaipal Reddy indicated that the govt. may not be able to clear Cairn

Energy Plc's move to sell control in its Indian arm to Vedanta Resources without

meeting state run ONGC's (ONGC IN) demand for an equitable royalty regime in the

Barmer oilfields that account for 90% of Cairn India's (CAIR IN) valuations. (TTOI)

14-Feb

MTD CYTD

FIIs

50

(369) (1,756)

MFs

56

100

(282)

Top movers -3mo basis

` Kishore Biyani is spinning off his consumer durables business, Ezone, into a separate

entity in order to maximize value from it. The promoter of Pantaloon Retail (PF IN) is

likely to induct strategic investors in 3 months. (ECNT)

` Reliance Industries Ltd (RIL IN) is now going after the tablet PC market, presently

dominated by Apple and Samsung at the premium end. (BSTD)

` GMR Infrastructures (GMRI IN) has raised around USD 113 mn of debt from India

Infrastructure Finance Company Ltd for modernizing Delhi International Airport.

(BSTD)

` Tata Motors (TTMT IN) said it was redrawing distribution plans of its joint venture

with Fiat as sales number of the Italian car maker had not been up to expectations.

Tata Motors global sales up 16% in January. (BSTD)

` TCS (TCS IN) expects to make its fully-integrated information technology solution for

small and medium enterprises, iON, a 1 bn on business in five years. TCS has already

signed up over 130 clients for iON and plans to take the customer base to 1,000 in a

year. (BSTD)

` Jindal Steel and Power Ltd (JSP IN) gets conditional green nod for Orissa plant. (THBL)

` Venus Remedies Ltd (VNR IN) announced the launch of its super speciality oncology

segment 'Passion Oncobiz', entailing an investment of USD 2 mn. (THBL)

` HCL Technologies (HCLT IN) sets up Global Enterprise Mobility lab in Singapore.

(THBL)

Source: ECNT= Economic Times, BSTD = Business Standard, FNLE = Financial Express, THBL = Business Line.

For Private Circulation Only. FOR IMPORTANT INFORMATION ABOUT KOTAK SECURITIES RATING SYSTEM AND OTHER DISCLOSURES.

REFER TO THE END OF THIS MATERIAL.

Change, %

Best performers

15-Feb 1-day

1-mo

3-mo

HCLT IN Equity

483.0

0.2

2.6

23.1

BHARTI IN Equity

329.2

0.5

(4.2)

5.0

NACL IN Equity

405.2

1.9

6.2

4.7

TCS IN Equity

1097.7

(1.3)

(2.0)

4.7

INFO IN Equity

3106.6

2.2

(3.1)

4.6

UT IN Equity

35.0

(3.6)

(39.2)

(53.0)

IVRC IN Equity

72.9

1.3

(33.7)

(45.1)

Worst performers

PUNJ IN Equity

72.5

(1.0)

(27.6)

(39.2)

IBREL IN Equity

115.3

(1.7)

(5.2)

(38.3)

RCOM IN Equity

101.6

4.4

(26.7)

(37.1)

BUY

Tata Steel (TATA)

Metals & Mining

FEBRUARY 16, 2011

RESULT

Coverage view: Attractive

Solid operational performance. Tata Steels standalone and consolidated EBITDA was

1.7% and 7% ahead of our estimate. However, below EBITDA line items such as high

tax provision and loss on impairment of assets led to net income miss. Corus

performance, on expected lines, was extremely weak. Tata Steel can deliver significant

earnings growth and stock performance over the next two years from cost-push based

steel price increase, growth from India brownfield expansion and overseas raw material

projects. We reinstate coverage with a BUY rating and end-FY2012E TP of Rs710.

Company data and valuation summary

Tata Steel

Stock data

52-week range (Rs) (high,low)

739-449

Market Cap. (Rs bn)

589.6

Shareholding pattern (%)

Promoters

32.5

FIIs

17.0

MFs

3.7

Price performance (%)

1M

3M

12M

Absolute

(0.9)

(0.3)

14.2

Rel. to BSE-30

2.2

10.8

0.2

Forecasts/Valuations

EPS (Rs)

EPS growth (%)

P/E (X)

Sales (Rs bn)

Net profits (Rs bn)

EBITDA (Rs bn)

EV/EBITDA (X)

ROE (%)

Div. Yield (%)

Price (Rs): 617

Target price (Rs): 710

BSE-30: 18,274

2010

2011E 2012E

(3.3)

64.4

69.7

(103.6) (2,051.8)

8.2

(186.8)

9.6

8.8

1,023.9 1,128.4 1,204.5

(3.3)

65.3

70.6

80.4

153.8 175.4

13.2

6.7

5.8

(1.5)

22.4

18.4

1.1

1.2

0.0

Indian operations shine with unexpected spike in steel realization

Tata Steel reported 3QFY11 standalone EBITDA of Rs28.2 bn (+30.8% yoy, +7.3% qoq), 1.7%

ahead of our estimate. Unexpected 8.8% qoq increase in realization to US$993/ ton (our estimate

was US$958/ ton) drove most of the surprise at the EBITDA level. Such a spike in realizations was

against the industry trend; Tata Steel management attributed this to qoq increase in long product

prices (Rs29,150/ ton, +6% qoq); in addition other steel products may have also contributed. Flat

product realizations declined sequentially. EBITDA/ ton increased to US$372, up 12.2% qoq. Net

income of Rs15.1 bn (+27% yoy, -26.7% qoq) missed our estimate on higher tax payout.

Consolidated net income missed our estimate, operational performance was strong

Tata Steel reported consolidated EBITDA of Rs34.2 bn (-6.7% qoq, +16.1% yoy). However, net

income of Rs8.3 bn (adjusted for extraordinary items) missed our and Street estimates. We

attribute the miss to two factors (1) Rs1.2 bn impairment charge in other income line after a fire in

Imjuiden plant destroyed a few facilities and (2) high effective tax rate of 39.7%.

Corus performance weak but on expected lines

On expected lines Corus reported a weak quarter with EBITDA of US$88 mn and EBITDA/ ton of

US$25 (-55% qoq, -33% yoy), though still better than our estimate. Lag impact of increase in raw

material prices (+9% qoq) on the P&L hurt profitability on a sequential basis. Performance was

helped by carbon credit sales of US$54 mn which in turn was partly offset by US$31 mn

impairment charge on certain Imjuiden assets. Tata indicates that carbon credit sales may recur as

long as plant capacity utilization is above 75%. Expect Corus profitability to improve in 4Q.

Maintain BUY on attractive valuations

Tata Steel trades at 5.9X FY2011E and 5.1X FY2012E EBITDA (adjusting for CWIP) and 8.8X

FY2012E earnings. Tata Steels brownfield expansion and investments in raw material projects can

deliver significant value in the medium term. Reinitiate with a BUY rating and end-FY2012E target

price of Rs710. We assign 6.5X to Tata Steel Indias FY2012E EBITDA and 5.5X to Corus.

For private Circulation Only. FOR IMPORTANT INFORMATION ABOUT KOTAK SECURITIES RATING SYSTEM AND OTHER DISCLOSURES, REFER TO THE END OF THIS MATERIAL.

Tata Steel

Metals & Mining

Debt increases by 11% to US$13.2 bn

Tata Steels consolidated gross debt and net debt increased by ~US$1.1 bn qoq to US$13.2

bn and US$11.8 bn, respectively. The following factors may have led to the increase (1)

increase in working capital requirements in Europe due to increase in raw material prices, (2)

US$250 mn increase due to fluctuation in various foreign currency debt of Tata Steel India.

Tata Steel indicates that all its FX debt is fully hedged and (3) gross block which increased by

about a US$1 bn. Note that Tata Steel has aggressive capex plans of about US$2.3 bn for

FY2012E and US$2.1 bn for FY2013E.

Update on strategic projects

` DSO and New Millennium Corp. Tata Steel and New Millennium Corporation (NML) are in

exclusive talks with respect to development of two of the latters iron ore projects

LabMag and KeMag which cumulatively have reserves of up to 5.6 bn tons. This

exclusivity agreement will expire on Feb 28, 2011. As far as the Direct Shipping Ore

project is concerned, environmental approval for the first phase has been obtained and

commercial iron ore production will likely commence by 2QCY12E.

` Orissa project. Ground work to start construction for the Orissa project is already

underway. Tata Steel has secured the project site with boundary wall and fence and

started piling, besides foundation at the sinter plant has commenced. Construction of

other utilities is under progress. Initial phase of the Orissa plant will start with steelmaking capacity of 3 mtpa.

Few changes to our estimates

We build in our economists revised Re/US$ forecast of Rs45.6, Rs45.5 and Rs44 for

FY2011E, FY2012E and FY2013E, respectively, from Rs45.5, Rs44.5 and Rs44.1 earlier. We

have also fine tuned our HRC price assumption for India business over the next two years

and build in higher raw material prices. We also model recent issuance of 57 mn share at

Rs610 from its follow-on public offering. All factors results in 6.5% and 3.9% reduction in

our FY2012E and FY2013E EPS. Our EBITDA estimates remain largely unchanged. Exhibit 1

details the key changes to our estimate. BUY with FY2012E fair value of Rs710/ share.

We value standalone India operations of Tata Steel at 6.5X FY2012E EBITDA. This is higher

than historical levels, but we believe it is fair as it partly captures volume growth potential

for the India business. Put slightly differently, FY2012E EBITDA does not capture brownfield

expansion while the debt taken for this expansion is fully captured in the EV; assigning

higher multiple corrects this anomaly. We assign 5.5X to Corus and far-east operations, fair

noting lower profitability and lack of raw material security. We value listed investments at a

20% discount to the market price.

Our target price captures value from MOU signed by Corus for sale of Teeside Cast Products

(TCP) plant to SSI, Malaysia for US$500 mn; this adds Rs24 to fair value. However, our fair

value does not capture any upside from New Millennium Corp (Canadian iron ore project) or

Riversdale Mining investment. Note that Rio Tinto recently extended an open offer to

acquire Riversdale Mining at an equity value of US$3.9 bn. Tata Steels stake in Riversdale is

worth Rs40/share at Rios acquisition offer price.

KOTAK INSTITUTIONAL EQUITIES RESEARCH

Metals & Mining

Tata Steel

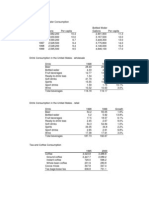

Exhibit 1: Tata Steel, Change in estimates, March fiscal year-ends, 2011-13E (Rs mn)

2011E

Earnings (consolidated)

Net sales

EBITDA

Adj. PAT

EPS (Rs)

Volumes

India (mn tons)

International operations (mn tons)

Pricing

HRC price India (US$/ton)

Realization (US$/ton)

Revised estimates

2012E

2013E

2011E

Old estimates

2012E

2013E

2011E

% change

2012E

2013E

1,128,398

153,843

65,270

64.4

1,204,467

175,421

70,606

69.7

1,232,243

202,586

88,655

87.5

1,149,759

156,206

63,411

66.3

1,181,781

175,766

71,290

74.5

1,224,905

201,721

87,106

91.1

(1.9)

(1.5)

2.9

(2.9)

1.9

(0.2)

(1.0)

(6.5)

0.6

0.4

1.8

(3.9)

6.4

14.4

6.9

14.7

9.0

14.8

6.5

14.8

7.1

14.9

9.0

15.1

(1.7)

(2.4)

(2.8)

(1.6)

(2.3)

728

1,110

756

1,142

744

1,117

728

1,085

743

1,100

738

1,067

2.3

1.7

3.8

0.7

4.7

Source: Kotak Institutional Equities estimates

Following factors underpin our BUY rating on Tata Steel

` Cost-push based steel price increase will benefit Tata Steel India. We expect steel

prices to move up led by (1) a cost-push increaseiron ore prices have increased by 20%

in the past three months to US$187/ ton China CFR on modest revival in demand

combined with persistent supply issues and (2) seasonal increase in demand in 1HCY11E.

This should benefit integrated players such as Tata Steel, in our view. A US$10/ ton

increase in iron ore prices benefits earnings by 5%. We assume that Corus with a

converter business model will earn steady conversion margin and will have the ability to

pass on raw material price increase to consumers.

` Commissioning of value-accretive India capacity expansion. Tata Steel India is on

track to commission 2.9 mtpa steel-making capacity expansion in Jamshedpur by end2011. This will reflect in strong 27% volume growth in FY2013E. Note that the expanded

capacity will be self-sufficient on iron ore and generate profitability in excess of US$300/

ton. More important, EBITDA contribution from Indian operations may increase to 70%

of the overall EBITDA by FY2013E from less than 50% in FY2008-09. In our view, this will

significantly de-risk earnings.

` Benefits from overseas raw material projects may surprise on the upside.

Investments in raw material security, i.e. Riversdale Mining and New Millennium (iron ore

project in Canada) can potentially add US$300 mn to annual EBITDA. In any case, Tata

Steels holding is worth Rs40/share, based on Rios bid price for Riversdale. This value is

not captured in our target price and can be a positive catalyst.

KOTAK INSTITUTIONAL EQUITIES RESEARCH

Tata Steel

Metals & Mining

Exhibit 2: Interim results of Tata Steel (standalone), March fiscal year-ends (Rs mn)

Net sales

Expenditure

Consumption of raw materials

Staff Cost

Power and fuel

Freight and handling

Other Expenditure

EBITDA

OPM (%)

Other income

Interest

Depreciation

Pretax profits

Extraordinaries

Tax

Net income

Ratios

EBITDA margin (%)

ETR (%)

EPS (Rs)

Segment revenue

Steel business

Others

Segment EBIT

Steel business

Others

Margins

Steel business

Others

3QFY11E

0.7

0.2

7.9

(12.7)

(4.8)

9.8

(3.3)

1.7

(% chg.)

3QFY10

16.0

8.5

15.4

(8.2)

13.9

10.8

7.0

30.8

2QFY11

4.1

2.2

12.5

(12.5)

(4.5)

10.2

(2.1)

7.3

(82.0)

(4.0)

(0.3)

0.4

26.6

(8.3)

(95.7)

(19.3)

9.2

26.8

26.5

27.0

(98.5)

(2.1)

1.7

(19.3)

3.6

(26.7)

64,971

4,488

16

8

4

(2)

20,141

163

21,764

43

14

5

6

297

34.5

21.7

33.5

32.9

(1.6)

32.9

1.4

(12.3)

3QFY11

73,974

(45,768)

(17,586)

(5,985)

(3,454)

(3,968)

(14,775)

28,205

38.1

113

(3,354)

(2,864)

22,100

(6,966)

15,135

3QFY11E

73,423

(45,683)

(16,301)

(6,859)

(3,626)

(3,614)

(15,282)

27,741

37.8

630

(3,493)

(2,871)

22,006

(5,502)

16,505

3QFY10

63,749

(42,180)

(15,241)

(6,523)

(3,032)

(3,581)

(13,803)

21,569

33.8

2,636

(4,157)

(2,622)

17,426

(5,508)

11,918

2QFY11

71,068

(44,777)

(15,637)

(6,837)

(3,615)

(3,603)

(15,086)

26,290

37.0

7,327

(3,425)

(2,815)

27,378

(6,726)

20,651

38.1

31.5

15.3

37.8

25.0

17.8

33.8

31.6

12.1

37.0

24.6

20.9

67,731

4,418

58,325

4,100

23,015

172

34.0

28.9

Source: Company, Kotak Institutional Equities estimates

KOTAK INSTITUTIONAL EQUITIES RESEARCH

Metals & Mining

Tata Steel

Exhibit 3: Interim results of Tata Steel (consolidated), March fiscal year-ends (Rs mn)

Net sales

Expenditure

Consumption of raw materials

Staff Cost

Power and fuel

Freight and handling

Other Expenditure

EBITDA

OPM (%)

Other income

Interest

Depreciation

Pretax profits

Extraordinaries

Tax

Net income

Minority interest

Share of profit from associates

PAT after minority interest

Adjusted PAT

Income tax rate (%)

Ratios

EBITDA margin (%)

ETR (%)

EPS (Rs)

Segment revenue

Steel business

Others

Segment EBIT

Steel business

Others

Segment capital employed

Steel business

Others

Margins

Steel business

Others

3QFY11

290,895

(256,648)

(138,887)

(36,087)

(10,314)

(15,935)

(55,426)

34,246

11.8

(1,043)

(7,432)

(11,264)

14,506

1,223

(6,240)

9,489

161

380

10,030

8,266

39.7

3QFY11E

271,006

(238,986)

(120,191)

(35,862)

(9,609)

(14,009)

(59,314)

32,020

11.8

714

(6,969)

(10,889)

14,876

(4,909)

9,967

103

3

10,072

9,967

33.0

3QFY10

262,020

(232,514)

(104,828)

(41,999)

(10,845)

(14,451)

(60,393)

29,506

11.3

4,099

(7,630)

(11,547)

14,428

(1,957)

(8,148)

4,323

(148)

551

4,726

6,280

65.3

2QFY11

286,462

(249,739)

(124,064)

(38,275)

(9,967)

(14,676)

(62,757)

36,723

12.8

8,143

(6,637)

(10,781)

27,448

(316)

(7,450)

19,682

103

3

19,788

19,998

27.5

11.8

39.7

10.5

11.8

33.0

10.5

11.3

65.3

4.8

12.8

27.5

20.7

275,784

32,357

278,086

26,020

273,067

30,067

21,651

2,036

22,655

3,636

560,932

51,757

7.9

6.3

3QFY11E

7.3

7.4

15.6

0.6

7.3

13.7

(6.6)

7.0

(246.2)

6.6

3.4

(2.5)

27.1

(4.8)

56.9

NM

(0.4)

(17.1)

(% chg.)

3QFY10

2QFY11

11.0

1.5

10.4

2.8

32.5

11.9

(14.1)

(5.7)

(4.9)

3.5

10.3

8.6

(8.2)

(11.7)

16.1

(6.7)

(125.5)

(2.6)

(2.4)

0.5

(162.5)

(23.4)

119.5

(209.1)

(31.0)

112.2

31.6

(112.8)

12.0

4.5

(47.1)

(487.3)

(16.2)

(51.8)

56.9

NM

(49.3)

(58.7)

(0.8)

24.4

1.0

7.6

31,391

2,340

(4.4)

(44.0)

(31.0)

(13.0)

515,096

40,055

535,477

48,788

8.9

29.2

4.8

6.1

8.1

14.0

11.5

7.8

(3.6)

(55.0)

(31.7)

(19.2)

Source: Company, Kotak Institutional Equities estimates

KOTAK INSTITUTIONAL EQUITIES RESEARCH

Tata Steel

Metals & Mining

Exhibit 4: Tata Steel, Quarterly analysis of cost-structure, March fiscal year-ends (US$/ton)

3Q 2009

4Q 2009

1Q 2010

2Q 2010

3Q 2010

4Q 2010

1Q 2011

2Q 2011

3Q 2011

Tata Steel India

Steel business

Average realization

Steel EBIT

855

246

672

147

752

228

737

239

783

270

864

342

940

387

842

282

918

312

Realization (US$/ ton)

Raw material cost

Employee cost

Power and fuel cost

Freight and handling

Other expenditure

EBITDA/ ton

906

204

109

50

50

222

270

723

299

74

32

41

122

155

803

232

73

47

46

162

243

798

202

74

42

44

173

264

847

205

88

41

48

185

280

927

160

87

43

48

201

387

1,014

151

91

56

55

217

444

912

203

89

47

47

196

332

993

238

81

47

54

200

372

Tata Steel (Consolidated)

Average realization

Steel EBIT

Steel EBITDA

1,130

81

117

878

(40)

(12)

917

(37)

(3)

901

(22)

16

961

78

104

1,003

118

136

1,068

119

155

1,010

116

126

1,083

85

133

Realization (US$/ ton)

Raw material cost

Employee cost

Power and fuel cost

Freight and handling

Other expenditure

EBITDA/ ton

1,116

616

150

49

47

158

97

891

514

130

38

44

164

1

901

460

153

37

45

207

(1)

846

395

145

34

49

211

12

906

362

145

37

50

209

102

942

361

135

34

51

199

163

985

375

137

35

57

220

161

1,059

459

142

37

54

232

136

1,142

545

142

40

63

218

134

Source: Company, Kotak Institutional Equities estimates

Exhibit 5: Tata Steel, valuation, March fiscal year-ends, 2012E basis (Rs mn)

Tata Steel standalone

Tata Steel Europe

Tata Steel thailand and other businesses

Total Enterprise Value

EBITDA

Multiple

(Rs mn)

(X)

Enterprise value

EV

(Rs mn)

(Rs/share)

122,600

6.5

799,353

789

44,473

5.5

244,601

241

6,515

5.5

35,834

35

1,079,788

1,066

Consolidated group net debt

400,056

Total borrowings

400,056

395

Arrived market capitalization

679,732

671

Add: Value of investments

Arrived market capitalization

Target price (Rs)

39,530

39

719,262

710

710

Source: Kotak Institutional Equities estimates

KOTAK INSTITUTIONAL EQUITIES RESEARCH

Metals & Mining

Tata Steel

Exhibit 6: China import iron-ore fines from India (China CFR) prices (US$/ton)

China CFR 63% Fe

250

200

150

100

50

Feb-11

Oct-10

Jun-10

Feb-10

Oct-09

Jun-09

Feb-09

Oct-08

Jun-08

Feb-08

Oct-07

Jun-07

Feb-07

Oct-06

Jun-06

Feb-06

Oct-05

Feb-05

Jun-05

Source: Bloomberg, Kotak Institutional Equities estimates

Exhibit 7: Tata Steel, Key assumptions, March fiscal year-ends, FY2008-2013E (Rs mn)

2008

2009

2010

2011E

2012E

2013E

705

4.8

394

749

5.2

380

635

6.2

307

728

6.4

389

756

6.9

391

744

9.0

355

1,034

22.8

88

1,254

19.0

103

981

14.2

(20)

1,070

14.4

58

1,060

14.7

67

1,055

14.8

77

42.5

46.0

47.3

45.6

45.5

44.0

Tata Steel (India)

Benchmark HRC Price (US$/ton)

Volume (mn tons)

EBITDA/ton (US$/ton)

Corus

Average realization (US$/ ton)

Volume (mn tons)

EBITDA/ton (US$/ton)

Re/US$ rate

Source: Company, Kotak Institutional Equities estimates

KOTAK INSTITUTIONAL EQUITIES RESEARCH

Tata Steel

Metals & Mining

Exhibit 8: Tata Steel (standalone), Profit model, balance sheet and cash flow model, March fiscal year-ends, 2008-2013E (Rs mn)

2008

2009

2010

2011E

2012E

2013E

Profit model (Rs mn)

Net sales

EBITDA

Other income

Interest

Depreciation

Profit before tax

Extraordinaries

Taxes

Profit after tax

Fully diluted EPS (Rs)

196,910

80,138

2,428

(7,865)

(8,346)

66,355

4,309

(23,793)

46,870

47.5

243,157

91,334

3,083

(11,527)

(9,734)

73,156

(21,139)

52,017

52.7

250,220

89,521

8,538

(15,084)

(10,832)

72,143

(21,675)

50,468

51.2

289,175

113,490

8,664

(13,428)

(11,475)

97,251

20,700

(28,308)

89,643

72.9

318,985

122,600

2,865

(12,930)

(13,490)

99,046

(29,714)

69,332

68.4

382,533

141,098

2,865

(10,448)

(17,616)

115,900

(34,770)

81,130

80.1

Balance sheet (Rs mn)

Equity

Deferred tax liability

Total Borrowings

Current liabilities

Total liabilities

Net fixed assets

Capital work in progress

Investments

Cash

Other current assets

Miscellaneous expenditure

Total assets

218,282

6,818

234,942

78,401

538,443

82,561

43,675

41,032

4,650

364,974

1,551

538,443

242,319

5,857

324,188

100,077

672,441

109,945

34,877

423,718

15,906

86,945

1,051

672,442

371,688

8,677

252,392

99,568

732,324

121,624

38,436

449,797

32,341

90,126

732,324

503,046

9,856

237,392

86,690

836,984

125,149

98,436

449,097

59,500

104,802

836,984

563,286

10,847

207,392

93,200

874,724

166,660

98,436

449,097

48,824

111,708

874,724

635,323

12,006

177,392

104,947

929,668

284,044

8,436

449,097

67,210

120,880

929,668

60,778

1,764

(23,951)

38,591

66,599

7,373

(27,711)

46,261

71,874

11,818

(20,237)

63,455

102,297

(8,849)

(75,000)

18,448

83,812

(396)

(55,000)

28,417

99,904

2,574

(45,000)

57,479

40.7

35.9

1.1

1.0

2.7

26.4

16.7

37.6

30.1

1.3

1.1

3.0

22.7

13.9

35.8

28.8

0.7

0.5

2.1

16.5

12.3

39.2

40.8

0.5

0.3

1.3

20.5

14.1

38.4

31.1

0.4

0.2

1.0

13.0

12.1

36.9

30.3

0.3

0.1

0.5

13.5

13.1

Free cash flow (Rs mn)

Operating cash flow excl.working capital

Working capital changes

Capital expenditure

Free cash flow

Ratios

EBITDA margin (%)

EBT margin (%)

Debt/equity (X)

Net debt/equity (X)

Net debt/EBITDA (X)

RoAE (%)

RoACE (%)

Source: Company, Kotak Institutional Equities estimates

KOTAK INSTITUTIONAL EQUITIES RESEARCH

Metals & Mining

Tata Steel

Exhibit 9: Tata Steel (consolidated), Profit model, balance sheet and cash flow model, March fiscal year-ends, 2008-2013E (Rs mn)

2008

2009

2010

2011E

2012E

2013E

Profit model (Rs mn)

Net sales

EBITDA

Other income

Interest

Depreciation

Profit before tax

Extraordinaries

Taxes

Profit after tax

Minority interest

Share in profit/(loss) of associates

Reported net income

Adjusted net income

Fully diluted EPS (Rs)

1,315,336

177,824

4,759

(40,854)

(41,370)

100,359

63,351

(40,493)

123,218

(1,399)

1,682

123,500

110,441

112.0

1,473,293

181,277

2,657

(32,902)

(42,654)

108,378

(40,945)

(18,940)

48,492

409

607

49,509

61,750

62.6

1,023,931

80,427

11,859

(30,221)

(44,917)

17,147

(16,837)

(21,518)

(21,208)

(152)

1,269

(20,092)

(3,255)

(3.3)

1,128,398

153,843

8,962

(28,076)

(45,048)

89,680

20,700

(30,906)

79,474

400

507

80,381

65,270

64.4

1,204,467

175,421

2,408

(31,398)

(47,166)

99,264

(29,779)

69,485

360

761

70,606

70,606

69.7

1,232,243

202,586

3,063

(30,147)

(50,401)

125,100

(37,530)

87,570

324

761

88,655

88,655

87.5

Balance sheet (Rs mn)

Equity

Deferred tax liability

Total Borrowings

Current liabilities

Minority interest

Total liabilities

Net fixed assets

Capital work in progress

Goodwill

Investments

Cash

Other current assets

Miscellaneous expenditure

Total assets

287,015

24,545

590,973

339,163

8,327

1,250,022

331,187

88,476

180,500

33,675

42,319

572,309

1,556

1,250,022

217,700

17,094

653,732

313,109

8,949

1,210,583

364,175

88,880

153,649

64,111

61,484

477,229

1,055

1,210,583

230,208

16,541

531,004

309,639

8,841

1,096,232

365,252

92,706

145,418

54,178

67,878

370,800

1,096,232

352,325

17,645

476,004

319,895

8,441

1,174,309

375,204

134,706

145,418

54,685

43,818

420,477

1,174,309

413,839

18,141

461,004

336,049

8,081

1,237,113

416,148

134,206

145,418

55,447

41,635

444,259

1,237,113

493,402

18,767

446,004

342,270

7,757

1,308,198

525,157

44,206

145,418

56,208

84,266

452,943

1,308,198

117,771

(22,227)

(79,967)

15,578

116,077

2,254

(83,608)

34,723

25,583

46,465

(69,472)

2,577

114,669

(39,421)

(97,000)

(21,752)

114,740

(7,628)

(87,610)

19,501

135,534

(2,463)

(69,410)

63,661

13.5

10.4

2.1

1.9

3.0

51.0

14.6

12.3

9.4

3.0

2.6

3.1

24.5

9.9

7.9

3.5

2.3

1.9

5.5

(1.5)

(34.8)

13.6

9.6

1.4

1.2

2.7

22.4

12.1

14.6

10.6

1.1

1.0

2.3

18.4

13.1

16.4

12.4

0.9

0.7

1.7

19.5

14.6

Free cash flow (Rs mn)

Operating cash flow excl. working capital

Working capital changes

Capital expenditure

Free cash flow

Ratios

EBITDA margin (%)

EBIT margin (%)

Debt/equity (X)

Net debt/equity (X)

Net debt/EBITDA (X)

RoAE (%)

RoACE (%)

Source: Company, Kotak Institutional Equities estimates

10

KOTAK INSTITUTIONAL EQUITIES RESEARCH

SELL

Reliance Power (RPWR)

Utilities

FEBRUARY 16, 2010

RESULT

Coverage view: Cautious

Expensive despite recent correction. Reliance Power (RPWR) stock has corrected by

~35% in the past three months and is now trading at 1.9X FY2012E book. We,

however, maintain our negative stance on account of (1) lack of fuel security for gasbased capacities, (2) dilution of earnings (and valuation) due to merger with RNRL, and

(3) inferior profitability of UMPPs. Operating results in 3QFY11 were ahead of our

estimate on account of better-than-estimated availability. Reiterate SELL.

Company data and valuation summary

Reliance Power

Stock data

193-106

52-week range (Rs) (high,low)

Market Cap. (Rs bn)

290.7

Shareholding pattern (%)

Promoters

84.8

FIIs

3.8

MFs

0.3

Price performance (%)

1M

3M

12M

Absolute

(17.5) (33.4) (14.0)

Rel. to BSE-30

(14.8) (25.9) (24.5)

Forecasts/Valuations

EPS (Rs)

EPS growth (%)

P/E (X)

Sales (Rs bn)

Net profits (Rs bn)

EBITDA (Rs bn)

EV/EBITDA (X)

ROE (%)

Div. Yield (%)

2011

2.9

0.1

42.5

11.5

8.0

3.0

220.5

5.2

0.0

2012E

4.0

38.4

30.7

41.9

11.1

15.9

48.0

6.6

0.0

Price (Rs): 121

Target price (Rs): 115

BSE-30: 18,274

2013E

2.5

(36.7)

48.4

121.5

7.0

43.7

18.8

4.0

0.0

Operating results beat estimates on better availability

RPWR reported revenues of Rs2.5 bn, operating profit of Rs617 mn and net income of Rs1.4 bn

against our estimates of Rs2.1 bn, Rs348 mn and Rs1.9 bn, respectively. Higher-than-estimated

revenues were primarily on account of better availability during the quarter (~80%) resulting in

better-than-estimated average realizations. Management has indicated that Rosa has secured the

permission to blend imported coal and availability and PLF should improve further going forward.

Net income miss was primarily driven by significantly lower-than-estimated other income (Rs1 bn

against our estimate of Rs2.9 bn) which was partially offset by (1) lower depreciation on account

of change in depreciation policy for Rosa plant to align with UPERC rates (resulting in depreciation

being lower by Rs297.9 mn) and (2) tax write-backs on account of higher provisioning in previous

quarters.

Maintain SELL despite recent correction as execution and fuel risks remain high

RPWR stock has corrected by ~35% in past three months and is now trading at 1.9X FY2012E

book. We, however, maintain our cautious stance on RPWR given the limited visibility on nearterm earnings growth and high degree of execution and fuel risks embedded in the portfolio.

Continued uncertainty over availability of gas on account of slow ramp-up of supply from KG-D6

block makes us skeptical about the prospects on securing gas in the near term for the proposed

9,200 MW of gas-based capacities (including near-term 2,400 MW at Samalkot). Further, we

believe that UMPPs will not be the value driver for RPWR as they have been bid at a relatively

lower tariff structure. Our DCF-based valuation for Sasan and Krishnapatnam implies a P/B of 1X

on the total equity investment for these projects.

Retain SELL with a revised target price of Rs115/share

We maintain our SELL rating on RPWR with a revised target price of Rs115/share (previously

Rs135/share) as we adjust for dilution upon merger with RNRL. Our target price implies a P/B of

1.8X on FY2012E book value. We have revised our EPS estimates for FY2011E to Rs2.9/share

(previously Rs3.9/share) and for FY2012E to Rs4/share (previously Rs5.3/share) as we account for

dilution upon merger with RNRL and delays in commissioning of projects.

For private Circulation Only. FOR IMPORTANT INFORMATION ABOUT KOTAK SECURITIES RATING SYSTEM AND OTHER DISCLOSURES, REFER TO THE END OF THIS MATERIAL.

Utilities

Reliance Power

Exhibit 1: Operating results beat estimates on better availability

Interim results for RPWR, March fiscal year-ends (Rs mn)

Net sales

Operating costs

Cost of fuel

Personnel costs

Other expenses

EBITDA

EBITDA margin (%)

Other income

Interest & finance charges

Depreciation

PBT

Provision for tax (net)

Net profit

Extraordinary

3QFY11

2,513

3QFY11E

2,108

3QFY10

(121)

(146)

(267)

2QFY11

1,687

(1,242)

(196)

(458)

617

25

1,038

(685)

(77)

892

544

1,436

(1,242)

(193)

(324)

348

17

2,912

(520)

(400)

2,341

(445)

1,896

1,792

(2)

1,523

(186)

1,336

(997)

(153)

(254)

282

17

3,437

(499)

(375)

2,845

(497)

2,348

EBITDA margin (%)

Tax rate (%)

25

(61)

17

19

12

Key operating parameters

Units generated (MU)

PLF (%)

Average realization (Rs/kwh)

Cost of fuel (Rs/unit)

O&M (Rs/unit)

719

55

3.7

1.7

0.9

690

53

3.3

1.8

0.8

3QFY11E

19

(% Chg.)

3QFY10

2QFY11

49

FY2010

207

FY2011E

11,530

(221)

(245)

(815)

(1,073)

(518)

8,227

(70)

(57)

7,026

(187)

6,839

(5,027)

(1,200)

(2,286)

3,016

26

8,961

(2,219)

(798)

8,960

(949)

8,011

17

17

(518)

3

26

11

545

42

3.3

1.8

0.7

149

69

1.4

1.5

7.1

2,989

66

3.9

1.7

1.2

77

(331)

119

(62)

(41)

(69)

(24)

(39)

(% Chg.)

5,463

2,175

390

181

(381)

28

17

Source: Company, Kotak Institutional Equities estimates

Exhibit 2: Gross value of power projects (Rs bn)

Capacity

Project

Type

(MW)

Rosa I

Coal

600

Rosa II

Coal

600

Butibori

Coal

600

Sasan UMPP

Coal

3,960

Krishnapatnam UMPP

Imported coal

4,000

Dadri

Gas

6,400

Chitrangi

Coal

3,960

Total

20,120

Equity Investment

(Rs bn)

6.0

6.2

7.0

41.0

48.6

38.4

47.5

P/B

(X)

1.5

-0.2

5.2

1.0

1.0

1.9

3.5

1.9

RPWR's

share

100%

100%

74%

100%

100%

100%

100%

Value

(Rs bn)

9.2

-0.9

26.7

42.2

47.7

74.3

166.5

365.6

Cost of equity

(%)

12.5

12.5

12.5

12.5

12.5

15.0

15.0

Source: Company, Kotak Institutional Equities estimates

Exhibit 3: Our SOTP-based target price is Rs115/share

Valuation of RPWR

Gross value of power projects

Add: Equity to be invested

Add: Cash and cash and cash equivalent

Net Value

Valuation

(Rs bn)

(Rs/share)

366

130

(200)

(71)

157

56

322

115

Source: Company, Kotak Institutional Equities estimates

12

KOTAK INSTITUTIONAL EQUITIES RESEARCH

Reliance Power

Utilities

Status of power projects and captive coal blocks

We highlight below the execution status of key power projects of RPWR as highlighted by

the management.

` Rosa II (600 MW) the project has achieved all necessary milestone and construction is in

progress. The project has linkage from CCL (E grade coal). The project is likely to

commission by end-FY2012E.

` Butibori (600 MW) the project has achieved all necessary milestone and construction is

in progress. The project has linkage from WCL (D grade coal). The project is likely to

commission by June 2012.

` Sasan UMPP (3,960 MW) all necessary clearances and approvals in place and

construction has commenced. Management has indicated that production from Sasan

coal block is likely to commence by 2012. Peak production is likely to be 25 mtpa. A part

of the coal will be used for Chitrangi project. Management has guided for commissioning

of first unit by January 2012.

` Krishnapatnam UMPP (3,960 MW) all necessary clearances and approvals in place.

RPWR has acquired 3 coal mines in Indonesia for the project. Management has indicated

that production from Indonesian mines will commence by mid-2013 and RPWR will likely

ship in 25 mtpa of Indonesian coal. Indonesian coal will be inferior quality coal (GCV of

4,000 kcal/kg) and boilers for Krishnapatnam UMPP will be designed accordingly.

Management has guided for commissioning of first unit by September 2013.

` Tilaiya UMPP (3,960 MW) the project is yet to achieve financial closure. Management

has indicated that production from Tilaiya coal block will likely commence by 2013. Peak

production from the project will be 40 mtpa, part of which will be used to fuel expansion

at Tilaiya.

` Chitrangi (3,960 MW) the project is yet to achieve financial closure and acquire the

entire land for the plant. Project will use excess coal from captive coal blocks allocated for

Sasan UMPP. Management has guided for commissioning of first unit by September 2013.

Exhibit 4: Progress on UMPPs have been sedate with both Sasan and Krishnapatnam missing original commissioning guidance

Execution status of near-term projects of RPWR

Project

Rosa II

Capacity

(MW)

600

Butibori

600

Land

Fuel

Enviroment

clearance

Financial

Closure

EPC

award

D

D

D

D

D

D

D

D

D

D

D

D

D

D

D

D

D

D

WIP

D

D

D

U

U

Sasan

3,960

WIP

Krishnapatnam

4,000

WIP

Chitrangi

3,960

WIP

Tilaya

4,000

WIP

Expected

CoD

Mar-12

Jun-12

Jun-13

Jul-15

Jul-14

Jun-17

Source: Company, Kotak Institutional Equities estimates

KOTAK INSTITUTIONAL EQUITIES RESEARCH

13

Utilities

Reliance Power

Exhibit 5: Profit model, balance sheet, cash model of RPWR, March fiscal year-ends, 2009-2013E (Rs

mn)

2009

2010

2011E

2012E

2013E

(1,031)

3,604

(2)

2,570

(119)

2,445

2,445

1.1

207

(1,073)

8,227

(70)

(57)

7,026

(187)

6,839

6,839

2.9

11,530

3,016

8,961

(2,219)

(798)

8,960

(310)

(639)

1

8,011

8,011

2.9

41,890

15,918

10,125

(5,934)

(4,770)

15,339

(1,542)

(2,286)

(421)

11,090

11,090

4.0

121,541

43,734

5,085

(22,033)

(14,823)

11,963

(2,665)

(1,171)

(1,103)

7,024

7,024

2.5

Balance sheet

Paid-up common stock

Total shareholders' equity

Deferred taxation liability

Minority interest

Total borrowings

Total liabilities and equity

Net fixed assets

Capital work-in progress

Investments

Cash

Net current assets (excl. cash)

Net current assets (incl. cash)

Total assets

23,968

137,791

13,325

151,116

2,879

46,780

103,172

216

(1,931)

(1,715)

151,116

23,968

144,630

22,406

167,037

23,408

68,029

79,152

1,338

(4,890)

(3,552)

167,037

28,051

167,294

689

1,679

415,223

584,885

100,160

432,280

42,386

10,059

52,445

584,885

28,051

178,384

2,975

2,100

493,229

676,688

238,153

398,568

22,491

17,475

39,966

676,688

28,051

185,408

4,146

3,203

535,197

727,954

569,471

126,960

5,341

26,181

31,523

727,954

Free cash flow

Operating cash flow, excl. working capital

Working capital changes

Capital expenditure

Free cash flow

2,447

(4,065)

(39,351)

(40,969)

6,896

2,959

(41,835)

(31,979)

9,447

(14,950)

(441,801)

(447,303)

18,567

(7,416)

(109,051)

(97,900)

24,121

(8,706)

(74,533)

(59,118)

10

1.8

57.5

15

4.8

60.3

4.3

221

5.1

59.9

2.7

261

6.4

64.7

2.5

281

3.9

67.6

3.3

Profit model

Net revenues

EBITDA

Other income

Interest (expense)/income

Depreciation

Pretax profits

Tax

Deferred taxation

Minority interest

Net income

Extraordinary items

Reported profit

Earnings per share (Rs)

Ratios

Net debt/equity (%)

Return on equity (%)

Book value per share (Rs)

ROCE (%)

Source: Company, Kotak Institutional Equities estimates

14

KOTAK INSTITUTIONAL EQUITIES RESEARCH

BUY

IVRCL (IVRC)

Construction

FEBRUARY 15, 2011

RESULT

Coverage view: Attractive

Revenue and EBITDA gains nullified by interest cost and depreciation. IVRCL

delivered reasonable revenues growth of 15% yoy in 3QFY11, however, higher interest

cost and depreciation led to flat PAT yoy. The management reduced FY2011 revenue

guidance to Rs62.5 bn (may still be aggressive as we build Rs58.2 bn). Debt and

working capital remain stable on a qoq basis, a partial tie up of equity for BOT assets

may help push execution as concession agreement, land, financial closure make

progress. Retain BUY as stock trades at 4X FY2012E P/E adj. for equity holdings.

Company data and valuation summary

IVRCL

Stock data

195-60

52-week range (Rs) (high,low)

Market Cap. (Rs bn)

19.2

Shareholding pattern (%)

Promoters

9.5

FIIs

57.7

MFs

7.9

Price performance (%)

1M

3M

12M

Absolute

(34.5) (48.4) (54.7)

Rel. to BSE-30

(32.1) (42.9) (59.8)

Forecasts/Valuations

EPS (Rs)

EPS growth (%)

P/E (X)

Sales (Rs bn)

Net profits (Rs bn)

EBITDA (Rs bn)

EV/EBITDA (X)

ROE (%)

Div. Yield (%)

2011

7.0

(11.7)

10.3

58.3

1.9

5.5

7.0

9.6

0.6

2012E

8.9

28.1

8.0

72.7

2.4

6.9

6.0

11.2

0.6

2013E

12.6

40.7

5.7

92.5

3.4

8.8

4.9

13.9

0.6

Reasonable revenue growth nullified by higher interest cost and depreciation

IVRCL reported revenues of Rs14.2 bn (up 15% yoy) and EBITDA margins of 9.9% (up 90 bps yoy)

led by lower raw material cost as a percentage of sales. The net profit line disappointed though,

led by higher interest cost of Rs592 mn (vs Rs372 mn last year and Rs480 mn in 2QFY11) and

depreciation cost of Rs199 mn (up 43% yoy) led to flat PAT of Rs423 mn. For 9MFY11, revenues

are Rs36 bn and EBITDA margin at 9.3% are flat yoy with higher interest cost and depreciation

increase leading to decline in PAT of 26%.

Price (Rs): 72

Target price (Rs): 125

BSE-30: 18,202

QUICK NUMBERS

Revenues at Rs14.2

bn up 15% yoy

EBITDA margins

expands 90 bps yoy

to 9.9%

Net PAT at Rs423

mn flat yoy due to

interest cost (up

59% yoy) and

depreciation (up

43% yoy)

Revises full year guidance of Rs62.5 bn; we build in full year revenues of Rs58.2 bn

The management reduced the FY11 revenues guidance to Rs62.5 bn. The present guidance still

implies a strong growth of 35% in the last quarter. We believe this would be difficult to achieve

and have built in FY2011E revenues of Rs58.2 bn, implying yoy revenue growth of 18% in 4QFY11.

Equity for BOTs partly tied upmay scale up execution; IVRCL parent not to invest directly

Present portfolio of IVRCL Assets BOT projects requires incremental equity of about Rs13.5 bn.

Funds up to Rs6.5 bn are already tied up through (1) issue of compulsorily convertible debentures

of Rs2.5 bn to IFCI (2) Rs1.5 bn investment from UTI and (3) Rs2.5 bn NCDs. The rest are to be

funded from the stake sale of existing and upcoming BOT projects, land sales as well as equity

dilution in IVR Prime. IVRCL Infra. as a parent entity is not likely to invest in IVR Prime to fund the

equity of BOT projects.

Revise est. on back of higher interest cost; retain BUY on valuation, visibility and likely pick up

We have revised our FY2011E, FY2012E and FY2013E estimate to Rs7 (Rs7.7 earlier), Rs8.9

(Rs10.3 earlier) and Rs12.6 (Rs15.7) primarily based on higher interest cost versus earlier estimates.

We have revised our target price to Rs125 from Rs190 earlier based on (1) using 10X multiple now

versus 13X earlier, (2) lower valuation of listed subsidiaries (Rs20 impact) and (c) reduction in

earnings estimates. We retain our BUY rating as (1) execution of road projects may pick up as a

part of equity gets tied up, and agreements and financial closures are completed, (2) attractive

valuation 4X FY2012E P/E adjusted for equity holdings in IVR Prime and HDO, (3) order book

visibility.

For private Circulation Only. FOR IMPORTANT INFORMATION ABOUT KOTAK SECURITIES RATING SYSTEM AND OTHER DISCLOSURES, REFER TO THE END OF THIS MATERIAL.

Construction

IVRCL

Result disappoint on interest cost and depreciation

IVRCL reported revenues of Rs14.2 bn, up 15% yoy. The company reported EBITDA margin

of 9.9%, up 90 bps yoy (9.0% in 3QFY10) and marginally better than our estimates of 9.5%.

The margin expansion was led by lower raw material cost as a percentage of sales. The

revenue and margin gains resulted in 26% yoy EBITDA growth to Rs1404 mn. IVRCL

disappointed on interest cost and depreciation leading to a net PAT of Rs433 mn, down 1%

yoy and 3.3% below our estimate of Rs437 mn. Interest cost increased 59% yoy to Rs592

mn due to the interest rate increase. Depreciation also increased significantly by 43% to

Rs199 mn.

For the nine months ending December 31, 2010, IVRCL reported flat revenues of Rs36 bn

and EBITDA of Rs3.36 bn. As in 3QFY11, the company disappointed on below EBITDA line

items leading to 9MFY11 net PAT contraction of 26% to Rs937 mn.

Revenue and EBITDA margins gains nullified by higher interest cost and depreciation

IVRCL - 3QFY11 - key numbers (Rs mn)

Net Sales

CoGS

Constrn, stores & spares

Subcontracting exp.

Masonry & labour

Staff cost

Other expenditure

Expenditure

EBITDA

Other income

PBIDT

Interest

Depreciation

Profit before tax

Tax

Profit after tax

3QFY11 3QFY11E

14,188

13,199

(11,769)

(5,325)

(1,894)

(4,551)

(604)

(411)

(12,784) (11,945)

1,404

1,254

11

54

1,415

1,308

(592)

(486)

(199)

(170)

625

653

(202)

(215)

423

437

3QFY10

12,347

(10,498)

(4,263)

(2,563)

(3,672)

(479)

(256)

(11,233)

1,115

39

1,153

(372)

(139)

643

(216)

427

2QFY11

10,750

(8,812)

(4,095)

(1,684)

(3,033)

(633)

(352)

(9,797)

953

57

1,010

(480)

(184)

345

(112)

233

Order book

Order backlog

Order booking

242,000

16,188

173,428

41,275

240,000

53,450

85.0

3.9

2.1

9.0

5.2

3.5

33.6

82.0

5.9

3.3

8.9

3.2

2.2

32.6

Key ratios (%)

CoGS/Sales

Staff cost/sales

Other expenditure/sales

EBITDA margin

PBT Margin

Net Profit margin

Effective tax rate

83.0

4.3

2.9

9.9

4.4

3.0

32.3

9.5

4.9

3.3

33.0

% change

yoy

14.9

12.1

24.9

(26.1)

23.9

26.1

60.6

7.0

13.8

12.0

26.0

(79.3)

(71.2)

8.2

22.7

21.8

59.0

17.2

43.3

(4.3)

(2.8)

(6.4)

(6.6)

(3.3)

(0.9)

vs est.

7.5

39.5

(60.8)

qoq

32.0

33.6

30.0

12.4

50.0

(4.6)

16.9

30.5

47.3

(80.2)

40.1

23.2

7.9

80.9

79.4

81.7

0.8

(69.7)

9MFY11

36,002

(29,703)

(13,026)

(5,479)

(11,198)

(1,888)

(1,045)

(32,637)

3,365

76

3,442

(1,525)

(540)

1,376

(440)

937

82.5

5.2

2.9

9.3

3.8

2.6

31.9

9MFY10

35,386

(30,158)

(13,311)

(7,271)

(9,576)

(1,299)

(673)

(32,130)

3,255

135

3,390

(1,115)

(401)

1,874

(608)

1,265

% change

1.7

(1.5)

(2.1)

(24.6)

16.9

45.3

55.4

1.6

3.4

(43.5)

1.5

36.8

34.7

(26.6)

(27.8)

(26.0)

#DIV/0!

#DIV/0!

85.2

3.7

1.9

9.2

5.3

3.6

32.5

Source: Company, Kotak Institutional Equities

Road projects execution slow as some projects may be just getting ready for

execution now

The slowdown in execution of the roads segment projects is reflected in the revenue

contribution of this segment (transportation segment) of 12% of the total 9MFY11 revenues

versus a backlog contribution of about 27%. We believe water resources and irrigation

segments have contributed their fair share to the revenues (equal revenue and backlog

contribution) while the buildings segment has recorded a strong revenue contribution of

about 24% versus a backlog contribution of 19%.

16

KOTAK INSTITUTIONAL EQUITIES RESEARCH

IVRCL

Construction

Segment wise break-up of IVRCL's order book and revenues for 1HFY11

9MFY11 revenues (Rs36 bn)

9MFY11-end backlog (Rs242 bn)

Oil & Gas

1%

Electrical

7%

Oil & Gas

14%

Water resources

46%

Water resources

46%

Electrical

4%

Buildings and

Industrial

19%

Transportation

27%

Strong buildings segment revenue

contribution versus backlog

contribution of 19%

Buildings and

Industrial

24%

Transportation

12%

Low revenue contribution

from roads segment

versus backlog share

Source: Company, Kotak Institutional Equities

Recently signed concession agreements for two BOT projects; Goa still remaining

The company has signed concession agreements for two of the three recent BOT project

wins viz. (1) Rs15 bn Sion-Panvel expressway (won in Sept-2010- financial closure likely to

happen soon) and (2) Rs7.5 bn Karanji-Wani-Ghuggus-Chandrapur road (won in Sept-2010

financial closure likely to happen soon). The Rs31 bn Maharashtra-Goa project (won in

June-2010) is still awaiting concession agreement and financial closure.

Sion-Panvel and Karanji-Chadrapur concession agreements signed in 3QFY11

Key details of existing and recent BOT project wins of IVRCL

Sion-Panvel

Expressway

Concession agreement yet to be signed

25 kms of a 10-lane

concrete expressway from

Sion to Panvel

Project Description

Company's share

51%

Other partners

Kakade Infra.

4 laning of Karanji - Wani

- Ghuggus - Chandrapur

highway

100%

NA

4/6 laning of 122 km

from Mah/Goa border to

Goa/Kar border

100%

NA

Project Type

Concession Period

Construction period

Toll

30 years

2 years

Toll

23 years

3 years

Positive grant of

Rs6,647.2 mn

Toll

18 years and 9 months

Grant structure

No grant

Concession agreement

signed, financial closure

expected soon

Project status

Estimated Funding structure (in Rs mn)

Total project Cost

14,500

Equity

3,000

Debt

7,600

Grant

3,900

IVRCL's Equity Commitment

1,530

Karanji - Wani Mah/Goa border to

Ghuggus - Chandrapur Goa/Kar border

Rs2,318.4 mn VGF

Concession agreement

signed, financial closure

expected soon

7,500

1,295

3,886

2,318

1,295

Concession agreement to

be signed

31,000

7,170

6,647

2,318

7,170

Source: Company, Kotak Institutional Equities

KOTAK INSTITUTIONAL EQUITIES RESEARCH

17

Construction

IVRCL

Construction work has begun on several financially closed BOT projects including BaramatiPhaltan, Chengapalli- Walayar and Indore-Gujarat.

Key details of completed and financially closed BOT projects of IVRCL

JallandharAmristar

Completed/ Financially closed projects

4 laning of 49 km

JallandharProject Description

Amristar stretch

Company's share

100%

Other partners

Project Type

Concession Period

Construction period

Grant structure

Toll

17.5 years

2.5 years

Positive grant of

Rs 330 mn

Project status

Operational

Estimated Funding structure (in Rs mn)

Total project Cost

3,430

Equity

671

Debt

2,365

Grant

395

IVRCL's Equity

671

Salem Kumarapalayam

Kumarapalayam

Chenagmpalli

Chennai

Water

BaramatiPhaltan

47 km from

53 km from Salem Kumarapalayam to

to Kumarapalayam Chengapalli

100 MLD

100%

100%

75%

Befesa

Chengapalli Indore-Gujarat Walayar

IOCL-tankage

4-laning of 78 km

Baramati-Phaltan- Construction of

Shirwal

12 tanks

75%

37.5%

155 km Indore

to Gujarat/MP

border

100%

NA

6-lanning of 42

km ChengapalliWalayar stretch

100%

NA

Two part

Toll

tariff

20 years

3 years

Positive grant of Rs

1290 mn

Toll

25 years

Annuity - (Rs350

mn per month)

Toll

15 years

27 years

Positive grant of

Rs1,220 mn

No grant

Rs230 mn

revenue share

Operational

Operational

Operational

25-27%

construction

completed

65%

construction

completed

Financial closure 7% construction

achieved

completed

5,020

800

2,930

1,290

800

4,215

650

3,390

175

650

5,680

1,730

3,950

3,820

700

1,900

1,220

525

30,000

2,250

2,250 -Sponser

25,500 - Senior

844

15,200

3,800

11,400

3,800

Toll

20 years

2 years

Positive grant of Rs

175 mn

1,297

Toll

25 years

Rs360 mn

revenue share

11,250

4,250

7,000

4,250

Source: Company, Kotak Institutional Equities

Order inflows just keeping pace; current backlog and its execution holds the key

The company reported an order backlog of Rs242 bn at end- 3QFY11 leading to an order

booking of about Rs16 bn in this quarter. The order backlog provides a revenue visibility of

about 3.4 years based on forward four quarter revenues.

Order book visibility at about three years based on forward four quarter revenues

Order backlog, booking and visibility (X) of IVRCL Infrastructure, March fiscal year-ends, 2002-3QFY11

Order Backlog (LHS)

(Rs bn)

280

Order Booking (LHS)

Visibility (RHS)

(years)

3.8

3Q11

2Q11

1Q11

4Q10

3Q10

2Q10

1Q10

4Q09

3Q09

2Q09

0.2

1Q09

40

4Q08

0.8

3Q08

80

2Q08

1.4

1Q08

120

FY07

2.0

FY06

160

FY05

2.6

FY04

200

FY03

3.2

FY02

240

(0.4)

Source: Company, Kotak Institutional Equities estimates

18

KOTAK INSTITUTIONAL EQUITIES RESEARCH

IVRCL

Construction

Reduced full-year revenue guidance of Rs62.5 bn requires strong growth in 4Q

The management reduced the FY11 revenues guidance to Rs62.5 bn vs. earlier guidance of

Rs67.5-71 bn. The present guidance still implies 4QFY11 revenue of Rs26.5 bn and a strong

yoy growth of 35.6%. We highlight that the company had booked revenues of Rs18.9 in

4QFY10 which was the strongest quarter in the year.

We have built in revenues of Rs58.2 bn implying 17% yoy growth in 4QFY11E. Our full-year

margin assumption of 9.5% implies an EBITDA margin requirement of 9.8% in 4QFY11E

relatively flat on a yoy basis. Full-year PAT of Rs2 bn implies a net PAT of Rs930 mn in

4QFY11E versus Rs850 mn in 4QFY10.

IVRCL - 4QFY11E - implied key numbers (Rs mn)

Net Sales

Expenditure

EBITDA

Other income

Interest

Depreciation

PBT

Tax

PAT

Order book

Order booking

Key ratios (%)

EBITDA margin

PBT margin

Net PAT margin

Effective tax rate

9MFY11 9MFY10 % chg.

36,002

35,386

1.7

(32,637) (32,130)

1.6

3,365

3,255

3.4

76

135

(43.5)

(1,525)

(1,115)

36.8

(540)

(401)

34.7

1,376

1,874

(26.6)

(440)

(608)

(27.8)

937

1,265

(26.0)

9.3

3.8

2.6

31.9

NA

9.2

5.3

3.6

32.5

4QFY11E

22,262

(20,092)

2,170

60

(625)

(190)

1,415

(487)

928

4QFY10 % chg.

19,537

13.9

(17,480)

14.9

2,058

5.5

20

202.4

(523)

19.5

(142)

34.1

1,412

0.2

(569)

(14.4)

844

10.0

FY2011E

58,265

(52,730)

5,535

136

(2,150)

(730)

2,791

(927)

1,864

FY2010 % chg.

54,923

6.1

(49,610)

6.3

5,313

4.2

155

(12.0)

(1,639)

31.2

(543)

34.5

3,286

(15.1)

(1,177)

(21.3)

2,109

(11.6)

NA

98,501

103,556

98,501

9.7

6.4

4.2

34.4

10.5

7.2

4.3

40.3

9.5

4.8

3.2

33.2

9.7

6.0

3.8

35.8

NA

5.1

Source: Company, Kotak Institutional Equities

Needs Rs13.5 bn of equity funding for road projects; may sell equity stake in

BOT projects

Present portfolio of IVRCL Assets BOT projects requires incremental equity of about Rs13.5

bn. Delays/difficulties in raising this equity would potentially lead to lower construction

revenues and/or may put stress on the standalone balance sheet. Funds up to Rs6.5 bn are

already tied up through (1) issue of compulsorily convertible debentures of Rs2.5 bn to IFCI

and (2) investment from UTI for about Rs1.5 bn and (3) issue of NCDs for a total of about

Rs2.5 bn. The rest are to be funded from stake sale of existing and upcoming BOT projects,

land sales etc. IVRCL Infrastructure as a parent entity is not envisaged to invest in equity of

BOT projects help in IVR Prime.

Debt and working capital remain stable on a qoq basis

IVRCL management indicated net debt at end-Dec 2010 of about Rs22 bn versus Rs21.2 bn

at end-Sept 2010 and Rs15.5 bn at FY2010-end level. The increase in debt levels was

primarily due to higher loans & advances to subsidiaries for investment in the BOT assets.

Loans and advances towards subsidiaries stood at about Rs4.5 bn versus end-FY2010 level

of about Rs2.8 bn. We have built in debt levels of about Rs23 bn at end-FY2011E.

KOTAK INSTITUTIONAL EQUITIES RESEARCH

19

Construction

IVRCL

Revise earnings estimates and target price to Rs125/share; retain BUY

We have revised our FY2011E, FY2012E and FY2013E estimate to Rs7 (Rs7.7 earlier), Rs8.9

(Rs10.3 earlier) and Rs12.6 (Rs15.7) earlier primarily based on higher interest cost versus

earlier estimates. We have revised our target price to Rs125 from Rs190 earlier based on (1)

using 10X multiple now versus 13X earlier (Rs30 impact on the target price), (2) lower

valuation of listed subsidiaries IVR Prime and Hindustan Dorr Oliver (Rs20 impact on the

target price) and (3) reduction in earnings estimates (Rs20 impact on the target price).

Revised estimates for IVRCL, March fiscal year-ends, 2011E-12E (Rs mn)

Revenues

EBIDTA

EBITDA margin (%)

PAT

EPS (Rs)

yoy growth (%)

Revenus

EBITDA

PAT

EPS

New estimates

FY2011E

FY2012E

58,265

72,655

5,535

6,902

9.5

9.5

1,864

2,389

7.0

8.9

6.1

4.2

(11.7)

(11.7)

24.7

24.7

28.1

28.1

Old estimates

FY2011E

FY2012E

58,664

74,642

5,573

7,091

9.5

9.5

2,063

2,759

7.7

10.3

6.8

(42.4)

(2.3)

(2.3)

% revision

FY2011E

FY2012E

(0.7)

(2.7)

(0.7)

(2.7)

(9.6)

(9.6)

(13.4)

(13.4)

27.2

(38.0)

33.7

33.7

Source: Company estimates, Kotak Institutional Equities estimates

We retain BUY as (1) execution of road projects may pick up as part of equity gets tied up,

and agreements and financial closures are completed, (2) attractive valuation 4X FY2012E

P/E adjusted for equity holdings in IVR Prime and HDO, (3) order book visibility.

20

KOTAK INSTITUTIONAL EQUITIES RESEARCH

IVRCL

Construction

Key order booking and execution segmental assumptions for IVRCL (standalone), March fiscal

yearends,2008-13E (Rs mn)

IVRCL Construction

Orders received

Revenues

Growth (%)

Order backlog - year end

Bill to book ratio

Segmental

Water resources and irrigation

Orders received

Growth (%)

Revenues

Growth (%)

Order backlog - year end

Bill to book ratio

Transportation

Orders received

Growth (%)

Revenues

Growth (%)

Order backlog - year end

Bill to book ratio

Buildings

Orders received

Growth (%)

Revenues

Growth (%)

Order backlog - year end

Bill to book ratio

Electrical

Orders received

Growth (%)

Revenues

Growth (%)

Order backlog - year end

Bill to book ratio

2008

2009

2010

2011E

2012E

2013E

87,967

36,622

59.5

122,415

31.8

63,229

48,819

33.3

136,825

31.7

136,175

56,000

14.7

217,000

27.3

103,556

58,265

4.0

262,292

21.7

101,252

72,655

24.7

290,889

23.2

116,340

92,542

27.4

314,688

26.5

58,272

181.1

17,824

52.0

75,728

27.7

44,209

(24.1)

25,874

45.2

94,063

26.4

39,937

(9.7)

26,000

0.5

108,000

22.8

39,937

25,594

(1.6)

122,343

20.0

39,937

32,020

25.1

130,260

22.5

45,927

15.0

38,306

19.6

137,881

25.0

440

(80.3)

6,933

115.3

11,157

38.8

1,583

259.9

6,346

(8.5)

6,394

53.1

53,606

7,000

10.3

53,000

32,164

(40.0)

8,635

23.4

76,528

25,731

20

13,409

55.3

88,850

21.1

12.5

15.0

29,591

15.0

23,320

73.9

95,121

22.5

25,410

445.9

6,935

77.4

28,015

31.2

12,304

(51.6)

10,252

47.8

30,067

30.0

15,933

29.5

11,000

7.3

35,000

28.9

17,526

10.0

14,661

33.3

37,866

33.5

20,155

15.0

15,582

6.3

42,439

32.5

23,178

15.0

17,559

12.7

48,058

32.5

3,845

(58.8)

4,930

20.2

7,515

46.9

5,132

33.5

6,346

28.7

6,301

63.0

12,700

147.5

5,000

(21.2)

14,000

39.5

11,430

(10.0)

6,900

38.0

18,529

35.0

11,430

8,485

23.0

21,473

35.0

13,144

15.0

9,816

15.7

24,802

35.0

Source: Company, Kotak Institutional Equities

We correspondingly revise our SOTP-based target price to Rs125/share from Rs190/share.

Our target price of Rs125/share is comprised of (1) Rs90/share from the core construction

business based on 10XFY2012E earnings, (2) IVRCL Assets contribution of Rs26/share, and

(3) Rs10/share contribution from Hindustan Dorr Oliver.

We arrive at an SOTP-based target price of Rs125/share for IVRCL

Project/ Business

Value of core construction business

Value of Hindustan Dorr Oliver

Value of IVRCL Prime Developers Ltd

Total

Valuation

(Rs mn) Rs/ share

24,156

89

2,697

10

6,921

26

125

Valuation methodology

# P/E multiple of 10X FY2012E earnings

# Discount to market price

# Discount to market price

#

Source: Company, Kotak Institutional Equities estimates

KOTAK INSTITUTIONAL EQUITIES RESEARCH

21

Construction

IVRCL

Profit model and balance sheet of IVRCL, March fiscal year-ends, 2007-13E (Rs mn)

2007

2008

2009

2010E

2011E

2012E

2013E

Income statement

Operating Income

Operating Expenses

EBITDA

Other Income

Interest & Finance charges

Depreciation

Profit Before Tax

Tax expense

PAT

EPS (Rs)

23,059

(19,497)

2,301

74

(308)

(216)

1,851

(436)

1,415

10.9

36,606

(30,965)

3,544

45

(407)

(328)

2,853

(749)

2,105

15.8

48,819

(41,772)

4,145

299

(1,233)

(473)

2,738

(478)

2,260

16.9

54,923

(46,281)

5,313

155

(1,637)

(543)

3,288

(1,177)

2,111

7.9

58,265

(49,525)

5,535

136

(2,150)

(730)

2,791

(927)

1,864

7.0

72,655

(61,975)

6,902

148

(2,611)

(863)

3,576

(1,187)

2,389

8.9

92,542

(78,938)

8,791

160

(2,913)

(1,007)

5,032

(1,671)

3,361

12.6

Balance sheet

Total share holders funds

Share Capital

Reserves & Surplus

Loan Funds

Working Capital Loan

Long term

Total Sources of Funds

Net fixed assets

Net block

Capital WIP

Investments

Net Current Assets (excl Cash)

Cash and Bank Balances

Total

13,217

259

12,918

5,561

2,864

1,580

18,834

2,435

1,929

506

2,829

11,332

2,238

18,834

16,060

267

15,789

10,678

5,215

5,159

26,841

3,733

3,192

541

3,409

17,928

1,772

26,841

18,106

267

17,839

13,980

7,645

3,949

32,203

5,403

5,207

196

3,892