Professional Documents

Culture Documents

Tutorial

Tutorial

Uploaded by

Dibya saha0 ratings0% found this document useful (0 votes)

36 views4 pagesEmerging market economies are developing countries that are becoming more involved in global trade but have not yet achieved the level of development of advanced economies. Common characteristics include potential for high economic growth, market volatility, and lower per capita incomes. The top five emerging markets are Brazil, Russia, India, China, and South Africa (BRICS). While these countries have experienced rapid growth in recent decades, sustained development is challenging, and political and economic instability can slow progress.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentEmerging market economies are developing countries that are becoming more involved in global trade but have not yet achieved the level of development of advanced economies. Common characteristics include potential for high economic growth, market volatility, and lower per capita incomes. The top five emerging markets are Brazil, Russia, India, China, and South Africa (BRICS). While these countries have experienced rapid growth in recent decades, sustained development is challenging, and political and economic instability can slow progress.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

36 views4 pagesTutorial

Tutorial

Uploaded by

Dibya sahaEmerging market economies are developing countries that are becoming more involved in global trade but have not yet achieved the level of development of advanced economies. Common characteristics include potential for high economic growth, market volatility, and lower per capita incomes. The top five emerging markets are Brazil, Russia, India, China, and South Africa (BRICS). While these countries have experienced rapid growth in recent decades, sustained development is challenging, and political and economic instability can slow progress.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 4

Tutorial

International Finance

Name: Dibya Saha

ID: 1100601596

Why some countries remain emerging economies for decades? Use emerging countries as a

case study.

An emerging market economy is a developing country's economy that is becoming more

involved in global markets as it grows. Emerging market economies are those that have

some but not all of the characteristics of developed markets.

Strong economic growth, high per capita income, liquid equity and debt markets,

accessibility to foreign investors, and a dependable regulatory system are all

characteristics of developed markets. As an emerging market economy grows, it

typically integrates more fully into the global economy. That means increased liquidity in

domestic debt and equity markets, increased trade volume, and increased foreign direct

investment. It has the potential to create modern financial and regulatory institutions.

India, Mexico, Russia, Pakistan, Saudi Arabia, China, and Brazil are currently notable

emerging market economies.

A critical transition for an emerging market economy is from a low-income, less

developed, often pre-industrial economy to a modern, industrial economy with a higher

standard of living.

Investors seek out emerging markets for the possibility of high returns because these

markets frequently experience faster economic growth as measured by GDP (GDP).

However, higher returns are usually accompanied by much higher risk.

Emerging Markets Features

The following are some common characteristics of emerging markets:

1. Market turbulence- Political instability, external price movements, and/or supply-

demand shocks caused by natural disasters all contribute to market volatility. It

exposes investors to the risk of currency fluctuations as well as market

performance.

2. Potential for growth and investment

Because of the high return on investment that emerging markets can provide, they

are frequently appealing to foreign investors. Countries that are transitioning from an

agriculture-based economy to a developed economy frequently require a large influx

of capital from foreign sources due to a lack of domestic capital. Using their

competitive advantage, such countries concentrate on exporting low-cost goods to

richer countries, boosting GDP growth, stock prices, and investor returns.

3. Rapid economic growth rates

Emerging market governments typically pursue policies that promote

industrialization and rapid economic growth. These policies result in lower

unemployment, higher disposable income per capita, increased investment, and

improved infrastructure. In contrast, developed countries such as the United States,

Germany, and Japan have low rates of economic growth due to early

industrialization.

4. Per capita income

Because of their reliance on agricultural activities, emerging markets typically have

low-middle income per capita in comparison to other countries. Income per capita

rises in tandem with GDP as the economy pursues industrialization and

manufacturing activities. Lower average incomes also act as inducements for

greater economic growth.

The Top Five Emerging Markets

Brazil, Russia, India, China, and South Africa are the world's largest emerging

markets. The leaders of Brazil, Russia, India, and China met in 2009 to form "BRIC,"

an association formed to improve political relationships and trade between the

world's largest emerging markets. South Africa became a member of the "BRIC"

group in 2010, which was later renamed "BRICS."

1. Brazilian

Brazil's economy grew rapidly relative to the rest of the world in the early 2010s, at a

rate of 7.5%. However, due to political unrest and trade sanctions, growth slowed

and turned negative in 2016 (-3.5%). Brazil also saw significant improvements in

income levels and poverty reduction from 2003 to 2014, but progress has slowed

since 2015 due to lower economic activity.Political uncertainty and reduced

government spending have had a significant impact on the Brazilian economy.

However, the country's future appears to be bright. The domestic economy

expanded by 0.6% in 2019 and is expected to maintain growth through infrastructure

improvements and foreign investments, as well as its reliance on agricultural

commodities such as soybeans and coffee.

2. Russian Federation

Russia's GDP increased exponentially between 1999 and 2008, owing primarily to

increased oil exports and rising oil prices (before the Global Financial Crisis). The

country's economic growth has been boosted by economic reforms and an export-

oriented trade policy since the country's transition from communism to capitalism

began in 1991.However, since 2014, Russia's economy has been harmed by

political conflicts and trade sanctions imposed by the United States, Canada, Japan,

and the European Union, as well as fluctuations in the price of oil, which accounts

for nearly 52% of Russian exports.

3. India

Following trade liberalization and other major economic reforms in 1991, India

established itself as an emerging market. The Indian economy has been expanding

at a relatively rapid pace. Over the last decade, it has averaged 7.1%, with some

fluctuations due to political instability and economic reforms.Essentially, long-term

economic growth in India can be attributed to the expansion of the manufacturing

and service sectors, which is fueled by exports and foreign investment. India is also

seeing increases in capital and labour productivity as a result of technological

advancements and educational reforms. India, along with China, is currently one of

the largest emerging markets.

4. China

Since the implementation of trade liberalization and economic reforms in 1978, the

Chinese economy has grown at an annual rate of 10%. China's economy has grown

as a result of government spending, the expansion of its manufacturing sector, and

exports (specifically electronic equipment). However, the country's per capita income

remains low. Although only 3.3% of the Chinese population is poor, 30% of the

population lives on less than US$5.50 per day. Nonetheless, as the Chinese

government focuses on increasing GDP through consumption, disposable incomes

are expected to rise, resulting in long-term economic growth.

5.South Africa is number five.

South Africa joined the BRICS association in 2010, after experiencing negative GDP

growth (-3%) in 2009 as a result of the 2008 Global Financial Crisis. Following the

financial crisis, the South African government implemented a number of policies

aimed at increasing GDP through increased government spending and consumption.

Economic growth increased in 2010-12, then slowed in 2012-16 before picking up

again in 2017.South African exports are primarily made up of mining commodities.

As a result, export volumes are determined by commodity prices, which are highly

volatile. Export volume fluctuations explain a portion of the variation in GDP growth

over the last few years. Although South Africa's GDP per capita has risen over time,

so has the country's unemployment rate (29% as of 2019). High unemployment and

crime rates have hampered the economy's growth and investment potential, and

these issues must be addressed through policy changes.

1. References: Nasdaq.

"What is the difference between a developed,

emerging, and frontier market?"

2. Statista. "Gross domestic product (GDP) of the BRICS countries from

2000 to 2026

You might also like

- Moody's Outlook For Global Banks 2024Document30 pagesMoody's Outlook For Global Banks 2024Tim MooreNo ratings yet

- Global Marketing and Sales DevelopmentDocument15 pagesGlobal Marketing and Sales Developmentdennis100% (2)

- (Palgrave Advances in Luxury) Cesare Amatulli, Matteo de Angelis, Michele Costabile, Gianluigi Guido Sustainable Luxury Brands - Evidence From Research and Implications For ManDocument253 pages(Palgrave Advances in Luxury) Cesare Amatulli, Matteo de Angelis, Michele Costabile, Gianluigi Guido Sustainable Luxury Brands - Evidence From Research and Implications For ManOns Bouriga100% (1)

- Global Advantage Across Multiple Countries. Explain The Primary Sources of AdvantageDocument9 pagesGlobal Advantage Across Multiple Countries. Explain The Primary Sources of AdvantageCarla Mairal MurNo ratings yet

- Tapping Into Global MarketsDocument5 pagesTapping Into Global MarketsAli RazzanNo ratings yet

- Case Study Emerging MarketDocument15 pagesCase Study Emerging MarketshaziaNo ratings yet

- What Are Emerging Markets?: Supply-DemandDocument3 pagesWhat Are Emerging Markets?: Supply-DemandMisbah UllahNo ratings yet

- International PoliticsDocument19 pagesInternational Politicsnit_kir123No ratings yet

- 2 - Factors Changing IBE, Economic Growth ImpactDocument11 pages2 - Factors Changing IBE, Economic Growth ImpactvbalodaNo ratings yet

- Presentation 2Document11 pagesPresentation 2Akash ShahNo ratings yet

- Globalization and Its Impact On IndiaDocument3 pagesGlobalization and Its Impact On IndiaJananee Rajagopalan100% (1)

- India and Its BOPDocument19 pagesIndia and Its BOPAshish KhetadeNo ratings yet

- BhutanDocument40 pagesBhutandhruv_jagtapNo ratings yet

- BricDocument3 pagesBricManhao TangNo ratings yet

- Indian Trade Policy After The Crisis: Ecipe Occasional Paper - No. 4/2011Document21 pagesIndian Trade Policy After The Crisis: Ecipe Occasional Paper - No. 4/2011Balram SinglaNo ratings yet

- " Are Developing Nations Really Developing" - Fact or Illusion?Document20 pages" Are Developing Nations Really Developing" - Fact or Illusion?Rahul GoyalNo ratings yet

- Impact of Globalization On Indian EconomyDocument32 pagesImpact of Globalization On Indian EconomyAbhijeet Kulshreshtha88% (25)

- International TradeDocument6 pagesInternational Trademaa.rrriaaaNo ratings yet

- Indian EconomyDocument13 pagesIndian EconomyPraval SaiNo ratings yet

- Globalization and India: Iipm SMDocument24 pagesGlobalization and India: Iipm SMRAJIV SINGHNo ratings yet

- SummaryDocument2 pagesSummaryKezia TumalaNo ratings yet

- 2.1. Economic Analysis:: Boom Recovery Recession Depression Invest DisinvestDocument5 pages2.1. Economic Analysis:: Boom Recovery Recession Depression Invest DisinvestbatkiNo ratings yet

- Courses Arts Economics 1144913623 2006 Economics Assessment TaskDocument6 pagesCourses Arts Economics 1144913623 2006 Economics Assessment TaskJimmyNo ratings yet

- AEE Study NotesDocument41 pagesAEE Study Notesyie_793No ratings yet

- Project KMFDocument96 pagesProject KMFLabeem SamanthNo ratings yet

- Fear of Global Economic RecessionDocument6 pagesFear of Global Economic RecessionT ForsythNo ratings yet

- Economics of PakistanDocument26 pagesEconomics of PakistanMUHAMMAD NAZARNo ratings yet

- Emerging MarketsDocument22 pagesEmerging MarketsAshmita Sharma100% (1)

- Unit - 2 IBDocument6 pagesUnit - 2 IBAyush devdaNo ratings yet

- Global PerpectiveDocument3 pagesGlobal Perpectivessharma_895257No ratings yet

- ASEAN PhilippinesDocument39 pagesASEAN PhilippinesleshamunsayNo ratings yet

- GLOBALIZATIONDocument12 pagesGLOBALIZATIONFloydCorreaNo ratings yet

- Global Economic RecessionDocument7 pagesGlobal Economic RecessionstrikerutkarshNo ratings yet

- Cite Five (5) Major Issues of Economic Development in The World TodayDocument6 pagesCite Five (5) Major Issues of Economic Development in The World TodayJannaNo ratings yet

- BricDocument14 pagesBricAnanth RamanNo ratings yet

- Commerce 3rd Yr Bcom Hons Econ DevtDocument41 pagesCommerce 3rd Yr Bcom Hons Econ DevtvermaashleneNo ratings yet

- Comsats Institute of Information Technology: "Working of Multinational Companies in Pakistan"Document15 pagesComsats Institute of Information Technology: "Working of Multinational Companies in Pakistan"Farhan Badar SiddiquiNo ratings yet

- India's Economic Performance - Globalisation As Its Key DriveDocument16 pagesIndia's Economic Performance - Globalisation As Its Key DriveludovicoNo ratings yet

- Brics at A GlanceDocument1 pageBrics at A GlanceCityPressNo ratings yet

- The Global Economy Report - DraftDocument9 pagesThe Global Economy Report - Draftmaddie.george020406No ratings yet

- Directors Report Year End: Mar '11Document11 pagesDirectors Report Year End: Mar '11Somanna MnNo ratings yet

- Overview of China's EconomyDocument9 pagesOverview of China's EconomyAakash SharmaNo ratings yet

- Call For Papers Managing Under Uncertainty: Paradigms For Developed & Emerging Econom EconomiesDocument4 pagesCall For Papers Managing Under Uncertainty: Paradigms For Developed & Emerging Econom EconomiesVishal GargNo ratings yet

- Gallardo ASSESSMENT5Document8 pagesGallardo ASSESSMENT5Ronn GallardoNo ratings yet

- India'S Economic Reforms: Lessons For South Africa: PDF StrydomDocument4 pagesIndia'S Economic Reforms: Lessons For South Africa: PDF StrydomsilberksouzaNo ratings yet

- Indian Economy OverviewDocument5 pagesIndian Economy OverviewmarkandeyulumNo ratings yet

- Globalization & LiberalizationDocument12 pagesGlobalization & Liberalizationmitul-desai-8682No ratings yet

- SPEX Issue 4Document8 pagesSPEX Issue 4SMU Political-Economics Exchange (SPEX)No ratings yet

- Summer Internship Report On LenovoDocument74 pagesSummer Internship Report On Lenovoshimpi244197100% (1)

- Economic Growth of India and ChinaDocument4 pagesEconomic Growth of India and Chinaswatiram_622012No ratings yet

- Beyond The New MediocreDocument28 pagesBeyond The New MediocrePAHNo ratings yet

- News/uk-News/uk-Average-Salary-26500 - Figures-3002995Document7 pagesNews/uk-News/uk-Average-Salary-26500 - Figures-3002995AnaMariaNo ratings yet

- 2013 Economics Half YearlyDocument3 pages2013 Economics Half YearlyIchi BerryNo ratings yet

- Causes For Slow Economic Growth in IndiaDocument10 pagesCauses For Slow Economic Growth in IndiaThakur Shobhit SinghNo ratings yet

- Econometrics Post Covid EconomyDocument14 pagesEconometrics Post Covid EconomyAtul JohnsonNo ratings yet

- Lovely Professional University: Submitted byDocument28 pagesLovely Professional University: Submitted byShivani SharmaNo ratings yet

- LenovoDocument84 pagesLenovoasifanis100% (1)

- Performance ApppraidDocument81 pagesPerformance ApppraidManisha LatiyanNo ratings yet

- Financial Markets AND Services: Presented To. Dr. Mrityunjaya CDocument62 pagesFinancial Markets AND Services: Presented To. Dr. Mrityunjaya CPoornima NayakNo ratings yet

- Orld Rade Rganization: Trade Policy Review Report by IndiaDocument24 pagesOrld Rade Rganization: Trade Policy Review Report by IndiaTarun Kumar SinghNo ratings yet

- India's Bubble Economy Headed Towards Iceberg?: CategorizedDocument6 pagesIndia's Bubble Economy Headed Towards Iceberg?: CategorizedMonisa AhmadNo ratings yet

- Banking in Africa: financing transformation amid uncertaintyFrom EverandBanking in Africa: financing transformation amid uncertaintyNo ratings yet

- Risk Management Tutorial 2.0Document7 pagesRisk Management Tutorial 2.0Dibya sahaNo ratings yet

- Assignment - 110056643 - Bangladesh Inter ManagementDocument14 pagesAssignment - 110056643 - Bangladesh Inter ManagementDibya sahaNo ratings yet

- Faculty of Business Manamgent & Globalization: International Economics Group AssignmentDocument6 pagesFaculty of Business Manamgent & Globalization: International Economics Group AssignmentDibya sahaNo ratings yet

- Financial Management 1 - Tutorial IrfanDocument4 pagesFinancial Management 1 - Tutorial IrfanDibya sahaNo ratings yet

- UAE GCC Cold Chain Profile 261017Document27 pagesUAE GCC Cold Chain Profile 261017Carlo ArcenalNo ratings yet

- World Economic Outlook: Managing Divergent RecoveriesDocument192 pagesWorld Economic Outlook: Managing Divergent RecoveriesRafa BorgesNo ratings yet

- Mergers and Acquisitions 2Document2 pagesMergers and Acquisitions 2blueberryNo ratings yet

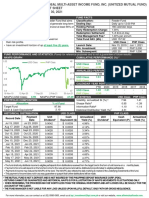

- Aggressive at Least Five (5) Years.: PHP Class - 0.98Document2 pagesAggressive at Least Five (5) Years.: PHP Class - 0.98Jaymes ShrimskiNo ratings yet

- JP Morgan Global Markets Outlook and StrategyDocument32 pagesJP Morgan Global Markets Outlook and StrategyEquity PrivateNo ratings yet

- DEV 1150 LECTURE Classification of Developing CountriesDocument17 pagesDEV 1150 LECTURE Classification of Developing Countriesanipa mwaleNo ratings yet

- 2020 Dividend Schedule: 2020 Record Date 2020 Reinvest Ex-Dividend Date 2020 Payable DateDocument27 pages2020 Dividend Schedule: 2020 Record Date 2020 Reinvest Ex-Dividend Date 2020 Payable DateAmer MadaniNo ratings yet

- Boeing Current Market Outlook 2014Document43 pagesBoeing Current Market Outlook 2014VaibhavNo ratings yet

- Deutsche Bank ResearchDocument12 pagesDeutsche Bank ResearchMichael GreenNo ratings yet

- Business Insights Emerging Markets 2021Document91 pagesBusiness Insights Emerging Markets 2021SowmiyaNo ratings yet

- IB Report Faria Aktar ID MBA 230322Document14 pagesIB Report Faria Aktar ID MBA 230322faria hossainNo ratings yet

- Module 1 Foundations of International Business in Asia PacificDocument20 pagesModule 1 Foundations of International Business in Asia PacificHải Đăng Vũ HoàngNo ratings yet

- Interview With Dr. J. Mark Mobius of Franklin Templeton InvestmentsDocument6 pagesInterview With Dr. J. Mark Mobius of Franklin Templeton InvestmentsMichael Cano LombardoNo ratings yet

- Breakout Nations 3Document4 pagesBreakout Nations 3PearlNo ratings yet

- Business Unit 4Document14 pagesBusiness Unit 4kaos 99No ratings yet

- Cushman & Wakefield - International Investment Atlas - 2014 MarchDocument28 pagesCushman & Wakefield - International Investment Atlas - 2014 MarchRidi YusfandrikNo ratings yet

- Business History and Management StudiesDocument30 pagesBusiness History and Management StudiesKrista SindacNo ratings yet

- A New Measure of Financial Openness: Menzie D. Chinn University of Wisconsin and NBERDocument19 pagesA New Measure of Financial Openness: Menzie D. Chinn University of Wisconsin and NBERMajd KhoudariNo ratings yet

- The Great Rebalancing: in This ArticleDocument16 pagesThe Great Rebalancing: in This ArticleCHUCLINHCUTENo ratings yet

- Office Space Across The World - 2017Document34 pagesOffice Space Across The World - 2017Sophy MoffatNo ratings yet

- A Comparative Performance Evaluation On Bipolar Risks in Emerging Capital Markets Using Fuzzy AHP-TOPSIS and VIKOR ApproachesDocument12 pagesA Comparative Performance Evaluation On Bipolar Risks in Emerging Capital Markets Using Fuzzy AHP-TOPSIS and VIKOR ApproachesWanli Kerja98No ratings yet

- Corporate Overview: Tcs StrategyDocument2 pagesCorporate Overview: Tcs StrategyShubham SinghNo ratings yet

- How To Improve New Product Performance Through Customer Relationship Management and Product Development Management: Evidence From ChinaDocument17 pagesHow To Improve New Product Performance Through Customer Relationship Management and Product Development Management: Evidence From ChinaSava KovacevicNo ratings yet

- Factors Affecting Housing FinanceDocument402 pagesFactors Affecting Housing Financedhavs4u100% (4)