Professional Documents

Culture Documents

Suggested Answer CAP II (Dec 2018) All Subjects PDF

Suggested Answer CAP II (Dec 2018) All Subjects PDF

Uploaded by

Dipendra kumar MehtaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Suggested Answer CAP II (Dec 2018) All Subjects PDF

Suggested Answer CAP II (Dec 2018) All Subjects PDF

Uploaded by

Dipendra kumar MehtaCopyright:

Available Formats

CHARTERED ACCOUNTANCY PROFESSIONAL II

(CAP-II)

Suggested Answer

December 2018

The Institute of Chartered Accountants of Nepal

Suggested Answer- December 2018

Paper 1: Advanced Accounting

The Institute of Chartered Accountants of Nepal 2

Suggested Answer- December 2018

Advance Account

Suggested

Roll No……………. Maximum Marks - 100

Total No. of Questions - 6 Total No. of Printed Pages - 14

Time Allowed - 3 Hours

Marks

Attempt all questions. Working notes should form part of the answer.

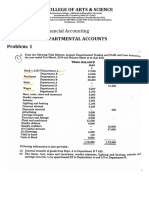

1. Ram, the owner of Ram Ltd. and Sita, the owner of Sita Ltd., got

married. So, they agreed to amalgamate their business. The scheme

envisaged a share capital, equal to the combined capital of Ram Ltd. &

Sita Ltd. for the purpose of acquiring the assets, liabilities and

undertakings of the two companies in exchange for share in Ram & Sita

Ltd.

The Summarized Balance Sheets of Ram Ltd. & Sita Ltd. as on 32nd

Ashadh, 2075 (the date of amalgamation) are given below:

Summarized Balance Sheets as on 32nd Ashadh, 2075

Equity & Liabilities Ram Ltd. Sita Ltd. Assets Ram Ltd. Sita Ltd.

(Rs.) (Rs.) (Rs.) (Rs.)

Shareholders Fund: Non-current Assets:

a. Share Capital 6,00,000 8,40,000 Fixed Assets,

b. Reserves 10,20,000 6,00,000 excluding goodwill 7,20,000 10,80,000

Current Assets:

Current Liabilities: Inventories 3,60,000 6,60,000

Bank Overdraft - 5,40,000 Trade Receivables 4,80,000 7,80,000

Trade Payables 2,40,000 5,40,000 Cash at Bank 3,00,000 -

18,60,000 25,20,000 18,60,000 25,20,000

The consideration was to be based on the net assets of the companies as

shown in the Balance Sheet above, but subject to an additional payment

to Ram Ltd. for its goodwill to be calculated as its weighted average net

profits for the three years ended 32nd Ashadh, 2075.

The profit had been

2072/73 Rs. 3,00,000; 2073/74 Rs. 5,25,000; 2074/75 Rs. 6,30,000.

The shares of Ram & Sita Ltd. were to be issued to Ram Ltd. & Sita Ltd.

at a premium and in proportion to the agreed net assets value of these

companies.

In order to raise working capital, Ram & Sita Ltd. proceeded to issue

72,000 shares of Rs. 10 each at the same rate of premium as issued for

discharging the purchase consideration to Ram Ltd. & Sita Ltd.

You are required to prepare: 20

a) Calculate the number of shares issued to Ram Ltd. & Sita Ltd.

b) Prepare required journal entries in the books of Ram & Sita Ltd.

c) Prepare the Balance Sheet of Ram & Sita Ltd. after recording the

necessary journal entries.

The Institute of Chartered Accountants of Nepal 3

Suggested Answer- December 2018

Solution:1

a) Calculation of number of shares issued to Ram Ltd. & Sita Ltd.

Amount of share capital as per Balance Sheet Rs.

Ram Ltd. 6,00,000

Sita Ltd. 8,40,000

14,40,000

Share of Ram Ltd. = 14,40,000*[21,60,000/(21,60,000+14,40,000) ]

= Rs. 8,64,000 or 86,400 Shares

Securities Premium= 21,60,000 - 8,64,000 = Rs. 12,96,000

Premium per share = 12,96,000/86,400 = Rs. 15 per share

Share of Sita Ltd. = 14,40,000*[14,40,000/(21,60,000+14,40,000) ]

= Rs. 5,76,000 or 57,600 Shares

Securities Premium= 14,40,000-5,76,000= Rs. 8,64,000

Premium per share = 8,64,000/57600= Rs. 15 per share

b) Journal Entries in the books of Ram & Sita Ltd.

i) Business Purchase Account Dr. 36,00,000

To, Liquidator of Ram Ltd. 21,60,000

To, Liquidator of Sita Ltd. 14,40,000

(Being the amount of purchase consideration payable to liquidator of Ram

Ltd. & Sita Ltd. for assets taken over)

ii) Goodwill Account Dr. 5,40,000

Fixed Assets Account Dr. 7,20,000

Inventory Account Dr. 3,60,000

Trade Receivables Account Dr. 4,80,000

Cash at Bank Account Dr. 3,00,000

To, Trade Payables Account 2,40,000

To, Business Purchase Account 21,60,000

(Being assets & liabilities of Ram Ltd. taken over)

iii) Fixed Assets Account Dr. 10,80,000

Inventory Account Dr. 6,60,000

Trade Receivables Account Dr. 7,80,000

To, Trade Payables Account 5,40,000

To, Bank Overdraft Account 5,40,000

To, Business Purchase Account 14,40,000

(Being assets & liabilities of Sita Ltd. taken over)

iv) Liquidator of Ram Ltd. Account Dr. 21,60,000

To, Equity Share Capital Account 8,64,000

To, Securities Premium Account 12,96,000

(Being the allotment of shares as per agreement for discharge of purchase

consideration)

v) Liquidator of Sita Ltd. Account Dr. 14,40,000

To, Equity Share Capital Account 5,76,000

To, Securities Premium Account 8,64,000

The Institute of Chartered Accountants of Nepal 4

Suggested Answer- December 2018

(Being the allotment of shares as per agreement for discharge of purchase

consideration)

vi) Bank Account Dr. 18,00,000

To, Equity Share Capital Account 7,20,000

To, Securities Premium Account 10,80,000

(Being Equity Share Capital raised for working capital )

c) Balance Sheet of Ram & Sita Ltd. as on 32-03-2075 after amalgamation

Equity & Liabilities Amount Assets Amount (Rs.)

(Rs.)

Shareholders Fund Non-current Assets

a. Share Capital 21,60,000 Fixed Assets 18,00,000

b. Securities Premium 32,40,000 Goodwill 5,40,000

Current Assets

Current Liabilities Inventories 10,20,000

Bank Overdraft 5,40,000 Trade Receivables 12,60,000

Trade Payables 7,80,000 Cash at Bank 21,00,000

67,20,000 67,20,000

Working Notes:

1. Calculation of Goodwill of Ram Ltd.

Year Profit Weight Weighted Amount

2072/73 3,00,000 1 3,00,000

2073/74 5,25,000 2 10,50,000

2074/75 6,30,000 3 18,90,000

Total 6 32,40,000

Weighted Average Amount = 32,40,000/6 = 5,40,000

Goodwill = Rs. 5,40,000

2. Calculation of Net Assets

Ram Ltd. Sita Ltd.

Assets

Goodwill 5,40,000 -

Fixed Assets 7,20,000 10,80,000

Inventory 3,60,000 6,60,000

Trade Receivables 4,80,000 7,80,000

Cash at Bank 3,00,000 -

Less: Liabilities

Bank Overdraft - 5,40,000

Trade Payables 2,40,000 5,40,000

Net Assets or Purchase Consideration 21,60,000 14,40,000

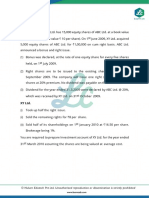

2.

a) From the following particulars, you are required to calculate the

amount of claim for Godawari Ltd., whose business premises was

partly destroyed by fire: 10

Sum insured (from 31st Chaitra, 2073) Rs. 4,00,000

The Institute of Chartered Accountants of Nepal 5

Suggested Answer- December 2018

Period of indemnity 12 months

Date of damage 1st

Baishakh, 2074

Date on which disruption of business ceased 31st Magh,

2074

The subject matter of the policy was gross profit but only net profit

and insured standing charges are included.

The books of account revealed:

i) The gross profit for the financial year 2073 was Rs. 3,60,000.

ii) The actual turnover for financial year 2073 was Rs. 12,00,000

which was also the turnover in this case.

iii) The turnover for the period from 1 st Baishakh to 31st Magh, in

the year preceding the loss, was Rs. 10,00,000.

During dislocation of the position, it was learnt that in Falgun-

Chaitra 2074, there has been an upward trend in business

(compared to the figure of the previous years) and it was stated that

had the loss not occurred, the trading results for 2074 would have

been better than those of the previous years.

The Insurance company official who was appointed to assess the loss

accepted this view and adjustments were made to the pre-damaged

figures to bring them up to the estimated amounts which would have

resulted in 2074.

The pre-damaged figures together with agreed adjustments were:

Period Pre damaged Adjustment to Adjusted Standard

figure be added Turnover

Rs. Rs. Rs.

Baishak 90,000 10,000 1,00,000

Jestha to Magh 9,10,000 50,000 9,60,000

Falgun to Chaitra 2,00,000 10,000 2,10,000

Total 12,00,000 70,000 12,70,000

Gross Profit 3,60,000 46,400 4,06,400

Rate of Gross Profit 30% (actual for 2073), 32% (adjusted for 2074).

Increased cost of working amounted to Rs. 1,80,000.

There was a clause in the policy relating to savings in insured

standard charges during the indemnity period and this amounted to

Rs. 28,000.

Standing Charges not covered by insurance amounted to Rs. 20,000

p.a. The annual turnover for Baishakh was nil and for the period

Jestha to Magh 2074 Rs. 8,00,000.

b) A company issued 1,50,000 shares of Rs. 10 each at a premium of

Rs. 10. The entire issue was underwritten as follows:

X-90,000 shares (firm underwriting 12,000 shares)

Y- 37,500 shares (firm underwriting 4,500 shares)

Z- 22,500 shares (firm underwriting 15,000 shares)

The Institute of Chartered Accountants of Nepal 6

Suggested Answer- December 2018

Total subscriptions received by the company (excluding firm

underwriting and marked applications) were 22,500 shares.

The marked applications (excluding firm underwriting) were as

follows:

X-15,000 shares

Y- 30,000 shares

Z- 7,500 shares

Commission payable to underwriters is at 5% of the issue price. The

underwriting contract provides that credit for unmarked applications

be given to the underwriters in proportion to the shares underwritten

and benefit of firm underwriting is to be given to individual

underwriters.

Required: 10

i) Determine the liability of each underwriter (number of shares)

ii) Compute the amounts payable or due from underwrites; and

iii) Pass Journal Entries in the books of the company relating to

underwriting.

Solution-2(a)

1) Short Sales

Period Adjusted Standard Turnover Actual Turnover Shortage

Rs. Rs. Rs.

Baishak 1,00,000 - 1,00,000

Jestha to Magh 9,60,000 8,00,000 1,60,000

10,60,000 8,00,000 2,60,000

2) Gross profit ratio for the purpose of insurance claim on loss of profit

Gross profit - Insured Standing Charges - Uninsured standing charges = Net profit Or

Net profit +Insured Standing Charges = Gross profit - Uninsured standing charges

= 4,06,400 – 20,000 = 3,86,400

=3,86,400/12,70,000×100%= 30.425%

3) Amount allowable in respect of additional expenses is least of the following

(i) Actual expenses 180,000

(ii) Gross profit on sales during 10 months period =8,00,000×30.425%=243,400

(iii)

Least i.e. 1,71,142 is admissible

The Institute of Chartered Accountants of Nepal 7

Suggested Answer- December 2018

4) Amount of Claim

Particulars Rs.

Gross profit on short sales = 2,60,000× 30.425% 79,105

Add: Amount allowable in respect of additional 1,71,142

expense

2,50,247

Less: Savings in Insured Standing Charges (28,000)

2,22,247

On the amount of final claim, the average clause will not apply since the amount of the

policy Rs.4,00,000 is higher than gross profit on annual adjusted turnover Rs.3,86,400.

Therefore the insurance claim will be Rs.2,22,247

Solution-2(b)

(i) Computation of total liability of underwriters in shares

(in shares)

X Y Z Total

Gross liability 90,000 37,500 22,500 1,50,000

Less: Marked applications

(excluding firm underwriting ) (15,000) (30,000) (7,500) (52,500)

75,000 7,500 15,000 97,5000

Less: Unmarked applications

in the ratio of gross liabilities

of 12:5:3 (excluding firm

underwriting ) (13,500) (5,625) (3,375) (22,500)

Less: Firm underwriting 61,500 1,875 11,625 75,000

(12,000) (4,500) (15,000) (31,500)

Less: Surplus of Y and Z 49,500 (2,625) (3,375) 43,500

adjusted in X's balance

(2,625+3,375) (6,000) 2,625 3,375 00

Net liability 43,500 - - 43,500

Add: Firm underwriting 12,000 4,500 15,000 31,500

Total liability 55,500 4,500 15,000 75,000

(ii) Calculation of amount payable to or due from underwriters

X Y Z Total

Total Liability in shares 55,500 4,500 15,000 75,000

Amount receivable @ Rs 20

from Underwriter (in Rs) 11,10,000 90,000 3,00,000 15,00,000

Less: Underwriting

Commission Payable @ 5% of (90,000) (37,500) (22,500) (1,50,000)

Rs 20 (in Rs)

Net amount receivable (in Rs)

10,20,000 52,500 2,77,500 13,50,000

The Institute of Chartered Accountants of Nepal 8

Suggested Answer- December 2018

(iii) Journal Entries in the books of the company (relating to underwriting)

Rs Rs

1 X Dr. 11,10,000

Y Dr. 90,000

Z Dr. 3,00,000

To Share capital A/c 7,50,000

To Securities Premium A/c 7,50,000

(Being allotment of shares to

underwriters)

2 Underwriting commission A/c Dr. 1,50,000

To X 90,000

To Y 37,500

To Z 22,500

(Being amount of underwriting

commission payable)

3 Bank A/c Dr. 13,50,000

To X 10,20,000

To Y 52,500

To Z 2,77,500

(Being net amount received by

underwriting for shares allotted less

underwriting commission)

3.

a) The Balance Sheets of X Co. Ltd. and Y Co. Ltd. as on 31st Chaitra,

2074 are as follows:

Balance sheet of X Co. Ltd.

Liabilities Rs. Assets Rs.

Share Capital: Fixed Assets:

Authorised Capital: Goodwill 80,000

10,000 shares of Other 8,00,000 8,80,000

Rs. 100 each 10,00,000 Current Assets,

Loans and Advances 9,00,000

Issued Capital:

10,000 shares of Rs.100 each

fully paid 10,00,000

Reserves and Surplus:

Capital Reserve 2,00,000

General Reserve 70,000 2,70,000

Unsecured Loans 2,00,000

Current Liabilities and

Provisions :

Sundry Creditors 3,10,000

17,80,000 17,80,000

The Institute of Chartered Accountants of Nepal 9

Suggested Answer- December 2018

Balance sheet of Y Co. Ltd.

Liabilities Rs. Assets Rs.

Share Capital: Fixed Assets: 16,00,000

Authorised Capital: Current Assets, Loans

2,00,000 share of Rs.10 and Advances:

each 20,00,000 Bank 2,00,000

Other 6,60,000 8,60,000

Issued Capital:

80,000 shares of Rs.10

each fully paid 8,00,000

Reserves and Surplus:

General Reserve 8,00,000

Secured Loans 5,00,000

Current Liabilities and

Provisions:

Sundry Creditors 3,60,000

24,60,000 24,60,000

It was proposed that X Co. Ltd. should be taken over by Y Co. Ltd.

The following arrangement was accepted by both the companies:

a. Goodwill of X Co. Ltd. is considered valueless.

b. Arrears of depreciation in X Co. Ltd. amounted to Rs. 40,000.

c. The holder of every 2 shares in X Co. Ltd. was to receive:

(i) as fully paid at per 10 shares in Y Co. Ltd. and

(ii) so much cash as in necessary to adjust the rights of

shareholders of both the companies in accordance with the

intrinsic value of the shares as per their balance sheets

subjects to necessary adjustments with regards to goodwill

and depreciation in X Co. Ltd.‘s Balance Sheet.

You are required to: 10

(a) Determine the composition of purchase consideration; and

(b) Show the Balance Sheet after absorption.

b) How will you disclose following items while preparing Cash Flow

Statement of Thapathali Ltd. as per Nepal accounting standard for

the year ended 32nd Ashadh 2075? 5

(i) 10% Debentures issued As on 1.4.2074 Rs. 110,000

As on 32.3.2075 Rs. 77,000

(ii) Debentures were redeemed at 5% premium at the end of the

year. Premium was charged to the profit & Loss account for

the year.

(iii) Unpaid interest on debentures As on 1.4.2074 Rs. 275

As on 32.3.2075 Rs. 1,175

(iv) Debtors of Rs. 36,000 were written off against the provision

for doubtful debts account during the year.

(v) Investment in 10% Bonds As on 1.4.2074 Rs. 350,000

As on 32.3.2075 Rs. 350,000

(vi) Accrued interest on investments As on 32.3.2075 Rs. 10,500

The Institute of Chartered Accountants of Nepal 10

Suggested Answer- December 2018

Solution-3(a)

a)

(a)Computation and Composition of Purchase Consideration

(i) Valuation of shares of X Co. Ltd. Rs.

Share Capital 10,0,000

Capital Reserve 2,00,000

General Reserve 70,000

12,70,000

Less: Goodwill,being valueless 80,000

Arrear of Depreciation 40,000 1,20,000

Value of Net Assets 11,50,000

No. of Shares 10,000

Intrinsic value per share Rs.115

(ii) Valuation of Shares of Y Co. Ltd.

Share Capital 8,00,000

General Reserve 8,00,000

16,00,000

No. of Shares 80,000

Value per share Rs. 20

On the basis of intrinsic values, every holder of two shares in X Co. Ltd. will

receive 10 shares in Y Co. Ltd. plus cash for the balance. The intrinsic value of the

two shares in X Co. Ltd. is Rs. 230 and that of 10 shares in Y Co. Ltd. is Rs.200 .

Therefore, for each lot of two shares in X Co. Ltd. , a shareholder will receive

Rs.30 in cash (Rs.230-200).

Y Co . Ltd. will therefore satisfy the purchase considerations as follows:

50,000 Shares of Rs.10 each issued at Rs. 20 each

10,00,000

Cash

1,50,000

11,50,000

(b)

Y Co. Ltd.(after absorption)

BALANCE SHEET

as on 31st Chaitra, 2074

Liabilities Rs. Liabilities Rs.

Share Capital: Fixed Assets 16,00,000

Authorised Addition on acquisition

2,00,000 shares of 7,60,000 23,60,000

Rs.10 each 20,00,000

Investment -

Issued and Subscribed Current Assets,Loans 15,60,000

1,30,000 Shares of &Advances

Rs.10 each fully paid Cash at Bank 50,000

(Issued for

The Institute of Chartered Accountants of Nepal 11

Suggested Answer- December 2018

consideration other

than cash:50,000

Shares of Rs.10 each

fully paid ) 13,00,000

Reserve and Surplus :

Share Premium 5,00,000

General Reserve 8,00,000

Secured Loans 5,00,000

Unsecured Loans 2,00,000

Current Liabilities &

Provisions :

Sundry Creditors 6,70,000

39,70,000 39,70,000

Solution-3(b)

Cash flow statement of Thapathali Ltd. for the year ended 32nd Ashad 2075

A Cash flow from operating activities

Net profit as per Profit & Loss a/c --------

Add: Premium on redemption of debentures 1,650

Add: interest on 10% debentures 11,000

Less: interest on 10% investments (35,000)

B Cash flow from investing activities

Interest on investments (35,000 – 10,500) 24,500

C Cash flow from financing activities

Interest on debentures paid [11,000 – (1,175-275)] (10,100)

Redemption of debentures [(110,000-77000) at 5% premium] (34,650)

Writing of debtors against provision for bad debt:

It will not be included in cash flow statement

4.

a) You are the Financial Accountant for Kathmandu Ltd., a company

that manufactures household furniture. Kathmandu Ltd. has

experienced both a reduction in sales revenue and cash flow during

the last financial period. You are provided with the following

information regarding Kathmandu Ltd. for the years 2072/73 and

2073/74:

Statement of Profit or Loss 2072/73 2073/74

(Rs.'000) (Rs.'000)

Revenue 500 700

Cost of sales (300) (350)

Gross profit 200 350

Operating expenses (75) (140)

Operating profit 125 210

Interest on debentures (30) (50)

Profit before tax 95 160

Tax (12) (20)

The Institute of Chartered Accountants of Nepal 12

Suggested Answer- December 2018

Profit after tax 83 140

Statement of Financial Position

Ashadh End 2073 Ashadh End 2074

Non-Current Assets: (Rs.'000) (Rs.'000)

Property, Plant and Equipment 1,160 1,200

Intangible assets 650 400

1,810 1,600

Current Assets:

Inventory 41 39

Trade Receivables 69 67

Bank - 150

110 256

Total Assets 1,920 1,856

Equity & Liabilities:

Issued Share Capital 800 800

Retained Earnings 612 529

1,412 1,329

Non-Current Liabilities:

10% Debenture 300 500

Current Liabilities:

Bank Overdraft 171 -

Trade Payables 37 27

508 527

1,920 1,856

Required: 10

Calculate the following ratios for both years:

i) Operating profit margin

ii) Current ratio

iii) Acid test ratio

iv) Inventory days

v) Receivable days

vi) Payable days

vii) Return on capital employed

viii) Gearing Ratio

b) Following is the information related to loan loss provisions (LLP) of

Big Bank Ltd. as on 32.03.2075.

Classification LLP (in lakhs)

Pass loan 2,500

Watchlist 500

Re-scheduled 350

Sub-standard 150

Doubtful 400

Bad 1,000

Sub-standard loan is fully insured with DCG Fund. Find out the level

of Non Performing Loan (NPL) as on 32.03.2075 of the bank. 5

The Institute of Chartered Accountants of Nepal 13

Suggested Answer- December 2018

Solution-4(a)

i) Operating Profit Margin 125/500*100=25%

210/700*100=30%

=Operating Profit/Sales*100

ii) Current Ratio 110:208= 0.53:1 256:27=9.48:1

=Current Assets: Current Liabilities

iii) Acid Test Ratio (110-41):208=0.33:1 (256-

39):27=8.04:1

=(Current Assets-Inventories): Liabilities

iv) Inventory Days 41/300*365= 50 Days 39/350*365= 41

Days

Inventory/Cost of Sales*365 Days

v) Receivable Days 69/500*365= 50 Days 67/700*365=35

Days

Receivable/Revenue*365 Days

vi) Payable Days 37/300*365= 45 Days 27/350*365=28

Days

Payable/Revenue*365 Days

vii) Return on capital employed 125/1712*100=7.3%

210/1829*100=11.48

=Operating Profit/(Total Assets-Current Liabilities)

viii) Gearing Ratio 300/1712*100=17.52%

500/1829*100=27.34%

or

Debt Equity Ratio

= Long term liabilities/(Total Assets- Current Liabilities)

Solution-4(b)

Statement of calculation of NPA as on 31.03.2075.

(Amount in Lakhs)

Classification LLP LLP rate Loan amount

Pass loan 2,500 1% 250,000

Watchlist 500 5% 10,000

Re-scheduled 350 12.50% 2,800

6.25%(insured so 25% only required) 2,400

Sub standard 150

Doubtful 400 50% 800

Bad 1,000 100% 1,000

The Institute of Chartered Accountants of Nepal 14

Suggested Answer- December 2018

Total 267,000

NPA 7,000

NPA% 2.62

5.

a) Tinkune Ltd.‘s head office building is the only building it owns.

Using professional valuers, it revalued the building on 1st Shrawan

2074, at Rs. 21,00,000. Tinkune Ltd. has adopted a

revaluation policy for buildings from this valuation date and has

decided that the original useful life of buildings has not changed as a

result of the revaluation. The building was acquired on 1st Shrawan

2064. The cost of the building on acquisition was Rs. 25,00,000 and

the accumulated depreciation to the Ashadh end, 2074 amounted to

Rs. 5,00,000. The depreciation up to 1st Shrawan 2074 was

depreciated evenly since acquisition. The professional valuer

believes that the residual value on the building would be Rs.

6,00,000 at the end of its useful life.

Required: 5

Calculate the depreciation amount of the building for the year ended

32nd Ashadh 2075 based on the information provided in the above

scenario.

b) A machine having expected useful life of 6 years is leased for 4

years. Both the cost and fair value of the machinery are Rs.

17,00,000. The amount will be paid in 4 equal installments and at the

termination of lease, lessor will get back the machinery. The

unguaranteed residual value at the end of the 4th year is Rs.

1,70,000. The IRR of investment is 10%. The present value of

annuity factor of Rs. 1 due at the end of 4th year at 10% IRR is 3.169.

The present value of Rs. 1 due at the end of 4th year at 10% rate of

interest is 0.683.

State with reason on the basis of your calculation, whether the lease

constitutes finance lease or not. 5

c) Rahul Trading gives the following information relating to items

forming part of inventory as on 32-3-2075. His factory produces

Product X using Raw material A.

i) 600 units of Raw material A (Produce @ Rs. 120). Replacement

cost of raw material A as on 32-3-2075 is Rs. 90 per unit.

ii) 500 units of partly finished goods in the process of producing X

and cost incurred till date Rs. 260 per unit. These units can be

finished next year by incurring additional cost of Rs. 60 per unit.

iii) 1500 units of finished product X and total cost incurred Rs. 320

per unit. Expected selling price of Product X is Rs. 300 per

unit.

Determine how each item of inventory will be valued as on 32-3-

2075. Also calculate the value of total inventory as on 32-3-2075. 5

Solution-5(a)

The depreciation amount is as follow:

To calculate the new depreciation amount, we use the following depreciation formula.

The Institute of Chartered Accountants of Nepal 15

Suggested Answer- December 2018

Revalued cost of asset-residual value 21,00,000-6,00,000

Expected useful life of asset 40 Years

Depreciation per year 37,500

Working Note 1

Building-original cost 25,00,000

Building- Accumulated Depreciation 5,00,000

Accumulated Depreciation/Cost= 20%

Building has been depreciated by 20 % over 10 years, so annual rate of depreciation has

been 2 % i.e. 20%/10 years, as asset has been depreciated evenly since acquisition.

Therefore, the original useful life is 50 years and the remaining useful life is 40 years.

Solution-5(b)

As per NAS 17 on "Leases", one of the situations that individually or in combination

would normally lead to a lease being classified as a finance lease is that if at the

inception of the lease the present value of the minimum lease payment amounts to at

least substantially all of the fair value of the leased asset.

Determination of nature of lease Rs.

Fair value of asset is Rs. 17,00,000 and unguaranteed residual value is Rs.1,70,000

Present value of residual value at the end of 4th year =1,70,000*0.683 =1,16,110

Present value of lease payment recoverable = 17,00,000–1,16,110 =15,83,890

The percentage of present value of lease payment to

fair value of the asset is =(15,83,890/17,00,000)*100% =93.17%

Since the present value of minimum lease payment substantially cover the major

portion of fair value of leased assets and life of the asset, the lease transaction meets the

definition of finance lease as per NAS -17. Hence, it constitutes a finance lease.

Solution-5(c)

As per NAS 2 ‗ Inventories‘ are valued at lower of cost and net realizable value.

Materials and other supplies held for use in the production of inventories are not written

down below cost if the finished products in which the will be incorporated are expected

to be sold at cost or above cost. However, when there has been a decline in the price of

materials and it is estimated that the cost of the finished products will exceed net

realizable value, the materials are written down to net realizable value. In such

circumstances, the replacement cost of the materials may be the best available measure

of their net realizable value. In the given case, selling price of product X is Rs. 300 and

total cost per unit for production is Rs.320.

Hence the valuation will be done as under:

i) 600 units of raw material will be written down to replacement cost as market value

of finished product is less than its cost, hence value at Rs. 90 per unit.

ii) 500 units of partly finished goods will be valued at 240 per unit i.e. lower of cost

Rs. 320 (Rs. 260+ additional cost Rs. 60) or Net estimated selling price Rs. 240(

Estimated selling price Rs. 300 per unit less additional cost of Rs. 60)

iii) 1500 units of finished product X will be valued at NRV of Rs. 300 per unit since it

is lower than cost Rs. 320 of product X.

The Institute of Chartered Accountants of Nepal 16

Suggested Answer- December 2018

Valuation of Total Inventory as on 32-03-2075

Units Cost NRV/ Value=units x cost or

(Rs.) Replacement NRV whichever is

cost less(Rs.)

Raw material A 600 120 90 54,000

Partly finished goods 500 260 240 1,20,000

Finished goof X 1,500 320 300 4,50,000

Value of inventory 6,24,000

6. Write short notes on: (5×3=15)

a) Unexpired Risk Reserve

b) Financial Instrument

c) Receipt and Expenditure Account

d) Debt Service Coverage Ratio

e) Elements of Financial Statements

Solution-6

a) Unexpired Risk Reserve

As per rule 15 of the Insurance Regulation 2049, every Insurer operating Non Life

Insurance Business shall transfer an amount not less than fifty percent of the Net

Insurance Premium show in Revenue Account to the ―Unexpired Risk Reserve"

account. Such amount shall be allocated for every category of Insurance the Insurer

operating. e.g. An insurer operating Non Life Insurance Business and accepting risk

for Fire Insurance, Marine Insurance, Motor Insurance and Aviation Insurance, then

the insurer shall maintain the Unexpired Risk Reserve For each of the fire, marine

motor and aviation insurance.

Such Unexpired Risk Reserve shall be recognized as income in next year except the

Unexpired Risk Reserve maintained for Maine Insurance. In case of Marine

Insurance, Unexpired Risk Reserve maintained for it shall not be recognized as

income for at least three years.

b) Financial Instrument

Financial instrument is any contract that gives rise to a financial asset to one entity

and a financial liability or equity instrument to another entity. Hence, financial

instruments include financial assets, financial liability and equity instrument. This

means that financial assets of one entity shall be financial liabilities or equity

instruments of another entity and financial liabilities or equity instrument of one

entity shall be financial assets of another entity. For example, bond, debenture or

bank loan is financial liabilities of entity issuing such bond or debenture or raising

loan and it is financial assets for holder of debenture or bond holder or provider of

loan. Similarly, share capital is equity instrument for share issuing entity and it is

financial assets of holder of equity.

c) Receipt and Expenditure Account

Receipt and Expenditure Account also can be taken as part of Financial Statements.

Some non-profit making organization like professional firms, educational institutes

etc. prefers to prepare Receipts and Expenditure account instead of Income and

Expenditure account as part of Financial Statements. Such an account includes all

expenses on accrual basis but incomes are recorded on cash basis. In other words, to

The Institute of Chartered Accountants of Nepal 17

Suggested Answer- December 2018

find out the result, all outstanding expenses are taken into account but the incomes

that are outstanding are not considered. The main reason behind this kind of

practice is that professionals consider it imprudent and risky to recognize the

outstanding incomes.

d) Debt Service Coverage Ratio

The ratio is a key financial ratio for the lenders.

Debt servicing means timely payment of principal amount of instalments plus

interest.

Borrower should be able to service the debt out of the profits. Profit means the

profit available for debt servicing.

This ratio is calculated as:

Profit available for Debt Servicing

Loan instalments +Interest

This ratio normally should be 1.33 but a higher coverage is of advantage to the

business as it improves its strength to service the debts promptly

e) Elements of Financial Statements

The framework classifies items of financial statements can be classified in five

broad groups depending on their economic characteristics: Asset, Liability,

Equity, Income/Gain and Expense/Loss.

Assets Resource controlled by the enterprise as a result of past events

from which future economic benefits are expected to flow to

the enterprise

Liability Present obligation of the enterprise arising from past events,

the settlement of which is expected to result in an outflow of a

resource embodying economic benefits.

Equity Residual interest in the assets of an enterprise after deducting

all its liabilities.

Income/Gain Increase in economic benefits during the accounting period

in the form of inflows or enhancement of assets or decreases

in liabilities that result in increase in equity other than those

relating to contributions from equity participants

Expenses/Loss Decrease in economic benefits during the accounting period

in the form of outflows or depletions of assets or incurrence

of liabilities that result in decrease in equity other than those

relating to distributions to equity participants.

The Institute of Chartered Accountants of Nepal 18

Suggested Answer- December 2018

Specific Comments on the performance of the students

Batch: - December 2018

Level: - CAP-II

Subject: Advanced Accounting

Question No. 1

Many students failed to exactly calculate no. of shares to be issued. Seems to lack of

proper conceptual knowledge in amalgamation problems.

Question No. 2

(a) Students lack proper understanding in determining short sales and the amount of

claim. None of the student solved this problem accurately.

(b) No clear concepts were found in Journal entries.

Question No. 3

(a) Calculation of purchase consideration and its settlement was not done well by

majority of students. Most of the students failed in computing intrinsic value per

shares and amount of PC.

(b) Students did not understand to present the items in the CFS. Further students lack

proper knowledge in journal entries and Balance sheet.

Question No. 4

(a) Calculation of ROCE and Gearing ratio is not done well by majority of students.

Almost all students could not be able to compute Receivable days, Payable days.

(b) Students are not well aware of calculation of NPA. Almost all students could not

find out loan amount given the LLP rate.

Question No. 5

(a) Calculation of original useful life is done well by students.

(b) Students did not understand to calculate the PV of leased asset.

(c) Major students fail to calculate value of WIP and in some cases RM.

Question No. 6

(a) Lack of concept of Insurance business.

(b) Some of the students did not understand the term FI.

(c) Students are confused with R & P A/c.

(d) Lack of concept of Debt service coverage ratio.

The Institute of Chartered Accountants of Nepal 19

Suggested Answer- December 2018

Paper 2:

Audit & Assurance

The Institute of Chartered Accountants of Nepal 20

Suggested Answer- December 2018

Audit & Assurance

Suggested

Roll No……………. Maximum Marks - 100

Total No. of Questions- 7 Total No. of Printed Pages- 10

Time Allowed - 3 Hours

Marks

Attempt all questions.

1. As an auditor, give your opinion with explanations on the following cases: (45=20)

a) Haribhakti Sugar Mills Limited is closed from last 11 months due to

outdated technology and has no sales as old technology produces inferior

products. The company will take minimum 2 years' time with substantial

modification of technology to restart production and make sales. Cost is very

substantial for upgrading technology. Due to factory closure, company

defaults in loan repayment and bank has issued notice for auction if loan is

not repaid within 3 months' time. Management is doubtful that funding can

be arranged.

CFO is of view that financial statement shall be prepared in going concern

basis as there is little hope that funding will be received.

b) The annual general meeting of Nepal Hydropower Limited failed to appoint

the auditor for the fiscal year 2074/75 due to time constraint and delegated

power to the board under the terms recommended by the audit committee.

The board of directors appoints M/s ABC & Co., Chartered Accountants as

auditor. Do you think the appointment is valid?

c) The total assets of Rs. 250 million of Y & Z Limited includes inventory

amounting to Rs. 50 million. The inventories were valued at cost. The

market price of the inventories was Rs. 42 million. The company has

disclosed this fact in the notes to accounts.

d) A Co. Ltd. has not included in the Balance Sheet as on 32-03-2075 a sum of

Rs. 1,500,000 being amount in the arrears of salaries and wages payable to

the staff for the last 2 years because the negotiations were going since last 18

months which concluded on 30-04-2075. The auditor wants to sign the said

financial statement and give the audit report on 31-05-2075. The auditor

came to know the result of the negotiations on 15-05-2075.

Answer:

a) As per NAS 1, an entity shall prepare its financial statements on a going concern

basis unless management intends to liquidate the entity or to cease trading, or that it

has no realistic alternative but to do so. When preparing Financial Statements,

management shall make an assessment of an entity's ability to continue as a going

concern. In making assessment, management is aware of material uncertainties

related to events or conditions that may cast significant doubt upon the entity's

ability to continue as a going concern, the entity shall disclose those uncertainties.

When financial statements are not prepared on going concern basis, It shall disclose

the fact, together with the basis on which it prepared the Financial Statements and

the reasons of doing so.

The Institute of Chartered Accountants of Nepal 21

Suggested Answer- December 2018

NSA 570 ―Going Concern‖ requires that the auditor shall consider whether there are

events or conditions that may cast significant doubt on the entity‘s ability to

continue as a going concern. In the given case, entity's inability to operate the

business for more than 11 months' time and significant doubt on availability of the

fund is one such example. If the financial statements have been prepared on a going

concern basis but, in the auditor‘s judgment, management‘s use of the going

concern assumption in the financial statements is inappropriate, the auditor shall

express a modified opinion.

In the given case, as there is significant doubt that entity will be operational and

going concern assumptions is questionable. The auditor shall evaluate the data on

which basis the management has made assessment and come to the conclusion of

the appropriateness of use of going concern assumption. Based on evaluation, the

auditor should form an appropriate opinion of the Financial Statements.

b) According to Section 110 of the Companies Act 2063, every company shall appoint

auditor under the act to have its accounts audited. As per the Section 111, the

general meeting shall appoint the auditor of the company from the amongst the

auditors licensed to carry out audit under the prevailing laws subject to Chapter 18

of the act in case of a public limited company. The act also provides that the board

of directors may appoint the auditor prior to holding first annual general meeting.

There is no any provision to delegate the authority to anyone for appointment of an

auditor. In the case of a public limited company the annual general meeting has

authority to appoint the auditor under the terms and conditions as recommended by

the Audit Committee as per Section 165 of the act.

As per section 113 of the act, in case of failure to appoint an auditor in the general

meeting of the company for any reason or where annual general meeting cannot be

held, the auditor is appointed by the Company Registrar‘s Office at the request of

the board of directors of the company.

Hence, the companies Act does not have any provision of delegating power of the

appointment of the auditor and no one can appoint auditor except the annual general

meeting and Company Register's Office in case of failure to appoint the auditors by

the AGM.

In the above context, the appointment of M/s ABC & Co., Chartered Accountants

by the board of Nepal Hydropower Limited is not valid. The Company Register's

Office can only appoint the auditor at the request of board of directors where annual

general meeting fails to appoint auditor.

c) As per Nepal Accounting Standards (NAS) 2, Inventories should be measured at

lower of cost and net realizable value. In the present case the cost price of the

inventories is Rs. 50 million and net realizable value is Rs. 42 million and hence the

inventories should be presented at Rs. 42 million in the balance sheet. However, the

company has presented the inventories at Rs. 50 million and disclosed in the notes

to accounts that the inventories have been presented at cost although its net

realizable value is lower than the cost. Mere disclosure of this fact in the notes

however does not result into compliance with the accounting standard.

Hence as an auditor, I will qualify my audit report because inventory in the present

case represents material item of the assets of the company and it has been materially

misstated in the balance sheet.

The Institute of Chartered Accountants of Nepal 22

Suggested Answer- December 2018

d) As per NAS 10 ―Events after the reporting period‖, adjustments to assets and

liabilities are required for events after the reporting date that provide additional

information materially affecting the determination of the amounts relating to

conditions existing at the reporting date. Similarly as per NAS 37 "Provisions,

Contingent liabilities and Contingent Assets", future events that may affect the

amount required to settle an obligation should be reflected in the amount of a

provision where there is sufficient objective evidence that will occur.

The amount of Rs 1,500,000 is a material amount and it is the result of an event,

which has occurred after the reporting date. The facts have become known to the

auditor before the date of issue of the Audit Report and Financial Statements. The

auditor has to perform the procedure to obtain sufficient, appropriate evidence about

the events occuring from the date of the financial statements i.e. 32-3-2075 to the

date of Auditors Report i.e. 31-05-2075. It is observed that as a result of long

pending negotiations a sum of Rs. 1,500,000 representing arrears of salaries of last

two years have not been included in the financial statements. It is quite clear that the

obligation requires provision for outstanding expenses. So the auditor should

request the management to adjust the sum of Rs. 1,500,000 by making provision for

expenses. If the management does not accept the request the auditor should qualify

the audit report.

2. Give your comments on the following cases: (45=20)

a) Mr. A, an auditor of Cold Drink Company has obtained trade secret formula

during audit process. A Case was lodged against Cold Drink Company for

putting non-edible components in the drink. Subsequently, auditor was

called by Supreme Court to provide documents and his knowing in the

formulae. He shared the information he has received on formula of Cold

Drink Company. Mr. B, lodged complaints to ICAN that, Mr. A has violated

Code of Ethics on the ground of breach of confidentiality.

b) National Company Limited had definite plan of its business being closed

within a short period from the close of the accounting year ended on

32ndAshadh, 2075. The Financial Statements for the year ended 32ndAshadh,

2075 had been prepared on the same basis as it had been in earlier periods

with an additional note that the business of the Company shall cease in near

future and the assets shall be disposed off in accordance with a plan of

disposal as decided by the management. The Statutory Auditors of the

Company indicated this aspect in "Key Audit Matters" only by a reference as

to a possible cessation of business and making of adjustments, if any, thereto

to be made at the time of cessation only. Comment on the reporting by the

Statutory Auditor as above.

c) Mr. Ajay, a practicing Chartered Accountant receives commission from Mr.

Sanjay, another practicing Chartered Accountant Rs. 175,000 being 25% of

the audit fee for the referral of statutory audit of company limited, a listed

company.

d) You are the auditor of Special Mart Ltd. for FY 2074/75. Your audit team

has approached to you on how to judge whether the particular risk is

significant or not. As a principal auditor how do you guide your audit team?

The Institute of Chartered Accountants of Nepal 23

Suggested Answer- December 2018

Answer:

a) Section 140.1 of Code of Ethics of ICAN, specifies about the Confidentiality to be

observed by members and professional accountants. The principle of confidentiality

imposes an obligation on all professional accountants to refrain from: (a) Disclosing

outside the firm or employing organization confidential information acquired as a

result of professional and business relationships without proper and specific

authority or unless there is a legal or professional right or duty to disclose; and (b)

Using confidential information acquired as a result of professional and business

relationships to their personal advantage or the advantage of third parties.

However, section 140.07, outlines circumstances where professional accountants is

required to disclose confidential information or when such disclosure is appropriate

and once such circumstances arise as required by law, for example i.e production of

documents or other provision of evidence in the course of legal proceedings.

Hence, in given case, complaint of Mr. B is not valid, as Mr. A has well followed

the code of Ethics and release confidential information on trade secret only upon

order of supreme court and such release of trade secret is allowed by Ethical Code

of ICAN and cannot be construed as release of confidential information by

breaching Ethical Code of ICAN for professional accountants.

b) As per NSA 570 ―Going Concern‖, management intentions to liquidate the entity or

to cease operations is one of the event or condition that may cast significant doubt

on the entity‘s ability to continue as going concern. If events or conditions have

been identified that may cast significant doubt on the entity‘s ability to continue as a

going concern but, based on the audit evidence obtained the auditor concludes that

no material uncertainty exists, the auditor shall evaluate whether, in view of the

requirements of the applicable financial reporting framework, the financial

statements provide adequate disclosures about these events or conditions

Further, as per NSA 701 ―Communicating Key Audit Matters in the Independent

Auditor‘s Report‖, when matters relating to going concern may be determined to be

key audit matters, and explains that a material uncertainty related to events or

conditions that may cast significant doubt on the entity‘s ability to continue as a

going concern is, by its nature, a key audit matter. NSA 701 also emphasizes on

auditor‘s responsibility to communicate key audit matters in the auditor‘s report.

As per the facts given in the case, intention of the National Company Limited had

definite plan of its business being closed down within short period from 32ndAshad,

2075. However, financial statements for the year ended 32ndAshad, 2075 had been

prepared on the same basis as it had been in earlier periods with an additional note.

Thus, management intentions to liquidate the entity or to cease operations is one of

the event or condition that may cast significant doubt on the entity‘s ability to

continue as going concern is a key audit matter. Therefore, the auditor is required to

communicate the Key Audit Matters in accordance with NSA 570 in above stated

manner. Simple reference as to a possible cessation of business and making of

adjustments, if any, be made at the time of cessation only by the auditor in his report

is not sufficient.

c) Section 240.5 of Code of Ethics of ICAN, accepting certain a referral fee or

commission creates a self-interest threat to objectivity and professional competence

and due care. According to Code of Ethics issued by ICAN, the payment or receipt

The Institute of Chartered Accountants of Nepal 24

Suggested Answer- December 2018

of commission by a professional accountant in public practice could impair

objectivity and independence. A professional accountant in public practice should

not therefore pay a commission to obtain a client nor should a commission be

accepted for referral of a client to a third party. The payment and receipt of

commission are permitted only for such engagements for which independence is not

required and the professional accountant in practice should nonetheless disclose the

facts to the client.

In the above case since the above assignments requires independence, Mr. Ajay and

Mr. Sanjay both are not complying with ethical requirements under Code of Ethics

issued by ICAN. The disciplinary action can be taken against Mr. Ajay and Mr.

Sanjay.

d) As per NSA 315 (Identifying and Assessing the Risks of Material Misstatement

through Understanding the Entity and Its Environment), in exercising judgment as

to which risks are significant risks, the auditor shall consider at least the following:

Whether the risk is a risk of fraud;

Whether the risk is related to recent significant economic, accounting or other

developments and, therefore, requires specific attention;

The complexity of transactions;

Whether the risk involves significant transactions with related parties;

The degree of subjectivity in the measurement of financial information related to

the risk, especially those measurements involving a wide range of measurement

uncertainty; and

Whether the risk involves significant transactions that are outside the normal

course of business for the entity, or that otherwise appear to be unusual. (Ref:

Para. A141–A145)

In the light of the aforesaid provision of NSA 315, I will guide my audit team to

ensure the risk identified by them are significant risk or otherwise.

3. Answer the following: (35=15)

a) In the light of NSA 315, explain understanding the entity and its

environment.

b) ―The auditor shall exercise professional judgment in planning and

performing an audit of financial statements‖. Comment.

c) What are the assertions with which an auditor is concerned with while

obtaining audit evidence from substantive procedures?

Answer:

a) The auditor‘s understanding of the entity and its environment consists of an

understanding of the following aspects:

Industry, regulatory, and other external factors, including the applicable financial

reporting framework.

Nature of the entity, including the entity‘s selection and application of accounting

policies.

Objectives and strategies and the related business risks that may result in a

material misstatement of the financial statements.

Measurement and review of the entity‘s financial performance.

The Institute of Chartered Accountants of Nepal 25

Suggested Answer- December 2018

Internal control.

b) Nepal Standard on Auditing 300 (Planning an audit of financial statements) stated

that the manner in which the auditor emphasizes to engagement team members

the need to maintain a questioning mind and to exercise professional skepticism

in gathering and evaluating audit evidence.

Professional Judgment is the application of relevant training, knowledge and

experience, within the context provided by auditing, accounting and ethical

standards, in making informed decisions about the courses of action that are

appropriate in the circumstances of the audit engagement. That the auditor shall

exercise professional judgment in planning and performing an audit of financial

statements. Exercise of professional judgment depends on facts & circumstances

known to the auditor. It is to be exercised throughout the audit and to be

appropriately documented. It is important when deciding about:

Materiality & audit risk.

Nature, time and extent of audit procedures.

Evaluating sufficiency & appropriateness of audit procedures.

Evaluating management judgment in applying applicable Financial Reporting

Framework.

Drawing conclusions based on audit evidence.

c) Nepal Standard on Auditing 500 (Audit Evidence) prescribes audit procedures for

obtaining audit evidences. Accordingly an auditor is concerned with following

assertions while obtaining audit evidences from substantive procedures:

Existence: That an asset or liability exists at a given date.

Rights and obligations: That an asset is a right of the concern and a liability is

an obligation at a given date.

Occurrence: That a transaction or event which took place pertains to the entity

during the relevant period.

Completeness: That there are no unrecorded assets, liabilities or transaction.

Valuation: That an asset or liability is recorded at an appropriate carrying value.

Measurement: That a transaction is recorded in the proper amount and revenue

or expense is allocated to the proper period.

Presentation and disclosure: That an item is disclosed classified and described in

accordance with recognized accounting policies and practices and relevant

statutory

4. Answer/Comment on the following: (35=15)

a) Significant Familiarity and self-interest threats are noted due to using of

same senior personnel on an audit engagement over a long period of time.

What are the safeguards to be applied to eliminate such threats or reduce

them to an acceptable level?

b) Explain situation resulting in threat to objectivity and threat to fundamental

principles arising from conflict of interest with examples.

c) During the fiscal year 2073/74 ABC & Co., Chartered Accountants, a

proprietor Firm have done the following Statutory Audits.

The Institute of Chartered Accountants of Nepal 26

Suggested Answer- December 2018

Listed Company: 3

Limited Company: 10

Private Limited Company: 75

INGOs: 5

In the fiscal year 2074/75, one existing listed company did not continue as

auditor and other two companies has approached to the firm to appoint as

auditor. In addition, 2 other limited company and 2 NGOs approached to the

firm for the audit of FY 2074/75.

Answer:

a) Section 290.148 of ICAN Code of Ethics deals with this matter. The significance of

threat depends on time duration the individual has been a member of audit team,

role given to her/him, structure of Firm, nature of audit engagement, whether the

entity's management team is same or changed and the nature or complexity of the

Client's accounting and reporting issues. Accordingly, the safeguards to be applied

to eliminate such threats or reduce them to an acceptable level are:

Rotating the senior personnel off the audit team;

Having a professional accountant who was not a member of the audit team

review the work of the senior personnel; or

Regular independent internal or external quality reviews of the engagement.

b) Section 220.1 of ICAN Code of Ethics deals with this matter. A professional

accountant in public practice may be faced with a conflict of interest when

performing a professional service. A conflict of interest creates a threat to

objectivity and may create threats to the other fundamental principles. Such threats may

be created when:

i. The professional accountant provides a professional service related to a

particular matter for two or more clients whose interests with respect to that

matter are in conflict; or

ii. The interests of the professional accountant with respect to a particular matter

and the interests of the client for whom the professional accountant provides a

professional service related to that matter are in conflict.

Examples of Conflicts of interest may include but not limited to:

Providing a transaction advisory service to a client seeking to acquire an audit

client of the firm, where the firm has obtained confidential information during

the course of the audit that may be relevant to the transaction.

Advising two clients at the same time who are competing to acquire the same

company where the advice might be relevant to the parties‘ competitive

positions.

Providing services to both a vendor and a purchaser in relation to the same

transaction.

Preparing valuations of assets for two parties who are in an adversarial position

with respect to the assets.

Representing two clients regarding the same matter that is in a legal dispute

with each other, such as during divorce proceedings or the dissolution of a

partnership.

The Institute of Chartered Accountants of Nepal 27

Suggested Answer- December 2018

Providing an assurance report for a licensor on royalties due under a license

agreement when at the same time advising the licensee of the correctness of the

amounts payable.

Advising a client to invest in a business in which, for example, the spouse of the

professional accountant in public practice has a financial interest.

Providing strategic advice to a client on its competitive position while having a

joint venture or similar interest with a major competitor of the client.

Advising a client on the acquisition of a business which the firm is also

interested in acquiring.

Advising a client on the purchase of a product or service while having a royalty

or commission agreement with one of the potential vendors of that product or

service.

c) 194th ICAN Council meeting dated 16th February 2015 had revised the earlier

council decision for the number of audits that can be carried out by the ICAN COP

holder with effect from 17th July 2015. As per revised decision, a member in

practice can conduct the audit of 100 organizations in a fiscal year including the

maximum 10 public companies.

In the given case the number of audit engagements of ABC & Co for the fiscal year

2074/75 as are follows:

Listed Company 3-1+2= 4

Limited Company: 10+2= 12

Private Limited Company: 75

INGOs: 5

NGOs: 2

Total: 98

Public Limited Company: 4+12 = 16.

As per the provision, a member in practice can audit 100 numbers of organizations

however the public limited company shall not exceed 10. In the given case, the total

number is below 100 however the public limited company has exceeded 10. So he

can accept only 10 audit engagements of public companies. He should not accept

the audit of either 6 public companies.

5. Answer the following: (25=10)

a) Miss Shristi, a Chartered Accountant, has been appointed as an auditor in the

22nd AGM of M/s Kantipur Ltd. She was removed by Board of Directors

when she was abroad for her personal visit.

b) Mr. Kumar KC is practicing as a Chartered Accountant from his

proprietorship firm. He nominated Mr. LK Khatri as partner on profit

sharing basis. Mr. Khatri, is not the member of ICAN.

Answer:

a) Section 119 (1) of the Company Act, 2063 provides that no auditor appointed

pursuant to Companies Act shall be removed pending the completion of audit of

accounts of any financial year for which he/she was appointed as the auditor.

As per Sub-section (2), notwithstanding anything contained in sub-section (1), if

any auditor breaches the code of conduct of auditors or does any act against the

interest of the company which has appointed him/her as the auditor or commits any

The Institute of Chartered Accountants of Nepal 28

Suggested Answer- December 2018

act contrary to the prevailing law, such auditor may be removed through the same

process whereby he/she was appointed as auditor, by giving prior information to the

ICAN, and with the approval of the regulatory authority, if any authorized by the

prevailing law for the regulation of business of the company concerned , and if there

is no such authority, with the approval of the Office of Registrar. While removing

an auditor pursuant to sub-section (2) above, the auditor shall be provided with a

reasonable opportunity to defend him/herself.

Thus, Board of Directors cannot remove if auditor has been appointed through

AGM. Further, reasonable opportunity to defend should be provided.

b) Chapter VIII of Section 34.3 of Nepal Chartered Accountant Act, 1997 states that

one shall not share or distribute as profit the auditing fees or remuneration with any

person other than a member of the Institute; and shall not pay any commission,

brokerage etc. out of the professional fees earned to any person or member.

In the given instance; Mr. Kumar, has nominated Mr. Khatri as a partner, who is not

member of ICAN on profit sharing basis, which is against the code of conduct

prescribed by ICAN.

Given the facts, Mr. Kumar is not allowed to nominate Mr. Khatri, who is not

member of ICAN as partner on profit sharing basis. Upon complaint to the Institute

against Mr., Kumar, for not upholding the conduct mentioned in this Act or the

Regulations framed under this Act, the Executive Director shall, if he finds

convincing information that proves Mr. Kumar, is not observing the conduct, submit

the proposal along with the related facts to the Council for further action against

such member or member holding Certificate of Practice, and Mr. Kumar, may face

disciplinary action by ICAN.

6. Write short notes on the following:

(42.5=10)

a) Employment with an Audit Client

b) Professional Skepticism

c) Peer Review

d) Independence of Internal Auditor

Answer:

a) Employment with an audit client may create self-interest and self-review threats.

Later on, familiarity or intimidation threats may be created if a director or officer of

the audit client, or an employee in a position to exert significant influence over the

preparation of the client‘s accounting records or the financial statements on which

the firm will express an opinion, has been a member of the audit team or partner of

the firm.

b) Professional skepticism is an attitude which includes a questioning mind, being alert

to conditions which may indicate possible misstatement due to error or fraud, and a

critical assessment of evidence. Therefore, the auditor should recognize the fact

that circumstances may exist that may cause the financial statements to be

materially misstated throughout the audit process.

The Institute of Chartered Accountants of Nepal 29

Suggested Answer- December 2018

c) This is a critical independent review of one public accounting firm's practices by

another public accounting firm. It is a review of the firm‘s accounting and auditing

practices. It is intended that the review be done by practitioners upon fellow

practitioners. Such an external review offers a more objective evaluation of the

quality of performance than could be done by self-review.

Peer review studies the adequacy of the firm's established quality control policies

and tests to determine the extent of the firm's compliance to these policies.

Suggestions for improvement to the system are outlined in a letter of comments

issued by peer reviewers to the reviewed firm. If a firm fails to take appropriate

corrective action, various actions may be imposed e.g. suspension from

membership.

In carrying out the review it is limited to:-

Professional aspects of the practice.

The overall total quality control policies.

Professional aspect of the firms accounting and auditing practices

d) The concept of independence is equally relevant for internal auditor too. Internal

auditing is an independent, objective assurance and consulting activity designed to

add value and improve an organization‘s operations.

Internal auditor is part of the management but s/he evaluates the functioning of the

management at different levels. Therefore, to be efficient and effective, the internal

auditor must have adequate independence. It may be noted that by its very nature,

the internal audit function cannot be expected to have the same degree of

independence as is essential when the external auditor expresses his opinion on the

financial information. To ensure his independence, he is made responsible directly

to the Board of Directors through audit committee.

Such a channel of communication provides an independence whereby an internal

auditor can communicate and share his views on the scope of internal audit,

findings, etc. If internal auditor is made subordinate to lower level, his

independence will be effected which will affect his functioning and effectiveness.

7. Distinguish between: (25=10)

a) Audit Report and Audit Certificate

b) Test Checking and Routine Checking

Answer:

a)

Basis Audit Report Audit Certificate

Meaning An Audit Report is an expression of Certificate is a written

opinion on the true and fair view confirmation of the accuracy of

presented by financial statements the fact stated therein and does

not involve any estimate of

opinion.

The Institute of Chartered Accountants of Nepal 30

Suggested Answer- December 2018

Utility The term audit report is used when The term certificate is used when

the auditor expresses his opinion on the auditor verifies certain exact

the financial statements fact e.g. Royalty payment made

to foreign collaborators, value of

import/exports of a company

during a financial year.

Implication Audit report implies that the auditor A certificate implies that the

- Has examined relevant records in Auditor

accordance with generally accepted - Has verified certain precise

auditing standards; and figures; and

- Is expressing an opinion whether or - Is in a position to vouch their

not the financial statements accuracy as per the examination

representing a true and fair view of of documents and books of

the state of affairs and of the account produced before him.

working results of the enterprise.

Accuracy The Auditor is responsible for The Auditor is responsible for the

ensuring that the report is based on factual accuracy of what is stated

factual data that his opinion is in therein.

accordance with facts, and that it is

arrived at by application of due care

& Skill.

b)

Criteria Test Checking Routine Checking

Concept Test checking involves selecting a Routine checking involves

few transactions on the basis of checking of books and records on

auditor‘s judgment and examining regular basis.

them.

User Generally Auditor (Internal/external) Generally Accountants (Lower &

etc. Middle level).

Objectives The main object of test checking is to The main object of routine

form an opinion on the financial checking is ensuring arithmetical

statements on the basis of accuracy of the entries in the

original books and ledgers and

examination of selected sample.

posting to correct ledgers

accounts.

Scope Limited Wide

Time Lesser time consuming Higher time consuming

Reliance Certain reliance can be taken on Reliance cannot be taken on test

routine checking checking

Risk Higher risk of improper result if Lesser risk of improper result if

internal control system is weak. internal control system is strong.

The Institute of Chartered Accountants of Nepal 31

Suggested Answer- December 2018

Specific Comments on the performance of the students

Batch: - December 2018

Level: - CAP-II

Subject: Audit and Assurance

Question No. 1

(a) Provision of NAS -1 not written in majorities of cases. Majority of the students

failed to explain the concept of going concern.

(b) Fairly attempted.

(c) About 10% of the student not aware of the Provision of NAS -2. Overall

impression on this question was good. Well attempted by students.

(d) NAS 37 Provisions, not written in majorities of the cases.

Question No. 2

(a) The concept of confidentiality as a code of conduct was well attempted.

(b) The students failed to explain the KAM & going concern issues – poorly

attempted. Failed to explain the Provisions of NAS 701 and conclusions were not

proper. Students are not able to provide auditors conclusion.

(c) Fairly attempted.

(d) In general, this question was not attempted by the students – poor preparation.

Answer is too generalized and wrong in majorities of the cases. Students are not

able to provide auditors conclusion.

Question No. 3

(a) Fairly attempted.

(b) Well attempted. Most candidates answered generally W/O stating the areas where

"Professional judgment" is applied. Professional judgments are not appropriately

explained.

(c) Some of the student misunderstands the question. About 5% student could not

answer the question.

Question No. 4

(a) Specific safeguards weren't mentioned by most of the students. The safeguard for

the related threats were not explained with the examples general answer were

seen.

(b) Most of the students didn't explain and wrote the examples of situation of conflict

of interest properly.

(c) Few were unaware of the limit of Public complies and some were confused with

limited company. Mostly students answered as 15 Public Ltd. company instead of

10. Mostly confused with listed companies.

Question No. 5

(a) Fairly attempted. However, Answer is not correct in most cases.

(b) Fairly attempted but most of the students did not explain disciplinary action as

recommended by suggested answer.

Question No. 6

Majorities cannot give the concept. About 50% could not catch the relationship

between IA and Management. Students were confused with internal review. Students

were confused regarding audit and employment and Peer review.

Question No. 7

Majorities are confused about "Audit Certificate". There is a confusion on "Audit

report and Audit certificate" for most of the students. The distinction with the routine

checking was not understood by majority of the candidates.

The Institute of Chartered Accountants of Nepal 32

Suggested Answer- December 2018

Paper 3:

Corporate & Other Laws

The Institute of Chartered Accountants of Nepal 33

Suggested Answer- December 2018

Corporate & Other Laws

Suggested

Roll No……………. Maximum Marks - 100

Total No. of Questions - 7 Total No. of Printed Pages -14

Time Allowed - 3 Hours

Marks

Attempt all questions.

1. Answer the following questions: (5×5=25)

a) You are the legal advisor of the Dev Limited. Mr. Ram Lal, chairman

of the company wants to know the following:

i) When a public limited company is required to issue the prospectus?

ii) Who shall sign the prospectus?

iii) What are the procedures of publication of prospectus?

b) Mr. Salil is interested to carry some business. He has no knowledge of

the business organizations. However he could notice that some of his

friends are carrying business by incorporating a company. So he

approached you regarding the incorporation of a company as an expert

of the company law. How would you suggest him regarding the

process of the incorporation of a company as to his interest as per the

prevailing law?

c) The Board of Directors of Spring Water Pvt. Ltd. had proposed Mr.

Karna as an auditor but the resolution failed and there is no chance of

appointing of another auditor. Therefore, it was suggested appointing

the auditor by the Office of Company Registrar. Give your opinion.

i) When the office can appoint the auditor of a company?

ii) Can auditor be appointed by the office in the above situation?

d) Sagarmatha Securities Limited, incorporated in 2075, under the

Companies Act, 2063. This company has objectives of undertaking

securities business in Nepal. The company is going to convene the first

annual general meeting any appropriate time and duration. What is the

procedure for annual general meeting of a public company?

e) Mr. CP Mishra, shareholder of ABC Limited, a public company, holds

2% ordinary shares out of total paid up capital of Rs. 300 million. Mr.

Mishra is of the opinion that since his holding in less than 5%, he is not

the substantial shareholder of the ABC Limited and not required to

give any information to the company. Critically examine the opinion of

Mr. Mishra citing relevant provision of the Companies Act, 2063.

Answer:

a)

i) Public Limited Company is required to issue prospectus prior to issuing

shares to general public. Section 23 of the Companies Act, 2063 provides

that a public company shall publish its prospectus prior to issuing its

securities publicly.

The Institute of Chartered Accountants of Nepal 34

Suggested Answer- December 2018

ii) While publishing the prospectus, the prospectus must be signed by all

directors of the board of a company and same has to be submitted, along

with a written application made to the Securities Board for approval.

iii) If it appears that the prospectus submitted omits any important matter or

contains any unnecessary matter the Securities Board shall cause such

prospectus to be amended or altered as required and grant approval to

publish it in accordance with law. Prior to the approval the company shall

also make a declaration before the Securities Board that the provisions of

the Companies Act have been complied with; and the Securities Board

may, if it deems necessary, seek opinion of Office of Company Registrar

on that matter.

After receipt of approval from the Securities Board, company shall give

information thereof to Company Registrar Office in writing, accompanied by a

copy of the approval letter of the Securities Board.

On receipt of that information the Office of Company Registrar shall register

the prospectus. However if it appears that any matter contained in Companies

Act has not been complied with, the Office of Company Registrar may refuse

to register it.

In publishing the prospectus company shall mention that the prospectus has

been approved by the Securities Board and registered with the Company

Registrar Office and the date thereof. The covering page of prospectus shall

also mention that Securities Board or Office of Company Registrar shall not

be liable to bear any kind of responsibility in respect of matters mentioned

therein.

b) To carry business under the name of a company it is mandatory to register