Professional Documents

Culture Documents

Factsheet AMRT 2023 01

Factsheet AMRT 2023 01

Uploaded by

arsyil1453Copyright:

Available Formats

You might also like

- Investments Analysis and Management 12th Edition Charles P Jones Test BankDocument10 pagesInvestments Analysis and Management 12th Edition Charles P Jones Test BankMohmed GodaNo ratings yet

- Channel Management PPT 1Document33 pagesChannel Management PPT 1Prakash Naik100% (1)

- Factsheet ARTO 2023 01Document4 pagesFactsheet ARTO 2023 01arsyil1453No ratings yet

- Factsheet ANTM 2023 01Document4 pagesFactsheet ANTM 2023 01arsyil1453No ratings yet

- Fra - Project - Group No.1 - Sec BDocument105 pagesFra - Project - Group No.1 - Sec BAkshita PaulNo ratings yet

- Proteanegovtechnologieslimitedrhp Ibcomments v2 2023Document11 pagesProteanegovtechnologieslimitedrhp Ibcomments v2 2023mohit_999No ratings yet

- Performance Overview: As of Sep 14, 2023Document2 pagesPerformance Overview: As of Sep 14, 2023Tirthkumar PatelNo ratings yet

- Exide ReportDocument85 pagesExide ReportAditya MehtaniNo ratings yet

- UTI Infrastructure Equity FundDocument16 pagesUTI Infrastructure Equity FundArmstrong CapitalNo ratings yet

- Factsheet 1705131940285Document2 pagesFactsheet 1705131940285umanarayanvaishnavNo ratings yet

- July 2009 Return SheetsDocument3 pagesJuly 2009 Return SheetsbentleyinvestmentgroupNo ratings yet

- Factsheet 1705132209349Document2 pagesFactsheet 1705132209349umanarayanvaishnavNo ratings yet

- Factsheet 1704957862487Document2 pagesFactsheet 1704957862487umanarayanvaishnavNo ratings yet

- 2024-04-06-Wright Reports-Wright Investors Service Comprehensive Report For Mastek Lim... - 107537243Document62 pages2024-04-06-Wright Reports-Wright Investors Service Comprehensive Report For Mastek Lim... - 107537243cvmentorgeraNo ratings yet

- Himanshu Parihar 211510023747 SocratesDocument7 pagesHimanshu Parihar 211510023747 SocratesHimanshu PariharNo ratings yet

- Schroder Dana Prestasi Plus: Fund FactsheetDocument1 pageSchroder Dana Prestasi Plus: Fund FactsheetGiovanno HermawanNo ratings yet

- Mirae Asset Hang Seng Technology ETF FundDocument8 pagesMirae Asset Hang Seng Technology ETF FundArmstrong CapitalNo ratings yet

- Midcap FundDocument1 pageMidcap Fundnitin choudharyNo ratings yet

- Sbi Life Midcap Fund Latest Fund Performance (Jan 2024)Document1 pageSbi Life Midcap Fund Latest Fund Performance (Jan 2024)Vishal Vijay SoniNo ratings yet

- 1h23 MPMX Analyst Investor PresentationDocument20 pages1h23 MPMX Analyst Investor PresentationLiem Willy kurniawan anindyaNo ratings yet

- India Consumer Fund PortfolioDocument1 pageIndia Consumer Fund PortfolioNitish KumarNo ratings yet

- Pubex 2023Document48 pagesPubex 2023Muhamad YusupNo ratings yet

- Syrma SGS Tech LTD IPO Research Note 1Document7 pagesSyrma SGS Tech LTD IPO Research Note 1Saurabh SinghNo ratings yet

- 4 7-PDF Mahindra Factsheet October 2019Document1 page4 7-PDF Mahindra Factsheet October 2019Yogesh PoteNo ratings yet

- 2024.04.24 RMIT Corporate Finance - DGW Final 4Document11 pages2024.04.24 RMIT Corporate Finance - DGW Final 4Tâm LêNo ratings yet

- Annual Report2018 PDFDocument282 pagesAnnual Report2018 PDFadnanNo ratings yet

- Quarterly Report - September 2021Document6 pagesQuarterly Report - September 2021Chaitanya JagarlapudiNo ratings yet

- Monthly Factsheet WorkingDocument1 pageMonthly Factsheet WorkingStrategies For TradingNo ratings yet

- KRChoksey LIC IPO NoteDocument13 pagesKRChoksey LIC IPO Noterajesh katareNo ratings yet

- The Company: Vodafone Idea Limited Is An Indian Telecom OperatorDocument6 pagesThe Company: Vodafone Idea Limited Is An Indian Telecom OperatorSaurabh SinghNo ratings yet

- Tatva Chintan Pharma Chem LTD IPODocument1 pageTatva Chintan Pharma Chem LTD IPOparmodNo ratings yet

- Equity FundDocument1 pageEquity Fundnitin choudharyNo ratings yet

- WWW - Starhealth.in.: Jayashree SethuramanDocument18 pagesWWW - Starhealth.in.: Jayashree Sethuramankrutika.blueoceaninvestmentsNo ratings yet

- SPDR S&P Midcap 400 ETF Trust: Fund Inception Date Cusip Key Features About This BenchmarkDocument2 pagesSPDR S&P Midcap 400 ETF Trust: Fund Inception Date Cusip Key Features About This BenchmarkmuaadhNo ratings yet

- Tata Technologies IPODocument1 pageTata Technologies IPOaws.rakNo ratings yet

- ITC Limited: Strategic ManagementDocument43 pagesITC Limited: Strategic ManagementmeghspatilNo ratings yet

- Primario Mar20 Fact SheetDocument2 pagesPrimario Mar20 Fact SheetRakshan ShahNo ratings yet

- Return On Capital EmplyedDocument7 pagesReturn On Capital EmplyedKAMAL SARINNo ratings yet

- Bentley Investment Group: Tuesday August 25, 2009Document1 pageBentley Investment Group: Tuesday August 25, 2009bentleyinvestmentgroupNo ratings yet

- Presented by ..: Fedora D'souza Nitin JadhavDocument24 pagesPresented by ..: Fedora D'souza Nitin JadhavHashmi SutariyaNo ratings yet

- 2019 Tribal IT Benchmark Survey: Tribal IT Spending & Staffing Assessment Findings & RecommendationsDocument42 pages2019 Tribal IT Benchmark Survey: Tribal IT Spending & Staffing Assessment Findings & RecommendationsFernando MartinezNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Atul KaulNo ratings yet

- SBI Technology Opportunities FundDocument14 pagesSBI Technology Opportunities FundArmstrong CapitalNo ratings yet

- Financial Modelling ReportDocument15 pagesFinancial Modelling ReportakshaynamsaniNo ratings yet

- Irday2019 Is eDocument10 pagesIrday2019 Is eThinh Tien NguyenNo ratings yet

- SML Isuzu ReportDocument7 pagesSML Isuzu ReportShivani KelvalkarNo ratings yet

- Placemat on Trancom Co., Ltd (20240521)Document2 pagesPlacemat on Trancom Co., Ltd (20240521)Premier Consult SolutionsNo ratings yet

- Fujitsu's Image Solution 201410Document32 pagesFujitsu's Image Solution 201410Wan Zainal Wan ZainNo ratings yet

- Summary Prospectus Tradewale Managed Fund 022019Document8 pagesSummary Prospectus Tradewale Managed Fund 022019hyenadogNo ratings yet

- 2009 Software Reviews2Document18 pages2009 Software Reviews2Vishesh DaveNo ratings yet

- E9e7e Motilal Oswal Nifty Smallcap 250 Index Fund Leaflet RDDocument3 pagesE9e7e Motilal Oswal Nifty Smallcap 250 Index Fund Leaflet RDfinal bossuNo ratings yet

- NSE Concept Note (One Digital)Document3 pagesNSE Concept Note (One Digital)YasahNo ratings yet

- List of Nse Nifty 50 Companies 2020 in Indian Stock Market PDFDocument8 pagesList of Nse Nifty 50 Companies 2020 in Indian Stock Market PDFaks1990okNo ratings yet

- Download Fact Sheet of NIFTY 200 (.pdf)Document2 pagesDownload Fact Sheet of NIFTY 200 (.pdf)Tushar PaygudeNo ratings yet

- Final Placement Report Batch of 2024Document6 pagesFinal Placement Report Batch of 2024swapnil kingeNo ratings yet

- 360 ONE Equity Opportunity Fund - Apr24Document2 pages360 ONE Equity Opportunity Fund - Apr24speedenquiryNo ratings yet

- SBI Contra FundDocument2 pagesSBI Contra FundScribbydooNo ratings yet

- Summer Internship Placement Report Batch of 2023Document4 pagesSummer Internship Placement Report Batch of 2023Mukesh MandalNo ratings yet

- Franklin India Tech FundDocument21 pagesFranklin India Tech FundArmstrong CapitalNo ratings yet

- Name Wt. / Stock (%) : Primario FundDocument2 pagesName Wt. / Stock (%) : Primario FundRakshan ShahNo ratings yet

- Irp Parameters For Comparative Analysis of Companies of An IndustryDocument2 pagesIrp Parameters For Comparative Analysis of Companies of An IndustryLAKSHITA 20111563No ratings yet

- Aspects of The Tax Efficient Supply ChainDocument4 pagesAspects of The Tax Efficient Supply ChainMalik AhmedNo ratings yet

- Dynamic Asset Allocation in A Changing WorldDocument3 pagesDynamic Asset Allocation in A Changing WorldAnna WheelerNo ratings yet

- GV SopDocument39 pagesGV SopjuanaNo ratings yet

- Final Outline For SubmissionDocument3 pagesFinal Outline For SubmissionTesda CACSNo ratings yet

- Students Material Case StudyDocument2 pagesStudents Material Case StudyFatima syedaNo ratings yet

- Mostafa Oil LTDDocument21 pagesMostafa Oil LTDNafisa Tausif AhmedNo ratings yet

- Amore PacificDocument12 pagesAmore PacificAditiaSoviaNo ratings yet

- The State in Economic Theory 3. by Joseph BelbrunoDocument25 pagesThe State in Economic Theory 3. by Joseph BelbrunonieschopwitNo ratings yet

- Fair & LovelyDocument11 pagesFair & LovelyAbhirup_Roy_Ch_8723No ratings yet

- MTF (BSPL) Stock Pick - TATASTEEL - 17102023Document3 pagesMTF (BSPL) Stock Pick - TATASTEEL - 17102023riddhi SalviNo ratings yet

- E - Commerce Project PDFDocument33 pagesE - Commerce Project PDFniharika.nigam.2805100% (1)

- Market Segmentation, Targeting and PositioningDocument14 pagesMarket Segmentation, Targeting and PositioningHuleshwar Kumar SinghNo ratings yet

- Ichimoku Cloud Definition and UsesDocument9 pagesIchimoku Cloud Definition and Usesselozok1No ratings yet

- IAS-33: Earnings Per ShareDocument17 pagesIAS-33: Earnings Per ShareRashed AliNo ratings yet

- Amway Case AnalysisDocument21 pagesAmway Case AnalysisSandeep AchařýaNo ratings yet

- Fi 16Document5 pagesFi 16priyanshu.goel1710No ratings yet

- Akanksha Tyagi - CVDocument1 pageAkanksha Tyagi - CVpreetika jainNo ratings yet

- LV 1 Sample 1Document42 pagesLV 1 Sample 1Updatest newsNo ratings yet

- Aleena Amir EM Quiz 7Document3 pagesAleena Amir EM Quiz 7Aleena AmirNo ratings yet

- Internship Presentation On Work Done in MORE Supermarket Marappalam, TVMDocument7 pagesInternship Presentation On Work Done in MORE Supermarket Marappalam, TVMBeema ShajahanNo ratings yet

- MBFS - PMSDocument12 pagesMBFS - PMSApparna BalajiNo ratings yet

- Q 2what Is A Responsibility Centre? List and Explain Different Types of Responsibility Centers With Sketches. Responsibility CentersDocument3 pagesQ 2what Is A Responsibility Centre? List and Explain Different Types of Responsibility Centers With Sketches. Responsibility Centersmadhura_454No ratings yet

- Question Bank: (020) 2447 6938 E MailDocument32 pagesQuestion Bank: (020) 2447 6938 E MailHardik BhondveNo ratings yet

- Periodic and Perpetual Inventory System ComparedDocument2 pagesPeriodic and Perpetual Inventory System Comparedkim aeong100% (2)

- Projects TopicsDocument116 pagesProjects TopicsRajesh Soni0% (1)

- SWOT Analysis of AdidasDocument2 pagesSWOT Analysis of AdidasMinnuan Tey100% (1)

- Current LiabilityDocument1 pageCurrent LiabilitySeunghyun ParkNo ratings yet

Factsheet AMRT 2023 01

Factsheet AMRT 2023 01

Uploaded by

arsyil1453Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Factsheet AMRT 2023 01

Factsheet AMRT 2023 01

Uploaded by

arsyil1453Copyright:

Available Formats

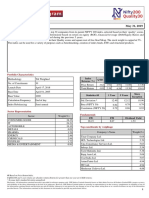

AMRT

Sumber Alfaria Trijaya Tbk.

IDX Company Fact Sheet

AMRT Sumber Alfaria Trijaya Tbk.

Date: 31 Jan 2023 v2.0.0

Company Profile Company History

PT Sumber Alfaria Trijaya Tbk. has a main business field of Retail trade. The Established Listing Date IPO Price (IDR) IPO Lead Underwriter

company's President Director and President Commisioner are Francis Indarto PT Ciptadana

and Feny Djoko Susanto. The largest shareholder of the company is PT 15 May 1989 15 Jan 2009 395 Securities

SIGMANTARA ALFINDO (52.74%). The percentage of public shareholding

(<5%) is 47.26%. The company has 5 subsidiaries. One of the biggest Stock Overview

subsidiaries is PT Midi Utama Indonesia Tbk.

Board Market Cap (MC) (IDR) Trad. Value 12M (IDR)

For more information click here: Main 117,514,339,811,000 31,728,198,521,355

https://www.idx.co.id/en-us/listed-companies/company-profiles/company-profile-detail/?kodeEmiten=AMRT

Listed Shares % of All Stocks % of All Stocks

Trading by Investor Types 41,524,501,700 1.25% 0.89%

Total Trading Value* Free Float Shares Rank Rank

(in billion IDR) Year 2022 YTD 2023 45.38% 12 of 838 28 of 842

Domestic 18,378.7 893.1

30% Individual 30.07% 35.88% Industrial Classification

39%

Institution 63.26% 38.83%

Others 6.67% 25.30% Sector Industry

Foreign 43,641.1 1,490.5 D Consumer Non-Cyclicals D11 Food & Staples Retailing

70% 61%

Individual 0.04% 0.05%

Institution 78.50% 68.39% Sub-Sector Sub-Industry

Others 21.47% 31.57% D1 Food & Staples Retailing D113 Supermarkets & Convenience Store

Year 2022 YTD 2023

Total 62,019.8 2,383.6

Fundamental & ESG

Stock Turnover Net Foreign**

(in billion IDR) Sell (in billion IDR) PER PBV ESG Risk Rating*

D F Total Year 2022 YTD 2023

YTD 2023

44.57x 11.77x 28.95 Medium

D 166.2 367.6 533.8

2,065.0 -174.6

F 193.0 464.9 658.0 *Total trading value by Foreign is the sum of

Total 359.2 832.6 1,191.8 foreign buy and foreign sell divided by 2. Total 0x 5x 10x 15x 20x 25x 30x 35x 40x 45x 50x 55x

Buy

trading value by Domestic is the sum of

Year 2022 domestic buy and domestic sell divided by 2.

**Net Foreign is The Total Trading Value of

D 4,163.3 3,993.5 8,156.8 "Foreign Buy-Domestic Sell" minus "Foreign Sell- AMRT Sector PER Market PER

Domestic Buy".

F 6,058.5 16,794.5 22,853.1 A positive net foreign indicates a net buy by

14.31x 12.68x

Total 10,221.9 20,788.0 31,009.9 foreign investors.

Note: Please see Methodology for more details. ESG = Environmental, Social, & Governance.

*ESG Risk Rating is provided by Sustainalytics. For more information, visit www.sustainalytics.com.

Dividend Payment Corporate Action

5 Recent Releases 5 Recent Releases

Year F/I/ Ratio Cash Per Share Date Year Corp. Ex Cum Ratio RTP DF

BS/SD (in IDR/USD) Ex Record Payment Action Date Price

2022 F - Rp18.78 07-Jun-22 08-Jun-22 24-Jun-22 2013 SS 29-Jul-13 6,350 10:1 630 0.100

2021 F - Rp9.30 20-May-21 21-May-21 04-Jun-21 - - - - - - -

2020 I - Rp6.03 14-Dec-20 15-Dec-20 22-Dec-20 - - - - - - -

2020 F - Rp13.38 28-May-20 29-May-20 12-Jun-20 - - - - - - -

2019 F - Rp2.64 27-May-19 28-May-19 18-Jun-19 - - - - - - -

Source: Company's disclosure on IDX website. Source: Company's disclosure on IDX website.

F = Final Cash Dividend; I = Interim Cash Dividend; BS = Bonus Shares; SD = Stock Dividend Note: RTP = Rounded Theoritical Price; DF = Delution Factor.

RI = Right Issues; SS = Stock Splits; RS = Reverse Splits; BS = Bonus Shares.

Industry Peers

No. Code Company Name Market Date Total Revenue Profit/Loss for

Cap Asset Liabilities Equity the Period

1. AMRT Sumber Alfaria Trijaya Tbk. 117,514.34 09/30/22 29,869,831 9,982,047 19,887,784 72,139,145 1,751,343

2. MIDI Midi Utama Indonesia Tbk. 10,232.35 12/31/22 6,905,148 1,986,727 4,918,421 15,623,654 399,121

3. HERO Hero Supermarket Tbk. 6,275.45 09/30/22 6,699,572 795,796 5,903,776 3,232,798 -85,410

4. RANC Supra Boga Lestari Tbk. 1,228.12 09/30/22 1,343,306 447,842 895,464 2,198,302 -60,087

5. MPPA Matahari Putra Prima Tbk. 1,110.58 12/31/22 3,784,871 166,017 3,618,854 7,017,530 -429,634

Note: Masket cap is as of Jan 31, 2023. Financial data are based on the companies' latest financial statement that submitted to IDX (see Date column), expressed in million IDR.

PER (x) PBV (x) ROA (%) ROE (%) DAR (x) DER (x)

1. AMRT Sumber Alfaria Trijaya Tbk. 44.57 11.77 5.86 8.81 0.33 0.50

2. MIDI Midi Utama Indonesia Tbk. 26.39 5.55 5.78 8.11 0.29 0.40

3. HERO Hero Supermarket Tbk. -20.81 7.89 -1.27 -1.45 0.12 0.13

4. RANC Supra Boga Lestari Tbk. -15.79 2.74 -4.47 -6.71 0.33 0.50

5. MPPA Matahari Putra Prima Tbk. -2.44 3.70 -11.35 -11.87 0.04 0.05

Note: The selected peers are based on the proximity of stocks' market capitalization.

Except Trailing PER & PBV (in times), data in this section are in Million IDR. Market Cap, Trailing PER, and PBV are as of Jan 30, 2022. Financial data used are from company's most recent financial statement.

PER, ROA, & ROE are calculated by using the trailing 12 months of profit attributable to owners entity.

© 2022 DATA SERVICES DIVISION | INDONESIA STOCK EXCHANGE

IDX Company Fact Sheet

AMRT Sumber Alfaria Trijaya Tbk.

Date: 31 Jan 2023 v2.0.0

Stock Performance & Trading Summary

Price Performance of Last 12 Months

Feb 02, 2022 - Jan 31, 2023 AMRT*

123.72%

IHSG

1.96%

LQ45

-1.20%

Sector**

Feb 22 Mar 22 Apr 22 May 22 Jun 22 Jul 22 Aug 22 Sep 22 Oct 22 Nov 22 Dec 22 Jan 23 12.05%

*Adjusted Close Price; **Consumer Non-Cyclicals

Trading Summary of Last 12 Months

Price (IDR) Feb-22 Mar-22 Apr-22 May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22 Jan-23

Highest 1,275 1,520 1,755 1,820 2,040 2,030 2,180 2,400 2,820 3,090 2,950 2,850

Lowest 1,090 1,055 1,485 1,505 1,770 1,835 1,825 2,060 2,330 2,600 2,500 2,660

Close 1,090 1,520 1,710 1,820 2,040 1,875 2,180 2,390 2,820 3,090 2,650 2,830

Adj. Close* 1,090 1,520 1,710 1,820 2,040 1,875 2,180 2,390 2,820 3,090 2,650 2,830

Growth (%) 39.45% 12.50% 6.43% 12.09% -8.09% 16.27% 9.63% 17.99% 9.57% -14.24% 6.79%

Shares Traded Feb-22 Mar-22 Apr-22 May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22 Jan-23

Volume (mill.) 466 870 1,334 3,222 1,183 1,396 1,320 2,195 872 1,037 1,374 432

Value (bill.) 571 1,141 2,241 5,607 2,219 2,657 2,610 4,917 2,208 2,872 3,495 1,192

Frequency (th.) 106 179 224 226 172 186 168 128 87 125 110 99

Days 19 19 18 17 18 20 22 22 21 22 22 21

Note: Volume in Million Shares, Value in Billion IDR, Frequency in Thousand Times.

Yearly Trading Summary of Last 5 Years Comparison to Peers

Price (IDR) 2018 2019 2020 2021 2022 Industry: Supermarkets & Convenience Store

Highest 950 1,025 920 1,440 3,090 No. Code 6M YTD 1Y 3Y 5Y

Lowest 550 800 625 765 1,020

Close 935 880 800 1,215 2,650 1. AMRT 102.9% 102.9% 142.9% 253.8% 367.8%

Adj. Close* 935 880 800 1,215 2,650 2. MIDI 63.6% 63.6% 72.3% 179.5% 246.3%

Growth (%) -5.88% -9.09% 51.88% 118.11% 3. HERO -11.8% -11.8% -19.4% 76.5% 54.6%

4. RANC -44.9% -44.9% -49.0% 156.5% 125.6%

Shares Traded 2018 2019 2020 2021 2022 5. MPPA -68.7% -68.7% -42.5% 11.0% -72.9%

Volume 3,526 1,400 1,365 8,776 15,690

Value 3,133 1,234 1,077 10,191 31,010 Note:

Frequency 25 15 45 756 1,792 Base date: 6M = Mar 23, 2022; YTD = Mar 23, 2022; 1Y = Jan 31, 2022; 3Y = Jan 31, 2020; 5Y = Jan 31, 2018;

Industry peer companies are in the same industry, selected based on the proximity of stocks' market capitalization;

Days 239 245 242 247 246 *Adjusted price refers to the close price after adjustments for any applicable corporate actions.

Note: Volume in Million Shares, Value in Billion IDR, Frequency in Thousand Times.

Index Membership

No. Index Code No. Index Code

1. BISNIS-27 11. MBX 21. 31.

2. COMPOSITE 12. 22. 32.

3. IDX30 13. 23. 33.

4. IDX80 14. 24. 34.

5. IDXG30 15. 25. 35.

6. IDXHIDIV20 16. 26. 36.

7. IDXNONCYC 17. 27. 37.

8. Investor33 18. 28. 38.

9. KOMPAS100 19. 29. 39.

10. LQ45 20. 30. 40.

Note: the index membership above is as of Mar 1, 2023

© 2022 DATA SERVICES DIVISION | INDONESIA STOCK EXCHANGE

IDX Company Fact Sheet

AMRT Sumber Alfaria Trijaya Tbk.

Date: 31 Jan 2023 v2.0.0

Financial Data & Ratios

Book End: December (Expressed in millions IDR, unless otherwise stated)

Balance Sheets Dec 2018 Dec 2019 Dec 2020 Dec 2021 Sep 2022

Cash & Cash Equivalents 2,070,429 3,898,050 3,877,560 3,269,642 2,167,803

Trade receivables 1,968,644 1,485,936 1,749,286 1,760,636 2,129,076 Total Asset & Liabilities (Bill. Rp)

Inventories 7,221,444 7,577,090 7,640,169 8,755,334 10,059,658 Asset Liabilities

35

Current Assets 12,791,052 14,782,817 13,558,536 14,211,903 14,935,751

- - - - - - 30

Fixed Asset 5,497,240 5,453,229 6,091,336 6,462,667 7,000,380

25

- - - - - -

Total Assets 22,165,968 23,992,313 25,970,743 27,493,748 29,869,831 20

Trade Payable 7,590,081 7,891,770 8,860,594 9,753,901 10,253,301

15

Curr. Maturities - Bank Loans 674,088 642,106 516,449 464,834 382,891

Curr. Maturities - Bonds Payable - 1,399,072 999,629 - - 10

- - - - - -

Current Liabilities 11,126,956 13,167,601 15,326,139 16,376,061 17,810,836 5

Long-term Bank Loans 800,742 707,168 724,494 606,625 328,798 -

Long-term Bonds Payable 2,393,957 998,553 - - - 2018 2019 2020 2021 2022

- - - - - -

Total Liabilities 16,148,410 17,108,006 18,334,415 18,503,950 19,887,784

Total Equity (Bill. Rp)

Common Stocks 415,245 415,245 415,245 415,245 415,245

Paid up Capital (Shares) 41,525 41,525 41,525 41,525 41,525

9,982

Par Value 10 10 10 10 10

8,990

Retained earnings 3,176,712 4,179,600 4,435,085 5,999,898 6,971,411

7,636

Total Equity 6,017,558 6,884,307 7,636,328 8,989,798 9,982,047 6,884

6,018

Income Statements Dec 2018 Dec 2019 Dec 2020 Dec 2021 Sep 2022

Revenues 66,817,305 72,944,988 75,826,880 84,904,301 72,139,145

Gross Profit 13,222,452 14,541,634 15,412,434 17,681,005 14,815,025

Operating Profit/Loss 650,216 899,886 763,809 1,849,311 1,612,909

Interest & Finance Costs -528,487 -397,856 -381,680 -322,031 -135,598

EBT 867,131 1,453,898 1,388,967 2,468,864 2,227,681

Tax -198,705 -315,010 -300,490 -480,114 -434,825

2018 2019 2020 2021 2022

Profit/Loss for the period 668,426 1,138,888 1,088,477 1,988,750 1,792,856

Profit/Loss Period Attributable 650,138 1,112,513 1,061,476 1,950,991 1,751,343

Comprehensive Income 1,010,579 977,914 1,566,127 1,902,831 1,799,768 Total Revenue (Bill. Rp)

Comprehensive Attributable 988,167 953,587 1,533,565 1,864,430 1,758,255 84,904

Cash Flow Statements Dec 2018 Dec 2019 Dec 2020 Dec 2021 Sep 2022 75,827

72,945 72,139

Net Cash - Operating 5,956,645 5,409,142 6,560,173 6,335,963 3,847,228 66,817

Net Cash - Investing -1,886,495 -2,689,191 -3,830,974 -3,659,677 -3,676,904

Net Cash - Financing -2,932,622 -892,330 -2,749,689 -3,278,614 -1,272,163

Net Increase/Decrease in C&CE 1,137,528 1,827,621 -20,490 -602,328 -1,101,839

C&CE, end of period 2,070,429 3,898,050 3,877,560 3,269,642 2,167,803

Ratios Dec 2018 Dec 2019 Dec 2020 Dec 2021 Sep 2022

Current Ratio (%) 1.15 1.12 0.88 0.87 0.84

DAR (x) 0.73 0.71 0.71 0.67 0.67

DER (x) 2.68 2.49 2.40 2.06 1.99

EPS (IDR) 12.96 23.24 26.51 36.85 56.63 2018 2019 2020 2021 2022

PER (x) 72.15 37.86 30.18 32.97 42.20

BV (IDR) 145 166 184 216 240 Profit/Loss for the Period (Bill. Rp)

PBV (x) 6.45 5.31 4.35 5.61 11.02

ROA (%) 3.02 4.75 4.19 7.23 6.00

ROE (%) 11.11 16.54 14.25 22.12 17.96

1,989

GPM (%) 19.79 19.94 20.33 20.82 20.54 1,793

OPM (%) 0.97 1.23 1.01 2.18 2.24

NPM (%) 1.00 1.56 1.44 2.34 2.49

DPS (IDR) 5.77 2.64 19.41 9.30 18.78 1,139 1,088

DPR (%) 44.52 11.36 73.23 25.24 33.16

Dividend Yield (%) 0.62 0.30 2.43 0.77 0.71 668

Miscellaneous Dec 2018 Dec 2019 Dec 2020 Dec 2021 Sep 2022

No. of Listed Shares, million 41,525 41,525 41,525 41,525 41,525

Market Capitalization, billion IDR 38,825 36,542 33,220 50,452 84,710

2018 2019 2020 2021 2022

USD Rate (BI-JISDOR), IDR* 14,542 13,945 14,105 14,269 15,232

*If the company's reported financial data is in USD then the financial data is converted to IDR by multiplying with the corresponding USD Rate.

© 2022 DATA SERVICES DIVISION | INDONESIA STOCK EXCHANGE

You might also like

- Investments Analysis and Management 12th Edition Charles P Jones Test BankDocument10 pagesInvestments Analysis and Management 12th Edition Charles P Jones Test BankMohmed GodaNo ratings yet

- Channel Management PPT 1Document33 pagesChannel Management PPT 1Prakash Naik100% (1)

- Factsheet ARTO 2023 01Document4 pagesFactsheet ARTO 2023 01arsyil1453No ratings yet

- Factsheet ANTM 2023 01Document4 pagesFactsheet ANTM 2023 01arsyil1453No ratings yet

- Fra - Project - Group No.1 - Sec BDocument105 pagesFra - Project - Group No.1 - Sec BAkshita PaulNo ratings yet

- Proteanegovtechnologieslimitedrhp Ibcomments v2 2023Document11 pagesProteanegovtechnologieslimitedrhp Ibcomments v2 2023mohit_999No ratings yet

- Performance Overview: As of Sep 14, 2023Document2 pagesPerformance Overview: As of Sep 14, 2023Tirthkumar PatelNo ratings yet

- Exide ReportDocument85 pagesExide ReportAditya MehtaniNo ratings yet

- UTI Infrastructure Equity FundDocument16 pagesUTI Infrastructure Equity FundArmstrong CapitalNo ratings yet

- Factsheet 1705131940285Document2 pagesFactsheet 1705131940285umanarayanvaishnavNo ratings yet

- July 2009 Return SheetsDocument3 pagesJuly 2009 Return SheetsbentleyinvestmentgroupNo ratings yet

- Factsheet 1705132209349Document2 pagesFactsheet 1705132209349umanarayanvaishnavNo ratings yet

- Factsheet 1704957862487Document2 pagesFactsheet 1704957862487umanarayanvaishnavNo ratings yet

- 2024-04-06-Wright Reports-Wright Investors Service Comprehensive Report For Mastek Lim... - 107537243Document62 pages2024-04-06-Wright Reports-Wright Investors Service Comprehensive Report For Mastek Lim... - 107537243cvmentorgeraNo ratings yet

- Himanshu Parihar 211510023747 SocratesDocument7 pagesHimanshu Parihar 211510023747 SocratesHimanshu PariharNo ratings yet

- Schroder Dana Prestasi Plus: Fund FactsheetDocument1 pageSchroder Dana Prestasi Plus: Fund FactsheetGiovanno HermawanNo ratings yet

- Mirae Asset Hang Seng Technology ETF FundDocument8 pagesMirae Asset Hang Seng Technology ETF FundArmstrong CapitalNo ratings yet

- Midcap FundDocument1 pageMidcap Fundnitin choudharyNo ratings yet

- Sbi Life Midcap Fund Latest Fund Performance (Jan 2024)Document1 pageSbi Life Midcap Fund Latest Fund Performance (Jan 2024)Vishal Vijay SoniNo ratings yet

- 1h23 MPMX Analyst Investor PresentationDocument20 pages1h23 MPMX Analyst Investor PresentationLiem Willy kurniawan anindyaNo ratings yet

- India Consumer Fund PortfolioDocument1 pageIndia Consumer Fund PortfolioNitish KumarNo ratings yet

- Pubex 2023Document48 pagesPubex 2023Muhamad YusupNo ratings yet

- Syrma SGS Tech LTD IPO Research Note 1Document7 pagesSyrma SGS Tech LTD IPO Research Note 1Saurabh SinghNo ratings yet

- 4 7-PDF Mahindra Factsheet October 2019Document1 page4 7-PDF Mahindra Factsheet October 2019Yogesh PoteNo ratings yet

- 2024.04.24 RMIT Corporate Finance - DGW Final 4Document11 pages2024.04.24 RMIT Corporate Finance - DGW Final 4Tâm LêNo ratings yet

- Annual Report2018 PDFDocument282 pagesAnnual Report2018 PDFadnanNo ratings yet

- Quarterly Report - September 2021Document6 pagesQuarterly Report - September 2021Chaitanya JagarlapudiNo ratings yet

- Monthly Factsheet WorkingDocument1 pageMonthly Factsheet WorkingStrategies For TradingNo ratings yet

- KRChoksey LIC IPO NoteDocument13 pagesKRChoksey LIC IPO Noterajesh katareNo ratings yet

- The Company: Vodafone Idea Limited Is An Indian Telecom OperatorDocument6 pagesThe Company: Vodafone Idea Limited Is An Indian Telecom OperatorSaurabh SinghNo ratings yet

- Tatva Chintan Pharma Chem LTD IPODocument1 pageTatva Chintan Pharma Chem LTD IPOparmodNo ratings yet

- Equity FundDocument1 pageEquity Fundnitin choudharyNo ratings yet

- WWW - Starhealth.in.: Jayashree SethuramanDocument18 pagesWWW - Starhealth.in.: Jayashree Sethuramankrutika.blueoceaninvestmentsNo ratings yet

- SPDR S&P Midcap 400 ETF Trust: Fund Inception Date Cusip Key Features About This BenchmarkDocument2 pagesSPDR S&P Midcap 400 ETF Trust: Fund Inception Date Cusip Key Features About This BenchmarkmuaadhNo ratings yet

- Tata Technologies IPODocument1 pageTata Technologies IPOaws.rakNo ratings yet

- ITC Limited: Strategic ManagementDocument43 pagesITC Limited: Strategic ManagementmeghspatilNo ratings yet

- Primario Mar20 Fact SheetDocument2 pagesPrimario Mar20 Fact SheetRakshan ShahNo ratings yet

- Return On Capital EmplyedDocument7 pagesReturn On Capital EmplyedKAMAL SARINNo ratings yet

- Bentley Investment Group: Tuesday August 25, 2009Document1 pageBentley Investment Group: Tuesday August 25, 2009bentleyinvestmentgroupNo ratings yet

- Presented by ..: Fedora D'souza Nitin JadhavDocument24 pagesPresented by ..: Fedora D'souza Nitin JadhavHashmi SutariyaNo ratings yet

- 2019 Tribal IT Benchmark Survey: Tribal IT Spending & Staffing Assessment Findings & RecommendationsDocument42 pages2019 Tribal IT Benchmark Survey: Tribal IT Spending & Staffing Assessment Findings & RecommendationsFernando MartinezNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Atul KaulNo ratings yet

- SBI Technology Opportunities FundDocument14 pagesSBI Technology Opportunities FundArmstrong CapitalNo ratings yet

- Financial Modelling ReportDocument15 pagesFinancial Modelling ReportakshaynamsaniNo ratings yet

- Irday2019 Is eDocument10 pagesIrday2019 Is eThinh Tien NguyenNo ratings yet

- SML Isuzu ReportDocument7 pagesSML Isuzu ReportShivani KelvalkarNo ratings yet

- Placemat on Trancom Co., Ltd (20240521)Document2 pagesPlacemat on Trancom Co., Ltd (20240521)Premier Consult SolutionsNo ratings yet

- Fujitsu's Image Solution 201410Document32 pagesFujitsu's Image Solution 201410Wan Zainal Wan ZainNo ratings yet

- Summary Prospectus Tradewale Managed Fund 022019Document8 pagesSummary Prospectus Tradewale Managed Fund 022019hyenadogNo ratings yet

- 2009 Software Reviews2Document18 pages2009 Software Reviews2Vishesh DaveNo ratings yet

- E9e7e Motilal Oswal Nifty Smallcap 250 Index Fund Leaflet RDDocument3 pagesE9e7e Motilal Oswal Nifty Smallcap 250 Index Fund Leaflet RDfinal bossuNo ratings yet

- NSE Concept Note (One Digital)Document3 pagesNSE Concept Note (One Digital)YasahNo ratings yet

- List of Nse Nifty 50 Companies 2020 in Indian Stock Market PDFDocument8 pagesList of Nse Nifty 50 Companies 2020 in Indian Stock Market PDFaks1990okNo ratings yet

- Download Fact Sheet of NIFTY 200 (.pdf)Document2 pagesDownload Fact Sheet of NIFTY 200 (.pdf)Tushar PaygudeNo ratings yet

- Final Placement Report Batch of 2024Document6 pagesFinal Placement Report Batch of 2024swapnil kingeNo ratings yet

- 360 ONE Equity Opportunity Fund - Apr24Document2 pages360 ONE Equity Opportunity Fund - Apr24speedenquiryNo ratings yet

- SBI Contra FundDocument2 pagesSBI Contra FundScribbydooNo ratings yet

- Summer Internship Placement Report Batch of 2023Document4 pagesSummer Internship Placement Report Batch of 2023Mukesh MandalNo ratings yet

- Franklin India Tech FundDocument21 pagesFranklin India Tech FundArmstrong CapitalNo ratings yet

- Name Wt. / Stock (%) : Primario FundDocument2 pagesName Wt. / Stock (%) : Primario FundRakshan ShahNo ratings yet

- Irp Parameters For Comparative Analysis of Companies of An IndustryDocument2 pagesIrp Parameters For Comparative Analysis of Companies of An IndustryLAKSHITA 20111563No ratings yet

- Aspects of The Tax Efficient Supply ChainDocument4 pagesAspects of The Tax Efficient Supply ChainMalik AhmedNo ratings yet

- Dynamic Asset Allocation in A Changing WorldDocument3 pagesDynamic Asset Allocation in A Changing WorldAnna WheelerNo ratings yet

- GV SopDocument39 pagesGV SopjuanaNo ratings yet

- Final Outline For SubmissionDocument3 pagesFinal Outline For SubmissionTesda CACSNo ratings yet

- Students Material Case StudyDocument2 pagesStudents Material Case StudyFatima syedaNo ratings yet

- Mostafa Oil LTDDocument21 pagesMostafa Oil LTDNafisa Tausif AhmedNo ratings yet

- Amore PacificDocument12 pagesAmore PacificAditiaSoviaNo ratings yet

- The State in Economic Theory 3. by Joseph BelbrunoDocument25 pagesThe State in Economic Theory 3. by Joseph BelbrunonieschopwitNo ratings yet

- Fair & LovelyDocument11 pagesFair & LovelyAbhirup_Roy_Ch_8723No ratings yet

- MTF (BSPL) Stock Pick - TATASTEEL - 17102023Document3 pagesMTF (BSPL) Stock Pick - TATASTEEL - 17102023riddhi SalviNo ratings yet

- E - Commerce Project PDFDocument33 pagesE - Commerce Project PDFniharika.nigam.2805100% (1)

- Market Segmentation, Targeting and PositioningDocument14 pagesMarket Segmentation, Targeting and PositioningHuleshwar Kumar SinghNo ratings yet

- Ichimoku Cloud Definition and UsesDocument9 pagesIchimoku Cloud Definition and Usesselozok1No ratings yet

- IAS-33: Earnings Per ShareDocument17 pagesIAS-33: Earnings Per ShareRashed AliNo ratings yet

- Amway Case AnalysisDocument21 pagesAmway Case AnalysisSandeep AchařýaNo ratings yet

- Fi 16Document5 pagesFi 16priyanshu.goel1710No ratings yet

- Akanksha Tyagi - CVDocument1 pageAkanksha Tyagi - CVpreetika jainNo ratings yet

- LV 1 Sample 1Document42 pagesLV 1 Sample 1Updatest newsNo ratings yet

- Aleena Amir EM Quiz 7Document3 pagesAleena Amir EM Quiz 7Aleena AmirNo ratings yet

- Internship Presentation On Work Done in MORE Supermarket Marappalam, TVMDocument7 pagesInternship Presentation On Work Done in MORE Supermarket Marappalam, TVMBeema ShajahanNo ratings yet

- MBFS - PMSDocument12 pagesMBFS - PMSApparna BalajiNo ratings yet

- Q 2what Is A Responsibility Centre? List and Explain Different Types of Responsibility Centers With Sketches. Responsibility CentersDocument3 pagesQ 2what Is A Responsibility Centre? List and Explain Different Types of Responsibility Centers With Sketches. Responsibility Centersmadhura_454No ratings yet

- Question Bank: (020) 2447 6938 E MailDocument32 pagesQuestion Bank: (020) 2447 6938 E MailHardik BhondveNo ratings yet

- Periodic and Perpetual Inventory System ComparedDocument2 pagesPeriodic and Perpetual Inventory System Comparedkim aeong100% (2)

- Projects TopicsDocument116 pagesProjects TopicsRajesh Soni0% (1)

- SWOT Analysis of AdidasDocument2 pagesSWOT Analysis of AdidasMinnuan Tey100% (1)

- Current LiabilityDocument1 pageCurrent LiabilitySeunghyun ParkNo ratings yet