Professional Documents

Culture Documents

Introduction To Business Taxation, Exclusions and Other Percentage Tax

Introduction To Business Taxation, Exclusions and Other Percentage Tax

Uploaded by

Dharel GannabanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction To Business Taxation, Exclusions and Other Percentage Tax

Introduction To Business Taxation, Exclusions and Other Percentage Tax

Uploaded by

Dharel GannabanCopyright:

Available Formats

INTERNATIONAL SCHOOL OF ASIA AND THE PACIFIC

Alimannao Hills, Penablanca, Cagayan HQ # 3

INTRODUCTION TO BUSINESS TAXATION, EXCLUSIONS AND

OTHER PERCENTAGE TAX

BUSINESS TAXES

Business – a habitual engagement in commercial activity involving the sale of goods or services

Registration of Business:

- Register with the appropriate Revenue District Officer and pay annual registration fee of

500 for every separate or distinct establishment where sales occur. A Certificate of

Registration shall be issued to the applicant upon compliance on the requirements for

registration.

Exemption to Business Tax: Business for subsistence or livelihood

Nature of Business Tax: Consumption Tax, Indirect Tax, Privilege Tax

Types of Business Taxes:

1. Percentage Tax

2. Value Added Tax

3. Excise Tax

Tax Base for Business Taxes:

➢ Goods or Properties – taxable on gross selling price

➢ Service or Lessor of Properties – taxable on gross receipts

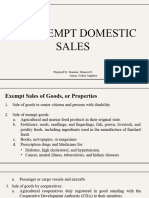

EXCLUSIONS FROM BUSINESS TAX

This means the sale of goods, properties or services and the use or lease of properties

are not subject to VAT (Output Tax) and the seller or lessor is not allowed to any tax

credit on VAT (Input Tax) on purchases.

The following are VAT exempt transactions as amended under TRAIN Law:

A. Sale or importation of:

1. agricultural and marine food product in their original state;

2. livestock and poultry used as, or producing foods for human consumption;

3. breeding stock and genetic materials.

Products that will be considered in their original state:

i. products which undergone simple processes of preparation or preservation for

the market (freezing, drying, salting, broiling, roasting, smoking or stripping)

ii. polished or husked rice

iii. corn grits

iv. raw cane sugar and molasses

v. ordinary salt

vi. copra

NOTE: Livestock or poultry does not include fighting cocks, race horses, zoo animals

and other animals generally considered as pets.

B. Sale or importation of:

1. Fertilizers

2. Seeds, seedlings and fingerlings

3. Fish, prawn, livestock and poultry feeds

4. Ingredients used in the manufacture of finished feeds (except specialty feeds

for race horses, fighting cocks, aquarium fish, zoo animals and other animals

generally considered as pets).

C. Importation of personal and household effects belonging to the:

1. residents of the Philippines returning from abroad; and

2. Non-resident citizens coming to resettle in the Philippines.

NOTE: Such goods must be exempt from customs duties.

Knowledge Engineer: MARK JOHN D. GONZALES,CPA,CTT,MPBM Page 1 of 20

INTERNATIONAL SCHOOL OF ASIA AND THE PACIFIC

Alimannao Hills, Penablanca, Cagayan HQ # 3

D. Importation of professional instruments and implements, tools of trade,

occupation or employment, wearing apparel, domestic animals, and personal

household effects, provided:

a It belongs to persons coming to settle in the Philippines, or Filipinos or their families and

descendants who are now residents or citizens of other countries such parties herein

referred to as overseas Filipinos;

b In quantities and of the class suitable to the profession, rank or position of the persons

importing said items;

c For their own use and not for sale, barter or exchange;

d Accompanying such persons, or arriving within a reasonable time.

Provided, that the Bureau of Customs may, upon the production of satisfactory evidence

that such persons are actually coming to settle in the Philippines and that the goods are

brought from their former place of abode, exempt such goods from payment of duties and

taxes: Provided, further, vehicles, vessels, aircrafts and machineries and other similar

goods for use in manufacture, shall not fall within this classification and shall therefore be

subject to duties, taxes and other charges.

E. Services subject to percentage tax

F. Services by agricultural contract growers and milling for others of palay into rice,

corn into grits and sugar cane into raw sugar;

G. Medical, dental, hospital and veterinary services except those rendered by

professionals;

NOTE:

1. Laboratory services are exempted. If the hospital or clinic operates a pharmacy or

drugstore, the sale of drugs and medicines are subject to VAT.

2. Hospital bills constitute medical services. The sales made by the drugstore to the in-

patients which are included in the hospital bills are part of medical bills (not subject to

vat).

3. The sales of the drug store to the out-patients are taxable because they are NOT PART

of medical services of the hospital.

H. Educational services rendered by:

e private educational institutions, duly accredited by:

Department of Education (DepEd)

Commission on Higher Education (CHED)

TechnicalEducation and Skills Development Authority (TESDA)

Government Educational Institutions

I. Services rendered by individuals pursuant to an employer-employee

relationship

J. Services rendered by regional or area headquarters

K. Transactions which are exempt under international agreements to

which the Philippines is a signatory or under special laws

L. For agricultural cooperatives:

i. Sales to their members

ii. Sales to non-members if the cooperative is the producer (if not, subject to

VAT)

iii. Importation of:

A. Direct farm inputs, machineries and equipment, including spare parts thereof

B. To be used directly and exclusively in the production and/or

processing of their produce.

TYPE OF PRODUCT SALE TO MEMBERS SALE TO NON-MEMBERS

Sale of coop’s own produce exempt exempt

Other than the coop’s produce, exempt vatable

i.e., form traders

Knowledge Engineer: MARK JOHN D. GONZALES,CPA,CTT,MPBM Page 2 of 20

INTERNATIONAL SCHOOL OF ASIA AND THE PACIFIC

Alimannao Hills, Penablanca, Cagayan HQ # 3

M. Gross receipts from lending activities by credit or multi-purpose

cooperatives

NOTE: Exemption is not only limited to the gross receipts on loans extended to its

members but also to other persons who are not members.

N. Sales by non-agricultural, non-electric and non-credit cooperatives,

provided, that the share capital contribution of each member does not

exceed P15,000

NOTE: Importation by non-agricultural, non-electric and noncredit cooperatives of

machineries and equipment including spare parts thereof, to be used by them are

subject to VAT.

O. Export sales by persons who are not VAT-registered

P. Sale of:

a) Real properties not primarily held for sale to customers or held for lease in the

ordinary course of trade or business. However, even if the real property is not

primarily held for sale to customers or held for lease in the ordinary course of

trade or business but the same is used in trade or business of the seller, the

sale thereof shall be subject to vat being a transaction incidental to the

taxpayer’s main business.

b) Real property utilized for low-cost housing as defined under RA No. 7279,

otherwise known as the “Urban Development and Housing Act of 1992” and

other related laws.

“Low-cost housing ” refers to housing projects intended for homeless low-

income family beneficiaries, undertaken by the Government or private

developers, which may either be a subdivision or a condominium, registered

and licensed by the Housing and Land Use Regulatory Board/Housing (HLURB)

under BP Blg. 220, PD 957, or any other similar law, wherein the unit selling

price is within the selling price per unit as set by the Housing and Urban

Development Coordinating Council (HUDCC) pursuant to RA 7279, otherwise

known as the “Urban Development and Housing Act of 1992” and other laws.

c) Real property utilized for “socialized housing” as defined by Republic Act No.

7279, and other related laws such as RA No. 7835 and RA No. 8763, wherein

the price ceiling per unit is P 450,000 or as may from time to time be

determined by HUDCC and the NEDA and other related laws.

“Socialized housing” refers to housing programs and projects covering houses and lots or home

lots only that are undertaken by the government or the private sector for the underprivileged and

homeless citizens, which shall include sites and services development, long-tem financing,

liberalized terms on interest payments, and as such other benefits in accordance with the

provisions of Republic Act 7279, otherwise known as the “Urban Development and Housing Act

of 1992” and RA No. 7835 and RA No. 8763. “Socialized Housing” shall also refer to projects

intended for the underprivileged and homeless wherein the housing package selling price is within

the lowest interest rates under the Unified Home Lending Program (UHLP) or any equivalent

housing program of the Government, the private sector or non-government organizations.

d. Real properties primarily held for sale to customers or held for lease in the

ordinary course of trade or business, if:

1. Residential lot valued at P1,500,000;

2. House and lot, and other residential dwellings valued at P2,500,000

NOTE:If two or more adjacent residential lots are sold or disposed in favor of one buyer, for the

purpose of utilizing the lots as one residential lot, the sale shall be exempt from vat only if the

aggregate value do not exceed P1,500,000 (as amended). Adjacent residential lots, although

covered by separate titles and/or separate tax declarations, when sold to one and the same buyer,

whether covered by one separate Deed of Conveyance, shall be presumed as sale of one

residential lot.

Provided, that beginning January 1, 2021, the vat exemption shall only apply to sale of real

properties not primarily held for sale to customers or held for lease in the ordinary course of

trade or business, sale of real property utilized for socialized housing as defined under RA No.

Knowledge Engineer: MARK JOHN D. GONZALES,CPA,CTT,MPBM Page 3 of 20

INTERNATIONAL SCHOOL OF ASIA AND THE PACIFIC

Alimannao Hills, Penablanca, Cagayan HQ # 3

7279, sale of house and lot and other residential dwellings with selling price of not more than

two million pesos (P2,000,000); Provided, further, that every three (3) years thereafter, the

amounts stated herein shall be adjusted to its present value using the Consumer Price Index,

as published by the Philippine Statistics Authority (PSA).

Q. Lease of a residential unit with a monthly rental not exceeding P15,000,

regardless of the amount of aggregated rentals received by the lessor during the

year.

NOTES:

❖ LEASE of RESIDENTIAL UNITS where the monthly rental per unit exceeds P15,000 but

the aggregate of such rentals of the lessor during the year do not exceed P3,000,000

shall likewise be exempt from VAT, however, the same shall be subjected to three (3%)

percentage tax (RR 16-2011; RR 13-2018).

❖ In cases where a lessor has SEVERAL RESIDENTIAL UNITS for LEASE, some are leased

out for a monthly rental per unit of not exceeding P15,000 while others are leased out

for more than P15,000 per unit, his tax liability will be:

- The gross receipts from rentals not exceeding P15,000 per month per unit shall be

exempt from VAT regardless of the aggregate annual gross receipts.

- The gross receipts from rentals exceeding P15,000 per month per unit shall be

subject to VAT if the annual gross receipts (from said units only – not including

the gross receipts from units leased out for not more than P15,000 exceed

P3,000,000. Otherwise, the gross receipts shall be subject to three percent (3%)

percentage tax under section 116 of the tax code (RR 16-2011; RR 13-2018).

R. Sale, importation, printing or publication of books and any newspaper,

magazine, review or bulletin which:

1) Appears at regular intervals;

2) With fixed prices for subscription and sale;

3) Not devoted principally to the publication of paid advertisements.

S. Transport of passengers by international carriers doing business in the

Philippines. The same shall not be subject to Other Percentage Taxes as

amended under RA10378 and Transport of cargo by international carriers doing

business in the Philippines, as the same is subject to 3% common carrier’s tax

(Other Percentage Taxes) as amended under RA10378.

T. "Sale, importation or lease of passenger or cargo vessels and aircraft, including

engine, equipment and spare parts thereof for domestic or international

transport operations

OTHER PERCENTAGE TAXES (BICAPFLOW)

✓ BANKS AND NON-BANKS

Tax on banks and non-bank financial Tax Base: Monthly gross

intermediaries performing quasi-banking receipts

functions:

a. On interests, commissions and discounts from lending activities as well as

income from financial leasing, based on remaining maturities of the

instruments, as follows:

Maturity period of more than 5 years 1%

Maturity period of 5 years or less 5%

Note: In case of pretermination, the maturity period shall be reckoned to end

as of the date of pretermination for purposes of classifying the transaction

and applying the correct rate of tax.

b. On royalties, rental of property (real or personal), profit from exchange and

all other items treated as gross income under Section 32 of the tax code. 7%

c. On trading gains within a taxable month on foreign currency, debt securities,

derivations and other similar financial instruments. 7%

d. On dividends and equity shares in the net income of subsidiaries. 0%

Knowledge Engineer: MARK JOHN D. GONZALES,CPA,CTT,MPBM Page 4 of 20

INTERNATIONAL SCHOOL OF ASIA AND THE PACIFIC

Alimannao Hills, Penablanca, Cagayan HQ # 3

Tax on other non-bank financial Monthly gross receipts

intermediaries,

including finance companies, money changers

and pawnshops:

a. On interests, commissions and discounts from lending activities as well as

income from financial leasing, based on remaining maturities of the

instruments, as follows:

Maturity period of more than 5 years 1%

Maturity period of 5 years or less 5%

Note: In case of pretermination, the maturity period shall be reckoned to end

as of the date of pretermination for purposes of classifying the transaction

and applying the correct rate of tax.

b. On royalties, rental of property (real or personal), profit from exchange and

all other items treated as gross income under Section 32 of the tax code. 5%

c. On dividends and equity shares in the net income of subsidiaries. -

✓ INTERNATONAL CARRIERS

OPT on international carriers (air & shipping) Monthly gross receipts 3%

for the transport of both passengers & cargoes

✓ COMMON CARRIERS

Percentage tax on domestic common carriers Monthly gross receipts 3%

by land for the transport of passengers and

keepers of garages, except owners of bancas

and animal-drawn two-wheeled vehicles.

The following shall be considered per unit minimum quarterly gross receipts (for Sec. 117 only):

Manila and other Provincial

Cities

⚫ Jeepney for hire P2,400 P1,200

⚫ Public utility bus:

Not exceeding 30 passengers 3,600 3,600

Exceeding 30 but not exceeding 50 6,000 6,000

Exceeding 50 7,200 7,200

⚫ Taxis 3,600 2,400

⚫ Car for hire (with chauffeur) 3,000 3,000

⚫ Car for hire (w/o chauffeur) 1,800 1,800

✓ AMUSEMENT

Amusement taxes from operators of:

Quarterly gross receipts 10%

1. Boxing exhibitions

(Exempt, if a World or Oriental championship in any division is at stake, promoted

by a Filipino citizen or Corporation, at least 60% Filipino owned, and one of the

contenders is a Filipino citizen)

2. Professional basketball games Quarterly gross receipts 15%

3. Cockpits Quarterly gross receipts 18%

4. Cabarets, night or day clubs Quarterly gross receipts 18%

5. Jai-alai and race tracks Quarterly gross receipts 30%

For the purpose of the amusement tax, the term “gross receipts” embraces all the receipts of

the proprietor, lessee or operator of the amusement place. Said gross receipts also include

income from television, radio, and motion picture rights, if any.

✓ PSE SALES

Tax on sale, barter or exchange of shares of stock listed and traded through the local stock

exchange (LSE), other than sale by a dealer in securities – 6/10 of 1% of gross selling price or

gross value in money of the shares of stock sold, bartered, exchanged or otherwise disposed

of.

Knowledge Engineer: MARK JOHN D. GONZALES,CPA,CTT,MPBM Page 5 of 20

INTERNATIONAL SCHOOL OF ASIA AND THE PACIFIC

Alimannao Hills, Penablanca, Cagayan HQ # 3

Tax on shares of stock sold or exchanged through the LSE in an initial public offering of shares

of stock of a closely held corporation in accordance with the proportion of shares of stock sold,

bartered or exchanged or disposed of to the total outstanding shares of stock after the listing

in the LSE*(IPO):

Up to 25% 4% of GSP

Over 25% to 33 1/3% 2% of GSP

Over 33 1/3% 1% of GSP

*Repealed under R.A. 11494 (Bayanihan To Recover As One Act) which took effect on September

15, 2020.

✓ FRANCHISES

Tax on franchises:

1. On gas and water utilities Monthly gross receipts 2%

2. On radio and/or television broadcasting Monthly gross receipts or pay 3%

companies with annual GR of not more VAT at their option. Once

than P10,000,000 exercised, it becomes

irrevocable.

✓ LIFE INSURANCE

Tax on life insurance premium, except purely Insurance premiums collected 5%

cooperative companies or associations

⚫ Owners of property who obtain insurance On premiums paid 5%

directly with foreign companies

⚫ Agents of foreign insurance companies Insurance premiums collected 10%

(fire, marine or miscellaneous insurance

agents)

✓ OVERSEAS DISPATCH

Tax on overseas dispatch, message or Quarterly gross receipts from

conversation originating from the Philippines such services 10%

Exempted from Sec. 120 are: (DING)

⚫ Diplomatic services

⚫ International organizations

⚫ News services

⚫ Government

✓ WINNINGS

Tax on winnings ⚫ Winner of the prizes in double 4% of the net

forecast/quinella & trifecta prize

bets

⚫ Person winning not in double 10% of the net

forecast/quinella & trifecta prize

bets

⚫ Owners of winning race horses 10% of the prize

Return and payment of other percentage taxes

a. General rule: Every person liable to pay percentage taxes shall file a monthly return of the

amount of his gross sales, receipts or earnings and pay the tax thereon within twenty (20)

days after the end of each taxable month. The taxpayer may file a separate return for each

branch or place of business, or a consolidated return for all branches or places of business

with the authorized agent bank, Revenue District Officer, Collection Agent or duly authorized

Treasurer of the City or Municipality where said business or principal place of business is

located, as the case maybe.

b. Exceptions:

⚫ The tax on overseas dispatch, message or conversation originating from the Philippines

shall be paid by the person rendering the service within twenty (20) days after the end of

each quarter.

Knowledge Engineer: MARK JOHN D. GONZALES,CPA,CTT,MPBM Page 6 of 20

INTERNATIONAL SCHOOL OF ASIA AND THE PACIFIC

Alimannao Hills, Penablanca, Cagayan HQ # 3

⚫ Amusement taxes shall be paid by the proprietor, lessee, operator or any party liable within

twenty (20) days after the end of each quarter.

⚫ The tax on winnings shall be deducted and withheld by the operator, manager or person in

charge of the horse races and remitted to the Bureau of Internal Revenue within twenty

(20) days from the date the tax was deducted and withheld.

⚫ The stock transaction tax of 1/2 of 1%, shall be collected by the stock broker and remitted

to the Bureau of Internal Revenue within five (5) banking days from the date of collection.

⚫ The stock transaction tax of 4%, 2% and 1%, in case of primary offering, shall be paid by

the corporation within thirty (30) days from the date of listing of the shares of stock in the

local stock exchange. In case of secondary offering, the tax shall be collected by the

stockbroker and remitted to the Bureau of Internal Revenue within five (5) banking days

from the date of collection.

⚫ Any person retiring from a business subject to percentage tax shall notify the nearest

internal revenue officer, file his return and pay the tax due thereon within twenty (20) days

after closing his business.

COMMON PROVISIONS

Any gain derived from the sale, barter, exchange or other disposition of shares of stock under

this Section shall be exempt from income tax.

RETURN AND PAYMENTS OF PERCENTAGE TAX

IN GENERAL – 25 days from the end of the quarter.

EXCEPTIONS

i Tax on winnings - 20 days from the date withheld.

ii Stock transaction tax of 6/10 of 1% and Secondary Offering-5 banking days from the date

withheld by the broker.

iii Primary Offering - 30 days from the date of listing in the local stock exchange.

RR NO. 6-2015

In general, the business tax (VAT or Percentage Tax) on the sale of raw sugar and refined

sugar, shall be paid in advance by the owner/seller before any warehouse receipt or

quedans are issued, or before the sugar is withdrawn from any sugar refinery/mill.

For taxpayers who are non-vat registered and exempt from vat under the Tax Code, the

amount of advance percentage tax shall be determined by applying the percentage tax rate

of three percent (3%) of the gross sales or receipts, provided, that cooperatives shall be

exempt from the 3% gross sales or receipts.

Exempt from Advance Payment:

❖ Withdrawal of raw cane sugar;

❖ Withdrawal of sugar by duly accredited and registered agricultural cooperative of good

standing;

❖ Withdrawal of sugar by duly accredited and registered agricultural cooperative which is

sold to another agricultural cooperative.

WITHHOLDING PERCENTAGE TAX

❖ Bureaus, offices and instrumentalities of the government, including government owned

and controlled corporations as well as their subsidiaries, provinces, cities and

municipalities making any money payment to private individuals, corporations,

partnerships and or associations are required to deduct and withhold the three (3%) taxes

due from the payees on account of such money payments

Knowledge Engineer: MARK JOHN D. GONZALES,CPA,CTT,MPBM Page 7 of 20

INTERNATIONAL SCHOOL OF ASIA AND THE PACIFIC

Alimannao Hills, Penablanca, Cagayan HQ # 3

POINTS TO REMEMBER ON CONSUMPTION TAX

1. There are two types of consumption

a) Domestic consumption and

b) Foreign consumption

NOTE:

1. Only Domestic consumption is subject to tax

2. If goods entered the Philippines, it will be taxed to consumption tax at the point of entry

3. If goods are exported, it is effectively not subjected to consumption tax at the point of

entry. It is subject to 0% VAT for VAT taxpayers and is exempt from percentage tax for Non-

VAT taxpayers. It is also exempt from excise tax.

2. There are two types of consumption tax on domestic consumption:

a) VAT on importation and

b) Business Tax

NOTE:

1. The VAT on importation applies uniformly to all taxpayers

2. The business tax applies only if the seller is engaged in business

3. There are three types of business tax:

a) VAT on sales

b) Percentage Tax

c) Excise Tax

NOTE:

1. Taxpayers either pay VAT on sales or percentage tax with excise tax as an additional tax

if it produces excisable products/articles.

2. The VAT on sales and percentage tax accrues at the point of sales or collection while excise

tax accrues at the point of production

3. VAT is based on the Value Added. It is 12% of sales or receipt less VAT paid on purchase.

Percentage tax is directly computed on the sales or receipts.

MNEMONICS for EXCLUSIONS TO BUSINESS TAX (AmHERERICQT)

1. Agri-Marine Food Products in their Original State

➢ Sale or importation of agricultural and marine food products in their original state,

livestock and poultry of a kind generally used as, or yielding or producing foods for human

consumption; and breeding stock and genetic materials therefor.

➢ Sale or importation of fertilizers; seeds, seedlings and fingerlings; fish, prawn, livestock

and poultry feeds, including ingredients, whether locally produced or imported, used in

the manufacture of finished feeds (except specialty feeds for race horses, fighting cocks,

aquarium fish, zoo animals and other animals generally considered as pets);

➢ Services by agricultural contract growers and milling for others of palay into rice, corn into

grits and sugar cane into raw sugar;

2. Health

➢ Medical, dental, hospital and veterinary services

3. Education

➢ Educational services rendered by private educational institutions, duly accredited by the

Department of Education, Culture and Sports (DECS) and the Commission on Higher

Education (CHED), and those rendered by government educational institutions;

➢ Sale, importation, printing or publication of books and any newspaper, magazine, review

or bulletin which appears at regular intervals with fixed prices for subscription and sale

and which is not devoted principally to the publication of paid advertisements;

4. Regional or Area Headquarter

➢ Services rendered by regional or area headquarters established in the Philippines by

multinational corporations which act as supervisory, communications and coordinating

centers for their affiliates, subsidiaries or branches in the Asia-Pacific Region and do not

earn or derive income from the Philippines;

Knowledge Engineer: MARK JOHN D. GONZALES,CPA,CTT,MPBM Page 8 of 20

INTERNATIONAL SCHOOL OF ASIA AND THE PACIFIC

Alimannao Hills, Penablanca, Cagayan HQ # 3

5. Employment

➢ Services rendered by individuals pursuant to an employer-employee relationship

6. Real Properties

➢ Sale of real properties not primarily held for sale to customers or held for lease in the

ordinary course of trade or business or real property utilized for low-cost and socialized

housing as defined by Republic Act No. 7279, otherwise known as the Urban Development

and Housing Act of 1992, and other related laws

➢ Lease of a residential unit with a monthly rental not exceeding Eight thousand pesos

(P8,000): Provided, That not later than January 31st of the calendar year subsequent to

the effectivity of Republic Act No. 8241 and each calendar year thereafter, the amount of

Eight thousand pesos (P8,000) shall be adjusted to its present value using the Consumer

Price Index as published by the National Statistics Office (NSO) (Now 10,000)

7. International / Domestic Air Carrier

➢ The sale, importation or lease of passenger or cargo vessels and aircraft, including engine,

equipment and spare parts, for domestic and international transport operations

8. Cooperatives

➢ Sales by agricultural cooperatives duly registered with the Cooperative Development

Authority to their members as well as sale of their produce, whether in its original state

or processed form, to non-members; their importation of direct farm inputs, machineries

and equipment, including spare parts thereof, to be used directly and exclusively in the

production and/or processing of their produce

➢ Gross receipts from lending activities by credit or multi-purpose cooperatives duly

registered with the Cooperative Development Authority whose lending operation is limited

to their members

9. Quasi-Importation

➢ Importation of professional instruments and implements, wearing apparel, domestic

animals, and personal household effects (except any vehicle, vessel, aircraft, machinery,

other goods for use in the manufacture and merchandise of any kind in commercial

quantity) belonging to persons coming to settle in the Philippines, for their own use and

not for sale, barter or exchange, accompanying such persons, or arriving within ninety

(90) days before or after their arrival, upon the production of evidence satisfactory to the

Commissioner, that such persons are actually coming to settle in the Philippines and that

the change of residence is bona fide;

➢ Importation of personal and household effects belonging to the residents of the Philippines

returning from abroad and nonresident citizens coming to resettle in the Philippines:

Provided, That such goods are exempt from customs duties under the Tariff and Customs

Code of the Philippines

10. Treaty

➢ Transactions which are exempt under international agreements to which the Philippines

is a signatory or under special laws

Knowledge Engineer: MARK JOHN D. GONZALES,CPA,CTT,MPBM Page 9 of 20

INTERNATIONAL SCHOOL OF ASIA AND THE PACIFIC

Alimannao Hills, Penablanca, Cagayan HQ # 3

MULTIPLE CHOICE QUESTIONS

Tax on Persons Exempt from VAT

1. Which of the following is not a requisite in order for a taxpayer be subject to percentage

tax under Section 116 of the Tax Code?

a. The taxpayer must not be a VAT-registered person;

b. The annual gross sales/receipts during the year does not exceed Php3,000,000;

c. The taxpayer did not opt to pay 8% income tax regime.

d. None of the choices

2. The following persons are exempt from percentage tax under Section 116 of the Tax

Code, except:

a. Persons subject to VAT

b. Persons exempt from VAT but NOT due to threshold

c. Cooperatives

d. All of the choices

3. One of the following is subject to three percent (3%) percentage tax

a. Establishments whose annual gross sales or receipts exceed Php3,000,000 and who

are VAT registered.

b. Businesses whose annual gross sales or receipts exceed Php3,000,000 and who are not

VAT registered.

c. VAT registered establishments whose annual gross sales or receipts do not exceed

Php3,000,000.

d. Establishments whose annual gross sales or receipts do not exceed Php3,000,000 and

who are not VAT registered.

4. Mr. Pancho, not a VAT-registered person, has the following data for the year 2019:

Sale of fresh fruits Php800,000

Sale of refined sugar 1,000,000

Sale of cooking oil 1,500,000

Compensation 700,000

Only 50% of the above sales were collected. Compensation income was collected in full

from his employer.

How much is the VAT or percentage tax for the year 2019?

a. P70,500 c. P120,000

b. P75,000 d. P480,000

5. Based on the preceding number, assuming the taxable year

is 2020, how much is the VAT or percentage tax for the year?

a. P50,000 c. P75,000

b. P70,500 d. P120,000

Use the following data for the next three (3) questions:

LJ, non-vat registered, has the following data for her first year of operations:

Merchandise purchased Php1,450,000

Merchandise inventory, Dec. 31,

2019 450,000

Collections 800,000

All sales are on account and goods sell at 30% above cost.

6. How much is the business tax for the year?

a. P24,000 c. P39,000

b. P30,000 d. nil

7. If LJ is a service provider, how much is the business tax for the year?

a. P24,000 c. P39,000

b. P30,000 d. nil

Knowledge Engineer: MARK JOHN D. GONZALES,CPA,CTT,MPBM Page 10 of 20

INTERNATIONAL SCHOOL OF ASIA AND THE PACIFIC

Alimannao Hills, Penablanca, Cagayan HQ # 3

8. If LJ is self-employed and she opted to be taxed at 8%

income tax rate, how much is her percentage tax during the year?

a. P24,000 c. P39,000

b. P30,000 d. nil

9. Pedro is a CPA practitioner. His gross receipts, expenses and other data for 2019 taxable

year are provided below:

Gross receipts Php2,800,000

Cost of services 1,200,000

Operating expenses 900,000

Rental income 575,000

10. Which of the following statements is correct?

a. Pedro is subject to 3% OPT under Section 116 of the Tax Code, as amended.

b. Pedro may choose to be taxed at 8% income tax rate in lieu of the graduated income tax

table and Section 116 of the Tax Code, as amended.

c. Pedro is subject to value added tax

d. None of the above

Percentage Tax on Domestic Carriers and Keepers of Garages

11. Which of the following is subject to the 3% common carrier’s tax?

Transportation contractors on their transport of goods or cargoes.

Common carriers by air and sea relative to their transport of passengers.

Owners of animal-drawn two-wheeled vehicle.

Domestic carriers by land for the transport of passengers.

12. All of the following, except one, are not subject to common carrier's tax

owner of a parking lot/building

rent-a-car companies

common carriers engaged in carriage of goods or cargo

domestic airline companies

13. Masbate Liner Co. is a common carrier with passenger buses and cargo trucks. For the

4TH quarter of 2019, it had the following data on receipts, taxes not included:

From transport of passengers Php800,000

From transport of cargoes 200,000

From bus rentals for school fieldtrips 400,000

Common carrier tax is:

a. P36,000 c. P24,000

b. P12,000 d. nil

14. Milagros Lines, a VAT-registered person, has the following gross receipts for the 1st

Quarter of 2019:

Bus 1 (carriage of goods, P18,000) P100,000

Bus 2 (carriage of goods, P13,500) 165,000

Taxi 90,000

Jeepney 35,500

Cargo truck 45,000

Sea vessel 250,000

Additional Information:

Salaries of drivers and conductor 125,000

Cost of oil and gasoline 175,000

During the quarter, Bus 1 was bumped by another bus owned by Mandaon Lines and

paid Milagros Lines Php120,000 for the damage.

The percentage tax due on Milagros Line is:

c.

a. P10,770 P11,715

b. P14,370 d. nil

Knowledge Engineer: MARK JOHN D. GONZALES,CPA,CTT,MPBM Page 11 of 20

INTERNATIONAL SCHOOL OF ASIA AND THE PACIFIC

Alimannao Hills, Penablanca, Cagayan HQ # 3

15. Which of the following is not subject to common carrier tax under Section 117 of the

NIRC, as amended?

a. A Transfer Network Company (TNC) who is a holder of a valid and current CPC

b. A TNC Partner who is a holder of a valid and current CPC

c. A TNC Partner who is accredited by LTFRB

d. None of the choices

16. Feona paid P500 to a GRAB driver who is a holder of a CPC. Twenty five percent (25%)

of said amount was later remitted by the driver to GRAB as the latter’s share. GRAB is

also a holder of a CPC. How much is the business tax applicable to the GRAB driver?

a. P60 c. P15

b. P53.57 d. nil

17. Based on the preceding number, how much is the business tax applicable to GRAB?

a. P15 c. P3.75

b. P13.39 d. nil

Percentage Tax on Domestic Carriers and Keepers of Garages

18. Which of the following is not a requisite in order for percentage tax on

international carrier to apply?

a. The flight or voyage must originate in the Philippines

b. The flight or voyage must be continuous and uninterrupted

c. The gross receipts must pertain to cargoes and/or mail

d. None of the choices

19. Which of the following maybe subject to Common Carrier’s Tax?

a. Online flights or voyages

b. Offline flights or voyages

c. Both “a” and “b”

d. Neither “a” nor “b”

20. Which of the following is considered to have originated in the Philippines?

a. Chartered flights or voyages originally commencing their flights or voyages from any

foreign port and whose stay in the Philippines is for more than forty-eight (48) hours

prior to embarkation wherein the reason for failure to depart within forty-eight (48) hours

is due to typhoon Ulyses.

b. Where a passenger, his excess baggage, cargo and/or mail originally commencing his

flight or voyage from a foreign port alights or is discharged in any Philippine port and

thereafter boards or is loaded on another airplane owned by the same airline company

or vessel owned by the same international sea carrier where the time intervening

between arrival and departure exceeds forty-eight (48) hours by reason of COVID-19

pandemic restrictions.

c. Where a passenger, his excess baggage, cargo and/or mail originally commencing his

flight or voyage from a foreign port alights or is discharged in any Philippine port and

thereafter boards or is loaded on another airplane owned by another airline company or

vessel where the time intervening between arrival and departure exceeds forty-eight (48)

hours by reason of magnitude 10 earthquake.

d. None of the choices

21. Emirates Airlines boarded passengers in NAIA Terminal 1 bound for New York, USA. The

plane will make a 5 hour stopover in Dubai for maintenance check and refueling, then

proceed to its final destination. Based on the facts presented, which of the following is

true?

a. The flight is continuous and uninterrupted from the Philippines to Dubai leg only.

b. The flight is continuous and uninterrupted from the Philippines to New York, USA.

c. The flight is continuous and uninterrupted from Dubai to New York, USA leg only.

d. None of the choices

22. China Northern Airlines Inc., a resident foreign corp. has the following Collections for the

quarter:

Knowledge Engineer: MARK JOHN D. GONZALES,CPA,CTT,MPBM Page 12 of 20

INTERNATIONAL SCHOOL OF ASIA AND THE PACIFIC

Alimannao Hills, Penablanca, Cagayan HQ # 3

Passengers airfare from China to Philippines 1,800,000

Passengers airfare from Philippines to China 1,500,000

Airfare for cargoes from China to Philippines 700,000

Airfare for cargoes from Philippines to China 1,300,000

How much is the common carrier’s tax payable for the quarter?

a. P60,000 c. P84,000

b. P39,000 d. P159,000

23. Which of the following business taxes will never apply to an off-line international carrier?

a. Tax on Persons Exempt from VAT (Section 116 of the NIRC)

b. VAT

c. Common Carrier’s Tax (Section 118 of the NIRC)

d. None of the choices

Tax on Franchises

24. Which of the following franchises will never be subject to Franchise Tax (OPT)?

a. Gas & water utilities

b. Radio and/or Television

c. Tollways

d. None of the choices

25. Which of the following franchises is subject to Franchise Tax regardless of annual gross

receipts?

a. Gas & water utilities

b. Radio and/or Television

c. Telecommunication

d. Mining

26. MATI Gas Company operates a gas and radio/television broadcasting franchise. It has the

following data for the year

2019:

Gross Receipts - Gas franchise P2,000,000

Gross Receipts - Radio franchise 10,000,000

(5,000,000)

Operating expenses

P7,000,000

Net Income

The total franchise tax is:

a. P340,000 c. P40,000

b. P300,000 d. P190,000

Tax on Overseas Dispatch, Message or Conversation Originating from the Philippines

(Sec. 120)

27. One of the following is subject to overseas communications tax:

a. Long distance call by a son from Manila to his father in Iloilo City.

b. Monthly telephone bill from PLDT for the landline connection.

c. Telephone bill on a call by a mother in the Philippines to her son in London.

d. Telephone call by Magda in Hongkong to her friend in Manila.

28. One of the following statements is incorrect.

a. Overseas communications tax is imposed on overseas communications originating from

the Philippines.

b. The person liable to overseas communications tax may or may not be engaged in any

trade or business.

c. The overseas communications tax is imposed on the owner of the communication facilities

used to make overseas communications.

d. None of the choices

29. Which of the following statements is false?

Knowledge Engineer: MARK JOHN D. GONZALES,CPA,CTT,MPBM Page 13 of 20

INTERNATIONAL SCHOOL OF ASIA AND THE PACIFIC

Alimannao Hills, Penablanca, Cagayan HQ # 3

a. BBC, an international news agency, is required to pay 10% percentage tax from messages

originating from the Philippines by telephone or telegraph.

b. Amounts paid for messages transmitted by an embassy and consular offices of a foreign

government is not subject to 10% overseas communications tax.

c. Overseas communications initiated by a resident citizen not engaged in trade or business

is subject to overseas communication tax.

d. None of the above

30. Moon Telecom Inc. has the following collections for the quarter:

Overseas call originating abroad P1,120,000

Overseas call originating in the Philippines 880,000

Local calls 2,240,000

How much is the overseas communication tax to be remitted by Moon for the quarter?

a. P220,000 c. P200,000

b. P88,000 d. P80,000

31. Based on the preceding number, how much is the output tax?

a. P240,000 c. P360,000

b. P454,286 d. P268,800

Tax on banks and non-bank financial intermediaries Performing Quasi-Banking

Functions

32. Which of the following is subject to Gross Receipts Tax?

a. Bank of the Philippine Islands

b. Pawnshops

c. Money changers

d. Bangko Sentral ng Pilipinas

30. Which of the following income items is not subject to Gross Receipts Tax?

a. Interest income from bank deposit in the Philippines

b. Interest income from loans granted to debtors in the Philippines

c. Gain on sale of ROPOA in the Philippines

d. Royalty income from abroad

31. The following expense items are not deductible in determining Gross Receipts Tax, except:

a. Interest expense

b. Rent expense

c. Losses on sale of ROPOA

d. Trading loss

32. Piggy Bank has the following data for the 1st Quarter of 2019:

Interest income, the remaining maturity

of the instrument is 5 years P100,000

Rentals (net of 5% expanded

withholding tax) 47,500

Net trading loss (10,000)

How much is the gross receipts tax?

a. P5,000 c. P7,800

b. P3,500 d. P8,500

33. In addition to the information in the preceding number, Piggy Bank has the following

information for the 2nd Quarter of 2019:

Interest income, the remaining maturity

of P100,000

the instrument is 6

years

Rentals (net of 5% expanded

withholding 47,500

tax)

Net trading gain 20,000

How much is the gross receipts tax for the 2nd

Quarter?

Knowledge Engineer: MARK JOHN D. GONZALES,CPA,CTT,MPBM Page 14 of 20

INTERNATIONAL SCHOOL OF ASIA AND THE PACIFIC

Alimannao Hills, Penablanca, Cagayan HQ # 3

a. P5,200 c. P9,200

b. P5,900 d. P9,900

34. Bobadila Leasing Corporation, a non-bank financial intermediary performing quasi-banking

functions, has the following summary of its trading transactions related to foreign currency,

debt securities and derivatives:

1st Quarter P3,000,000

2nd Quarter (5,000,000)

3rd Quarter 6,000,000

How much is the Gross Receipts Tax for the 3rd

Quarter?

a. P420,000 c. P280,000

b. P70,0000 d. P630,000

35. Mr. D executed on January 1, 2019, a long-term loan from Bank C in the amount of

P6,000,000 payable within ten (10) years, with an annual interest of 2%. However, on

December 31, 2022, the loan was pre-terminated. Assuming Bank C declared correctly the

interest from 2019 to 3rd quarter of 2022 and the applicable gross receipts taxes were paid,

how much gross receipts tax should be paid for the 4th Quarter of 2022?

a. P19,200 c. P19,700

b. P24,500 d. P19,500

Tax on Other Non-Bank Financial Intermediaries

36. Which of the following statements is not true?

a. The generally accepted accounting principles as may be prescribed by the Bangko Sentral

ng Pilipinas shall likewise be the basis for calculation of gross receipts for banks.

b. The generally accepted accounting principles as may be prescribed by the Securities and

Exchange Commission shall likewise be the basis for calculation of gross receipts of non-

bank financial intermediaries performing quasi banking functions.

c. The generally accepted accounting principles as may be prescribed by the Securities and

Exchange Commission shall likewise be the basis for calculation of gross receipts of non-

bank financial intermediaries not performing quasi banking functions.

d. None of the choices

37. A pawnshop, classified as not-performing quasi-banking functions, has the following

information for the 2nd Quarter of 2019:

Interest income, the remaining maturity

of P200,000

the instrument is 1 year

Gain on sale of jewelries 800,000

Trading gain on derivatives 400,000

Trading loss on derivatives 250,000

How much is the gross receipts tax for the 2nd Quarter of 2019?

a. P57,500 c. P50,000

b. P70,000 d. P98,000

Tax on Life Insurance Premiums

38. The following persons doing insurance business in the Philippines is/are subject to 2%

premiums tax:

a. Purely cooperative companies or associations engaged in selling life insurance.

b. Insurance company selling non-life insurance.

c. Insurance company selling life insurance.

d. All of the choices

Knowledge Engineer: MARK JOHN D. GONZALES,CPA,CTT,MPBM Page 15 of 20

INTERNATIONAL SCHOOL OF ASIA AND THE PACIFIC

Alimannao Hills, Penablanca, Cagayan HQ # 3

39. Which of the following is subject to premiums tax?

a. Premiums refund within twelve (12) months after payment on account of rejection of risk

or returned for other reason to a person insured;

b. Reinsurance by a company that has already paid the tax;

c. Premiums collected or received by any branch of a domestic corporation, firm, or

association doing business outside the Philippines on account of any life insurance of the

insured who is a non-resident, if any tax on such premium is imposed by the foreign country

where the branch is established;

d. Premiums collected or received on account of any reinsurance, if the insured, in case of

personal insurance, resides outside the Philippines, if any tax on such premiums is imposed

by the foreign country where the original insurance has been issued or perfected;

40. Sigurista Insurance Co. collected premiums on variable contracts (as defined in Sec. 232(2)

of Presidential Decree No. 612) in excess of the amounts necessary to insure the lives of the

variable contract workers. Which of the following statements is correct?

a. To the extent necessary to insure the lives of the variable contract workers, it is subject

to 2% premiums tax.

b. Premiums collected in excess of the amount necessary to insure the lives of the variable

contract workers is either subject to VAT or section 116.

c. Both “a” and “b”

d. Neither “a” nor “b”

41. Which of the following is not subject to 2% Premiums Tax?

I. Premium on Health and Accident Insurance

II. Income earned by the life insurance company from services which can be pursued

independently of the insurance business activity

III. Investment income earned by the life insurance companies from investing the premiums

received

IV. Investment income realized from the investment of funds obtained from others, if these

investment activities have been allowed and approved by the Insurance Commission

a. II only

b. II, III and IV

c. II and IV

d. I, II and IV

42. Rose Insurance Co. furnished us its data shown below:

Insurance Premiums collectible is P3,750,000

The breakdown of the above premiums is as follows:

Life Insurance Premiums 75%

Non-life insurance premiums 25%

During the quarter, life insurance premium collected

represents 70%.

The Premiums Tax payable is:

a. P94,437.50 c. P78,750.00

b. P39,375.00 d.P196,875.00

Tax on Agents of Foreign Insurance Companies

43. Paelo wants to procure fire insurance for his Mansion in Dasmarinas Village from ABC

Insurance Co., a non-resident foreign corporation, through its agent in the Philippines Mr.

Webner. He paid premiums in 2019 amounting to P5 million. How much is the premiums tax

payable on the transaction?

a. P500,000 c. P100,000

b. P250,000 d. P200,000

44. Using the same information above, assuming Paelo directly obtained the insurance policy from

ABC Insurance Co., how much is the premiums tax payable on the transaction?

a. P500,000 c. P100,000

b. P250,000 d. P200,000

Knowledge Engineer: MARK JOHN D. GONZALES,CPA,CTT,MPBM Page 16 of 20

INTERNATIONAL SCHOOL OF ASIA AND THE PACIFIC

Alimannao Hills, Penablanca, Cagayan HQ # 3

Amusement Tax

45. Sinner Corp., a cabaret, had the following data during the 2nd Quarter of 2019:

Revenue P1,500,000

Collections during the quarter 1,000,000

Gross income 800,000

Net income during the quarter 500,000

How much is the amusement tax for the Quarter?

a. P180,000 c. P270,000

b. P144,000 d. P90,000

46. Based on the preceding number, if it is a racetrack, how much is the amusement tax

payable?

a. P450,000 c. P240,000

b. P300,000 d. P150,000

47. Romar operates a cockpit in Bacolod City. Inside the cockpit is a restaurant which he also

operates. The data during the quarter are presented below:

Receipts from Entrance Fee P1,780,000

Gross Receipts from Restaurant:

Sale of food and beverages 342,000

Sale of wines &

liquor 266,000

Expenses 844,000

How much is the amusement

tax?

a. P320,400 c. P429,840

b. P381,960 d. P277,920

51. Based on the preceding number, suppose the restaurant is owned and operated by Ryan, a

non-VAT registered person, the percentage tax payable by Ryan is –

a. P18,240 c. P60,800

b. P109,440 d. nil

52. Continuing number 51, the percentage tax due on Romar is

a. P320,400 c. P178,000

b. P53,400 d. nil

53. Golden Boy is the operator of Golden Coliseum. During the quarter it had the following gross

receipts from various activities:

Concert by Pedro P1,170,000

Professional basketball game 1,240,000

Boxing Exhibition 1,780,000

NOTE: The boxing exhibition is a world championship fight between Marchweather and

Chavez, American and Mexican. The fight is promoted by Mr. Bobadilla, a Filipino Citizen.

How much is the amusement tax payable?

a. P186,000 c. P178,000

b. P364,000 d. nil

54. Based on the preceding number, if Chavez is a Filipino, how much is the amusement tax

payable?

c.

a. P186,000 P178,000

b. P364,000 d. nil

Tax on Winnings

55. The Percentage Tax on Winnings is imposed on the winnings of bettors in:

a. Cockfighting

b. Horse racing

Knowledge Engineer: MARK JOHN D. GONZALES,CPA,CTT,MPBM Page 17 of 20

INTERNATIONAL SCHOOL OF ASIA AND THE PACIFIC

Alimannao Hills, Penablanca, Cagayan HQ # 3

c. Jai-alai

d. Boxing

56. Which of the following may not be subject to 10% Tax on Winnings?

a. Winnings from horse races by a bettor

b. Winnings from horse races by a horse owner

c. Both “a” and “b”

d. Neither “a” nor “b”

57. A race track bettor won the following bets:

On double, a bet of P200 and dividend of P200 per P20 ticket.

On winner take all, a bet of P500 and a dividend of P1,000 per P50 ticket

On forecast, a bet of P1,000 and dividend of P100 per P20 ticket

The total percentage tax due from the winnings is:

a. P682 c. P1,280

b. P1,182 d. P1,530

58. Mang Jose had the following records of his horse races in the 3rd Quarter of 2019:

Type of Gross Cost of

Horse Winnings Winnings Winnings

Super Vice Trifecta P90,000 P40,000

Anne Kurot Ordinary 250,000 50,000

John Mongoloyd Double 60,000 10,000

Cruz

Angelica Sinaniban Ordinary 175,000 25,000

How much is the business tax on winnings?

a. P45,000 c. P39,000

b. P48,500 d. P57,500

59. Using the same information above, assuming that Mang Jose is a bettor, how much

percentage tax was withheld from him?

a. P45,000 c. P39,000

b. P48,500 d. P57,500

Tax on Sale, Barter or Exchange of Shares of Stock Listed and Traded Through the

Local Stock Exchange or Through Initial Public Offering

Questions 60 to 65 are the based on the following data:

Bato Realty Corp., a closely-held corporation, has an authorized capital stock of 100,000,000

shares with par value of P1.00/share.

Of the 100,000,000 authorized shares, 25,000,000 thereof is subscribed and fully paid up by the

following stockholders:

Mr. Trillanes 5,000,000

Mrs. Villar 5,000,000

Mr. Angara 5,000,000

Mr. Tolentino 5,000,000

Mr. Go 5,000,000

Total Shares Outstanding 25,000,000

On March 2019, Bato Realty Corp. finally decides to conduct an IPO and initially offers 25,000,000

of its unissued shares to the investing public for P1.50/share.

During IPO period, one of its existing stockholders, Mrs. Villar, has likewise decided to sell her

entire 5,000,000 shares to the public for P1.50/share.

60. How much is the percentage tax due on the primary offering?

a. P375,000 c. P750,000

b. P1,500,000 d. nil

Knowledge Engineer: MARK JOHN D. GONZALES,CPA,CTT,MPBM Page 18 of 20

INTERNATIONAL SCHOOL OF ASIA AND THE PACIFIC

Alimannao Hills, Penablanca, Cagayan HQ # 3

61. Based on the preceding number, assuming the transaction happened after the effectivity of

BARO Act?

a. P375,000 c. P750,000

b. P1,500,000 d. nil

62. How much is the percentage tax due on the secondary offering?

a. P75,000 c. P150,000

b. P300,000 d. nil

63. Based on the preceding number, assuming the transaction happened after the effectivity of

BARO Act?

a. P75,000 c. P150,000

b. P300,000 d. nil

64. If in June 2019, Bato Realty Corp. again decides to increase capitalization by offering another

30,000,000 of unissued

shares to the public at P2.00/share, how much is the percentage tax due?

a. P600,000 c. P2,400,000

b. P1,200,000 d. nil

65. If in July 2019, Mr. Trillanes decides to sell his entire stock ownership to the public at

P2.00/share, how much is the percentage tax due?

a. P60,000 c. P400,000

b. P200,000 d. nil

66. A domestic corporation paid P80,000 stock transaction tax on Initial Public Offering (IPO) of

500,000 shares. After the

IPO, there were 800,000 shares outstanding. The selling price of IPO per share was?

a. P20 c. P8

b. P16 d. P6

67. 1st Statement: Sale by a dealer in securities of shares of stock through the local stock

exchange is subject to the stock transactions tax.

2nd Statement: Sale by a dealer in securities of shares of stock direct to a buyer is subject

to the Value Added Tax

a. Both statements are correct.

b. Both statements are incorrect.

c. Only the first statement is correct.

d. Only the second statement is correct.

68. Which of the following transactions will not result to payment of stock transaction tax?

a. Sale of unissued shares during an Initial Public Offering by a closely-held corporation.

b. Sale of outstanding shares during an Initial Public Offering by a shareholder.

c. Sale of unissued shares subsequent to Initial Public Offering by a closely-held

corporation.

d. Sale of outstanding shares subsequent to Initial Public Offering by a shareholder.

Return and Payments of Percentage Tax

69. Statement 1: Payment of stock transaction tax of 6/10 of 1% is within five (5) banking days

from the date withheld by the broker.

Statement 2: Payment of stock transaction tax of 4%, 2% and 1% on primary offering should

be within thirty (30) days from the date of listing in the local stock exchange.

a. Both statements are correct.

b. Both statements are incorrect.

c. Only the first statement is correct.

d. Only the second state statement is correct.

70. Which of the following percentage taxes is not required to be filed within 25 days from the

end of the quarter?

a. Gross receipts tax

b. Premiums Tax

c. Common Carriers Tax

Knowledge Engineer: MARK JOHN D. GONZALES,CPA,CTT,MPBM Page 19 of 20

INTERNATIONAL SCHOOL OF ASIA AND THE PACIFIC

Alimannao Hills, Penablanca, Cagayan HQ # 3

d. Percentage Tax on Winnings

71. Which of the following is subject to advance payment of percentage tax?

a. Withdrawal of raw cane sugar;

b. Withdrawal of sugar by duly accredited and registered agricultural cooperative of good

standing;

c. Withdrawal of sugar by duly accredited and registered agricultural cooperative which is

sold to another agricultural cooperative.

d. Withdrawal of raw sugar.

72. Withholding percentage tax is applicable to:

a. Sale of goods to the government

b. Sale of service to the government

c. Both “a” and “b”

d. Neither “a” nor “b”

Knowledge Engineer: MARK JOHN D. GONZALES,CPA,CTT,MPBM Page 20 of 20

You might also like

- VAT - CPA Reviewer in Taxation - Enrico D. Tabag PDFDocument103 pagesVAT - CPA Reviewer in Taxation - Enrico D. Tabag PDFDGAENo ratings yet

- Vat Exempt SalesDocument4 pagesVat Exempt SalesEmma Mariz GarciaNo ratings yet

- Taxation 2 Midterm NotesDocument42 pagesTaxation 2 Midterm NotesTet Legaspi100% (1)

- Promise To PayDocument1 pagePromise To PayYehezkiel Romartogi0% (1)

- Vat Exempt Transactions: Page 3 of 6Document4 pagesVat Exempt Transactions: Page 3 of 6Lei Anne GatdulaNo ratings yet

- TAXATION 2 Chapter 9 Exempt SalesDocument5 pagesTAXATION 2 Chapter 9 Exempt SalesKim Cristian MaañoNo ratings yet

- Vat Exempt TransactionDocument7 pagesVat Exempt TransactionFatima Zaida JahaniNo ratings yet

- Lesson 9Document22 pagesLesson 9Iris Lavigne RojoNo ratings yet

- VATDocument12 pagesVATIngrid VerasNo ratings yet

- Bus Tax Chap 2Document11 pagesBus Tax Chap 2David LijaucoNo ratings yet

- 12 Value Added Taxes 1Document91 pages12 Value Added Taxes 1Vince ManahanNo ratings yet

- Business Taxation: Submitted To: Mr. Raphy Leonardo M. OrtañezDocument33 pagesBusiness Taxation: Submitted To: Mr. Raphy Leonardo M. OrtañezcarlaNo ratings yet

- Subject To VAT Subject To VAT 3) Real Property Utilized For Socialized Housing VAT ExemptDocument32 pagesSubject To VAT Subject To VAT 3) Real Property Utilized For Socialized Housing VAT ExemptNikka SanzNo ratings yet

- Tax3. Lecture 1 - Value Added Tax SCDocument40 pagesTax3. Lecture 1 - Value Added Tax SCsuzyshii 888No ratings yet

- Value Added Tax ModuleDocument11 pagesValue Added Tax ModuleDaniella RachoNo ratings yet

- M3 Exempt Sales of Goods Properties & ServicesDocument27 pagesM3 Exempt Sales of Goods Properties & ServicesAlicia FelicianoNo ratings yet

- Chapter 4: Exempt Sales of Goods, Properties and Services Exempt SalesDocument7 pagesChapter 4: Exempt Sales of Goods, Properties and Services Exempt SalesWearIt Co.No ratings yet

- Answers - Business Taxation - Exempt Sales (Chapter 4)Document3 pagesAnswers - Business Taxation - Exempt Sales (Chapter 4)Gino CajoloNo ratings yet

- Tax Consequences: No Output Tax Allowed and Seller IsDocument12 pagesTax Consequences: No Output Tax Allowed and Seller IsXerez SingsonNo ratings yet

- To Print TaxDocument13 pagesTo Print TaxVee SyNo ratings yet

- Adzu Tax02 A Learning Packet 2 Value Added TaxDocument9 pagesAdzu Tax02 A Learning Packet 2 Value Added TaxJustine Paul Pangasi-an100% (1)

- Chapter 4Document3 pagesChapter 4Marinelle DiazNo ratings yet

- VAT (Chapter 8 Compilation of Summary)Document36 pagesVAT (Chapter 8 Compilation of Summary)Dianne LontacNo ratings yet

- B. Introduction To VAT FinalDocument102 pagesB. Introduction To VAT FinalNatalie SerranoNo ratings yet

- VAT Exempt SalesDocument5 pagesVAT Exempt SalesNEstandaNo ratings yet

- Introduction To Business TaxesDocument32 pagesIntroduction To Business TaxesGracelle Mae Oraller100% (2)

- Tax 30222Document5 pagesTax 30222Ronariza BondocNo ratings yet

- Vat NotesDocument11 pagesVat NotesStephen CabalteraNo ratings yet

- VAT Exempt SalesDocument14 pagesVAT Exempt SalesJuvanni SantosNo ratings yet

- MODULE 2 Value Added TaxDocument21 pagesMODULE 2 Value Added TaxLenson NatividadNo ratings yet

- Value Added Tax: A. Business TaxesDocument3 pagesValue Added Tax: A. Business TaxesNerish PlazaNo ratings yet

- Async 2022 VAT UPDATEDocument8 pagesAsync 2022 VAT UPDATEBogs QuitainNo ratings yet

- Chapter 8 - VAT - Part 1 - LatestDocument38 pagesChapter 8 - VAT - Part 1 - Latestargene.malubayNo ratings yet

- TAX-302 (VAT-Exempt Transactions)Document7 pagesTAX-302 (VAT-Exempt Transactions)Edith DalidaNo ratings yet

- LawDocument43 pagesLawMARIANo ratings yet

- TAX-302 (VAT-Exempt Transactions) PDFDocument5 pagesTAX-302 (VAT-Exempt Transactions) PDFclara san miguelNo ratings yet

- TAX 302 VAT Exempt Transactions 1Document6 pagesTAX 302 VAT Exempt Transactions 1Jeen JeenNo ratings yet

- Tax 302 - Vat-Exempt TransactionsDocument6 pagesTax 302 - Vat-Exempt TransactionsiBEAYNo ratings yet

- Exempt Sales of Goods, Properties and Services: Anie P Martinez, CpaDocument56 pagesExempt Sales of Goods, Properties and Services: Anie P Martinez, CpaAnie MartinezNo ratings yet

- Tax Ch6 VAT BinaluyoDocument6 pagesTax Ch6 VAT Binaluyomavrhyck.21No ratings yet

- Jude Feliciano: What Are VAT Exempt Transactions in The Philippines?Document10 pagesJude Feliciano: What Are VAT Exempt Transactions in The Philippines?Michelle NacisNo ratings yet

- VAT Exempt TransactionsDocument7 pagesVAT Exempt TransactionsLove RosalunaNo ratings yet

- VALUE ADDED TAX ModuleDocument12 pagesVALUE ADDED TAX ModuleAngela VecinoNo ratings yet

- Business Tax NotesDocument5 pagesBusiness Tax NotesRizzle RabadillaNo ratings yet

- 04 Vat Exempt TransactionsDocument4 pages04 Vat Exempt TransactionsJaneLayugCabacunganNo ratings yet

- Business Taxes: Certified Accounting Technician NIAT Office 2015Document33 pagesBusiness Taxes: Certified Accounting Technician NIAT Office 2015Anonymous Lz2qH7No ratings yet

- Exempt SalesDocument46 pagesExempt SalesKheianne DaveighNo ratings yet

- Donors and VatDocument179 pagesDonors and VatGlino ClaudioNo ratings yet

- Output VatDocument9 pagesOutput Vatyatot carbonelNo ratings yet

- Business Taxation 1Document81 pagesBusiness Taxation 1Prince Isaiah Jacob100% (1)

- Handouts 56Document11 pagesHandouts 56Omar CabayagNo ratings yet

- VAT Group 3Document39 pagesVAT Group 3Andrea GranilNo ratings yet

- Exempt Sales - NotesDocument28 pagesExempt Sales - NotesSunny DaeNo ratings yet

- Donors and VatDocument179 pagesDonors and VatLayca Clarice Germino BrimbuelaNo ratings yet

- vat exemptionDocument2 pagesvat exemptiontmiss5461No ratings yet

- Exempt Sale of Goods ch4Document2 pagesExempt Sale of Goods ch4Marionne GNo ratings yet

- Added: ValueDocument49 pagesAdded: ValueFearl Hazel Languido BerongesNo ratings yet

- PT, Excise and DST NotesDocument10 pagesPT, Excise and DST NotesFayie De LunaNo ratings yet

- (G5 P2) VatDocument76 pages(G5 P2) VatFiliusdeiNo ratings yet

- Module 8 - Value Added TaxDocument28 pagesModule 8 - Value Added TaxKyrah Angelica DionglayNo ratings yet

- The Secrets To Making Money From Commercial Property: Property Investor, #2From EverandThe Secrets To Making Money From Commercial Property: Property Investor, #2Rating: 5 out of 5 stars5/5 (1)

- Uberita - InventoriesDocument17 pagesUberita - InventoriesDharel GannabanNo ratings yet

- MAS - Test Bank - CVPDocument24 pagesMAS - Test Bank - CVPDharel GannabanNo ratings yet

- UntitledDocument15 pagesUntitledDharel GannabanNo ratings yet

- Estate TaxDocument21 pagesEstate TaxDharel GannabanNo ratings yet

- HQ 2 Donors TaxationDocument12 pagesHQ 2 Donors TaxationDharel GannabanNo ratings yet

- M11GM IIa 1 2, M11GM IIb 1 2 (Annuity)Document39 pagesM11GM IIa 1 2, M11GM IIb 1 2 (Annuity)EdwardJohnG.CalubIINo ratings yet

- Northern Arc BookletDocument16 pagesNorthern Arc BookletPRAPTI TIWARINo ratings yet

- Urban ChinaDocument583 pagesUrban ChinaBob FinlaysonNo ratings yet

- Cash Conversion ModelsDocument34 pagesCash Conversion ModelsRanShibasaki0% (1)

- Account Statement - 2024 03 01 - 2024 03 31 - en - 2c1825Document5 pagesAccount Statement - 2024 03 01 - 2024 03 31 - en - 2c1825mgxshotsNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsSTAR BOYNo ratings yet

- Scarb Eesbm6e TB 11Document40 pagesScarb Eesbm6e TB 11Nour AbdallahNo ratings yet

- Hospicemd Data From Elner PDFDocument2 pagesHospicemd Data From Elner PDFLisette TrujilloNo ratings yet

- Bank DefinationDocument2 pagesBank Definationgaurav069No ratings yet

- Types of Budgeting Techniques: Topic 4Document59 pagesTypes of Budgeting Techniques: Topic 4Sullivan LyaNo ratings yet

- Lease Agreement - Word Doc LAGDocument8 pagesLease Agreement - Word Doc LAGLiset Angela Ramirez-GarciaNo ratings yet

- A Case StudyDocument5 pagesA Case StudypawpawXONo ratings yet

- Bank Statement 6 MonthsDocument57 pagesBank Statement 6 Monthssrinivas rao kNo ratings yet

- Pdic Foreclosed Properties Public Auction October 25 2016Document4 pagesPdic Foreclosed Properties Public Auction October 25 2016G DNo ratings yet

- FaizanDocument1 pageFaizanMehran Rasheed GorayaNo ratings yet

- 07 Activity 2 BugnotDocument2 pages07 Activity 2 BugnotclarenceNo ratings yet

- Item Description RCVD Unit Price Gross Amt Disc % Ta Amount DeptDocument1 pageItem Description RCVD Unit Price Gross Amt Disc % Ta Amount DeptGustu LiranNo ratings yet

- Huff N PuffDocument1 pageHuff N PuffA. CampbellNo ratings yet

- A Case Study of The JK Bank Ltd. in SrinagarDocument7 pagesA Case Study of The JK Bank Ltd. in SrinagarkumardattNo ratings yet

- Accounts Revision QuestionsDocument293 pagesAccounts Revision QuestionsRishab Gupta100% (1)

- WFH WfoDocument5 pagesWFH WfoMuhammad Galih PrakosoNo ratings yet

- Accounting 3Document6 pagesAccounting 3Princess Frean VillegasNo ratings yet

- Lic Under SiegeDocument4 pagesLic Under SiegeAjay Narang0% (1)

- Case Study TaxDocument7 pagesCase Study TaxMUHAMMAD 'IMRAN HAZIQ MD ISSANo ratings yet

- Assignment 1Document20 pagesAssignment 1SarthakAryaNo ratings yet

- Pricing Decisions and Cost ManagementDocument18 pagesPricing Decisions and Cost ManagementAmrit PrasadNo ratings yet

- Rmo15 03anxb3Document21 pagesRmo15 03anxb3Maureen PerezNo ratings yet

- Price Action Reversal StrategiesDocument7 pagesPrice Action Reversal Strategiesmanoj tomer100% (1)

- Levine Smume7 Bonus Ch02Document2 pagesLevine Smume7 Bonus Ch02Kiran SoniNo ratings yet