Professional Documents

Culture Documents

Manage Finances 2

Manage Finances 2

Uploaded by

Ashish JaatOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Manage Finances 2

Manage Finances 2

Uploaded by

Ashish JaatCopyright:

Available Formats

Assessment 2

Unit Code: - SITXFIN009

Unit Name: - Manage finances within a

budget

Assessment for this Unit of Details

Competency/Cluster

Assessment 1 Written Test

Assessment 2 Case Study & Project

Assessment 3

Assessment conducted in this instance: Assessment 1 2 X 3

SITXFIN009 Manage finances within a budget

Assessment Guidelines

What will be assessed

The purpose of this assessment is to assess your underpinning knowledge to complete the tasks

outlined in the elements and performance criteria for this unit of competency and ability to

complete tasks outlined in elements and performance criteria of this unit in the context of the job role, and:

manage a budget for a business over a three-month period that meets the specific business’ needs

undertake at least two of the following to inform management of the above budget:

discussions with existing suppliers

evaluation of staffing and rostering requirements

evaluation of impact of potential roster changes

review of operating procedures

sourcing new suppliers

monitor income and expenditure and evaluate budgetary performance over the above budgetary life

cycle

complete financial reports related to the above budget within designated timelines and using correct

budget terminology

Place/Location where assessment will be conducted

DC Class Room and DC Training Kitchen

Resource Requirements

Pen, Paper or computer

Refer to the Assessment conditions attached to the Futura Group Mapping Document located in

the teacher support tools folder or the “Assessment Conditions” for this unit in the current SIT

Training Package.

Instructions for assessment including WHS requirements

You are required to address all questions to achieve competence.

Your trainer will provide you with instructions for time frames and dates to complete this

assessment.

If more space is required for any answer you may attach a separate page containing your

ID number, your name, unit title, unit code and the assessment task number and attach this

page with the current assessment task before submission or alternatively use the back of

each paper with a clear reference to the relevant question(s). Once completed, carefully read

the responses you have provided and check for completeness.

Ensure you check your work and keep a copy before submitting. You are encouraged to

clarify any tasks, requirements or questions you may have with your trainer Your trainer will

provide you with feedback and the result you have achieved.

Duke College (DC) Assessment 2, Oct 2022

CRICOS ID: 02564C Version 2.1

RTO ID: 90681 Page 2 of 7

SITXFIN009 Manage finances within a budget

Assessment 2: Case study and Project

Your Task:

Task 1: Case Study Analysis

PART A: Case Study

Analysis on Budget Variance

Top of the Town Hotel has asked you to calculate the variance for the following figures for

the month of July and August. Also calculate the total profit that was budgeted and actual.

Analyse the findings and inform them about the variance as they are concerned and would

like to monitor the income, expenditure, profit levels, budgetary performance of their Food

and Beverage Department.

Item July August

Budget Actual Variance Budget Actual Variance

Sales 230,000 225,000 -5000 - 230,000 228,000 2,000

-2000

Revenue 5,000

Food Costs 85,000 87,000 +2000-2,000 85,000 86,000 +1000

-1,000

Beverage 14,000 15,000 +1000 - 15,000 15,000 0

0

Costs 1,000

Labour 77,000 82,000 - 78,000 82,000 -4,000

+4000

Costs +5000

5,000

Fixed Costs 35,000 35,000 0 0 35,000 35,000 0 0

Total Costs 211,000

211,000 219,000

219,000 8000 -8,000 213,000

213,000 218,000 5,000

218,000 -5,000

Profit 19,000

19,000 6,000

6000 -13000

-13,000 17,000

17000 10,000

10,000 -8,000

-7000

The Hotel owners and managers would like to know from you the major areas of concern

where there is a deviation that needs further monitoring and improvement.

Answer may include:

To

1. calculate the following

Sales revenue, formulas

food costs, labour should be used

costs, fixed costs and total costs

Total Costs = (Food Costs + Beverage Costs + Labour Costs + Fixed Costs)

Profit = (Total Cost – Sales Revenue) – should be calculated for Budget and Actual.

Variance = (Budget – Actual) – should be used for each item individually

• Sales Revenue

• Food Costs

• Beverage Costs

Duke College (DC) Assessment 2, Oct 2022

CRICOS ID: 02564C Version 2.1

RTO ID: 90681 Page 3 of 7

SITXFIN009 Manage finances within a budget

PART B

Answer the following questions.

Questions:

1. Explain the importance to the owners of monitoring budgets and why do you think

it will help them to manage their finances better for the business.

1.Budget provide direction : Realistic targets are set for the future without which management and

staff would have no goals would that direction. People work together when they understand what to

require. This mean you must set clear and realistic goal and requirement.

2.Budget motivate staff: providing a goal for Staff and involving them in in setting those goals will

motivate staff to

2. Explain to them

achieve

thethem

use of, and the keythe

analysing aspect is thebudget

monthly involvement of the staffthe

and comparing

3. Budgets coordinate the business activities: the budgets look at the business as a whole and ensure

forecasted

that budget

the activities of against thedepartments

the every actual budgets.

or coordinated

Question 2 : Explain to them the use of analysing the monthly budget and comparing the forecasted

budget against the actual budgets.

Comparing the projected budget with the actual budget and completing a variance analyses to

calculate the deviation and variance is, he is an important step in and analyses monthly budget and

forecasted budget so you can actually manage finances in all the time

3. Explain your findings and possible reasons for these variances.

So the reason for these variances in the labour cost and the food cost could be because of high

labour cost particular. If the staff wage are on hourly basis and hour rate could be more comparing to

the regular staff salary or permanent staff member

If the cost of food, the buying food supplies goes out up due to the external environment factor that

may have variances

4. Research and suggest what improvements do you think the owners can take to

improve this situation?

Regular monitoring of budget can help significantly to reduce the variance. Improving sales by

launching new schemes can help in making situation better. Regular check on labour costs can

definitely reduce the variance. Shifting expected targets according to actual budget can really help

in improving this situation.

Duke College (DC) Assessment 2, Oct 2022

CRICOS ID: 02564C Version 2.1

RTO ID: 90681 Page 4 of 7

SITXFIN009 Manage finances within a budget

Task 2 – Variance Analysis Note

You have been provided with the projected data sheet for reference in the Task 2 Spread

sheet.

Please use the Assessment Task 2 spread sheet file to complete the calculations.

In this task you are provided with an excel file with 2 spread sheets

(Budgeted Rooms Revenue Sheet, Actual Rooms Revenue sheet) with the actual figures on the

rooms for a given quarter. You are required to calculate the actual revenue that has been generated

for each month in the given quarter based on the actual occupancy rate.

Calculate the following details using the appropriate sheet as per the given instructions

Budgeted Rooms Revenue Sheet

In this sheet first calculate the total projected/forecasted revenue per room type for all 365

days.

Budgeted Rooms Revenue Sheet

• You are also required to calculate total projected/forecasted revenue per room type

for each month for Jan, Feb and Mar.

• Calculate the total rooms for each month –

• Calculate the Total Revenue for all room types for each month –

• Calculate the total projected revenue for 3 months (Jan, Feb and Mar) –

Actual Rooms Revenue Sheet

In this sheet you are provided with the Actual occupancy for each month.

• Calculate the Revenue per room type for each month (Jan, Feb and Mar)

• Calculate the total rooms for each month –

• Calculate the Total Revenue for all room types for each month –

• Calculate the total revenue per room for 3 months (Jan, Feb and Mar) –

Duke College (DC) Assessment 2, Oct 2022

CRICOS ID: 02564C Version 2.1

RTO ID: 90681 Page 5 of 7

SITXFIN009 Manage finances within a budget

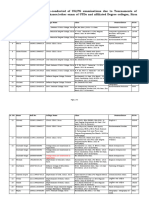

The Bentley Hotel

Forecast room revenues

Annually

Room Type Total Projected/ Room Rate Available Projected /Forecasted

Rooms Forecasted days Revenue per room type

Available Occupancy

King Suite 20 70% $575 365 2938350

Queen Suite 10 80% $475 365 1387000

Deluxe Room 50 89% $375 365 6090937.5

Standard Room 40 90% $275 365 3613500

Total 120 14,029,787.5

Monthly

Room Type Total Projected/ Room Rate Jan Projected /Forecasted

Rooms Forecasted Revenue per room type

Available Occupancy

King Suite 20 70% $575 31 249550

Queen Suite 10 80% $475 31 117800

Deluxe Room 50 89% $375 31 517312.5

Standard Room 40 90% $275 31 306900

Total 1,191,562.5

Monthly

Room Type Total Projected/ Room Rate Feb Projected /Forecasted

Rooms Forecasted Revenue per room type

Available Occupancy

King Suite 20 70% $575 28 225400

Queen Suite 10 80% $475 28 106400

Deluxe Room 50 89% $375 28 467250

Standard Room 40 90% $275 28 277200

Total 1,076,250

Monthly

Room Type Total Projected/ Room Rate Mar Projected /Forecasted

Rooms Forecasted Revenue per room type

Available Occupancy

King Suite 20 70% $575 31 249550

Queen Suite 10 80% $475 31 117800

Deluxe Room 50 89% $375 31 517312.5

Standard Room 40 90% $275 31 306900

Total 1,191,562.5

Duke College (DC) Assessment 2, Oct 2022

CRICOS ID: 02564C Version 2.1

RTO ID: 90681 Page 6 of 7

SITXFIN009 Manage finances within a budget

Actual room revenues

Monthly

Room Type Total Actual Room Jan Revenue per Variance

Rooms Occupancy Rate room type

Available

King Suite 20 65% $575 31 231725 17,825

Queen Suite 10 70% $475 31 103075 14,725

Deluxe Room 50 85% $375 31 494062.5 23,250

Standard Room 40 85% $275 31 289850 17,050

Total 1,118,712.5 72,850

Monthly

Room Type Total Actual Room Feb Revenue per Variance

Rooms Occupancy Rate room type

Available

King Suite 20 68% $575 28 218960 6,440

Queen Suite 10 55% $475 28 73150 33,250

Deluxe Room 50 85% $375 28 446250 21,000

Standard Room 40 70% $275 28 215600 61,600

Total 953,960 122,290

Monthly

Room Type Total Actual Room Mar Revenue per Variance

Rooms Occupancy Rate room type

Available

King Suite 20 67% $575 31 238855 10,695

Queen Suite 10 80% $475 31 117800 0

Deluxe Room 50 89% $375 31 517312.5 0

Standard Room 40 90% $275 31 306900 0

Total 1,180,867.5

Duke College (DC) Assessment 2, Oct 2022

CRICOS ID: 02564C Version 2.1

RTO ID: 90681 Page 7 of 7

You might also like

- SITXFIN009 Student Assessment Task 2Document15 pagesSITXFIN009 Student Assessment Task 2HADHI HASSAN KHAN100% (3)

- SITHKOP015 Project PortfolioDocument13 pagesSITHKOP015 Project PortfolioLAST BENDER67% (3)

- SITHKOP015 LAP F v1.1Document62 pagesSITHKOP015 LAP F v1.1Yashika100% (2)

- Sithkop002 Short QuestionDocument23 pagesSithkop002 Short QuestionMukta AktherNo ratings yet

- SITHCCC030 Student Assessment TasksDocument36 pagesSITHCCC030 Student Assessment TasksLalit AyerNo ratings yet

- SITHCCC026 Assessment V1.1-1 Copy 2Document15 pagesSITHCCC026 Assessment V1.1-1 Copy 2gunjan sahota0% (1)

- SITHCCC036 - Student Pack Acacia (Kamal)Document26 pagesSITHCCC036 - Student Pack Acacia (Kamal)gunjan sahotaNo ratings yet

- SITXFSA005 - Use Hygienic Practices For Food Safety PDFDocument14 pagesSITXFSA005 - Use Hygienic Practices For Food Safety PDFAshish Jaat100% (1)

- SITHCCC040 Unit Assessment PackDocument57 pagesSITHCCC040 Unit Assessment PackPrabjeet Dhot100% (1)

- Purchase GoodsDocument9 pagesPurchase GoodsAshish JaatNo ratings yet

- Manage Finances 1Document9 pagesManage Finances 1Ashish Jaat100% (1)

- Assessment 1 Sithccc 008 Prepare Vegetable Fruit Eggs and Farinaceous Dishes CompleteDocument19 pagesAssessment 1 Sithccc 008 Prepare Vegetable Fruit Eggs and Farinaceous Dishes Completesandeep kesarNo ratings yet

- SITHKOP005 - AT1 of 5 - Short Answer QuestionsDocument15 pagesSITHKOP005 - AT1 of 5 - Short Answer Questionszamuel capalunganNo ratings yet

- Lesson Plan Format: in Meaningful Ss Language, So Ss Can Monitor Their LearningDocument6 pagesLesson Plan Format: in Meaningful Ss Language, So Ss Can Monitor Their LearningjayNo ratings yet

- V2 - SITXHRM003 Lead and Manage People Student Assessment GuideDocument83 pagesV2 - SITXHRM003 Lead and Manage People Student Assessment GuideManzu PokharelNo ratings yet

- SITHCCC020 - AMajor Individual Menu and Practical Assessment (3045)Document15 pagesSITHCCC020 - AMajor Individual Menu and Practical Assessment (3045)Jack Jolly0% (1)

- Sitxinv002 Maintain The Quality of Perishable Items: Assessment Tool 2 of 2: Practical ProjectDocument41 pagesSitxinv002 Maintain The Quality of Perishable Items: Assessment Tool 2 of 2: Practical ProjectManawNo ratings yet

- Student Assessment: SITHCCC0013 Prepare Seafood DishesDocument42 pagesStudent Assessment: SITHCCC0013 Prepare Seafood DishesSonu SainiNo ratings yet

- CBOK Requirements: Importance of Internal ControlsDocument2 pagesCBOK Requirements: Importance of Internal ControlsmeyyNo ratings yet

- SITHCCC006 Assessment 2 - Practical ObservationDocument12 pagesSITHCCC006 Assessment 2 - Practical ObservationHarkamal singhNo ratings yet

- SITXFSA001 Practical AssessmentDocument21 pagesSITXFSA001 Practical Assessmenthazem khudairNo ratings yet

- Sithccc037 Student Pack.Document21 pagesSithccc037 Student Pack.Jaismeen RalhanNo ratings yet

- Sub. SITHCCC004 Assessment 1 - Short AnswersDocument13 pagesSub. SITHCCC004 Assessment 1 - Short AnswersUMAIR NASIRNo ratings yet

- Sitxfin003 - Knowledge TestDocument8 pagesSitxfin003 - Knowledge Testdetailed trickzNo ratings yet

- A2 SITXFIN010 Prepare and Monitor Budgets - Docx ANSDocument6 pagesA2 SITXFIN010 Prepare and Monitor Budgets - Docx ANSKrinakshi Chaudhary0% (1)

- SITHKOP004 Assessment 2 Abdullah ATC210150Document67 pagesSITHKOP004 Assessment 2 Abdullah ATC210150Taimoor Ahmed100% (1)

- SITXHRM002-Roster Staff Worksheets Section 1: Develop Staff RostersDocument5 pagesSITXHRM002-Roster Staff Worksheets Section 1: Develop Staff RostersPiyush GuptaNo ratings yet

- SITHKOP004 ProjectDocument30 pagesSITHKOP004 ProjectSUKH50% (4)

- SITHCCC019 Student Assessment TasksDocument29 pagesSITHCCC019 Student Assessment TasksAshish ShahiNo ratings yet

- SITXFSA001 - Assessment 2 - Practical ObservationsDocument13 pagesSITXFSA001 - Assessment 2 - Practical ObservationsHarkamal singhNo ratings yet

- Assessment 1 SITHKOP005 - Coordinate Cooking Operations Questioning - Quiz Answer The Following QuestionsDocument17 pagesAssessment 1 SITHKOP005 - Coordinate Cooking Operations Questioning - Quiz Answer The Following QuestionsbeyNo ratings yet

- Resubmission Srikanth Sitxhrm003 Task 1Document17 pagesResubmission Srikanth Sitxhrm003 Task 1Vijay VijjuNo ratings yet

- SITXHRM003 Assessment Task 2 Global V1.0Document19 pagesSITXHRM003 Assessment Task 2 Global V1.0Agus BudionoNo ratings yet

- 4 - BSBWOR203 Student VersionDocument40 pages4 - BSBWOR203 Student VersionJyoti VermaNo ratings yet

- Meeting Room Hazard Inspection ChecklistDocument4 pagesMeeting Room Hazard Inspection ChecklistNitinNo ratings yet

- Assessment Booklet: SIT40516 Certificate IV in Commercial CookeryDocument29 pagesAssessment Booklet: SIT40516 Certificate IV in Commercial CookeryNiroj Adhikari50% (2)

- SITHKOP014 - Hemanta Shrestha - Task 2 of 2 Activity 1.v1.0Document4 pagesSITHKOP014 - Hemanta Shrestha - Task 2 of 2 Activity 1.v1.0Hemanta Shrestha100% (1)

- Sithind002 A2Document13 pagesSithind002 A2Rabia BhardwajNo ratings yet

- SITHCCC043 Observation Checklist (Aman)Document12 pagesSITHCCC043 Observation Checklist (Aman)VEERPALNo ratings yet

- SITHCCC018 Student LogbookDocument31 pagesSITHCCC018 Student LogbookTaimoor Ahmed0% (1)

- Workflow Template Task 5Document4 pagesWorkflow Template Task 5nirajan parajuli100% (1)

- SITXMGT005 Student Assessment TasksDocument17 pagesSITXMGT005 Student Assessment TasksTainara Silva100% (1)

- Anne 09-3100 SA SITXFIN003 1Document61 pagesAnne 09-3100 SA SITXFIN003 1Marina PolycarpoNo ratings yet

- Son - 071 Service Planning TemplateDocument6 pagesSon - 071 Service Planning Templateamir kunwarNo ratings yet

- At2-Sitxmgt001 (1) Done 1 MayDocument8 pagesAt2-Sitxmgt001 (1) Done 1 MayDRSSONIA11MAY SHARMA100% (1)

- SITHCCC015 - Shree Krishna GurungDocument19 pagesSITHCCC015 - Shree Krishna Gurungbrooke luffy100% (1)

- Assessment A - Short - QuestionsDocument59 pagesAssessment A - Short - Questionsjoe joy0% (1)

- SITHCCC005 SITHCCC018 Assessment Task 1Document17 pagesSITHCCC005 SITHCCC018 Assessment Task 1nirajan parajuliNo ratings yet

- Assessment-Task-3 SITXGLC002Document23 pagesAssessment-Task-3 SITXGLC002Gaela KasangkeNo ratings yet

- Sithpat006ccc019 A - 2021.1Document34 pagesSithpat006ccc019 A - 2021.1Mark Andrew Clarete100% (2)

- SITXFIN003 - Case Study Part 2Document6 pagesSITXFIN003 - Case Study Part 2detailed trickzNo ratings yet

- Sitxfsa001 Cat V2.0.20Document61 pagesSitxfsa001 Cat V2.0.20Nidhi Gupta100% (1)

- xBSBDIV501 - Manage Diversity in The Workplace: ProjectDocument10 pagesxBSBDIV501 - Manage Diversity in The Workplace: ProjectPiyush GuptaNo ratings yet

- SITXCOM005 Assessment 2 Observations - ReachDocument11 pagesSITXCOM005 Assessment 2 Observations - ReachAnzel AnzelNo ratings yet

- SITHCCC030 Service Planning Template v1.1Document4 pagesSITHCCC030 Service Planning Template v1.1Binod Maharjan100% (2)

- Sithkop004 Develop Menus For Special Dietary Requirements 3 PDF FreeDocument14 pagesSithkop004 Develop Menus For Special Dietary Requirements 3 PDF Freebrooke luffyNo ratings yet

- A1 - Work Based Training Logbook - Ver - Oct - 2019Document39 pagesA1 - Work Based Training Logbook - Ver - Oct - 2019NitinNo ratings yet

- BSBSUS401 Templates: Water Meter Meter ReadingDocument4 pagesBSBSUS401 Templates: Water Meter Meter ReadingCristhianNo ratings yet

- Salisbury College AustraliaDocument33 pagesSalisbury College AustraliaBikash sharmaNo ratings yet

- Randeep Cert 3Document152 pagesRandeep Cert 3Mr. MeMe100% (1)

- SITHCCC001 Assessment 1 Short AnswersDocument17 pagesSITHCCC001 Assessment 1 Short AnswersAmbika Suwal100% (1)

- SITHCCC040 Service Planning TemplateDocument4 pagesSITHCCC040 Service Planning TemplateRicha AgrawalNo ratings yet

- SITXMGT001 Appendix C Coaching Session Plan TemplateDocument2 pagesSITXMGT001 Appendix C Coaching Session Plan Templatevasavi yennuNo ratings yet

- At2-Sitxfin003 (1) 1 MayDocument6 pagesAt2-Sitxfin003 (1) 1 MayDRSSONIA11MAY SHARMANo ratings yet

- Modul Jawaban Koeliah: Akuntansi BiayaDocument16 pagesModul Jawaban Koeliah: Akuntansi BiayaAndika Putra SalinasNo ratings yet

- Service To CustomerDocument4 pagesService To CustomerAshish JaatNo ratings yet

- New WaliDocument17 pagesNew WaliAshish JaatNo ratings yet

- 2Document3 pages2Ashish JaatNo ratings yet

- Manage Finances 2Document11 pagesManage Finances 2Ashish JaatNo ratings yet

- 2014 Cyber WellnessDocument54 pages2014 Cyber WellnessNadia KayNo ratings yet

- Assessing Personality States What To Consider When Constructing PersonalityDocument23 pagesAssessing Personality States What To Consider When Constructing PersonalityThiago MontalvãoNo ratings yet

- Factors of Absenteeism in Senior High School Grade 11 Students in Ateneo de Naga UniversityDocument4 pagesFactors of Absenteeism in Senior High School Grade 11 Students in Ateneo de Naga UniversityElan Francesca BaytaNo ratings yet

- Introductory Statistics For The Behavioral Sciences Presentation - Chapters 1 & 2Document37 pagesIntroductory Statistics For The Behavioral Sciences Presentation - Chapters 1 & 2Tim E.No ratings yet

- Analysis of Uplift Bearing Capacity of Pile Based On ABAQUSDocument5 pagesAnalysis of Uplift Bearing Capacity of Pile Based On ABAQUSramtin hajirezaeiNo ratings yet

- Résumé Emily Martin FullDocument3 pagesRésumé Emily Martin FullEmily MartinNo ratings yet

- Afa12 FP Q3 W2 SLMDocument5 pagesAfa12 FP Q3 W2 SLMwhite kiNo ratings yet

- OECD MTG 3 - 26may2023Document31 pagesOECD MTG 3 - 26may2023rusu.elenaNo ratings yet

- CKA Exam - Free Questions and Answers - ITExams - Com - 2Document5 pagesCKA Exam - Free Questions and Answers - ITExams - Com - 2TomNo ratings yet

- Game Design SyllabusDocument2 pagesGame Design Syllabusapi-204505803No ratings yet

- Fieldwork Description:: TPE Reflection and Tracking Sheet - Multiple SubjectDocument10 pagesFieldwork Description:: TPE Reflection and Tracking Sheet - Multiple Subjectapi-550356295No ratings yet

- Outliness of NAATI CredentialsDocument1 pageOutliness of NAATI CredentialsFranjo KovačNo ratings yet

- 5054 w14 QP 11 PDFDocument20 pages5054 w14 QP 11 PDFHaroon GhaniNo ratings yet

- Welding SimulatorDocument11 pagesWelding SimulatorImam Al MahdiNo ratings yet

- Students List, Dec.-2023Document5 pagesStudents List, Dec.-2023Rahul Sarwan RajputNo ratings yet

- Quantifiers: Some/Any With A': Grammar QuizDocument2 pagesQuantifiers: Some/Any With A': Grammar QuizInnkaBordeiNo ratings yet

- WritingDocument3 pagesWritingla min minNo ratings yet

- SBM Initial Assessment Process and Tool A. Leadership and GovernanceDocument9 pagesSBM Initial Assessment Process and Tool A. Leadership and GovernanceAileen TamayoNo ratings yet

- Methodology and Application of One-Way ANOVA: KeywordsDocument6 pagesMethodology and Application of One-Way ANOVA: KeywordsDan Lhery Susano GregoriousNo ratings yet

- What Are 21st Century Skills?Document14 pagesWhat Are 21st Century Skills?Felix JosephNo ratings yet

- Todd Jacqueline Finalpersusasive EssayDocument5 pagesTodd Jacqueline Finalpersusasive Essayapi-317359035No ratings yet

- M1Q2 Joseph, Child of God PDFDocument12 pagesM1Q2 Joseph, Child of God PDFEven Villar100% (1)

- Luteria I3Document9 pagesLuteria I3mierrepatrickNo ratings yet

- Unconscious Bias WorkshopDocument45 pagesUnconscious Bias WorkshopSydnie TomNo ratings yet

- Dassault Systems Academic CalenderDocument5 pagesDassault Systems Academic CalenderSarath KumarNo ratings yet

- Term Paper ENG 102Document10 pagesTerm Paper ENG 102Sakibul Islam AlveNo ratings yet

- Homeschooling Parent Guide ContentDocument4 pagesHomeschooling Parent Guide ContentAnonymous YBAHVQNo ratings yet

- Operating Systems - Internal and Design Priciples PDFDocument820 pagesOperating Systems - Internal and Design Priciples PDFJuan Carlos Avila AraujoNo ratings yet