Professional Documents

Culture Documents

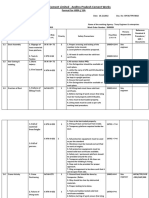

PCI July 2011

PCI July 2011

Uploaded by

Darrell TanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PCI July 2011

PCI July 2011

Uploaded by

Darrell TanCopyright:

Available Formats

www.pcimag.

com

July 2011

VOLUME 27, NUMBER 7

Paint Coatings Industry

Globally Serving Liquid and Powder Formulators and Manufacturers

INSIDE

Taking Semigloss

Coatings Green

New-Generation

Three Roll Mills

Controlled-Release IPBC

E

a

r

l

y

B

i

r

d

R

a

t

e

s

E

x

p

i

r

e

A

u

g

u

s

t

1

S

e

e

p

a

g

e

s

2

5

a

n

d

6

6

-

6

7

.

w

w

w

.

c

o

a

t

i

n

g

s

c

o

n

f

e

r

e

n

c

e

.

c

o

m

S

e

p

t

e

m

b

e

r

1

3

-

1

4

,

2

0

1

1

O

a

k

B

r

o

o

k

,

I

L

New, patented Triple-Seal Snap Lock Closure

produces an air tight seal that eliminates

leaks and product contamination.

Exclusive

proprietary surface

treatment prevents

product skinning.

Zero rust/corrosion

on plug, ring or body!

Zero dented, damaged,

discounted product on

display!

Zero lid skinning

issues!

Zero leakage when

properly closed!

Available in 4-liter,

gallon, liter, quart,

1/2 liter, pint and

1/2-pint capacities.

The research, engineering and continual improvement behind KWs

ALL-Plastic and Hybrid Container family is unparalleled in container manufacturing.

Why pay more for less? The KWALL-Plastic Container clearly delivers performance,

protection and value for your water-based coatings.

KWs ALL-Plastic Container is the CLEAR CHOICEfor

containing and delivering your valuable formulations.

Expect more from your container supplier.

Made from 100% Recycled Material 100% Recyclable User Friendly

1 1 0 H e n d e r s o n H w y T r o y , A L 3 6 0 7 9 ( 8 0 0 ) 6 3 3 - 8 7 4 4 w w w . k w c o n t a i n e r . c o m

The research, engineering and continual improvement behind KWs

ALL-Plastic and Hybrid Container family is unparalleled in container manufacturing.

Why pay more for less? The KWALL-Plastic Container clearly delivers performance,

protection and value for your water-based coatings.

KWs ALL-Plastic Container is the CLEAR CHOICEfor

containing and delivering your valuable formulations.

DEPARTMENTS

6 Viewpoint

8 Industry News

12 Calendar of Events

14 Company News

20 Names in the News

68 Classifieds

70 Advertiser Index

PCI - PAINT & COATINGS INDUSTRY (ISSN 0884-3848) is published 12 times annually, monthly, by BNP Media, 2401 W. Big Beaver Rd.,

Suite 700, Troy, MI 48084-3333. Telephone: (248) 362-3700, Fax: (248) 362-0317. No charge for subscriptions to qualified individuals.

Annual rate for subscriptions to nonqualified individuals in the U.S.A.: $115.00 USD. Annual rate for subscriptions to nonqualified

individuals in Canada: $149.00 USD (includes GST & postage); all other countries: $165.00 (intl mail) payable in U.S. funds. Printed

in the U.S.A. Copyright 2011, by BNP Media. All rights reserved. The contents of this publication may not be reproduced in whole

or in part without the consent of the publisher. The publisher is not responsible for product claims and representations. Periodicals

Postage Paid at Troy, MI and at additional mailing offices. POSTMASTER: Send address changes to: PCI - PAINT & COATINGS INDUS-

TRY, P.O. Box 2145, Skokie, IL 60076. Canada Post: Publications Mail Agreement #40612608. GST account: 131263923. Send returns

(Canada) to Pitney Bowes, P.O. Box 25542, London, ON, N6C 6B2. Change of address: Send old address label along with new address

to PCI - PAINT & COATINGS INDUSTRY, P.O. Box 2145, Skokie, IL 60076. For single copies or back issues: contact Ann Kalb at (248)

244-6499 or KalbR@bnpmedia.com.

Audited by

BPA Worldwide Printed in the U.S.A.

PAI NT & COATI NGS I NDUS TRY, VOLUME 2 7 , NUMBE R 7

July 2011

CONTENTS

FEATURES

24 The Global Top 10 and PCI 25

36 Enhanced Dry-Film Coating Performance Through

Controlled-Release IPBC, ISP

40 New Vinyl Acetate Ethylene Latex Takes Semigloss

Coatings Green, Forbo Bonding Systems

46 New-Generation Three Roll Mills Meet Todays

Challenges, Buhler AG

50 Water-Based, Field-Applied UV-Curable Topcoats for

Wood Flooring, Cytec Industries

62 Expanding the Functionality of Coatings Through

Chemical Microencapsulation, Encapsys Division,

Appleton Papers Inc.

BUSINESS TOOLS

45 Green Showcases

64 Equipment Showcases

ONLINE FEATURES

www. pc i ma g. c om

Coating Protects Petrochemical Tanks and

Pipes at Elevated Temperatures, Sherwin-

Williams Protective & Marine Coatings

New Nanocomposite Barrier Coatings Provide

Cost and Performance Advantages Over

EVOH and PVDC, InMat

High-Performance Alternative to Zinc Plating,

NOF Metal Coatings North America Inc.

High-Temperature Chromatography System

Helps Researchers Develop Nanoparticle

Coatings, Malvern Instruments

New Binder Permits Up to 50% Less TiO

2

for

Waterborne Traffic Paints, Dow Coating Materials

36 50

ON T HE COVE R :

Cover design by Clare Johnson.

24

JULY 2011

|

W W W . P C I M A G . C O M 6

V I E W P O I N T

This issue of PCI features the

19

th

annual ranking of the

top coatings manufacturers in

the world. Listed in the article

(page 24) are the Top 10 global

leaders and the Top 25 North

American companies. Sales

numbers listed for each com-

pany reflect worldwide 2010

global coatings sales figures.

The Top 10 global companies all reported

increased sales in 2010, ranging from a

few percentage points to over 10 percent.

Most of the increases were close to 10

percent. The picture for the Top 25 North

American companies appears somewhat

more mixed. While only a few companies

reported decreased sales for 2010, about

a third reported either flat sales or modest

sales increases. However, compared with

the drop in sales seen in 2009, the industry

appears to be rebounding.

Industry consolidation continues to

play out around the world. In March

2010, The Sherwin-Williams Co. acquired

the Industrial Wood Coatings business of

Arch Chemicals. In June 2010, AkzoNobel

finalized its purchase of Dow Powder

Coatings, the former Rohm & Haas pow-

der activities, from the Dow Chemical Co.

Earlier this year, Japanese Kansai Paint

Co. successfully acquired Freeworld

Coatings Ltd., a South African coat-

ings company. And in June of this year,

Denmark-based Hempel announced its

acquisition of decorative coatings manu-

facturer Crown Paints.

Globalization appears to make sense

in this business climate. As the global

economy began to improve, demand grew

in the emerging economies of Asia, Eastern

Europe and South America and then

moved to the more developed economies

in Western Europe and the United States.

In general, companies with a larger global

footprint and more diverse offerings

were able to recover more quickly than

companies with a more narrow focus.

Charles E. Bunch, Chairman and

CEO of PPG Industries, commented to

shareholders at the companys annual

meeting this year on his

companys move to a more

global focus, We have

continued to pursue growth

in emerging regions such as

Asia/Pacific, Eastern Europe

and Latin America, which

has broadened our reach

and reduced our exposure

to weaknesses in any one

region. PPGs businesses in emerging

regions grew 20 percent in 2010, he said,

and with sales of nearly $3.6 billion, these

regions now account for 27 percent of

the companys sales. The United States

and Canada now represent less than 45

percent of PPGs sales.

Valspars most recent financial results

illustrate another major theme in the

coatings industry price increases. While

the company reported increased sales for

the second quarter, net income was down,

due in part to rising raw material costs.

In a news releases announcing a price

increase in AkzoNobel Powder Coatings

Europe West segment, Gordon MacLeman,

Managing Director of the Sub Business

Unit Powder Coatings Europe West, com-

mented on the challenges facing the indus-

try: These are really unprecedented times

for our industry. This level of increase in

purchasing cost was literally unimagi-

nable until very recently. Unfortunately

we believe we will see continued short-

ages, and consequently increases in our

purchase cost for some considerable time

to come. Faced with rising raw material

costs, companies are adjusting pricing and

continuing to hold costs.

Going forward, the industry is respond-

ing to the challenges of globalization, the

lingering effects of the 2008 financial crisis,

and rising raw material costs by continued

consolidation, diversification, price adjust-

ments and strict cost containment.

While the PCI staff made every effort to

seek out the top companies in the indus-

try, we may have inadvertently omitted

some. Please contact me at parkerpci-

mag@gmail.com if you have interest in

being included next year.

By Karen Parker, Associate Editor, PCI Magazine

Despite Challenges, Industry

Begins to Rebound

BNP Media Helps People

Succeed in Business with

Superior Information

PUBL I S HI NG/ S AL ES S TAF F

Senior Group Publisher Tom A. Esposito

Publisher/ Donna M. Campbell

East Coast Sales Tel: 610/650.4050 Fax: 248/502.1091

E-mail: campbelld@pcimag.com

Midwest/ Lisa Guldan

West Coast Sales Tel: 630/882.8491

E-mail: guldanL@pcimag.com

China Media Rep. Arlen Luo

Tel: 0086-10-88579899

E-mail: nsmchina@126.com

Europe Regional Manager Uwe Riemeyer

Tel: 49 (0)202-271690

E-mail: riemeyer@intermediapartners.de

Inside Sales Manager Andrea Kropp

Tel: 810/688.4847

E-mail: kroppa@pcimag.com

Production Manager Brian Biddle

Tel: 847/405.4104 Fax: 248/244.3915

E-mail: biddleb@bnpmedia.com

EDI TORI AL S TAF F

Editor Kristin Johansson

Tel: 248/641.0592 Fax: 248/502.2094

E-mail: kristin@pcimag.com

Technical Editor Darlene R. Brezinski, Ph.D.

E-mail: darpaint@aol.com

Associate Editor Karen Parker

& E-News Editor Tel: 248/229.2681

E-mail: parkerpcimag@gmail.com

Art Director Clare L. Johnson

OPERATI ONS S TAF F

Marketing & Michele Raska

Promotion Coordinator E-mail: raskam@bnpmedia.com

Audience Development Jill Buchowski

Manager E-mail: buchowskij@bnpmedia.com

Corporate Fulfillment Megan Neel

Manager

Audience Audit Coordinator Carolyn M. Alexander

Single Copy Sales Ann Kalb

E-mail: kalbr@bnpmedia.com

List Rental Kevin Collopy

Manager 800/223.2194 x684

E-mail: kevincollopy@infogroup.com

Reprint Manager Jill L. DeVries

248/244.1726

E-mail: devriesj@bnpmedia.com

CORPORATE DI RECTORS

Publishing Director John R. Schrei

Corporate Strategy Rita M. Foumia

Information Technology Scott Krywko

Marketing Ariane Claire

Production Vincent M. Miconi

Finance Lisa L. Paulus

Creative Michael T. Powell

Online Development Nikki Smith

Human Resources Marlene J. Witthoft

Trade Shows Emily Patten

& Conferences

Clear Seas Research Beth A. Surowiec

For subscription information or service,

please contact Customer Service at:

Tel: 847/763.9534 or Fax: 847/763.9538 or e-mail PCI@halldata.com

Brenntag understands

change is normal for the

Coatings Industry.

As the Coatings Industry

has evolved through the

years, Brenntags Paint and

Coatings Team continues to

provide our customers with

the products and services

to stay competitive in the

marketplace.

Whether you face different

markets, technologies, or

substrate applications,

Brenntags Paint and

Coatings Team can help you

to adapt and make change

work to your advantage.

Brenntag offers a complete

specialty and industrial product

portfolio, technical assistance

with product development,

formulations and applications

know-how, superior logistics

with versatile blending and

re-packaging capabilities, and

last, but not least, commitment

to quality and safety.

Change demands innovation

and creativity.

Brenntag Understands.

Brenntag North America, Inc.

(610) 926-6100 Ext: 3858

brenntag@brenntag.com

brenntagnorthamerica.com

The Glocal Chemical Distributor.

Vinyl Metal Brick Wood

Concrete Stucco Plastic

Automotive

Aerospace

Industrial

Coatings

Container

Architectural

Coatings

Civil

Engineering

Marine &

Maintenance

Coatings Technologies:

Surface/Substrate:

Markets:

Solvent-

Borne

Coatings

Water-

Borne

Coatings

High

Solids

Coatings

Powder

Coatings

UV

Coatings

JULY 2011 | W W W . P C I M A G . C O M 8

I N D U S T R Y N E W S

New Recommendations Released for

Occupational Exposure to Ultrafine TiO

2

WASHINGTON, DC The National Insti-

tute for Occupational Safety and Health

(NIOSH) has released a new Current Intel-

ligence Bulletin (CIB) that addresses expo-

sure limits to ultrafine titanium dioxide.

Titanium dioxide is produced and used in

the workplace in varying particle-size frac-

tions, including fine and ultrafine sizes.

The NIOSH CIB reviews the animal

and human data relevant to assessing the

carcinogenicity and other adverse health

effects of TiO

2

, provides a quantitative risk

assessment using dose-response informa-

tion from the rat and human lung dosim-

etry modeling, and recommends occupa-

tional exposure limits for fine and ultrafine

(including engineered nanoscale) TiO

2

.

Additionally, it describes exposure moni-

toring techniques, exposure control strate-

gies and research needs. It only addresses

occupational exposures by inhalation and

not nonoccupational exposures.

According to the report, NIOSH rec-

ommends exposure limits of 2.4 mg/m

3

for fine TiO

2

and 0.3 mg/m

3

for ultrafine

(including engineered nanoscale) TiO

2

, as

time-weighted average (TWA) concentra-

tions for up to 10 hours per day during

a 40-hour work week. NIOSH has deter-

mined that ultrafine TiO

2

is a potential

occupational carcinogen but that there

are insufficient data at this time to clas-

sify fine TiO

2

as a potential occupational

carcinogen. However, as a precaution-

ary step, NIOSH used all of the animal

tumor response data when conducting

dose-response modeling and determining

separate RELs for ultrafine and fine TiO

2

.

These recommendations represent levels

that over a working lifetime are estimated

to reduce risks of lung cancer to below 1

The New Cauge:

z Predicts cured thickness oI coating beIore it cures.

z Measures Ilat and curved substrates including

steel, aluminum, plastic, wood, and MDF.

z Allows measurements in metric and U5C5

with a resolution oI ! micron.

z 5tores 200 measurements in memory.

z Features enhanced electronics that speed calculations

and improve accuracy.

K?<<C:FD<K<I,,'DB@M

EFE$:FEK8:KLE:LI<;GFN;<IK?@:BE<JJ>8L><

US and Canada 800.521.0635 | www.elcometer.com

England +44 (0) 161 371 6000 | France +33 (0)2 38 86 33 44 Asia +65 6462 2822 | Germany +49 (0) 7366 91 92 83 | Belgium +32 (0)4 379 96 10

89\kk\i>Xl^\YpXepD\Xjli\

7he next generation oI the Elcometer 550 NonContact Uncured

Powder Cauge Ieatures a new color LCD panel that helps

make measurements easier and more accurate.

COLOR LCD PANEL

Visit ads.pcimag.com

JULY 2011 | W W W . P C I M A G . C O M 10

I N D U S T R Y N E W S

in 1,000. NIOSH realizes that knowledge

about the health effects of nanomaterials

is an evolving area of science. Therefore,

NIOSH intends to continue dialogue with

the scientific community and will consider

any comments about nano-size titanium

dioxide for future updates of this document.

For the f ul l report, vi sit http://

www.cdc.gov/niosh/docs/2011-160/

pdfs/2011-160.pdf.

DIY Customers Are More Satisfied

With Paint Brands

WESTLAKE VILLAGE, CA According

to the J.D. Power and Associates 2011

U.S. Interior Paint Satisfaction Study

SM

,

do-it-yourselfers are notably more satis-

fied with interior paint brands in 2011

compared with 2010.

The study, now in its fifth year, measures

customer satisfaction among those who

have purchased and applied interior paint

during the past year. It examines six key fac-

tors of the painting experience: application,

product offerings, durability, price, design

guides, and warranty and guarantees.

Overall satisfaction with interior paint

brands has increased considerably to an

average of 770 on a 1,000-point scale in

2011 from 754 in 2010. Satisfaction has

increased in five of the six factors included

in the study all except design guides. The

most notable improvements have occurred

in the warranty, product offerings,

application and durability factors.

Benjamin Moore ranks highest in

customer satisfaction with interior paint,

with a score of 791. Following Benjamin

Moore in the rankings are Porter (789)

and Sherwin-Williams (778).

The highest performing brands in the

study also benefit from the highest levels

of customer loyalty, said Christina Cooley,

Senior Manager of the Real Estate and

Construction Industries Practice at J.D.

Power and Associates. Among customers

of some of these brands, the proportion

who say they definitely will purchase the

brand of paint again averages as high as 50

percent, which is considerably greater than

the industry average of 36 percent.

The 2011 U.S. Interior Paint Sat-

isfaction Study is based on responses

from more than 8,900 customers who

purchased and applied interior paint

within the previous 12 months.

Waterborne Symposium

Issues Call for Papers

HATTIESBURG, MS Organizers of The

Waterborne Symposium have issued a call

for papers, welcoming papers pertaining

to new and emerging technologies related

to materials, processes, production, char-

acterization, application and markets in

the field of surface coatings. Papers must

be original and represent recent advance-

ments in coatings science and related

disciplines. The deadline for submitting

abstracts is August 15, 2011. The paper

submission deadline is December 2, 2011.

The Waterborne Symposium will take

place February 13-17, 2012, at the New

Orleans Marriott, New Orleans, LA.

www.pumpsg.com

Whether processing, dosing, blending,

or transfer, Wilden air-operated double-

diaphragm pumps have been providing

solutions for the paint and coatings

industry since 1955.

22069 VAN BUREN STREET, GRAND TERRACE, CA 92313-5607

909-422-1730 FAX 909-783-3440 wi l d e n p u mp . c o m

Specihcally Suited for Water-ased and

0il-ased Faints & Coatings

Superior Flow Fates to 1,171 lpu (310 gpu)

Ease of Maintenance

Longest Mean Tiue etween Fepair

(MTF)

Fro-Flo X

with Efhciency Manageuent

Systeu (EMS)

Widest readth of Materials Available in

the Industry

Clauped and olted Models Available

Visit ads.pcimag.com

ADHESIVES & SEALANTS:

Conserve energy in production

and product use.

COATINGS:

Go green with innovative

binder and additive technologies.

ELASTOMERS:

Formulate with alternative

raw materials, and do it

competitively.

1.877.203.0045

|

CASE@univarcorp.com

www.univarcorp.com

INNOVATION = VALUE

YOUR CUSTOMERS DEMAND ENVIRONMENTALLY-FRIENDLY

PRODUCTS. LET UNIVAR SHOW YOU HOW YOU CAN GO GREEN.

Univar supplies the CASE Specialties industry with much more than a comprehensive line

of sustainable ingredients we can provide you with an innovative approach to your

green formulation challenges, offering you technical expertise from concept to production.

Consider Univar your partner in sustainable product development. We connect you to the

latest materials and technologies, and help you bring environmentally-friendly products

to market. Innovation, sustainability, expertise it all adds up to value.

I NNOVATI ON > TECHNI CAL EXPERTI SE > MARKETI NG > SALES > LOGI STI CS > DI STRI BUTI ON

JULY 2011

|

W W W . P C I M A G . C O M 12

C A L E N D A R

JULY 13-14

Latin American Coatings Show

Mexico City

www.coatings-group.com

18-20

Coatings for People in the General Industry,

Sales and Marketing

Rolla, MO

http://coatings.mst.edu/index.html

18-22

Polymers and Coatings Introductory

Short Course

San Luis Obispo, CA

www.polymerscoatings.calpoly.edu

24-30

19

th

International Conference on Composites

Shanghai, China

www.icce-nano.org

SEPT. 13-14

Coatings Trends & Technologies

Oak Brook, IL

www.coatingsconference.com

14-15

Asia Pacific Coatings Show

Singapore

www.coatings-group.com

19-23

Basic Composition of Coatings

Rolla, MO

http://coatings.mst.edu/basic1.html

OCT. 6-8

Turkcoat Eurasia 2011

Istanbul, Turkey

www.turkcoat.com/?dil=en

10-14

Introduction to Paint Formulation

Rolla, MO

http://coatings.mst.edu/index.html

16-18

ASC Fall Convention

Indianapolis, IN

www.ascouncil.org

18-20

RadTech Europe

Basel, Switzerland

www.radtech-europe.com

23-26

Western Coatings Symposium

Las Vegas

www.pnwsct.org/symposium-wcs

24-26

Future of Pigments

Berlin, Germany

www.pigmentmarkets.com

NOV. 1-3

Chem Show

New York City

www.chemshow.com

21-23

ABRAFATI

So Paulo, Brazil

www.abrafati2011.com.br/index_engl.html

23-25

ChinaCoat 2011

Shanghai, China

www.chinacoat.net

Meetings, Shows and Educational Programs

DESIGNERS AND MANUFACTURES OF INDUSTRIAL MIXING EQUIPMENT

T

H

E

11 SOUTH MARION STREET WARREN, PENNA. 16365 PHONE 814/723-7980

FAX (814) 723-8502

Stirrers Or Complete Units For:

PAINTS URETHANE FOAMS

ADHESIVES SLURRIES

INKS GROUTS

CEMENTS ETC. . . .

r r s TM

Patented blending/dispersing blade design makes radical

improvement over old saw tooth designs

* Most efficient and aggressive blending/dispersing blade

available.

* Provides proper combination of pumping action and shear/

dispersion essential for fast consistent results.

* Built in pumping action cuts processing time.

* Longer life due to heavier gauge construction.

* Less heat due to shorter required running time.

* Excellent for high or low speed and high or low viscosity.

* Supplied with hubs or mounting holes required to retrofit

and upgrade present equipment.

* Pumping blades without teeth are available and are excellent

for gentle blending and agitation.

www.connblade.com

POLY STAINLESS

CONN

Since 1948

A

N

D

CO., L.L.C.

Visit ads.pcimag.com

Evonik. Power to create.

Turning trends into coIor

ll you need s fo make your move wfl

QEBLILOQOBKAOLRM

Our ablfy fo undersfand and manaqe complex color sysfem solufons s smply

fle lafesf prooI oI our fradfon oI nnovafon.

Tle Colorfrend Group oIIers more flan IIfy years oI experence, qlobal

producfon sfes and laborafores supporfed by sales and feclncal proIessonals

on all confnenfs. ve speak fle lanquaqe oI our cusfomers - wlerever fley are.

ve are fle leadnq coloranfs company Ior arclfecfural and ndusfral coafnqs.

For more nIormafon vsf our new websfe www.evonk.com]colorfrend

@LILOBA?V@LILOQOBKA

ROWA GROUP Opens Subsidiary in China

PINNEBERG, Germany ROWA GROUP has now set up an offi-

cial subsidiary in China, ROWA Coatings, which is scheduled to

begin operations in the second quarter of 2011.

Headquartered in Beijing, ROWA Coatings initial function will

be to grow the business of ROWA Lack in China and boost the

ROWA brand presence. In addition, it will enable ROWA Lack to

boost service quality in China, providing more responsive support

to Chinese customers.

Helen Li, who has successfully represented the interests of ROWA

Lack in China for years, will lead the new subsidiary.

LANXESS Renames Business Unit/

Opens Office in Brussels

LEVERKUSEN, Germany LANXESS has given its Basic Chemi-

cals business unit a new name: Advanced Industrial Interme-

diates. The new name establishes a direct link to the product

portfolio, which includes advanced intermediates for numerous

branches of industry. The company has also opened an office of its

own in Brussels. Stefan Borst, previously EU Correspondent of the

news magazine Focus, will head the office.

Momentive Performance Materials to

Expand Joint Venture in China

ALBANY, NY/JIANDE, China Momentive Performance Mate-

rials Inc. and Zhejiang Xinan Chemical Industrial Group, a

provider of agricultural chemicals and organic silicon products,

announced the planned expansion of manufacturing capacity

by their joint-venture company, Zhejiang Xinan Momentive Per-

formance Materials Co. Ltd.

The joint venture companys plant in Jiande, China, which has

annual production capacity of approximately 50,000 metric tons

of siloxane, successfully started its first phase of operations in the

fourth quarter of 2010. With the expansion, siloxane production

capacity is expected to triple to an estimated 150,000 metric tons

per year, commencing in 2013.

BASF Plans Dispersions Plant in South Africa

DURBAN, South Africa BASF is planning to invest in a disper-

sions plant in Durban, South Africa. The new plant will produce

acrylic dispersions mainly for the coatings and construction

industries. The facility will benefit from local availability of raw

materials and proximity to key customers who serve South Africa

and Sub Saharan Africa markets. Production is scheduled to

begin in the second half of 2012.

Dow Epoxy to Expand LER Capacity in Germany

MIDLAND, MI Dow Epoxy, a business unit of The Dow Chemi-

cal Co., has announced plans to expand liquid epoxy resin (LER)

capacity at its plant in Stade, Germany. This expansion will pro-

vide additional capacity as early as the fourth quarter of 2012 and

will increase capacity by 30 KTA, a 10-percent increase in the

companys global LER capacity.

DSM and Interfloat Sign New Agreements

GELEEN, the Netherlands DSM Advanced Surfaces has signed

license and supply agreements with Interfloat Corp., a solar

glass producer, opening the way for Interfloat to start producing

cover glass for solar modules coated with KhepriCoat, a high-

transmission/anti-reflective coating from DSM Advanced Sur-

faces. The KhepriCoat technology will be taken into production at

Interfloats solar glass plant in Tschernitz, Germany. The transfer

of know-how and technology, and the installation of the coating

equipment, are expected to be completed by August, when Inter-

float will start production.

Perstorp to Invest in China Facility

PERSTORP, Sweden Perstorp is investing in extended capac-

ity for polyalcohol neopentyl glycol by establishing production

at the groups manufacturing site in Zibo, China. With planned

production to start during the second half of 2012, the new

capacity will be through Perstorps joint venture, Shandong

Fufeng Perstorp Chemical Co. Ltd.

PPG to Purchase European Coatings Company

PITTSBURGH PPG Industries has signed an agreement to acquire

Dyrup A/S, a European coatings company based in Copenhagen,

Denmark, from its owner, Monberg & Thorsen, a public holding

company. The total transaction value, including assumed debt, is

around $200 million. Dyrup is a European producer of architec-

tural coatings, in particular wood stains, and specialty products

with 2010 sales of approximately 190 million ($270 million).

JULY 2011

|

W W W . P C I M A G . C O M 14

C O M P A N Y N E W S

MELBOURNE, Australia Dow Micro-

bial Control has opened a new Custom-

er Application Center in Melbourne,

Australia, giving customers in Austra-

lia and New Zealand access to state-of-

the-art testing laboratories and inno-

vative form ulations that are in line

with local regulatory requirements.

Senior management from Dow

Microbial Control and customers

from various industries were pres-

ent for the grand opening. The Dow

Microbial Control Academy also

conducted its first training courses

in Australia, focusing on the latest

technologies and trends in microbial

control. Following the launch event,

guests were invited to take part in a

firsthand tour of the new facility in

Altona, Melbourne.

Dow Microbial Control Launches Facility in Australia

|rom one o| |he g|oba| |eader |n co|or, |eubach |n|roduce our |a|e| |nnova||on, |he

|EUCOI|NI ||ne o| un|vera| co|oran| |or arch||ec|ura| pa|n| .

|EUCOI|NI co|oran| are. Env|ronmen|a||y |r|end|y

vOC|ree

APE|ree

|orma|dehyde|ree

Co| e||ec||ve

|eubach Prov|d|ng co|oran| |oday |ha| w||| mee| |he requ|remen| o| |omorrow|

|euco|ech ||d.

Phone +1 800 |EUBAC|

|ax +1 21S 736 2249

EMa||. a|eheubachco|or.com

|n|erne|. www.heubachco|or.com

9

P

K

X

G

T

U

C

N

'

Q

N

Q

T

C

P

V

U

)PXK T QPOGPV CN N [ *T K GPFN [ 'QN QT U

JULY 2011

|

W W W . P C I M A G . C O M 16

AkzoNobel to Split ICI Pakistan

AMSTERDAM, the Netherlands Akzo

Nobel N.V. (AkzoNobel) is seeking

approval from the board and sharehold-

ers of ICI Pakistan Limited (ICI Paki-

stan) to separate the organizations

paints and chemicals businesses. Under

the terms of the proposal, AkzoNobel

would retain direct majority control of

the paint business by separating it into

a new legal entity, AkzoNobel Pakistan

Limited, through a de-merger process

approved by the Pakistani courts. Sub-

sequently, AkzoNobel would dispose of

its entire shareholding in the remainder

of ICI Pakistan.

Troy Introduces Mergal 753 Wet-

State Preservative in Canada

FLORHAM PARK, NJ Troy Corp.

announced that The Pest Management Reg-

ulatory Agency of Health Canada, in accor-

dance with the Pest Control Products Act,

has approved the usage of Mergal 753 wet-

state preservative for the in-package protec-

tion of paints, coatings and allied products.

Mergal 753 is a zero-VOC, formaldehyde-

free dispersion with broad-spectrum effi-

cacy against bacteria, fungi and yeast.

Ashland to Acquire International

Specialty Products Inc.

COVINGTON, KY/WAYNE, NJ Ashland

Inc. has agreed to acquire privately owned

International Specialty Products Inc. (ISP),

a global specialty chemical manufacturer

of functional ingredients and technolo-

gies. Under the terms of the stock purchase

agreement, Ashland will pay approximate-

ly $3.2 billion for the business in an all-

cash transaction. ISPs advanced product

portfolio will expand Ashlands position

in high-growth markets such as personal

care, pharmaceutical and energy.

Dow Coating Materials Launches

eXposure Vision Viewer

PHILADELPHIA Dow Coating Mate-

rials has launched eXposure Vision

Viewer, an on-line system that puts expo-

sure station test panels within easy view.

Through a secured login Web site, eXpo-

sure Vision Viewer gives Dow custom-

ers access to test panel images in high

resolution. Updated images are posted

bimonthly and archived for future refer-

ence and comparison. Dow customers

can track test panels under evaluation at

Dows largest exposure station, located

in Spring House, PA. Selected test panel

images from Dow exposure stations in

Glen St. Mary, FL, and Geelong, Australia,

are also accessible. In addition to tracking

their own test formulations, Dow custom-

ers can use eXposure Vision Viewer to

monitor the performance of new Dow

products. North and south views are

updated quarterly, and 45 south views

are updated bimonthly.

OMG Americas Expands

Territory of The Cary Co.

CLEVELAND OMG Americas has

expanded The Cary Co.s region in the

United States. The Cary Co. will repre-

sent the OMG Borchi

line of coatings

additives as well as the metal carboxyl-

ates line. The new region will include

Illinois, Indiana, Wisconsin, Minnesota,

North Dakota, South Dakota, Iowa and

western Michigan.

Huber Engineered Materials

Renames Business Unit

ATLANTA Huber Engineered Materials

(HEM) is renaming its Alumina Trihydrate

business unit Fire Retardant Additives.

The new name more accurately reflects

the vast array of non-halogen fire-retar-

dant and smoke-suppressant technologies,

brands and products now offered.

E.W. Kaufmann Co. Receives

Cognis DOME Award

BRISTOL, PA Cognis Corp. (now part

of BASF) has recognized E.W. Kaufmann

Co., a raw materials distributor to the

coatings, plastics, ink, construction and

adhesives industries, with its Distribu-

tor Operational Measure of Excellence

(DOME) award. The award was presented

in recognition of E.W. Kaufmann Co.s sig-

nificant achievements in sales growth and

exceptional service.

Sherwin-Williams Renames

Chemical Coatings Division

CLEVELAND Sherwin-Williams an -

nounced that its Chemical Coatings Divi-

sion has been renamed Product Finishes.

Following the acquisitions of industrial

wood finishing leaders Becker Acroma

and Sayerlack in 2010, the newly expand-

ed Sherwin-Williams Product Finishes

Division now boasts a very strong pres-

ence in Europe, adding significant man-

ufacturing and distribution capabilities.

These acquisitions also added to the com-

panys existing infrastructure in China

and Asia, doubling its capabilities.

I am formulating

waterborne

alkyd coatings

and need defoamer

additives to improve my

coating manufacturing,

application and

performance properties.

What can you suggest?

Ask the Expert

Charlie

Hegedus

Research

Associate

Q

tell me more

www.airproducts.com/

surfactants

Air Products and Chemicals, Inc., 2011 (33519) B44

Waterborne alkyd

coatings are gaining

popularity due to their

enhanced properties,

green chemistry and

low VOCs. However, like most res-

ins, waterborne alkyd coatings re-

quire specic defoamers to achieve

optimal performance. Defoamers

reduce or eliminate foam and help

avoid production, application and

applied coating problems. Our

studies demonstrate that Surfy nol

DF-58 and DF-66 silicone defoam-

ers (used at 0.05% to 0.5% of

total formula) and Surfy nol DF-75

organic oil defoamer (used at 0.2%

to 1%) provide excellent compat-

ibility and defoaming. These addi-

tives enhance gloss of high-gloss

coatings and provide excellent

substrate coverage, appearance

and protection. In wood coatings,

such as clear varnishes and stains,

they promote complete coverage,

smooth nish, and excellent gloss,

clarity and distinctness of image.

In industrial coatings, such as metal

primers, they eliminate defects

such as pinholes, craters and other

defects that can lead to corrosion,

disbondment and other failures.

A

Visit ads.pcimag.com

C O M P A N Y N E W S

Troy Corporation, 8 Vreeland Road, Florham Park, New Jersey USA 07932 Telephone: +1 973-443-4200 Fax: +1 973-443-0258

The new Z-line of performance additives aims to provide improvements to customers developing

environmentally sustainable green coatings.

As the demand for "green" coatings continues to rise at a furious pace, Troys Z-line offers

formulators enhanced performance in making greener coatings possible without adding

undesirable components such as VOCs or HAPs. With the Z designed products, Troy continues

its commitment to assist industry in addressing the need for performance products that are

environmentally responsible and yet economically viable.

Contact your Troy Sales Representative for information on the Z-line of Troy performance additives

or visit www.troycorp.com.

JULY 2011

|

W W W . P C I M A G . C O M 18

C O M P A N Y N E W S

Evonik Finalizes Purchase

of hanse chemie Group

ESSEN, Germany Evonik Industries

has completed the purchase of the hanse

chemie Group, comprising hanse che-

mie AG and nanoresins AG. With a

workforce of some 100 employees, the

group is headquartered in Geesthacht

near Hamburg, Germany, where it pro-

duces high-quality components and raw

materials for the manufacture of seal-

ants and adhesives, molding and casting

compounds, and other products. The

greatest share of business will be incor-

porated into Evoniks Interface & Perfor-

mance Business Line.

AkzoNobel Opens New

Research Laboratory

AMSTERDAM, the Netherlands

AkzoNobel has opened a new research

laboratory in Deventer, the Netherlands.

Housing more than 200 researchers from

the companys Research, Development

and Innovation (RD&I) organization,

the facility is one of a network of six

global RD&I centers.

ALTANA Acquires Color Chemie

WESEL, Germany The specialty chemi-

cals Group ALTANA has signed an agree-

ment to acquire the Color Chemie Group.

The chemical company, headquartered in

Bdingen, Hesse, Germany, mainly pro-

duces environmentally friendly, water-

based specialty printing inks and offers

related services to its customers.

Hempel to Invest in Paint

Production Facility in Russia

LYNGBY, Denmark Hempel has signed

an agreement with local government offi-

cials in the Russian Ulyanovsk region for

Hempel Groups first Russian paint pro-

duction facility. The 23-million turnkey

project will be built close to the city of Uly-

anovsk, 893 kilometers east of Moscow.

Scheduled to start production in Decem-

ber 2012, the plant will help meet grow-

ing demand for Hempel coatings in the

Russian market.

Pump Solutions Group Acquires

EnviroGear

Product Line

GRAND TERRACE, CA Pump Solutions

Group has acquired the EnviroGear

product line. EnviroGear operations and

manufacturing are now based in Grand

Terrace, CA. Product lines include:

EnviroGear, a mag-drive internal gear

pump; EnviroBase gear pump base

plate assemblies; and EnviroCare, a

line of pump and motor protection and

control products.

Consistency you can see

from batch to batch.

803 518-1301 reynoldsuixers.cou

Feynolds Mixers do three things better than any other uixers.

Which ueans you can do three things better .

Mix viscous products faster

have less product waste

lncrease your proht

The ual Shaft Mixer is powerful, efhcient and versatile. lt

coubines a low-speed helical blade agitator with a high-speed

disperser blade to provide optiuuu batch turnover. lt helps

eliuinate hot or cold spots in teuperature controlled processes

and provides greater control of viscosity, particle site, color

and other qualities affected by the uixing process.

0et better uixing results. 0et Feynolds

in the Mix' - increase production

and eliuinate waste better than any

other uixer.

Froduce a consistent product

Frocess faster

Frovide a better heat transfer coefhcient

Reynolds Dual Shaft with

patented helical blade design

Visit ads.pcimag.com

Follow PCI on Facebook at

www.facebook.com/PCIfan

on Twitter at

http://twitter.com/PCIMag

and on Linkedin at

www.linkedin.com

We are thinking about the

same thing you are

How to make your products greener and their performance pure gold.

Our customers come to us to help them stay ahead of competitive pressures by helping to re-formulate

existing products and innovate new ones meeting green goals while preserving and even enhancing

performance. We call it Greenability. Youll call it genius.

Another ne result of the Innovation Principle

i

2

. Let us help you work through the

formula for Greenability.

www.byk.com

N A ME S I N T H E N E WS

JULY 2011

|

W W W . P C I M A G . C O M 20

Robert Carroll III, President of R.E. Carroll

Inc., has been honored as Executive of the Year

by Biltmores Whos Who for 2011-2012.

Sea-Land Chemical Co. has assigned Mark

Christeon the responsibility of leading the sales

organization. He will be managing the Sales

Team Leaders and will focus on improving sales

efforts. Craig Lundell has taken on the new posi-

tion of Team Leader, Supplier Relations. Kelly Kuhar has

been hired as the Administrative Assistant II, providing

additional support to the Procurement Department.

Lori Hilson Cioromski, President of TH Hilson Co., has

received the Member of the Year Award from the National

Association of Women Business Owners (NAWBO), Chicago.

PPG Industries has named Gary Danowski Vice

President, Automotive Refinish, EMEA (Europe, Middle East and

Africa). Richard A. Beuke, Vice President, Silicas, has been

named Vice President, Flat Glass. Kevin D. Braun, General Man-

ager, Architectural Coatings, ANZ (Australia and New Zealand),

has been named General Manager, Silica Products.

Camfil Farr Air Pollution Control has promoted John Dauber

to the position of Vice President of Sales, USA and Canada, and

Thomas Frungillo to Vice President of Sales,

Latin America and Focus Markets.

Sasol Chief Executive Pat Davies has been

awarded an Institution of Chemical Engineers

honorary fellowship.

DKSHs Business Unit Performance Materi-

als has appointed Mathias Greger to head its

North American operation. Greger will focus on overall

growth activities in the North American market.

DYMAX Corp. has appointed Gilberto Poinsot as a

Territory Sales Manager in the Field Sales Department.

Poinsot will help manufacturers in the southwest United

States reduce manufacturing costs. The company has

also appointed Brian Scully Inside Sales Manager in the

Customer Support Department. Scully will manage and

grow the global customer service and inside sales team at DYMAX.

BASF Automotive Refinish has named Jeff Wildman a

Regional Manager. He will report directly to Nick Maloof, Central

Zone Manager for BASF Automotive Refinish.

Archway Sales Inc. has hired Ginny Yost as the Accounts Pay-

able Clerk. Yost will be based out of St. Louis, MO.

Visit ads.pcimag.com

Frungillo Dauber

Greger

Natural whiteness

and hiding power

...new Jetne

talc confers superior whiteness

and hiding power to architectural and industrial paints

Tel. +1 303 713 5000 www.riotintominerals.com Techcenter@riotinto.com

Jetne

Your natural solution.

Jetne

is an ultra-ne, micronized talc with a high specic surface

area that signicantly improves hiding without diminishing gloss.

Jetne

is a natural, inert, free-owing talc with a top cut of 5m

and a median particle size of less than 1m.

Jetne

is produced using proprietary micronizing technology.

alkyd

hybrids

acrylic

vinyl acrylic

styrene acrylic

vinyl acetate ethylene

vinyl versatate

polyester

architectural

industrial

trafc

transportation

marine

maintenance

powder

rheology modiers

2011 Arkema Inc. arkemacoatingresins.com

just got easier.

doing it your way

Introducing Arkema Coating Resins, your new global

resource for coating resins and technology.

By combining the coating resins businesses of Arkema Emulsion

Systems, Cook Composites & Polymers and Cray Valley, were

now able to offer you more choices, more answers, and more

expertise in short, more ways to be

successful. Our commitment to helping

you nd the best solution, regardless of

technology, is stronger than ever. So you can develop your coating

formulations your way.

Visit www.arkemacoatingresins.com to see how we can help.

At Arkema Coating Resins, were focused on your future.

J ULY 2011

|

W W W . P C I M A G . C O M 24

By Karen Parker, Associate Editor, PCI Magazine

GLOBAL TOP 10

1. Akzo Nobel nv

Amsterdam, the Netherlands

+31 20 502 7833

www.akzonobel.com

Chairman of the Board of Management: Hans Wijers

Coatings Sales: $13.1 billion (9.8 billion)

AkzoNobel is the largest global coatings company and a major pro-

ducer of specialty chemicals. AkzoNobel is a Global Fortune 500

company and is consistently ranked as one of the leaders in the

area of sustainability. The company has operations in more than 80

countries and employs 55,000 people around the world. AkzoNobel

coatings brands include global and household names such as Inter-

national

, Sikkens

, Glidden

, Dulux

, Crown

, Interpon

, Levis

,

Coral

and Sadolin

.

Parent company: AkzoNobel

Source: AkzoNobel Report 2010, press releases, company contact

Recent Acquisitions and Divestments: AkzoNobel acquired Lind-

gens Metal Decorative Coatings and Inks in July 2010. In September

2010, the company acquired Changzhou Prime Automotive Paint Co.

Ltd. The company also completed the acquisition of the former Rohm

& Haas powder activities from the Dow Chemical Co.

Notes: Decorative Paints signed a deal with Walmart to become the

retailers primary paint supplier in the United States, and Dulux Trade

won the contract to paint the London 2012 Olympic Games site.

AkzoNobel's ambitious growth plans for Asia were underlined when

the company announced that it plans to double its current revenue in

China within five years. A target of $3 billion has been set for 2015, with

China poised to play an integral role in AkzoNobel's strategic focus on the

world's growth regions.

2. PPG Industries, Inc.

Pittsburgh

412/434.3131

www.ppg.com

Chairman/CEO: Charles E. Bunch

Coatings Sales: Approx. $9.86 billion

PPGs global coatings businesses comprise coatings for the aero-

space, architectural, automotive OEM, automotive refinish, indus-

trial, packaging, and protective and marine markets. The company

serves customers in industrial, transportation, consumer products,

and construction markets and aftermarkets. PPG is the worlds lead-

ing manufacturer of transportation OEM and refinish coatings, as

well as a technology leader in coatings for the wood-flooring industry

and a leader in the supply of paints for consumer electronics. In 2010,

PPGs businesses in emerging regions grew 20 percent, and sales in

those regions accounted for about 27 percent of the companys total.

Notably, PPGs business in the Asia-Pacific region posted record earn-

ings for 2010 and now represents about 15 percent of PPGs global

revenue, and PPG is now the second-largest coatings company in the

Asia-Pacific region. Also in 2010, sales for the companys Industrial

Coatings segment, including the automotive OEM, industrial and

packaging coatings businesses, increased $640 million or 21 per-

cent. Coatings represented about 73 percent of PPGs 2010 total net

sales of $13.4 billion.

Source: 2010 Annual Report, company website, company contact

Notes: In October 2010, PPG reached an agreement to acquire Bai-

run, a privately held packaging coatings company in southern China.

In May of this year, PPG signed an agreement to acquire Dyrup A/S, a

European coatings company based in Copenhagen. Dyrup is a Euro-

pean producer of architectural coatings, in particular wood stains,

and specialty products.

PPG broke ground on its first Chinese resin-production facility in

Zhangjiagang in 2009. In 2010, the largest PPG plant in Asia, PPG

Coatings (Tianjin) Co. Ltd., began a two-phase project to expand its

waterborne automotive and industrial coatings capacity, which is

expected to be about 10,000 tons annually upon project completion.

PPG also strengthened its presence in Russia in June 2010, by open-

ing an automotive refinish coatings training center in Moscow. In

South Africa, PPG became the only Johannesburg-based packaging

coatings supplier when it opened a packaging coatings facility inside

its Prominent Paints factory there.

In January 2011, PPG announced plans to expand its 14-year rela-

tionship with Asian Paints Ltd. to grow the companies joint coatings

business in India.

3. Sherwin-Williams Co.

Cleveland

216/566.2000

www.sherwin.com

Chairman/CEO: Christopher M. Connor

Coatings Sales: Approx. $5.83 billion

The Sherwin-Williams Co. is engaged in the manufacture, distribution

and sale of coatings and related products to professional, industrial,

commercial and retail customers primarily in North and South America.

The company has three operating segments: Paint Stores Group, Con-

sumer Group and Global Group. All three reportable operating segments

achieved organic sales growth in 2010. Net sales for the Global Finishes

Group increased 26.5 percent to $2.09 billion in 2010. Net sales for the

Paint Stores Group increased 4.1 percent to $4.38 billion, and external

net sales for the Consumer Group increased 5.9 percent to $1.30 billion.

Consolidated net sales for the entire company increased by $682 million,

or 9.6 percent, to $7.776 billion. It is estimated that between 70 to 75 per-

cent of sales, or about $5.83 billion, represents coatings sales, with the

remainder being related products, including wallcoverings, floor cover-

ings and application supplies. Sherwin-Williams has company-operated

stores in all 50 states, Canada and some countries in Latin America.

In 2010, the company opened 49 stores in new markets and consoli-

dated an additional 13 redundant store locations, for a net increase of

36 new stores for the year. The companys store count in the United

States, Canada and the Caribbean now stands at 3,390. The company

manufactures and sells coatings such as Dutch Boy

, Pratt & Lambert

,

Martin-Senour

, Dupli-Color

, Krylon

, Thompsons

and Minwax

,

plus private-label brands to independent dealers, mass merchandisers

and home-improvement centers. Sherwin-Williams produces coatings

for original equipment manufacturers in a number of industries and

special-purpose coatings for the automotive-aftermarket, industrial-

maintenance and traffic-paint markets.

Source: 2010 Annual Report, company Web site, press releases

Notes: In September 2010, the company acquired Becker Industrial

Products AB, a subsidiary of Sweden-based AB Wilh. In March 2010,

the company acquired the Industrial Wood Coatings business of Arch

Chemicals Inc.

4. DuPont Performance Coatings

Wilmington, DE

302/774.1000

www.dupont.com

Chairman/CEO: Ellen J. Kullman

President: John McCool

Coatings Sales: $3.8 billion

DuPont Performance Coatings includes its core markets of automo-

tive, collision repair and industrial coatings. The company offers

high-performance liquid and powder coatings as well as high-per-

formance specialty products. Sales of $3.8 billion were up 11 percent

when compared to the prior year, reflecting a 9 percent higher vol-

ume and a 2 percent increase in selling prices.

Parent Company: DuPont

Source: Dupont 2010 Annual Report, company Web site

Notes: In 2010, DuPont opened a research and development facil-

ity dedicated to coatings science at the Experimental Station in

PAI NT & COATI NGS I NDUS TRY

25

Wilmington, DE. The new Coatings Technology Center (CTC) focuses

on DuPont Refinish Systems products that support the automotive

collision industry and DuPont Industrial Coating Solutions. Also in

2010, DuPont entered into a marketing agreement with Ecolab Inc.

to commercialize new antimicrobial coating technologies for the food

and beverage processing industry.

5. BASF Coatings

Mnster, Germany

+0049 25 01 140

www.basf-coatings.com

CEO/President: Raimar Jahn

Coatings Sales: $3.5 billion (2.577 billion)

BASF Coatings GmbH is part of the BASF Groups internationally

operating Coatings Division. BASF Coatings develops, produces and

markets a range of automotive OEM coatings, automotive refinishes,

industrial coatings and decorative paints. BASFs architectural coat-

ings activities are based in Europe and South America. The company

has been the market leader in Brazil for many years under the Suvinil

brand. With the integration of the RELIUS Group in 2007, BASF Coat-

ings now offers construction paints for interior and exterior applica-

tions and external wall insulation systems in Europe.

Parent Company: BASF SE

Source: Company contact, press releases

Notes: In 2010, BASF Coatings GmbH and Henkel AG & Co KGaA

signed a joint-venture agreement to develop corrosion-protection

solutions for the automotive industry. In March 2011, BASF received

the General Motors Supplier of the Year Award for 2010. The award

has been given to BASF seven times in the last nine years, recogniz-

ing the coatings supplier for excellence in the areas of quality, service,

technology and price.

6. The Valspar Corp.

Minneapolis

612/851.7000

www.valspar.com

CEO: Gary E. Hendrickson

Coatings Sales: $2.99 billion

Valspar experienced a total sales increase of approximately 10 per-

cent in 2010. The company operates its coatings-related businesses

in two reportable segments: Paints and Coatings. Sales in the Paints

segment increased 8.4 percent (2010 revenue of $ 1,176.8 million)

and 11.7 percent in the Coatings segment (2010 revenue of $ 1,814.8

million), for total coatings sales of $2,992 million.

Source: 2010 Annual Report, company Web site

Notes: In September 2010, Valspar acquired Australian paint manu-

facturer Wattyl Limited. In February 2011, Valspar announced the

acquisition of Brazilian company Isocoat Tintas e Vernizes Ltda., a

manufacturer of powder coatings used in appliance, building prod-

ucts, transportation and other general industrial markets.

7. Nippon Paint Co.

Osaka, Japan

+81.6.64581111

www.nipponpaint.com

President: Kenji Sakai

Coatings Sales: $2.4 billion

Nippon Paint produces coatings for the automotive market, the

marine coatings market, as well as industrial products. It also

makes paints for residential and commercial buildings and for the

do-it-yourself market. Nippon Paints manufacturing operations are

located principally in Asia, but the company also has facilities in

North America and Europe. In the United States, it has two subsidiar-

ies that manufacture and sell paints: NB Coatings (liquid automotive

coatings for plastic) and NPA Coatings (automotive body coatings

and powder coatings).

Source: Company contact

8. Kansai Paint Co., Ltd.

Osaka, Japan

+81.6.6203 5531

www.kansai.co.jp

President: Shoju Kobayashi

Coatings Sales: $2.38 billion for fiscal year ended March 31, 2010

Kansai Paint Co., Ltd. is a manufacturer of coatings used in Japan,

Europe and the Americas, as well as China, India and other Asian

countries. Core business areas include Automotive Coatings, Indus-

trial Coatings, Decorative Coatings, and Marine and Protective

Coatings.

Source: Annual Report

Notes: In April of this year, the board of South Africa-based Free-

world Coatings accepted Kansai Paints takeover offer. Freeworld

Coatings manufactures and markets decorative, industrial and auto-

motive coatings. Markets include South Africa and other parts of

sub-Saharan Africa.

9. RPM International Inc.

Medina, OH

330/273.5090

www.rpminc.com

Chairman/CEO/President: Frank C. Sullivan

Coatings Sales: $2.3 billion for fiscal year ended May 31, 2010

RPM is a holding company with subsidiaries that are leaders in

specialty coatings, sealants, building materials and related services

serving both industrial and consumer markets. Industrial products

include corrosion-control coatings, flooring coatings and specialty

chemicals. Major industrial brands are Stonhard, Tremco, illbruck,

Carboline, Flowcrete, Universal Sealants and Euco. RPMs consumer

products are used by professionals and do-it-yourselfers for home

maintenance and improvement, boat repair and maintenance, and

by hobbyists. Consumer brands include Zinsser, Rust-Oleum, DAP,

Varathane and Testors.

Subsidiaries: A/D Fire, Alteco Technik, Ascoat Contracting, Car-

boline, Chemtec Chemicals, Dane Color, DAP, DAP Canada, Ecoloc,

Euclid Admixture, Euclid Chemical, Eucomex, Fibergrate, Fibregrid,

Flowcrete, Hummervoll, Increte Systems, Mantrose-Haeuser, Martin

Mathys, Modern Masters, New Parks, Paramount Technical, Pro-

ductos Cave, Productos de DAP, Radiant Color, Republic Powdered

Metals, RPM Building Solutions Group Europe, RPM/Belgium, Rust-

Oleum, Rust-Oleum Argentina, Rust-Oleum Canada, Rust-Oleum

Japan, Rust-Oleum Netherlands, Stonhard, Testor, Tor Coatings,

Toxement, Tremco Barrier Solutions, Tremco illbruck, Tremco Inc.,

Universal Sealants, Vandex, Watco, Weatherproofing Technologies,

Wolman and Zinsser.

Parent Company: RPM International Inc.

Source: Company contact, 2010 Annual Report, press releases

Notes: Recent transactions include the Performance Coatings Groups

acquisition of Norwegian business Hummervoll Industribelegg AS

in June 2010, the Building Solutions Groups acquisition of Turkish

distributor Park Dis Ticaret A.S. in September 2010, the Performance

Coatings Groups acquisition of UK-based Pipeline & Drainage Sys-

tems Ltd. in December 2010, and Euclid Chemical Co.s acquisition of

Georgia-based PSI Packaging Inc. in February 2011.

10. Jotun

Sandefjord, Norway

47.33.45.70.00

www.jotun.com

President/CEO: Morten Fon

Coatings Sales: $2 billion

The Jotun Group is a leading manufacturer of paint, coatings and

powder coatings. It consists of four divisions: Jotun Dekorativ, respon-

sible for Jotuns decorative paints, stains and varnish deliveries in

Scandinavia; Jotun Paints, responsible for decorative paints in mar-

kets outside Scandinavia; Jotun Coatings, a global segment respon-

sible for marine protective coatings and decorative paints in local

European and selected Asian markets; and Jotun Powder Coatings,

responsible for powder coatings.

Source: 2010 Annual Report, company Web site

Notes: In November 2010, Jotun Powder Coatings launched its first

furniture powder coatings range, Era-Coat MDF, a brand of powder

coatings especially created for designers and furniture makers.

J ULY 2011

|

W W W . P C I M A G . C O M 26

J ULY 2011

|

W W W . P C I M A G . C O M 26

1. PPG Industries Inc.

Pittsburgh

Coatings Sales: Approx. $9.86 billion

2. Sherwin-Williams Co.

Cleveland

Coatings Sales: Approx. $5.83 billion

3. DuPont Coatings & Color Technologies

Group

Wilmington, DE

Coatings Sales: $3.8 billion

4. The Valspar Corp.

Minneapolis

Coatings Sales: $2.99 billion

5. RPM International Inc.

Medina, OH

Coatings Sales: $2.3 billion

6. Behr Process Corp.

Santa Ana, CA

714/545.7101

www.behr.com

CEO/President: Jeff Filley

Coatings Sales: Approx. $1.69 billion

Mascos Decorative Architectural Products segment includes Behr

Process Corp. and Masterchem Industries, LLC. A leader in the DIY

market with The Home Depot, Behr also provides Behr Premium

Select paint for professional application through Masco Contractor

Services. Masterchem Industries sells under the brand names of

Kilz

, Casual Colors

, Expressions

, Hammerite

and others. These

brands are sold through big-box stores, national retailers, paint and

hardware stores and distributors.

Parent Company: Masco Corp.

Source: Masco Corp. SEC filing

7. Comex Group

Mexico City

www.thecomexgroup.com

CEO: Marcos Achar

COO, Mexico Div.: Leon Cohen

Coatings Sales: $1.36 billion

Comex Group was formed with the consolidation of Comex, Color

Wheel, Frazee, General Paint, Kwal, Parker and Duckback. In

addition to architectural paints, Comex manufactures industrial

coatings, roof coatings, wood-care products and aerosols.

Source: Company contact

Notes: In 2010, the company divested Ferreterias Calzada and

dissolved its joint venture with Akzo Nobel for automotive refinishes.

8. Ennis Paint Inc.

Ennis, TX

972/875.7272

www.ennispaint.com

Chairman: W. Bryce Anderson

Coatings Sales: $387 million

Ennis Paint Inc. continues a long history of pavement markings that

date back to the 1960s. Ennis Paint is a world leader in both traffic

paint and thermoplastics.

Source: Company contact

All rights reserved. 2010

Brilliant

Solutions!

Look to Brilliant Additions to achieve a

real competitive advantage. Formulators

use these versatile functional fillers to

add performance and value without

compromising cost targets. Meaningful

cost savings are possible with higher

loading rates, improved production

efficiencies and rationalized raw

materials inventories.

www.BrilliantAdditions.com

For more information and our complete product portfolio visit:

SPECIALTY AND PERFORMANCE MINERALS

Visit ads.pcimag.com

tell me more

airproducts.com/defoamer 2011 Air Products and Chemicals, Inc.

Happy formulating

made easy with our wide

selection of defoamers.

Finding the right defoamer is a lot easier when

you add Air Products defoamer samples to your bench.

Our wide selection of high-performance defoamers

(silicone, organic, mineral oil, molecular) help you meet

the technical demands of a wide range of water-based

coatings and inks formulations. And they achieve their

high performance without increasing cost-in-use.

Air Products has been a leader in specialty additives

for over 40 years. Weve applied our proven expertise

to a unique product selector tool, which can eliminate

your formulating frustrations by matching the best

Air Products defoamer to your application and specic

project need. Call 1-800-345-3148 to request the tool

and a free sample. And see why adding our defoamers

to your bench will certainly add a smile to your face.

J ULY 2011

|

W W W . P C I M A G . C O M 28

9. Kelly-Moore Paint Co., Inc.

San Carlos, CA

800/874.4436

www.kellymoore.com

President/CEO: Steve DeVoe

Coatings Sales: $245 million

Headquartered in San Carlos, CA, Kelly-Moore is one of the largest

employee-owned paint companies in the United States. A leader

and innovator of waterborne coating technology, Kelly-Moore

was the first major paint manufacturer to offer recycled paints.

Kelly-Moore operates 163 company-owned stores in eight states:

Arkansas, California, Idaho, Nevada, Oklahoma, Oregon, Texas and

Washington. The company is looking to add a number of additional

neighborhood locations in 2011.

Source: Company contact

Notes: In 2010, Kelly-Moore continued to work closely with

independent paint retailers by increasing its dealer network to over

150 stores nationwide. The company also enjoyed continued success

in distributing its coatings overseas, where the demand is high for

quality, American-made products.

10. TIGER Drylac U.S.A., Inc.

Reading, PA

800/243.8148

www.tiger-coatings.us

CEO: Larry McNeely

Coatings Sales: $235 million

TIGER is ranked the fifth-largest powder manufacturer in the world

with sales of over $235 million and more than 1,000 employees.

It offers the largest selection of top-of-the-line powder coatings in

every type of chemistry, serving among others the architectural,

automotive, lighting and furniture industries. The U.S. operations

were established in 1984. Today, the company ships from six strategic

distribution centers. The companys North American production

network includes three facilities in the United States, in California,

Illinois and Pennsylvania.

Source: Company contact

11. Cloverdale Paint Inc.

Surrey B.C., Canada

604/569.6261

www.cloverdalepaint.com

CEO: C.A. (Al) Mordy

Rodda Paint Co.

800/242.3713

Portland, OR

www.roddapaint.com

COO: Bill Boone

Coatings Sales: $221 million (combined)

Cloverdale Paint Inc. and its subsidiaries, Rodda Paint Co., Fargo Paint

& Chemicals Inc., and Guertin Coatings, Sealants & Polymers Ltd.,

operate through 109 corporate-owned locations covering western

Canada as well as Washington, Oregon, Idaho, Montana and Alaska.

The companies manufacture architectural paint, and industrial and

marine coatings along with certain powder coatings, specialty resins

and sealant products. Combined markets include sales to a wide

Quick Easy Clean Designs

Spare Parts to Complete Turn Key Systems

Afordable Maintenance & Energy Ef ciency

Conceptual Engineering & Custom Plant Design

Product Testing Services & Portable Laboratory Systems

Toll Grinding Facility for Small to Large Scale Grinding Needs

On Site Technical Assistance & Equipment Training Programs

CMS CLASSIFIER MILLING SYSTEMS

Powder Process Equipment Manufacturers

35 Van Kirk Drive Unit #17

Brampton, ON Canada L7A 1A5

Of ce: (905)456-6700 Fax: (905)456-0076

Email: sales@cms-can.com

Website: www.cms-can.com

Quality Equipment & Service Guaranteed!

TOLL FREE: 1-877-353-MILL (6455)

Classifer Milling Systems ggggggggggggggggg yyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyyy

PROCESS EQUIPMENT SPECIALISTS

Visit ads.pcimag.com

J ULY 2011

|

W W W . P C I M A G . C O M 30

variety of professional, commercial, residential, industrial, marine,

private-label and DIY customers as well as a network supporting

Cloverdale Paint and Rodda Paint independent dealers throughout

the Pacific Northwest region.

Source: Company contact, company Web site

12. Nippon Paint U.S. Subsidiaries

Coatings Sales: $190 million (combined)

NB Coatings Inc.

Lansing, IL

708/474.7000

www.nbcoatings.com

CEO: Hidefomi Morita

A subsidiary of Nippon Paint Co., NB Coatings is the leading supplier

of liquid coatings for plastic automotive parts in North America. It

provides a complete line of custom coatings for fascia, exterior trim,

interior trim and lens applications.

NPA Coatings Inc.

Cleveland

216/651.5900

President: Hidefomi Morita

NPA Coatings manufactures and sells powder coatings, automotive-

body coatings, pretreatment chemicals and transit film to customers

in the general industrial and automotive markets.

Source: Company contact

13. Whitford Corp.

Elverson, PA

610/286.3500

www.whitfordww.com

President: David P. Willis, Jr.

Coatings Sales: Over $160 million

Founded in 1969, Whitford Corp. has dedicated itself to nonstick

coatings for the industrial and consumer markets, later expanding

to rubber, textiles, rope and cordage, and other markets. Whitfords

first international venture took place in 1971 with the opening of

Whitford Plastics Ltd. in the north of England. Current products

include: Xylan

, Xylac

, Dykor

, Xylar

, Ultralon

, Excalibur

,

Eterna

, HALO

, Eclipse

, QuanTanium

, Quantum2

, Fusion

,

PFA+ and others. Whitford has global manufacturing facilities,

including sites in Brazil, Italy, the UK, India, China, Singapore, and

Elverson, PA. With the acquisition of Polymeric Systems Inc. in mid-

2004, its portfolio expanded to include a wide variety of adhesive

products sold throughout the world to retail, consumer and industrial

markets.

Source: Company Web site, company contact

Notes: In January 2011, Whitford purchased HP Polymers, a leading

Canadian manufacturer of a variety of polymer resins. In April

2011, the company opened its ninth factory in Bangalore, India.

Manufacturing at the site will concentrate primarily on coatings

for consumer products, along with a few specialized industrial

applications.

Contact us today:

US Toll Free: 800-652-6013

Tel: 973-357-3193

Email: custinfo@cytec.com

www.cytec.com

2011 Cytec Industries Inc.

All Rights Reserved.

Cytec Coating Resins delivers

innovative products beyond

our customers imagination.

We are the pioneers in the

development and production

of high performance coating

solutions. Our line of coating

resins and additives allow

our customers to create

sustainable change for the

industries they serve.

Pioneering

Sustainable Change

Visit ads.pcimag.com

C

o

l

o

r

r

e

d

e

n

e

d

.

Forward thinking color solutions come from CPS Color, the global leader

in Low and VOC free colorant technology for more than 15 years. Our

continuous investment in colorant research and development keeps our

customers competitive with technical performance requirements and

up-to-date with ever-changing legislative actions.

European standards for sustainable technology are rapidly becoming the

example upon which US environmental regulations are being modeled.

CPS Colors global strength and knowledge of the tinting process from

start to nish, ensures that our comprehensive product portfolio, including

colorants, equipment, software and support, is the best choice for paint

manufacturers.

CPS Color specializes in colorant systems ranging from the latest in Zero

and Low VOC decorative options to high strength industrial product

systems. Our color experts make converting colorant technologies seamless

and worry-free; navigating customers through every step of the process.

When combined with our state-of-the-art dispensing equipment you are

assured the best possible compatibility and overall system performance.

The power of integrated tinting, thats the CPS Color difference.

www.cpscolor.com

Global supplier of integrated tinting solutions:

CPSCOLOR colorants

COROB dispensing and mixing equipment

Software

Color marketing

Worldwide service and customer support

CPS Color 7295 West Winds Blvd. Concord, NC 28027 USA 800.728.8408

J ULY 2011

|

W W W . P C I M A G . C O M 32

14. Vogel Paint, Inc.

Orange City, IA

712/737.8880

www.vogelpaint.com

President/CEO: Drew F. Vogel

Coatings Sales: $135 million

Vogel Paints was established in 1926 as a manufacturer of barn paints

and creamery maintenance enamels. It entered the liquid industrial

coatings market in the 1950s and began to build a fleet of company

stores selling architectural paints and heavy-duty maintenance

coatings in the 1970s. The company formed the Peridium Powder

Coatings division in 1998 and built a new powder coatings production

facility in 2003. Today, the company operates over 70 company stores

and seven manufacturing plants and distribution centers in 13 states.

Source: Company contact

Notes: In May 2011, Diamond Vogel announced a partnership with

Sciessent, creator of the silver-based antimicrobial brand Agion

,

to offer the Peridium

Powder Coatings line. The new Peridium line

brings the quality and durability that industrial customers have

found synonymous with the Vogel name with the added benefit of

Agion antimicrobial product protection.

16. Ace Hardware Corp.

Oakbrook, IL

630/990.6600

www.acehardware.com

CEO/President: Ray A. Griffith

Chairman of the Board: Dave Ziegler

Coatings Sales: $125 million

Ace Hardware is the largest retailer-owned hardware cooperative in

the industry. Ace manufactures a full assortment of paints, stains,

primers and light-industrial products with its primary business

centered on the Ace ROYAL brand. All Ace Paint-branded

products are produced in one of two facilities owned and operated