Professional Documents

Culture Documents

ICICI Direct On Ador Welding

ICICI Direct On Ador Welding

Uploaded by

Dhittbanda GamingOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ICICI Direct On Ador Welding

ICICI Direct On Ador Welding

Uploaded by

Dhittbanda GamingCopyright:

Available Formats

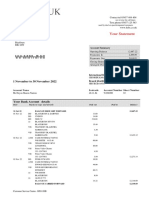

Ador Welding (ADOWEL)

CMP: | 859 Target: | 1015 (18%) Target Period: 12-18 months BUY

November 18, 2022

Decent performance…

About the stock: Ador Welding (AWL) is a leading player in the welding

Company Update

consumables (~19% market share), welding equipment, automation and projects

Particulars

business. Welding consumables contributed ~81% of revenue in FY22.

Particular Amount

AWL is expected to continue strong RoCE, positive free cash flow trajectory Market Capitalization | 1168 Crore

in consumables in comings years despite a challenging environment Total Debt (FY22) | 1 Crore

Cash and Inv (FY22) | 3 Crore

Aims to reduce legacy costs in projects business to improve return ratios EV (FY22) | 1165 Crore

52 week H/L (|) 880 / 535

Equity capital | 13.6 Crore

Face value (|) 10.0

Q2FY23 Results: AWL reported decent Q2FY23 results. Shareholding pattern (%)

Revenues came in at | 184.9 crore, up 15.9% YoY, 17.1% QoQ (in %) Dec-21 Mar-22 Jun-22 Sep -22

Promoter 56.9 56.9 56.9 56.9

FII 0.3 0.2 0.2 0.3

EBITDA came in at | 15.2 crore up 16.3% YoY, aided by reduced losses in

DII 6.7 6.7 6.7 4.8

flares & process equipment business Others 36.1 36.2 36.2 38.0

Price Performance

Consequently, adjusted PAT was at | 10 crore, down 31% YoY

1100 17000

What should investors do? Going forward, better consumables volumes, rebound

12000

ICICI Securities – Retail Equity Research

in equipment sales and projects business turnaround to drive growth, profitability.

600

Considering strong growth outlook, margin revival, we maintain BUY rating 7000

Target Price and Valuation: We value AWL at | 1015 i.e. 21x P/E on FY24E EPS. 100 2000

Nov-20

Nov-19

Nov-21

Nov-22

Key triggers for future price performance:

AWL IS E QUITY NSE5 00 Inde x

AWL aims to focus on core welding business, reduce legacy costs while

streamlining projects business to regain growth and improve profitability Recent event & Key risks

Domestic welding & automation business to focus on improving margins Key Risk: (i) Headwinds in overall

and realisations with cost rationalisation, enhance advanced product infrastructure and project execution

portfolio, improving strike ratio of order wins and optimised product mix (ii) Volatile raw material costs,

further headwinds in projects

Overall, we expect revenue, EBITDA CAGR of 15.8% and 26.3%,

business

respectively, in FY22-24E with margins rebounding to 10.5% levels

Research Analyst

Alternate Stock Idea: Besides AWL, we also like AIA Engineering in our coverage.

Chirag Shah

AIA to gain incremental volume growth in coming years despite likely base Shah.chirag@icicisecurities.com

volume impact due to anti-dumping in Canada, South Africa

Ameya Mahurkar

BUY with a target price of | 3240 ameya.mahurkar@icicisecurities.com

Key Financial Summary

5-Year CAGR 2-year CAGR

(| Crore) FY20 FY21 FY22 FY23E FY24E

(FY17-22) FY22-FY24E

Revenue (| crore) 526.5 447.7 661.5 8.4% 756.7 887.4 15.8%

EBITDA (| crore) 42.9 20.1 58.4 14.2% 70.4 93.2 26.3%

EBITDA margin (%) 8.2 4.5 8.8 9.3 10.5

Net Profit (| crore) 28.8 (10.4) 45.2 15.2% 46.4 65.6 -

EPS (|) 21.2 (7.6) 33.2 34.1 48.3

P/E (x) 41.1 (114.0) 26.2 25.5 18.0

Price / Book (x) 4.4 5.0 4.5 4.0 3.5

EV/EBITDA (x) 29.4 60.0 20.2 16.8 12.7

RoCE (%) 12.0 6.1 19.9 21.6 26.5

RoE (%) 10.8 3.1 13.6 15.7 19.3

es

Source: Company, ICICI Direct Research

Company Update | Ador Welding ICICI Direct Research

Key takeaways of recent quarter & key triggers

Q2FY23 Results: Decent performance

Ador Welding (AWL) reported consolidated revenues at | 184.9 crore, up

15.9% YoY and 17.1% QoQ led by better performance in consumable, flares

& process business

For Q2FY23, consumables segment revenue came in at | 148.1 crore (which

contributed ~80.1% to total revenue), up 17.5% YoY, 22% QoQ. Equipment

& automation segment grew 3% to | 28.5 crore YoY & 25.1% QoQ. Flares &

process equipment business revenue came in at | 8.5 crore, strongly

growing 37% YoY and down by 39.1% QoQ. EBIT margin for consumable

business expanded 100 bps YoY to 11.1% and contracted 400 bps QoQ,

Equipment & automation EBIT margin came in at 6% (vs. 11.3% in Q2FY22)

and (3% in Q1FY23) while flares & process equipment business margin

came in at -0.5% vs -12.1% in Q2FY22 and 14.4% in Q1FY23

EBITDA came in at | 15.2 crore, up 16.3% YoY and down 6.8% QoQ. EBITDA

margin came in at 8.2%, remaining flat YoY and contracting 210 bps QoQ.

Gross margins for Q2FY23 was at 29.5% vs 27.4% in Q2FY22 and 33.9% in

Q1FY23

Adjusted PAT came in at | 10 crore, down 31% YoY, 12.3% QoQ

Q2FY23 Earnings Conference Call highlights

For the first half of FY23, volume growth was largely flat from H1FY22.

However, for H2FY23, the management is confident that 15-20% volume

growth will come as demand scenario is fairly good also with good product

mix. The company has seen demand stabilisation since August, September

2022. In July, AWL consciously took the hit on margins to clear the high cost

inventory. General infrastructure looks very good in terms of demand. Also,

sectors like railways, defence, power, auto, oil & gas can contribute

Sectoral contribution to total revenue is as follows: Heavy engineering

contributes 30%, auto 20%, construction 10-11%, railways 8-10%. Total

65% of sales happened through distribution network while ~200

distributors are there currently and balance sales comes through direct

sales

Consumables: As per management guidance, in consumable segment there

is scope for margin improvement of 150 bps from currently 11-12% and that

is achievable by the next two to four quarters. Currently, capacity utilisation

varies from 65-90% depending on products. The company is going to

expand some product lines, which will take its capacity from 75000 TPA to

85000 TPA in coming years

Equipment: Recently, AWL launched new improved machines in the

equipment segment. This segment is growing rapidly thanks to automation.

Volumes are expected to get better from here with 12-15% growth. In

equipment segment, the management is expecting mid-teens margins in

coming years. Current capacity utilisation is at 70%

Flares & Process Equipment (FPED): AWL’s FPED division has already

surpassed the order booking target of | 75 crore for FY23 while current

orders in hand is at – | 134 crore. AWL received a major order in FPED

business worth | 145 crore (including GST) to design, engineering,

fabrication, erection & commissioning of complete demountable flare

package in ONGC’s Uran project with execution timeline of 30 months. From

this big project, 10% revenue will be incurred in Q4FY23. Also, ~55-60%

revenue will come in FY24E while balance will be pushed into FY25. Margins

are expected to be healthier for this project. AWL may require capital of

~| 35 crore and progressive payment for this project. FPED segment posted

positive EBIT in H1FY23 owing to robust and stable order book.

ICICI Securities | Retail Research 2

Company Update | Ador Welding ICICI Direct Research

Ador International: Revenue grew 140% YoY for Ador International this

quarter. The company plans to strengthen the market presence in existing

markets like Middle East, Africa, etc, and enter new markets like Brazil.

Recently, Ador opened a new showroom/office in JAFZA in Dubai. Also, it

is restructuring its distribution network in Middle East. Ador is making

efforts to position itself as an MNC company abroad. Ador International is

on track to achieve 50% growth in FY23. Also, tremendous growth

opportunities are seen in the exports markets. The company is on track to

achieve ~| 45 crore of exports in FY23E

Capex: Total capex planed for FY23E is | 23.3 crore. Out of this, | 5.7 crore

has been spent in H1FY23 and of the remaining | 17.5 crore will be utilised

in H2FY23 mainly on technology upgradation and capacity enhancement for

welding business/FPED and general IT and others. New product line is

coming up.

Commodity price impact: Fluctuation in steel prices is a major issue though

volatility in steel prices has reduced since last quarter

Updates on amalgamation of ADFL with AWL – Currently, it is in NCLT. The

merger is supposed to happen by end of FY23E. However, it seems it may

drag beyond that and will take about a year from now to be completed

ICICI Securities | Retail Research 3

Company Update | Ador Welding ICICI Direct Research

Exhibit 1: Variance Analysis

EESes es

Year Q2FY23

Q1FY22 Q2FY22 YoY (%) Q1FY23 QoQ (%) Comments

Revenue growth aided by better performance in Flares & Process

Income from Operation 184.9 159.5 15.9 157.9 17.1

Equipment followed by consumables

Other Income 1.6 1.3 16.4 2.0 (23.2)

Cost of materials consumed 120.0 112.89 6.3 122.0 (1.6)

Power & Fuel 0.0 0.0 - 0.0 -

Changes in inventories of finished

10.3 2.9 252.9 (17.7) (158.1)

goods & WIP

Employee cost 14.1 12.3 14.0 13.6 3.1

Other expenses 25.4 18.4 38.2 23.7 7.1

EBITDA 15.2 13.0 16.3 16.3 (6.8)

EBITDA Margin (%) 8.2 8.2 3 bps 10.3 -210 bps

Depreciation 2.9 2.7 8.3 2.8 3.2

Interest 0.5 1.2 (56.5) 0.4

PBT 13.3 10.6 26.2 15.1 (11.7)

Taxes 3.4 3.1 9.1 3.4 (2.3)

Adjusted PAT 10.0 9.6 4.2 11.4 (12.3)

Segment Revenue Q2FY23 Q2FY22 YoY (%) Q1FY23 QoQ (%)

Consumable 148.1 126.0 17.5 121.4 22.0

% Contribution 80.1 79.0 76.9

Equipments & Automation 28.5 27.6 3.0 22.7 25.1

% Contribution 15.4 17.3 14.4

Flares & Process Equipment 8.5 6.2 37.0 13.9 (39.1)

% Contribution 4.6 3.9 8.8

Net Sales 184.9 159.5 157.9

Source: Company, ICICI Direct Research

Exhibit 2: Change in estimates

FY20 FY21 FY22 FY23E FY24E

(| Crore) Actual Actual New Old New % Change Old New % Change

Revenue 527 448 661 751 757 1 851 887 4

EBITDA 43 20 58 71 70 -1 92 93 1

EBITDA Margin (%) 8.2 4.5 8.8 9.4 9.3 -10 bps 10.8 10.5 -30 bps

PAT 29 7 36 51 46 -9 67 66 -2

EPS (|) 21.2 -7.6 33.2 37.5 34.1 -9.1 49.3 48.3 -2.1

v

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 4

Company Update | Ador Welding ICICI Direct Research

Exhibit 2: Overall revenue trend…. Exhibit 3: Overall EBITDA margin (%) trend…

1000 887.4 60% 12.0

48.7%

756.7 50%

800 9.3 10.5

666.8 40% 10.0 8.6 8.8

8.2

30% 7.4

600 512.4 529.0 8.0 6.8

463.4 459.3 448.3 13.5% 20%

17.3%

400 13.5% 6.0

11.6% 10% 4.5

3.2% 0%

200 -0.9% 4.0

-15.3% -10%

0 -20% 2.0

FY17 FY18 FY19 FY20 FY21 FY22 FY23E FY24E

0.0

Total Revenue (| crore) YoY (%) Growth [R.H.S]

FY17 FY18 FY19 FY20 FY21 FY22 FY23E FY24E

Source: Company, ICICI Direct Research Source: Company, ICICI Direct Research

Exhibit 4: Consumable segment revenue trend Exhibit 5: Consumable segment EBIT margin (%) trend

800 712.9 60% 20

52.0%

605.4 18 16.4 15.9

600 535.7 40% 16 13.2 13.5

14 11.6 12.1

386.0 405.0 352.3 11.3 13.5

400 314.4 312.3 23.6% 13.0% 17.8%

20% 12

14.4% 10

4.9% 8

200 -0.6% 0%

-13.0% 6

4

0 -20%

2

FY17 FY18 FY19 FY20 FY21 FY22 FY23E FY24E

Consumable Segment (| crore) 0

FY17 FY18 FY19 FY20 FY21 FY22 FY23E FY24E

Consumable Rev. Growth (%) [RHS]

Source: Company, ICICI Direct Research Source: Company, ICICI Direct Research

Exhibit 6: Consumable segment RoCE trend... Exhibit 7: Overall RoE, RoCE trend….

60 59.5 30

49.1 26.5

25 21.6

50 19.9

41.0

37.7 20

40 32.7

30.0 13.3 19.3

29.6 29.6 15 12.0

10.1 10.0 15.7

30

10 6.1 13.6

10.8

20 5 9.4

7.6 7.5

10 0 3.1

FY17 FY18 FY19 FY20 FY21 FY22 FY23E FY24E

0

RoCE (%) RoNW (%)

FY17 FY18 FY19 FY20 FY21 FY22 FY23E FY24E

Source: Company, ICICI Direct Research Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 5

Company Update | Ador Welding ICICI Direct Research

Financial Summary

Exhibit 8: Profit & loss statement (| crore) Exhibit 9: Cash flow statement (| crore)

(| Crore) FY20 FY21 FY22 FY23E FY24E (| Crore) FY21 FY22 FY23E FY24E

Net Sales 447.7 661.5 756.7 887.4 Profit after Tax (10.4) 45.2 46.4 65.6

Other Operating Income - - - - Depreciation 11.2 10.9 12.2 13.4

Total Operating Income 447.7 661.5 756.7 887.4 Interest 6.4 3.7 3.8 5.3

% Growth (15.0) 47.8 14.4 17.3 Other income (25.4) 9.0 - -

Other Income 7.4 5.5 7.6 13.3 Prov for Taxation (3.7) 13.1 15.6 22.1

Total Revenue 455.1 667.0 764.3 900.7 Cash Flow before WC changes (21.9) 81.8 77.9 106.5

Cost of materials consumed 326.2 421.3 514.5 594.6 Change in Working Capital 108.4 (10.4) (5.8) (23.7)

Purchase of stock-in-trade 9.5 58.5 7.6 8.9 Taxes Paid (0.6) (13.1) (15.6) (22.1)

Other Expenses 66.1 84.6 103.7 120.7 Cashflow from Operating Activities85.9 58.4 56.6 60.7

Total expenditure 427.6 603.1 686.3 794.2 (Purchase)/Sale of Fixed Assets (6.1) (2.7) (27.9) (30.0)

EBITDA 20.1 58.4 70.4 93.2 (Purchase)/Sale of Investments (6.5) (9.2) (6.0) (6.0)

% Growth (53.2) 190.4 20.6 32.4 Other Income - - - -

Interest 6.4 3.7 3.8 5.3 Cashflow from Investing Activities(12.6) (11.9) (33.9) (36.0)

Depreciation 11.2 10.9 12.2 13.4 Issue/(Repayment of Debt) (53.9) (27.3) 9.4 -

PBT (14.1) 58.2 62.0 87.7 Changes in Minority Interest - - - -

Tax (3.7) 13.1 15.6 22.1 Changes in Networth (37.2) (8.0) (17.7) (19.0)

PAT (10.4) 45.2 46.4 65.6 Interest (6.4) (3.7) (3.8) (5.3)

% Growth (136.1) (535.1) 2.7 41.6 Others - - - -

EPS (7.6) 33.2 34.1 48.3 Cashflow from Financing Activities(97.5) (39.1) (12.1) (24.4)

Source: Company, ICICI Direct Research Changes in Cash 1.2 (1.6) 10.6 0.3

Opening Cash/Cash Equivalent 3.8 5.0 3.4 14.0

Closing Cash/ Cash Equivalent 5.0 3.4 14.0 14.3

Source: Company, ICICI Direct Research

Exhibit 10: Balance Sheet (| crore) Exhibit 11: Key ratios

(| Crore) FY21 FY22 FY23E FY24E (Year-end March) FY20 FY21 FY22 FY23E FY24E

Share Capital 13.6 13.6 13.6 13.6 EPS (7.6) 33.2 34.1 48.3

Reserves & Surplus 223.9 252.1 280.8 327.4 Cash EPS 0.6 41.2 43.1 58.2

Networth 237.5 265.7 294.4 341.0 BV 174.7 195.4 216.5 250.7

Total Debt 28.0 0.7 10.1 10.1 DPS 13.0 12.5 13.0 14.0

Deferred tax liability (net) - - - - Cash Per Share 117.1 125.2 134.1 144.0

Total Liabilities 270.5 272.5 308.9 356.3 EBITDA Margin 4.5 8.8 9.3 10.5

Gross Block 267.6 267.6 297.6 327.6 PBT / Net Sales 2.0 7.2 7.7 9.0

Acc: Depreciation 159.3 170.2 182.4 195.8 PAT Margin 1.6 5.5 6.1 7.4

Net Block 109.3 97.4 115.2 131.8 Inventory days 50.9 49.6 48.0 48.0

Capital WIP 3.3 7.1 5.0 5.0 Debtor days 85.9 51.4 51.1 51.1

Investments 19.0 28.2 34.2 40.2 Creditor days 60.3 39.2 47.0 47.0

Inventory 62.5 90.0 99.5 116.7 RoE 3.1 13.6 15.7 19.3

Sundry debtors 105.4 93.2 105.9 124.2 RoCE 6.1 19.9 21.6 26.5

Cash and bank balances 5.0 3.4 14.0 14.3 RoIC 3.7 19.0 20.9 24.6

Loans and advances 1.2 0.4 0.5 0.6 P/E (112.5) 25.9 25.2 17.8

Other Current Assets 22.3 18.9 26.5 31.1 EV / EBITDA 59.3 20.0 16.5 12.5

Total current Assets 198.2 205.9 248.6 289.5 EV / Net Sales 2.7 1.8 1.5 1.3

CL& Prov. 78.9 77.5 103.9 120.8 Market Cap / Sales 2.6 1.8 1.5 1.3

Net Current Assets 93.5 102.7 112.2 130.6 Price to Book Value 4.9 4.4 4.0 3.4

e

Total Assets 268.5 272.5 308.8 357.0 Debt/EBITDA 1.4 0.0 0.1 0.1

Source: Company, ICICI Direct Research Net Debt / Equity 0.1 0.0 0.0 0.0

Current Ratio 2.4 2.6 2.2 2.3

v

Quick Ratio 1.6 1.5 1.3 1.3

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 6

Company Update | Ador Welding ICICI Direct Research

Exhibit 3: ICICI Direct coverage universe (Capital Goods)

Company CMP M Cap EPS (|) P/E (x) RoCE (%) RoE (%)

(|) TP(|) Rating (| Cr) FY22 FY23E FY24E FY22 FY23E FY24E FY22 FY23E FY24E FY22 FY23E FY24E

L&T (LARTOU) 2,012 2,355 Buy 282324 56.8 66.1 76.7 35.4 30.4 26.2 8.9 9.3 11.6 12.1 12.9 13.6

Siemens Ltd 2,846 3,660 Buy 101352 29.5 36.7 50.5 96.5 77.5 56.4 13.9 15.7 19.2 10.1 11.6 14.2

AIA Engineering (AIAENG) 2,685 3,239 Buy 25325 64.6 89.8 92.5 41.6 29.9 29.0 16.5 19.9 17.9 13.2 15.8 14.3

Thermax (THERMA) 2,140 2,536 Hold 25499 36.5 51.7 61.0 58.6 41.4 35.1 14.6 18.3 18.7 11.4 14.3 14.4

KEC International (KECIN) 419 515 Buy 10772 12.9 15.4 30.3 32.4 27.2 13.8 11.9 13.8 20.5 10.6 10.7 17.9

Greaves Cotton (GREAVE) 151 209 Buy 3491 0.7 3.9 3.6 213.3 38.9 42.2 2.5 10.4 10.6 1.3 7.5 7.7

Elgi Equipment (ELGEQU) 499 520 Hold 15814 7.2 9.4 11.4 69.7 53.2 43.7 19.0 21.4 22.0 19.8 21.3 21.1

Bharat Electronics (BHAELE) 108 135 Buy 78799 3.2 3.8 4.5 33.7 28.4 24.0 26.1 28.4 30.0 19.5 21.2 22.4

Cochin Shipyard (COCSHI) 668 745 Buy 8787 42.9 38.6 42.8 15.6 17.3 15.6 10.9 10.5 10.6 12.7 11.0 11.3

SKF (SKFIND) 5,070 5,215 Buy 25065 77.0 108.7 130.3 65.8 46.6 38.9 26.0 30.7 31.3 20.6 23.3 23.4

Timken India (TIMIND) 3,594 3,561 Buy 27034 43.5 61.3 71.2 82.6 58.6 50.5 25.3 36.2 42.0 19.7 27.9 32.2

NRB Bearing (NRBBEA) 149 220 Buy 1444 7.8 9.2 12.1 19.1 16.2 12.3 15.0 15.3 19.2 12.6 12.6 14.8

Action Construction (ACTCON) 325 365 Buy 3870 8.8 15.1 19.2 36.9 21.5 16.9 23.0 25.6 26.7 13.9 18.3 18.9

Data Patterns (DATPAT) 1355 1,555 Buy 7031 18.1 22.0 30.4 74.8 61.7 44.6 23.8 24.9 28.4 16.4 18.2 21.0

HAL (HINAER) 2,619 3,300 Buy 87577 151.9 132.7 145.0 17.2 19.7 18.1 27.4 30.5 30.1 26.3 23.1 22.8

ABB (ABB) 3,093 3,275 Buy 65543 25.5 40.5 37.2 121.4 76.4 83.1 45.0 49.2 57.3 11.2 12.9 15.1

Ador Welding (ADOWEL) 858 1,014 Buy 1167 33.2 34.1 48.3 25.8 25.2 17.8 19.9 21.6 26.5 13.6 15.7 19.3

Bharat Dynamics (BHADYN) 933 1,200 Buy 17100 27.3 33.0 42.7 34.2 28.3 21.9 24.6 24.7 27.9 17.3 17.7 20.0

Mazagon Dock (MAZDOC) 833 562 Buy 16801 30.3 31.2 40.1 27.5 26.7 20.8 20.0 18.1 20.9 16.1 14.6 16.6

Solar Industries India (SOLIN) 3,980 4,701 Buy 36015 48.8 76.6 99.7 81.6 52.0 39.9 22.5 32.5 34.6 23.9 29.0 28.8

Anup Engineering (THEANU) 917 1,085 Buy 908 62.7 49.5 72.3 14.6 18.5 12.7 15.3 16.6 19.4 12.2 12.5 14.5

Control Prints (CONTROLPR) 422 520 Buy 689 24.7 28.7 34.6 17.1 14.7 12.2 17.9 21.4 23.4 13.8 15.4 16.3

KSB Ltd. (KSBPUM) 1,930 2,180 Buy 6716 43.7 50.0 62.2 44.2 38.6 31.0 15.7 16.0 18.3 14.7 14.9 15.9

Source: Company, ICICI Direct Research

ICICI Securities | Retail Research 7

Company Update | Ador Welding ICICI Direct Research

RATING RATIONALE

ICICI Direct endeavours to provide objective opinions and recommendations. ICICI Direct assigns ratings to its

stocks according to their notional target price vs. current market price and then categorizes them as Buy, Hold,

Reduce and Sell. The performance horizon is two years unless specified and the notional target price is defined

as the analysts' valuation for a stock

Buy: >15%

Hold: -5% to 15%;

Reduce: -15% to -5%;

Sell: <-15%

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

ICICI Direct Research Desk,

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No 7, MIDC,

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

ICICI Securities | Retail Research 8

Company Update | Ador Welding ICICI Direct Research

ANALYST CERTIFICATION

I/We, Chirag Shah, PGDBM and Ameya Mahurkar, MFM (Master in Financial Management), Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this

research report accurately reflect our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in

this report. It is also confirmed that above mentioned Analysts of this report have not received any compensation from the companies mentioned in the report in the preceding twelve months and do not serve as an officer, director

or employee of the companies mentioned in the report

Terms & conditions and other disclosures:

ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products.

ICICI Securities is Sebi registered stock broker, merchant banker, investment adviser, portfolio manager and Research Analyst. ICICI Securities is registered with Insurance Regulatory Development Authority of India Limited (IRDAI)

as a composite corporate agent and with PFRDA as a Point of Presence. ICICI Securities Limited Research Analyst SEBI Registration Number – INH000000990. ICICI Securities Limited SEBI Registration is INZ000183631 for stock

broker. ICICI Securities is a subsidiary of ICICI Bank which is India’s largest private sector bank and has its various subsidiaries engaged in businesses of housing finance, asset management, life insurance, general insurance, venture

capital fund management, etc. (“associates”), the details in respect of which are available on www.icicibank.com.

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment banking and other business relationship

with a significant percentage of companies covered by our Investment Research Department. ICICI Securities and its analysts, persons reporting to analysts and their relatives are generally prohibited from maintaining a financial

interest in the securities or derivatives of any companies that the analysts cover.

Recommendation in reports based on technical and derivative analysis centre on studying charts of a stock's price movement, outstanding positions, trading volume etc as opposed to focusing on a company's fundamentals and, as

such, may not match with the recommendation in fundamental reports. Investors may visit icicidirect.com to view the Fundamental and Technical Research Reports.

Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein.

ICICI Securities Limited has two independent equity research groups: Institutional Research and Retail Research. This report has been prepared by the Retail Research. The views and opinions expressed in this document may or may

not match or may be contrary with the views, estimates, rating, and target price of the Institutional Research.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and meant solely for the selected

recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities. While we would

endeavour to update the information herein on a reasonable basis, ICICI Securities is under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI

Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in

circumstances where ICICI Securities might be acting in an advisory capacity to this company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein

is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Though disseminated to all the customers

simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting

and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who

must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient.

The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities accepts no liabilities

whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks

associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing or co-

managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction.

ICICI Securities or its associates might have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the companies mentioned in the report in the past

twelve months.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did not receive any compensation or other

benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI Securities nor Research Analysts and their relatives have any material conflict of

interest at the time of publication of this report.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of

the research report.

Since associates of ICICI Securities and ICICI Securities as a entity are engaged in various financial service businesses, they might have financial interests or actual/ beneficial ownership of one percent or more or other material

conflict of interest various companies including the subject company/companies mentioned in this report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report.

We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or

use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in

all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and to observe such restriction.

ICICI Securities | Retail Research 9

You might also like

- 2022 11 30 - StatementDocument7 pages2022 11 30 - StatementGiovanni SlackNo ratings yet

- Security Markets: Bodie, Kane, and Marcus Eleventh EditionDocument40 pagesSecurity Markets: Bodie, Kane, and Marcus Eleventh EditionFederico PortaleNo ratings yet

- Mahindra & Mahindra: (Mahmah)Document10 pagesMahindra & Mahindra: (Mahmah)Ashwet JadhavNo ratings yet

- IDirect Powergrid Q3FY22Document6 pagesIDirect Powergrid Q3FY22Yakshit NangiaNo ratings yet

- Sterlite Technologies: Ambitious Target To Double Revenues in Three Years!Document8 pagesSterlite Technologies: Ambitious Target To Double Revenues in Three Years!Guarachandar ChandNo ratings yet

- Icici DmartDocument6 pagesIcici DmartGOUTAMNo ratings yet

- IDirect Berger Q2FY23Document9 pagesIDirect Berger Q2FY23Rutuparna mohantyNo ratings yet

- IDirect Voltas Q1FY23Document11 pagesIDirect Voltas Q1FY23Rehan SkNo ratings yet

- IDirect SunTV Q2FY22Document7 pagesIDirect SunTV Q2FY22Sarah AliceNo ratings yet

- TATACOMM ICICIDirect 06082021Document8 pagesTATACOMM ICICIDirect 06082021gbNo ratings yet

- Time TechnoplastDocument8 pagesTime Technoplastagrawal.minNo ratings yet

- PVR LTD: (Pvrlim)Document8 pagesPVR LTD: (Pvrlim)Vansh MalhotraNo ratings yet

- Havells Equity ResearchDocument9 pagesHavells Equity ResearchRicha P SinghalNo ratings yet

- Bajaj Electrical: (Bajele)Document9 pagesBajaj Electrical: (Bajele)premNo ratings yet

- IDirect AstralPoly Q1FY23Document9 pagesIDirect AstralPoly Q1FY23Denish GalaNo ratings yet

- IDirect JustDial CoUpdate Jul21Document5 pagesIDirect JustDial CoUpdate Jul21ShivangimahadevNo ratings yet

- Globus SpiritsDocument5 pagesGlobus SpiritsTejesh GoudNo ratings yet

- IDirect Symphony Q2FY22Document8 pagesIDirect Symphony Q2FY22darshanmaldeNo ratings yet

- Pidilite Industries (PIDIND) : High Raw Material Prices Hit MarginDocument10 pagesPidilite Industries (PIDIND) : High Raw Material Prices Hit MarginSiddhant SinghNo ratings yet

- Buy - Vardhman TextilesIDirect - 1.11.2021.Document5 pagesBuy - Vardhman TextilesIDirect - 1.11.2021.Mritunjay BhartiNo ratings yet

- IDirect Titan Q1FY23Document10 pagesIDirect Titan Q1FY23AKHILESH HEBBARNo ratings yet

- ICICI Direct - Astec Lifesciences - Q3FY22Document7 pagesICICI Direct - Astec Lifesciences - Q3FY22Puneet367No ratings yet

- IDirect Pidilite Q1FY22Document8 pagesIDirect Pidilite Q1FY22Ranjith ChackoNo ratings yet

- Brokerage1 May23Document6 pagesBrokerage1 May23anik.harry1017No ratings yet

- IDirect ABFRL Q3FY22Document7 pagesIDirect ABFRL Q3FY22Parag SaxenaNo ratings yet

- MM Forgings: (Mmforg)Document6 pagesMM Forgings: (Mmforg)satyendragupta0078810No ratings yet

- Cyient 28 11 2022 AnandDocument13 pagesCyient 28 11 2022 AnandParth DongaNo ratings yet

- Voltas LTD: Strong Performance of UCP SegmentDocument10 pagesVoltas LTD: Strong Performance of UCP SegmentVipul Braj BhartiaNo ratings yet

- IDirect AmarRaja ConvictionIdea Nov2023Document9 pagesIDirect AmarRaja ConvictionIdea Nov2023rajendra.rathoreNo ratings yet

- IDirect CenturyPly Q3FY22Document9 pagesIDirect CenturyPly Q3FY22Tai TranNo ratings yet

- IDirect TVToday Q2FY23Document7 pagesIDirect TVToday Q2FY23pete meyerNo ratings yet

- Action Construction Equipment: Sturdy Performance..Document6 pagesAction Construction Equipment: Sturdy Performance..Aryan SharmaNo ratings yet

- Irect TataSteel Q2FY23Document8 pagesIrect TataSteel Q2FY23jeff bezozNo ratings yet

- IDirect Gokaldas Q2FY22Document6 pagesIDirect Gokaldas Q2FY22Bharti PuratanNo ratings yet

- HOLD Relaxo Footwears IDirect 16.5.2022Document9 pagesHOLD Relaxo Footwears IDirect 16.5.2022Vaishali AgrawalNo ratings yet

- IDirect PGElectroplast ManagementMeetDocument7 pagesIDirect PGElectroplast ManagementMeetbharat.divineNo ratings yet

- Icici Direct ResearchDocument9 pagesIcici Direct Researchfinanceharsh6No ratings yet

- HDFC Life Insurance: Healthy Growth Outlook On Growth OptimisticDocument7 pagesHDFC Life Insurance: Healthy Growth Outlook On Growth OptimisticJay BhushanNo ratings yet

- Divi's Laboratories: Strong Growth Outlook Backed by ExecutionDocument9 pagesDivi's Laboratories: Strong Growth Outlook Backed by ExecutionRahul AggarwalNo ratings yet

- IDirect UnitedSpirits Q4FY21Document6 pagesIDirect UnitedSpirits Q4FY21Ranjith ChackoNo ratings yet

- CMP: Inr913 TP: Inr1030 (+13%) Buy Beats Expectation With Strong Operating PerformanceDocument10 pagesCMP: Inr913 TP: Inr1030 (+13%) Buy Beats Expectation With Strong Operating Performanceyousufch069No ratings yet

- Entire en SVK Ar22Document160 pagesEntire en SVK Ar22Gerardo MarquezNo ratings yet

- Siemens India: Thematically It Makes Sense But Valuations Don'tDocument9 pagesSiemens India: Thematically It Makes Sense But Valuations Don'tRaghvendra N DhootNo ratings yet

- Variable and Absorption Costing Problems Without SolutionsDocument4 pagesVariable and Absorption Costing Problems Without SolutionsMeca CorpuzNo ratings yet

- IDirect AmaraRaja CoUpdate Feb21Document6 pagesIDirect AmaraRaja CoUpdate Feb21Romelu MartialNo ratings yet

- Stove Kraft Initiating CoverageDocument30 pagesStove Kraft Initiating Coverageprat wNo ratings yet

- IDirect GreavesCotton Q1FY23Document8 pagesIDirect GreavesCotton Q1FY23Ayush GoelNo ratings yet

- Ahluwalia Contracts: Strong Results Superior Fundamentals - Maintain BUYDocument6 pagesAhluwalia Contracts: Strong Results Superior Fundamentals - Maintain BUY14Myra HUNDIANo ratings yet

- Indo Count: (Indcou)Document5 pagesIndo Count: (Indcou)Romelu MartialNo ratings yet

- Ultratech Cement: Cost Optimisation Drive To Scale Up ProfitabilityDocument10 pagesUltratech Cement: Cost Optimisation Drive To Scale Up ProfitabilityRohan AgrawalNo ratings yet

- IDirect Zensar CoUpdate Aug22Document10 pagesIDirect Zensar CoUpdate Aug22aditya goswamiNo ratings yet

- Volvo Report q1 2020 Eng 2020 04 23 05 20 31 2020 04 23 05 20 31Document34 pagesVolvo Report q1 2020 Eng 2020 04 23 05 20 31 2020 04 23 05 20 31Mustafa YilmazNo ratings yet

- Crompton Greaves ConsumerDocument24 pagesCrompton Greaves ConsumerSasidhar ThamilNo ratings yet

- IDirect KECIntl Q2FY21Document8 pagesIDirect KECIntl Q2FY21mayank98108No ratings yet

- IDirect AartiInds Q4FY21Document9 pagesIDirect AartiInds Q4FY21AkchikaNo ratings yet

- EMBRAC.B - RedEyeDocument16 pagesEMBRAC.B - RedEyeJacksonNo ratings yet

- TCI Express IDirect 050822 EBRDocument8 pagesTCI Express IDirect 050822 EBRसुनिवेशक समूहNo ratings yet

- Abb - 1qcy20 - Hsie-202005150621199235065Document10 pagesAbb - 1qcy20 - Hsie-202005150621199235065darshanmaldeNo ratings yet

- AR Equity PDFDocument6 pagesAR Equity PDFnani reddyNo ratings yet

- Hindalco Industries LTD - Q3FY24 Result Update - 14022024 - 14-02-2024 - 14Document9 pagesHindalco Industries LTD - Q3FY24 Result Update - 14022024 - 14-02-2024 - 14Nikhil GadeNo ratings yet

- Hindalco Industries: IndiaDocument8 pagesHindalco Industries: IndiaAshokNo ratings yet

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- Nuvama On Ador WeldingDocument32 pagesNuvama On Ador WeldingDhittbanda GamingNo ratings yet

- Geojit On Power MechDocument5 pagesGeojit On Power MechDhittbanda GamingNo ratings yet

- AnandRathi On Power MechDocument18 pagesAnandRathi On Power MechDhittbanda GamingNo ratings yet

- IIFL - Powermech Projects - Company Update - 20230118-1Document9 pagesIIFL - Powermech Projects - Company Update - 20230118-1Dhittbanda GamingNo ratings yet

- Preqin Insight Alternative Assets in Australia and New Zealand September 2017 PDFDocument78 pagesPreqin Insight Alternative Assets in Australia and New Zealand September 2017 PDFPaulo MottaNo ratings yet

- Major ProjectDocument80 pagesMajor ProjectAllan RajuNo ratings yet

- Quiz 5Document4 pagesQuiz 5gautam_hariharanNo ratings yet

- Syndicate 5 - Krakatau Steel ADocument19 pagesSyndicate 5 - Krakatau Steel AEdlyn Valmai Devina SNo ratings yet

- Audited Financial Result 2019 2020Document22 pagesAudited Financial Result 2019 2020Avrajit SarkarNo ratings yet

- Chapter 9Document3 pagesChapter 9Jao FloresNo ratings yet

- FINAL Q1 22 Shareholder Letter (Netflix)Document12 pagesFINAL Q1 22 Shareholder Letter (Netflix)Melissa EckNo ratings yet

- Partnership LiquidationDocument10 pagesPartnership LiquidationchristineNo ratings yet

- Bond and Equity Trading Strategies UZ Assignment 2Document15 pagesBond and Equity Trading Strategies UZ Assignment 2Milton ChinhoroNo ratings yet

- Pi 13 Lampiran Peta Okupasi Bidang Logistik Dan Supply ChainDocument81 pagesPi 13 Lampiran Peta Okupasi Bidang Logistik Dan Supply ChainZeo BentNo ratings yet

- Cash Budget Analysis and Pro Forma FSDocument5 pagesCash Budget Analysis and Pro Forma FSMarijobel L. SanggalangNo ratings yet

- Rashmi Class Rough WorkDocument10 pagesRashmi Class Rough WorkTejas Suhas MuleyNo ratings yet

- Weak Balance Sheet Drags Profitability: Q3FY18 Result HighlightsDocument8 pagesWeak Balance Sheet Drags Profitability: Q3FY18 Result Highlightsrishab agarwalNo ratings yet

- Change in Profit Sharing Ratio Among The Existing Partners Class 12 Accountancy MCQs PDFDocument7 pagesChange in Profit Sharing Ratio Among The Existing Partners Class 12 Accountancy MCQs PDFAryan RawatNo ratings yet

- Financial Management BY Prasanna Chandra Financial Management BY Khan and Jain Financial Management BY I.M.PandeyDocument151 pagesFinancial Management BY Prasanna Chandra Financial Management BY Khan and Jain Financial Management BY I.M.PandeyAksh KhandelwalNo ratings yet

- FA IV Rewritten070306Document549 pagesFA IV Rewritten070306Collins Abere100% (1)

- Financing Entrepreneurial VentureDocument34 pagesFinancing Entrepreneurial VentureAmos SylvesterNo ratings yet

- Bav TheoryDocument8 pagesBav TheoryPratik KhetanNo ratings yet

- Accounting Icom Part 2Document2 pagesAccounting Icom Part 2Ayman ChishtyNo ratings yet

- Manual 16 Jun 2021 - Part 1Document6 pagesManual 16 Jun 2021 - Part 1Feni AlvitaNo ratings yet

- Q1 REPORT - 2020: Aega ASADocument13 pagesQ1 REPORT - 2020: Aega ASArohitmahaliNo ratings yet

- Aud ProbDocument9 pagesAud ProbKulet AkoNo ratings yet

- DSEX Market PriceDocument93 pagesDSEX Market PriceMd. Hasibul HuqNo ratings yet

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysiszunaedNo ratings yet

- Priority PackDocument1 pagePriority PackYogesh BantanurNo ratings yet

- Esg Scores Fact SheetDocument2 pagesEsg Scores Fact SheetfalakiltafNo ratings yet

- Dwnload Full Cornerstones of Financial Accounting Canadian 1st Edition Rich Solutions Manual PDFDocument36 pagesDwnload Full Cornerstones of Financial Accounting Canadian 1st Edition Rich Solutions Manual PDFjayden77evans100% (18)

- Quiz BFDocument3 pagesQuiz BFlope pecayo0% (1)