Professional Documents

Culture Documents

Mahindra and Mahindra LTD: Time To Get On Board

Mahindra and Mahindra LTD: Time To Get On Board

Uploaded by

Vanshika BiyaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mahindra and Mahindra LTD: Time To Get On Board

Mahindra and Mahindra LTD: Time To Get On Board

Uploaded by

Vanshika BiyaniCopyright:

Available Formats

Mahindra and Mahindra Ltd Time to get on board…

With 3 healthy back-to-back cropping seasons and good monsoon, which has Vishal Srivastav

Research Analyst

resulted in strong rural sentiment, we reiterate our stance that the tractor Vishal.srivastav@edelweissfin.com

upcycle may last for a couple of years. Being the market leader in the tractor

segment, Mahindra & Mahindra (M&M) the key beneficiary of this surge. The

re-rating catalyst will be new management’s ability towards achieving key

milestones it has laid down viz. 1) Gradual improvement in the financial health

from FY22; and 2) Boost cash flow and Return on Equity (RoE). Hence stock is a CMP: INR 614

Tactical BUY with a target price of INR 758 per share, based on SoTP valuation. Rating: Tactical BUY

FES business to benefit from a revival in rural India Target price: INR 758

Our report, titled: ‘Automobile Industry - Coronavirus deals a decade blow’, lays Upside: 23%

our case of the rural economy leading the economic revival. We continued to

maintain our positive stance on the tractor industry is poised for multi-year

upcycle (refer our report on Escorts dated July 6, titled: ‘Escorts – Journey from

turnaround to excellence’). Back-to-back bountiful harvest seasons, increased

government procurement, healthy monsoon are the key drivers. With over 45%

market share, M&M is best placed to reap benefits of this surge.

Bloomberg: MM:IN

Automotive business to gradually recover from H2FY21

The light commercial vehicle (LCV) segment will drive growth for the automotive 52-week range (INR): 245/667

business in the short term. Being market leader, M&M will significantly benefit Share in issue (crore): 119

from the gradual revival in LCV demand. Course correction by the management in

M-cap (INR crore): 74,853

the utility vehicle (UV) segment off late and renewed focus towards strengthening

its strong hold in the conventional mid-size SUV segment through new launches Promoter holding (%) 19.58

may help it arrest the sharp market share loss.

Focus on improving RoE across businesses – A key re-rating driver

The new management’s focus on improving cash flows and RoE across all

businesses and subsidiaries is encouraging. Willingness to exit business that do

not fall in its strategic growth path or those unable to achieve 18% RoE is a clear

change of stance. Turning around loss-making subsidiaries and scaling up its

market share in the UV business will result in a significant valuation re-rating.

Outlook and valuation

We see a valuation re-rating catalyst will be new management’s ability towards

achieving key milestones viz. 1) healthy revival in the standalone operations driven

by FES business; 2) focus on gradually improving the financial health of

subsidiaries from FY22; and 3) emphasis on improving cash flow and RoE across

all businesses. The stock is a Tactical BUY with a target price of INR 758 per share.

Year to March FY18 FY19 FY20 FY21E FY22E

Revenue (INR crore) 47,577 52,848 44,865 40,773 47,332

Revenue growth (%) 13.5 11.0 -15.0 -9.0 16.0

EBITDA (INR crore) 7,043 7,530 6,350 5,178 6,484

Adjusted PAT (INR crore) 4,320 5,418 3,889 3,025 4,031

P/E (x) 16.4 13.1 18.2 23.4 17.6 25.8 40.9

Price-to-book value (x) 2.3 2.0 2.0 1.9 1.7

EV-to-EBITDA (x) 9.7 9.0 10.9 13.0 10.0

RoACE (%) 19.9 20.0 14.6 10.6 13.1

Date: 6th November, 2020

RoAE (%) 15.1 16.5 11.1 8.4 10.3

Edelweiss Professional Investor Research 1

Mahindra and Mahindra

Investment hypothesis

I. Rural India – The bright spot and key to economic growth

In our April 28 research note, titled: ‘Automobile Industry - Coronavirus deals a decade blow’, we

presented our case of the rural economy leading the economic revival. Back-to-back bountiful harvest

seasons, increased government procurement, healthy water storage levels and expectations of a

normal monsoon were the key drivers buttressing our expectation.

Six months from the release of our report, we see strong rural demand momentum. Despite increasing

COVID-19, infections off late, sentiment remains buoyant, influenced by high income visibility,

because of record kharif sowing this season and plentiful monsoon. Strong revival in tractor sales, 40%

YoY growth since June, after easing in lockdown restrictions is evidence of healthy rural sentiment.

We continue to maintain our positive stance on the tractor industry. In our initiation coverage on

Escorts Ltd on July 6, titled: ‘Escorts – Journey from turnaround to excellence’, we estimated tractor

demand to clock 2-4% growth and industry is poised for a next upcycle that would be for couple of

years. We continue to maintain our view on the tractor cycle, however our channel checks indicates

buoyancy in rural sentiments may push domestic tractor sales growth towards double digit levels for

FY21.

Exhibit 1: Tractor industry to clock double digit growth in FY21 significantly surpassing our earlier expectation

20%

42% 18%

12%

12% 12%

23% 25% 7%

13% 7%

12% 5%

4% 6%

-6%

-10% -12%

-14% -14%

FY20 FY21E FY22E FY23E

-5%

Q4FY20

Q1FY20

Q2FY20

Q3FY20

Q1FY21

Q2FY21E

Q3FY21E

Q4FY21E

-10%

Pessimistic Optimistic Realistic Pessimistic Optimistic Realistic

Source: TMA, Industry and Edelweiss Professional Investor Research

M&M: FES business will continue to provide strong support during challenging times

Business-wise With over 45% market share in the tractor industry, Mahindra & Mahindra (M&M) will be one on the

share in revenue major beneficiaries of the surge in tractor demand. Its farm equipment business (FES) contributes

and profits around one-third of standalone topline and over two-third to Profit Before Interest and Tax (PBIT).

34%

69%

Exhibit 2: FES contributes one-third to topline and more than two-third to profits

71% 69%

62%

30% 59% 61%

52% 49%

Revenue PBIT share

share

34% 31% 32% 34%

31% 31%

Automotive FES Others

FY15 FY16 FY17 FY18 FY19 FY20

Topline share PBT share

Source: Company reports and Edelweiss Professional Investor Research

Edelweiss Professional Investor Research 2

Mahindra and Mahindra

Investment hypothesis

Despite increase in competition intensity in the last 6-7 years, the management has been able to

maintain its market share of ~40-42% on the back of frequent model launches. The company plans to

launch a new light weight tractor platform ‘K2’ in collaboration with Mitsubishi, which will help it

strengthen its domestic market share going forward and also scale up exports.

Exhibit 3: FES business to reap significant benefits from the surge in tractor demand

22,000 16% 20%

15%

20,000 11% 15%

18,000 10%

5%

16,000 5%

19,753

17,104

16,562

14,000 0%

15,762

15,402

12,000 -5%

-7%

10,000 -10%

FY18 FY19 FY20 FY21E FY22E

FES revenues (INR cr) Growth (RHS)

Source: Edelweiss Professional Investor Research

UV segment: Last decade’s concerns still persist

Dropping market share in the utility-vehicle (UV) segment has been a key concern for M&M’s

automotive business. Although it has been at the forefront of new launches and has introduced

models in high growing lower engine capacity UV market, it has not been able to rein in the market

share slide. The company has been unable to lure customers as newer entrants like Maruti Suzuki,

Hyundai Motor Co. and Kia Motors Corp. continued to eat into its market share.

Exhibit 4: M&M’s market share dropped by over 50% in the last decade…

11% 10% 13% 15% 15%

20% 18% 19%

13% 27% 31%

13% 8% 2% 8% 6%

3% 6%

12% 7%

17% 5% 12% 11% 11%

21% 19% 4%

14% 11% 13% 12% 13%

15% 28%

48% 29% 25% 25%

42% 38% 19%

54% 56% 37%

26% 28% 28% 25%

14% 12% 12% 16%

2% 2%

FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20

Maruti Suzuki M&M Hyundai+Kia Toyota Kirloskar Tata Motors Others

Source: Edelweiss Professional Investor Research

Edelweiss Professional Investor Research 3

Mahindra and Mahindra

Investment hypothesis

Exhibit 5: … as it couldn’t make significant inroads in the rapidly growing small SUV market despite

a slew of model launches

Segment FY11 FY12 FY15 FY16 FY17 FY18 FY19 FY20

Large SUV Scorpio

Large SUV Bolero

Large SUV Xylo

Small SUV Quanto

Large SUV XUV500

Small SUV KUV100

Small SUV NovoSport

Small SUV TUV300

Large SUV Thar

Large SUV Alturas

Large SUV Marazzo

Small SUV XUV300

Source: Edelweiss Professional Investor Research

Exhibit 6: Market share loss in smaller SUVs was even Exhibit 7: …as the sub-segment saw significant growth in

sharper… overall UV market in the last decade

77%

22%

74%

29%

29%

33%

37%

42%

45%

51%

66%

68%

45%

78%

36%

71%

71%

67%

32%

63%

30%

58%

55%

49%

25%

21%

34%

32%

17%

14%

FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20

FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 Large SUV % in overall UV market Small SUV % in overall UV market

Source: SIAM and Edelweiss Professional Investor Research

FY21 will continue to remain a challenging year for M&M…

A stronger revival in this segment is encouraging for M&M’s UV business. However, a sharp increase

in competition from other leading players like Maruti and Hyundai through their new launches of

Vitara Brezza, S-Cross, Creta, and Venue, coupled with successful launches of Seltos and Sonet from

new entrant Kia, will only make the job tougher for M&M.

Although M&M has the XUV300, which is a popular model, the company dearly requires the success

of recently launched Thar (upgrade), near term expected launches of W601 (i.e. Scorpio upgrade) and

Bolero (upgrade) to turn the tide in its favour.

Edelweiss Professional Investor Research 4

Mahindra and Mahindra

Investment hypothesis

Exhibit 8: Recovery in the UV segment has been faster… Exhibit 9: …with growth continuing to outpace that of the

overall PV industry

25%

12% 15%

28% 9% 18% 15%

7% 5%

12% -5% 10%

-5% -3%

-15%

5%

2%

-10% -7%

-72%

-11%

Q1FY20

Q2FY20

Q3FY20

Q4FY20

Q1FY21

Q2FY21

Q3FY21E

Q4FY21E

-17%

FY20 FY21E FY22E FY23E

Pessimistic Optimistic Realistic

Pessimistic Optimistic Realistic

Source: SIAM and Edelweiss Professional Investor Research

…however, focus on its conventional segment may help arrest near term market share loss

R&D as a % to The management’s focus on strengthening its position in the mid-sports utility vehicle (SUV), i.e.

revenue

6.6%

conventional sub-segment, with the launch of Thar (upgrade); expected launch of new models -- W601

5.0% 5.0%

or Scorpio upgrade (through the M&M and Ford joint-venture) and Z101 in Q1 and Q3FY22,

4.4% respectively; and the launch of the Bolero upgrade over the next 3-4 quarters.

3.8%

4.2% Renewed focus on its stronghold mid-SUV sub-segment is the right strategy because of its strong

acceptance among its conventional SUV customer segment.

FY15

FY16

FY17

FY18

FY19

FY20

Exhibit 10: New launch pipeline comprises more large SUVs indicating a change in management’s

stance

Segment FY21E FY22E FY23E

Large SUV Thar upgrade

Large SUV W601

Large SUV Z101

Large SUV Bolero upgrade

Small SUV S 204

Source: Edelweiss Professional Investor Research

Ford JV can help the UV business to scale up to the next level l

Acquisition of 51% stake in the JV with Ford, may help M&M scale up the business to the next level,

which the management has always strived off. In addition to gaining use of Ford’s 4.4 lakh unit

manufacturing capacity in India, which will help it reap the benefits of economies of scale, M&M will

also get access to any future model technology by Ford.

The benefits from this JV will start accruing from next year, with the launch of model W601. In FY23,

a new model (S 204) will be launched by this JV in the compact SUV space. There are also plans of

developing a new electric vehicle (EV) platform under this JV.

Edelweiss Professional Investor Research 5

Mahindra and Mahindra

Investment hypothesis

M&M also plans to use this facility as a manufacturing base for exporting vehicles to Ford’s overseas

markets. The company will initially invest INR 650 crore in this entity, which will be gradually raised to

INR 1,400 crore.

LCV demand to drive overall CV revival in FY21

Exhibit 11: Revival influenced by pick-up in consumption Exhibit 12: LCVs to witness healthy growth momentum in the

levels short to medium term

35%

20% 40% 35%

25%

10%

-2% 5%

25% 22%

-6% -6% -8%

-25% 12%

-43% -12%

-5%

-21% -21%

-78%

-30%

Q4FY20

Q1FY20

Q2FY20

Q3FY20

Q1FY21

Q2FY21

Q3FY21E

Q4FY21E

FY21E

FY22E

FY23E

FY20

Pessimistic Optimistic Realistic Pessimistic Optimistic Realistic

Source: SIAM, Edelweiss Professional Investor Research

Edelweiss Professional Investor Research 6

Mahindra and Mahindra

Investment hypothesis

Mahindra and M&M’s strong hold over the LCV segment may see it benefit from a pick-up in demand

Mahindra Ltd Frequent model launches, based on different applications, have led M&M to surpass Tata Motors as

market leader in FY20. We expect demand for light commercial vehicles (LCVs) to recover much faster

as compared to other segments in the commercial vehicle (CV) industry, with increased traction from

the rapidly growing e-commerce sector.

The recent pick-up seen in LCV sales in the last few months indicates encouraging signs of a swift

recovery in demand.

Exhibit 13: Growth in LCV sales for M&M

13% 9% 10% 11% 12% 12% 10% 8% 8%

15%

7% 2% 4% 4%

2% 6% 7% 7% 8% 8% 9% 9%

48% 43% 38% 38% 40% 41% 39%

56% 58% 57%

39% 42% 42% 40% 38% 39%

35%

29% 28% 27%

FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20

M&M Tata Motors Ashok Leyland Maruti Others

Source: Edelweiss Professional Investor Research

Although competition has intensified with recent launches by all major competitors (like Bada Dost

from Ashok Leyland and Intra V20 from Tata Motors), M&M’s strong offerings will help it keep pace

with competition and maintain its stronghold over this segment.

Exhibit 14: A pick-up in sales will lead to revival in the automotive business from FY22

40,000 50%

37%

35,000

30%

30,000 10%

0% 10%

25,000

35,328

32,081

-20% -10%

28,069

20,000 -28%

28,409

-30%

20,527

15,000

10,000 -50%

FY18 FY19 FY20 FY21E FY22E

Automotive revenues (INR crore) Growth (RHS)

Source: Edelweiss Professional Investor Research

Edelweiss Professional Investor Research 7

Mahindra and Mahindra

Investment hypothesis

Mahindra and Management’s focus on reducing subsidiary losses and rise in RoE will boost investor confidence

Mahindra Ltd The board’s recent decision to reject the INR 3,000 crore restructuring plan for SsangYong Motor

Company in April and the new management’s willingness to cede majority or even its entire stake in

the latter indicates a clear change in its approach. The 3 key focus areas laid down to categorise all

subsidiaries are detailed below:

a. Subsidiaries should have clear path towards 18% Return on Equity (RoE)

b. Unclear path to profitability but with strategic benefits like Sampo Rosenlew – M&M will continue

to invest

c. Unclear path to profitability with no strategic benefits – M&M will exit

This shift in focus towards improving RoE to 18% in the medium term by scaling up profitability across

businesses and laying parameters for evaluating all potential investments will be key towards

improving investor confidence and result in a re-rating in valuations.

Exhibit 15: Tough market scenario and heavy subsidiary losses significantly deteriorated M&M’s

RoE profile

18%

15% 15% 15% 15%

6%

4%

3% 3% 3% 3%

-1%

FY15 FY16 FY17 FY18 FY19 FY20

Standalone RoE Consol RoE

Source: Edelweiss Professional Investor Research

Edelweiss Professional Investor Research 8

Mahindra and Mahindra

Investment hypothesis

Exhibit 16: Subsidiaries like SsangYong Motor Company, Mahindra USA, Mahindra Aerospace and Mahindra Tractor Assembly

has been a consistent drag on M&M’s performance

Investments (INR cr) Sector % Holdings FY19 FY20

Listed subsidiaries, JVs, associated companies

Ssangyong Motor Co. Automotive 72% (283) (2,268)

Mahindra Lifespace Dev. Real Estate 52% 30 (116)

Mahindra Holidays & Resorts India Leisure 67% 43 (73)

EPC Industrie Limited Agriculture 55% 6 13

Swaraj Engines Limited Agriculture 33% 28 25

Mahindra CIE Automotive Agriculture 17% 66 41

Mahindra Logistics Limited Logistics 59% 80 56

M&M Financial Services NBFC 51% 801 466

Tech Mahindra Limited IT services 26% 1,245 1,165

Gems recognised by the management

Mahindra Electric Automotive 100% (53) (55)

Mahindra First Choice Automotive 100% (50) (38)

Mahindra Agri Solutions Agriculture 99% (63) (19)

Meru Mobility 86% - (18)

Classic Legends Automotive 60% (11) (4)

Bristlecone IT services 75% 31 26

Mahindra Susten Pvt Ltd Renewable 100% 63 42

Mahindra Rural Housing Finance NBFC 51% 128 76

Loss making unlisted subsidiaries

Mahindra USA Inc Agriculture 100% (549) (507)

Mahindra Aerospace Aerospace 90% (161) (287)

Mahindra Vehicle sales Automotive 100% (127) (248)

Peugot Motorcycles SAS Automotive 100% (282) (256)

Mahindra Aerospace Aus Aerospace 90% (81) (241)

Mahindra Tractor Assembly (incl. Genze) Automotive 100% (243) (222)

Automobili Pininfarina Automotive 100% (101) (130)

Source: Company reports and Edelweiss Professional Investor Research

Revival in the demand environment for its standalone operations and management’s focus on

turning around its loss-making businesses…

With a revival in demand across key businesses, we expect a gradual YoY increase in topline from

H2FY21 and a significant surge in FY22. Benefits of economies of scale and focus of the new

management on reducing cost and increasing profitability across businesses will lead to substantial

improvement in the profitability of standalone operations in the short to medium term.

Few key loss-making subsidiaries, which will cease to exist in FY21, are: 1) Mahindra Tractor Assembly,

which reported a loss of INR 222 crore in FY20; and 2) Mahindra Aerospace Australia, which incurred

a loss of ~INR 240 crore in FY20.

Few loss-making subsidiaries which we believe are next in line are: 1) SsangYong Motor, which

reported a loss of INR 2,268 crore in FY20; 2) Peugeot Motocycles, which posted a loss of INR 256

crore; and 3) Mahindra Aerospace, which incurred a loss of INR 287 crore. These loss-making

subsidiaries contribute over 85% of overall subsidiary losses.

FY21 will be challenging for subsidiaries with weak financial health. The management’s focused

approach towards turning around subsidiary operations and sale of significant loss-making

subsidiaries will start adding meaningful benefits to the bottomline as well as cash flow from FY22

onwards.

Edelweiss Professional Investor Research 9

Mahindra and Mahindra

Investment hypothesis

…will result in a valuation re-rating from current levels l

We believe parameters like; 1) A healthy revival is expected in the standalone operations of major

businesses from H2FY21; 2) Renewed focus of the management on gradually improving the financial

health of subsidiaries from FY22; and 3) Emphasis on improving cash flow and achieving 18% RoE

across all businesses and investments, will lead to a valuation re-rating from current levels. Hence we

initiate Tactical BUY on M&M with a target price of INR 758 per share.

Exhibit 17: SoTP valuation methodology

M&M % in M Value per share

Listed subsidiaries M Cap (INR cr) % Holding CMP (INR)

Cap (INR cr) (INR)

Mahindra Lifespace Dev. 1,196 51.1% 611 267 5

Mahindra Holidays & Resorts India 2,298 67.5% 1,551 175 13

Swaraj Engines Limited 1,709 33.2% 567 1413 5

Mahindra CIE Automotive 5,218 17.3% 903 143 8

Mahindra Logistics Limited 2,508 58.8% 1,475 379 12

M&M Financial Services 16,006 51.2% 8,195 130 69

Tech Mahindra Limited 79,501 26.7% 21,227 839 178

Total value 289

Investment valued at 50% discount (A) 203

EPS FY22E 35

Estimated FES EPS FY22 23

Estimated Automotive EPS FY22 11

Target P/E

FES business 18

Automotive business 12

Core business value (B) 555

Target Price (A+B) 758

Source: Company reports and Edelweiss Professional Investor Research

Edelweiss Professional Investor Research 10

Mahindra and Mahindra

Investment hypothesis

Exhibit 18: Core P/E valuation

30

26

22

19

17 20

17

FY15 FY16 FY17 FY18 FY19 FY20

P/E 2 year froward Average P/E for last 10 years

Source: Edelweiss Professional Investor Research

Exhibit 19: Key assumptions for our estimates

Key assumptions of our estimates FY19 FY20 FY21E FY22E

Domestic Tractor industry growth 11% (11%) 12% 12%

Domestic UV industry growth 2% (2%) (11%) 18%

Domestic LCV industry growth 17% (21%) (21%) 25%

Domestic MHCV industry growth 13% (42%) (30%) 31%

Growth in M&M FES business 5% (7%) 14% 15%

Growth in M&M Automotive business 10% (20%) (21%) 34%

Capex (INR cr) 3,640 2,148 1,500 3,000

Source: Edelweiss Professional Investor Research

New management team

The new management team led by Dr Anish Shah, who currently is Deputy Managing Director and

Group Chief Financial Officer (CFO), will be taking over as MD and CEO from Dr Pawan Goenka from

April 1, 2021. Before joining M&M, Shah was President and CEO at GE Capital India, where he led the

turnaround of the SBI Card venture.

Rajesh Jejurikar has been appointed as Whole-time Director and Executive Director of the FES business

from April 1. He was part of the development team of Scorpio and has headed businesses like FES and

Mahindra Two Wheeler in his earlier assignments with M&M.

Edelweiss Professional Investor Research 11

Mahindra and Mahindra

Financials

INR Cr

Income statement FY18 FY19 FY20 FY21E FY22E

Income from operations 47,577 52,848 44,865 40,773 47,332

Materials costs 31,628 35,997 29,866 27,237 31,239

Manufacturing expenses 5,742 6,037 5,424 5,096 6,058

Employee costs 3,162 3,283 3,223 3,261 3,549

Total operating expenses excluding depreciation and amortisation 40,533 45,318 38,514 35,595 40,848

EBITDA 7,043 7,530 6,350 5,178 6,484

Depreciation & Amortization 1,625 2,003 2,363 2,243 2,337

EBIT 5,418 5,527 3,987 2,934 4,147

Interest expenses 188 146 124 150 180

Other income 951.71 1,630.26 1,539.13 1,223.21 1,372.65

Profit before tax 6,181 7,010 5,402 4,007 5,340

Provision for tax 1,991 1,586 1,851 981 1,308

Exceptionals (before PBT) 433 -22 -2,811 0 0

Reported PAT 4,623 5,401 739 3,025 4,031

Less: Exceptional Items (Net of Tax) 303 -17 -802 0 0

Adjusted PAT 4,320 5,418 3,889 3,025 4,031

Basic shares outstanding (mn) 113 113 113 113 113

Adjusted basic EPS (INR) 37.9 47.5 34.1 26.5 35.3

Diluted equity shares (mn) 113 113 113 113 113

Adjusted diluted EPS (INR) 37.9 47.5 34.1 26.5 35.3

CEPS (INR) 52.1 65.1 54.8 46.2 55.8

Dividend per share (INR) 7.8 8.8 7.4 6.6 8.1

Dividend payout (%) 22.7 21.9 136.7 29.8 27.3

Common size metrics FY18 FY19 FY20 FY21E FY22E

Materials costs 66.4 68.1 66.5 66.8 66

Employee expenses 6.6 6.2 7.1 8 7.5

S G & A expenses 12 11.4 12 12.5 12.8

Operating expenses 85.1 85.7 85.8 87.3 86.3

Depreciation 3.4 3.7 5.2 5.5 4.9

Interest expenditure 0.3 0.2 0.2 0.3 0.3

EBITDA margins 14.8 14.2 14.1 12.7 13.7

Net profit margins 9 10.2 8.6 7.4 8.5

Growth ratios (%) FY18 FY19 FY20 FY21E FY22E

Revenues Growth 13.5 11 -15 -9 16

EBITDA Growth 24.5 6.9 -16 -18 25.2

PBT Growth 19.8 13.4 -23 -26 33.2

Net profit Growth 15.4 25.4 -28 -22 33.2

EPS Growth -40 25.4 -28 -22 33.2

Edelweiss Professional Investor Research 12

Mahindra and Mahindra

Financials

Balance sheet (INR Cr) FY18 FY19 FY20 FY21E FY22E

Equity capital 594 595 596 596 596

Reserves & surplus 29,892 34,397 34,032 36,505 39,955

Shareholders funds 30,487 34,993 34,629 37,101 40,552

Long term debt 2,545 2,231 2,039 2,039 2,039

Short term debt 668 448 1,113 1,113 1,113

Borrowings 3,214 2,680 3,153 3,153 3,153

Deferred Tax liability 455 789 1,506 1,506 1,506

Sources of funds 34,157 38,463 39,288 41,761 45,212

Gross block 19,648 23,829 23,496 25,496 27,496

Net block 9,682 11,853 10,394 10,098 9,622

Capital work in progress 3,324 2,643 6,514 6,067 7,206

Total fixed assets 13,006 14,496 16,909 16,165 16,828

Non current investments 15,462 17,383 15,343 16,843 17,643

Cash and equivalents 5,360 5,534 4,513 6,443 9,122

Inventories 3,327 4,763 4,040 4,000 4,644

Sundry debtors 3,098 3,811 2,901 3,050 3,541

Loans and advances 1,018 861 651 597 615

Other current assets 8,055 8,065 7,458 7,478 7,497

Total current assets (ex cash) 15,499 17,501 15,052 15,126 16,298

Trade payable 9,373 10,360 7,200 7,596 8,818

Others current liabilities 5,798 6,092 5,328 5,221 5,862

Total current liabilities & provisions 15,172 16,453 12,529 12,817 14,680

Net current assets (ex cash) 327 1,048 2,523 2,309 1,617

Uses of funds 34,157 38,463 39,288 41,761 45,212

Book value per share (INR) 267.4 307 303.8 325.5 355.7

Free cash flow FY18 FY19 FY20 FY21E FY22E

Net profit 4,623 5,401 739 3,025 4,031

Depreciation 1,625 2,003 2,363 2,243 2,337

Interest (Net of Tax) 131 113 35 113 135

Others -895 -1,404 2,282 -1,186 -1,328

Less: Changes in WC -1,320 721 1,474 -213 -691

Operating cash flow 6,805 5,391 3,945 4,410 5,867

Less: Capex 3,287 3,492 4,775 1,500 3,000

Free Cash Flow 3,518 1,899 -829 2,910 2,867

Edelweiss Professional Investor Research 13

Mahindra and Mahindra

Financials

Profitability and efficiency ratios FY18 FY19 FY20 FY21E FY22E

ROAE (%) 15.1 16.5 11.1 8.4 10.3

ROACE (%) 19.9 20.0 14.6 10.6 13.1

Inventory day 31.0 35.0 45.0 45.0 42.0

Debtors days 22.0 23.0 27.0 26.0 25.0

Payable days 99.0 100.0 107.0 99.0 95.0

Cash conversion cycle (days) -44.0 -41.0 -34.0 -27.0 -28.0

Current ratio 1.3 1.4 1.5 1.6 1.7

Gross Debt/EBITDA 0.4 0.3 0.4 0.6 0.4

Gross Debt/Equity 0.1 0.0 0.0 0.0 0.0

Adjusted debt/equity 0.1 0.0 0.0 0.0 0.0

Net Debt/Equity 0.0 0.0 0.0 0.0 0.0

Interest coverage 28.7 37.6 32.0 19.5 23.0

Operating ratios FY18 FY19 FY20 FY21E FY22E

Total asset turnover 1.4 1.4 1.1 1 1

Fixed asset turnover 5.0 4.9 4.0 3.9 4.8

Equity turnover 1.6 1.6 1.2 1.1 1.2

Du pont analysis FY18 FY19 FY20 FY21E FY22E

NP Margin % 9.0 10.2 8.6 7.4 8.5

Total Assets Turnover 1.4 1.4 1.1 1.0 1.0

Leverage multiplier 1.1 1.1 1.1 1.1 1.1

ROAE % 15.1 16.5 11.1 8.4 10.3

Valuation parameters FY18 FY19 FY20 FY21E FY22E

EPS (INR) diluted 37.9 47.5 34.1 26.5 35.3

Y-o-Y growth (%) -40.0 25.4 -28.0 -22.0 33.2

Cash EPS 52.1 65.1 54.8 46.2 55.8

Diluted PE (x) 16.4 13.1 18.2 23.4 17.6

Price/BV (x) 2.3 2.0 2.0 1.9 1.7

EV/Sales (x) 1.4 1.2 1.5 1.6 1.3

EV/EBITDA (x) 9.7 9.0 10.9 13.0 10.0

Edelweiss Professional Investor Research 14

Edelweiss Broking Limited, 1st Floor, Tower 3, Wing B, Kohinoor City Mall, Kohinoor City, Kirol Road, Kurla(W)

Board: (91-22) 4272 2200

Vinay Khattar

VINAY

Digitally signed by VINAY KHATTAR

DN: c=IN, o=Personal, postalCode=400072,

st=MAHARASHTRA,

Head Research serialNumber=cd5737057831c416d2a5f7064

vinay.khattar@edelweissfin.com KHATTAR cb693183887e7ff342c50bd877e00c00e2e82

a1, cn=VINAY KHATTAR

Date: 2020.11.06 17:11:38 +05'30'

Rating Expected to

BUY appreciate more than 15% over a 12-month period

HOLD appreciate between 5-15% over a 12-month period

REDUCE return below 5% over a 12-month period

180

160

140

120

Indexed

100

80

60

40

20

0

Jan-15

Mar-15

May-15

Jan-16

Mar-16

May-16

Jan-17

Mar-17

May-17

Jan-18

Mar-18

May-18

Jan-19

Mar-19

May-19

Jan-20

Mar-20

May-20

Feb-15

Sep-15

Feb-16

Sep-16

Feb-17

Sep-17

Feb-18

Sep-18

Feb-19

Sep-19

Feb-20

Sep-20

Apr-15

Jul-15

Nov-15

Dec-15

Apr-16

Jul-16

Nov-16

Dec-16

Apr-17

Jul-17

Nov-17

Dec-17

Jul-18

Apr-18

Nov-18

Dec-18

Apr-19

Jul-19

Nov-19

Dec-19

Apr-20

Jul-20

Nov-20

Jun-15

Aug-15

Oct-15

Jun-16

Aug-16

Oct-16

Jun-17

Aug-17

Oct-17

Jun-18

Aug-18

Oct-18

Jun-19

Aug-19

Oct-19

Jun-20

Aug-20

Oct-20

M&M Sensex

Edelweiss Professional Investor Research 15

Disclaimer

Edelweiss Broking Limited (“EBL” or “Research Entity”) is regulated by the Securities and Exchange Board of India (“SEBI”) and is licensed to carry on the business of broking, depository

services and related activities. The business of EBL and its Associates (list available on www.edelweissfin.com) are organized around five broad business groups – Credit including Housing

and SME Finance, Commodities, Financial Markets, Asset Management and Life Insurance.

Broking services offered by Edelweiss Broking Limited under SEBI Registration No.: INZ000005231; Name of the Compliance Officer: Mr. Brijmohan Bohra, Email ID:

complianceofficer.ebl@edelweissfin.com Corporate Office: Edelweiss House, Off CST Road, Kalina, Mumbai - 400098; Tel. 18001023335/022-42722200/022-40094279

This Report has been prepared by Edelweiss Broking Limited in the capacity of a Research Analyst having SEBI Registration No.INH000000172 and distributed as per SEBI (Research

Analysts) Regulations 2014. This report does not constitute an offer or solicitation for the purchase or sale of any financia l instrument or as an official confirmation of any transaction.

The information contained herein is from publicly available data or other sources believed to be reliable. This report is pro vided for assistance only and is not intended to be and must

not alone be taken as the basis for an investment decision. The user assumes the entire risk of any use made of this information. Each recipient of this report should make such

investigation as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks

involved), and should consult his own advisors to determine the merits and risks of such investment. The investment discussed or views expressed may not be suitable for all investors.

This information is strictly confidential and is being furnished to you solely for your information. This information should not be reproduced or redistributed or passed on directly or

indirectly in any form to any other person or published, copied, in whole or in part, for any purpose. This report is not directed or intended for distribution to, or use by, any person or

entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribut ion, publication, availability or use would be contrary to law,

regulation or which would subject EBL and associates / group companies to any registration or licensing requirements within s uch jurisdiction. The distribution of this report in certain

jurisdictions may be restricted by law, and persons in whose possession this report comes, should observe, any such restrictions. The information given in this report is as of the date of

this report and there can be no assurance that future results or events will be consistent with this information. This information is subject to change without any prior notice. EBL reserves

the right to make modifications and alterations to this statement as may be required from time to time. EBL or any of its associates / group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. EBL is committed to providing independent and transparent

recommendation to its clients. Neither EBL nor any of its associates, group companies, directors, employees, agents or representatives shall be liable for any damages whether direct,

indirect, special or consequential including loss of revenue or lost profits that may arise from or in connection with the use of the information. Our proprietary trading and investment

businesses may make investment decisions that are inconsistent with the recommendations expressed herein. Past performance is not necessarily a guide to future performance .The

disclosures of interest statements incorporated in this report are provided solely to enhance the transparency and should not be treated as endorsement of the views expressed in the

report. The information provided in these reports remains, unless otherwise stated, the copyright of EBL. All layout, design, original artwork, concepts and other Intellectual Properties,

remains the property and copyright of EBL and may not be used in any form or for any purpose whatsoever by any party without the express written permission of the copyright holders.

EBL shall not be liable for any delay or any other interruption which may occur in presenting the data due to any reason including network (Internet) reasons or snags in the system,

break down of the system or any other equipment, server breakdown, maintenance shutdown, breakdown of communication services or inability of the EBL to present the data. In no

event shall EBL be liable for any damages, including without limitation direct or indirect, special, incidental, or consequential damages, losses or expenses arising in connection with the

data presented by the EBL through this report.

We offer our research services to clients as well as our prospects. Though this report is disseminated to all the customers simultaneously, not all customers may receive this report at

the same time. We will not treat recipients as customers by virtue of their receiving this report.

EBL and its associates, officer, directors, and employees, research analyst (including relatives) worldwide may: (a) from time to time, have long or short positions in, and buy or sell the

securities thereof, of company(ies), mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market

maker in the financial instruments of the subject company/company(ies) discussed herein or act as advisor or lender/borrower to such company(ies) or have other potential/material

conflict of interest with respect to any recommendation and related information and opinions at the time of publication of research report or at the time of public appearance. EBL may

have proprietary long/short position in the above mentioned scrip(s) and therefore should be considered as interested. The vi ews provided herein are general in nature and do not

consider risk appetite or investment objective of any particular investor; readers are requested to take independent professional advice before investing. This should not be construed

as invitation or solicitation to do business with EBL.

EBL or its associates may have received compensation from the subject company in the past 12 months. EBL or its associates may have managed or co-managed public offering of

securities for the subject company in the past 12 months. EBL or its associates may have received compensation for investment banking or merchant banking or brokerage services from

the subject company in the past 12 months. EBL or its associates may have received any compensation for products or services other than investment banking or merchant banking or

brokerage services from the subject company in the past 12 months. EBL or its associates have not received any compensation or other benefits from the Subject Company or third party

in connection with the research report. Research analyst or his/her relative or EBL’s associates may have financial interest in the subject company. EBL, its associates, research analyst

and his/her relative may have other potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of publication of

research report or at the time of public appearance.

Participants in foreign exchange transactions may incur risks arising from several factors, including the following: ( i) exchange rates can be volatile and are subject to large fluctuations;

( ii) the value of currencies may be affected by numerous market factors, including world and national economic, political and regulatory events, events in equity and debt markets and

changes in interest rates; and (iii) currencies may be subject to devaluation or government imposed exchange controls which could affect the value of the currency. Investors in securities

such as ADRs and Currency Derivatives, whose values are affected by the currency of an underlying security, effectively assume currency risk.

Research analyst has served as an officer, director or employee of subject Company: No

EBL has financial interest in the subject companies: No

EBL’s Associates may have actual / beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of

research report.

Research analyst or his/her relative has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of

publication of research report: No

EBL has actual/beneficial ownership of 1% or more securities of the subject company at the end of the month immediately preceding the date of publication of research report: No

Subject company may have been client during twelve months preceding the date of distribution of the research report.

There were no instances of non-compliance by EBL on any matter related to the capital markets, resulting in significant and material disciplinary action during the last three years.

A graph of daily closing prices of the securities is also available at www.nseindia.com

Analyst Certification:

The analyst for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their

securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report.

Edelweiss Professional Investor Research 16

Disclaimer

Additional Disclaimer for U.S. Persons

Edelweiss is not a registered broker – dealer under the U.S. Securities Exchange Act of 1934, as amended (the“1934 act”) and under applicable state laws in the United States. In addition

Edelweiss is not a registered investment adviser under the U.S. Investment Advisers Act of 1940, as amended (the "Advisers Act" and together with the 1934 Act, the "Acts), and under

applicable state laws in the United States. Accordingly, in the absence of specific exemption under the Acts, any brokerage and investment services provided by Edelweiss, including the

products and services described herein are not available to or intended for U.S. persons.

This report does not constitute an offer or invitation to purchase or subscribe for any securities or solicitation of any investments or investment services and/or shall not be considered

as an advertisement tool. "U.S. Persons" are generally defined as a natural person, residing in the United States or any entity organized or incorporated under the laws of the United

States. US Citizens living abroad may also be deemed "US Persons" under certain rules.

Transactions in securities discussed in this research report should be effected through Edelweiss Financial Services Inc.

Additional Disclaimer for U.K. Persons

The contents of this research report have not been approved by an authorised person within the meaning of the Financial Services and Markets Act 2000 ("FSMA").

In the United Kingdom, this research report is being distributed only to and is directed only at (a) persons who have professional experience in matters relating to investments falling

within Article 19(5) of the FSMA (Financial Promotion) Order 2005 (the “Order”); (b) persons falling within Article 49(2)(a) to (d) of the Order (including high net worth companies and

unincorporated associations); and (c) any other persons to whom it may otherwise lawfully be communicated (all such persons together being referred to as “relevant persons”).

This research report must not be acted on or relied on by persons who are not relevant persons. Any investment or investment activity to which this research report relates is available

only to relevant persons and will be engaged in only with relevant persons. Any person who is not a relevant person should not act or rely on this research report or any of its contents.

This research report must not be distributed, published, reproduced or disclosed (in whole or in part) by recipients to any other person.

Additional Disclaimer for Canadian Persons

Edelweiss is not a registered adviser or dealer under applicable Canadian securities laws nor has it obtained an exemption from the adviser and/or dealer registration requirements

under such law. Accordingly, any brokerage and investment services provided by Edelweiss, including the products and services described herein, are not available to or intended for

Canadian persons.

This research report and its respective contents do not constitute an offer or invitation to purchase or subscribe for any securities or solicitation of any investments or investment

services.

Disclosures under the provisions of SEBI (Research Analysts) Regulations 2014 (Regulations)

Edelweiss Broking Limited ("EBL" or "Research Entity") is regulated by the Securities and Exchange Board of India ("SEBI") and is licensed to carry on the business of broking, depository

services and related activities. The business of EBL and its associates are organized around five broad business groups – Credit including Housing and SME Finance, Commodities,

Financial Markets, Asset Management and Life Insurance. There were no instances of non-compliance by EBL on any matter related to the capital markets, resulting in significant and

material disciplinary action during the last three years. This research report has been prepared and distributed by Edelweiss Broking Limited ("Edelweiss") in the capacity of a Research

Analyst as per Regulation 22(1) of SEBI (Research Analysts) Regulations 2014 having SEBI Registration No.INH000000172.

Edelweiss Professional Investor Research 17

You might also like

- Art of Scripting GuideDocument3 pagesArt of Scripting Guidesaminitsok100% (2)

- Lesson 1 - History of DanceDocument1 pageLesson 1 - History of DanceFA LopezNo ratings yet

- Cervantes V FajardoDocument2 pagesCervantes V FajardoTedrick DanaoNo ratings yet

- Unit 4 Test - Inside OutDocument5 pagesUnit 4 Test - Inside OutJesus VillanuevaNo ratings yet

- MOSL Subros 201809 Initiating CoverageDocument18 pagesMOSL Subros 201809 Initiating Coveragerchawdhry123No ratings yet

- Financial Accounting Project by Apo 2Document21 pagesFinancial Accounting Project by Apo 2Uttu AgrawalNo ratings yet

- The Race To Win How Automakers Can Succeed in A Post Pandemic China VFDocument36 pagesThe Race To Win How Automakers Can Succeed in A Post Pandemic China VFJonathan WenNo ratings yet

- Mahindra & Mahindra LTD: Equity Research ReportDocument8 pagesMahindra & Mahindra LTD: Equity Research Report869jshh52hNo ratings yet

- Hikal LTD: Crop Protection Propels Growth But Margins MissDocument10 pagesHikal LTD: Crop Protection Propels Growth But Margins MissRakesh KumarNo ratings yet

- Management Discussion and AnalysisDocument22 pagesManagement Discussion and AnalysisChiradeep BhattacharyaNo ratings yet

- Team GreenTickers - IIM ShillongDocument14 pagesTeam GreenTickers - IIM Shillongpushpak maggoNo ratings yet

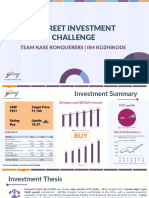

- R-Street Investment Challenge: Team Kase Konquerers - Iim KozhikodeDocument12 pagesR-Street Investment Challenge: Team Kase Konquerers - Iim KozhikodeApoorva JainNo ratings yet

- Auto Compendium Fy21 v2Document16 pagesAuto Compendium Fy21 v2Aswin KondapallyNo ratings yet

- India - Strategy 4qfy23 20230405 Mosl RP PG0238Document238 pagesIndia - Strategy 4qfy23 20230405 Mosl RP PG0238Aditya HalwasiyaNo ratings yet

- Page Industries: Revenue Growth Improves While Margins DeclineDocument8 pagesPage Industries: Revenue Growth Improves While Margins DeclinePuneet367No ratings yet

- Acrysil Investor Presentation 31102018Document34 pagesAcrysil Investor Presentation 31102018Sajid FlexwalaNo ratings yet

- Mahindra & Mahindra: CMP: INR779 TP: INR900 (+16%) Focus Shifts To Growth Post Capital Allocation ChangesDocument20 pagesMahindra & Mahindra: CMP: INR779 TP: INR900 (+16%) Focus Shifts To Growth Post Capital Allocation ChangesM StagsNo ratings yet

- IFB IndustriesDocument5 pagesIFB IndustriesPrashanth SagarNo ratings yet

- ICICI Securities Initiating Coverage On Landmark Cars With An UPSIDEDocument19 pagesICICI Securities Initiating Coverage On Landmark Cars With An UPSIDEDusk TilldownNo ratings yet

- Mahindra & Mahindra LTD.: Key Result Highlights - Q4FY17Document6 pagesMahindra & Mahindra LTD.: Key Result Highlights - Q4FY17anjugaduNo ratings yet

- Gabriel India Limited: AJINKYA YADAV - 19020348002 - MBA FINANCE (EXECUTIVE) 2019-22Document22 pagesGabriel India Limited: AJINKYA YADAV - 19020348002 - MBA FINANCE (EXECUTIVE) 2019-22Ajinkya YadavNo ratings yet

- Cummins India (KKC IN) : Analyst Meet UpdateDocument5 pagesCummins India (KKC IN) : Analyst Meet UpdateADNo ratings yet

- Eicher Motors - Company Update 03-04-18 - SBICAP SecDocument6 pagesEicher Motors - Company Update 03-04-18 - SBICAP SecdarshanmadeNo ratings yet

- MOSL AGIC - Highlights From The ConferenceDocument74 pagesMOSL AGIC - Highlights From The ConferenceqwertixNo ratings yet

- Castrol India LTD: November 06, 2018Document17 pagesCastrol India LTD: November 06, 2018Yash AgarwalNo ratings yet

- PB Fintech Icici SecuritiesDocument33 pagesPB Fintech Icici SecuritieshamsNo ratings yet

- Group 1 PM Project PlanDocument32 pagesGroup 1 PM Project PlanSomya ShrivastavaNo ratings yet

- Credit Analysis of Premier Foods PLC - Sample 1Document14 pagesCredit Analysis of Premier Foods PLC - Sample 1BethelNo ratings yet

- MOSL Ashok Leyland Comprehensive ReportDocument34 pagesMOSL Ashok Leyland Comprehensive Reportrchawdhry123No ratings yet

- Mahindra and Mahindra 18052024 LKPDocument6 pagesMahindra and Mahindra 18052024 LKPsamplemail3000No ratings yet

- AU SFB - Centrum - 190324 - EBRDocument11 pagesAU SFB - Centrum - 190324 - EBRDivy JainNo ratings yet

- Safari Industries BUY: Growth Momentum To Continue.Document20 pagesSafari Industries BUY: Growth Momentum To Continue.dcoolsamNo ratings yet

- IDirect MarutiSuzuki Q2FY19Document12 pagesIDirect MarutiSuzuki Q2FY19Rajani KantNo ratings yet

- Reliance Retail - Update - Apr20 - HDFC Sec-202004142249010251722Document27 pagesReliance Retail - Update - Apr20 - HDFC Sec-202004142249010251722hemant pawdeNo ratings yet

- Divis RRDocument10 pagesDivis RRRicha P SinghalNo ratings yet

- EPC Industrie (EPCIND) : Micro-Irrigation: Niche SegmentDocument4 pagesEPC Industrie (EPCIND) : Micro-Irrigation: Niche SegmentpriyaranjanNo ratings yet

- Marico Equity Research ReportDocument47 pagesMarico Equity Research ReportamitNo ratings yet

- Top 10 Stocks Motilal OswalDocument74 pagesTop 10 Stocks Motilal OswalAbhiroop DasNo ratings yet

- Mahindra & Mahindra: Smooth Ride AheadDocument10 pagesMahindra & Mahindra: Smooth Ride Aheadarun_algoNo ratings yet

- Case 1Document15 pagesCase 1sanjNo ratings yet

- Avenue Supermarts: CMP: INR5,360 TP: INR4,900 (-9%) Continuing To Deliver On GrowthDocument10 pagesAvenue Supermarts: CMP: INR5,360 TP: INR4,900 (-9%) Continuing To Deliver On GrowthLucifer GamerzNo ratings yet

- IDirect MuhuratPick 2022Document10 pagesIDirect MuhuratPick 2022Vinodh kumar chelluNo ratings yet

- Wallfort - 29 April 2022Document24 pagesWallfort - 29 April 2022Utsav LapsiwalaNo ratings yet

- Edelweiss Financial: Continuous Divestment in Key Subsidiaries ContinuesDocument7 pagesEdelweiss Financial: Continuous Divestment in Key Subsidiaries ContinuesAshish AwasthiNo ratings yet

- Task 3 Sec A Group 12Document4 pagesTask 3 Sec A Group 12Pulkit AggarwalNo ratings yet

- Mahindra & Mahindra: Strong Quarter New Launches To Drive GrowthDocument9 pagesMahindra & Mahindra: Strong Quarter New Launches To Drive Growthparchure123No ratings yet

- Aptus Housing Finance LTD: SubscribeDocument5 pagesAptus Housing Finance LTD: SubscribeupsahuNo ratings yet

- Reliance Industries Fundamental PDFDocument6 pagesReliance Industries Fundamental PDFsantosh kumariNo ratings yet

- 3M India Q4FY21 ResultsDocument7 pages3M India Q4FY21 ResultsdarshanmaldeNo ratings yet

- New Media Strategy For IFFCO-Tokio, Supporting DocumentDocument56 pagesNew Media Strategy For IFFCO-Tokio, Supporting Documentsahilchopra1987No ratings yet

- Consumer - Outlook - 3jan22 - JM FinancialDocument14 pagesConsumer - Outlook - 3jan22 - JM FinancialBinoy JariwalaNo ratings yet

- Exide LTD Market Impact Q1FY19Document2 pagesExide LTD Market Impact Q1FY19Shihab MonNo ratings yet

- Morning India 20210323 Mosl Motilal OswalDocument8 pagesMorning India 20210323 Mosl Motilal Oswalvikalp123123No ratings yet

- IBF Term ProjectDocument21 pagesIBF Term Projectzayans84No ratings yet

- 2022 05 04 - Volkswagen Group Q1 - IR CallDocument32 pages2022 05 04 - Volkswagen Group Q1 - IR CallbuivunguyetminhNo ratings yet

- Arvind LTD - Initiating Coverage - Dalal and Broacha - BUYDocument19 pagesArvind LTD - Initiating Coverage - Dalal and Broacha - BUYManoj KumarNo ratings yet

- Golden Large Cap Portfolio: June 2021 UpdateDocument7 pagesGolden Large Cap Portfolio: June 2021 UpdateRam KumarNo ratings yet

- Rallis India (RALIND) : Poised For Growth Buy To Reap Rich GainsDocument12 pagesRallis India (RALIND) : Poised For Growth Buy To Reap Rich GainsJatin SoniNo ratings yet

- Ref: SEC/SE/2021-22 Date: August 19, 2021 Scrip Symbol: NSE-DABUR, BSE Scrip Code: 500096Document78 pagesRef: SEC/SE/2021-22 Date: August 19, 2021 Scrip Symbol: NSE-DABUR, BSE Scrip Code: 500096utsav9maharjanNo ratings yet

- Value Conservation To Value Creation: COVID-19: Path To RecoveryDocument25 pagesValue Conservation To Value Creation: COVID-19: Path To RecoveryPrem RavalNo ratings yet

- UntitledDocument9 pagesUntitledAsfatin AmranNo ratings yet

- AMC Sector - HDFC Sec-201901111558114702001 PDFDocument99 pagesAMC Sector - HDFC Sec-201901111558114702001 PDFmonikkapadiaNo ratings yet

- Chairman's Message PDFDocument2 pagesChairman's Message PDFharshit abrolNo ratings yet

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- W Lhlath Reduii: Roduchiuih OoDocument5 pagesW Lhlath Reduii: Roduchiuih OoVanshika BiyaniNo ratings yet

- Interim Placement Report: (Updated On 24th February 2023)Document1 pageInterim Placement Report: (Updated On 24th February 2023)Vanshika BiyaniNo ratings yet

- Crisil: PVR LTDDocument36 pagesCrisil: PVR LTDVanshika BiyaniNo ratings yet

- Q3FY22 Result Update DLF LTD.: Strong Residential Performance ContinuesDocument10 pagesQ3FY22 Result Update DLF LTD.: Strong Residential Performance ContinuesVanshika BiyaniNo ratings yet

- Lufthansa Case Study-Main ProblemDocument3 pagesLufthansa Case Study-Main ProblemjeanetteNo ratings yet

- Apes Final ReviewDocument41 pagesApes Final ReviewirregularflowersNo ratings yet

- (Stephen Burt, Hannah Brooks-Motl) Randall JarrellDocument197 pages(Stephen Burt, Hannah Brooks-Motl) Randall JarrellAlene Saury100% (2)

- The Following Text Is For Questions 91 To 95Document4 pagesThe Following Text Is For Questions 91 To 95NapNo ratings yet

- Topic One The Context of Strategic Human Resource Management (Autosaved)Document61 pagesTopic One The Context of Strategic Human Resource Management (Autosaved)Maha DajaniNo ratings yet

- Go JoseonDocument7 pagesGo JoseonSanket PatilNo ratings yet

- 12 - Epstein Barr Virus (EBV)Document20 pages12 - Epstein Barr Virus (EBV)Lusiana T. Sipil UnsulbarNo ratings yet

- Creating Racism: Psychiatry's BetrayalDocument36 pagesCreating Racism: Psychiatry's Betrayalapmendez317No ratings yet

- Land Revenue ActDocument2 pagesLand Revenue ActPeeaar Green Energy SolutionsNo ratings yet

- Artificial Intelligence Is It Worth Our FutureDocument7 pagesArtificial Intelligence Is It Worth Our FutureKashikaNo ratings yet

- 10 PH2672 40 StkupDocument3 pages10 PH2672 40 StkupSasan Abbasi100% (1)

- Does V Boies Schiller Reply BriefDocument20 pagesDoes V Boies Schiller Reply BriefPaulWolfNo ratings yet

- Topic 1 - Introduction To Economics (Week1)Document30 pagesTopic 1 - Introduction To Economics (Week1)Wei SongNo ratings yet

- Advances in Accounting, Incorporating Advances in International AccountingDocument14 pagesAdvances in Accounting, Incorporating Advances in International AccountingWihl Mathew ZalatarNo ratings yet

- Henry FieldingDocument12 pagesHenry FieldingMary Rose BaluranNo ratings yet

- The Differences Between A Parliamentary and Presidentialist Democracy and The Advantages and Disadvantages of EachDocument1 pageThe Differences Between A Parliamentary and Presidentialist Democracy and The Advantages and Disadvantages of EachElli GeissNo ratings yet

- Verma Committee ReportDocument170 pagesVerma Committee Reportaeroa1No ratings yet

- Trends in Nursing InformaticsDocument2 pagesTrends in Nursing InformaticsHannah Jane PadernalNo ratings yet

- Biometric Service Provider (BSP) : John "Jack" Callahan VeridiumDocument20 pagesBiometric Service Provider (BSP) : John "Jack" Callahan VeridiumSamir BennaniNo ratings yet

- Adoption: The Hindu Adoption and Maintenance Act, 1956Document5 pagesAdoption: The Hindu Adoption and Maintenance Act, 1956Harnoor KaurNo ratings yet

- PhA 081 - Huby - Theophrastus of Eresus, Commentary Volume 4 - Psychology (Texts 265-327) 1999 PDFDocument271 pagesPhA 081 - Huby - Theophrastus of Eresus, Commentary Volume 4 - Psychology (Texts 265-327) 1999 PDFPhilosophvs AntiqvvsNo ratings yet

- Tithonus' by TennysonDocument10 pagesTithonus' by TennysonMs-CalverNo ratings yet

- HR Om11 Ism ch02Document7 pagesHR Om11 Ism ch02143mc14No ratings yet

- Spartanburg Magazine SummerDocument124 pagesSpartanburg Magazine SummerJose FrancoNo ratings yet

- Keota Eagle Dec. 19, 2012Document16 pagesKeota Eagle Dec. 19, 2012Mike-Tomisha SprouseNo ratings yet

- Obligations and Contracts: San Beda College of LawDocument36 pagesObligations and Contracts: San Beda College of LawGlory Nicol OrapaNo ratings yet