Professional Documents

Culture Documents

Midterms Entrepreneurial Mind Reviewer

Midterms Entrepreneurial Mind Reviewer

Uploaded by

Prince LitchOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Midterms Entrepreneurial Mind Reviewer

Midterms Entrepreneurial Mind Reviewer

Uploaded by

Prince LitchCopyright:

Available Formats

Page |1

Handout 5 Van Duzer’s Model

Entrepreneurial Habits - Jeff Van Duzer, dean of the School of Business and Economics

- mental habits set entrepreneurs apart from non- at Seattle Pacific University.

entrepreneurs.

Purpose of business is two (2)-fold:

Habits of entrepreneurs:

Curious being To serve customers by providing goods and services

- open and curious about everything. that promote human flourishing

- curiosity keeps them asking questions and generating - customers and the broader community.

ideas for their next moves. To serve employees by providing opportunities for

Turn obstacles into assets meaningful and creative work

- entrepreneurs believe and act as if everything is a gift. - tends to focus on employees and vendors.

Having a high tolerance for ambiguity

- clear set of rules and expectations. - profit should be best viewed as a means to serve customers

Using fears and anxieties as fuel and employees.

- the anxiety must be reframed as excitement. - pursuit of profit is necessary for business but is not the

Focus on the causes, not effects, of confidence and purpose of business.

success

- success represents more incredible adversity than “The purpose of a business, in other words, is not to make a

failure. profit, full stop. It is to make a profit so that the business can

Be proactive do something more or better.” – Jeff Van Duzer

- merely taking the initiative.

- as human beings, people are responsible for their lives. Parikh’s Model

Put first things first - Indira Parikh, president of the Foundation for Liberal and

- Two (2) factors define an activity: urgent and important. Management Education (FLAME)

1. Urgent - ancient wisdom of Hindu scriptures can be appropriated to

- requires immediate attention. business practices.

- usually visible; they insist on action. Bhagavad Gita

2. Importance - thoughts and actions rather than the outcomes of

- results. those actions.

- contributes to an entrepreneur’s mission, 1. Greed is bad

values, and high-priority goals. - never engage in action only for the desire of

Think win-win rewards.

- frame of mind and heart that constantly seeks mutual 2. Be fair

benefit in all human interactions. - leaders are compassionate and selfless.

- agreements or solutions are mutually beneficial and - “They treat everyone as equals.”

satisfying. 3. Act rather than react

Seek first to understand, then to be understood - leader’s actions today can become the “karma”

- profound paradigm shift. that influences their status tomorrow.

- seek first to be understood. - “excellence by taking action.”

Synergize 4. Seek higher consciousness

- relationship of departments within an organization is - view problems within their larger contexts.

catalytic, empowering, unifying, and exciting. Dharma

Sharpen the saw - Dr. Athreya, renowned management guru.

- balanced program in four (4) areas of life (physical, - core concepts of Dharma (natural law), as enshrined in

social/emotional, mental, and spiritual). the Indian Shastras (timeless principles).

- righteous duty or the right path to uphold the family

HANDOUT 6 and the organizational and social fabric.

Naert’s Model Main principles of Dharma:

- Philippe Naert, dean of the Antwerp Management School in 1. Loka Sangraha (Public Good)

Belgium - seeking one’s gains and catering to the welfare

- value creation is the purpose of business. of others.

- economic and societal values can be pursued at the same 2. Kausalam (Efficacy)

time. - use of resources for future generations.

Page |2

3. Vividhta (Innovation) of investment involved.

- engine of innovation, constantly seeking more Income Statement

effective solutions to meet its economic and social - summarizes the revenues earned and expenses incurred by a

business over an accounting period.

expectations. - profit-and-loss (P&L) statement.

4. Jigyasa (Learning)

- change and continuity coexist. Income statement may help in providing information on:

Wealth generation

Business Model - wealth has been created is vital for businesses.

- firm’s business plan, income statements, and cash flow Profit derivative

- information needed to gauge business performance.

projections.

Cash Flow Statement

- conceptual, rather than a financial, framework. - focuses on liquidity.

- describes how a company creates and captures value. - cash flows are the inflows and outflows of cash into and

out of business.

Primary considerations in developing a business model: - net cash flows are the difference between inflows and

1. A more personalized product or service outflows.

- tailored to customers’ individual and immediate needs.

2. A closed-loop process Financial Ratios

- closed loop, in which used products are recycled. The following are the common types of ratios:

3. Asset sharing

- innovations succeed because they enable sharing of Return on Investments (ROI)

costly assets. - return on the owner's equity; hence it is sometimes referred

4. Usage-based pricing to as return on equity (ROE).

- charge customers when they use the product or service FORMULA:

rather than requiring them to buy something outright. Return on Investments = ___Income After Income Tax___

5. A more collaborative ecosystem Average Stockholder’s Equity

- new technology improves the relationship with supply Profit Margin/Return on Sales (ROS)

chain partners - the income to net sales ratio.

6. An agile and adaptive organization

FORMULA:

- make decisions that better reflect market needs and

Profit Margin = ___Income___

allow real-time adaptation to those needs.

Net Sales

Handout 7 Return on Assets (ROA)

Types of Financial Statement: - effectively the company has utilized its assets.

Balance Sheet/Statement of Financial Position FORMULA:

Return on Assets = _____Income_____

- financial position of a business on a certain date (usually the

end of the month or year). Average Total Asset

- presents a business view of assets equal to the sum of Current Ratio

liabilities and capital.

- relates current assets to current liabilities and shows a firm's

Primary functions of a balance sheet: immediate solvency and liquidity.

Business funds Solvency

- meet long-term obligations.

- capital contribution of owners and outside lenders.

Liquidity

- acquired assets of the business.

- enterprise's ability to pay short-term bills and debts.

Business value FORMULA:

- firm's value since it lists all the assets and business Current Ratio = __Current Asset’s__

claims.

Current liabilities

Business assets and claims Quick Ratio (Acid-Test Ratio)

- relationships between various statements of financial - company's short-term liquidity and measures.

position items. FORMULA:

Business performance Quick Ratio = ____Quick Asset____

- generating wealth can be assessed against the amount Current liabilities

Page |3

- drives companies to focus simultaneously on eliminating,

Debt Ratio reducing, raising, and creating while unlocking a new blue

- compares a company's total debt to its total assets. ocean.

FORMULA:

Debt Ratio = ___Total Liabilities___

Total Asset

Stockholder's Ratio

- measures how much of a company's assets are funded by

issuing stock rather than borrowing money.

FORMULA:

Stockholder's Ratio = __Total Stockholder’s Equity__

Total Asset

Debt-Equity Ratio

- percentage of the company's balance sheet.

FORMULA:

Debt-Equity Ratio = ______ Total Liabilities______

Total Stockholder’s Equity

Interest Coverage Ratio

- company's ability to meet its interest payment obligations.

FORMULA:

Interest Coverage Ratio = __Operating Income__

Interest Expense

Handout 8

Blue Ocean Strategy

- creates a new market space and stimulates new demand.

- can create brand equity that lasts for decades.

- rejects the fundamental principle of conventional strategy.

Red Ocean Strategy

- competing in an existing market space to capture demand.

Red Ocean Strategy

Compete in existing market space

Beat the competition

Exploit existing demand

Make the value/cost tradeoff

Align the company’s activities with its strategic choice of

differentiation or low cost

Blue Ocean Strategy

Create uncontested market space

Make the competition irrelevant

Create and capture new demand

Break the value/cost tradeoff

Align the whole system of a company’s activities in pursuit of

differentiation and low cost

Strategy Canvas

- graphically depicts a company’s and its competitor’s value

proposition.

“Four (4) Actions Framework”

- tool in crafting a future strategy canvas.

Eliminate-Reduce-Raise-Create (ERRC)

- developed by W. Chan Kim and Renee Mauborgne

You might also like

- Audit of Inventories - Roque 2018Document60 pagesAudit of Inventories - Roque 2018Renelyn David69% (13)

- Case AnalysisDocument9 pagesCase AnalysisDebasish Padhy67% (3)

- EntrepreneurshipDocument3 pagesEntrepreneurshipTricia Baltazar0% (1)

- The Purpose of BusinessDocument2 pagesThe Purpose of BusinessMark Julius Bongalbal100% (1)

- ENTREPRENEURSHIPDocument8 pagesENTREPRENEURSHIPPark JeongwooNo ratings yet

- Hatdog Ewan Ko DitoDocument6 pagesHatdog Ewan Ko DitominnieNo ratings yet

- 3rd Monthly EntrepDocument4 pages3rd Monthly Entrepkiel macalaladNo ratings yet

- Business ManagementDocument5 pagesBusiness ManagementVoltaire Eroy Lopez IINo ratings yet

- Cobfsen ReviewweDocument12 pagesCobfsen ReviewweGian Carla RicoNo ratings yet

- LMCW Week 1 and 2 Entrepeneur Entrepreneurship and Entrepreneurial Mindset-20200207120508Document36 pagesLMCW Week 1 and 2 Entrepeneur Entrepreneurship and Entrepreneurial Mindset-20200207120508api-552020694No ratings yet

- Entrepreneurship ReviewerDocument3 pagesEntrepreneurship ReviewerBianca De Castro VillaruelNo ratings yet

- Lecture 1 - Entrepeneur, Entrepreneurship and Entrepreneurial MindsetDocument39 pagesLecture 1 - Entrepeneur, Entrepreneurship and Entrepreneurial Mindsetfarah syahirahNo ratings yet

- ENTREP NotesDocument19 pagesENTREP NotesBrendon BaguilatNo ratings yet

- GEE 1: The Entrepreneurial Mind: Course DescriptionDocument3 pagesGEE 1: The Entrepreneurial Mind: Course DescriptionJemalyn De Guzman TuringanNo ratings yet

- Entrep MidtermsDocument4 pagesEntrep Midtermskc.jarobillaNo ratings yet

- CBM 0016 Chapter 1 - The Practice of EntrepreneurshipDocument3 pagesCBM 0016 Chapter 1 - The Practice of EntrepreneurshipJames Matthew BedayoNo ratings yet

- Entrepreneurship ReviewerDocument2 pagesEntrepreneurship ReviewerZoie CorañezNo ratings yet

- Entrepreneurship Reviewer 1quarterDocument8 pagesEntrepreneurship Reviewer 1quarterJulia Renee PANLILIO IGNACIONo ratings yet

- Entrepreneurship ReviewerDocument4 pagesEntrepreneurship ReviewerKent Ronnel Ranque PilarNo ratings yet

- ENTREP REVIEWERDocument7 pagesENTREP REVIEWERNathalie Nichole I. Inductivo Pesta�oNo ratings yet

- ReviewDocument6 pagesReviewig: vrlcmNo ratings yet

- Prelims Org ManDocument5 pagesPrelims Org ManClaire Evann Villena EboraNo ratings yet

- Entrepreneurship 123Document8 pagesEntrepreneurship 123Gela V.No ratings yet

- Week 1 and Two For Offline LearnersDocument5 pagesWeek 1 and Two For Offline LearnersJemalyn De Guzman TuringanNo ratings yet

- Entrepreneurship: Chapter 1: The Entrepreneurial MindsetDocument4 pagesEntrepreneurship: Chapter 1: The Entrepreneurial Mindsetayah eliviaNo ratings yet

- Entrepreneurial Intentions and Corporate Entrepreneurship: Hisrich Peters ShepherdDocument15 pagesEntrepreneurial Intentions and Corporate Entrepreneurship: Hisrich Peters Shepherdyuki kai100% (1)

- Elec 1 Mmodule 1 1Document4 pagesElec 1 Mmodule 1 1Marion Pierre MateoNo ratings yet

- Entrepreneurship: Module 1-2Document7 pagesEntrepreneurship: Module 1-2Kay Kay100% (1)

- Ed - Balaji Mba College KadapaDocument141 pagesEd - Balaji Mba College KadapaVeluru ManojNo ratings yet

- Handouts Entrep 2Document3 pagesHandouts Entrep 2Frenchie BasaloNo ratings yet

- ENTREPDocument8 pagesENTREPCJ TalayNo ratings yet

- Entrepreneurship Reviewer 1QDocument8 pagesEntrepreneurship Reviewer 1QKenshin Ivan Q FelicianoNo ratings yet

- q1 Reviewer (Entrep)Document9 pagesq1 Reviewer (Entrep)kris krossNo ratings yet

- Innovation Forms: A. New Product B. New Production Method C. New Market D. New Supplier E. New Industry StructureDocument6 pagesInnovation Forms: A. New Product B. New Production Method C. New Market D. New Supplier E. New Industry StructureYuan OrtegaNo ratings yet

- Entrep Module PDFDocument3 pagesEntrep Module PDFkheannNo ratings yet

- English For Business - ClasesDocument10 pagesEnglish For Business - ClasesValeria Alessandra Huamaní TrellesNo ratings yet

- ENTREPRENEURDocument11 pagesENTREPRENEURDhey Anne NavarroNo ratings yet

- Entrep - ReviewerDocument11 pagesEntrep - Reviewerjcmansanadis8126qcNo ratings yet

- 21st Century Trends in Entrepreneurship ResearchDocument5 pages21st Century Trends in Entrepreneurship ResearchkimashleymandronNo ratings yet

- GR 12 - EntrepreneurshipDocument15 pagesGR 12 - Entrepreneurshipdot comNo ratings yet

- Reviewer in Entrep11Document3 pagesReviewer in Entrep11yannie isanan100% (3)

- Entrep ReviewerDocument6 pagesEntrep ReviewerjouxkaaNo ratings yet

- 1st Quarter Entrep ReviewDocument9 pages1st Quarter Entrep ReviewMitch Rhedzelle T. CunananNo ratings yet

- Pa 111 NotesDocument13 pagesPa 111 NotesMara JavierNo ratings yet

- Entrepreneurship ReviewerDocument11 pagesEntrepreneurship ReviewerChristian BelanoNo ratings yet

- Entrepreneurship ReviewerDocument3 pagesEntrepreneurship Reviewerauhsojgab07No ratings yet

- Introduction To Entrepreneurship What Is Entrepreneurship?Document7 pagesIntroduction To Entrepreneurship What Is Entrepreneurship?Pogi PauleNo ratings yet

- EntrepreneurDocument12 pagesEntrepreneurEissa SamanoNo ratings yet

- Entrepreneurship ReviewerDocument14 pagesEntrepreneurship Reviewervinagrera.thepauleenNo ratings yet

- Entrep Reviewer by - MelodieDocument8 pagesEntrep Reviewer by - MelodieMelodie BrionesNo ratings yet

- Entrepreneurship ReviewerDocument11 pagesEntrepreneurship ReviewerChristian BelanoNo ratings yet

- Entrepreneurial Competencies Why Is It Important? According To Man and ChanDocument7 pagesEntrepreneurial Competencies Why Is It Important? According To Man and ChanDimple MontemayorNo ratings yet

- EntrepreneurshipDocument3 pagesEntrepreneurshipKisumi ShiginoNo ratings yet

- Economics NOTESDocument2 pagesEconomics NOTESKisumi ShiginoNo ratings yet

- Entrep ReviewerDocument2 pagesEntrep ReviewerSylvia DanisNo ratings yet

- Tough Competition - An Entrepreneur Needs ToDocument3 pagesTough Competition - An Entrepreneur Needs ToMary Ianne Therese GumabongNo ratings yet

- Entrepreneurial ReviewerDocument2 pagesEntrepreneurial ReviewerDonnaNo ratings yet

- Week 6 - Group 5Document2 pagesWeek 6 - Group 5Công NguyênNo ratings yet

- Entrep NotesDocument6 pagesEntrep Noteslara salundaguitNo ratings yet

- Business Plan Exam #1Document17 pagesBusiness Plan Exam #1ScribdTranslationsNo ratings yet

- Entrepreneurship and The Entrepreneurial Mind-Set: Hisrich Peters ShepherdDocument19 pagesEntrepreneurship and The Entrepreneurial Mind-Set: Hisrich Peters ShepherdAwab HamidNo ratings yet

- What's the Big Idea? (Review and Analysis of Davenport, Prusak and Wilson's Book)From EverandWhat's the Big Idea? (Review and Analysis of Davenport, Prusak and Wilson's Book)No ratings yet

- Midterms Facilities Mnagement ReviewerDocument4 pagesMidterms Facilities Mnagement ReviewerPrince LitchNo ratings yet

- Midterms RIPH ReviewerDocument4 pagesMidterms RIPH ReviewerPrince LitchNo ratings yet

- Midterms Basic Microeconomics ReviewerDocument3 pagesMidterms Basic Microeconomics ReviewerPrince LitchNo ratings yet

- Costing ReviewerDocument9 pagesCosting ReviewerPrince LitchNo ratings yet

- Facilities ManagementDocument2 pagesFacilities ManagementPrince LitchNo ratings yet

- Contemporary WorldDocument1 pageContemporary WorldPrince LitchNo ratings yet

- Basic MicroeconomicsDocument1 pageBasic MicroeconomicsPrince LitchNo ratings yet

- Contemporary WorldDocument2 pagesContemporary WorldPrince LitchNo ratings yet

- Contemporary World LectureDocument2 pagesContemporary World LecturePrince LitchNo ratings yet

- Atul Education TYBCOM Marketing PointersDocument7 pagesAtul Education TYBCOM Marketing PointersSANTIAUNTI6 MENo ratings yet

- ERP - Business Functions & ProcessDocument44 pagesERP - Business Functions & Processsarvjeet_kaushalNo ratings yet

- Business Environment Chapter 1Document12 pagesBusiness Environment Chapter 1Muneeb SadaNo ratings yet

- ORourke Hyatt Services OverviewDocument12 pagesORourke Hyatt Services OverviewAaryan SedhainNo ratings yet

- IESE GlovoDocument17 pagesIESE GlovoBill Jason Duckworth100% (1)

- Management Accounting764 eVyE8h3I7eDocument3 pagesManagement Accounting764 eVyE8h3I7eABHINAV AGRAWALNo ratings yet

- 05 Slides Production PDFDocument48 pages05 Slides Production PDFSamiyah HaqueNo ratings yet

- Chapter 13 Solutions 2241Document18 pagesChapter 13 Solutions 2241JamesNo ratings yet

- International Auditing Overview: Principles of Auditing: An Introduction To International Standards On Auditing - Ch. 1Document42 pagesInternational Auditing Overview: Principles of Auditing: An Introduction To International Standards On Auditing - Ch. 1Rica Mae Recososa100% (2)

- Final Exam, s2, 2018-FINALDocument11 pagesFinal Exam, s2, 2018-FINALShivneel Naidu0% (1)

- Cover Project ContractDocument4 pagesCover Project ContractnursyahzananiNo ratings yet

- B.Voc II (Fundamentals in Accouting and Technology (Computer Skill) - IIDocument165 pagesB.Voc II (Fundamentals in Accouting and Technology (Computer Skill) - IIsharmarohtashNo ratings yet

- Ques TestDocument3 pagesQues Testaastha124892823No ratings yet

- Strategic Management and Business Policy Globalization Innovation and Sustainability 14th Edition Wheelen Solutions ManualDocument20 pagesStrategic Management and Business Policy Globalization Innovation and Sustainability 14th Edition Wheelen Solutions Manualequally.ungown.q5sgg100% (16)

- Multiple ChoiceDocument4 pagesMultiple ChoiceIqbale HimawanNo ratings yet

- Tugas 4. Proses Penyesuaian-Ricky Andrian K. RumereDocument50 pagesTugas 4. Proses Penyesuaian-Ricky Andrian K. RumererickyNo ratings yet

- Ratios Liquidity Ratios:: Days Sales OutstandingDocument3 pagesRatios Liquidity Ratios:: Days Sales OutstandingPraise BuenaflorNo ratings yet

- Modigliani & Miller Capital Structure TheoryDocument2 pagesModigliani & Miller Capital Structure TheoryJoao Mariares de VasconcelosNo ratings yet

- CA2211054 Ramona Bucur TSD Entrepreneurship Correction - EditedDocument12 pagesCA2211054 Ramona Bucur TSD Entrepreneurship Correction - EditedMd Samiuzzaman92BNo ratings yet

- The Importance of Marketing ResearchDocument4 pagesThe Importance of Marketing ResearchJAY MARK TANONo ratings yet

- Engineered, Discretionary and Committed CostsDocument6 pagesEngineered, Discretionary and Committed CostsAjiLalNo ratings yet

- Problem 10 and 13Document2 pagesProblem 10 and 13jiiNo ratings yet

- Introduction To Wireless Earbuds ManufacturingDocument10 pagesIntroduction To Wireless Earbuds ManufacturingMayur MahajanNo ratings yet

- Mas 3Document9 pagesMas 3Krishia GarciaNo ratings yet

- ECON1001 Lecture 7 - Monday 15th April 2019Document5 pagesECON1001 Lecture 7 - Monday 15th April 2019garyNo ratings yet

- Market Opportunity Analysis & Consumer AnalysisDocument67 pagesMarket Opportunity Analysis & Consumer AnalysisAlondra SioconNo ratings yet

- EC304 Assignment1 W12Document3 pagesEC304 Assignment1 W12Moatez HabayebNo ratings yet

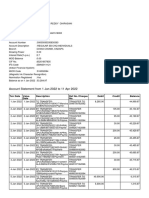

- Jan 2022 - Mar 2022Document11 pagesJan 2022 - Mar 2022Chirasani Yogeshwar ReddyNo ratings yet