Professional Documents

Culture Documents

Property and Title 2022 Mid-Year Industry Report

Property and Title 2022 Mid-Year Industry Report

Uploaded by

Daniela TunaruOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Property and Title 2022 Mid-Year Industry Report

Property and Title 2022 Mid-Year Industry Report

Uploaded by

Daniela TunaruCopyright:

Available Formats

U.S.

Property & Casualty and Title Insurance Industries – 2022 First Half Results

Property & Casualty Insurance Industry

PROPERTY & CASUALTY OVERVIEW

Net income in the U.S. Property & Casualty Insurance Industry fell 14.5% to $34.0

billion in the first half of 2022, driven by underwriting losses compared to Inside the Report

underwriting gains last year. This was largely due to a significant deterioration in Page No.

auto results, as auto physical damage was impacted by inflation and supply chain Market Conditions .......................2

issues, and social inflation continued to impact commercial liability. Strong Writings .......................................3

investment returns offset the downturn in underwriting results. However, Underwriting Operations ......... 3-4

stressed equity markets resulted in significant unrealized capital losses, which Investment Operations ................5

more than offset net income. As a result, policyholders’ surplus fell 8.1% since Net Income ..................................6

the prior year end to $989.8 billion. Cash Flow & Liquidity ..................6

Capital & Surplus .........................6

While the long trend of industry profits continued into the first half of 2022, Reserves ......................................7

operating results in the second half of the year will certainly be impacted by Looking Ahead .............................7

economic inflation, the stock market decline, social inflation, and natural Title Industry.......................... 8-11

catastrophes.

U.S. Property/Casualty Insurance Industry Results (i n bi l l i ons , except for percent)

For the six months ended

June 30,

Chg. 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013

Di rect Premi ums Wri tten 9.9% $434.0 $394.8 $362.3 $355.2 $340.6 $321.3 $306.9 $295.5 $282.8 $269.1

Net Premi ums Wri tten 10.6% $388.6 $351.2 $327.6 $315.3 $316.7 $280.4 $268.8 $261.1 $251.4 $241.4

Net Premi ums Ea rned 8.8% $362.6 $333.3 $316.6 $308.3 $297.4 $270.4 $261.6 $252.5 $243.0 $243.0

Net Los s & LAE Incurred 15.0% $266.6 $231.9 $217.2 $215.8 $204.9 $197.5 $186.9 $175.0 $171.8 $159.5

Underwri ti ng Expens es 6.4% $99.7 $93.7 $90.2 $85.4 $85.3 $75.8 $74.5 $72.4 $69.3 $67.6

Underwri ti ng Ga i n (Los s ) NM ($4.2) $7.3 $8.9 $6.5 $7.0 ($3.2) ($0.2) $4.7 $1.5 $5.8

Net Los s Ra ti o 4.0 pts 73.5% 69.6% 68.6% 70.0% 68.9% 73.0% 71.4% 69.3% 70.7% 70.7%

Expens e Ra ti o (0.9) pts 25.7% 26.7% 27.5% 27.1% 26.9% 27.0% 27.7% 27.7% 27.6% 26.9%

Di vi dend Ra ti o (0.2) pts 0.47% 0.71% 1.55% 0.55% 0.53% 0.54% 0.55% 0.53% 0.57% 0.52%

Combi ned Ra ti o 2.8 pts 99.7% 96.9% 97.7% 97.6% 96.3% 100.6% 99.7% 97.6% 98.8% 98.1%

Inves tment Inc. Ea rned 35.7% $39.2 $28.9 $28.3 $29.3 $28.9 $25.6 $24.2 $24.7 $25.2 $27.0

Rea l i zed Ga i ns (Los s es ) (63.3%) $3.6 $9.7 ($0.9) $4.6 $5.5 $3.9 $4.8 $8.5 $7.6 $11.1

Inves tment Ga i n (Los s ) 10.8% $42.8 $38.6 $27.4 $33.9 $34.4 $29.5 $29.0 $33.2 $32.8 $38.1

Inves tment Yi el d (a ) 0.85-pts 3.75% 2.90% 3.15% 3.47% 3.50% 3.28% 3.24% 3.32% 3.48% 3.96%

Net Income (b) (14.5%) $34.0 $39.8 $26.8 $34.8 $35.8 $17.7 $22.2 $32.7 $28.5 $35.7

Return on Revenue (2.3)-pts 8.4% 10.7% 7.8% 10.2% 10.8% 5.9% 7.6% 11.4% 10.3% 12.7%

June 30, December 31, 2013-2021

Chg. 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013

Ca pi ta l & Surpl us (b) (8.1%) $989.8 $1,077.6 $955.1 $891.2 $780.0 $786.0 $734.0 $705.9 $706.7 $686.1

(a ) a nnua l i zed, (b) a djus ted to removed s ta cked enti ti es

NM = Not Mea ni ngful

© 2022 National Association of Insurance Commissioners [1]

U.S. Property & Casualty and Title Insurance Industries – 2022 First Half Results

MARKET CONDITIONS

Premium Pricing

While hard market conditions existed in the U.S. Property & Casualty in most lines of business, there appear to be signs

of stabilization as premium increases in most commercial lines began to slow in Q4-2020. According to the Council of

Insurance Agents and Brokers (CIAB) Commercial Property/Casualty Market Report Q2 2022 (April 1 – June 30), Q2

2022 was the nineteenth consecutive quarter of increased commercial premiums with respondents reporting an

average increase of 7.1% across all account sizes, compared to 6.6% in Q1. Despite the small increase, respondents

indicated the market continued to stabilize due to price moderation and additional competition.

The report also noted that the insurance industry is feeling the impact of inflation primarily in the commercial property

and commercial auto lines of business. Inflation has led to higher valuations for buildings and increasing costs for

building materials and auto parts, which has resulted in higher insuring values and rates. Respondents reported an

8.3% average increase in commercial property premium rates and an average 7.2% increase in commercial auto, which

has now seen forty-four consecutive quarters of premium rate increases.

Capacity Net Writings Leverage

Insurer capacity to write new business remains 100%

abundant as evidenced by a net writings leverage ratio

of 76.5% at June 30, 2022, as seen in the accompanying 95%

chart. A trend of industry profits has boosted capital

90%

levels and kept the ratio below 80.0% for thirteen

consecutive years. 85%

76.5%

Although the first half of 2022 was relatively mild with 80%

respect to natural catastrophes, the active hurricane

75%

season predicted for the second half of the year,

combined with inflationary pressures facing the 70%

industry, will likely weigh on insurers’ bottom lines.

Despite this uncertainty, we know capital levels in the 65%

'08 '09 '10 '11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21 Jun-

industry remain strong. 22

© 2022 National Association of Insurance Commissioners [2]

U.S. Property & Casualty and Title Insurance Industries – 2022 First Half Results

WRITINGS

Direct premiums written (DPW) increased 9.9% to $434.1 billion in the first half of 2022 compared to $394.8 billion

for the same period in 2021. The growth can be attributed to an increase in rates as a result of the continued hard

market resulting from economic and social inflation, and increased frequency and severity of catastrophe events.

Nearly all major lines of business saw premium increases.

Homeowners DPW increased 11.3% compared to the first half of last year to $64.0 billion. The increased frequency

and severity of natural catastrophes in recent years has placed pressure on profitability. As a result, reinsurance pricing

has increased, which has placed upward pressure on consumer premium rates. The latest headwind has been inflation

as mentioned previously. Over the last year there have been dramatic increases in construction costs, causing insurers

to adjust rates.

Private passenger auto liability DPW increased 2.8% to $79.2 billion. Insurers have adjusted rates based on increased

claims activity as traffic volumes have returned to normal post pandemic. More recently, inflation and supply chain

issues have impacted claim costs, which also drove rates higher.

Beginning in 2022, the premium for personal and commercial auto physical damage is reported separately. For

comparison, however, the combined DPW was $64.5 billion for the current year-to-date, 6.9% higher than the year

ago period.

Other liability DPW increased 13.7% to $56.3 billion. This coverage includes professional, environmental, general

liability, directors and officers (D&O), and employers’ liability. Rates have increased in response to rising loss costs

primarily due to adverse development of prior accident year reserves and social inflation. Also within the commercial

space, workers’ compensation, commercial multiple peril, and commercial auto liability DPW increased 9.4%, 10.9%,

and 14.7%, respectively.

From a geographic perspective, all states and territories experienced DPW growth Year on Year (YoY), except for

American Samoa and the U.S. Virgin Islands. California recorded the greatest market share at 11.8% and DPW

increased 9.7% YoY. Texas’ market share was 9.2% and had a 13.4% YoY increase in DPW while Florida (9.0% market

share) had a 15.8% increase, and New York (6.8% market share) increased 9.1%.

UNDERWRITING OPERATIONS

The industry recorded a $4.2 billion underwriting loss for

the first half of 2022, its first loss in the last five mid-year Underwriting Income (Six months ended June 30)

Earned Prem Loss, LAE, & U/W Exp

periods and the largest mid-year loss since 2012. The Combined Ratio

downturn was primarily driven by a deterioration in $380 110%

personal auto results, as the rising severity of liability losses $360

and inflationary pressure on physical damage resulted in $340

rate adequacy challenges for carriers. Underwriting 105%

$320

performance was also negatively impacted by commercial

liability lines, where commercial carriers have seen a steady $300

upward trend in calendar year loss ratios over the last few $280 100%

years, driven by economic and social inflation. To a lesser $260

extent, insured losses from natural catastrophes totaling $240

roughly $19.0 billion, nearly all related to thunderstorms 95%

$220

and tornadoes, also had an impact on underwriting results.

$200

For the current period, net premiums earned increased $180 ($B) '13 '14 '15 '16 '17 '18 '19 '20 '21 '22

90%

8.8% to $362.6 billion while net losses and LAE incurred

increased 15.0% to $266.6 billion resulting in a 4.0-point

© 2022 National Association of Insurance Commissioners [3]

U.S. Property & Casualty and Title Insurance Industries – 2022 First Half Results

deterioration in the net loss ratio to 73.5%. The 10.2% growth in net premiums written outpaced the 6.4% increase in

underwriting expenses, resulting in a small improvement in the expense ratio to 25.7%. Overall, the combined ratio

deteriorated 2.8-points to 99.7%.

Worsening Auto Results Pure Direct Loss Ratio - six months ended

As economic activity returned to normal in 2021 June 30,

following the Covid-19 shutdowns, auto claims activity 80.0%

returned to normal frequency. The YoY increase in

frequency is now compounded by economic inflation and 60.0%

supply chain issues which has driven the increase in loss

severity as the accompanying chart shows. Auto liability 40.0%

represented 27.3% of total industry direct losses incurred

in the first half of 2022. Commercial auto liability losses 20.0%

increased 17.5% while personal auto liability losses

increased 18.5%. Auto physical damage losses increased 0.0%

2017 2018 2019 2020 2021 2022

34.0% compared to the prior year to date and Personal Auto Liability Commercial Auto Liability Auto Physical Damage

represented 19.0% of total direct losses incurred.

Commercial Liability

Commercial liability, particularly auto (above) and other liability-occurrence, have been challenging lines of business in

recent years from an underwriting standpoint. With regard to other liability-occurrence, underwriting losses have been

recognized each year since 2013. Loss costs have trended upward in recent years primarily due to adverse development

of prior accident year reserves, rising costs due to social inflation, and a prolonged stretch of soft market conditions

that existed until roughly 2020 in most lines. For the current period, the pure direct loss ratio (PDLR) increased 2.1-

points since the prior year end to 63.6%.

The chart below shows a sharp increase in average net claim payments in the last three years for carriers that report

claim count information per claimant. In addition, adverse development of prior accident year reserves occurred in the

last seven years. It was noted that the 2021 deficiency added 5.1-points to the calendar year net loss ratio of 71%.

Other Liability - Occurrence

PY Reserve Development Accident Year Average Net Claim Payments in

($ in millions) Initial Loss Year

$3,660 ($ in thousands and Excludes A&O)

$3,098

$2,639

$2,371

$2,125 $1.2

$1.1

$1.0

$1,214 $0.6

$834

$102

$0.8

$0.5 $0.5

$(142) $0.4

$0.4

$0.3 $0.3

$(1,248)

2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

Accident Year Initial Loss Year Average (2012-2021)

© 2022 National Association of Insurance Commissioners [4]

U.S. Property & Casualty and Title Insurance Industries – 2022 First Half Results

INVESTMENT OPERATIONS

Investment gains were 10.8% higher than the first half Investment Income (Six months ended June 30)

of last year, totaling $42.8 billion for the six months

Investment Income ($B) Investment Yield (Annualized)

ended June 30, 2022. Net investment income earned

$45.0 4.5%

was 35.7% higher while the downturn in equity markets

resulted in a 63.3% decrease in realized capital gains to $40.0 4.0%

$3.6 billion compared to $9.7 billion a year ago. 3.5%

$35.0

3.0%

Investment yield (annualized) was 3.75% versus 2.90% $30.0 2.5%

for the prior year period. The primary factor for the

increase in the investment yield is an increase in the $25.0 2.0%

federal funds rate. The U.S. Federal Reserve (Fed) has 1.5%

increased the federal funds rate at five straight $20.0

1.0%

meetings in 2022, the most activity since 2005, to $15.0

combat inflation. The Fed raised the rate by three 0.5%

quarters of a point in September for the third time in $10.0 0.0%

2022, bringing the benchmark interest rate up to a '13 '14 '15 '16 '17 '18 '19 '20 '21 '22

target range of 3-3.25%, the highest since 2008.

A trend in the industry’s cash and invested assets allocation is shown below. Bonds comprised the majority totaling

$1.2 trillion, which equated to 51.1% of total cash and invested assets at June 30, 2022. It is important to note there

has been a shift in investment strategy to riskier investments over the last several years in response to the lower

investment rate environment. The lower percentage of unaffiliated equities to total cash and invested assets at June

30, 2022 compared to the prior year represented lower valuations resulting from the downturn in equity markets

rather than a shift in investment strategy. In fact, property & casualty insurers purchased more equities in the first half

of the year compared to the same period last year.

Cash and Invested Assets Composition Dec. 31, 2013-2021 and June 30, 2022

6.8% 7.1% 7.3% 7.4% 8.3% 8.0% 7.9% 8.6% 8.4% 7.9%

7.3% 7.5% 7.2% 7.5% 7.6% 7.4% 7.3% 8.1% 7.5% 7.8%

13.2% 13.0% 13.4% 13.7% 14.1% 14.0% 14.4% 14.1%

14.3% 19.7%

15.7% 16.3% 15.7% 15.9% 16.0%

17.4% 18.8% 18.8% 21.4% 13.5%

57.0% 56.0% 56.4% 55.5% 52.7% 54.7% 51.6% 50.2% 48.6% 51.1%

2013 2014 2015 2016 2017 2018 2019 2020 2021 30-Jun-22

Bonds Unaffiliated Equities Affiliated Equities BA Assets Other

© 2022 National Association of Insurance Commissioners [5]

U.S. Property & Casualty and Title Insurance Industries – 2022 First Half Results

NET INCOME Net Income (Six months ended June 30)

Despite the unfavorable underwriting results, the industry Net Income ($B) ROR

still recorded a profit of $34.0 billion in the first half of $45 14%

2022 due to the previously mentioned increase in $40 12%

investment gains. $35

10%

Return on revenue (RoR) of 8.4% reflected the solid $30

profitability but was 2.3-points lower compared to last $25 8%

year’s RoR of 10.7% as net income was lower in relation to $20

6%

net premiums earned and investment gains.

$15

4%

CASH FLOW & LIQUIDITY $10

2%

Net cash provided by operating activities decreased 25.6% $5

compared to the same period in 2021 to $47.8 billion. The $0 0%

deterioration stemmed from a 24.7% increase in benefit '13 '14 '15 '16 '17 '18 '19 '20 '21 '22

and loss related payments related to higher loss costs

primarily in the personal auto and commercial liability Cash from Operations (Six months ended June 30)

markets. Partially offsetting the increase in loss payments $70 $64.2

was a 7.1% increase in premiums collected net of

reinsurance and the previously mentioned increase in $60

investment income.

$50 $45.9 $47.8

The liquidity ratio remained solid, but worsened 4.5-points $40.8

$40 $37.2

since the prior year-end to 79.7% at June 30, 2022. Liquid

assets increased 2.6% while adjusted liabilities increased $30 $26.4 $26.1

at a greater pace of 7.4%. $23.3 $22.9

$20 $16.0

CAPITAL & SURPLUS

$10

Industry aggregated policyholders’ surplus (adjusted to

eliminate stacking) totaled $989.8 billion at June 30, 2022, $0

an 8.1% decrease compared to $1.1 trillion at December (Billions) '13 '14 '15 '16 '17 '18 '19 '20 '21 '22

31, 2021. The decline was due to unrealized capital losses

of $122.1 billion reflecting the recent downturn in equity

markets.

Capital & Surplus ($B)

$1,100

989.8

$1,000

$900

$800

$700

$600

$500

$400

$300

$200

'00 '02 '04 '06 '08 '10 '12 '14 '16 '18 20 6/30/2022

© 2022 National Association of Insurance Commissioners [6]

U.S. Property & Casualty and Title Insurance Industries – 2022 First Half Results

RESERVES

Loss and LAE reserves increased 2.4% since the prior year- Loss & LAE Reserves ($B)

end to $816.9 billion at June 30, 2022, and was comprised Loss & LAE Reserves Reserve Leverage

of $683.2 billion unpaid losses and $133.7 billion unpaid $850 140%

LAE. For the current period, reserve leverage worsened $817

$798

8.5-points to 74.7% compared to 82.5% at the prior year- $800 130%

end attributable to the decline in surplus.

$750 $735 120%

The trend in net favorable loss reserve development $700

$692

110%

$673

continued with an overall redundancy of $6.8 billion in the $658

first half of 2022, which consisted of a $60.1 billion $650 $632 100%

$609 $612 $618

redundancy in prior year IBNR loss and LAE reserves,

$600 90%

partially offset by a $54.2 billion deficiency in prior year

known case loss and LAE reserves. $550 80%

$500 70%

'13 '14 '15 '16 '17 '18 '19 '20 '21 6/22

LOOKING AHEAD

While the industry remained profitable and well capitalized in the first half of 2022 there are a number of challenges

facing the property and casualty market that will likely put a strain on insurers’ bottom lines.

• Economic inflation is at a forty year high, leading to increased loss costs in property lines that could impact

reserve adequacy.

• There has been an increase in frequency and severity of natural disasters which has resulted in a 10%-30%

increase in reinsurance pricing. Reports indicate insured losses from Hurricane Ian could reach between $40-

$60 billion.

• Social inflation, a sharp rise in compensatory jury awards driven by third party capital funding lawsuits, was a

main driver in a deterioration in commercial liability lines in the first half of the year.

• The stock market downturn resulted in significant unrealized capital losses in 2022 as property & casualty

companies invest more in equities than they did ten years ago (see cash and invested assets chart on the

bottom of page 5). This was the primary factor in the decline in surplus.

© 2022 National Association of Insurance Commissioners [7]

U.S. Property & Casualty and Title Insurance Industries – 2022 First Half Results

Title Industry

Title Industry Results (in millions, except for percent data)

For the six months

ended June 30, YoY Chg. 2022 2021 2020 2019 2018

Direct Premiums Written (0.7)% $12,234 $12,315 $8,136 $6,913 $7,019

Direct Ops. 5.4% $1,292 $1,226 $863 $854 $832

Non-Aff. Agency Ops. 0.3% $8,022 $7,997 $5,211 $4,257 $4,354

Aff. Agency Ops. (5.6)% $2,919 $3,092 $2,063 $1,803 $1,833

Premiums Earned 0.2% $11,988 $11,969 $8,034 $6,871 $6,982

Loss & LAE Incurred 9.5% $313 $285 $255 $283 $306

Operating Exp Incurred 0.1% $11,461 $11,454 $7,828 $6,710 $6,739

Net Operating Gain/(Loss) (8.8)% $1,085 $1,190 $633 $465 $499

Net Inv. Income Earned 4.9% $177 $168 $203 $202 $160

Net Realized Gain/(Loss) NM $77 $25 $(26) $44 $13

Net Inv. Gain (Loss) 31.6% $254 $193 $178 $247 $174

Net Income (1.3)% $1,093 $1,108 $675 $585 $676

Loss Ratio 0.2-pts 2.6% 2.4% 3.2% 4.1% 4.4%

Expense Ratio (0.1)-pts 95.6% 95.7% 97.5% 97.7% 96.6%

Combined Ratio 0.1-pts 98.2% 98.1% 100.6% 101.8% 100.9%

Net Unrealized Gain/(Loss) NM $(667) $270 $(187) $215 $(75)

Net Cash from Operations (31.6)% $879 $1,286 $689 $348 $462

NM=Not Meaningful

Premium

The Monthly New Residential Construction, June 2022 report from the U.S. Census Bureau and the U.S. Department of

Housing and Urban Development showed June privately owned housing starts were down 6.3% (±10.2%) from June

2021. Nationally, completions increased 4.6 % (±13.4%) over the past year, while permits increased by 1.4%. These

changes over the prior year to date were seen across all regions.

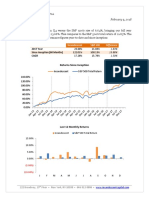

The U.S. title insurance business reflected this decrease in Mid-Year Direct Premiums Written - Title ($B)

starts as direct premiums written (DPW) stagnated,

decreasing 0.7% (or $81 million) to $12.2 billion for the first Direct

$14.0 $12.3 $12.2

half of 2022, with this decrease concentrated in affiliated Non-Aff. Agency

$12.0 Aff. Agency

agency operations. The majority (65.6%) of DPW continued $3.1 $2.9

to be produced through non-affiliated agency operations, $10.0 $8.1

as has been true for the past several years. $8.0 $7.0 $6.9

$2.1

$6.0 $1.8 $1.8

The four largest title insurance companies continued to $8.0 $8.0

dominate market share, comprising 63.8% collectively, a $4.0

$4.4 $4.3 $5.2

2.3 point increase over mid-year 2021. The largest $2.0

insurance group, containing two of the four largest $- $0.8 $0.9 $0.9 $1.2 $1.3

companies as well as 3 smaller insurers, wrote $3.9 billion 2018 2019 2020 2021 2022

© 2022 National Association of Insurance Commissioners [8]

U.S. Property & Casualty and Title Insurance Industries – 2022 First Half Results

(32.2%) in DPW, while the second-largest insurance group wrote $2.8 billion (23.5%) in DPW. The third largest group

wrote $1.8 billion (15.1%) in DPW. Insurers without a group wrote $1.7 billion (13.9%) in DPW.

The five largest states by DPW (TX, FL, CA, NY, and PA) remained the same as mid-year 2021. Together, these five states

(shown in light grey below) represented 48.0% of the market during the first half of 2022, up 1.7 points from the prior

year end. Only three of these states experienced growth over mid-year 2021, with Pennsylvania decreasing 15.4% and

California decreasing 18.5% compared to the prior mid-year period. Twenty-one locales experienced DPW growth

compared to the prior mid-year period while thirty-six saw a decrease, with 20 seeing a decrease of greater than 10%.

The overall average (below) was a slight decrease in DPW of 0.6%.

Four states saw change in mid-year DPW exceeding 20%. Alaska (-20.0%) and Oregon (-28.7%) saw decreases of over

20%, while Texas (20.5%) and Tennessee (21.7%) saw growth over 20%. The Virgin Islands saw growth of 68.6% and

Northern Mariana Islands saw growth of 81.0%, both on very small DPW totals.

80.0%

DPW by State: YoY Change

60.0%

40.0%

20.0%

0.0%

-20.0%

-40.0%

VI

TN

TX

LA

VA

OK

WV

OT

WA

OR

PR

OH

VT

PA

RI

WY

HI

WI

Average

IL

KY

IN

ID

IA

MP

KS

CT

CO

CA

MN

ME

MO

MT

DC

MD

MA

UT

MI

AK

NY

GU

MS

DE

AL

GA

NC

FL

SC

CAN

SD

NV

NJ

ND

NE

NH

AR

NM

AZ

Profitability

A net operating gain of $1.1 billion was reported for the first half of 2022, representing an 8.8% YoY decrease compared

to $1.2 billion for the first half of 2021. This decrease was attributable to a 0.6% (or $71.8 million) decrease in total

operating income to $12.9 billion and a 0.3% (or $33.3 million) increase in total operating expenses to $11.8 billion.

The decrease in total operating income was largely driven by a 18.8% ($65.2 million) decrease in escrow and settlement

services, while the increase in operating expenses was largely due to a 9.5% ($27.1 million) increase in losses and loss

adjustment expenses incurred.

© 2022 National Association of Insurance Commissioners [9]

U.S. Property & Casualty and Title Insurance Industries – 2022 First Half Results

The mid-year combined ratio of 98.2% was 0.1 points higher Mid-Year Net Income ($M)

than last year but remains below 100% for only the second and the Combined Ratio

103%

time since 2009. The loss ratio increased 0.2 points to 2.6%, $1,200 $1,108 $1,093

reversing a longstanding trend of decreasing values, while $1,100 102%

the expense ratio decreased 0.1 points, continuing its $1,000 100.6%

101.8% 101%

trend. $900

$800 100.9% 100%

A net investment gain of $254.2 million was 31.6% higher $676 $675

$700

$585 99%

compared to the prior year period. Net investment income $600

earned was $176.8 million, an $8.3 million increase 98%

$500

compared to 2021. Net realized capital gains increased 98.1% 98.2%

$400 97%

214.0% over 2021, to $77.4 million. This increase of $52.7

2018 2019 2020 2021 2022

million, larger than the prior year’s increase of $50.3 million,

brought net realized capital gains above the pre-pandemic Net Income Combined Ratio

level.

Overall, the solid net investment gain was insufficient to offset the decline in operating income, decreasing net income

by 1.3% to $1.1 billion for the first half of 2022. Mid-year net income is still nearly double the industry’s 2019 mid-year

net income.

Capital & Surplus

June 30 PHS ($M) and Return of Surplus

$8,000

$6,978

20% Policyholder Surplus (PHS) decreased 7.9% compared to

$6,429 mid-year 2021. This decrease was primarily driven by

18%

$6,000 $5,323 $5,450 $924.6 million in dividends to stockholders. Additionally,

$5,079

16% there was a $666.5 million decrease to PHS from the

16.8%

$4,000

16.1%

14%

negative impact of rising net unrealized losses

13.7% 12% The return on surplus decreased 0.7 points YoY, as both

$2,000 12.1%

11.4% 10% net income and PHS declined, but remains higher than

pre-pandemic levels.

$ 8%

2018 2019 2020 2021 2022

PHS ($M) Return on Surplus

Cash & Liquidity

Net cash from operations for the first half of 2022 totaled $879.3 million, a 31.6% decrease compared to the same

period in 2021. Cash inflows decreased a nominal 0.7% to $13.3 billion while cash outflows increased 2.5% ($306.7

million) to $12.4 billion. The primary driver of outflow change was a 2.2% ($255.6 million) increase in commissions,

expenses paid, and aggregate write-ins for deductions.

Acquisitions exceeded dispositions in investments, resulting in a net loss for cash from investments of $5.4 million, a

large improvement over the prior mid-year’s net loss of $533.7 million. This change was likely due to financial market

deterioration, making new investments less attractive. Net cash from financing recorded a loss of $1.2 billion in cash,

nearly double the prior year’s loss of $696.0 million. This loss included $47.5 million in cash applied for surplus notes

and capital as well as a $289.3 million (45.5%) increase to $924.6 million in dividends to stockholders.

Liquidity remained strong at 67.4% as of June 30, 2022. This was a 3 point deterioration over mid-year 2021 Liquid

assets increased 1.0% to $10.1 billion on a small 0.3% ($35.5 million) increase in cash and invested assets as well as a

4.3% ($69.6 million) decrease in affiliated investments.

© 2022 National Association of Insurance Commissioners [10]

U.S. Property & Casualty and Title Insurance Industries – 2022 First Half Results

Mid-year Cash Flows ($M) and Liquidity Ratio

$1,500 67.4% 70%

$1,286

65.3% 65.9%

$1,000 64.5%

63.7% $879

$462 65%

$500 $689

$119 $349

$70 $109 $56

$ 60%

$(3) $(24) $(98) $(5)

$(500) $(344)

$(413) $(460) $(534)

$(696) 55%

$(1,000) $(763)

$(1,217)

$(1,500) 50%

2018 2019 2020 2021 2022

Cash From Operations Cash From Investments Cash from Finance Net Cash Liquidity Ratio

NAIC Financial Regulatory Services

Financial Analysis and Examination Department

Contributors:

Brian Briggs, Senior Financial Analyst

Bbriggs@naic.org | 816.783.8925

Topher Hughes, Financial Analyst

Chughes@naic.org | 816.783.8125

Contacts:

Bruce Jenson, Assistant Director - Solvency Monitoring

BJenson@naic.org | 816.783.8348

Andy Daleo, Senior Manager – Property/Casualty and International Analysis

ADaleo@naic.org | 816.783.8141

Rodney Good, Property/Casualty & Title Financial Analysis Manager II

RGood@naic.org | 816.783.8430

DISCLAIMER

The NAIC 2022 Mid-Year Property/Casualty & Title Insurance Industry Analysis Report is a limited scope analysis based on the aggregated

information filed to the NAIC’s Financial Data Repository as of June 30, 2022 and written by the Financial Regulatory Services Department staff.

This report does not constitute the official opinion or views of the NAIC membership or any particular state insurance department.

© 2022 National Association of Insurance Commissioners [11]

You might also like

- Tattoo Parlor Business PlanDocument19 pagesTattoo Parlor Business PlanChanchal Gulati100% (1)

- AP Investments Quizzer QDocument55 pagesAP Investments Quizzer QLordson Ramos75% (4)

- FIN526 Financial Statement Analysis Template JeffDocument5 pagesFIN526 Financial Statement Analysis Template Jeffjeffff woodsNo ratings yet

- PC2020 Mid Year ReportDocument9 pagesPC2020 Mid Year ReportKW SoldsNo ratings yet

- 2022 Franchising Economic OutlookDocument36 pages2022 Franchising Economic OutlookNguyệt Nguyễn MinhNo ratings yet

- Backus Valuation ExcelDocument28 pagesBackus Valuation ExcelAdrian MontoyaNo ratings yet

- Data UgaDocument2 pagesData UgasheokandgangNo ratings yet

- WWE q1 2020 Trending SchedulesDocument6 pagesWWE q1 2020 Trending SchedulesHeel By NatureNo ratings yet

- Class Exercise Fashion Company Three Statements Model - CompletedDocument16 pagesClass Exercise Fashion Company Three Statements Model - CompletedbobNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2020.21Document85 pagesCurrent Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2020.21SuZan TimilsinaNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2020.21Document85 pagesCurrent Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2020.21devi ghimireNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2020.21Document85 pagesCurrent Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2020.21devi ghimireNo ratings yet

- Data Col PDFDocument2 pagesData Col PDFNelson ArturoNo ratings yet

- AMC Entertainment Holdings, Inc. Reports Second Quarter 2023 ResultsDocument17 pagesAMC Entertainment Holdings, Inc. Reports Second Quarter 2023 ResultsDinheirama.comNo ratings yet

- Egypt, Arab Rep.: Income and Economic GrowthDocument2 pagesEgypt, Arab Rep.: Income and Economic GrowthPlaystation AccountNo ratings yet

- Appendix 4E: South32 LimitedDocument42 pagesAppendix 4E: South32 LimitedTimBarrowsNo ratings yet

- ABSA Bank Kenya FY23 Earnings NoteDocument4 pagesABSA Bank Kenya FY23 Earnings NoteDenis KibetNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2022.23 4Document84 pagesCurrent Macroeconomic and Financial Situation Tables Based On Eleven Months Data of 2022.23 4shyam karkiNo ratings yet

- Tanzania: Income and Economic GrowthDocument2 pagesTanzania: Income and Economic GrowthFelix MgimbaNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Eight Months Data 2020.21 1Document83 pagesCurrent Macroeconomic and Financial Situation Tables Based On Eight Months Data 2020.21 1Kiran RaiNo ratings yet

- Investor Conference 2023Q2 en - tcm33 86078Document27 pagesInvestor Conference 2023Q2 en - tcm33 86078潘祈睿No ratings yet

- MCB Focus No. 83 - Economic UpdateDocument12 pagesMCB Focus No. 83 - Economic UpdateTanNo ratings yet

- Static Files99811264 94ac 4767 b4b8 A9ca45f1629aDocument10 pagesStatic Files99811264 94ac 4767 b4b8 A9ca45f1629arrroloNo ratings yet

- Philippines Economic OutlookDocument9 pagesPhilippines Economic Outlookrain06021992No ratings yet

- Japan Statistical 2010Document2 pagesJapan Statistical 2010Gabriel KanekoNo ratings yet

- Nestle India Dupont AnalysisDocument2 pagesNestle India Dupont AnalysisINDIAN REALITY SHOWSNo ratings yet

- Tech Mahindra Valuation Report FY21 Equity Inv CIA3Document5 pagesTech Mahindra Valuation Report FY21 Equity Inv CIA3safwan hosainNo ratings yet

- Monthly Bulletin July 2023 EnglishDocument13 pagesMonthly Bulletin July 2023 EnglishNirmal MenonNo ratings yet

- Naic-Covid19 03202020 PDFDocument12 pagesNaic-Covid19 03202020 PDFShrinivas PuliNo ratings yet

- Naic-Covid19 03202020 PDFDocument12 pagesNaic-Covid19 03202020 PDFShrinivas PuliNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On One Month Data of 2023.24 1Document85 pagesCurrent Macroeconomic and Financial Situation Tables Based On One Month Data of 2023.24 1shyam karkiNo ratings yet

- Maruti India Limited: SuzukiDocument15 pagesMaruti India Limited: SuzukiNikhil AdesaraNo ratings yet

- V Guard Industries Q3 FY22 Results PresentationDocument17 pagesV Guard Industries Q3 FY22 Results PresentationRATHINo ratings yet

- NG Debt Press Release June 2023 1Document2 pagesNG Debt Press Release June 2023 1Ma. Theresa BerdanNo ratings yet

- Statistical TablesDocument108 pagesStatistical TablesAakriti AdhikariNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Eight Months Data of 2022.23Document84 pagesCurrent Macroeconomic and Financial Situation Tables Based On Eight Months Data of 2022.23acharya.arpan08No ratings yet

- 101 01 Otis 10 K RawDocument322 pages101 01 Otis 10 K Rawzhou maggieNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Seven Months Data of 2022.23 3Document84 pagesCurrent Macroeconomic and Financial Situation Tables Based On Seven Months Data of 2022.23 3shyam karkiNo ratings yet

- Target Corporation - Simple Operating Model: General AssumptionsDocument6 pagesTarget Corporation - Simple Operating Model: General AssumptionsoussemNo ratings yet

- Current Macroeconomic Situation Tables Based On Six Months Data of 2080.81 1Document85 pagesCurrent Macroeconomic Situation Tables Based On Six Months Data of 2080.81 1gharmabasNo ratings yet

- Econ AssDocument2 pagesEcon AssHannah Joyce MirandaNo ratings yet

- Strategic Management - IBMDocument20 pagesStrategic Management - IBMPaulArsenieNo ratings yet

- NYT Press Release Q3 2023Document22 pagesNYT Press Release Q3 2023Hafidz Ash ShidieqyNo ratings yet

- Global Crisis and The Indian Economy-On A Few Unconventional AssertionsDocument23 pagesGlobal Crisis and The Indian Economy-On A Few Unconventional AssertionsDipesh MalhotraNo ratings yet

- IDirect Banking SectorReport Apr21Document12 pagesIDirect Banking SectorReport Apr21Vipul Braj BhartiaNo ratings yet

- Zenith Bank Group 2022 Fye Press ReleaseDocument4 pagesZenith Bank Group 2022 Fye Press Releasechiomachristian43No ratings yet

- FTNT - Q2'21 Investor Slides FinalDocument14 pagesFTNT - Q2'21 Investor Slides FinalJOhnNo ratings yet

- Summary of Economic & Financial Data - September 2020Document14 pagesSummary of Economic & Financial Data - September 2020Fuaad DodooNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Three Months Data of 2021.22 2Document84 pagesCurrent Macroeconomic and Financial Situation Tables Based On Three Months Data of 2021.22 2Chetan PokharelNo ratings yet

- CRISIL - Indian Pharmaceutical and CDMO MarketDocument69 pagesCRISIL - Indian Pharmaceutical and CDMO Marketnandhiniravi90100% (1)

- CS&FP 2021-2022 Example Model Hershire Versus SeepersDocument6 pagesCS&FP 2021-2022 Example Model Hershire Versus Seepersgabriela2299No ratings yet

- US Bangladesh RelationDocument5 pagesUS Bangladesh RelationSayedur RahmanNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Six Months Data of 2022.23 1Document84 pagesCurrent Macroeconomic and Financial Situation Tables Based On Six Months Data of 2022.23 1shyam karkiNo ratings yet

- Nucor Corporation (NUE) : Key MetricsDocument3 pagesNucor Corporation (NUE) : Key MetricsepbeaverNo ratings yet

- Life Insurance Update For November 2023Document6 pagesLife Insurance Update For November 2023rajautoprincNo ratings yet

- Annual Letter 2017Document24 pagesAnnual Letter 2017Incandescent CapitalNo ratings yet

- PWC Ghana 2023 Budget DigestDocument49 pagesPWC Ghana 2023 Budget DigestAl SwanzyNo ratings yet

- Current Macroeconomic and Financial Situation Tables Based On Six Months Data of 2021.22Document85 pagesCurrent Macroeconomic and Financial Situation Tables Based On Six Months Data of 2021.22Sashank GaudelNo ratings yet

- Data PakDocument2 pagesData Pakamberharoon18No ratings yet

- 2018 - Investor - Presentation - Q1-2019 ICICILombard - General - Insurance PDFDocument20 pages2018 - Investor - Presentation - Q1-2019 ICICILombard - General - Insurance PDFRAHUL PANDEYNo ratings yet

- Evercore Partners 8.6.13 PDFDocument6 pagesEvercore Partners 8.6.13 PDFChad Thayer VNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Admin,+4 +Muhammad+Iqbal+Al+Banna+ (Edited) +2Document9 pagesAdmin,+4 +Muhammad+Iqbal+Al+Banna+ (Edited) +2Daniela TunaruNo ratings yet

- ThebureaucratsDocument30 pagesThebureaucratsDaniela TunaruNo ratings yet

- Admin,+4 +Muhammad+Iqbal+Al+Banna+ (Edited) +2Document11 pagesAdmin,+4 +Muhammad+Iqbal+Al+Banna+ (Edited) +2Daniela TunaruNo ratings yet

- The Paradox of Bureaucratic Collaboration GovernmeDocument13 pagesThe Paradox of Bureaucratic Collaboration GovernmeDaniela TunaruNo ratings yet

- Published Webers Ideal Bureaucracy and ADocument10 pagesPublished Webers Ideal Bureaucracy and ADaniela TunaruNo ratings yet

- Effects of Violent Video Games On Aggressive BehavDocument8 pagesEffects of Violent Video Games On Aggressive BehavDaniela TunaruNo ratings yet

- Mental Disorderand CrimeDocument4 pagesMental Disorderand CrimeDaniela TunaruNo ratings yet

- Global Insurance Report 2022Document37 pagesGlobal Insurance Report 2022Daniela TunaruNo ratings yet

- 2022 Federal Insurance Office Annual Report On The Insurance IndustryDocument73 pages2022 Federal Insurance Office Annual Report On The Insurance IndustryDaniela TunaruNo ratings yet

- Engel CurveDocument48 pagesEngel CurveDaniela TunaruNo ratings yet

- Predeescu Dementa PDFDocument2 pagesPredeescu Dementa PDFDaniela TunaruNo ratings yet

- Despre NestleDocument7 pagesDespre NestleDaniela TunaruNo ratings yet

- Demo Ndivind$defaultview SpreadsheetDocument19 pagesDemo Ndivind$defaultview SpreadsheetDaniela TunaruNo ratings yet

- Case Study of NestléDocument7 pagesCase Study of NestléDaniela TunaruNo ratings yet

- Death Through The Ages A Brief OverviewDocument13 pagesDeath Through The Ages A Brief OverviewDaniela TunaruNo ratings yet

- Case Study of Nestle LO2&LO3Document8 pagesCase Study of Nestle LO2&LO3Daniela TunaruNo ratings yet

- Reasoning About Climate ChangeDocument37 pagesReasoning About Climate ChangeDaniela TunaruNo ratings yet

- Teaching Business Communication Skills: A Clarion Call: February 2018Document20 pagesTeaching Business Communication Skills: A Clarion Call: February 2018Daniela TunaruNo ratings yet

- Public Administration Characteristics and Performance in EU28Document39 pagesPublic Administration Characteristics and Performance in EU28Daniela TunaruNo ratings yet

- Structure of SPO EssayDocument1 pageStructure of SPO EssayDaniela TunaruNo ratings yet

- Power in Social Organization: A Sociological Review: February 2008Document22 pagesPower in Social Organization: A Sociological Review: February 2008Daniela TunaruNo ratings yet

- Power A Central Force Governing PsycholoDocument33 pagesPower A Central Force Governing PsycholoDaniela TunaruNo ratings yet

- Austerity and RefDocument9 pagesAusterity and RefDaniela TunaruNo ratings yet

- Learning From Our Mistakes Public Management Reform and The Hope of Open GovernmentDocument16 pagesLearning From Our Mistakes Public Management Reform and The Hope of Open GovernmentDaniela TunaruNo ratings yet

- (c39611f7 3543 4a0a 9e8e B7af896e8e70) Management Acceleration Programme INSEADDocument22 pages(c39611f7 3543 4a0a 9e8e B7af896e8e70) Management Acceleration Programme INSEADEric BalagourouNo ratings yet

- Financial System of BangladeshDocument14 pagesFinancial System of BangladeshMosharraf SauravNo ratings yet

- Law II R. Kit Final As at 3 July 2006Document248 pagesLaw II R. Kit Final As at 3 July 2006kevoh1No ratings yet

- Tax Exemption Rules For Cooperatives ApprovedDocument2 pagesTax Exemption Rules For Cooperatives Approvedmrlee28No ratings yet

- Engineering EconomicsDocument161 pagesEngineering EconomicsggrNo ratings yet

- Kanohar Electricals Limited: Ra BillDocument2 pagesKanohar Electricals Limited: Ra BillAnoop Dikshit100% (1)

- Sault Ste. Marie 2014 Preliminary BudgetDocument313 pagesSault Ste. Marie 2014 Preliminary BudgetMichael PurvisNo ratings yet

- Calculus Mathematics For BusinessDocument112 pagesCalculus Mathematics For BusinessR. Mega MahmudiaNo ratings yet

- WelcomeKit - T02331230922015210 - 4 Nov 2022Document3 pagesWelcomeKit - T02331230922015210 - 4 Nov 2022Sambath KumarNo ratings yet

- Best Practices SOD Remediation ISACA V2 06.12.15Document12 pagesBest Practices SOD Remediation ISACA V2 06.12.15Norman AdimoNo ratings yet

- Petroleum LicensingDocument26 pagesPetroleum LicensingZhangHuiChenNo ratings yet

- SOP - FinanceDocument17 pagesSOP - Financetomzayco67% (3)

- Invoice: PT - Sitc IndonesiaDocument1 pageInvoice: PT - Sitc IndonesiaMuhammad SyukurNo ratings yet

- Proforma TECHTOUCH 2023.7Document10 pagesProforma TECHTOUCH 2023.7tesemaNo ratings yet

- Step by Step Process For New Business ApplicationDocument2 pagesStep by Step Process For New Business ApplicationJed de LeonNo ratings yet

- Welcome To The Ifrs For Smes UpdateDocument3 pagesWelcome To The Ifrs For Smes UpdateDarrelNo ratings yet

- Guidelines On The Establishment of One Person Corporation PDFDocument19 pagesGuidelines On The Establishment of One Person Corporation PDFSeasaltandsand100% (1)

- 09 Hontiveros V TRBDocument45 pages09 Hontiveros V TRBMichael RentozaNo ratings yet

- Benefits, Risks and Opportunities of Financial Derivatives in BangladeshDocument12 pagesBenefits, Risks and Opportunities of Financial Derivatives in BangladeshAndy DropshipperNo ratings yet

- Ashutosh Eco11Document27 pagesAshutosh Eco11ashish664No ratings yet

- Question Paper Mba 2018Document15 pagesQuestion Paper Mba 2018Karan Veer SinghNo ratings yet

- Affidavit of Adverse ClaimDocument2 pagesAffidavit of Adverse ClaimMagdalena TabaniagNo ratings yet

- Curriculum For Amfi-Mutual Fund (Basic) Module: Chapter One Concept and Role of Mutual Funds Section OneDocument10 pagesCurriculum For Amfi-Mutual Fund (Basic) Module: Chapter One Concept and Role of Mutual Funds Section OneJignesh MehtaNo ratings yet

- Elizabeth Del Carmen Vs Spouses Restituto Sabordo and Mima Mahilim-SabordoDocument6 pagesElizabeth Del Carmen Vs Spouses Restituto Sabordo and Mima Mahilim-SabordoChoi ChoiNo ratings yet

- 1-Accounting EquationDocument4 pages1-Accounting EquationNoraNo ratings yet

- Sub: Erection Work Order - CSPDCL Rural Electrification Works in The Dist of BastarDocument9 pagesSub: Erection Work Order - CSPDCL Rural Electrification Works in The Dist of BastarKiran Kumar ViswarajuNo ratings yet

- ACC 8211 Oil and Gas Accounting PDFDocument93 pagesACC 8211 Oil and Gas Accounting PDFNikhil AnandNo ratings yet

- Gujarat State Road Transport Corporation: Franchisee Reservation Voucher Tin: PQMFX2Document2 pagesGujarat State Road Transport Corporation: Franchisee Reservation Voucher Tin: PQMFX2vipulNo ratings yet