Professional Documents

Culture Documents

12 Month Rolling Cash Flow Forecast - Blank

12 Month Rolling Cash Flow Forecast - Blank

Uploaded by

Muskan GargOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

12 Month Rolling Cash Flow Forecast - Blank

12 Month Rolling Cash Flow Forecast - Blank

Uploaded by

Muskan GargCopyright:

Available Formats

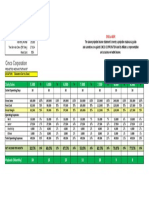

Monthly Cash Flow Forecasting Model

Table of Contents

12 Month Rolling Forecast

Notes

This Excel model is for educational purposes only and should not be used for any other reason.

All content is Copyright material of CFI Education Inc.

https://corporatefinanceinstitute.com/

© 2019 CFI Education Inc.

All rights reserved. The contents of this publication, including but not limited to all written material, content layout, images, formulas, and code, are protected under international copyright and

Strictly Confidential

otected under international copyright and trademark laws.

© Corporate Finance Institute Actuals --> Forecast -->

US$ thousands 31/Aug/17

Balance Sheet Check OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK OK

Assumptions

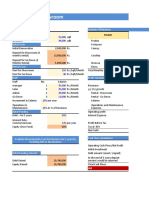

Income Statement

Balance Sheet

Cash Flow Statement

Supporting Schedules

Summary Charts

© Management Development Associates (NA) Inc. - 21317

Revenue assumption

Number of stores

Number of new stores 0.0 1.0 0.0 0.0 1.0 0.0

Sq ft per store 46,000.0 46,000.0 46,000.0 46,000.0 46,000.0 46,000.0

Sales per square foot ($/ft/yr) 535.0 535.0 535.0 535.0 535.0 535.0

Operating cost assumptions

Gross margins 26.5% 26.5% 26.5% 26.5% 26.5% 26.5%

SG&A 9,500 9,500 9,500 9,500 9,500 9,500

SG&A as a percent of revenues

Tax assumptions

Effective tax rate 35.0% 35.0% 35.0% 35.0% 35.0% 35.0%

Working capital assumptions

Receivable Days 7.0 7.0 7.0 7.0 7.0 7.0

Inventory Days 29.0 29.0 29.0 29.0 29.0 29.0

Payable Days 28.0 28.0 28.0 28.0 28.0 28.0

Capital expenditure assumptions

Depreciation rate 10.0% 10.0% 10.0% 10.0% 10.0% 10.0%

Cost to build per square foot 100.0 100.0 100.0 100.0 100.0 100.0

Financing assumptions

Equity raised (repurchased) 0.0 0.0 0.0 0.0 0.0 0.0

Dividends paid 0.0 0.0 0.0 0.0 0.0 0.0

Term debt issued 0.0 0.0 0.0 0.0 0.0 0.0

Term debt principal repayment 500.0 500.0 500.0 500.0 500.0 500.0

Term debt interest rate 5.75% 5.75% 5.75% 5.75% 5.75% 5.75%

Debt/Equity ratio covenant 0.75x 0.75x 0.75x 0.75x 0.75x 0.75x

Debt service coverage ratio covenant 3.00x 3.00x 3.00x 3.00x 3.00x 3.00x

0.0 0.0 1.0 0.0 0.0 0.0

46,000.0 46,000.0 46,000.0 46,000.0 46,000.0 46,000.0

535.0 535.0 535.0 535.0 535.0 535.0

26.5% 26.5% 26.5% 26.5% 26.5% 26.5%

9,500 9,500 9,500 9,500 9,500 9,500

35.0% 35.0% 35.0% 35.0% 35.0% 35.0%

7.0 7.0 7.0 7.0 7.0 7.0

29.0 29.0 29.0 29.0 29.0 29.0

28.0 28.0 28.0 28.0 28.0 28.0

10.0% 10.0% 10.0% 10.0% 10.0% 10.0%

100.0 100.0 100.0 100.0 100.0 100.0

0.0 0.0 0.0 0.0 0.0 0.0

0.0 0.0 0.0 0.0 0.0 0.0

0.0 0.0 0.0 0.0 0.0 0.0

500.0 500.0 500.0 500.0 500.0 500.0

5.75% 5.75% 5.75% 5.75% 5.75% 5.75%

0.75x 0.75x 0.75x 0.75x 0.75x 0.75x

3.00x 3.00x 3.00x 3.00x 3.00x 3.00x

You might also like

- Potato Corner Sample BreakevenDocument1 pagePotato Corner Sample BreakevenOver Mango50% (2)

- Capital Budgeting DCFDocument38 pagesCapital Budgeting DCFNadya Rizkita100% (4)

- Financial Model Forecasting - Case StudyDocument15 pagesFinancial Model Forecasting - Case Study唐鹏飞No ratings yet

- Disclaimer: International Financial Reporting Standards (IFRS) 17 Insurance Contracts ExampleDocument41 pagesDisclaimer: International Financial Reporting Standards (IFRS) 17 Insurance Contracts ExampleYen HoangNo ratings yet

- AMT Geninterest STD 2018Document9 pagesAMT Geninterest STD 2018Mai SuwanchaiyongNo ratings yet

- Financial Modeling Mid-Term ExamDocument17 pagesFinancial Modeling Mid-Term ExamКамиль БайбуринNo ratings yet

- Potato Corner Sample BreakevenDocument1 pagePotato Corner Sample Breakevenphuri.siaNo ratings yet

- Tax Attribution Percentages 30 June 2020Document5 pagesTax Attribution Percentages 30 June 2020Ben BieberNo ratings yet

- Business Plan Financial Plan: FY2020 FY2021 Fy2022Document9 pagesBusiness Plan Financial Plan: FY2020 FY2021 Fy2022Christine CarpoNo ratings yet

- Resource 20221117092754 WSC - Case - ClassDocument51 pagesResource 20221117092754 WSC - Case - ClassRajat OnzNo ratings yet

- Sample Company Project Assumptions LOC AssumptionDocument4 pagesSample Company Project Assumptions LOC AssumptionRasserNo ratings yet

- Financial Model 1Document1 pageFinancial Model 1ahmedmostafaibrahim22No ratings yet

- 02 Laboratory Exercise 1 TemplateDocument11 pages02 Laboratory Exercise 1 TemplateMarie OsorioNo ratings yet

- 03.2018 Question Answer Horizontal-2Document17 pages03.2018 Question Answer Horizontal-2umeshNo ratings yet

- 04.2018 Question Answer HorizontalDocument28 pages04.2018 Question Answer HorizontalumeshNo ratings yet

- Finance Assignment - Sugar CompanyDocument1 pageFinance Assignment - Sugar CompanyHassan KhanNo ratings yet

- Campbell Soup Three Statement Template 2021Document12 pagesCampbell Soup Three Statement Template 2021Krish ShahNo ratings yet

- Banking - Prof. Rafael Schiozer - Exercícios de Aula - Aulas 5 A 9 - SoluçõesDocument5 pagesBanking - Prof. Rafael Schiozer - Exercícios de Aula - Aulas 5 A 9 - SoluçõesCaioGamaNo ratings yet

- Trend AnalysisDocument1 pageTrend Analysisapi-385117572No ratings yet

- Case 13Document7 pagesCase 13Nguyễn Quốc TháiNo ratings yet

- Inputs For Valuation Current InputsDocument6 pagesInputs For Valuation Current Inputsapi-3763138No ratings yet

- Anta Forecast Template STD 2023Document8 pagesAnta Forecast Template STD 2023Ronnie KurtzbardNo ratings yet

- AF Ch. 4 - Analysis FS - ExcelDocument9 pagesAF Ch. 4 - Analysis FS - ExcelAlfiandriAdinNo ratings yet

- EVA, VPL e CVA 2003Document4 pagesEVA, VPL e CVA 2003Pedro CoutinhoNo ratings yet

- Valuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página871Document1 pageValuation Measuring and Managing The Value of Companies by Tim Koller, Marc Goedhart, David Wessels-Página871franzmartiniiNo ratings yet

- APECS Financial Modelling Test (Updated) - by Keng YangDocument16 pagesAPECS Financial Modelling Test (Updated) - by Keng YangDarren WongNo ratings yet

- Form of Ownership Chosen and ReasoningDocument14 pagesForm of Ownership Chosen and ReasoningSheikh MarufNo ratings yet

- FM TemplateDocument3 pagesFM TemplateWynn WizzNo ratings yet

- Dynamic ModelDocument48 pagesDynamic ModelJohnny BravoNo ratings yet

- 3PL Integrated Valuation ModelDocument15 pages3PL Integrated Valuation ModelQamar PashaNo ratings yet

- Franchise - CarDocument14 pagesFranchise - Carshrish guptaNo ratings yet

- APECS Financial Modelling Test (Updated) - DarrenDocument22 pagesAPECS Financial Modelling Test (Updated) - DarrenDarren WongNo ratings yet

- 3) Broken Models and Circular References PDFDocument7 pages3) Broken Models and Circular References PDFAkshit SoniNo ratings yet

- Sensitivity Model - CompleteDocument13 pagesSensitivity Model - CompleteMile MileNo ratings yet

- Guideline ICE1 TextOnlyDocument4 pagesGuideline ICE1 TextOnlyRima AkidNo ratings yet

- UntitledDocument2 pagesUntitledAli Mubin FitranandaNo ratings yet

- IFS - Sales Model - Blank - Extended VersionDocument6 pagesIFS - Sales Model - Blank - Extended VersionGaurav MishraNo ratings yet

- Chennai JigarthanthaDocument10 pagesChennai JigarthanthaVimal AnbalaganNo ratings yet

- Sample Questions and Solutions - Final ExamDocument4 pagesSample Questions and Solutions - Final ExamNadjah JNo ratings yet

- Chapter 6 - Capital BudgetingDocument12 pagesChapter 6 - Capital BudgetingParth GargNo ratings yet

- WacccalcDocument41 pagesWacccalcHellery FilhoNo ratings yet

- Present-Worth Analysis Example 5.1: Conventional-Payback Period: PP 195 - 196Document11 pagesPresent-Worth Analysis Example 5.1: Conventional-Payback Period: PP 195 - 196tan lee huiNo ratings yet

- 3.2 Financial PlanDocument6 pages3.2 Financial PlanMerca Rizza SolisNo ratings yet

- Dupont DPC LBO AssignmentDocument3 pagesDupont DPC LBO Assignmentw_fibNo ratings yet

- Case 11 Financial ForecastingDocument9 pagesCase 11 Financial ForecastingFD ReynosoNo ratings yet

- Ali Mubin Fitrananda - 2210312310066 - Trade Company Case For FR - AccountingDocument8 pagesAli Mubin Fitrananda - 2210312310066 - Trade Company Case For FR - AccountingAli Mubin FitranandaNo ratings yet

- Sample Company Project AssumptionsDocument4 pagesSample Company Project AssumptionsRasserNo ratings yet

- Edgestone Capital Equity FundDocument2 pagesEdgestone Capital Equity Fund/jncjdncjdnNo ratings yet

- DCF Financial Model Blank BDocument24 pagesDCF Financial Model Blank BBHAVVYA WADHERANo ratings yet

- Assignment 3 FinanceDocument1 pageAssignment 3 FinanceUsman GhaniNo ratings yet

- NYSF Practice TemplateDocument13 pagesNYSF Practice TemplateTâm LêNo ratings yet

- A Company Has An Existing Capital StructureDocument5 pagesA Company Has An Existing Capital StructureMesajalNo ratings yet

- SwasDocument28 pagesSwasAnusha ShinuNo ratings yet

- DCF Valuation-BDocument11 pagesDCF Valuation-BElsa100% (1)

- Figures and Illustrations - Financial RatiosDocument19 pagesFigures and Illustrations - Financial RatioscamillaNo ratings yet

- Ch3-02 Riley BrunsDocument5 pagesCh3-02 Riley BrunsRi BNo ratings yet

- My Patent Valuation Tool 3Document6 pagesMy Patent Valuation Tool 3nsadnanNo ratings yet

- Financial PlanDocument14 pagesFinancial Planagotevan0No ratings yet

- Common Size AnalysisDocument3 pagesCommon Size Analysisjose miguel baezNo ratings yet

- Soal Etika AuditDocument4 pagesSoal Etika AuditJudiono JoemanaNo ratings yet

- Pengakun II 1Document38 pagesPengakun II 1Cok Angga PutraNo ratings yet

- Engineeringinterviewquestions Mcqs On Requirement Engineering AnswersDocument6 pagesEngineeringinterviewquestions Mcqs On Requirement Engineering Answersdevid mandefroNo ratings yet

- NYU MKT Planning and Strategy SyllabusDocument8 pagesNYU MKT Planning and Strategy SyllabusTram AnhNo ratings yet

- ALDANA AESOS Act5Document2 pagesALDANA AESOS Act5Aeriel AldanaNo ratings yet

- Factors Affecting Dividend PolicyDocument3 pagesFactors Affecting Dividend PolicyAarti TawaNo ratings yet

- Forex Scams in MalaysiaDocument6 pagesForex Scams in MalaysiaAnonymous Ue4IcaNo ratings yet

- Tting StartedDocument2 pagesTting StartedALNo ratings yet

- MBA Resume Template Free Download PDFDocument1 pageMBA Resume Template Free Download PDFarun kNo ratings yet

- HRM - Job Description & Job SpecializationDocument6 pagesHRM - Job Description & Job SpecializationNahida RipaNo ratings yet

- Annual Report 2020Document75 pagesAnnual Report 2020nusrat jehanNo ratings yet

- Kieso Ifrs2e SM Ch05Document82 pagesKieso Ifrs2e SM Ch05Rics GabrielNo ratings yet

- Ig2 Risk Assessment Self Evaluation ChecklistDocument2 pagesIg2 Risk Assessment Self Evaluation ChecklistprinceNo ratings yet

- Measuring Customer Experience in Service: A Systematic ReviewDocument22 pagesMeasuring Customer Experience in Service: A Systematic ReviewTheatre GareNo ratings yet

- Classification of Elements: Overheads - Accounting and ControlDocument11 pagesClassification of Elements: Overheads - Accounting and ControlAyushi GuptaNo ratings yet

- Pahalwan's: Need For A New Marketing StrategyDocument7 pagesPahalwan's: Need For A New Marketing StrategySrajan GuptaNo ratings yet

- Apple ProjectDocument25 pagesApple ProjectNadia VirkNo ratings yet

- Mid Term 2022 Company LawDocument4 pagesMid Term 2022 Company Lawpradeep ranaNo ratings yet

- National Aviation College: Online Final ExaminationDocument17 pagesNational Aviation College: Online Final Examinationcn comNo ratings yet

- RBI Circular On Export Finance - 1Document21 pagesRBI Circular On Export Finance - 1Anonymous l0MTRDGu3MNo ratings yet

- 3 DERIVATIVES AND HEDGING ACTIVITIES FinalDocument2 pages3 DERIVATIVES AND HEDGING ACTIVITIES FinalCha ChieNo ratings yet

- BanglalinkDocument42 pagesBanglalinkiphone nokiaNo ratings yet

- Wa0025.Document8 pagesWa0025.Pieck AckermannNo ratings yet

- Job Vacancy Announcement Action Contre La Faim-Myanmar: Head of Project (Nutrition)Document3 pagesJob Vacancy Announcement Action Contre La Faim-Myanmar: Head of Project (Nutrition)draftdelete101 errorNo ratings yet

- Trainee'S Record Book: Technical Education and Skills Development AuthorityDocument10 pagesTrainee'S Record Book: Technical Education and Skills Development AuthorityVirgil Keith Juan PicoNo ratings yet

- Question Paper On KYCDocument9 pagesQuestion Paper On KYCNaresh JoshiNo ratings yet

- Mercantile Law PDFDocument3 pagesMercantile Law PDFSmag SmagNo ratings yet

- Part A: All 10 Questions Are Compulsory. 1/2 Mark For Each QuestionDocument2 pagesPart A: All 10 Questions Are Compulsory. 1/2 Mark For Each QuestionDimanshu BakshiNo ratings yet

- CHAPTER 9 Written ReportDocument17 pagesCHAPTER 9 Written ReportSharina Mhyca SamonteNo ratings yet