Professional Documents

Culture Documents

Zero Zero Three Zero Two Zero: DD MM Yy

Zero Zero Three Zero Two Zero: DD MM Yy

Uploaded by

Shubham Pandey WatsonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Zero Zero Three Zero Two Zero: DD MM Yy

Zero Zero Three Zero Two Zero: DD MM Yy

Uploaded by

Shubham Pandey WatsonCopyright:

Available Formats

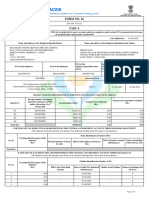

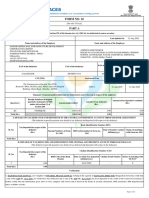

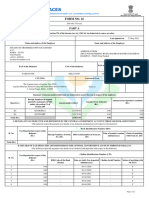

T.D.S.

/ TCS TAX CHALLAN Single Copy (to be sent to the ZAO)

Tax Applicable (Tick one)

Assessment

CHALLAN TAX DEDUCTED / COLLECTED AT SOURCE FROM

Year

NO./ ITNS 281 (0020) COMPANY DEDUCTEES [ ] (0021) NON-COMPANY DEDUCTEES [] 2019-20

Tax Deduction Account No. (T.A.N.)

ALDG02947A

Full Name

GURU GORAKHNATH SEWA SANSTHAN

Complete Address with City & State

0, GORAKHNATH MANDIR

GORAKHPUR, UTTAR PRADESH

Phone No. Pin 273001

Type of Payment Code 94C

TDS / TCS Payable by Tax Payer (200) FOR USE IN RECEIVING BANK

TDS / TCS Regular Assessment (Raised by

I.T.deptt.)

(400) Debit to A/c / Cheque credited on

DETAILS OF PAYMENTS

Amount (In Rs. Only) DD MM YY

Income Tax 3020 SPACE FOR BANK SEAL

Fee under sec. 234E

Surcharge

Education Cess 0

Interest

Penalty 0

Total 3020

Total (in words):

CRORES LACS THOUSANDS HUNDERDS TENS UNITS

Zero Zero Three Zero Two Zero

Paid in Cash/Debit to A/c/Cheque

No. 083349 Dated 27/03/2019

Drawn on STATE BANK OF INDIA

(Name of the Bank and Branch)

Date: Signature of the Person making payment Rs.

Taxpayers Counterfoil (To be filled up by tax payer) SPACE FOR BANK SEAL

TAN ALDG02947A

Received from GURU GORAKHNATH SEWA SANSTHAN

Cash/Debit to A/c/Cheque No. 083349 For Rs. 3020

Rs. (in Words) Three Thousand Twenty Only

Drawn on STATE BANK OF INDIA

(Name of the Bank and Branch)

Companies/Non-Companies

on account of Tax Deducted at Source (TDS) / Tax Collected at

Source (TCS) from 94C

For the Assessment Year 2019-20 Rs.

You might also like

- ATH Technologies: Case-3 Strategic ImplementationDocument8 pagesATH Technologies: Case-3 Strategic ImplementationSumit RajNo ratings yet

- Chryslar WarrantsDocument5 pagesChryslar WarrantsRavi Prakash0% (1)

- DT MCQs For June DecDocument208 pagesDT MCQs For June DecnaveedamurnaveedamurNo ratings yet

- HOW TO BUY GOOD - LIVE CC FROM SHOP by DC PDFDocument26 pagesHOW TO BUY GOOD - LIVE CC FROM SHOP by DC PDFВиталий Мак100% (1)

- T.D.S. / Tcs Tax Challan: Zero Zero One Two Seven OneDocument5 pagesT.D.S. / Tcs Tax Challan: Zero Zero One Two Seven OneSachin KumarNo ratings yet

- (0021) Non Company Deductees BPLJ01048F: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2021-22 BPLJ01048FDocument1 page(0021) Non Company Deductees BPLJ01048F: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2021-22 BPLJ01048FAngad MundraNo ratings yet

- Ashima Kalra 194 CDocument1 pageAshima Kalra 194 CSudhanshu JaiswalNo ratings yet

- (0021) Non Company Deductees A: T.D.S./T.C.S. Tax ChallanDocument3 pages(0021) Non Company Deductees A: T.D.S./T.C.S. Tax ChallanRambabuNo ratings yet

- PrintTDSChallan (281) 2020-2021 PDFDocument1 pagePrintTDSChallan (281) 2020-2021 PDFAmeyNo ratings yet

- Self Assessment Tax Challan NiDocument1 pageSelf Assessment Tax Challan NiNitin KarwaNo ratings yet

- Draft Challan IchhaDocument1 pageDraft Challan IchhaSneha SharmaNo ratings yet

- Tds ChallanDocument2 pagesTds Challannilesh vithalaniNo ratings yet

- TDS ChallanDocument1 pageTDS ChallanJainsanjaykumarNo ratings yet

- TDS ChallanDocument1 pageTDS ChallanJayNo ratings yet

- Challan No. ITNS 281Document1 pageChallan No. ITNS 281jagdish412301No ratings yet

- Sri Ram SilksDocument1 pageSri Ram SilksMathanagopal KNo ratings yet

- Advance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersDocument1 pageAdvance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersAnujaNo ratings yet

- T.D.S. / Tcs Tax Challan: DD MM YyDocument1 pageT.D.S. / Tcs Tax Challan: DD MM Yyar8ku9sh0aNo ratings yet

- Itns-281 TDS ChallanDocument1 pageItns-281 TDS Challanvirendra36999100% (2)

- Challan - 281Document1 pageChallan - 281Kelly WilliamsNo ratings yet

- ChallanDocument1 pageChallanShilesh GargNo ratings yet

- Challan PDFDocument1 pageChallan PDFShilesh GargNo ratings yet

- Challan Income TaxDocument1 pageChallan Income Taxrahul jhaNo ratings yet

- Single (Copy To Be Sent The ZAO)Document1 pageSingle (Copy To Be Sent The ZAO)James GonzalezNo ratings yet

- 322 PartaDocument2 pages322 Partaritik tiwariNo ratings yet

- Form 16 Lenskart - AspxDocument7 pagesForm 16 Lenskart - AspxPrince JainNo ratings yet

- Arvind Kumar SoniDocument1 pageArvind Kumar SoniAngad MundraNo ratings yet

- Income Tax ChallanDocument1 pageIncome Tax ChallanSHRI RAMAYANINo ratings yet

- For Payment From July 2005 OnwardsDocument1 pageFor Payment From July 2005 Onwardsvijay123*75% (4)

- 1 - Form16 - 218 - FY 2021-22Document9 pages1 - Form16 - 218 - FY 2021-22Sasi NimmakayalaNo ratings yet

- ChallanDocument1 pageChallanabhi7991No ratings yet

- Ganraj ConstructionDocument2 pagesGanraj ConstructionSUNIL GAIKWADNo ratings yet

- Form16 Till 14 Dec 2019Document11 pagesForm16 Till 14 Dec 2019Aviral SankhyadharNo ratings yet

- PB Tax 2022Document1 pagePB Tax 2022greenstoresaviNo ratings yet

- Form No 16Document3 pagesForm No 16rsharma09170No ratings yet

- Challan Advance TaxDocument1 pageChallan Advance Taxamit22505No ratings yet

- Ahhpt7531m 2020-21 PDFDocument2 pagesAhhpt7531m 2020-21 PDFAshish BhartiNo ratings yet

- Income Tax - Bank Remittance CHALLANDocument1 pageIncome Tax - Bank Remittance CHALLANvivek anandanNo ratings yet

- ITNS 280: Challan No. Challan No. ITNS 281Document1 pageITNS 280: Challan No. Challan No. ITNS 281Sar-Im Teron AcousticNo ratings yet

- Form 16 (2022-23) Assessment Year 2023-24Document6 pagesForm 16 (2022-23) Assessment Year 2023-24Hidden future techNo ratings yet

- Form 16Document6 pagesForm 16Ashwani KumarNo ratings yet

- ChallanDocument1 pageChallanYash KavteNo ratings yet

- Form16 Signed-1Document7 pagesForm16 Signed-1akh.278No ratings yet

- BZVPK1481J: (0020) Income Tax On Companies (Corporation Tax) (0021) Income TaxDocument1 pageBZVPK1481J: (0020) Income Tax On Companies (Corporation Tax) (0021) Income TaxBhandari AdvNo ratings yet

- Salary Jan 2001Document2 pagesSalary Jan 2001Kharde HrishikeshNo ratings yet

- Form No. 16: Part ADocument8 pagesForm No. 16: Part AFarhan23inamdaRNo ratings yet

- Form16 Mar 2023Document9 pagesForm16 Mar 2023PRAJAKTA GAJBHIYENo ratings yet

- ImportantDocument1 pageImportantWilliam SureshNo ratings yet

- Dinkar Thakur - ATBPT9919P - 2023-24Document11 pagesDinkar Thakur - ATBPT9919P - 2023-24Dinkar Prasad ThakurNo ratings yet

- Challan 280Document1 pageChallan 280Jayesh BajpaiNo ratings yet

- Form 16: Warora Kurnool Transmission LimitedDocument10 pagesForm 16: Warora Kurnool Transmission LimitedBHASKAR pNo ratings yet

- Challan No. ITNS 280: Tax Applicable Assessment YearDocument1 pageChallan No. ITNS 280: Tax Applicable Assessment YearNalini SenthilkumarNo ratings yet

- Income Tax Challan - 280Document1 pageIncome Tax Challan - 280Subrata SarkarNo ratings yet

- JN Fil Stn. SK TDS CH 94Q May 23Document1 pageJN Fil Stn. SK TDS CH 94Q May 23Piyush JainNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part AVinaya ChennadiNo ratings yet

- TCS TenduDocument1 pageTCS TenduSwetha KarthickNo ratings yet

- Challanitns 280Document1 pageChallanitns 280saritabh05No ratings yet

- Ddopm6840n 2021-22Document2 pagesDdopm6840n 2021-22Gaurav MishraNo ratings yet

- Jayanth 2022Document6 pagesJayanth 2022Murali K MadugulaNo ratings yet

- HTMLReportsDocument7 pagesHTMLReportsPushpraj ThakurNo ratings yet

- Research On Employee SatisfactionDocument61 pagesResearch On Employee SatisfactionShubham Pandey WatsonNo ratings yet

- Madan Mohanmalaviya University of Technology, Gorakhpur: Department of Computer Science & EngineeringDocument2 pagesMadan Mohanmalaviya University of Technology, Gorakhpur: Department of Computer Science & EngineeringShubham Pandey WatsonNo ratings yet

- Answer All Questions: (Fall, 2013) AssignmentDocument1 pageAnswer All Questions: (Fall, 2013) AssignmentShubham Pandey WatsonNo ratings yet

- Unit 1 Introduction To Mobile Computing: StructureDocument18 pagesUnit 1 Introduction To Mobile Computing: StructureShubham Pandey WatsonNo ratings yet

- Doeacc Society: 124 / 012 O-Level ENG 14667Document1 pageDoeacc Society: 124 / 012 O-Level ENG 14667Shubham Pandey WatsonNo ratings yet

- Company Profile - Agridesa 11042022 v2Document10 pagesCompany Profile - Agridesa 11042022 v2Budi WahyuNo ratings yet

- Chapter 21 - Capital Structure DecisionsDocument107 pagesChapter 21 - Capital Structure Decisionsanon_955424412No ratings yet

- Clearline Manufacturing: Refinance PlanDocument1 pageClearline Manufacturing: Refinance Planapi-28116943No ratings yet

- Investment ExercisesDocument8 pagesInvestment ExercisesAlexanderJacobVielMartinezNo ratings yet

- IFRS 15 Revenue From Contracts With Customers - Summary: SilviaDocument8 pagesIFRS 15 Revenue From Contracts With Customers - Summary: SilviaCleofe Jane PatnubayNo ratings yet

- Accounting Practices of MSMEs in Quezon ProvinceDocument12 pagesAccounting Practices of MSMEs in Quezon ProvinceAMNo ratings yet

- TS IT FY 2023-24 Full Version 1.0Document16 pagesTS IT FY 2023-24 Full Version 1.0varshithvarma051No ratings yet

- Low Sulphur Gasoil Futures: Contract SpecificationsDocument3 pagesLow Sulphur Gasoil Futures: Contract SpecificationsGuilhermeNo ratings yet

- 650 Chap002 Fa14Document66 pages650 Chap002 Fa14MaywellNo ratings yet

- Real Estate Finance Prelim Q2Document4 pagesReal Estate Finance Prelim Q2Michelle EsperalNo ratings yet

- Chapter 11: Bond Valuation: The Pricing of BondsDocument2 pagesChapter 11: Bond Valuation: The Pricing of BondsFreimond07No ratings yet

- Cash Loan Specific Terms and Conditions PDFDocument2 pagesCash Loan Specific Terms and Conditions PDFDanny AcohonNo ratings yet

- 2023 09 01 19 40 52apr 23 - 495668Document3 pages2023 09 01 19 40 52apr 23 - 495668harsha.tahalaniNo ratings yet

- 8 Apq3 FR 09 02 2022Document41 pages8 Apq3 FR 09 02 2022MaddyNo ratings yet

- A Study On Loans and Advances at State Bank of India.Document85 pagesA Study On Loans and Advances at State Bank of India.shahidafzalsyedNo ratings yet

- Audit of BankDocument37 pagesAudit of BankDaniel ShettyNo ratings yet

- Secure Future!: Protect Your Customers For ADocument2 pagesSecure Future!: Protect Your Customers For AViveksomuNo ratings yet

- NBFCsDocument17 pagesNBFCsTarun ParasharNo ratings yet

- Mt700 Format SpecificationsDocument1 pageMt700 Format Specificationslovesmile_281No ratings yet

- f303 Stocktrak Final Write UpDocument12 pagesf303 Stocktrak Final Write Upapi-252138631No ratings yet

- 1 30Document2 pages1 30Jocelyn Requillo FlordelizNo ratings yet

- Internship On Nepal Bank LimitedDocument12 pagesInternship On Nepal Bank Limitedsabita100% (2)

- The Macroeconomic E Ects of Housing Wealth, Housing Finance, and Limited Risk-Sharing in General EquilibriumDocument96 pagesThe Macroeconomic E Ects of Housing Wealth, Housing Finance, and Limited Risk-Sharing in General EquilibriumAdnan KamalNo ratings yet

- NAZ 3RD Exam Form Payment Receipt - 100317Document2 pagesNAZ 3RD Exam Form Payment Receipt - 100317Pulakesh TahbildarNo ratings yet

- Service Innovation in Malaysian Banking Industry Towards Sustainable Competitive Advantage Through Environmentally and Socially PracticesDocument9 pagesService Innovation in Malaysian Banking Industry Towards Sustainable Competitive Advantage Through Environmentally and Socially PracticesReigy MayaNo ratings yet

- Test 2 True / False QuestionsDocument6 pagesTest 2 True / False QuestionsIslam FarhanaNo ratings yet