Professional Documents

Culture Documents

A34

A34

Uploaded by

Access Materials0 ratings0% found this document useful (0 votes)

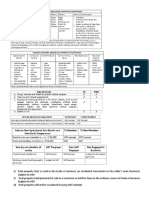

3 views10 pagesThe document discusses various goods and services and whether they are exempt or subject to value-added tax (VAT) in the Philippines. International carriers' transport services are exempt from VAT. Agricultural cooperatives are exempt, while electric cooperatives are subject to VAT. The sale of commercial lots below 1.9 million pesos per unit and bookstores are exempt from VAT, while schools and hospitals are subject to VAT. Export sales by VAT taxpayers are exempt from VAT, while non-VAT taxpayers' export sales are subject to zero-rated VAT.

Original Description:

ijfjddfi

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses various goods and services and whether they are exempt or subject to value-added tax (VAT) in the Philippines. International carriers' transport services are exempt from VAT. Agricultural cooperatives are exempt, while electric cooperatives are subject to VAT. The sale of commercial lots below 1.9 million pesos per unit and bookstores are exempt from VAT, while schools and hospitals are subject to VAT. Export sales by VAT taxpayers are exempt from VAT, while non-VAT taxpayers' export sales are subject to zero-rated VAT.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3 views10 pagesA34

A34

Uploaded by

Access MaterialsThe document discusses various goods and services and whether they are exempt or subject to value-added tax (VAT) in the Philippines. International carriers' transport services are exempt from VAT. Agricultural cooperatives are exempt, while electric cooperatives are subject to VAT. The sale of commercial lots below 1.9 million pesos per unit and bookstores are exempt from VAT, while schools and hospitals are subject to VAT. Export sales by VAT taxpayers are exempt from VAT, while non-VAT taxpayers' export sales are subject to zero-rated VAT.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 10

True 1. The transport services of an international carrier is exempt from VAT. True 2.

Agricultural cooperatives are exempt fro

ltural cooperatives are exempt from VAT. True 3. Electric cooperatives are subject to VAT. True 4. The sale of commercial lots where the s

ale of commercial lots where the selling prices do not exceed P1,919,500 a unit is exempt. False 5. Bookstores are totally exempt from VA

stores are totally exempt from VAT. False 6. Schools are subject to VAT. False 7. Hospitals are subject to VAT. False 8. The export sales by

VAT. False 8. The export sales by VAT taxpayers are exempt from VAT. False 9. The export sales of non-VAT taxpayers are subject to zero-

VAT taxpayers are subject to zero-rated VAT. False 10. Consultants are exempt from VAT because their services are akin to employment. F

ervices are akin to employment. False 11. The leasing of residential units is exempt from VAT if the annual rentals do not exceed P15,000

ual rentals do not exceed P15,000 per unit. False 12. Domestic airliners are exempt from VAT on their transport of passengers. False 13. T

ansport of passengers. False 13. The sale of a residential dwelling by a non-dealer is subject to VAT if the selling price per unit does not ex

selling price per unit does not exceed P3,199,200. True 14. The sale of an adjacent lot to the

You might also like

- 1.1. Problems On VAT (With Answers and Solutions)Document29 pages1.1. Problems On VAT (With Answers and Solutions)Jem Valmonte88% (26)

- CHAPTER 6 7 and 8 TAXDocument38 pagesCHAPTER 6 7 and 8 TAXMark Lawrence Yusi100% (1)

- TAX 2 ExercisesDocument22 pagesTAX 2 ExercisesWinter Summer50% (4)

- Tax Banggawan2019 Ch.15-ADocument12 pagesTax Banggawan2019 Ch.15-ANoreen LeddaNo ratings yet

- CombinepdfDocument129 pagesCombinepdfMary Jane G. FACERONDANo ratings yet

- Universal College of Parañaque: Value Added TaxDocument14 pagesUniversal College of Parañaque: Value Added TaxDin Rose Gonzales67% (3)

- Taxation MCQ Final ExamDocument11 pagesTaxation MCQ Final ExamLex AnneNo ratings yet

- Tax2 Seatworks-03.23.2020Document2 pagesTax2 Seatworks-03.23.2020Allen Fey De JesusNo ratings yet

- Chapter 6Document3 pagesChapter 6Ricky LavillaNo ratings yet

- Chapter 6Document3 pagesChapter 6Marichris AlbuferaNo ratings yet

- Bus Tax Chap 6Document3 pagesBus Tax Chap 6yayayaNo ratings yet

- Taxation Chapter 6 Ad 7 Test BankDocument34 pagesTaxation Chapter 6 Ad 7 Test BankXyrene Keith MedranoNo ratings yet

- Chapter 6Document21 pagesChapter 6Justin TempleNo ratings yet

- CHAPTER3 Bustax SolmanDocument24 pagesCHAPTER3 Bustax SolmanAngela Shaine Castro Garcia50% (2)

- Chapter 8Document9 pagesChapter 8nena cabañesNo ratings yet

- Modified Finals VatDocument3 pagesModified Finals VatClyden Jaile RamirezNo ratings yet

- Chapter 14 Percentage TaxesDocument11 pagesChapter 14 Percentage TaxesGeraldNo ratings yet

- 1.2. Problems On VAT - For Tax ReviewDocument19 pages1.2. Problems On VAT - For Tax ReviewJem ValmonteNo ratings yet

- Business Tax - Assessment (Part 2)Document1 pageBusiness Tax - Assessment (Part 2)Hulaan MoNo ratings yet

- Vat ReviewDocument4 pagesVat ReviewVensen FuentesNo ratings yet

- VAT ReviewerDocument3 pagesVAT ReviewerCJ LopezNo ratings yet

- Chapter 3 Lecture Notes 3Document25 pagesChapter 3 Lecture Notes 3Kean Leigh Felicano IIINo ratings yet

- Final PeriodDocument6 pagesFinal PeriodjayNo ratings yet

- Lease of Properties: ExemptDocument12 pagesLease of Properties: Exemptmariyha PalangganaNo ratings yet

- Tax 2 Midterm Exercises and ExamDocument7 pagesTax 2 Midterm Exercises and ExamLynceeLapore0% (1)

- Tax 2 - Midterm Quiz 2-ModifiedDocument6 pagesTax 2 - Midterm Quiz 2-ModifiedUy SamuelNo ratings yet

- 2011 Tax-Bar ExamDocument30 pages2011 Tax-Bar ExamCazzandhra Mae BullecerNo ratings yet

- Subject To VAT Subject To VAT 3) Real Property Utilized For Socialized Housing VAT ExemptDocument32 pagesSubject To VAT Subject To VAT 3) Real Property Utilized For Socialized Housing VAT ExemptNikka SanzNo ratings yet

- TBLTAX Chapter 2 Percentage Tax Exempt Sales of Goods or Properties and ServicesDocument6 pagesTBLTAX Chapter 2 Percentage Tax Exempt Sales of Goods or Properties and ServicesBeny MiraflorNo ratings yet

- Final Exam in Tax 2Document5 pagesFinal Exam in Tax 2elminvaldezNo ratings yet

- Principles of Taxation For Business and Investment Planning 16th Edition Jones Test Bank 1Document36 pagesPrinciples of Taxation For Business and Investment Planning 16th Edition Jones Test Bank 1shannonwaltersqwdifntckm100% (33)

- Business and Transfer Taxation - T or FDocument3 pagesBusiness and Transfer Taxation - T or FEuli Mae SomeraNo ratings yet

- Tax Reviewer MTEDocument41 pagesTax Reviewer MTEMary Rose Juan100% (1)

- Income Taxation T or F ReviewerDocument13 pagesIncome Taxation T or F ReviewerZalaR0cksNo ratings yet

- Pdfcoffee Problems On VatDocument30 pagesPdfcoffee Problems On VatJunmar AMITNo ratings yet

- Tax CDocument18 pagesTax Calmira garciaNo ratings yet

- Tax 2 - Midterm Quiz 2Document6 pagesTax 2 - Midterm Quiz 2Uy SamuelNo ratings yet

- HANDOUT-business TaxesDocument29 pagesHANDOUT-business TaxesGianJoshuaDayrit67% (3)

- False 1. Marginal Income Earners Are Exempt From Both Business Tax and Income Tax. False 2. An Employed Professional Is Engaged in BusinessDocument3 pagesFalse 1. Marginal Income Earners Are Exempt From Both Business Tax and Income Tax. False 2. An Employed Professional Is Engaged in BusinessLazy LeathNo ratings yet

- Exempt Sales of Goods, Properties and Services: Anie P Martinez, CpaDocument56 pagesExempt Sales of Goods, Properties and Services: Anie P Martinez, CpaAnie MartinezNo ratings yet

- Chapter 4Document18 pagesChapter 4christineNo ratings yet

- Tax Solman PDFDocument141 pagesTax Solman PDFAngelManuelCabacungan100% (1)

- Dia Mae A. Generoso - Learning Activity 3Document10 pagesDia Mae A. Generoso - Learning Activity 3Dia Mae Ablao GenerosoNo ratings yet

- Bustamante TAX CDocument19 pagesBustamante TAX CJean Rose Tabagay BustamanteNo ratings yet

- Tax 2 - Midterm Quiz 2Document6 pagesTax 2 - Midterm Quiz 2Uy SamuelNo ratings yet

- TAX2UNIT9TO12Document4 pagesTAX2UNIT9TO12Catherine Joy VasayaNo ratings yet

- Business and Transfer TaxationDocument16 pagesBusiness and Transfer TaxationEuli Mae SomeraNo ratings yet

- 2011 Taxation Bar Exam Questions and AnswerDocument7 pages2011 Taxation Bar Exam Questions and Answerwwe_jhoNo ratings yet

- Quiz 1: Tax 3 Final Period QuizzesDocument10 pagesQuiz 1: Tax 3 Final Period QuizzesJhun bondocNo ratings yet

- Chap 11 - Percentage Taxes ValenciaDocument23 pagesChap 11 - Percentage Taxes ValenciaDanzen Bueno Imus0% (1)

- Pdfcoffee Problems On VatDocument30 pagesPdfcoffee Problems On Vatjohnfrancissegarra1105No ratings yet

- Summatve 4 - TaxDocument8 pagesSummatve 4 - TaxkmarisseeNo ratings yet

- Lesson 9Document22 pagesLesson 9Iris Lavigne RojoNo ratings yet

- Answer Sheet Value Added TaxDocument3 pagesAnswer Sheet Value Added TaxMagbanu Andrea JoneleNo ratings yet

- ExampleDocument2 pagesExampleAliansNo ratings yet

- Consumption Tax Is A Tax Level Upon BusinessesDocument1 pageConsumption Tax Is A Tax Level Upon BusinessesSophia KeratinNo ratings yet

- Very Awkward Tax: A bite-size guide to VAT for small businessFrom EverandVery Awkward Tax: A bite-size guide to VAT for small businessNo ratings yet

- Micro Multinationals: A guide to international finance for small businessesFrom EverandMicro Multinationals: A guide to international finance for small businessesNo ratings yet

- Legally Avoid Property Taxes: 51 Top Tips to Save Property Taxes and Increase Your WealthFrom EverandLegally Avoid Property Taxes: 51 Top Tips to Save Property Taxes and Increase Your WealthNo ratings yet

- What Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemFrom EverandWhat Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemNo ratings yet

- F38Document10 pagesF38Access MaterialsNo ratings yet

- F28Document10 pagesF28Access MaterialsNo ratings yet

- F34Document10 pagesF34Access MaterialsNo ratings yet

- F24Document9 pagesF24Access MaterialsNo ratings yet

- F35Document10 pagesF35Access MaterialsNo ratings yet

- F33Document10 pagesF33Access MaterialsNo ratings yet

- F27Document10 pagesF27Access MaterialsNo ratings yet

- F29Document10 pagesF29Access MaterialsNo ratings yet

- F31Document10 pagesF31Access MaterialsNo ratings yet

- F37Document10 pagesF37Access MaterialsNo ratings yet

- F39Document10 pagesF39Access MaterialsNo ratings yet

- F32Document10 pagesF32Access MaterialsNo ratings yet

- F36Document9 pagesF36Access MaterialsNo ratings yet

- F15Document10 pagesF15Access MaterialsNo ratings yet

- F26Document10 pagesF26Access MaterialsNo ratings yet

- F10Document10 pagesF10Access MaterialsNo ratings yet

- F22Document10 pagesF22Access MaterialsNo ratings yet

- F17Document10 pagesF17Access MaterialsNo ratings yet

- F21Document1 pageF21Access MaterialsNo ratings yet

- F30Document10 pagesF30Access MaterialsNo ratings yet

- F23Document10 pagesF23Access MaterialsNo ratings yet

- F20Document10 pagesF20Access MaterialsNo ratings yet

- F25Document10 pagesF25Access MaterialsNo ratings yet

- F18Document10 pagesF18Access MaterialsNo ratings yet

- F16Document10 pagesF16Access MaterialsNo ratings yet

- F19Document10 pagesF19Access MaterialsNo ratings yet

- F12Document10 pagesF12Access MaterialsNo ratings yet

- F13Document10 pagesF13Access MaterialsNo ratings yet

- F9Document10 pagesF9Access MaterialsNo ratings yet

- F14Document10 pagesF14Access MaterialsNo ratings yet