Professional Documents

Culture Documents

D4

D4

Uploaded by

Access Materials0 ratings0% found this document useful (0 votes)

7 views9 pages1. A realty dealer sold two residential units for a total of PHP 6,000,000 and incurred PHP 210,000 in input VAT during the month. The VAT payable is PHP 297,500.

2. A restaurant had PHP 600,000 in food receipts, PHP 200,000 in soft drink receipts, and PHP 500,000 in purchases. The VAT payable is PHP 72,000.

3. A VAT-registered tax practitioner disclosed operating results of PHP 654,000 exclusive of VAT.

Original Description:

pofpwoeriwer32

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. A realty dealer sold two residential units for a total of PHP 6,000,000 and incurred PHP 210,000 in input VAT during the month. The VAT payable is PHP 297,500.

2. A restaurant had PHP 600,000 in food receipts, PHP 200,000 in soft drink receipts, and PHP 500,000 in purchases. The VAT payable is PHP 72,000.

3. A VAT-registered tax practitioner disclosed operating results of PHP 654,000 exclusive of VAT.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

7 views9 pagesD4

D4

Uploaded by

Access Materials1. A realty dealer sold two residential units for a total of PHP 6,000,000 and incurred PHP 210,000 in input VAT during the month. The VAT payable is PHP 297,500.

2. A restaurant had PHP 600,000 in food receipts, PHP 200,000 in soft drink receipts, and PHP 500,000 in purchases. The VAT payable is PHP 72,000.

3. A VAT-registered tax practitioner disclosed operating results of PHP 654,000 exclusive of VAT.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 9

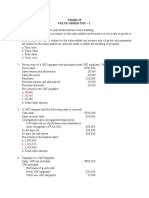

MC- Problem Part 2 1. A realty dealer disposed two residential units during the month.

Unit 141-B 2,500,000 Unit 142-C 3,500

141-B 2,500,000 Unit 142-C 3,500,000 Total sales, Exclusive of VAT 6,000,000 Total input Vat During the month 210,000 Compute the VA

e month 210,000 Compute the VAT payable. C. 297,500 2. A vat registered restaurant had the following transaction during the month: Re

transaction during the month: Receipt from foods served 600,000 Receipts from soft drink 200,000 Purchase of rice,meat and vegetable

chase of rice,meat and vegetable 200,000 Purchase of vegetable 100,000 Purchase of soft drink 120,000 Purchase of food condiments 80

Purchase of food condiments 80,000 Assuming all amounts are exclusive of VAT, compute the vat Payable D. 72,000 3. A Vat-registered

ble D. 72,000 3. A Vat-registered tax practitioner who uses the cash basis of accounting disclosed the ff results of operation (exclusive of

results of operation (exclusive of Vat) d. 654,000 4. A manufacturing subcontractor generated the ff receipt from various clients. Compute

eipt from various clients. Compute the VAT payable D. 0

You might also like

- Tax QuizzerDocument33 pagesTax QuizzerClarisse Peter86% (14)

- DocxDocument14 pagesDocxtrisha100% (1)

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Quiz 4 VATDocument3 pagesQuiz 4 VATAsiong Salonga100% (2)

- Mock Test 2Document9 pagesMock Test 2Toàn ĐứcNo ratings yet

- Joey, A non-VAT Taxpayer Purchased Merchandise Worth P11,200, VATDocument10 pagesJoey, A non-VAT Taxpayer Purchased Merchandise Worth P11,200, VATLeah Isabelle Nodalo DandoyNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- DocxDocument28 pagesDocxGrace Managuelod GabuyoNo ratings yet

- Transitional Input VATDocument21 pagesTransitional Input VATJoanne TolentinoNo ratings yet

- Value Added TaxDocument5 pagesValue Added TaxRaven Vargas DayritNo ratings yet

- VAT QuizzerDocument16 pagesVAT QuizzerAnonymous 2ajCCT03VM50% (6)

- Business Tax - Prelim Exam - Set BDocument6 pagesBusiness Tax - Prelim Exam - Set BRenalyn ParasNo ratings yet

- Chapter 10 - TBTDocument11 pagesChapter 10 - TBTKatKat Olarte100% (4)

- E52Document11 pagesE52Access MaterialsNo ratings yet

- UntitledDocument11 pagesUntitledAccess MaterialsNo ratings yet

- Chapter 7 - TBTDocument14 pagesChapter 7 - TBTKatKat Olarte0% (3)

- Midterm Examination BSAISDocument11 pagesMidterm Examination BSAISAlexis Kaye DayagNo ratings yet

- Vat 2Document4 pagesVat 2Allen KateNo ratings yet

- Value Added TaxDocument6 pagesValue Added TaxjamNo ratings yet

- Tax 2 PDFDocument16 pagesTax 2 PDFLeah MoscareNo ratings yet

- CPA Review - VAT Quizzer - 2019Document11 pagesCPA Review - VAT Quizzer - 2019Kenneth Bryan Tegerero Tegio50% (2)

- Business Tax - Prelim Exam - Set ADocument7 pagesBusiness Tax - Prelim Exam - Set ARenalyn Paras0% (1)

- Output and Input VAT: Business TaxDocument13 pagesOutput and Input VAT: Business TaxKathleen AgustinNo ratings yet

- Vat Quizzer Vat Payable - CompressDocument28 pagesVat Quizzer Vat Payable - Compressacc.docs20No ratings yet

- Value Added Tax PracticeDocument7 pagesValue Added Tax PracticeSelene DimlaNo ratings yet

- B6Document11 pagesB6Access MaterialsNo ratings yet

- B6Document11 pagesB6Access MaterialsNo ratings yet

- VAT ExercisesDocument2 pagesVAT ExercisesJunezel AshleyNo ratings yet

- ACT 184 - QUIZ 4 (SET A) - 50 CopiesDocument3 pagesACT 184 - QUIZ 4 (SET A) - 50 CopiesAthena Fatmah AmpuanNo ratings yet

- VAT ReviewDocument10 pagesVAT ReviewRachel LeachonNo ratings yet

- Accounting Cycle of A Merchandising Business Part 2Document7 pagesAccounting Cycle of A Merchandising Business Part 2Amie Jane MirandaNo ratings yet

- VAT - No. 5Document5 pagesVAT - No. 5Jay-ar Pre0% (1)

- Take Home Quiz 1Document9 pagesTake Home Quiz 1Akira Marantal Valdez100% (1)

- Exercises and Problems - Merchandising BusinessDocument4 pagesExercises and Problems - Merchandising BusinessNems PsycheNo ratings yet

- Exercise 5 VATDocument3 pagesExercise 5 VATQuenie De la CruzNo ratings yet

- CHAPTER 3 - Transfer and Business TaxDocument6 pagesCHAPTER 3 - Transfer and Business TaxKatKat Olarte0% (1)

- VAT QuizzerDocument13 pagesVAT QuizzerGrace Managuelod GabuyoNo ratings yet

- VatDocument16 pagesVatCPA100% (1)

- Tax 2Document3 pagesTax 2Emmanuel DiyNo ratings yet

- Exercise 2-Chapter 3-Intro To Business TaxationDocument3 pagesExercise 2-Chapter 3-Intro To Business TaxationQuenie De la CruzNo ratings yet

- QuizDocument2 pagesQuizIaiaiaiNo ratings yet

- HO6 PretestDocument3 pagesHO6 PretestJason Saberon QuiñoNo ratings yet

- Finalppt - INPUT VATDocument20 pagesFinalppt - INPUT VATcharissetosloladoNo ratings yet

- Letters. Strictly No Erasures/Alterations. Show Your SolutionDocument4 pagesLetters. Strictly No Erasures/Alterations. Show Your SolutionRenalyn ParasNo ratings yet

- Vat 4Document4 pagesVat 4Allen KateNo ratings yet

- UntitledDocument10 pagesUntitledAccess MaterialsNo ratings yet

- E51Document10 pagesE51Access MaterialsNo ratings yet

- Business Tax - Sat Prelim - 2ND Sem - 2019-2020Document4 pagesBusiness Tax - Sat Prelim - 2ND Sem - 2019-2020Renalyn ParasNo ratings yet

- Assignments For All Chapters Principle of Accounting IIDocument6 pagesAssignments For All Chapters Principle of Accounting IITolesa MogosNo ratings yet

- Tax Lecture VATDocument4 pagesTax Lecture VATRozzane Ann RomaNo ratings yet

- Acc 109 P3 Quiz No 2Document2 pagesAcc 109 P3 Quiz No 2Wilmz SalacsacanNo ratings yet

- Tax Practices: Certificate in Accounting and Finance Stage ExaminationDocument2 pagesTax Practices: Certificate in Accounting and Finance Stage ExaminationDaniyal AhmedNo ratings yet

- TQ VatDocument6 pagesTQ VatJaneNo ratings yet

- DocxDocument6 pagesDocxnena cabañesNo ratings yet

- Solutions To Quiz 2 - VAT PAYABLEDocument4 pagesSolutions To Quiz 2 - VAT PAYABLEMark Emil BaritNo ratings yet

- Worksheet For Financial Acc. IDocument5 pagesWorksheet For Financial Acc. IFantay100% (1)

- Corresponding Supporting ScheduleDocument2 pagesCorresponding Supporting Schedulealmira garciaNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- F38Document10 pagesF38Access MaterialsNo ratings yet

- F28Document10 pagesF28Access MaterialsNo ratings yet

- F34Document10 pagesF34Access MaterialsNo ratings yet

- F24Document9 pagesF24Access MaterialsNo ratings yet

- F35Document10 pagesF35Access MaterialsNo ratings yet

- F33Document10 pagesF33Access MaterialsNo ratings yet

- F27Document10 pagesF27Access MaterialsNo ratings yet

- F29Document10 pagesF29Access MaterialsNo ratings yet

- F31Document10 pagesF31Access MaterialsNo ratings yet

- F37Document10 pagesF37Access MaterialsNo ratings yet

- F39Document10 pagesF39Access MaterialsNo ratings yet

- F32Document10 pagesF32Access MaterialsNo ratings yet

- F36Document9 pagesF36Access MaterialsNo ratings yet

- F15Document10 pagesF15Access MaterialsNo ratings yet

- F26Document10 pagesF26Access MaterialsNo ratings yet

- F10Document10 pagesF10Access MaterialsNo ratings yet

- F22Document10 pagesF22Access MaterialsNo ratings yet

- F17Document10 pagesF17Access MaterialsNo ratings yet

- F21Document1 pageF21Access MaterialsNo ratings yet

- F30Document10 pagesF30Access MaterialsNo ratings yet

- F23Document10 pagesF23Access MaterialsNo ratings yet

- F20Document10 pagesF20Access MaterialsNo ratings yet

- F25Document10 pagesF25Access MaterialsNo ratings yet

- F18Document10 pagesF18Access MaterialsNo ratings yet

- F16Document10 pagesF16Access MaterialsNo ratings yet

- F19Document10 pagesF19Access MaterialsNo ratings yet

- F12Document10 pagesF12Access MaterialsNo ratings yet

- F13Document10 pagesF13Access MaterialsNo ratings yet

- F9Document10 pagesF9Access MaterialsNo ratings yet

- F14Document10 pagesF14Access MaterialsNo ratings yet