Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

22 viewsBL Corporation Reviewer

BL Corporation Reviewer

Uploaded by

Christine RepuldaThis document summarizes key aspects of the Revised Corporation Code of the Philippines.

It explains that the code was revised in 2019 to further ease the formation of corporations and streamline bureaucratic processes. The code defines corporations and establishes their legal rights and responsibilities. It also defines the different classes of corporations, and stipulates that corporations have perpetual existence and the right of succession regardless of changes in ownership. The code provides the framework for incorporating and regulating private corporations in the Philippines.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Dwnload Full Introduction To Quantum Mechanics 3rd Edition Griffiths Solutions Manual PDFDocument20 pagesDwnload Full Introduction To Quantum Mechanics 3rd Edition Griffiths Solutions Manual PDFChristopherNortonwqnmc82% (17)

- A Man For All Seasons - Robert BoltDocument95 pagesA Man For All Seasons - Robert BoltHoda Elhadary92% (12)

- CORPORATION LAW Reviewer PDFDocument40 pagesCORPORATION LAW Reviewer PDFYnah Lopez100% (1)

- PFA 3e 2021 SM CH 03 - Adjusting Accounts For Financial StatementsDocument71 pagesPFA 3e 2021 SM CH 03 - Adjusting Accounts For Financial Statementscalista sNo ratings yet

- Revised Corporation CodeDocument16 pagesRevised Corporation CodeLielet MatutinoNo ratings yet

- R.A 11232 - Title 1Document24 pagesR.A 11232 - Title 1Ana AmolatNo ratings yet

- Notes On Corporation Law (Sec 1-9)Document8 pagesNotes On Corporation Law (Sec 1-9)davemarklazaga179No ratings yet

- Notes in Business Laws and RegulationsDocument10 pagesNotes in Business Laws and RegulationsZie TanNo ratings yet

- Comrev NotesDocument161 pagesComrev NotesJasper BagniNo ratings yet

- Reviewer Corpo (Etona)Document29 pagesReviewer Corpo (Etona)Karylle Ynah MalanaNo ratings yet

- Corpo Week2 NotesDocument6 pagesCorpo Week2 NotesnayhrbNo ratings yet

- Pomoly Bar Reviewer Day 2 Am CommDocument22 pagesPomoly Bar Reviewer Day 2 Am CommRomeo RemotinNo ratings yet

- Corpo Week2 Notes MergedDocument42 pagesCorpo Week2 Notes MergednayhrbNo ratings yet

- Corpo Week2 NotesDocument6 pagesCorpo Week2 NotesnayhrbNo ratings yet

- Group 2 Law Reporting Round 3Document44 pagesGroup 2 Law Reporting Round 3CABRIGA, Aira Rosemyr G.No ratings yet

- Stonehill v. Diokno:: A. Sole Proprietorship v. Corporation Sole Proprietorship CorporationDocument17 pagesStonehill v. Diokno:: A. Sole Proprietorship v. Corporation Sole Proprietorship Corporationemmanuel fernandezNo ratings yet

- Revised Corporation Code of The Philippines Sec. 1-3Document2 pagesRevised Corporation Code of The Philippines Sec. 1-3Nicki Lyn Dela Cruz100% (1)

- Title I General Provisions: "The Corporation Code of The Philippines"Document1 pageTitle I General Provisions: "The Corporation Code of The Philippines"asdasdasdasdasdasNo ratings yet

- Today's Topics (March 31, 2022)Document51 pagesToday's Topics (March 31, 2022)Miguel Anas Jr.No ratings yet

- Corpo. 1st MeetingDocument13 pagesCorpo. 1st MeetingMika RapananNo ratings yet

- Corporation Law Notes by AquinoDocument3 pagesCorporation Law Notes by Aquinopinky paroliganNo ratings yet

- Corporation Law Notes by AquinoDocument3 pagesCorporation Law Notes by AquinoBaesittieeleanor Mamualas100% (1)

- V. Imperial Insurance)Document3 pagesV. Imperial Insurance)Di CanNo ratings yet

- Corporation - Insurance (Lecture Transcriptions)Document160 pagesCorporation - Insurance (Lecture Transcriptions)Vanessa Evans CruzNo ratings yet

- Corporation Code NotesDocument19 pagesCorporation Code NotesApay GrajoNo ratings yet

- Cfas Week 1-2awfawfawfDocument13 pagesCfas Week 1-2awfawfawfMharc PerezNo ratings yet

- Law of CorporationDocument33 pagesLaw of Corporationmissy dalagan100% (1)

- By-Laws Regulate, Stockholders Members Adopted Having AffairsDocument7 pagesBy-Laws Regulate, Stockholders Members Adopted Having AffairsEmmanuel PenullarNo ratings yet

- Corporation Law Notes - SubiaDocument57 pagesCorporation Law Notes - SubiaRolan Jeff Amoloza LancionNo ratings yet

- Law On Corporation Reviewer 1Document12 pagesLaw On Corporation Reviewer 1Mica Angel GonzalesNo ratings yet

- Corporation Law ReviewerDocument4 pagesCorporation Law ReviewerKeziah HuelarNo ratings yet

- BLWN05B MM1Document8 pagesBLWN05B MM1Yolly Diaz100% (1)

- BLG. 68, Section 2) : Different Forms of Business OrganizationDocument5 pagesBLG. 68, Section 2) : Different Forms of Business OrganizationKristin LuceroNo ratings yet

- The Corporation Code of The Philippines PDFDocument85 pagesThe Corporation Code of The Philippines PDFDawn BarondaNo ratings yet

- Corporation Defined: The Revised Corporation Code of The PhilippinesDocument6 pagesCorporation Defined: The Revised Corporation Code of The Philippineschristine anglaNo ratings yet

- The Corporation Code of The Philippines B.P. Blg. 68: Title 1 General Provisions Definitions and ClassificationsDocument7 pagesThe Corporation Code of The Philippines B.P. Blg. 68: Title 1 General Provisions Definitions and ClassificationsKarl KiwisNo ratings yet

- Corpo Notes DelfinDocument151 pagesCorpo Notes DelfinUE LawNo ratings yet

- Week 2 CorpoDocument18 pagesWeek 2 Corpopretty100% (1)

- Final Corpo Midterm CoverageDocument29 pagesFinal Corpo Midterm CoverageRedd ClosaNo ratings yet

- Law Quiz 2Document3 pagesLaw Quiz 2john eric rogelNo ratings yet

- Bam Examination ReviewerDocument7 pagesBam Examination ReviewerDanah EstilloreNo ratings yet

- Summary Outline of Revised Corporation CodeDocument12 pagesSummary Outline of Revised Corporation CodeBianca JampilNo ratings yet

- Corporation: Republic Act No. 11232 Revised Corporation Code (2019)Document12 pagesCorporation: Republic Act No. 11232 Revised Corporation Code (2019)Steffanie OlivarNo ratings yet

- Private Corporations Preliminaries DiscussionDocument7 pagesPrivate Corporations Preliminaries DiscussionMay ToyokenNo ratings yet

- Corporation: Title IDocument8 pagesCorporation: Title IDarrel SapinosoNo ratings yet

- Corporation (2019) Midterm Reviewer Atty. Gaviola-ClimacoDocument16 pagesCorporation (2019) Midterm Reviewer Atty. Gaviola-ClimacoLaBron JamesNo ratings yet

- Corpo Midterm CoverageeeeDocument30 pagesCorpo Midterm CoverageeeeRedd ClosaNo ratings yet

- Corpo Code 128-157Document31 pagesCorpo Code 128-157Aejay Villaruz BariasNo ratings yet

- Bus OrgDocument3 pagesBus OrgEditha RoxasNo ratings yet

- Corpo Reporting FinalDocument9 pagesCorpo Reporting FinalVance AgumNo ratings yet

- CorpoDocument17 pagesCorpoKim Estal100% (1)

- Corporation Finals 1 TheoriesDocument9 pagesCorporation Finals 1 TheoriesEphreen Grace MartyNo ratings yet

- Notes and CommentsDocument10 pagesNotes and CommentsGracia SullanoNo ratings yet

- Revised Corporation Code of The PhilippinesDocument2 pagesRevised Corporation Code of The PhilippinesElyssa ReahnaNo ratings yet

- RFBT Notes PDFDocument6 pagesRFBT Notes PDFElijah MendozaNo ratings yet

- Prelims Reviewer Corpo Momo Eats Et - Al 1 1Document73 pagesPrelims Reviewer Corpo Momo Eats Et - Al 1 1Francois Amos PalomoNo ratings yet

- Corpo ReviewerDocument24 pagesCorpo ReviewerJovie Hernandez-MiraplesNo ratings yet

- Corporation Law Chapter 1Document16 pagesCorporation Law Chapter 1karmela hernandezNo ratings yet

- Revised Corporation Code - ReviewerDocument5 pagesRevised Corporation Code - ReviewerKyle SantosNo ratings yet

- Corporation 2Document5 pagesCorporation 2Mary Rica DublonNo ratings yet

- Corporation 1 34Document24 pagesCorporation 1 34Annamarisse parungaoNo ratings yet

- STS Finals ReviewerDocument4 pagesSTS Finals ReviewerChristine RepuldaNo ratings yet

- Notes in Purposive Communicatio N: Mr. Gary A. Garay ProfessorDocument5 pagesNotes in Purposive Communicatio N: Mr. Gary A. Garay ProfessorChristine RepuldaNo ratings yet

- Domestic Corporation - Is OneDocument3 pagesDomestic Corporation - Is OneChristine RepuldaNo ratings yet

- Understanding The Self Assignment 1Document13 pagesUnderstanding The Self Assignment 1Christine RepuldaNo ratings yet

- Repulda Reviewer For Semi FinalsDocument15 pagesRepulda Reviewer For Semi FinalsChristine RepuldaNo ratings yet

- Fin Mar Script TineDocument3 pagesFin Mar Script TineChristine RepuldaNo ratings yet

- FINANCIAL MARKETS REVIEWER. CH 3&4docxDocument29 pagesFINANCIAL MARKETS REVIEWER. CH 3&4docxChristine RepuldaNo ratings yet

- Unadjusted Trial Balance Adjusting Journal Entries Account Debit Credit Debit CreditDocument5 pagesUnadjusted Trial Balance Adjusting Journal Entries Account Debit Credit Debit CreditChristine RepuldaNo ratings yet

- Psychological SelfDocument18 pagesPsychological SelfChristine RepuldaNo ratings yet

- GCAS 09 Rizal Semi-Final Activity - REPULDADocument3 pagesGCAS 09 Rizal Semi-Final Activity - REPULDAChristine RepuldaNo ratings yet

- Department of Human Settlement and Urban Development: Activity 1Document21 pagesDepartment of Human Settlement and Urban Development: Activity 1Christine RepuldaNo ratings yet

- Financial Markets ReviewerDocument21 pagesFinancial Markets ReviewerChristine RepuldaNo ratings yet

- GCAS 09 Rizal Semi-Finals Complete The Chart BelowDocument2 pagesGCAS 09 Rizal Semi-Finals Complete The Chart BelowChristine RepuldaNo ratings yet

- Risk Identification and ResponseDocument1 pageRisk Identification and ResponseChristine RepuldaNo ratings yet

- Dominican Province of The Philippines UST Central SeminaryDocument13 pagesDominican Province of The Philippines UST Central SeminaryNathaniel RemendadoNo ratings yet

- KGZ - Access To Justice For Vulnerable Groups in KR - 161214 - ENG - ReducedDocument91 pagesKGZ - Access To Justice For Vulnerable Groups in KR - 161214 - ENG - ReducedGheorghinaDrumeaNo ratings yet

- Pupillage Checklist KLDocument14 pagesPupillage Checklist KLdacedaceluhNo ratings yet

- FINAL Contract Drafting and Negotation ScheduleDocument3 pagesFINAL Contract Drafting and Negotation ScheduleBARSHANo ratings yet

- Puerto Thesis Draft 3Document96 pagesPuerto Thesis Draft 3Khenett PuertoNo ratings yet

- Lo Chua vs. CADocument1 pageLo Chua vs. CAVEDIA GENONNo ratings yet

- EXECUTIVE ORDER NO. 022 2021 Devolution Transition CommitteeDocument3 pagesEXECUTIVE ORDER NO. 022 2021 Devolution Transition CommitteeLyn Tabelisma Ozar100% (3)

- Swoffer-Sauls COA OpinionDocument6 pagesSwoffer-Sauls COA OpinionJustin HinkleyNo ratings yet

- Notes For International LawDocument5 pagesNotes For International LawPatricia GonzalesNo ratings yet

- SFS SCO Diesel EN590 CIF Only For CAP Terry ZAGOKPROTDocument3 pagesSFS SCO Diesel EN590 CIF Only For CAP Terry ZAGOKPROTDeby Aprilucia Farahdevira100% (1)

- Dicoese of Bacolod v. COMELECDocument45 pagesDicoese of Bacolod v. COMELECAnsai CaluganNo ratings yet

- NBC S Rule 7 & 8 - Focusing On Residential BuildingsDocument15 pagesNBC S Rule 7 & 8 - Focusing On Residential BuildingsEnP. Garner Ted OlavereNo ratings yet

- IHT404Document6 pagesIHT404prifroddalloifroi-9741No ratings yet

- Commissioner of Correctional Services MR WOO Ying-Ming, CSDSM 2582 5200Document1 pageCommissioner of Correctional Services MR WOO Ying-Ming, CSDSM 2582 5200Lunag DonbelleNo ratings yet

- Subject: Schedule of Online Interviews For Appointment of Notaries For The State ofDocument79 pagesSubject: Schedule of Online Interviews For Appointment of Notaries For The State ofvandana tarangeNo ratings yet

- Criminal Evidence Module 2Document8 pagesCriminal Evidence Module 2Scarlette Joy CooperaNo ratings yet

- Common Law Admission Test - 2022: Consortium of National Law UniversitiesDocument3 pagesCommon Law Admission Test - 2022: Consortium of National Law UniversitiesVetoc94090No ratings yet

- General Guide Service Tax V2 - 30082018Document51 pagesGeneral Guide Service Tax V2 - 30082018Abdul RehmanNo ratings yet

- A. Sworn Statement: Question and AnswerDocument9 pagesA. Sworn Statement: Question and AnswerIris Lianne BonifacioNo ratings yet

- H.L.A. Hart On Justice and Morality: John TasioulasDocument27 pagesH.L.A. Hart On Justice and Morality: John TasioulasMuhammad HafeezNo ratings yet

- Sandoval Political Law 2017 Atty Edwin Rey Sandoval Political Law Political Law Notes 2017 Sandoval Notes Sandoval Political Law ReviewDocument116 pagesSandoval Political Law 2017 Atty Edwin Rey Sandoval Political Law Political Law Notes 2017 Sandoval Notes Sandoval Political Law ReviewFerdinand VillanuevaNo ratings yet

- Regional Trial Court: Republic of The Philippines Fifth Judicial Region Branch 52 Sorsogon CityDocument5 pagesRegional Trial Court: Republic of The Philippines Fifth Judicial Region Branch 52 Sorsogon CityCyril OropesaNo ratings yet

- DOJ Motion To Dismiss Civil Fraud Lawsuit Against Dish NetworkDocument30 pagesDOJ Motion To Dismiss Civil Fraud Lawsuit Against Dish NetworkJackNo ratings yet

- Ordinance Making Power of The ExecutiveDocument4 pagesOrdinance Making Power of The ExecutiveAnonymous sLAPznxNo ratings yet

- PT IndomobilDocument273 pagesPT Indomobilnina maulidyaNo ratings yet

- United Employees Union of Gelmart Industries Philippines (UEUGIP) vs. NorielDocument11 pagesUnited Employees Union of Gelmart Industries Philippines (UEUGIP) vs. NorielLyndon MelchorNo ratings yet

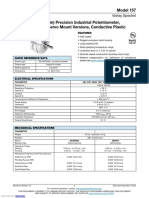

- Model 157: Vishay SpectrolDocument4 pagesModel 157: Vishay SpectrolIsos CellNo ratings yet

BL Corporation Reviewer

BL Corporation Reviewer

Uploaded by

Christine Repulda0 ratings0% found this document useful (0 votes)

22 views4 pagesThis document summarizes key aspects of the Revised Corporation Code of the Philippines.

It explains that the code was revised in 2019 to further ease the formation of corporations and streamline bureaucratic processes. The code defines corporations and establishes their legal rights and responsibilities. It also defines the different classes of corporations, and stipulates that corporations have perpetual existence and the right of succession regardless of changes in ownership. The code provides the framework for incorporating and regulating private corporations in the Philippines.

Original Description:

Original Title

BL CORPORATION REVIEWER

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes key aspects of the Revised Corporation Code of the Philippines.

It explains that the code was revised in 2019 to further ease the formation of corporations and streamline bureaucratic processes. The code defines corporations and establishes their legal rights and responsibilities. It also defines the different classes of corporations, and stipulates that corporations have perpetual existence and the right of succession regardless of changes in ownership. The code provides the framework for incorporating and regulating private corporations in the Philippines.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

22 views4 pagesBL Corporation Reviewer

BL Corporation Reviewer

Uploaded by

Christine RepuldaThis document summarizes key aspects of the Revised Corporation Code of the Philippines.

It explains that the code was revised in 2019 to further ease the formation of corporations and streamline bureaucratic processes. The code defines corporations and establishes their legal rights and responsibilities. It also defines the different classes of corporations, and stipulates that corporations have perpetual existence and the right of succession regardless of changes in ownership. The code provides the framework for incorporating and regulating private corporations in the Philippines.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 4

BL CORPORATION REVIEWER 4.

Declares the rights and liabilities of

stockholders and members;

REPULDA

5. Prescribes the conditions under which

corporations including foreighn

corporations may transact business;

SECTION 1 6. Provides penalties for violations of the

TITLE OF THE CODE Code; and

7. Repeals all laws and parts of laws in

Batas Pambansa Blg 68 – May 1980 conflict and inconsistent with the Code.

Revised Corporation Code – February 20, 2019 SECTION 2 CORPORATION DEFINED

RA 11232

- A Corporation is an artificial being

Why they revised this code? created by operation of law, having the

- It aims to further ease the formation of right of succession and the powers,

corporations and filing applications and attributes, and properties expressly

reports which have frustrated those authorized by law or incidental to its

who deal with the bureaucracy. existence.

- Para mapadali yung pagform ng mga - Explains that it refers only to private

corporations kasi yung bureaucracy sya corporations or to corporations

yung nagpapatagal ng process kasi organized under the Corporation Code.

madami pang kamay na dapat ATTRIBUTES OF CORPORATION

pagdaanan so with this promulgation of

the revised corp code mas pinili nilang 1. It is an artificial being

pabilisin yun. 2. It is created by operation of law

- It empowers the SEC to fully enforce 3. It has the right of succession

the new law. It also introduces new 4. It has only the powers, attributes and

rules that akllighn with the properties expressly authorized by law

development in technology and new or incident to its existence.

laws that came after the Old Corp Code. Corporation as an artificial personality

Scope of the Code Doctrinally, a corporation is a legal or juridical

The Corporation Code of the Philippines law is person with a personality separate and apart

an act which: from its individual stockholders or members

and from any other legal entity to which it may

1. Provides for incorporation, be connected.

organization, and regulation of private

corporations, both stock and non-stock,

including educational and religious As a consequence of this legal concept of a

corporation; corporation:

2. Defines their powers and provides for

their dissolution;

3. Fixes the duties and liabilities of

1. Liability for acts or contracts – As the

directors or trustees and other officers

general rule is that obligations incurred

thereof;

by a corporation acting through its

authorized agents are its sole liabilities. purposes of convenience and to

Similarly a stockholders ( or members) promote the ends of justice. This fiction

or those of the legal entities to which it therefore cannot be extended to a

may be connected and vice versa. point beyond its reason and policy

2. . Rights to acquire and possess property In other words the law will not

– it may acquire and possess property recognize separate corporate existence

of all kinds. ( Art. 46 Civil Code) when it is clearly established that it

Property conveyed to or acquired by used as a shield for wrong doing

the corporation is in law the property of This non – recognition is sometimes

the corporation itself as a distinct legal referred to as the Doctrine of piercing

entity ( Art. 44[3]) and not that of the the veil of corporate entity or

stockholders or members as such and disregarding the fiction of corporate

vice versa. entity.

3. 3. All contracts entered into in its name

Corporation as a creation of law or by

by its regular appointed officers and

operating of law

agents are the contracts of the

corporation and not those of the Special authority or grant by the State

stockholders or members. required – a corporation is created by

4. 4. A tax exemption granted to a law or by operation of law. They require

corporation cannot be extended to special authority or grant from the

include the dividends paid by such state. This power is exercised by the

corporation to its stockholders. ( Manila State through the legislative either by a

Gas Corporation vs. Collector of Internal special incorporation law or charter

Revenue, 71 Phil. 513 [ 19411]. which directly creates the corporation

5. 5. A corporation has no personality to or by means of a general corporation

bring an action for and in behalf of its law under which individuals desiring to

stockholders or members for the be and act as corporation may

purpose of recovering property which incorporate.

belongs to said stockholders or An exception to the rule that legislative

members in their personal capacities. grant or authority is necessary for the

( Sulo ng Bayan, Inc. vs G. Araneta Inc, creation of a corporation obtains with

72 SCRA 347 [1976] respect to corporations by prescription.

6. Likewise as an entity distinct from its

members or stockholder a corporation Right of succession of a corporation

remains unchanged and unaffected in - A corporation has a capacity of

its identity by changes in its individual continuous existence irrespective of the

membership. death, withdrawal, insolvency, or

Doctrine of piercing the veil of incapacity of the individual stockholders

corporate entity or members and regardless of the

The doctrine that a corporation is a transfer of their interest or share of

legal entity or a person in law, distinct stock.

from the persons composing it or any

other corporation to which it may be Under the revised Corporation Code a

related, is merely a legal fiction for corporation shall have perpetual existence

unless its articles of incorporation provides SECTION 4

otherwise.

Corporations created by Special Laws or

Corporation created by special laws have Charters – corporations created by special laws

the right of succession for the term or charters shall be governed primarily by the

provided in the laws creating them. provision of the special law or charter creating

them or applicable to them, supplemented by

Power, attributes, and properties of a

the provisions of this Code, insofar as they are

corporation

applicable.

- A corporation being purely a creation of

The enactment of special act creating a private

law may exercise only such powers as are

corporation is subject to the constitutional

granted by the law of its creation. An

limitation that such corporation shall be owned

express grant however is not necessary. All

or controlled by the government.

powers which are incidental or essential to

the corporation’s existence may also be The reason for the restriction is obvious:

exercised.

1. It is chiefly to prevent the granting of special

SECTION 3 privileges to one body of men without giving all

others the right to obtain them in the same

• Classes of Corporation – Corporations

conditions and

formed or organized under this Code

may be stock or non – stock 2. Perhaps it is partly to prevent bribery and

corporations. Corporations which have corruption of the legislature. (Clark on

capital stock divided into shares and are Corporations p. 45)

authorized to distribute to the holders

SECTION 5

of such shares dividends, or allotments

of surplus profits on the basis of the Corporators and Incorporators, Stockholders

share held. All other corporations are and members – Corporators are those who

non – stock corporation. compose a corporation, whether as

stockholders or shareholders in a stock

Classification of corporations under the code

corporation or as members in a nonstock

1. Stock Corporation – is the ordinary corporation. Incorporators are those

business corporation created and stockholders or members mentioned in the

operated for the purpose of making a articles of incorporation as originally forming

profit which may be distributed in the and composing the corporation and who are

form of dividends to stockholders on signatories thereof.

the basis of their invested capital.

COMPONENTS OF A CORPORATION

2. Unlike stock corporation, non – stock

1. Corporators or those who compose the

corporations do not issue stock and are

corporation, whether stockholders or

created not for profit but for the public

members.

good and welfare.

2. Incorporators or those corporators

• Non – stock corporation they are

mentioned in the articles of

primarily governed by title XI ( Sec. 87 –

incorporation as originally forming and

95) of the code.

composing the corporation and who

executed and signed the articles of

incorporation and acknowledge the

same before a notary public.

3. Stockholders or the owners of shares of

stock in a stock corporation. They are

the owners of the corporation. They are

also called shareholders.

4. Members or the corporators of a

corporation which has no capital

3 OTHER CLASSS

Promoters

Subscribers

Underwriters

SECTION 6

Classification of shares – The classification of

shares, their corresponding rights, privileges, or

restrictions, and their stated par value, if any,

must be indicated in the articles of

incorporation. Each share shall be equal in all

respects to every other share, except as

otherwise provided in the articles of

incorporation and in the certificate of stock.

The shares in stock corporations may be divided

into classes or series of shares, or both. No

share may be divided into classes or series of

shares, or both. No share may be deprived of

voting rights except those classified and issued

as “preferred” or “redeemable” shares, unless

otherwise provided in this code: Provided, that

there shall be always be a class or series of

shares with complete voting rights.

You might also like

- Dwnload Full Introduction To Quantum Mechanics 3rd Edition Griffiths Solutions Manual PDFDocument20 pagesDwnload Full Introduction To Quantum Mechanics 3rd Edition Griffiths Solutions Manual PDFChristopherNortonwqnmc82% (17)

- A Man For All Seasons - Robert BoltDocument95 pagesA Man For All Seasons - Robert BoltHoda Elhadary92% (12)

- CORPORATION LAW Reviewer PDFDocument40 pagesCORPORATION LAW Reviewer PDFYnah Lopez100% (1)

- PFA 3e 2021 SM CH 03 - Adjusting Accounts For Financial StatementsDocument71 pagesPFA 3e 2021 SM CH 03 - Adjusting Accounts For Financial Statementscalista sNo ratings yet

- Revised Corporation CodeDocument16 pagesRevised Corporation CodeLielet MatutinoNo ratings yet

- R.A 11232 - Title 1Document24 pagesR.A 11232 - Title 1Ana AmolatNo ratings yet

- Notes On Corporation Law (Sec 1-9)Document8 pagesNotes On Corporation Law (Sec 1-9)davemarklazaga179No ratings yet

- Notes in Business Laws and RegulationsDocument10 pagesNotes in Business Laws and RegulationsZie TanNo ratings yet

- Comrev NotesDocument161 pagesComrev NotesJasper BagniNo ratings yet

- Reviewer Corpo (Etona)Document29 pagesReviewer Corpo (Etona)Karylle Ynah MalanaNo ratings yet

- Corpo Week2 NotesDocument6 pagesCorpo Week2 NotesnayhrbNo ratings yet

- Pomoly Bar Reviewer Day 2 Am CommDocument22 pagesPomoly Bar Reviewer Day 2 Am CommRomeo RemotinNo ratings yet

- Corpo Week2 Notes MergedDocument42 pagesCorpo Week2 Notes MergednayhrbNo ratings yet

- Corpo Week2 NotesDocument6 pagesCorpo Week2 NotesnayhrbNo ratings yet

- Group 2 Law Reporting Round 3Document44 pagesGroup 2 Law Reporting Round 3CABRIGA, Aira Rosemyr G.No ratings yet

- Stonehill v. Diokno:: A. Sole Proprietorship v. Corporation Sole Proprietorship CorporationDocument17 pagesStonehill v. Diokno:: A. Sole Proprietorship v. Corporation Sole Proprietorship Corporationemmanuel fernandezNo ratings yet

- Revised Corporation Code of The Philippines Sec. 1-3Document2 pagesRevised Corporation Code of The Philippines Sec. 1-3Nicki Lyn Dela Cruz100% (1)

- Title I General Provisions: "The Corporation Code of The Philippines"Document1 pageTitle I General Provisions: "The Corporation Code of The Philippines"asdasdasdasdasdasNo ratings yet

- Today's Topics (March 31, 2022)Document51 pagesToday's Topics (March 31, 2022)Miguel Anas Jr.No ratings yet

- Corpo. 1st MeetingDocument13 pagesCorpo. 1st MeetingMika RapananNo ratings yet

- Corporation Law Notes by AquinoDocument3 pagesCorporation Law Notes by Aquinopinky paroliganNo ratings yet

- Corporation Law Notes by AquinoDocument3 pagesCorporation Law Notes by AquinoBaesittieeleanor Mamualas100% (1)

- V. Imperial Insurance)Document3 pagesV. Imperial Insurance)Di CanNo ratings yet

- Corporation - Insurance (Lecture Transcriptions)Document160 pagesCorporation - Insurance (Lecture Transcriptions)Vanessa Evans CruzNo ratings yet

- Corporation Code NotesDocument19 pagesCorporation Code NotesApay GrajoNo ratings yet

- Cfas Week 1-2awfawfawfDocument13 pagesCfas Week 1-2awfawfawfMharc PerezNo ratings yet

- Law of CorporationDocument33 pagesLaw of Corporationmissy dalagan100% (1)

- By-Laws Regulate, Stockholders Members Adopted Having AffairsDocument7 pagesBy-Laws Regulate, Stockholders Members Adopted Having AffairsEmmanuel PenullarNo ratings yet

- Corporation Law Notes - SubiaDocument57 pagesCorporation Law Notes - SubiaRolan Jeff Amoloza LancionNo ratings yet

- Law On Corporation Reviewer 1Document12 pagesLaw On Corporation Reviewer 1Mica Angel GonzalesNo ratings yet

- Corporation Law ReviewerDocument4 pagesCorporation Law ReviewerKeziah HuelarNo ratings yet

- BLWN05B MM1Document8 pagesBLWN05B MM1Yolly Diaz100% (1)

- BLG. 68, Section 2) : Different Forms of Business OrganizationDocument5 pagesBLG. 68, Section 2) : Different Forms of Business OrganizationKristin LuceroNo ratings yet

- The Corporation Code of The Philippines PDFDocument85 pagesThe Corporation Code of The Philippines PDFDawn BarondaNo ratings yet

- Corporation Defined: The Revised Corporation Code of The PhilippinesDocument6 pagesCorporation Defined: The Revised Corporation Code of The Philippineschristine anglaNo ratings yet

- The Corporation Code of The Philippines B.P. Blg. 68: Title 1 General Provisions Definitions and ClassificationsDocument7 pagesThe Corporation Code of The Philippines B.P. Blg. 68: Title 1 General Provisions Definitions and ClassificationsKarl KiwisNo ratings yet

- Corpo Notes DelfinDocument151 pagesCorpo Notes DelfinUE LawNo ratings yet

- Week 2 CorpoDocument18 pagesWeek 2 Corpopretty100% (1)

- Final Corpo Midterm CoverageDocument29 pagesFinal Corpo Midterm CoverageRedd ClosaNo ratings yet

- Law Quiz 2Document3 pagesLaw Quiz 2john eric rogelNo ratings yet

- Bam Examination ReviewerDocument7 pagesBam Examination ReviewerDanah EstilloreNo ratings yet

- Summary Outline of Revised Corporation CodeDocument12 pagesSummary Outline of Revised Corporation CodeBianca JampilNo ratings yet

- Corporation: Republic Act No. 11232 Revised Corporation Code (2019)Document12 pagesCorporation: Republic Act No. 11232 Revised Corporation Code (2019)Steffanie OlivarNo ratings yet

- Private Corporations Preliminaries DiscussionDocument7 pagesPrivate Corporations Preliminaries DiscussionMay ToyokenNo ratings yet

- Corporation: Title IDocument8 pagesCorporation: Title IDarrel SapinosoNo ratings yet

- Corporation (2019) Midterm Reviewer Atty. Gaviola-ClimacoDocument16 pagesCorporation (2019) Midterm Reviewer Atty. Gaviola-ClimacoLaBron JamesNo ratings yet

- Corpo Midterm CoverageeeeDocument30 pagesCorpo Midterm CoverageeeeRedd ClosaNo ratings yet

- Corpo Code 128-157Document31 pagesCorpo Code 128-157Aejay Villaruz BariasNo ratings yet

- Bus OrgDocument3 pagesBus OrgEditha RoxasNo ratings yet

- Corpo Reporting FinalDocument9 pagesCorpo Reporting FinalVance AgumNo ratings yet

- CorpoDocument17 pagesCorpoKim Estal100% (1)

- Corporation Finals 1 TheoriesDocument9 pagesCorporation Finals 1 TheoriesEphreen Grace MartyNo ratings yet

- Notes and CommentsDocument10 pagesNotes and CommentsGracia SullanoNo ratings yet

- Revised Corporation Code of The PhilippinesDocument2 pagesRevised Corporation Code of The PhilippinesElyssa ReahnaNo ratings yet

- RFBT Notes PDFDocument6 pagesRFBT Notes PDFElijah MendozaNo ratings yet

- Prelims Reviewer Corpo Momo Eats Et - Al 1 1Document73 pagesPrelims Reviewer Corpo Momo Eats Et - Al 1 1Francois Amos PalomoNo ratings yet

- Corpo ReviewerDocument24 pagesCorpo ReviewerJovie Hernandez-MiraplesNo ratings yet

- Corporation Law Chapter 1Document16 pagesCorporation Law Chapter 1karmela hernandezNo ratings yet

- Revised Corporation Code - ReviewerDocument5 pagesRevised Corporation Code - ReviewerKyle SantosNo ratings yet

- Corporation 2Document5 pagesCorporation 2Mary Rica DublonNo ratings yet

- Corporation 1 34Document24 pagesCorporation 1 34Annamarisse parungaoNo ratings yet

- STS Finals ReviewerDocument4 pagesSTS Finals ReviewerChristine RepuldaNo ratings yet

- Notes in Purposive Communicatio N: Mr. Gary A. Garay ProfessorDocument5 pagesNotes in Purposive Communicatio N: Mr. Gary A. Garay ProfessorChristine RepuldaNo ratings yet

- Domestic Corporation - Is OneDocument3 pagesDomestic Corporation - Is OneChristine RepuldaNo ratings yet

- Understanding The Self Assignment 1Document13 pagesUnderstanding The Self Assignment 1Christine RepuldaNo ratings yet

- Repulda Reviewer For Semi FinalsDocument15 pagesRepulda Reviewer For Semi FinalsChristine RepuldaNo ratings yet

- Fin Mar Script TineDocument3 pagesFin Mar Script TineChristine RepuldaNo ratings yet

- FINANCIAL MARKETS REVIEWER. CH 3&4docxDocument29 pagesFINANCIAL MARKETS REVIEWER. CH 3&4docxChristine RepuldaNo ratings yet

- Unadjusted Trial Balance Adjusting Journal Entries Account Debit Credit Debit CreditDocument5 pagesUnadjusted Trial Balance Adjusting Journal Entries Account Debit Credit Debit CreditChristine RepuldaNo ratings yet

- Psychological SelfDocument18 pagesPsychological SelfChristine RepuldaNo ratings yet

- GCAS 09 Rizal Semi-Final Activity - REPULDADocument3 pagesGCAS 09 Rizal Semi-Final Activity - REPULDAChristine RepuldaNo ratings yet

- Department of Human Settlement and Urban Development: Activity 1Document21 pagesDepartment of Human Settlement and Urban Development: Activity 1Christine RepuldaNo ratings yet

- Financial Markets ReviewerDocument21 pagesFinancial Markets ReviewerChristine RepuldaNo ratings yet

- GCAS 09 Rizal Semi-Finals Complete The Chart BelowDocument2 pagesGCAS 09 Rizal Semi-Finals Complete The Chart BelowChristine RepuldaNo ratings yet

- Risk Identification and ResponseDocument1 pageRisk Identification and ResponseChristine RepuldaNo ratings yet

- Dominican Province of The Philippines UST Central SeminaryDocument13 pagesDominican Province of The Philippines UST Central SeminaryNathaniel RemendadoNo ratings yet

- KGZ - Access To Justice For Vulnerable Groups in KR - 161214 - ENG - ReducedDocument91 pagesKGZ - Access To Justice For Vulnerable Groups in KR - 161214 - ENG - ReducedGheorghinaDrumeaNo ratings yet

- Pupillage Checklist KLDocument14 pagesPupillage Checklist KLdacedaceluhNo ratings yet

- FINAL Contract Drafting and Negotation ScheduleDocument3 pagesFINAL Contract Drafting and Negotation ScheduleBARSHANo ratings yet

- Puerto Thesis Draft 3Document96 pagesPuerto Thesis Draft 3Khenett PuertoNo ratings yet

- Lo Chua vs. CADocument1 pageLo Chua vs. CAVEDIA GENONNo ratings yet

- EXECUTIVE ORDER NO. 022 2021 Devolution Transition CommitteeDocument3 pagesEXECUTIVE ORDER NO. 022 2021 Devolution Transition CommitteeLyn Tabelisma Ozar100% (3)

- Swoffer-Sauls COA OpinionDocument6 pagesSwoffer-Sauls COA OpinionJustin HinkleyNo ratings yet

- Notes For International LawDocument5 pagesNotes For International LawPatricia GonzalesNo ratings yet

- SFS SCO Diesel EN590 CIF Only For CAP Terry ZAGOKPROTDocument3 pagesSFS SCO Diesel EN590 CIF Only For CAP Terry ZAGOKPROTDeby Aprilucia Farahdevira100% (1)

- Dicoese of Bacolod v. COMELECDocument45 pagesDicoese of Bacolod v. COMELECAnsai CaluganNo ratings yet

- NBC S Rule 7 & 8 - Focusing On Residential BuildingsDocument15 pagesNBC S Rule 7 & 8 - Focusing On Residential BuildingsEnP. Garner Ted OlavereNo ratings yet

- IHT404Document6 pagesIHT404prifroddalloifroi-9741No ratings yet

- Commissioner of Correctional Services MR WOO Ying-Ming, CSDSM 2582 5200Document1 pageCommissioner of Correctional Services MR WOO Ying-Ming, CSDSM 2582 5200Lunag DonbelleNo ratings yet

- Subject: Schedule of Online Interviews For Appointment of Notaries For The State ofDocument79 pagesSubject: Schedule of Online Interviews For Appointment of Notaries For The State ofvandana tarangeNo ratings yet

- Criminal Evidence Module 2Document8 pagesCriminal Evidence Module 2Scarlette Joy CooperaNo ratings yet

- Common Law Admission Test - 2022: Consortium of National Law UniversitiesDocument3 pagesCommon Law Admission Test - 2022: Consortium of National Law UniversitiesVetoc94090No ratings yet

- General Guide Service Tax V2 - 30082018Document51 pagesGeneral Guide Service Tax V2 - 30082018Abdul RehmanNo ratings yet

- A. Sworn Statement: Question and AnswerDocument9 pagesA. Sworn Statement: Question and AnswerIris Lianne BonifacioNo ratings yet

- H.L.A. Hart On Justice and Morality: John TasioulasDocument27 pagesH.L.A. Hart On Justice and Morality: John TasioulasMuhammad HafeezNo ratings yet

- Sandoval Political Law 2017 Atty Edwin Rey Sandoval Political Law Political Law Notes 2017 Sandoval Notes Sandoval Political Law ReviewDocument116 pagesSandoval Political Law 2017 Atty Edwin Rey Sandoval Political Law Political Law Notes 2017 Sandoval Notes Sandoval Political Law ReviewFerdinand VillanuevaNo ratings yet

- Regional Trial Court: Republic of The Philippines Fifth Judicial Region Branch 52 Sorsogon CityDocument5 pagesRegional Trial Court: Republic of The Philippines Fifth Judicial Region Branch 52 Sorsogon CityCyril OropesaNo ratings yet

- DOJ Motion To Dismiss Civil Fraud Lawsuit Against Dish NetworkDocument30 pagesDOJ Motion To Dismiss Civil Fraud Lawsuit Against Dish NetworkJackNo ratings yet

- Ordinance Making Power of The ExecutiveDocument4 pagesOrdinance Making Power of The ExecutiveAnonymous sLAPznxNo ratings yet

- PT IndomobilDocument273 pagesPT Indomobilnina maulidyaNo ratings yet

- United Employees Union of Gelmart Industries Philippines (UEUGIP) vs. NorielDocument11 pagesUnited Employees Union of Gelmart Industries Philippines (UEUGIP) vs. NorielLyndon MelchorNo ratings yet

- Model 157: Vishay SpectrolDocument4 pagesModel 157: Vishay SpectrolIsos CellNo ratings yet