Professional Documents

Culture Documents

Venture Capitalist Screening Criteria and Associated Tools: Progressive Screening Matrix & Mean-IRR Index

Venture Capitalist Screening Criteria and Associated Tools: Progressive Screening Matrix & Mean-IRR Index

Uploaded by

Shaun ScoonCopyright:

Available Formats

You might also like

- Morning Star Equity Research Process MethodologyDocument16 pagesMorning Star Equity Research Process MethodologyKalle AhiNo ratings yet

- (A. Thomas Fenik) Strategic Management (Quickstudy PDFDocument4 pages(A. Thomas Fenik) Strategic Management (Quickstudy PDFZewdu Tsegaye100% (4)

- Inka Philosophy and Its Projection Into The FutureDocument122 pagesInka Philosophy and Its Projection Into The FutureJuvenal PachecoNo ratings yet

- To Recapture The DreamDocument5 pagesTo Recapture The DreamgabrielpiemonteNo ratings yet

- Zs VC - Screening - Criteria - and - Its - Tools - 2011Document20 pagesZs VC - Screening - Criteria - and - Its - Tools - 2011Alessia YangNo ratings yet

- Equity Research Methodology by MorningstarDocument14 pagesEquity Research Methodology by MorningstarJason KWAGHENo ratings yet

- New Microsoft Excel WorksheetDocument19 pagesNew Microsoft Excel WorksheetMothi ManoharanNo ratings yet

- Module-Iv Swot Analysis Analyzing Company's Resources & Competitive PositionDocument6 pagesModule-Iv Swot Analysis Analyzing Company's Resources & Competitive PositionkimsrNo ratings yet

- CA Final (New) - Risk Management - Mock Test Paper - Apr 2023 - Question PaperDocument13 pagesCA Final (New) - Risk Management - Mock Test Paper - Apr 2023 - Question PaperBijay AgrawalNo ratings yet

- Joint 25Document113 pagesJoint 25falahkNo ratings yet

- IJCRT2305032Document10 pagesIJCRT2305032mrcooldude037No ratings yet

- Swot Analysis of Venture Capital Undertakings: CenturyDocument27 pagesSwot Analysis of Venture Capital Undertakings: CenturybjoshnaNo ratings yet

- Unit 3 - Entrepreneurial Process and Decision MakingDocument38 pagesUnit 3 - Entrepreneurial Process and Decision MakingGOVIND SINGH NARUKANo ratings yet

- IOSCOPD335Document109 pagesIOSCOPD335Chou ChantraNo ratings yet

- Dwnload Full Strategic Management Creating Competitive Advantages Canadian 4th Edition Dess Solutions Manual PDFDocument35 pagesDwnload Full Strategic Management Creating Competitive Advantages Canadian 4th Edition Dess Solutions Manual PDFashermats100% (13)

- Risk Assessment: Overlooked and Under Tested : Robert J. Bradley, CAMSDocument12 pagesRisk Assessment: Overlooked and Under Tested : Robert J. Bradley, CAMSAleAleNo ratings yet

- Chapter10 STRATEGIC MARKETING PLANNINGDocument17 pagesChapter10 STRATEGIC MARKETING PLANNINGKalkidanNo ratings yet

- Session 1Document40 pagesSession 1Aastha AasthaNo ratings yet

- Credit Analysis and Framewok - MODULE 1Document9 pagesCredit Analysis and Framewok - MODULE 1Boci & Company Services LimitedNo ratings yet

- Prospects OF Venturecapital in India: Presented By: Shweta Gupta 10MBA 32Document21 pagesProspects OF Venturecapital in India: Presented By: Shweta Gupta 10MBA 32shwetajiiNo ratings yet

- S08 SWOT TOWS AND VRIO 26 SlidesDocument26 pagesS08 SWOT TOWS AND VRIO 26 SlidesEva JessenNo ratings yet

- Case Study Dot Com CrashDocument2 pagesCase Study Dot Com CrashElaineKongNo ratings yet

- IT Risk ManagementDocument16 pagesIT Risk ManagementBenny Julisha PratidaNo ratings yet

- Unit 6.2 - Final AssessmentDocument35 pagesUnit 6.2 - Final AssessmentdonaldibeNo ratings yet

- Corporate Risk MGTDocument3 pagesCorporate Risk MGTdbutt15No ratings yet

- Important Questions Startup and New Venture ManagementDocument2 pagesImportant Questions Startup and New Venture Managementsanskarrishi0005No ratings yet

- AsianInvestor EDHEC-Risk Research Insights June 2013Document20 pagesAsianInvestor EDHEC-Risk Research Insights June 2013cranthirNo ratings yet

- RAM A Study On Equity Research Analysis at India Bulls LimitedDocument44 pagesRAM A Study On Equity Research Analysis at India Bulls Limitedalapati173768No ratings yet

- Equity ResearchDocument56 pagesEquity ResearchRobin Saha100% (1)

- Building A Discount Rate For Early Stage CompaniesDocument4 pagesBuilding A Discount Rate For Early Stage Companieselitevaluation2022No ratings yet

- CH 2Document25 pagesCH 2amonNo ratings yet

- Tata MotorsDocument3 pagesTata MotorsAmit JainNo ratings yet

- CH 2Document10 pagesCH 2Miftahudin Miftahudin100% (1)

- Operational Risk Management Systems 2008Document34 pagesOperational Risk Management Systems 2008raul.riveraNo ratings yet

- CGAP Technical Guide Due Diligence Guidelines For The Review of Microcredit Loan Portfolios Dec 2009Document58 pagesCGAP Technical Guide Due Diligence Guidelines For The Review of Microcredit Loan Portfolios Dec 2009assefamenelik1No ratings yet

- The Ultimate Guide To Strategy 1715861783Document20 pagesThe Ultimate Guide To Strategy 1715861783ambassyounyNo ratings yet

- Edelweiss - IIM CalcuttaDocument3 pagesEdelweiss - IIM CalcuttaPulkit SharmaNo ratings yet

- It Fin Repaired)Document97 pagesIt Fin Repaired)Dharmesh BhikadiyaNo ratings yet

- Chapter 9Document17 pagesChapter 9jaoceelectricalNo ratings yet

- Chandan - A Study On Risk Management System For Equity Portfolio Managers' in India With Reference To Karvy Stock Broking LimtedDocument89 pagesChandan - A Study On Risk Management System For Equity Portfolio Managers' in India With Reference To Karvy Stock Broking LimtedVenky PoosarlaNo ratings yet

- Chapter 2Document18 pagesChapter 2Yosef KetemaNo ratings yet

- Critial Startup SucessDocument6 pagesCritial Startup SucessFull SheBang FuntimeNo ratings yet

- Role of Competitive Intelligence in Multinational Companies: 1 Introduction and Background of The StudyDocument10 pagesRole of Competitive Intelligence in Multinational Companies: 1 Introduction and Background of The StudyAmber JamilNo ratings yet

- SME Rating (Methodology)Document6 pagesSME Rating (Methodology)radhika1991No ratings yet

- SWOT AnalysisDocument8 pagesSWOT AnalysisPhan Hoai Khanh TienNo ratings yet

- Corporate Metrics TechDocument135 pagesCorporate Metrics TechLinh LinhNo ratings yet

- Internship ReportDocument38 pagesInternship ReportManasvi DoshiNo ratings yet

- How Venture Capitalists Evaluate Potential Venture OpportunitiesDocument4 pagesHow Venture Capitalists Evaluate Potential Venture OpportunitiesARSHAD QAYUMNo ratings yet

- Is Risk Based Audit The Best ApproachDocument7 pagesIs Risk Based Audit The Best ApproachRached LazregNo ratings yet

- A Report ON A Study On The Plans&Fund Ivestements of Unit Link Products in Shiiram Life Insurance Co - Ltd. By: Veera Hanuman 19BSP3190Document60 pagesA Report ON A Study On The Plans&Fund Ivestements of Unit Link Products in Shiiram Life Insurance Co - Ltd. By: Veera Hanuman 19BSP3190bathula veerahanumanNo ratings yet

- 02 Idea Assessment Feasibility Analysis Business ModelDocument4 pages02 Idea Assessment Feasibility Analysis Business ModelImaan IqbalNo ratings yet

- Case Study 1 Group 1Document8 pagesCase Study 1 Group 1Spheal GTNo ratings yet

- Business Enterprise SimulationDocument12 pagesBusiness Enterprise SimulationCha Eun WooNo ratings yet

- Manufacturing CompaniesDocument5 pagesManufacturing CompaniesVineet_Sharma_9432No ratings yet

- AIMA's Guide To Sound Practices For Business Continuity Management For Hedge Fund Managers June 2006Document26 pagesAIMA's Guide To Sound Practices For Business Continuity Management For Hedge Fund Managers June 2006NaisscentNo ratings yet

- The Executive Guide to Enterprise Risk Management: Linking Strategy, Risk and Value CreationFrom EverandThe Executive Guide to Enterprise Risk Management: Linking Strategy, Risk and Value CreationNo ratings yet

- Ethical Valuation: Navigating the Future of Startup InvestmentsFrom EverandEthical Valuation: Navigating the Future of Startup InvestmentsNo ratings yet

- El Destino de La Civilización - Michael HudsonDocument311 pagesEl Destino de La Civilización - Michael HudsonAXEL FLORES MONTES DE OCANo ratings yet

- The Playwright Was Born in 1915, and During The Dep-: PlaysDocument15 pagesThe Playwright Was Born in 1915, and During The Dep-: PlaysAncaNo ratings yet

- Time, Space & Capitalism: Aejaz Ahmad Wani, Mohd. Rafiq WaniDocument4 pagesTime, Space & Capitalism: Aejaz Ahmad Wani, Mohd. Rafiq WaniGulshaRaufNo ratings yet

- Science of Pub AdDocument12 pagesScience of Pub AdBiswajit MohantyNo ratings yet

- Sample Business Proposal Impact of Microfinance in KenyaDocument64 pagesSample Business Proposal Impact of Microfinance in Kenyayedinkachaw shferawNo ratings yet

- GlobalizationDocument60 pagesGlobalizationFrancesca Veronique TablonNo ratings yet

- Index S.No Chapter P.No 1. 1 2. 7 3. 16 4. 24 5. 33 6. 40 7. 48 8. 56 9. 64 10. 72Document47 pagesIndex S.No Chapter P.No 1. 1 2. 7 3. 16 4. 24 5. 33 6. 40 7. 48 8. 56 9. 64 10. 72Suryansh jainNo ratings yet

- (Bela Kun) Revolutionary EssaysDocument60 pages(Bela Kun) Revolutionary EssaysANTENOR JOSE ESCUDERO GÓMEZNo ratings yet

- Economic Planning PDFDocument93 pagesEconomic Planning PDFShoiab Khaki100% (4)

- Thesis FinalDocument80 pagesThesis FinalJessie Christian JumuadNo ratings yet

- Beyond Guilt and Privilege Abolishing The White Race - Viewpoint Mag - DigitalDocument64 pagesBeyond Guilt and Privilege Abolishing The White Race - Viewpoint Mag - DigitalZack Hershman50% (2)

- Japanese IndustrializationDocument4 pagesJapanese IndustrializationTruckerNo ratings yet

- Trends, Networks, and Critical Thinking in The 21st Century: Quarter 2 - Module 2Document32 pagesTrends, Networks, and Critical Thinking in The 21st Century: Quarter 2 - Module 2Shaina jane UyNo ratings yet

- Economy Results Due To Faulty Legal System and Unjust State of Georgia Convictions On All 5 Counts of Banks' Cases of Innocent Srinivas VaddeDocument1,553 pagesEconomy Results Due To Faulty Legal System and Unjust State of Georgia Convictions On All 5 Counts of Banks' Cases of Innocent Srinivas VaddesvvpassNo ratings yet

- ButtersDocument17 pagesButtersCaleb_R_DillmanNo ratings yet

- Anne Laurence History of Women As Investors RoBookFiDocument337 pagesAnne Laurence History of Women As Investors RoBookFiJonathan David Lozano AriasNo ratings yet

- Development of Economic Systems & ExamplesDocument21 pagesDevelopment of Economic Systems & Examplesanon-583057100% (2)

- Global Rupture. Neoliberal Capitalism and The Rise of Informal Labour in The Global SouthDocument353 pagesGlobal Rupture. Neoliberal Capitalism and The Rise of Informal Labour in The Global SouthJason WeidnerNo ratings yet

- 2000.thinking Underside-Linda Alcoff Eduardo MendietaDocument301 pages2000.thinking Underside-Linda Alcoff Eduardo MendietaBruno ThiagoNo ratings yet

- ACTPACO - Lesson 3 (Revised)Document52 pagesACTPACO - Lesson 3 (Revised)Harry KingNo ratings yet

- An Ethnography of Neoliberalism Understanding Competition in Artisan Economies PDFDocument26 pagesAn Ethnography of Neoliberalism Understanding Competition in Artisan Economies PDFSeptiawan jiwandonoNo ratings yet

- Tom Brass Unfree Labour As Primitive AcumulationDocument16 pagesTom Brass Unfree Labour As Primitive AcumulationMauro FazziniNo ratings yet

- History of CooperationDocument367 pagesHistory of CooperationSebestyén GyörgyNo ratings yet

- Dundon Rollinson Sample ChapterDocument40 pagesDundon Rollinson Sample ChapterrhodaNo ratings yet

- Programa Patria 2013 in English (Chavez's Plan For Bolivarian Socialist Management 2013-2019)Document91 pagesPrograma Patria 2013 in English (Chavez's Plan For Bolivarian Socialist Management 2013-2019)Revolutionary Communist GroupNo ratings yet

- Laumann (2013) Colonial Africa (1884-1994) 2Document11 pagesLaumann (2013) Colonial Africa (1884-1994) 2onyame3838No ratings yet

- Lewis' Theory of Unlimited Supply of Labour PPT 3.2Document23 pagesLewis' Theory of Unlimited Supply of Labour PPT 3.2Kat SullvianNo ratings yet

- İslam Eği̇ti̇mi̇ SorunlarDocument187 pagesİslam Eği̇ti̇mi̇ SorunlarMustafa ÇetinNo ratings yet

Venture Capitalist Screening Criteria and Associated Tools: Progressive Screening Matrix & Mean-IRR Index

Venture Capitalist Screening Criteria and Associated Tools: Progressive Screening Matrix & Mean-IRR Index

Uploaded by

Shaun ScoonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Venture Capitalist Screening Criteria and Associated Tools: Progressive Screening Matrix & Mean-IRR Index

Venture Capitalist Screening Criteria and Associated Tools: Progressive Screening Matrix & Mean-IRR Index

Uploaded by

Shaun ScoonCopyright:

Available Formats

1

Venture Capitalist Screening Criteria and

Associated Tools: Progressive Screening Matrix &

Mean-IRR Index

By Marvin Lai

Partner, iTM Ventures Inc

enquiry@itmventures.com

Marvin Lai, iTM Ventures Inc, 2006

All Rights Reserved

2

EXECUTIVE SUMMARY .............................................................................................. 3

1 INITIAL SCREENING ............................................................................................ 5

2 PROGRESSIVE SCREENING ............................................................................... 5

2.1 SCREENING CRITERIA................................................................................................. 5

2.1.1 Criteria for Determining Management (Entrepreneur) Strength ............... 5

2.1.2 Criteria for Determining Business (Market and Product) Attractiveness . 6

2.1.3 Criteria for Determining Exit Potential...................................................... 6

2.2 PROGRESSIVE SCREENING MATRIX (PSM) .......................................................... 7

2.3 APPLICATION OF PROGRESSIVE SCREENING MATRIX ........................................... 8

2.3.1 Management Strength Measure .................................................................. 8

2.3.2 Business Attractiveness Measure................................................................ 9

2.3.3 Exit Potential Measure ............................................................................. 11

2.4 EXAMPLE SUMMARY ......................................................................................... 11

3 FINAL SCREENING ............................................................................................. 12

3.1 CRITERIA FOR DETERMINING INTERNAL RATE OF RETURN (IRR)..................... 12

3.2 IRR COEFFICIENT MEASURE.............................................................................. 13

3.3 MEAN-IRR INDEX.............................................................................................. 13

CONCLUSIONS ............................................................................................................. 15

APPENDICES ................................................................................................................. 16

APPENDIX A: TYPES OF VENTURE CAPITALIST .............................................................. 16

APPENDIX B: TOP 10 CONSIDERED CRITERIA ................................................................ 17

APPENDIX C: PERCENTAGE OF VENTURE CAPITALISTS WHO ARE LIKELY TO REJECT

PROPOSALS FAILING ON TWO CRITERIA ........................................................................ 18

REFERENCES................................................................................................................ 19

VITA................................................................................................................................. 20

Marvin Lai, iTM Ventures Inc, 2006

All Rights Reserved

3

Executive Summary

The Venture Capital (VC) industry is becoming a formidable force in contributing to

innovation in technology, creation of jobs, and elevation of state economies not only in

the Western World but also in China. As a result it is important to study the entry point of

all venture investments, i.e. the selection of ventures and the criteria used to screen

investments.

This paper aims to provide a practical framework for venture capitalists and investors

alike. It will illustrate how to select the most viable, lowest risk ventures in order to

increase the chance of success in venture investing.

The author by no means wishes to suggest that the following quantitative approach is the

best way to select ventures in which to invest. It is however a practical and objective way

to establish a framework by which prospective ventures can be evaluated.

This paper proposes three levels of screening – initial, progressive, and final screening.

Initial screening filters all ventures from a macro-level perspective and determines

whether the venture should progress to the next level of screening. The following

considerations accompany initial screening: (1) The size of the investment and the

investment policy of the venture fund, (2) Technology and market sector of the venture,

(3) Geographic location of the venture, and (4) Stage of financing. These initial screening

criteria serve to provide a preliminary overview of the ventures in question in order to

identify those to be progressed to the next level of screening.

Progressive screening filters the ventures under three progressive screening criteria as

follows: (1) management strength, (2) business attractiveness, and (3) exit potential. The

goal of progressive screening is to determine which “star” ventures should be in the

“upper-left three squares” of the Progressive Screening Matrix (PSM), representing the

ventures that are the most favourable to invest in. In most cases, progressive screening is

sufficient for most venture capital firms to determine their investment portfolio. There are

Marvin Lai, iTM Ventures Inc, 2006

All Rights Reserved

4

however times when there are many good investment ventures to choose from. At this

point final screening is used.

Final screening gathers all “star” ventures from the “upper-leftmost square” of the PSM

and performs the “Mean-IRR Indexing” computation to determine which venture shall be

selected. Mean-IRR Index is also a way to prioritise the best ventures available in order

for venture capitalists to better determine their resource allocation.

The author recognises that evaluation of screening criteria is often a very subjective

exercise for most venture capitalists, in which personal views and experience can have a

significant effect on the outcome of the evaluation. Venture capitalists themselves vary

considerably but generally fall into one of three types, as outlined in Appendix A.

Recognition of this fact should enable venture capitalists to better understand their

investment preferences, and to be aware of potential shortcomings. Ten generally

accepted screening criteria are also enclosed in Appendix B to serve as a quick guide for

screening ventures. Appendix C illustrates ten top pairs of criteria used by venture

capitalists to detect flawed ventures, together with the percentages of venture capitalists

who would reject the ventures on the basis of these criteria.

All feedbacks are welcome; the author can be contacted at enquiry@itmventures.com.

Marvin Lai, iTM Ventures Inc, 2006

All Rights Reserved

5

1 Initial Screening

The number of proposals received by venture capital firms frequently outweigh their

capability to manage them relative to their staff size. Large numbers of proposals can be

excluded using the following criteria: (1) The size of the investment and the investment

policy of the venture fund. “Is the investment size suitable?”; (2) The technology and

market sector of the venture. “Am I familiar with the technology and market sector?”; (3)

Geographic location of the venture. “Is the venture close enough to be monitored?”; (4)

Stage of financing. “Is the stage of the venture’s financing suitable?” (MacMillan et al.,

1987) By employing these four criteria in the initial screening phase, unwanted ventures

can be effectively removed whilst retaining more suitable ventures for subsequent

scrutiny them in the next ‘progressive screening’ phase.

2 Progressive Screening

2.1 Screening Criteria

Screening criteria in the following sectors are considered: Management (entrepreneur)

strength, business (market & and product) attractiveness, and exit potential. The factors

comprising each screening criteria are listed below.

.

2.1.1 Criteria for Determining Management (Entrepreneur)

Strength

• Is the venture team capable for sustained and intense effort?

• Is the venture team able to evaluate and react to risk well?

• Is the venture team able to articulate well when discussing the venture?

• Does the venture team pay attention to detail?

• Is the venture team compatible with me?

• Am I familiar with the market targeted by the venture?

• Has the venture team demonstrated its past leadership ability?

• Has the venture team demonstrated its relevant track record?

• Am I familiar with the venture team’s reputation?

Marvin Lai, iTM Ventures Inc, 2006

All Rights Reserved

6

• Is the venture team referred by a trustworthy source?

2.1.2 Criteria for Determining Business (Market and Product)

Attractiveness

Market Attractiveness

• Does the target industry have a well-established distribution channel to which the

venture team has access?

• Is the target market enjoying a significant growth rate?

• Will an existing market be stimulated?

• Am I familiar with the industry of the venture?

• Is there little threat of competition during the first two years?

• Can the venture create a new market?

Product Attractiveness

• Is the product proprietary or otherwise protected?

• Does the product enjoy and demonstrate market acceptance?

• Has the product developed to the point of a functioning prototype?

• Is the product considered “high tech”1?

2.1.3 Criteria for Determining Exit Potential

• How liquid is the investment?

• Can the investment produce a ten-fold return over a period of five years?

• Is there a requirement to make any subsequent investments ?

• Is there a requirement to participate in the initial round of investment?

(MacMillan et al., 1987).

1

Although most venture capitalists claim that “high tech” is not important in their consideration,

MacMillan’s surprising finding is that over 70% of ventures are in the “high tech” industry.

Marvin Lai, iTM Ventures Inc, 2006

All Rights Reserved

7

These factors can now be applied to constructing a Progressive Screening Matrix , to

determine which ventures would most probably lie in the “upper-left three squares”

where they would more likely be funded. See section 2.2 for more details.

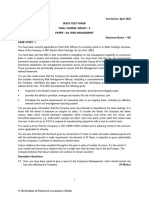

2.2 Progressive Screening Matrix (PSM)

The success in investing in ventures can be pictorially represented on a matrix as depicted

in Figure 1. Management strength is plotted on the vertical axis and business (market

and product) attractiveness is plotted on the horizontal axis. Management strength is

divided into three zones (strong, average and weak). Business (market and product)

attractiveness is similarly divided into three regions (high, medium, and low). Strong

management strength is rated with a score of 7 or higher; average strength with a score of

4 to 6; and weak with a score of 1 to 3. Similarly, high attractiveness is associated with 7

or higher; medium with a score of 4 to 6; and low with a score of 1 to 3. Each venture is

further ranked by its exit potential and is marked by symbols “star”, “triangle”, and ‘X”.

“ Star” symbolizes high exit potential and is rated 7 or higher; “triangle” represents

medium, with a score of 4 to 6; and “X” represents low, with a score of 1 to 3.

The matrix shown in Figure 1 shows the investment priorities in these upper-left three

squares, enabling identification of the most probable ventures in which to invest.

Ventures which fall outside of the “upper-left three squares” should be rejected unless the

deficiencies displayed in these “star” ventures can be countered by the venture capitalists

themselves.

Marvin Lai, iTM Ventures Inc, 2006

All Rights Reserved

8

B usiness Attractiveness

H igh (>7) M edium (4 – 6) Low (1 – 3)

Strong F B

Management Strength

(>7)

S

S A

D

ES

A verage

(4 - 6) 8C

G

W eak

(1 - 3)

: H igh Exit Potential

S : M edium Exit Potential Preferred ventures to invest

8 : Low Exit Potential & Ventures to reject

Figure 1: Progressive Screening Matrix

(Thompson et al., 1990)

2.3 Application of Progressive Screening Matrix

Each factor in the progressive screening criteria must be rated from 1 to 10, where 1 is

the weakest or least attractive and 10 the strongest or most attractive. Weight is to be

given to each criterion in proportion to its contribution to the measure. The following

example provides an illustration:

2.3.1 Management Strength Measure

Suppose for example that each of the management strength criteria are equally important

and weighted evenly at 10% per criterion. In this case the final rating will be as shown in

Table 1.

Marvin Lai, iTM Ventures Inc, 2006

All Rights Reserved

9

Table 1: Management Strength Measure (An Example)

Management Strength Weight Strength Rating Weighted Strength

Measure Rating

Capacity for sustained and 0.1 5 0.5

intense effort

Ability to evaluate and react 0.1 8 0.8

to risk well

Ability to articulate well when 0.1 2 0.2

discussing venture

Attention to detail 0.1 6 0.6

Personal compatibility with 0.1 4 0.4

the venture capitalist

Familiarity with the market 0.1 7 0.7

targeted by venture

Degree of leadership ability 0.1 4 0.4

demonstrated in the past

Track record relevant to the 0.1 5 0.5

venture

Familiarity with the venture 0.1 6 0.6

team’s reputation

Venture team referred by a 0.1 8 0.8

trustworthy source

Sum of assigned weight: 1.00

Management Strength 5.8

Rating:

2.3.2 Business Attractiveness Measure

Similarly, suppose that each of the criteria in the business (market and product)

attractiveness are equally important and weighted evenly at 10% per criterion. In this case

the final rating will be as shown in Table 2.

Marvin Lai, iTM Ventures Inc, 2006

All Rights Reserved

10

Table 2: Business (Market & Product) Attractiveness Measure (An Example)

Business (Market and Weight Strength Rating Weighted Strength

Product) Attractiveness Rating

Measure

Well-established distribution 0.1 5 0.5

channel of the targeted

industry, to which the venture

team has access

Target market is enjoying a 0.1 8 0.8

significant growth rate

An existing market would be 0.1 8 0.8

stimulated

Venture in an industry with 0.1 6 0.6

which venture capitalists are

familiar

Competition present or 0.1 4 0.4

anticipated in first two years

The venture could create a 0.1 7 0.7

new market

Protection of product 0.1 6 0.6

The product enjoyed 0.1 5 0.5

demonstrated market

acceptance

Product developed to the point 0.1 8 0.8

of a functioning prototype

The product is “high tech” 0.1 8 0.8

Sum of assigned weight: 1.00

Business Attractiveness 7.5

Rating:

Marvin Lai, iTM Ventures Inc, 2006

All Rights Reserved

11

2.3.3 Exit Potential Measure

Suppose that each of the criteria in the exit potential are equally important and weighted

evenly at 25% per criterion. In this case the final rating will be as shown in Table 3.

Table 3: Exit Potential Measure (An Example)

Exit Potential Weight Strength Rating Weighted Strength

Rating

Investment could be readily 0.25 4 1

liquefied

The investment will make a 0.25 6 1.5

ten-fold return over a five year

period

Not expected to make 0.25 7 1,75

subsequent investments

It was the first round of 0.25 6 1.5

investment

Sum of assigned weight: 1.00

Exit Potential Rating: 5.75

2.4 Example Summary

This case can then be summarised as follows:

• Management strength rated at 5.8 signifies “average” strength.

• Business (market and product) attractiveness rated at 7.5 signifies “high”

attractiveness.

• Exit potential rated at 5.75 signifies “medium” potential.

Venture A is depicted as “A” in the matrix, see Figure 1.

Marvin Lai, iTM Ventures Inc, 2006

All Rights Reserved

12

Referring to the portfolio of proposals depicted in Figure 1, those shown with a “star” in

the upper-left three squares are the preferred ventures to be invested in. At times when

there are many good investment ventures to choose from, closer scrutiny is required by

the venture capitalists. This capability is provided in the form of ‘Final screening’ using a

Mean-IRR Indexing model (see Section 3).

3 Final Screening

Suppose the six ventures in the three upper-left squares of Figure 1 have the strength-

attractiveness portfolio as depicted in Table 4.

Table 4: Strength-Attractiveness Portfolio in the Upper-Left Three Squares. (An Example)

Name of Management Business Exit Potential Internal Rate

Venture Strength Attractiveness of Return

B 8 6 5 18%

C 5 8 3 25%

D 7 8 7 35%

E 6 7 6 12%

F 8 7 7 19%

G 4 8 8 28%

It can be noticed that ventures B, C, E, and G fall outside of the most upper-left square;

therefore, these ventures will not be considered for funding. Ventures D and F however

both fall inside the upper-leftmost square. Further screening can identify the successful

venture. This can be done by considering an additional factor, namely the expected

Internal Rate of Return (IRR).

3.1 Criteria for Determining Internal Rate of Return (IRR)

Ventures that are highly likely to attain their expected IRR are rated 7 or higher; those

with medium likelihood, 4 to 6; and those with low likelihood, 1 to 3. The IRR

Marvin Lai, iTM Ventures Inc, 2006

All Rights Reserved

13

coefficient is then determined by dividing the score of the likelihood by ten (since ten is

the full score for IRR to be attained) and then multiplying it by the IRR percentage as

shown in the next section.

3.2 IRR Coefficient Measure

Venture D’s IRR percentage is 35%, and let’s suppose that the likelihood of this

attainment is low, say 1. The likelihood is first normalised by dividing it by ten; in this

case, the normalized likelihood is 0.1. The IRR coefficient is then derived by multiplying

the normalised likelihood (0.1) by venture D’s IRR percentage of 35%. Venture D’s IRR

coefficient is then 0.035 (0.1 x 0.35). In the same way, the IRR coefficient for venture F

is 0.11 (0.6 x 0.19) assuming that the likelihood of attainment is 6 to signify medium

attainment of its expected IRR.

3.3 Mean-IRR Index

The Mean-IRR model averages the ratings of management strength, business

attractiveness and exit potential and multiplies by the IRR coefficient ρ to arrive at the

Mean-IRR index.

The Mean-IRR Indexing model for ventures D and F is depicted in Table 5.

Table 5: Mean-IRR Indexing Model for Ventures D and F. (An Example)

Name of venture Mean of ratings of IRR Coefficient ρ Mean-IRR Index

strength-attractiveness (note 2)

(note 1)

D 7.3 0.035 0.26

Marvin Lai, iTM Ventures Inc, 2006

All Rights Reserved

14

Name of venture Mean of ratings of IRR Coefficient ρ Mean-IRR Index

strength-attractiveness (note 2)

(note 1)

F 7.3 0.11 0.80

Note 1: Mean is the average of management strength, business attractiveness and exit

potential. For example, mean of venture D is (7+8+7)/3=7.3

Note 2: Mean-IRR index is derived by multiplying the Mean by IRR coefficient. For

example, the Mean-IRR index for venture F is 0.80, (7.3 x 0.11).

By rearranging Table 5 by its Mean-IRR Index yields Table 6, in which the final

investment priority is identified.

Table 6: Investment Priority (An Example)

Name of venture Mean-IRR Index

F 0.80

D 0.26

Clearly the venture capitalist should invest in venture F since its Mean-IRR Index is

higher than that of venture D. This is actually quite surprising because on the surface

many investors would have funded venture D because the IRR percentage of venture D is

much higher than that of venture F: i.e. 49% and 19%, respectively. But with further

scrutiny by the venture capitalist, venture D’s likelihood of attaining its expected IRR is

much lower than venture F’s; in other words, venture D has inflated the expected return,

which is normalised by the venture capitalist’s scrutiny score of a 1. Venture F’s return is

more likely to be attained, which is given a rating of 6 by the venture capitalist, and thus

venture F’s IRR coefficient is higher than venture D’s. This leads to both a higher Mean-

IRR index for venture F and subsequent accompanying funding.

Marvin Lai, iTM Ventures Inc, 2006

All Rights Reserved

15

Conclusions

Initial, progressive and final screenings have been discussed in this paper for use by

venture capitalists. These techniques are intended to improve the screening of potential

ventures in order to increase the chances of investing successfully.

Initial Screening is undertaken as a preliminary scan to weed out most of the unwanted

ventures, by asking the following questions: (1) “Is the investment size suitable?” (2)

“Am I familiar with the technology and market sector?” (3) “Is the venture close enough

to monitor?” and (4) “Is the stage of the venture’s financing appropriate?”

Ventures that pass Initial Screening may then be subjected to Progressive Screening. This

is the main screening effort, employing a Progressive Screening Matrix to categorise

ventures into the “upper-left three squares” of Figure 1 by analysing the venture’s

management strength, business attractiveness and exit potential.

Final Screening (employing the Mean-IRR index) is used when there are needs to

prioritise multiple good investment ventures. In this case the Mean-IRR index model can

be used to establish the investment portfolio.

Finally, it should be noted that investing is often more of an art than science, and that all

tools have limitations. The ultimate decision as to whether to invest lies with venture

capitalists themselves.

Marvin Lai, iTM Ventures Inc, 2006

All Rights Reserved

16

Appendices

Appendix A: Types of Venture Capitalist

There are three types of venture capitalist according to MacMillan et al. (1985):

• “Purposeful Risk Managers” are inclined to manage and assess all competitive

and implementation risks.

• “Determined Eclectics” are prepared to consider any ventures and put minimum

restrictions on venture selection.

• “Parachutists” tend to support most ventures as long as they feel comfortable

about the exit route when ventures fail.

(Which one are you?)

Marvin Lai, iTM Ventures Inc, 2006

All Rights Reserved

17

Appendix B: Top 10 Considered Criteria

Rank Screening Criteria

1 Capable of sustained intense effort

2 Thoroughly familiar with market

3 At least ten-fold return in 5-10 years

4 Demonstrated leadership in the past

5 Evaluates and reacts to risk well

6 Investment can be made liquid

7 Significant market growth

8 Track record relevant to venture

9 Articulates venture well

10 Proprietary protection

(from MacMillan et al. 1985)

Marvin Lai, iTM Ventures Inc, 2006

All Rights Reserved

18

Appendix C: Percentage of Venture Capitalists Who Are

Likely to Reject Proposals Failing on Two Criteria

Pairs of criteria Percentage who

reject the

proposal

1 Capable of effort 84%

Ten-fold return within 5-10 years

2 Capable of effort 80%

Functionally balanced management team

3 Demonstrated leadership 80%

Familiar with target market

4 Capable of effort 79%

Demonstrated leadership

5 Able to evaluate risk 77%

Familiar with target market

6 Capable of effort 77%

Track record relevant to record

7 Able to evaluate risk 76%

Ten-fold return within 5-10 years

8 Capable of effort 76%

Significant growth rate of market

9 Demonstrated leadership 75%

Ten-fold return within 5-10 years

10 Capable of effort 75%

Proprietary product

The above pairs are also known to identify flawed ventures; for example, for pair no. 1,

85% of the venture capital firms would reject the venture; no. 2, 80%, and so on.

(MacMillan et al. 1985)

Marvin Lai, iTM Ventures Inc, 2006

All Rights Reserved

19

References

MACMILLAN, I., SIEGEL, R., & SUBBANARASIMHA, P.N. (1985) Criteria used by venture

capitalists to evaluate new venture proposals. Journal of Business Venturing, 1(1): 119-128.

MACMILLAN, I., ZEMANN, L., & SUBBANARASIMHA, P.N. (1987) Criteria distinguishing successful

from unsuccessful ventures in the venture screening process. Journal of Business Venturing, 2(2):

123-137.

TYEBJEE, T.T. & BRUNO A.V. (1984) A model of venture capitalist investment activity, Management

Science 30: 1051-1066

THOMPSON, A. & STRICKLAND, A (1990) Strategic Management: Concepts and Cases, 5th ed.,

BPI/Irwin, Homewood, III: 201

Marvin Lai, iTM Ventures Inc, 2006

All Rights Reserved

20

Vita

Marvin Lai is the partner of iTM Ventures Inc and Chairman of

Trans-Telecom Group. He is currently serving as the Chairman

of SME sub-committee of Hong Kong Venture Capital

Association, President of Columbia University Alumni

Association in Hong Kong, and a Board of Director of a local

Rotary club. He was with AT&T Bell Laboratories, now Lucent, and IBM in the U.S.

The author obtained his Bachelor of Science degree in Electrical Engineering from

Columbia University in the city of New York, USA; Master of Science degree in

Electrical Engineering from Johns Hopkins University in Baltimore, MD, USA; MBA

from Kensington University in Glendale, CA, USA; and a PhD candidate at Macquarie

Graduate School of Management (MGSM) in Sydney, Australia. The author lives in

Hong Kong with his lovely wife, Acme, and 2 wonderful sons, Christopher and Austin.

Marvin Lai, iTM Ventures Inc, 2006

All Rights Reserved

You might also like

- Morning Star Equity Research Process MethodologyDocument16 pagesMorning Star Equity Research Process MethodologyKalle AhiNo ratings yet

- (A. Thomas Fenik) Strategic Management (Quickstudy PDFDocument4 pages(A. Thomas Fenik) Strategic Management (Quickstudy PDFZewdu Tsegaye100% (4)

- Inka Philosophy and Its Projection Into The FutureDocument122 pagesInka Philosophy and Its Projection Into The FutureJuvenal PachecoNo ratings yet

- To Recapture The DreamDocument5 pagesTo Recapture The DreamgabrielpiemonteNo ratings yet

- Zs VC - Screening - Criteria - and - Its - Tools - 2011Document20 pagesZs VC - Screening - Criteria - and - Its - Tools - 2011Alessia YangNo ratings yet

- Equity Research Methodology by MorningstarDocument14 pagesEquity Research Methodology by MorningstarJason KWAGHENo ratings yet

- New Microsoft Excel WorksheetDocument19 pagesNew Microsoft Excel WorksheetMothi ManoharanNo ratings yet

- Module-Iv Swot Analysis Analyzing Company's Resources & Competitive PositionDocument6 pagesModule-Iv Swot Analysis Analyzing Company's Resources & Competitive PositionkimsrNo ratings yet

- CA Final (New) - Risk Management - Mock Test Paper - Apr 2023 - Question PaperDocument13 pagesCA Final (New) - Risk Management - Mock Test Paper - Apr 2023 - Question PaperBijay AgrawalNo ratings yet

- Joint 25Document113 pagesJoint 25falahkNo ratings yet

- IJCRT2305032Document10 pagesIJCRT2305032mrcooldude037No ratings yet

- Swot Analysis of Venture Capital Undertakings: CenturyDocument27 pagesSwot Analysis of Venture Capital Undertakings: CenturybjoshnaNo ratings yet

- Unit 3 - Entrepreneurial Process and Decision MakingDocument38 pagesUnit 3 - Entrepreneurial Process and Decision MakingGOVIND SINGH NARUKANo ratings yet

- IOSCOPD335Document109 pagesIOSCOPD335Chou ChantraNo ratings yet

- Dwnload Full Strategic Management Creating Competitive Advantages Canadian 4th Edition Dess Solutions Manual PDFDocument35 pagesDwnload Full Strategic Management Creating Competitive Advantages Canadian 4th Edition Dess Solutions Manual PDFashermats100% (13)

- Risk Assessment: Overlooked and Under Tested : Robert J. Bradley, CAMSDocument12 pagesRisk Assessment: Overlooked and Under Tested : Robert J. Bradley, CAMSAleAleNo ratings yet

- Chapter10 STRATEGIC MARKETING PLANNINGDocument17 pagesChapter10 STRATEGIC MARKETING PLANNINGKalkidanNo ratings yet

- Session 1Document40 pagesSession 1Aastha AasthaNo ratings yet

- Credit Analysis and Framewok - MODULE 1Document9 pagesCredit Analysis and Framewok - MODULE 1Boci & Company Services LimitedNo ratings yet

- Prospects OF Venturecapital in India: Presented By: Shweta Gupta 10MBA 32Document21 pagesProspects OF Venturecapital in India: Presented By: Shweta Gupta 10MBA 32shwetajiiNo ratings yet

- S08 SWOT TOWS AND VRIO 26 SlidesDocument26 pagesS08 SWOT TOWS AND VRIO 26 SlidesEva JessenNo ratings yet

- Case Study Dot Com CrashDocument2 pagesCase Study Dot Com CrashElaineKongNo ratings yet

- IT Risk ManagementDocument16 pagesIT Risk ManagementBenny Julisha PratidaNo ratings yet

- Unit 6.2 - Final AssessmentDocument35 pagesUnit 6.2 - Final AssessmentdonaldibeNo ratings yet

- Corporate Risk MGTDocument3 pagesCorporate Risk MGTdbutt15No ratings yet

- Important Questions Startup and New Venture ManagementDocument2 pagesImportant Questions Startup and New Venture Managementsanskarrishi0005No ratings yet

- AsianInvestor EDHEC-Risk Research Insights June 2013Document20 pagesAsianInvestor EDHEC-Risk Research Insights June 2013cranthirNo ratings yet

- RAM A Study On Equity Research Analysis at India Bulls LimitedDocument44 pagesRAM A Study On Equity Research Analysis at India Bulls Limitedalapati173768No ratings yet

- Equity ResearchDocument56 pagesEquity ResearchRobin Saha100% (1)

- Building A Discount Rate For Early Stage CompaniesDocument4 pagesBuilding A Discount Rate For Early Stage Companieselitevaluation2022No ratings yet

- CH 2Document25 pagesCH 2amonNo ratings yet

- Tata MotorsDocument3 pagesTata MotorsAmit JainNo ratings yet

- CH 2Document10 pagesCH 2Miftahudin Miftahudin100% (1)

- Operational Risk Management Systems 2008Document34 pagesOperational Risk Management Systems 2008raul.riveraNo ratings yet

- CGAP Technical Guide Due Diligence Guidelines For The Review of Microcredit Loan Portfolios Dec 2009Document58 pagesCGAP Technical Guide Due Diligence Guidelines For The Review of Microcredit Loan Portfolios Dec 2009assefamenelik1No ratings yet

- The Ultimate Guide To Strategy 1715861783Document20 pagesThe Ultimate Guide To Strategy 1715861783ambassyounyNo ratings yet

- Edelweiss - IIM CalcuttaDocument3 pagesEdelweiss - IIM CalcuttaPulkit SharmaNo ratings yet

- It Fin Repaired)Document97 pagesIt Fin Repaired)Dharmesh BhikadiyaNo ratings yet

- Chapter 9Document17 pagesChapter 9jaoceelectricalNo ratings yet

- Chandan - A Study On Risk Management System For Equity Portfolio Managers' in India With Reference To Karvy Stock Broking LimtedDocument89 pagesChandan - A Study On Risk Management System For Equity Portfolio Managers' in India With Reference To Karvy Stock Broking LimtedVenky PoosarlaNo ratings yet

- Chapter 2Document18 pagesChapter 2Yosef KetemaNo ratings yet

- Critial Startup SucessDocument6 pagesCritial Startup SucessFull SheBang FuntimeNo ratings yet

- Role of Competitive Intelligence in Multinational Companies: 1 Introduction and Background of The StudyDocument10 pagesRole of Competitive Intelligence in Multinational Companies: 1 Introduction and Background of The StudyAmber JamilNo ratings yet

- SME Rating (Methodology)Document6 pagesSME Rating (Methodology)radhika1991No ratings yet

- SWOT AnalysisDocument8 pagesSWOT AnalysisPhan Hoai Khanh TienNo ratings yet

- Corporate Metrics TechDocument135 pagesCorporate Metrics TechLinh LinhNo ratings yet

- Internship ReportDocument38 pagesInternship ReportManasvi DoshiNo ratings yet

- How Venture Capitalists Evaluate Potential Venture OpportunitiesDocument4 pagesHow Venture Capitalists Evaluate Potential Venture OpportunitiesARSHAD QAYUMNo ratings yet

- Is Risk Based Audit The Best ApproachDocument7 pagesIs Risk Based Audit The Best ApproachRached LazregNo ratings yet

- A Report ON A Study On The Plans&Fund Ivestements of Unit Link Products in Shiiram Life Insurance Co - Ltd. By: Veera Hanuman 19BSP3190Document60 pagesA Report ON A Study On The Plans&Fund Ivestements of Unit Link Products in Shiiram Life Insurance Co - Ltd. By: Veera Hanuman 19BSP3190bathula veerahanumanNo ratings yet

- 02 Idea Assessment Feasibility Analysis Business ModelDocument4 pages02 Idea Assessment Feasibility Analysis Business ModelImaan IqbalNo ratings yet

- Case Study 1 Group 1Document8 pagesCase Study 1 Group 1Spheal GTNo ratings yet

- Business Enterprise SimulationDocument12 pagesBusiness Enterprise SimulationCha Eun WooNo ratings yet

- Manufacturing CompaniesDocument5 pagesManufacturing CompaniesVineet_Sharma_9432No ratings yet

- AIMA's Guide To Sound Practices For Business Continuity Management For Hedge Fund Managers June 2006Document26 pagesAIMA's Guide To Sound Practices For Business Continuity Management For Hedge Fund Managers June 2006NaisscentNo ratings yet

- The Executive Guide to Enterprise Risk Management: Linking Strategy, Risk and Value CreationFrom EverandThe Executive Guide to Enterprise Risk Management: Linking Strategy, Risk and Value CreationNo ratings yet

- Ethical Valuation: Navigating the Future of Startup InvestmentsFrom EverandEthical Valuation: Navigating the Future of Startup InvestmentsNo ratings yet

- El Destino de La Civilización - Michael HudsonDocument311 pagesEl Destino de La Civilización - Michael HudsonAXEL FLORES MONTES DE OCANo ratings yet

- The Playwright Was Born in 1915, and During The Dep-: PlaysDocument15 pagesThe Playwright Was Born in 1915, and During The Dep-: PlaysAncaNo ratings yet

- Time, Space & Capitalism: Aejaz Ahmad Wani, Mohd. Rafiq WaniDocument4 pagesTime, Space & Capitalism: Aejaz Ahmad Wani, Mohd. Rafiq WaniGulshaRaufNo ratings yet

- Science of Pub AdDocument12 pagesScience of Pub AdBiswajit MohantyNo ratings yet

- Sample Business Proposal Impact of Microfinance in KenyaDocument64 pagesSample Business Proposal Impact of Microfinance in Kenyayedinkachaw shferawNo ratings yet

- GlobalizationDocument60 pagesGlobalizationFrancesca Veronique TablonNo ratings yet

- Index S.No Chapter P.No 1. 1 2. 7 3. 16 4. 24 5. 33 6. 40 7. 48 8. 56 9. 64 10. 72Document47 pagesIndex S.No Chapter P.No 1. 1 2. 7 3. 16 4. 24 5. 33 6. 40 7. 48 8. 56 9. 64 10. 72Suryansh jainNo ratings yet

- (Bela Kun) Revolutionary EssaysDocument60 pages(Bela Kun) Revolutionary EssaysANTENOR JOSE ESCUDERO GÓMEZNo ratings yet

- Economic Planning PDFDocument93 pagesEconomic Planning PDFShoiab Khaki100% (4)

- Thesis FinalDocument80 pagesThesis FinalJessie Christian JumuadNo ratings yet

- Beyond Guilt and Privilege Abolishing The White Race - Viewpoint Mag - DigitalDocument64 pagesBeyond Guilt and Privilege Abolishing The White Race - Viewpoint Mag - DigitalZack Hershman50% (2)

- Japanese IndustrializationDocument4 pagesJapanese IndustrializationTruckerNo ratings yet

- Trends, Networks, and Critical Thinking in The 21st Century: Quarter 2 - Module 2Document32 pagesTrends, Networks, and Critical Thinking in The 21st Century: Quarter 2 - Module 2Shaina jane UyNo ratings yet

- Economy Results Due To Faulty Legal System and Unjust State of Georgia Convictions On All 5 Counts of Banks' Cases of Innocent Srinivas VaddeDocument1,553 pagesEconomy Results Due To Faulty Legal System and Unjust State of Georgia Convictions On All 5 Counts of Banks' Cases of Innocent Srinivas VaddesvvpassNo ratings yet

- ButtersDocument17 pagesButtersCaleb_R_DillmanNo ratings yet

- Anne Laurence History of Women As Investors RoBookFiDocument337 pagesAnne Laurence History of Women As Investors RoBookFiJonathan David Lozano AriasNo ratings yet

- Development of Economic Systems & ExamplesDocument21 pagesDevelopment of Economic Systems & Examplesanon-583057100% (2)

- Global Rupture. Neoliberal Capitalism and The Rise of Informal Labour in The Global SouthDocument353 pagesGlobal Rupture. Neoliberal Capitalism and The Rise of Informal Labour in The Global SouthJason WeidnerNo ratings yet

- 2000.thinking Underside-Linda Alcoff Eduardo MendietaDocument301 pages2000.thinking Underside-Linda Alcoff Eduardo MendietaBruno ThiagoNo ratings yet

- ACTPACO - Lesson 3 (Revised)Document52 pagesACTPACO - Lesson 3 (Revised)Harry KingNo ratings yet

- An Ethnography of Neoliberalism Understanding Competition in Artisan Economies PDFDocument26 pagesAn Ethnography of Neoliberalism Understanding Competition in Artisan Economies PDFSeptiawan jiwandonoNo ratings yet

- Tom Brass Unfree Labour As Primitive AcumulationDocument16 pagesTom Brass Unfree Labour As Primitive AcumulationMauro FazziniNo ratings yet

- History of CooperationDocument367 pagesHistory of CooperationSebestyén GyörgyNo ratings yet

- Dundon Rollinson Sample ChapterDocument40 pagesDundon Rollinson Sample ChapterrhodaNo ratings yet

- Programa Patria 2013 in English (Chavez's Plan For Bolivarian Socialist Management 2013-2019)Document91 pagesPrograma Patria 2013 in English (Chavez's Plan For Bolivarian Socialist Management 2013-2019)Revolutionary Communist GroupNo ratings yet

- Laumann (2013) Colonial Africa (1884-1994) 2Document11 pagesLaumann (2013) Colonial Africa (1884-1994) 2onyame3838No ratings yet

- Lewis' Theory of Unlimited Supply of Labour PPT 3.2Document23 pagesLewis' Theory of Unlimited Supply of Labour PPT 3.2Kat SullvianNo ratings yet

- İslam Eği̇ti̇mi̇ SorunlarDocument187 pagesİslam Eği̇ti̇mi̇ SorunlarMustafa ÇetinNo ratings yet