Professional Documents

Culture Documents

Untitled

Untitled

Uploaded by

sauravOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Untitled

Untitled

Uploaded by

sauravCopyright:

Available Formats

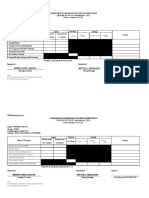

Policy rates and Reserve ratios Policy rates, Reserve ratios, lending, and deposit rates as on 16 June, 2011

Bank Rate 6.0% Repo Rate 7.50% Reverse Repo Rate 6.50% Cash Reserve Ratio (CRR) 6.0% Statutory Liquidity Ratio (SLR) 24.0% Base Rate 9.25%/10.00% Savings Bank Rate 4% Deposit Rate 8.25% 9.10% Bank Rate: RBI lends to the commercial banks through its discount window to help the banks meet depositor s demands and reserve requirements. The interest rate the RBI charges the banks for this purpose is called bank rate. If the RBI wants to increase the liquidity and money supply in the market, it will decrease the bank rate and if it wants to reduce the liquidity and money supply in the system, it will increase the bank rate. As of 5 May, 2011 the bank rate was 6%. Cash Reserve Ratio (CRR): Every commercial bank has to keep certain minimum cash reserves with RBI. RBI can vary this rate between 3% and 15%. RBI uses this too l to increase or decrease the reserve requirement depending on whether it wants to affect a decrease or an increase in the money supply. An increase in Cash Res erve Ratio (CRR) will make it mandatory on the part of the banks to hold a large proportion of their deposits in the form of deposits with the RBI. This will re duce the size of their deposits and they will lend less. This will in turn decre ase the money supply. The current rate is 6%. Statutory Liquidity Ratio (SLR): Apart from the CRR, banks are required to maint ain liquid assets in the form of gold, cash and approved securities. Higher liqu idity ratio forces commercial banks to maintain a larger proportion of their res ources in liquid form and thus reduces their capacity to grant loans and advance s, thus it is an anti-inflationary impact. A higher liquidity ratio diverts the bank funds from loans and advances to investment in government and approved secu rities. In well developed economies, central banks use open market operations--buying an d selling of eligible securities by central bank in the money market--to influen ce the volume of cash reserves with commercial banks and thus influence the volu me of loans and advances they can make to the commercial and industrial sectors. In the open money market, government securities are traded at market related ra tes of interest. The RBI is resorting more to open market operations in the more recent years. Generally RBI uses three kinds of selective credit controls: 1. Minimum margins for lending against specific securities. 2. Ceiling on the amounts of credit for certain purposes. 3. Discriminatory rate of interest charged on certain types of advances. Direct credit controls in India are of three types: 1. Part of the interest rate structure i.e. on small savings and provident funds, are administratively set. 2. Banks are mandatorily required to keep 25% of their deposits in the form of government securities. 3. Banks are required to lend to the priority sectors to the extent of 40% of their advances

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Project Report On Portfolio ManagementDocument115 pagesProject Report On Portfolio Managementsaurav86% (14)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Sbi Reverse Mortgage LoanDocument4 pagesSbi Reverse Mortgage LoanSukant Suku100% (3)

- Summer Training Project On NTPCDocument124 pagesSummer Training Project On NTPCsaurav100% (2)

- Investment AvenuesDocument17 pagesInvestment Avenuessaurav43% (7)

- Case Study 2 An Irate Distributor Students Excel SpreadsheetDocument4 pagesCase Study 2 An Irate Distributor Students Excel SpreadsheetPaRas NaSaNo ratings yet

- Form W-8BEN-E With Affidavit PDFDocument24 pagesForm W-8BEN-E With Affidavit PDFfmagnet50% (2)

- Ratio AnalysisDocument22 pagesRatio Analysiskeertheswaran100% (3)

- Project On Derivative MarketDocument102 pagesProject On Derivative Marketsaurav79% (24)

- Strategic Management of of Coca-ColaDocument17 pagesStrategic Management of of Coca-Colasaurav67% (3)

- In Investment Avenues FinalDocument9 pagesIn Investment Avenues FinalsauravNo ratings yet

- of InsuranceDocument18 pagesof InsuranceDeepika verma100% (4)

- Fiscal Policy of IndiaDocument20 pagesFiscal Policy of Indiasaurav82% (11)

- Fiscal Policy of IndiaDocument18 pagesFiscal Policy of IndiasauravNo ratings yet

- PanLapat Carbon Calculation ZERODocument2 pagesPanLapat Carbon Calculation ZEROLapatifyNo ratings yet

- The Automobile Industry - : Environmental IssuesDocument33 pagesThe Automobile Industry - : Environmental IssuesArnika KarekarNo ratings yet

- Brgy. Rizal Estanzuela BFDP - Monitoring - Form ADocument4 pagesBrgy. Rizal Estanzuela BFDP - Monitoring - Form AVillanueva YuriNo ratings yet

- F 1120 FM 1Document1 pageF 1120 FM 1croyal01No ratings yet

- Training For Work Scholarship Program (TWSP) Techvoc Skills Inc. Carlo E. Grebialde 82 Hours Tile Setting NC Ii 181813061200581Document2 pagesTraining For Work Scholarship Program (TWSP) Techvoc Skills Inc. Carlo E. Grebialde 82 Hours Tile Setting NC Ii 181813061200581ChristianNo ratings yet

- Crompton Case1Document5 pagesCrompton Case1Manoj AnandNo ratings yet

- Trend Percentage Analysis 2019Document5 pagesTrend Percentage Analysis 2019Rachit SrivastavaNo ratings yet

- Mori, Yoshitaka 2016 Mobility and PlaceDocument8 pagesMori, Yoshitaka 2016 Mobility and Place신현준No ratings yet

- Unwto Tourism Highlights: 2018 EditionDocument20 pagesUnwto Tourism Highlights: 2018 Editionкристина раджабоваNo ratings yet

- An Overview of Load Management Techniques in Smart GridDocument6 pagesAn Overview of Load Management Techniques in Smart Gridبلال شبیرNo ratings yet

- (Students) Cost Accounting ExercisesDocument7 pages(Students) Cost Accounting Exercisescuishan makNo ratings yet

- Top 100 Chemical CompaniesDocument11 pagesTop 100 Chemical Companiestawhide_islamicNo ratings yet

- John Schuler's ResumeDocument1 pageJohn Schuler's ResumeJohn SchulerNo ratings yet

- Killing The KDocument19 pagesKilling The KJeron JacksonNo ratings yet

- ESIC LDC (Employees State Insurance Corporation) MathsDocument3 pagesESIC LDC (Employees State Insurance Corporation) MathssuganyaNo ratings yet

- New Requirements Flyer-FinalDocument1 pageNew Requirements Flyer-FinalplattehealthdeptNo ratings yet

- G8 - Monthly Test PreparationDocument8 pagesG8 - Monthly Test Preparationshadow gamingNo ratings yet

- 87 190E 190e2point6 OMDocument113 pages87 190E 190e2point6 OMCenk KORKUTURNo ratings yet

- TenYearsDevelopmentPlanofEthiopia2021-2030 ACriticalReviewDocument15 pagesTenYearsDevelopmentPlanofEthiopia2021-2030 ACriticalReviewየጎርጎራው መጧልNo ratings yet

- Pharmax 0204 - 70Document62 pagesPharmax 0204 - 70Hector HernandezNo ratings yet

- Chapter 3 TestbankDocument4 pagesChapter 3 TestbankMinh Huỳnh Nguyễn NhậtNo ratings yet

- Road Freight TransportDocument14 pagesRoad Freight TransportIon DouNo ratings yet

- CEO Job DescriptionDocument5 pagesCEO Job DescriptionHumayun Rashid KhanNo ratings yet

- Notice: Sub: Fsa Status of Existing Linked Consumers of SeclDocument32 pagesNotice: Sub: Fsa Status of Existing Linked Consumers of SeclShabbir MoizbhaiNo ratings yet

- MNB101 SummaryDocument18 pagesMNB101 SummaryBeNobody2No ratings yet

- CSC ReviewerDocument57 pagesCSC Reviewerbernadette concillesNo ratings yet

- Marketing Management Assignment 3Document12 pagesMarketing Management Assignment 3Stephen DuncanNo ratings yet