Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

36 viewsOPT Summary Rates

OPT Summary Rates

Uploaded by

DISEREE AMOR ATIENZAThe document defines various taxes in the Philippines using abbreviations:

- ST - sales tax, ET - excise tax, PT - percentage tax, GR - gross receipts

- CCT - common carrier's tax is 3% of quarterly gross receipts for domestic carriers and keepers of garages.

- VAT applies to services at 12% if annual gross receipts are over 3 million pesos.

- Franchise tax is 3% of annual gross receipts up to 3 million pesos for none-VAT registered entities.

- Amusement tax ranges from 10-30% depending on the type of amusement. Stock transaction tax is 6/10 of 1% of gross selling price.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Chapter 5Document20 pagesChapter 5christineNo ratings yet

- Section 117-118 Carriers Tax As Amended by RA 9377 (July 1, 2005)Document12 pagesSection 117-118 Carriers Tax As Amended by RA 9377 (July 1, 2005)Dennie Vieve IdeaNo ratings yet

- Reviewer On PercentageDocument2 pagesReviewer On PercentageNeil EreaNo ratings yet

- Opt 1Document5 pagesOpt 1Bridget Zoe Lopez BatoonNo ratings yet

- Lecture 7 - Other Percentage TaxDocument3 pagesLecture 7 - Other Percentage TaxJohn Felix Morelos DoldolNo ratings yet

- Exempt If: (All Must Present)Document5 pagesExempt If: (All Must Present)Jessa Delos SantosNo ratings yet

- Percentage Taxes UstDocument5 pagesPercentage Taxes UstGabriel PonceNo ratings yet

- OPTDocument4 pagesOPTMarie MAy MagtibayNo ratings yet

- Other Percentage Tax Tax Base Tax Rate Under Section: Wheel Animal Driven Vehicles and BancasDocument4 pagesOther Percentage Tax Tax Base Tax Rate Under Section: Wheel Animal Driven Vehicles and BancasLumingNo ratings yet

- BUSTAX Notes M4-5Document12 pagesBUSTAX Notes M4-5Rosette TuazonNo ratings yet

- Opt HandoutDocument4 pagesOpt HandoutjulsNo ratings yet

- TAX.2904 Percentage Tax.Document12 pagesTAX.2904 Percentage Tax.Rodge Gabayoyo100% (2)

- OTHER PERCENTAGE TAXES - Imposed in Lieu of VAT. Section 117: Tax On Common CarriersDocument3 pagesOTHER PERCENTAGE TAXES - Imposed in Lieu of VAT. Section 117: Tax On Common CarriersXerez SingsonNo ratings yet

- Percentage TaxDocument7 pagesPercentage Taxyatot carbonelNo ratings yet

- Percentage TaxesDocument8 pagesPercentage TaxesTokha YatsurugiNo ratings yet

- Lecture 7 - Other Percentage TaxDocument3 pagesLecture 7 - Other Percentage TaxJeffrey BionaNo ratings yet

- Percentage Taxes NotesDocument4 pagesPercentage Taxes NotesWearIt Co.No ratings yet

- Enotes 10 Percentage TaxDocument12 pagesEnotes 10 Percentage TaxIrish Gracielle Dela CruzNo ratings yet

- Percentage Tax: Percentage Tax Is A Business Tax Imposed On Persons, Entities, or TransactionsDocument16 pagesPercentage Tax: Percentage Tax Is A Business Tax Imposed On Persons, Entities, or TransactionsDon CabasiNo ratings yet

- Percentage Tax CTBDocument16 pagesPercentage Tax CTBDon CabasiNo ratings yet

- Dagupan Accountancy Review - Dare - May 2020 Cpa Exam "Dare Us To Bring Out The Best in You."Document14 pagesDagupan Accountancy Review - Dare - May 2020 Cpa Exam "Dare Us To Bring Out The Best in You."Reginald ValenciaNo ratings yet

- Module 16 Vat Vs Percentage TaxDocument6 pagesModule 16 Vat Vs Percentage TaxKristine Camille MadambaNo ratings yet

- Business Tax Chapter 9 ReviewerDocument3 pagesBusiness Tax Chapter 9 ReviewerMurien LimNo ratings yet

- CPAR TAX - Other Percentage Taxes PDFDocument13 pagesCPAR TAX - Other Percentage Taxes PDFJohn Carlo CruzNo ratings yet

- Tax.102 2 Other Percentage Taxes EEsDocument11 pagesTax.102 2 Other Percentage Taxes EEsJoana Lyn GalisimNo ratings yet

- Add A Heading To Your DocumentDocument2 pagesAdd A Heading To Your DocumentJaznyDaeBandiwanFerrerNo ratings yet

- COMMERCIAL CALULATORDocument172 pagesCOMMERCIAL CALULATORDevender KumarNo ratings yet

- Tax2.001 - Other Percentage Taxes - EEDocument9 pagesTax2.001 - Other Percentage Taxes - EEAbby Umipig75% (4)

- OPT - HandoutDocument16 pagesOPT - HandoutGrant Kenneth D. FloresNo ratings yet

- Quotation Hilux GRS BlackDocument1 pageQuotation Hilux GRS BlackOME Pakil, LagunaNo ratings yet

- 94-12 OPT - HandoutDocument14 pages94-12 OPT - HandoutMj BauaNo ratings yet

- Business Tax 2nd Sem FinalDocument3 pagesBusiness Tax 2nd Sem FinalRizeth GarayNo ratings yet

- OptDocument2 pagesOptArahbellsNo ratings yet

- CPAR OPT Batch 93 HandoutDocument14 pagesCPAR OPT Batch 93 Handout6wv84xgwnbNo ratings yet

- Module 1.3 - Other Percentage Taxes Notes and Exercises - My Students'Document10 pagesModule 1.3 - Other Percentage Taxes Notes and Exercises - My Students'Jann Exequiel FranciscoNo ratings yet

- Other Percentage Taxes Focus Notes (Group 1)Document7 pagesOther Percentage Taxes Focus Notes (Group 1)LeonilaEnriquez100% (1)

- TAX Chapter 5 Reviewer - Summary Principles of Business Taxation TAX Chapter 5 Reviewer - Summary Principles of Business TaxationDocument5 pagesTAX Chapter 5 Reviewer - Summary Principles of Business Taxation TAX Chapter 5 Reviewer - Summary Principles of Business TaxationMakoy BixenmanNo ratings yet

- (CPAR2016) TAX-8014 (+llamado Notes - OTHER PERCENTAGE TAXES)Document12 pages(CPAR2016) TAX-8014 (+llamado Notes - OTHER PERCENTAGE TAXES)jamNo ratings yet

- Other Percentage Taxes ("Opt") : 1) Section 116: Tax On Persons Exempt From VATDocument14 pagesOther Percentage Taxes ("Opt") : 1) Section 116: Tax On Persons Exempt From VATJana Trina LibatiqueNo ratings yet

- Subject To Vat (Nccidactee) : (Contribution Per Member P15,000 - VAT, Electric Cooperatives - VAT)Document13 pagesSubject To Vat (Nccidactee) : (Contribution Per Member P15,000 - VAT, Electric Cooperatives - VAT)Michael AquinoNo ratings yet

- Module 5 - Percentage TaxesDocument5 pagesModule 5 - Percentage TaxesPat QuiaoitNo ratings yet

- Material 9 OPTDocument14 pagesMaterial 9 OPTnodnel salonNo ratings yet

- 11 Exercise Drill 1Document1 page11 Exercise Drill 1Cielo YumulNo ratings yet

- Type Who / What Are Subject RA TE TAX Basis Additional NotesDocument7 pagesType Who / What Are Subject RA TE TAX Basis Additional NotesSavage KongNo ratings yet

- Other Percentage Taxes TableDocument5 pagesOther Percentage Taxes TableKim EspinaNo ratings yet

- Withholding Tax at Source OR Expanded Withholding Tax (EWT)Document32 pagesWithholding Tax at Source OR Expanded Withholding Tax (EWT)rickmortyNo ratings yet

- Percentage Taxes Ust PDFDocument6 pagesPercentage Taxes Ust PDFcalliemozartNo ratings yet

- Other Percentage Taxes Summary: From UnderDocument4 pagesOther Percentage Taxes Summary: From UnderZee GuillebeauxNo ratings yet

- Summary of Final Tax Under The Nirc, As Amended Individual Citizen AlienDocument16 pagesSummary of Final Tax Under The Nirc, As Amended Individual Citizen AlienXiaoyu KensameNo ratings yet

- 56 Tds Tcs Rate Chart W e F 01 10 09Document1 page56 Tds Tcs Rate Chart W e F 01 10 09Shankar BidadiNo ratings yet

- Percentage TaxDocument3 pagesPercentage TaxCHESTER JAN BOSONGNo ratings yet

- K41SRH: 24/7 Call Centre - 044 3001 2001 E-Mail: Customersupport@airindiaexpress - inDocument2 pagesK41SRH: 24/7 Call Centre - 044 3001 2001 E-Mail: Customersupport@airindiaexpress - inAnonymous mFZEvaNo ratings yet

- Buss Tax Exam Part 1Document1 pageBuss Tax Exam Part 1prexielynlosaria22889904No ratings yet

- OPT NotesDocument2 pagesOPT NotesMei Leen DanielesNo ratings yet

- BusinessDocument59 pagesBusinessKenncy70% (10)

- D000655041 201807091145 ScheduleSC PDFDocument4 pagesD000655041 201807091145 ScheduleSC PDFPinky BhagwatNo ratings yet

- Other Percentage Taxes: Sec. 116. Persons Exempt From VATDocument22 pagesOther Percentage Taxes: Sec. 116. Persons Exempt From VATMakoy BixenmanNo ratings yet

- Vat-Exempt - AleighaDocument3 pagesVat-Exempt - Aleigha2022104174No ratings yet

- 2022 ManufacturersDocument2 pages2022 ManufacturersDISEREE AMOR ATIENZANo ratings yet

- Combinepdf 1Document42 pagesCombinepdf 1DISEREE AMOR ATIENZANo ratings yet

- Pinnacle Online Undergrad Tutorials ProgramDocument28 pagesPinnacle Online Undergrad Tutorials ProgramDISEREE AMOR ATIENZANo ratings yet

- 2022 DOH Annual Sin Tax Report FRMDocument38 pages2022 DOH Annual Sin Tax Report FRMDISEREE AMOR ATIENZANo ratings yet

- HomophobiaDocument2 pagesHomophobiaDISEREE AMOR ATIENZANo ratings yet

- Concepts of Capital Maintenance in Fair Value AccountingDocument6 pagesConcepts of Capital Maintenance in Fair Value AccountingDISEREE AMOR ATIENZANo ratings yet

- Family Values On The Coming Out Process of Gay Male Adolescents, Traditional FamilyDocument8 pagesFamily Values On The Coming Out Process of Gay Male Adolescents, Traditional FamilyDISEREE AMOR ATIENZANo ratings yet

- Fortuitous Events: Act of God (Calamities) and Act of Man (Robbery, Riots, Etc.)Document6 pagesFortuitous Events: Act of God (Calamities) and Act of Man (Robbery, Riots, Etc.)DISEREE AMOR ATIENZANo ratings yet

- Disclosures in Real Estate TransactionsDocument79 pagesDisclosures in Real Estate TransactionsAlves Real Estate100% (3)

- Sweden: WHAT CAN WE LEARN FROM SWEDEN'S DRUG POLICY EXPERIENCE?Document11 pagesSweden: WHAT CAN WE LEARN FROM SWEDEN'S DRUG POLICY EXPERIENCE?Paul Gallagher100% (1)

- The Wall Street Journal - 2022.09.27Document38 pagesThe Wall Street Journal - 2022.09.27EDGAR BAUTISTA LEONNo ratings yet

- David vs. ArroyoDocument6 pagesDavid vs. ArroyoRoyce Ann PedemonteNo ratings yet

- GST EntriesDocument5 pagesGST EntriessrestanandNo ratings yet

- Risk Surcharge: AWB No: H63537762 Owner CarrierDocument1 pageRisk Surcharge: AWB No: H63537762 Owner CarrierAnandNo ratings yet

- English 9 Module 1 Activity 1Document1 pageEnglish 9 Module 1 Activity 1Rowell Digal BainNo ratings yet

- IPO Admin CaseDocument13 pagesIPO Admin CaseisraeljamoraNo ratings yet

- IDBI Federal Annual Report 2015-2016 PDFDocument204 pagesIDBI Federal Annual Report 2015-2016 PDFJavaniNo ratings yet

- Chemical Checkpoints: Department of Occupational Safety and HealthDocument13 pagesChemical Checkpoints: Department of Occupational Safety and HealthpsssNo ratings yet

- KT 400 Installation Guide v01 - R004 - LT - en PDFDocument54 pagesKT 400 Installation Guide v01 - R004 - LT - en PDFLorenz Adriano RoblesNo ratings yet

- Changing Seats Re-Domiciliation To Curaçao FinalDocument2 pagesChanging Seats Re-Domiciliation To Curaçao FinalRicardo NavaNo ratings yet

- 2023.3.10 (Class)Document57 pages2023.3.10 (Class)vuvygyiNo ratings yet

- The HR Management and Payroll CycleDocument97 pagesThe HR Management and Payroll CycleErwin David SianturiNo ratings yet

- The Company FinalDocument6 pagesThe Company FinalMavambu JuniorNo ratings yet

- Macke vs. Camps G.R. No. 2962Document2 pagesMacke vs. Camps G.R. No. 2962Maria Fiona Duran MerquitaNo ratings yet

- Message of Po3 Ronald Villanueva Daguro Monday Flag Raising Ceremony of PSJLC June 1, 2015Document4 pagesMessage of Po3 Ronald Villanueva Daguro Monday Flag Raising Ceremony of PSJLC June 1, 2015menchayNo ratings yet

- Ncnda & Imfpa (Icc1)Document6 pagesNcnda & Imfpa (Icc1)King RoodNo ratings yet

- Asnake InternshipDocument36 pagesAsnake Internshipkassahungedefaye3120% (1)

- Seatwork 10.6.21Document6 pagesSeatwork 10.6.21Ashley MarloweNo ratings yet

- UnitedHealthCare Fillable Reconsideration FormDocument1 pageUnitedHealthCare Fillable Reconsideration FormDavid R. GonzálezNo ratings yet

- Institusi Pelayanan Kesehatan: Chapter 10-Healthcare InstitutionsDocument27 pagesInstitusi Pelayanan Kesehatan: Chapter 10-Healthcare InstitutionsasiyahNo ratings yet

- Lamia Assignment AlifaDocument5 pagesLamia Assignment AlifaMD Kamruzzaman RafaelNo ratings yet

- Full Text Set 3 - TaxDocument33 pagesFull Text Set 3 - TaxulticonNo ratings yet

- Globalization and Its Key ElementsDocument2 pagesGlobalization and Its Key ElementsRashil ShahNo ratings yet

- Hours On Projects Manila: Other Tasks (Turn-Over) FSD AFGHANISTAN Vacation LeaveDocument4 pagesHours On Projects Manila: Other Tasks (Turn-Over) FSD AFGHANISTAN Vacation LeaveRyle PlatinoNo ratings yet

- Edexcel IAL P2 Exercise 7C (Solution)Document5 pagesEdexcel IAL P2 Exercise 7C (Solution)Kaif HasanNo ratings yet

- Varsha Mishra XB13 DisabilityDocument6 pagesVarsha Mishra XB13 DisabilityKanchan ManhasNo ratings yet

- ANSYS Inc. Known Issues and LimitationsDocument34 pagesANSYS Inc. Known Issues and LimitationsV CafNo ratings yet

- Representative Assessee - An Overview and Future OutlookDocument63 pagesRepresentative Assessee - An Overview and Future Outlookjoseph davidNo ratings yet

OPT Summary Rates

OPT Summary Rates

Uploaded by

DISEREE AMOR ATIENZA0 ratings0% found this document useful (0 votes)

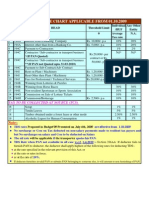

36 views2 pagesThe document defines various taxes in the Philippines using abbreviations:

- ST - sales tax, ET - excise tax, PT - percentage tax, GR - gross receipts

- CCT - common carrier's tax is 3% of quarterly gross receipts for domestic carriers and keepers of garages.

- VAT applies to services at 12% if annual gross receipts are over 3 million pesos.

- Franchise tax is 3% of annual gross receipts up to 3 million pesos for none-VAT registered entities.

- Amusement tax ranges from 10-30% depending on the type of amusement. Stock transaction tax is 6/10 of 1% of gross selling price.

Original Description:

dsfsdfdf

Original Title

OPT-summary-rates

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document defines various taxes in the Philippines using abbreviations:

- ST - sales tax, ET - excise tax, PT - percentage tax, GR - gross receipts

- CCT - common carrier's tax is 3% of quarterly gross receipts for domestic carriers and keepers of garages.

- VAT applies to services at 12% if annual gross receipts are over 3 million pesos.

- Franchise tax is 3% of annual gross receipts up to 3 million pesos for none-VAT registered entities.

- Amusement tax ranges from 10-30% depending on the type of amusement. Stock transaction tax is 6/10 of 1% of gross selling price.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

36 views2 pagesOPT Summary Rates

OPT Summary Rates

Uploaded by

DISEREE AMOR ATIENZAThe document defines various taxes in the Philippines using abbreviations:

- ST - sales tax, ET - excise tax, PT - percentage tax, GR - gross receipts

- CCT - common carrier's tax is 3% of quarterly gross receipts for domestic carriers and keepers of garages.

- VAT applies to services at 12% if annual gross receipts are over 3 million pesos.

- Franchise tax is 3% of annual gross receipts up to 3 million pesos for none-VAT registered entities.

- Amusement tax ranges from 10-30% depending on the type of amusement. Stock transaction tax is 6/10 of 1% of gross selling price.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

ST – sales tax

ET – excise tax

PT – percentage tax

GR – gross receipts

S – sale

I – importation

L - lease

Sv – services

PH – Philippines

goods, cargo - same lang

BT - business tax

CCT - common carrier's tax

OCT - overseas communication tax

GRT - gross receipts tax

AT - amusement tax

STT - stock transaction tax

QGR - quarterly gross receipts

GSR - gross sales receipts

GSP - gross selling price

GMS – gross monthly sales

AGR - annual gross receipts

FT - franchise tax (or OPT)

CGT - capital gains tax

PSE - Philippine Stock Exhange

C - city

P - province

OPT in Tax Code Rules/Rates: OPT in Tax Code Rules/Rates:

DOMESTIC carriers & keepers Gen rule: 3% CCT on QGR Persons EXEMPT from VAT 3% on GMS: AGR ≤ 3M & nonVAT reg.

of garages (CCT) *by land, passengers: 3% CCT on QGR AMUSEMENT *Boxing exhibitions: 10%

- Cars 4 rent, driver *by land, cargo: 12% VAT if GSR > 3M ( imposed on proprietor, lessee, operator) - (both foreigner will compete: AT

lessee *by air/sea, passengers/goods: VAT - may Pilipinong lalaban: exempt from

- Transpo contractors *int'l flights of domestic carriers: 0% VAT or VAT exempt AT)

- Domestic carriers by *Professional basketball games: 15%

land Min. QGR: *Cockpits, cabarets, night, day clubs: 18%

- Keepers of garages - Jeep for hire - C:2400, P:1200 (videoke bar, etc: AT)

- Taxis - C:3600, P: 2400 *Jai-Alai & racetracks: 30%

- PUB, seaters (owner of racetrack = own of concessionaire: 30%)

- ≤ 30: C/P: 3600 (owner of racetrack ≠ owner of concessionaire:

- 30-50: C/P: 6000 - owner of racetrack: 30%

- > 50: 7200 - o of concessionaire: 12% VAT / 3% OPT)

- Car for hire

- w/ chauffeur - C/P: 3000 (all based on GR, incl from tv radio motion pictures)

- w/o chauffeur - C/P: 1800

DOMESTIC AIR CARRIER Gen rule: 12% VAT on Sv performed in PH (PH to PH) AGENTS OF FOREIGN INSURANCE companies *Fire, marine, miscellaneous insurance:

engaged in BOTH domestic and - 4% of total premium collected

international transport *PH to foreign: 0% VAT *Property insurance bought by property owners

operations *foreign to PH: exempt from BT - 5% on premiums paid

INTERNATIONAL carriers *abroad to PH, passengers/goods: not taxable WINNINGS *Winning in horse races: 10% of win./dividends

(air & sea doing bus in PH) *PH to abroad, passenger: not taxable (person who wins in horse races pay:) *W. from double, forecast/quinella, trifecta bets:

*PH to abroad, goods: 3% of QGR 4% of winnings

*Owners of winning racehorses: 10% of prize

FRANCHISE *Gov't, radio/TV broadcasting LIFE INSURANCE PREMIUMS Gen: 2% of total premium collected

(Grantor, type of franchise) - 3% FT ( AGR ≤ 10M)

- 12% VAT (VAT reg or AGR > 10M for prece. yr) *Not included in taxable receipts:

*Gov't, gas & water utilities - premiums refunded w/in 6 months

- 2% FT regardless of GR - reinsurance premiums

*Gov't, all others | *Private Co, all types - any life insurance of a non-resident

- 12% VAT - on account of reinsurance

- 3% FT (AGR ≤ 3M & nonVAT reg) - received on variable contracts

Overseas dispatch, message, Gen: 10% on amount paid for such service Sale, Barter, Exchange of shares of stock listed & Gen: 6/10 of 1% of GSP

conversation originating from Note: traded thru local stock exchange (STT)

PH (international calls) (OCT) *Domestic long distance calls, reg monthly tel bills: VAT (assessed on every disposition of shares) *Not listed in PSE: CGT 15%

*Gov't, diplomatic Sv, int'l orgs, news Sv: OCT not app.

Sale, Barter, Exchange or Issuance of shares of Proportion of disposal shares to outstanding

stock thru initial public offering (IPO tax) shares: rate on GSP

* ≤ 25% : 4%

* > 25% ≤ 33 ⅓% : 2%

* > 33 ⅓% : 1%

*Sale to public subsq to IPO: 6/10 of 1% of GSP

You might also like

- Chapter 5Document20 pagesChapter 5christineNo ratings yet

- Section 117-118 Carriers Tax As Amended by RA 9377 (July 1, 2005)Document12 pagesSection 117-118 Carriers Tax As Amended by RA 9377 (July 1, 2005)Dennie Vieve IdeaNo ratings yet

- Reviewer On PercentageDocument2 pagesReviewer On PercentageNeil EreaNo ratings yet

- Opt 1Document5 pagesOpt 1Bridget Zoe Lopez BatoonNo ratings yet

- Lecture 7 - Other Percentage TaxDocument3 pagesLecture 7 - Other Percentage TaxJohn Felix Morelos DoldolNo ratings yet

- Exempt If: (All Must Present)Document5 pagesExempt If: (All Must Present)Jessa Delos SantosNo ratings yet

- Percentage Taxes UstDocument5 pagesPercentage Taxes UstGabriel PonceNo ratings yet

- OPTDocument4 pagesOPTMarie MAy MagtibayNo ratings yet

- Other Percentage Tax Tax Base Tax Rate Under Section: Wheel Animal Driven Vehicles and BancasDocument4 pagesOther Percentage Tax Tax Base Tax Rate Under Section: Wheel Animal Driven Vehicles and BancasLumingNo ratings yet

- BUSTAX Notes M4-5Document12 pagesBUSTAX Notes M4-5Rosette TuazonNo ratings yet

- Opt HandoutDocument4 pagesOpt HandoutjulsNo ratings yet

- TAX.2904 Percentage Tax.Document12 pagesTAX.2904 Percentage Tax.Rodge Gabayoyo100% (2)

- OTHER PERCENTAGE TAXES - Imposed in Lieu of VAT. Section 117: Tax On Common CarriersDocument3 pagesOTHER PERCENTAGE TAXES - Imposed in Lieu of VAT. Section 117: Tax On Common CarriersXerez SingsonNo ratings yet

- Percentage TaxDocument7 pagesPercentage Taxyatot carbonelNo ratings yet

- Percentage TaxesDocument8 pagesPercentage TaxesTokha YatsurugiNo ratings yet

- Lecture 7 - Other Percentage TaxDocument3 pagesLecture 7 - Other Percentage TaxJeffrey BionaNo ratings yet

- Percentage Taxes NotesDocument4 pagesPercentage Taxes NotesWearIt Co.No ratings yet

- Enotes 10 Percentage TaxDocument12 pagesEnotes 10 Percentage TaxIrish Gracielle Dela CruzNo ratings yet

- Percentage Tax: Percentage Tax Is A Business Tax Imposed On Persons, Entities, or TransactionsDocument16 pagesPercentage Tax: Percentage Tax Is A Business Tax Imposed On Persons, Entities, or TransactionsDon CabasiNo ratings yet

- Percentage Tax CTBDocument16 pagesPercentage Tax CTBDon CabasiNo ratings yet

- Dagupan Accountancy Review - Dare - May 2020 Cpa Exam "Dare Us To Bring Out The Best in You."Document14 pagesDagupan Accountancy Review - Dare - May 2020 Cpa Exam "Dare Us To Bring Out The Best in You."Reginald ValenciaNo ratings yet

- Module 16 Vat Vs Percentage TaxDocument6 pagesModule 16 Vat Vs Percentage TaxKristine Camille MadambaNo ratings yet

- Business Tax Chapter 9 ReviewerDocument3 pagesBusiness Tax Chapter 9 ReviewerMurien LimNo ratings yet

- CPAR TAX - Other Percentage Taxes PDFDocument13 pagesCPAR TAX - Other Percentage Taxes PDFJohn Carlo CruzNo ratings yet

- Tax.102 2 Other Percentage Taxes EEsDocument11 pagesTax.102 2 Other Percentage Taxes EEsJoana Lyn GalisimNo ratings yet

- Add A Heading To Your DocumentDocument2 pagesAdd A Heading To Your DocumentJaznyDaeBandiwanFerrerNo ratings yet

- COMMERCIAL CALULATORDocument172 pagesCOMMERCIAL CALULATORDevender KumarNo ratings yet

- Tax2.001 - Other Percentage Taxes - EEDocument9 pagesTax2.001 - Other Percentage Taxes - EEAbby Umipig75% (4)

- OPT - HandoutDocument16 pagesOPT - HandoutGrant Kenneth D. FloresNo ratings yet

- Quotation Hilux GRS BlackDocument1 pageQuotation Hilux GRS BlackOME Pakil, LagunaNo ratings yet

- 94-12 OPT - HandoutDocument14 pages94-12 OPT - HandoutMj BauaNo ratings yet

- Business Tax 2nd Sem FinalDocument3 pagesBusiness Tax 2nd Sem FinalRizeth GarayNo ratings yet

- OptDocument2 pagesOptArahbellsNo ratings yet

- CPAR OPT Batch 93 HandoutDocument14 pagesCPAR OPT Batch 93 Handout6wv84xgwnbNo ratings yet

- Module 1.3 - Other Percentage Taxes Notes and Exercises - My Students'Document10 pagesModule 1.3 - Other Percentage Taxes Notes and Exercises - My Students'Jann Exequiel FranciscoNo ratings yet

- Other Percentage Taxes Focus Notes (Group 1)Document7 pagesOther Percentage Taxes Focus Notes (Group 1)LeonilaEnriquez100% (1)

- TAX Chapter 5 Reviewer - Summary Principles of Business Taxation TAX Chapter 5 Reviewer - Summary Principles of Business TaxationDocument5 pagesTAX Chapter 5 Reviewer - Summary Principles of Business Taxation TAX Chapter 5 Reviewer - Summary Principles of Business TaxationMakoy BixenmanNo ratings yet

- (CPAR2016) TAX-8014 (+llamado Notes - OTHER PERCENTAGE TAXES)Document12 pages(CPAR2016) TAX-8014 (+llamado Notes - OTHER PERCENTAGE TAXES)jamNo ratings yet

- Other Percentage Taxes ("Opt") : 1) Section 116: Tax On Persons Exempt From VATDocument14 pagesOther Percentage Taxes ("Opt") : 1) Section 116: Tax On Persons Exempt From VATJana Trina LibatiqueNo ratings yet

- Subject To Vat (Nccidactee) : (Contribution Per Member P15,000 - VAT, Electric Cooperatives - VAT)Document13 pagesSubject To Vat (Nccidactee) : (Contribution Per Member P15,000 - VAT, Electric Cooperatives - VAT)Michael AquinoNo ratings yet

- Module 5 - Percentage TaxesDocument5 pagesModule 5 - Percentage TaxesPat QuiaoitNo ratings yet

- Material 9 OPTDocument14 pagesMaterial 9 OPTnodnel salonNo ratings yet

- 11 Exercise Drill 1Document1 page11 Exercise Drill 1Cielo YumulNo ratings yet

- Type Who / What Are Subject RA TE TAX Basis Additional NotesDocument7 pagesType Who / What Are Subject RA TE TAX Basis Additional NotesSavage KongNo ratings yet

- Other Percentage Taxes TableDocument5 pagesOther Percentage Taxes TableKim EspinaNo ratings yet

- Withholding Tax at Source OR Expanded Withholding Tax (EWT)Document32 pagesWithholding Tax at Source OR Expanded Withholding Tax (EWT)rickmortyNo ratings yet

- Percentage Taxes Ust PDFDocument6 pagesPercentage Taxes Ust PDFcalliemozartNo ratings yet

- Other Percentage Taxes Summary: From UnderDocument4 pagesOther Percentage Taxes Summary: From UnderZee GuillebeauxNo ratings yet

- Summary of Final Tax Under The Nirc, As Amended Individual Citizen AlienDocument16 pagesSummary of Final Tax Under The Nirc, As Amended Individual Citizen AlienXiaoyu KensameNo ratings yet

- 56 Tds Tcs Rate Chart W e F 01 10 09Document1 page56 Tds Tcs Rate Chart W e F 01 10 09Shankar BidadiNo ratings yet

- Percentage TaxDocument3 pagesPercentage TaxCHESTER JAN BOSONGNo ratings yet

- K41SRH: 24/7 Call Centre - 044 3001 2001 E-Mail: Customersupport@airindiaexpress - inDocument2 pagesK41SRH: 24/7 Call Centre - 044 3001 2001 E-Mail: Customersupport@airindiaexpress - inAnonymous mFZEvaNo ratings yet

- Buss Tax Exam Part 1Document1 pageBuss Tax Exam Part 1prexielynlosaria22889904No ratings yet

- OPT NotesDocument2 pagesOPT NotesMei Leen DanielesNo ratings yet

- BusinessDocument59 pagesBusinessKenncy70% (10)

- D000655041 201807091145 ScheduleSC PDFDocument4 pagesD000655041 201807091145 ScheduleSC PDFPinky BhagwatNo ratings yet

- Other Percentage Taxes: Sec. 116. Persons Exempt From VATDocument22 pagesOther Percentage Taxes: Sec. 116. Persons Exempt From VATMakoy BixenmanNo ratings yet

- Vat-Exempt - AleighaDocument3 pagesVat-Exempt - Aleigha2022104174No ratings yet

- 2022 ManufacturersDocument2 pages2022 ManufacturersDISEREE AMOR ATIENZANo ratings yet

- Combinepdf 1Document42 pagesCombinepdf 1DISEREE AMOR ATIENZANo ratings yet

- Pinnacle Online Undergrad Tutorials ProgramDocument28 pagesPinnacle Online Undergrad Tutorials ProgramDISEREE AMOR ATIENZANo ratings yet

- 2022 DOH Annual Sin Tax Report FRMDocument38 pages2022 DOH Annual Sin Tax Report FRMDISEREE AMOR ATIENZANo ratings yet

- HomophobiaDocument2 pagesHomophobiaDISEREE AMOR ATIENZANo ratings yet

- Concepts of Capital Maintenance in Fair Value AccountingDocument6 pagesConcepts of Capital Maintenance in Fair Value AccountingDISEREE AMOR ATIENZANo ratings yet

- Family Values On The Coming Out Process of Gay Male Adolescents, Traditional FamilyDocument8 pagesFamily Values On The Coming Out Process of Gay Male Adolescents, Traditional FamilyDISEREE AMOR ATIENZANo ratings yet

- Fortuitous Events: Act of God (Calamities) and Act of Man (Robbery, Riots, Etc.)Document6 pagesFortuitous Events: Act of God (Calamities) and Act of Man (Robbery, Riots, Etc.)DISEREE AMOR ATIENZANo ratings yet

- Disclosures in Real Estate TransactionsDocument79 pagesDisclosures in Real Estate TransactionsAlves Real Estate100% (3)

- Sweden: WHAT CAN WE LEARN FROM SWEDEN'S DRUG POLICY EXPERIENCE?Document11 pagesSweden: WHAT CAN WE LEARN FROM SWEDEN'S DRUG POLICY EXPERIENCE?Paul Gallagher100% (1)

- The Wall Street Journal - 2022.09.27Document38 pagesThe Wall Street Journal - 2022.09.27EDGAR BAUTISTA LEONNo ratings yet

- David vs. ArroyoDocument6 pagesDavid vs. ArroyoRoyce Ann PedemonteNo ratings yet

- GST EntriesDocument5 pagesGST EntriessrestanandNo ratings yet

- Risk Surcharge: AWB No: H63537762 Owner CarrierDocument1 pageRisk Surcharge: AWB No: H63537762 Owner CarrierAnandNo ratings yet

- English 9 Module 1 Activity 1Document1 pageEnglish 9 Module 1 Activity 1Rowell Digal BainNo ratings yet

- IPO Admin CaseDocument13 pagesIPO Admin CaseisraeljamoraNo ratings yet

- IDBI Federal Annual Report 2015-2016 PDFDocument204 pagesIDBI Federal Annual Report 2015-2016 PDFJavaniNo ratings yet

- Chemical Checkpoints: Department of Occupational Safety and HealthDocument13 pagesChemical Checkpoints: Department of Occupational Safety and HealthpsssNo ratings yet

- KT 400 Installation Guide v01 - R004 - LT - en PDFDocument54 pagesKT 400 Installation Guide v01 - R004 - LT - en PDFLorenz Adriano RoblesNo ratings yet

- Changing Seats Re-Domiciliation To Curaçao FinalDocument2 pagesChanging Seats Re-Domiciliation To Curaçao FinalRicardo NavaNo ratings yet

- 2023.3.10 (Class)Document57 pages2023.3.10 (Class)vuvygyiNo ratings yet

- The HR Management and Payroll CycleDocument97 pagesThe HR Management and Payroll CycleErwin David SianturiNo ratings yet

- The Company FinalDocument6 pagesThe Company FinalMavambu JuniorNo ratings yet

- Macke vs. Camps G.R. No. 2962Document2 pagesMacke vs. Camps G.R. No. 2962Maria Fiona Duran MerquitaNo ratings yet

- Message of Po3 Ronald Villanueva Daguro Monday Flag Raising Ceremony of PSJLC June 1, 2015Document4 pagesMessage of Po3 Ronald Villanueva Daguro Monday Flag Raising Ceremony of PSJLC June 1, 2015menchayNo ratings yet

- Ncnda & Imfpa (Icc1)Document6 pagesNcnda & Imfpa (Icc1)King RoodNo ratings yet

- Asnake InternshipDocument36 pagesAsnake Internshipkassahungedefaye3120% (1)

- Seatwork 10.6.21Document6 pagesSeatwork 10.6.21Ashley MarloweNo ratings yet

- UnitedHealthCare Fillable Reconsideration FormDocument1 pageUnitedHealthCare Fillable Reconsideration FormDavid R. GonzálezNo ratings yet

- Institusi Pelayanan Kesehatan: Chapter 10-Healthcare InstitutionsDocument27 pagesInstitusi Pelayanan Kesehatan: Chapter 10-Healthcare InstitutionsasiyahNo ratings yet

- Lamia Assignment AlifaDocument5 pagesLamia Assignment AlifaMD Kamruzzaman RafaelNo ratings yet

- Full Text Set 3 - TaxDocument33 pagesFull Text Set 3 - TaxulticonNo ratings yet

- Globalization and Its Key ElementsDocument2 pagesGlobalization and Its Key ElementsRashil ShahNo ratings yet

- Hours On Projects Manila: Other Tasks (Turn-Over) FSD AFGHANISTAN Vacation LeaveDocument4 pagesHours On Projects Manila: Other Tasks (Turn-Over) FSD AFGHANISTAN Vacation LeaveRyle PlatinoNo ratings yet

- Edexcel IAL P2 Exercise 7C (Solution)Document5 pagesEdexcel IAL P2 Exercise 7C (Solution)Kaif HasanNo ratings yet

- Varsha Mishra XB13 DisabilityDocument6 pagesVarsha Mishra XB13 DisabilityKanchan ManhasNo ratings yet

- ANSYS Inc. Known Issues and LimitationsDocument34 pagesANSYS Inc. Known Issues and LimitationsV CafNo ratings yet

- Representative Assessee - An Overview and Future OutlookDocument63 pagesRepresentative Assessee - An Overview and Future Outlookjoseph davidNo ratings yet