Professional Documents

Culture Documents

Icici MF Capitalgain 2021FY

Icici MF Capitalgain 2021FY

Uploaded by

vinay44106Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Icici MF Capitalgain 2021FY

Icici MF Capitalgain 2021FY

Uploaded by

vinay44106Copyright:

Available Formats

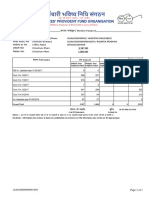

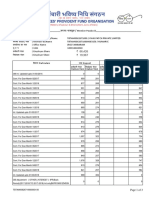

Investment Gain / (Loss) Statement *

For the period 01-APR-2021 To 31-MAR-2022

ICICI Prudential Mutual Fund

All Schemes Page 1 of 3

Folio No. 9701989 / 47 25-Jul-2022

Name : Vinay Kumar Status : Individual PAN : BXNPK4923R

KALIKA ROAD WEST TOLA TOWN

VILL HASANPUR BAJAR ANCHAL

HASANPUR DISTT SAMASTIPUR

SAMASTIPUR - 848205

Bihar B : Corresponding Units in Purchase / Switch-In / IDCW C. Grandfathered Investments as on

A : Redemption / Switch-Out D : Capital Gains / (Losses) E: TDS (if applicable)

Reinvested 31st Jan 2018

Purchase Redeemed Indexed Units as on NAV as on Market Value as on Short Term Long Term with Long Term without Tax Tax Tax +

Description Date Units Amount Price STT Description Date Units Units Unit Cost Cost ** 31/01/2018 31/01/2018 31/01/2018 Indexation Indexation % Deducted Surcharge

ICICI Prudential Long Term Equity Fund (Tax Saving) - Direct Plan - Growth ELSS, ISIN: INF109K01Y31

Switch Out 30-Aug-2021 237.710 146,827.25 617.68 1.47 Switch In 09-Aug-2017 29.521 29.521 338.74 29.521 382.19 11,282.631 NA 0.00 0 0

6,951.90

Switch In 11-Aug-2017 30.240 30.240 330.69 30.240 382.19 11,557.426 NA 7,121.22

Switch In 14-Nov-2017 27.914 27.914 358.24 27.914 382.19 10,668.452 NA 6,573.47

Switch In 04-Dec-2017 27.691 27.691 361.13 27.691 382.19 10,583.223 NA 6,520.95

Purchase 02-Feb-2018 26.797 26.797 373.18 NA 6,551.87

Switch In 05-Feb-2018 13.467 13.467 371.28 NA 3,318.27

Switch In 06-Feb-2018 27.394 27.394 365.05 NA 6,920.55

Switch In 18-May-2018 27.198 27.198 367.68 NA 6,799.50

Switch In 21-May-2018 27.488 27.488 363.79 NA 6,978.93

Redemption 17-Jan-2022 132.591 89,515.27 675.13 0.90 Switch In 21-Sep-2018 25.314 25.314 395.04 NA 0.00 0 0

7,090.20

Switch In 25-Sep-2018 25.693 25.693 389.21 NA 7,346.14

Switch In 05-Oct-2018 27.554 27.554 362.92 NA 8,602.63

Switch In 19-Oct-2018 27.473 27.473 364.00 NA 8,547.67

* Refer Disclaimer at the end of Statement.

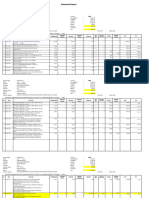

Investment Gain / (Loss) Statement *

ICICI Prudential Mutual Fund For the period 01-APR-2021 To 31-MAR-2022

All Schemes Page 2 of 3

25-Jul-2022

Folio No: 9701989 / 47 Name : Vinay Kumar

B : Corresponding Units in Purchase / Switch-In / IDCW C. Grandfathered Investments as on

A : Redemption / Switch-Out D : Capital Gains / (Losses) E: TDS (if applicable)

Reinvested 31st Jan 2018

Purchase Redeemed Unit Cost Indexed Units as on NAV as on Market Value as on Short Term Long Term with Long Term without Tax Tax Tax +

Description Date Units Amount Price STT Description Date Cost ** Indexation Indexation Deducted Surcharge

Units Units 31/01/2018 31/01/2018 31/01/2018 %

Switch In 03-Jan-2019 26.557 26.557 376.55 NA 7,929.39

Total 370.301 236,342.52 97,252.69

Summary of IDCWs received in this period in this scheme Paid Out : 0.00 Reinvested : 0.00 IDCW Transfer OUT: 0.00

ICICI Prudential Savings Fund - Direct Plan - Growth Ultra Liquid, ISIN: INF109K01O82

Redemption 27-Jul-2021 534.815 228,589.88 427.4186 0.00 Purchase 17-Dec-2020 600.169 534.815 416.5479 5,813.80 0.00 0 0

Total 534.815 228,589.88 5,813.80

Summary of IDCWs received in this period in this scheme Paid Out : 0.00 Reinvested : 0.00 IDCW Transfer OUT: 0.00

ICICI Prudential Banking and PSU Debt Fund - Direct Plan - Growth STP, ISIN: INF109K010A6

Redemption 08-Sep-2021 3,786.645 100,000.00 26.4086 0.00 Switch In 02-Sep-2021 5,568.025 3,786.645 26.3697 147.23 0.00 0 0

Redemption 26-Nov-2021 2,619.212 70,000.00 26.7256 0.00 Switch In 02-Sep-2021 5,568.025 1,781.380 26.3697 633.96 0.00 0 0

Purchase 28-Oct-2021 1,880.390 837.832 26.5902 113.42

Redemption 06-Dec-2021 1,009.519 27,000.00 26.7454 0.00 Purchase 28-Oct-2021 1,880.390 1,009.519 26.5902 156.65 0.00 0 0

Redemption 24-Jan-2022 2,436.400 65,000.00 26.6787 0.00 Purchase 28-Oct-2021 1,880.390 33.039 26.5902 2.92 0.00 0 0

* Refer Disclaimer at the end of Statement.

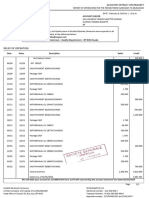

Investment Gain / (Loss) Statement *

ICICI Prudential Mutual Fund For the period 01-APR-2021 To 31-MAR-2022

All Schemes Page 3 of 3

25-Jul-2022

Folio No: 9701989 / 47 Name : Vinay Kumar

B : Corresponding Units in Purchase / Switch-In / IDCW C. Grandfathered Investments as on

A : Redemption / Switch-Out D : Capital Gains / (Losses) E: TDS (if applicable)

Reinvested 31st Jan 2018

Purchase Redeemed Unit Cost Indexed Units as on NAV as on Market Value as on Short Term Long Term with Long Term without Tax Tax Tax +

Description Date Units Amount Price STT Description Date Cost ** Indexation Indexation Deducted Surcharge

Units Units 31/01/2018 31/01/2018 31/01/2018 %

Purchase 04-Jan-2022 2,435.731 2,403.361 26.6860 -17.63

Total 9,851.776 262,000.00 1,036.55

Summary of IDCWs received in this period in this scheme Paid Out : 0.00 Reinvested : 0.00 IDCW Transfer OUT: 0.00

*Disclaimer: This statement of gain/loss is issued at your request as additional information and should not be considered as the basis for determining your tax liability. For the purpose of determining capital gains, the first in first out ('FIFO') principle of appropriating withdrawals against

subscriptions is followed. This statement is generated based on latest available Cost Inflation Index ('CII') issued by the Central Board of Direct Tax ('the CBDT') on the date of preparation of the statement. CII declaration generally happen after 3/4 months, from the start of the Financial

Year. Where applicable, Tax has been deducted based on the available CII on the date of redemption / switch-outs transaction and could be at variance from the applicable CII for the financial year. The Indexed cost is rounded off to 2-4 decimals. Pursuant to the Amendments made by the

Finance Act 2018, the units disclosed under Section C – ‘Grandfathered Investments as on 31st Jan 2018’ relates to the number of units that were considered for the redemption (withdrawal), where the cost value would be the market value shown as of 31st Jan 2018. For equity mergers, the

grandfathered value as on 31st Jan 2018 is considered and disclosed as NAV as on 31/01/2018’, duly adjusted as per units created in target scheme. In respect of scheme mergers within the same Asset Class, the original investment value in the erstwhile scheme (scheme which merged) is

considered and is reflected in Section B, as 'Unit Cost' which is adjusted as per units created in target scheme, for ease of verification. Please note that in respect of schemes where segregated portfolio is created, the original investment value of those investments prior to such creation, has been

adjusted, basis the segregated percentile, for the purpose of Capital Gain. The statement shows actual STT and Tax deducted from your withdrawals and displays your tax status as on the date of generation of the statement. You are advised to consult your financial/tax advisor to verify the

correctness and appropriateness of the contents of this statement. The Mutual Fund, Trustees, Asset Management Company, CAMS and each of their directors, employees or agents will not be liable for either determining your tax liability or any loss or damage arising out of any

decisions/actions arising out of the contents of this statement. Please note that CBDT has notified the revisions in CII with base year as 1st April 2001 (changed from 1st April 1981). Accordingly, for investments made prior to 1st April 2001, new CII shall be applied on the fair market value as

of 1st April 2001 or cost of acquisition, whichever is higher. In absence of any information of total long-term capital gains earned during the financial year by a unitholder being a non-resident, while deducting taxes at source on the long-term capital gain earned on redemption/transfer of units

of equity oriented funds which are chargeable to tax, the exemption available to the extent of INR 1 Lakh on such gains as provided under section 112A of the Income-tax Act, 1961 has not been considered.

Note : Unit Cost = Purchase Price ( inclusive of stamp duty )

** CII cost is shown for eligible investors and schemes. ITN CAMSWS 25072215479

For Internal Use Only Investrak.Net-V12.4.0-23 Computer Age Management Services Limited

You might also like

- AT 6th Edition (May 2023)Document508 pagesAT 6th Edition (May 2023)myturtle gameNo ratings yet

- Capital GainDocument4 pagesCapital Gainhimanshudhawale18No ratings yet

- Capital Gain STMT 18012022 160245 13650911 PDFDocument1 pageCapital Gain STMT 18012022 160245 13650911 PDFEVEREST ANALYTICALS MEGHANANo ratings yet

- Get DocumentDocument6 pagesGet DocumentAbhijit RathiNo ratings yet

- fb2019 Halaman PDFDocument180 pagesfb2019 Halaman PDFputrii auliaNo ratings yet

- Factbook 2019 Indesign Halaman 2 PDFDocument180 pagesFactbook 2019 Indesign Halaman 2 PDFerlangga suryarahmanNo ratings yet

- Capital Gain SummaryDocument8 pagesCapital Gain SummaryMayank PandeyNo ratings yet

- Consumer Bill - SNGPLDocument1 pageConsumer Bill - SNGPLMH PNo ratings yet

- Liqui Deuda inDocument1 pageLiqui Deuda inian barionNo ratings yet

- MR - Manender Pal William Jt1: Page 1 of 2 M-76543125-1Document2 pagesMR - Manender Pal William Jt1: Page 1 of 2 M-76543125-1PRO AND HEDGE TRADINGS INDIANo ratings yet

- LNL Iklcqd /: Grand Total 3,287 1,006 0 0 2,221Document1 pageLNL Iklcqd /: Grand Total 3,287 1,006 0 0 2,221LAXMINo ratings yet

- Account Portfolio Summary From 01-APR-2016 To 31-MAR-2017: Page 1 of 3 3158700 / 24Document9 pagesAccount Portfolio Summary From 01-APR-2016 To 31-MAR-2017: Page 1 of 3 3158700 / 24Bimal Kumar MohataNo ratings yet

- Capital Gains Statement: Nippon India Credit Risk Fund - Growth Plan Growth Option (Inf204K01Fq3)Document3 pagesCapital Gains Statement: Nippon India Credit Risk Fund - Growth Plan Growth Option (Inf204K01Fq3)kulwinder singhNo ratings yet

- LNL Iklcqd /: Grand Total 9,846 3,012 4,200 0 6,834Document1 pageLNL Iklcqd /: Grand Total 9,846 3,012 4,200 0 6,834dablu kumarNo ratings yet

- Outstanding As On 31.10.18 Action PlanDocument13 pagesOutstanding As On 31.10.18 Action PlanRaman ChoudharyNo ratings yet

- Centro Escolar University: Villaflor, Hailie Jade PDocument1 pageCentro Escolar University: Villaflor, Hailie Jade PHailie JadeNo ratings yet

- Aldo SummaryDocument3 pagesAldo SummaryRahmitaDwinesiaNo ratings yet

- Realized Capital GainsDocument3 pagesRealized Capital GainsRAMGOPAL GUPTANo ratings yet

- LNL Iklcqd /: Employee Share Employer Share Employee Share Employer ShareDocument2 pagesLNL Iklcqd /: Employee Share Employer Share Employee Share Employer ShareSubhash SubhashNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961rajniNo ratings yet

- Inv 308839Document1 pageInv 308839Arun D MaxNo ratings yet

- Win Min Htike, UDocument4 pagesWin Min Htike, Ujulykoko2157No ratings yet

- India ICICI Bank Statement WordDocument2 pagesIndia ICICI Bank Statement WordRuo KingNo ratings yet

- Aefpm5487a 2023Document4 pagesAefpm5487a 2023enjoy enjoy enjoyNo ratings yet

- Acctstmt L 16071593EmailAcctStmt PDFDocument4 pagesAcctstmt L 16071593EmailAcctStmt PDFSaurabh ShuklaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Palani KumarNo ratings yet

- Abmm Idx 1234Document3 pagesAbmm Idx 1234Rudi PramonoNo ratings yet

- MH Ban 00472640000050186Document1 pageMH Ban 00472640000050186prasadmalbariNo ratings yet

- ABMMDocument3 pagesABMMerikNo ratings yet

- LNL Iklcqd /: Grand Total 11,526 3,527 11,526 3,527 7,567Document1 pageLNL Iklcqd /: Grand Total 11,526 3,527 11,526 3,527 7,567Subhash Kumar KNo ratings yet

- Fa Gross Block555Document8 pagesFa Gross Block555Nayan SarmaNo ratings yet

- MHBAN00451870000304465Document1 pageMHBAN00451870000304465SACHIN DEVIDAS PATILNo ratings yet

- General LedgerDocument13 pagesGeneral LedgerHei GadisNo ratings yet

- BRIXTON 1014 - PS ComputationDocument2 pagesBRIXTON 1014 - PS ComputationAndrea SisonNo ratings yet

- MR PANG JUN JIE Bill 6Document4 pagesMR PANG JUN JIE Bill 6Jun Jie PangNo ratings yet

- Mypdf PDFDocument2 pagesMypdf PDFnileshmandlikNo ratings yet

- APKKP15812350000010279Document1 pageAPKKP15812350000010279Ratnakar AryasomayajulaNo ratings yet

- ST 14081002Document1 pageST 14081002motazNo ratings yet

- GRCDP00696190000029942Document2 pagesGRCDP00696190000029942Gokul KrishnanNo ratings yet

- Account Extract On RequestDocument1 pageAccount Extract On Requestbenoit sophieNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961safiNo ratings yet

- HPSML00041100000010830Document1 pageHPSML00041100000010830bruceNo ratings yet

- Aecpc3653h 2018 ShailDocument4 pagesAecpc3653h 2018 ShailbookNo ratings yet

- VLPK PF StatementDocument1 pageVLPK PF StatementhariveerNo ratings yet

- LNL Iklcqd /: Grand Total 6,137 1,877 0 0 4,260Document1 pageLNL Iklcqd /: Grand Total 6,137 1,877 0 0 4,260sanjib pandaNo ratings yet

- Ahwpl0214g 2023Document5 pagesAhwpl0214g 2023cagopalofficebackupNo ratings yet

- TKXEL - Unrealised Gains and Losses WORKINGDocument9 pagesTKXEL - Unrealised Gains and Losses WORKINGfaheemNo ratings yet

- Gas Bill August 2017Document1 pageGas Bill August 2017salmansaleemNo ratings yet

- Anugerah Kagum Karya Utama TBK.: Company Report: January 2019 As of 31 January 2019Document3 pagesAnugerah Kagum Karya Utama TBK.: Company Report: January 2019 As of 31 January 2019Alan TechNo ratings yet

- Valuation ReportDocument5 pagesValuation Reportjai dNo ratings yet

- P 14 - 8 - Titania - PracticeDocument5 pagesP 14 - 8 - Titania - PracticePinnPiyapatNo ratings yet

- TBVLR00742840000016942Document1 pageTBVLR00742840000016942raghavajaganNo ratings yet

- LNL Iklcqd /: Employee Share Employer Share Employee Share Employer ShareDocument3 pagesLNL Iklcqd /: Employee Share Employer Share Employee Share Employer ShareSheak AbdullaNo ratings yet

- 285 Units Rs. 8,032.56: Hi Rise BuildersDocument2 pages285 Units Rs. 8,032.56: Hi Rise BuildersZameel MustafaNo ratings yet

- Aahpw9410b 2018Document4 pagesAahpw9410b 2018Abhijit WaghNo ratings yet

- MRNOI15773880000011316Document1 pageMRNOI15773880000011316Riya SinghNo ratings yet

- MbssDocument3 pagesMbssErvin KhouwNo ratings yet

- LNL Iklcqd /: Grand Total 5,519 1,689 5,519 1,689 3,018Document1 pageLNL Iklcqd /: Grand Total 5,519 1,689 5,519 1,689 3,018Kgn Xerox &CommunicationNo ratings yet

- Axis Bank Interest CertDocument1 pageAxis Bank Interest Certvinay44106No ratings yet

- LIC-RenewalPremium 22829309Document1 pageLIC-RenewalPremium 22829309vinay44106No ratings yet

- DSL Dated 09 Aug 2022Document3 pagesDSL Dated 09 Aug 2022vinay44106No ratings yet

- Ap Dated 06 Jul 2022Document4 pagesAp Dated 06 Jul 2022vinay44106No ratings yet

- Ap Dated 04 Sep 2022Document5 pagesAp Dated 04 Sep 2022vinay44106No ratings yet

- Ap Dated 06 Aug 2022Document4 pagesAp Dated 06 Aug 2022vinay44106No ratings yet

- Edit 3Document3 pagesEdit 3vinay44106No ratings yet

- 2018 Xiaohe Huang Tax ReturnDocument48 pages2018 Xiaohe Huang Tax ReturnKaren Xie100% (2)

- Urdu Essay WritingDocument9 pagesUrdu Essay Writingb6yf8tcd100% (2)

- Agricultural Taxation and SubsidiesDocument21 pagesAgricultural Taxation and SubsidiesRohit SoniNo ratings yet

- Bianca LTD Also Purchased Two Second-Hand Cars On 1 April 2022. Details AreDocument50 pagesBianca LTD Also Purchased Two Second-Hand Cars On 1 April 2022. Details AreJOJONo ratings yet

- Income Under The Head Capital Gains: LTCG Arising From The Transfer of RHP and Is Reinvested in New RHP (Exemption U/s 54)Document14 pagesIncome Under The Head Capital Gains: LTCG Arising From The Transfer of RHP and Is Reinvested in New RHP (Exemption U/s 54)dosadNo ratings yet

- Taxation of Joint Development Agreement Other Than Under S. 45 (5A)Document55 pagesTaxation of Joint Development Agreement Other Than Under S. 45 (5A)Srinivasulu HanumanthgafiNo ratings yet

- Applied Direct Taxation Objective Questions and AnswersDocument11 pagesApplied Direct Taxation Objective Questions and AnswersAbhijit HoroNo ratings yet

- Home Loan - Tax Benefit - 2Document3 pagesHome Loan - Tax Benefit - 2Rajesh KumarNo ratings yet

- Capital Gain TemplateDocument27 pagesCapital Gain TemplateNayan WadhwaniNo ratings yet

- Chapter 10 - Bond Prices and YieldsDocument42 pagesChapter 10 - Bond Prices and YieldsA_Students100% (3)

- TX ZAF Examiner's ReportDocument9 pagesTX ZAF Examiner's ReportKevin KausiyoNo ratings yet

- The Commissioner of Income vs. Manjula J. Shah Bombay High CourtDocument18 pagesThe Commissioner of Income vs. Manjula J. Shah Bombay High CourtHarsh WadhwaniNo ratings yet

- CHAPTER 9 To CHAPTER 15 ANSWERSDocument38 pagesCHAPTER 9 To CHAPTER 15 ANSWERSryanmartintaanNo ratings yet

- Office No. 204 A, Hans Sarowar Premises Soc., Market Yard, Pune - 411037 Date:30/01/2023 Pan No:ACDPK5011C ToDocument2 pagesOffice No. 204 A, Hans Sarowar Premises Soc., Market Yard, Pune - 411037 Date:30/01/2023 Pan No:ACDPK5011C ToSubhash KalambeNo ratings yet

- Corporate Finance: Chapter-8Document16 pagesCorporate Finance: Chapter-8AnongNo ratings yet

- Ketan & Karia V URADocument30 pagesKetan & Karia V URAjoram muziraNo ratings yet

- Review Article Piketty RevDocument18 pagesReview Article Piketty RevCreomar BaptistaNo ratings yet

- Mutual FundsDocument16 pagesMutual Fundsvirenshah_9846No ratings yet

- Txmwi 2018 Dec ADocument7 pagesTxmwi 2018 Dec AangaNo ratings yet

- I. The Income Tax Act, 1961 Short Notes: S.No Topics P. NoDocument5 pagesI. The Income Tax Act, 1961 Short Notes: S.No Topics P. NoAhila SekarNo ratings yet

- Taxation Sec A May 2024 1703224575Document10 pagesTaxation Sec A May 2024 1703224575Umang NagarNo ratings yet

- FS2122-INCOMETAX-02: BSA 1202 Atty. F. R. SorianoDocument11 pagesFS2122-INCOMETAX-02: BSA 1202 Atty. F. R. SorianoKatring O.No ratings yet

- SS and SSS Chap 1 To 10 (2020)Document215 pagesSS and SSS Chap 1 To 10 (2020)Dinh TranNo ratings yet

- Investment&Portfolio 260214Document285 pagesInvestment&Portfolio 260214Yonas Tsegaye HaileNo ratings yet

- Chapter 11 Capital Budgeting Cash Flows: Principles of Managerial Finance, 13e, Global Edition (Gitman)Document33 pagesChapter 11 Capital Budgeting Cash Flows: Principles of Managerial Finance, 13e, Global Edition (Gitman)Statistics ABMNo ratings yet

- Income Tax Divyastra CH 12 Set Off Carry Forward of Losses RDocument17 pagesIncome Tax Divyastra CH 12 Set Off Carry Forward of Losses R655priya THAPANo ratings yet

- Capital Gains Charts - May 2024 & June 2024Document10 pagesCapital Gains Charts - May 2024 & June 2024CA Tushar GuptaNo ratings yet

- MODULE 2 - Personal Cash Flow StatementDocument5 pagesMODULE 2 - Personal Cash Flow StatementKeiko KēkoNo ratings yet

- Nota RPGT LatestDocument8 pagesNota RPGT LatestSiva NanthaNo ratings yet