Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

13 viewsServices Rendered by Banks.: Advancing of Loans

Services Rendered by Banks.: Advancing of Loans

Uploaded by

Kulgeet TanyaBanks provide various services including lending through loans, overdrafts, and bill discounting. They also facilitate payments through checks, collection and payment of credit instruments. Additionally, banks offer foreign currency exchange, bank guarantees, funds remittance, credit/debit cards, ATM services, online and mobile banking, and accepting deposits from customers.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Business Development Audit ChecklistDocument2 pagesBusiness Development Audit Checklistandruta197867% (3)

- Banking FacilitiesDocument3 pagesBanking FacilitiesOsama AhmedNo ratings yet

- Banking ServicesDocument5 pagesBanking Servicesbeena antuNo ratings yet

- Unit-2: Banking and Insurance Services: Collection of Cheques, Bills and DraftsDocument45 pagesUnit-2: Banking and Insurance Services: Collection of Cheques, Bills and DraftsRaghu BMNo ratings yet

- Advancing of Loans: Difference Between Bank Overdraft and Cash CreditDocument7 pagesAdvancing of Loans: Difference Between Bank Overdraft and Cash CreditpraharshithaNo ratings yet

- Business Services Class 11 Notes Business Studies - 7114551Document8 pagesBusiness Services Class 11 Notes Business Studies - 7114551TanishqNo ratings yet

- Chapter 4 - Business ServicesDocument12 pagesChapter 4 - Business Servicestayalaryaman751No ratings yet

- CH 4Document10 pagesCH 4RaashiNo ratings yet

- Functions of Commercial BanksDocument19 pagesFunctions of Commercial BanksAravind Kumar G100% (1)

- E BankingDocument65 pagesE Bankingzeeshan shaikh100% (1)

- Financial Services SectorDocument12 pagesFinancial Services SectorDominic RomeroNo ratings yet

- CBO Module 1 Retail Banking Deposit ProductsDocument17 pagesCBO Module 1 Retail Banking Deposit ProductsRajabNo ratings yet

- Commercial BankDocument2 pagesCommercial BankFardin Ahmed MugdhoNo ratings yet

- Banking Awareness, FBNDocument10 pagesBanking Awareness, FBNtoniahokekeNo ratings yet

- General Utility Services of Commercial Banks: Transactions. They Are Called Authorized Dealers. The BankDocument10 pagesGeneral Utility Services of Commercial Banks: Transactions. They Are Called Authorized Dealers. The BankSharan YadavNo ratings yet

- Nature of Business Serv1cesDocument11 pagesNature of Business Serv1cesmadhavanramuduNo ratings yet

- CH 4 Business ServicesDocument13 pagesCH 4 Business ServicesBaklol Babu JiNo ratings yet

- 11 Business Studies Notes Ch04 Business Services 02Document12 pages11 Business Studies Notes Ch04 Business Services 02Subodh SaxenaNo ratings yet

- Unit 4 Business Studies NotesDocument8 pagesUnit 4 Business Studies NotesDhakshithaNo ratings yet

- Bank ServicesDocument2 pagesBank ServicesKürti AnettaNo ratings yet

- Chapter 13 BankingDocument5 pagesChapter 13 BankingdragongskdbsNo ratings yet

- Banking Terms 2021Document48 pagesBanking Terms 2021Sammar AbbasNo ratings yet

- Important Functions of Bank: What Is A Bank?Document3 pagesImportant Functions of Bank: What Is A Bank?Samiksha PawarNo ratings yet

- Role of Commercial Bank-1Document9 pagesRole of Commercial Bank-1TanzeemNo ratings yet

- Unit 2 - Sbaa7001 Banking Products and ServicesDocument38 pagesUnit 2 - Sbaa7001 Banking Products and ServicesGracyNo ratings yet

- 2-Notes On Banking Products & Services-Part 1Document16 pages2-Notes On Banking Products & Services-Part 1Kirti GiyamalaniNo ratings yet

- I) Primary Functions:: A) Accepting DepositsDocument4 pagesI) Primary Functions:: A) Accepting DepositsJoshna SinghNo ratings yet

- Chapter 24 The Role and Function of Financial InstitutionsDocument3 pagesChapter 24 The Role and Function of Financial InstitutionsVỹ San KohNo ratings yet

- Research Paper On Banker As An Agent: Critical Study: Banking and Insurance LawDocument16 pagesResearch Paper On Banker As An Agent: Critical Study: Banking and Insurance LawGyanendra kumarNo ratings yet

- Banking Chapter OneDocument17 pagesBanking Chapter OnefikremariamNo ratings yet

- Lession 3 OperationsDocument13 pagesLession 3 Operationssusma susmaNo ratings yet

- (A.) Commercial Banks - FunctionsDocument3 pages(A.) Commercial Banks - FunctionsEPP-2004 HaneefaNo ratings yet

- Banking NotesDocument84 pagesBanking NotesNitesh MahatoNo ratings yet

- BRO - 4th BBADocument41 pagesBRO - 4th BBANithyananda PatelNo ratings yet

- LPB Unit-1 Introduction To BankingDocument13 pagesLPB Unit-1 Introduction To BankingVeena ReddyNo ratings yet

- Functions of BanksDocument3 pagesFunctions of BanksEbne FahadNo ratings yet

- April 23 2021 12B, C, D, E, F, GChapter14BANKS NotesDocument16 pagesApril 23 2021 12B, C, D, E, F, GChapter14BANKS NotesStephine BochuNo ratings yet

- Chap 1. Banking System in IndiaDocument24 pagesChap 1. Banking System in IndiaShankha MaitiNo ratings yet

- Commercial BankingDocument4 pagesCommercial Bankingsn nNo ratings yet

- Functions of Commercial Banks Commercial Banks Perform A Variety of Functions Which Can Be Divided AsDocument3 pagesFunctions of Commercial Banks Commercial Banks Perform A Variety of Functions Which Can Be Divided AsBalaji GajendranNo ratings yet

- Com BankDocument25 pagesCom BankAnonymous y3E7iaNo ratings yet

- Chapter Three Commercial Banking: 1 by SityDocument10 pagesChapter Three Commercial Banking: 1 by SitySeid KassawNo ratings yet

- Products and Services Offer by BankDocument11 pagesProducts and Services Offer by BankRohit JaiswalNo ratings yet

- Functions of Commercial BanksDocument2 pagesFunctions of Commercial BanksAbdul Rasheed ShaikhNo ratings yet

- Instruments of Exchange and PaymentDocument3 pagesInstruments of Exchange and PaymentAnnika liburdNo ratings yet

- Banking Products and ServicesDocument5 pagesBanking Products and ServicesAikya GandhiNo ratings yet

- Banking U5Document4 pagesBanking U5alemayehuNo ratings yet

- Indian BankDocument94 pagesIndian BankManzuhonnur100% (2)

- Financial Analysis at Indian BankDocument93 pagesFinancial Analysis at Indian BankAbhay JainNo ratings yet

- Management of Commercial BankDocument7 pagesManagement of Commercial BankSamridhi RakhejaNo ratings yet

- Functions of Commercial BanksDocument52 pagesFunctions of Commercial BanksPulkit_Saini_789No ratings yet

- XI BS Ch04 Creative PPT With ObjectivesDocument158 pagesXI BS Ch04 Creative PPT With ObjectivesHiya MakhijaNo ratings yet

- Banking Functions: Navjeet Parvez Rakesh Majid NavjotDocument13 pagesBanking Functions: Navjeet Parvez Rakesh Majid Navjotharesh KNo ratings yet

- Amrit Summer Report 000Document68 pagesAmrit Summer Report 000RPSinghNo ratings yet

- Commercial BankingDocument12 pagesCommercial BankingwubeNo ratings yet

- Document (2) 1Document28 pagesDocument (2) 1Bi bi fathima Bi bi fathimaNo ratings yet

- Ethiopian Banking Sector: 2.1. Organization and Structure of Ethiopian Banking Industry BanksDocument9 pagesEthiopian Banking Sector: 2.1. Organization and Structure of Ethiopian Banking Industry Banksመስቀል ኃይላችን ነውNo ratings yet

- CH 4 Business ServicesDocument11 pagesCH 4 Business Serviceskeshav sarafNo ratings yet

- Review of Some Online Banks and Visa/Master Cards IssuersFrom EverandReview of Some Online Banks and Visa/Master Cards IssuersNo ratings yet

- Evaluation of Some Online Payment Providers Services: Best Online Banks and Visa/Master Cards IssuersFrom EverandEvaluation of Some Online Payment Providers Services: Best Online Banks and Visa/Master Cards IssuersNo ratings yet

- KULGEETDocument5 pagesKULGEETKulgeet TanyaNo ratings yet

- Mr. A Mr. B: CourtDocument2 pagesMr. A Mr. B: CourtKulgeet TanyaNo ratings yet

- NullDocument9 pagesNullKulgeet TanyaNo ratings yet

- Fund Structure & Legal EnvironmentDocument32 pagesFund Structure & Legal EnvironmentKulgeet TanyaNo ratings yet

- MandateDocument2 pagesMandateKulgeet TanyaNo ratings yet

- Off-Balance Sheet BusinessDocument3 pagesOff-Balance Sheet BusinessKulgeet TanyaNo ratings yet

- Bike Premsons Honda: Banker's LienDocument2 pagesBike Premsons Honda: Banker's LienKulgeet TanyaNo ratings yet

- Different Types of Deposit Products: 1. Savings Bank AccountDocument6 pagesDifferent Types of Deposit Products: 1. Savings Bank AccountKulgeet TanyaNo ratings yet

- Methods of Food PurchasingDocument10 pagesMethods of Food Purchasingrizzwan khan100% (1)

- Data Analyst - AssignmentDocument3 pagesData Analyst - AssignmentChandrakant Babar50% (2)

- Sales Contract No. 001/SC-SHP/09/2021Document2 pagesSales Contract No. 001/SC-SHP/09/2021QrenNo ratings yet

- Kuliah Ke-5 #Cost of CapitalDocument45 pagesKuliah Ke-5 #Cost of CapitalHASNA PUTRINo ratings yet

- What Is Test Scenario - Template With ExamplesDocument3 pagesWhat Is Test Scenario - Template With ExamplesFlorin ConduratNo ratings yet

- Marketing - 5-Segmenntation, Targeting and PositioningDocument46 pagesMarketing - 5-Segmenntation, Targeting and PositioningYogendra ShuklaNo ratings yet

- 3 Org Structures To Consider For Experience Led TransformationDocument15 pages3 Org Structures To Consider For Experience Led TransformationYangjin KwonNo ratings yet

- Concept of Salary Under Income Tax ActDocument29 pagesConcept of Salary Under Income Tax ActMaaz Alam100% (2)

- Cement Industry WCMDocument18 pagesCement Industry WCMAzwad ChowdhuryNo ratings yet

- RW2011-15 Toc 183749110917062932Document6 pagesRW2011-15 Toc 183749110917062932Dwi AgungNo ratings yet

- ZoOm Pitch DeckDocument5 pagesZoOm Pitch DeckHakimuddin TinwalaNo ratings yet

- Account Statement: PrakashDocument1 pageAccount Statement: PrakashRny buriaNo ratings yet

- Property and Equity 2Document101 pagesProperty and Equity 2Bc Violá100% (1)

- PDF TDocument2 pagesPDF TahmdkamyabrjmNo ratings yet

- 31jan2019 - PDs CompiledDocument108 pages31jan2019 - PDs CompiledharigroupphilippinesNo ratings yet

- Cad Cam TheoryDocument12 pagesCad Cam TheoryShashank VermaNo ratings yet

- Financing A Car Loan WorksheetDocument3 pagesFinancing A Car Loan WorksheetDestiney GriffinNo ratings yet

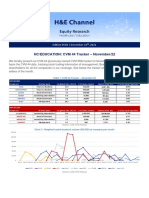

- HC/EDUCATION: CVM 44 Tracker - November/22: Edition #548 - December 16, 2022Document4 pagesHC/EDUCATION: CVM 44 Tracker - November/22: Edition #548 - December 16, 2022CAIO HENRIQUE FIORDELIZNo ratings yet

- Economics Slide C5Document41 pagesEconomics Slide C5Tamara Jacobs100% (1)

- Econ CE GDP MCDocument19 pagesEcon CE GDP MCs sNo ratings yet

- Arnolds v. WillitsDocument1 pageArnolds v. WillitsStephanie Erica Louise RicamonteNo ratings yet

- MBA Case Let It Be MeDocument1 pageMBA Case Let It Be MeMichelle AlvarezNo ratings yet

- Kalbe Farma TBK - Billingual - 30 - Sept - 2023 - ReleasedDocument145 pagesKalbe Farma TBK - Billingual - 30 - Sept - 2023 - ReleasedTimothy GracianovNo ratings yet

- Life Cycle Costing Q&ADocument2 pagesLife Cycle Costing Q&AanjNo ratings yet

- Egyptian International Pharmaceutical Industries Company (EIPICO)Document1 pageEgyptian International Pharmaceutical Industries Company (EIPICO)yasser massryNo ratings yet

- Class Exercises - Accounting Errors - AnswersDocument4 pagesClass Exercises - Accounting Errors - Answerseshakaur100% (2)

- Analysis of Marketing of PerfumeDocument10 pagesAnalysis of Marketing of Perfume337 Nandawat KanishkaNo ratings yet

- HMSI Company Profile 2019 - HinoDocument25 pagesHMSI Company Profile 2019 - HinoahmadmubarokharbarindoNo ratings yet

- Assignment1 - Group 8Document8 pagesAssignment1 - Group 8digamber patilNo ratings yet

Services Rendered by Banks.: Advancing of Loans

Services Rendered by Banks.: Advancing of Loans

Uploaded by

Kulgeet Tanya0 ratings0% found this document useful (0 votes)

13 views3 pagesBanks provide various services including lending through loans, overdrafts, and bill discounting. They also facilitate payments through checks, collection and payment of credit instruments. Additionally, banks offer foreign currency exchange, bank guarantees, funds remittance, credit/debit cards, ATM services, online and mobile banking, and accepting deposits from customers.

Original Description:

Original Title

Untitled

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBanks provide various services including lending through loans, overdrafts, and bill discounting. They also facilitate payments through checks, collection and payment of credit instruments. Additionally, banks offer foreign currency exchange, bank guarantees, funds remittance, credit/debit cards, ATM services, online and mobile banking, and accepting deposits from customers.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

13 views3 pagesServices Rendered by Banks.: Advancing of Loans

Services Rendered by Banks.: Advancing of Loans

Uploaded by

Kulgeet TanyaBanks provide various services including lending through loans, overdrafts, and bill discounting. They also facilitate payments through checks, collection and payment of credit instruments. Additionally, banks offer foreign currency exchange, bank guarantees, funds remittance, credit/debit cards, ATM services, online and mobile banking, and accepting deposits from customers.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

SERVICES RENDERED BY BANKS.

1. Advancing of loans - Banks are profit-oriented business organizations.

So they have to advance a loan to the public and generate interest

from them as profit. After keeping certain cash reserves, banks

provide short-term, medium-term and long-term loans to needy

borrowers. Interest on loan account is payable on the entire amount

till paid off.

2. Overdraft - The customer may be allowed to overdraw his current

account with or without security if he requires temporary

accommodation. Interest is charged from the customers on the

overdrawn amount.

3. Discounting of Bills Of Exchange - This is another popular type of

lending by modern banks. Through this method, a holder of a bill of

exchange can get it discounted by the bank, in a bill of exchange, the

debtor accepts the bill drawn upon him by the creditor (i.e., holder of

the bill) and agrees to pay the amount mentioned on maturity. After

making some marginal deductions (in the form of commission), the

bank pays the value of the bill to the holder. When the bill of

exchange matures, the bank gets its payment from the party, which

had accepted the bill.

4. Cheque payments - Banks provide cheque pads to the account

holders. Account holders can draw cheque upon the bank to pay

money. Banks pay for cheques of customers after formal verification

and official procedures.

5. Collection & Payment of Credit Instruments - In modern business,

different types of credit instruments such as the bill of exchange,

promissory notes, cheques etc. are used. Banks deal with such

instruments. Modern banks collect and pay different types of credit

instruments as the representative of the customers.

6. Foreign Currency Exchange - Banks deal with foreign currencies. As

the requirement of customers, banks exchange foreign currencies

with local currencies, which is essential to settle down the dues in the

international trade.

7. Bank Guarantee - Customers are provided the facility of bank

guarantee by modern commercial banks. When customers have to

deposit certain fund in governmental offices or courts for a specific

purpose, a bank can present itself as the guarantee for the customer,

instead of depositing fund by customers.

8. Remittance of Funds - Banks help their customers in transferring

funds from one place to another through cheques, drafts, etc.

9. Credit Cards - A credit card is cards that allow their holders to make

purchases of goods and services in exchange for the credit card’s

provider immediately paying for the goods or service, and the

cardholder promising to pay back the amount of the purchase to the

card provider over a period of time, and with interest.

10. ATM Service – ATM is a user friendly, computer driven system which

operates 24 hours a day, 7 days a week. Key advantages of ATMs

include:

24 hour availability

Elimination of labor cost

Convenience of location

11. Debit Cards - Debit cards are used to electronically withdraw funds

directly from the cardholders’ accounts. Most debit cards require a

Personal Identification Number (PIN) to be used to verify the

transaction.

12. Online Banking - Online banking is a service offered by banks that

allows account holders to access their account data via the internet.

Online banking is also known as “Internet banking” or “Web

banking.” Online banking through traditional banks enable customers

to perform all routine transactions, such as account transfers,

balance inquiries, bill payments, and stop-payment requests, and

some even offer online loan and credit card applications. Account

information can be accessed anytime, day or night, and can be done

from anywhere.

13. Mobile Banking - Mobile banking (also known as M-Banking) is a

term used for performing balance checks, account transactions,

payments, credit applications and other banking transactions

through a mobile device such as a mobile phone or Personal Digital

Assistant (PDA).

14. Accepting Deposits - Accepting deposit from savers or account

holders is the primary function of a bank. Banks accept deposit from

those who can save money but cannot utilize in profitable sectors.

People prefer to deposit their savings in a bank because by doing so,

they earn interest.

You might also like

- Business Development Audit ChecklistDocument2 pagesBusiness Development Audit Checklistandruta197867% (3)

- Banking FacilitiesDocument3 pagesBanking FacilitiesOsama AhmedNo ratings yet

- Banking ServicesDocument5 pagesBanking Servicesbeena antuNo ratings yet

- Unit-2: Banking and Insurance Services: Collection of Cheques, Bills and DraftsDocument45 pagesUnit-2: Banking and Insurance Services: Collection of Cheques, Bills and DraftsRaghu BMNo ratings yet

- Advancing of Loans: Difference Between Bank Overdraft and Cash CreditDocument7 pagesAdvancing of Loans: Difference Between Bank Overdraft and Cash CreditpraharshithaNo ratings yet

- Business Services Class 11 Notes Business Studies - 7114551Document8 pagesBusiness Services Class 11 Notes Business Studies - 7114551TanishqNo ratings yet

- Chapter 4 - Business ServicesDocument12 pagesChapter 4 - Business Servicestayalaryaman751No ratings yet

- CH 4Document10 pagesCH 4RaashiNo ratings yet

- Functions of Commercial BanksDocument19 pagesFunctions of Commercial BanksAravind Kumar G100% (1)

- E BankingDocument65 pagesE Bankingzeeshan shaikh100% (1)

- Financial Services SectorDocument12 pagesFinancial Services SectorDominic RomeroNo ratings yet

- CBO Module 1 Retail Banking Deposit ProductsDocument17 pagesCBO Module 1 Retail Banking Deposit ProductsRajabNo ratings yet

- Commercial BankDocument2 pagesCommercial BankFardin Ahmed MugdhoNo ratings yet

- Banking Awareness, FBNDocument10 pagesBanking Awareness, FBNtoniahokekeNo ratings yet

- General Utility Services of Commercial Banks: Transactions. They Are Called Authorized Dealers. The BankDocument10 pagesGeneral Utility Services of Commercial Banks: Transactions. They Are Called Authorized Dealers. The BankSharan YadavNo ratings yet

- Nature of Business Serv1cesDocument11 pagesNature of Business Serv1cesmadhavanramuduNo ratings yet

- CH 4 Business ServicesDocument13 pagesCH 4 Business ServicesBaklol Babu JiNo ratings yet

- 11 Business Studies Notes Ch04 Business Services 02Document12 pages11 Business Studies Notes Ch04 Business Services 02Subodh SaxenaNo ratings yet

- Unit 4 Business Studies NotesDocument8 pagesUnit 4 Business Studies NotesDhakshithaNo ratings yet

- Bank ServicesDocument2 pagesBank ServicesKürti AnettaNo ratings yet

- Chapter 13 BankingDocument5 pagesChapter 13 BankingdragongskdbsNo ratings yet

- Banking Terms 2021Document48 pagesBanking Terms 2021Sammar AbbasNo ratings yet

- Important Functions of Bank: What Is A Bank?Document3 pagesImportant Functions of Bank: What Is A Bank?Samiksha PawarNo ratings yet

- Role of Commercial Bank-1Document9 pagesRole of Commercial Bank-1TanzeemNo ratings yet

- Unit 2 - Sbaa7001 Banking Products and ServicesDocument38 pagesUnit 2 - Sbaa7001 Banking Products and ServicesGracyNo ratings yet

- 2-Notes On Banking Products & Services-Part 1Document16 pages2-Notes On Banking Products & Services-Part 1Kirti GiyamalaniNo ratings yet

- I) Primary Functions:: A) Accepting DepositsDocument4 pagesI) Primary Functions:: A) Accepting DepositsJoshna SinghNo ratings yet

- Chapter 24 The Role and Function of Financial InstitutionsDocument3 pagesChapter 24 The Role and Function of Financial InstitutionsVỹ San KohNo ratings yet

- Research Paper On Banker As An Agent: Critical Study: Banking and Insurance LawDocument16 pagesResearch Paper On Banker As An Agent: Critical Study: Banking and Insurance LawGyanendra kumarNo ratings yet

- Banking Chapter OneDocument17 pagesBanking Chapter OnefikremariamNo ratings yet

- Lession 3 OperationsDocument13 pagesLession 3 Operationssusma susmaNo ratings yet

- (A.) Commercial Banks - FunctionsDocument3 pages(A.) Commercial Banks - FunctionsEPP-2004 HaneefaNo ratings yet

- Banking NotesDocument84 pagesBanking NotesNitesh MahatoNo ratings yet

- BRO - 4th BBADocument41 pagesBRO - 4th BBANithyananda PatelNo ratings yet

- LPB Unit-1 Introduction To BankingDocument13 pagesLPB Unit-1 Introduction To BankingVeena ReddyNo ratings yet

- Functions of BanksDocument3 pagesFunctions of BanksEbne FahadNo ratings yet

- April 23 2021 12B, C, D, E, F, GChapter14BANKS NotesDocument16 pagesApril 23 2021 12B, C, D, E, F, GChapter14BANKS NotesStephine BochuNo ratings yet

- Chap 1. Banking System in IndiaDocument24 pagesChap 1. Banking System in IndiaShankha MaitiNo ratings yet

- Commercial BankingDocument4 pagesCommercial Bankingsn nNo ratings yet

- Functions of Commercial Banks Commercial Banks Perform A Variety of Functions Which Can Be Divided AsDocument3 pagesFunctions of Commercial Banks Commercial Banks Perform A Variety of Functions Which Can Be Divided AsBalaji GajendranNo ratings yet

- Com BankDocument25 pagesCom BankAnonymous y3E7iaNo ratings yet

- Chapter Three Commercial Banking: 1 by SityDocument10 pagesChapter Three Commercial Banking: 1 by SitySeid KassawNo ratings yet

- Products and Services Offer by BankDocument11 pagesProducts and Services Offer by BankRohit JaiswalNo ratings yet

- Functions of Commercial BanksDocument2 pagesFunctions of Commercial BanksAbdul Rasheed ShaikhNo ratings yet

- Instruments of Exchange and PaymentDocument3 pagesInstruments of Exchange and PaymentAnnika liburdNo ratings yet

- Banking Products and ServicesDocument5 pagesBanking Products and ServicesAikya GandhiNo ratings yet

- Banking U5Document4 pagesBanking U5alemayehuNo ratings yet

- Indian BankDocument94 pagesIndian BankManzuhonnur100% (2)

- Financial Analysis at Indian BankDocument93 pagesFinancial Analysis at Indian BankAbhay JainNo ratings yet

- Management of Commercial BankDocument7 pagesManagement of Commercial BankSamridhi RakhejaNo ratings yet

- Functions of Commercial BanksDocument52 pagesFunctions of Commercial BanksPulkit_Saini_789No ratings yet

- XI BS Ch04 Creative PPT With ObjectivesDocument158 pagesXI BS Ch04 Creative PPT With ObjectivesHiya MakhijaNo ratings yet

- Banking Functions: Navjeet Parvez Rakesh Majid NavjotDocument13 pagesBanking Functions: Navjeet Parvez Rakesh Majid Navjotharesh KNo ratings yet

- Amrit Summer Report 000Document68 pagesAmrit Summer Report 000RPSinghNo ratings yet

- Commercial BankingDocument12 pagesCommercial BankingwubeNo ratings yet

- Document (2) 1Document28 pagesDocument (2) 1Bi bi fathima Bi bi fathimaNo ratings yet

- Ethiopian Banking Sector: 2.1. Organization and Structure of Ethiopian Banking Industry BanksDocument9 pagesEthiopian Banking Sector: 2.1. Organization and Structure of Ethiopian Banking Industry Banksመስቀል ኃይላችን ነውNo ratings yet

- CH 4 Business ServicesDocument11 pagesCH 4 Business Serviceskeshav sarafNo ratings yet

- Review of Some Online Banks and Visa/Master Cards IssuersFrom EverandReview of Some Online Banks and Visa/Master Cards IssuersNo ratings yet

- Evaluation of Some Online Payment Providers Services: Best Online Banks and Visa/Master Cards IssuersFrom EverandEvaluation of Some Online Payment Providers Services: Best Online Banks and Visa/Master Cards IssuersNo ratings yet

- KULGEETDocument5 pagesKULGEETKulgeet TanyaNo ratings yet

- Mr. A Mr. B: CourtDocument2 pagesMr. A Mr. B: CourtKulgeet TanyaNo ratings yet

- NullDocument9 pagesNullKulgeet TanyaNo ratings yet

- Fund Structure & Legal EnvironmentDocument32 pagesFund Structure & Legal EnvironmentKulgeet TanyaNo ratings yet

- MandateDocument2 pagesMandateKulgeet TanyaNo ratings yet

- Off-Balance Sheet BusinessDocument3 pagesOff-Balance Sheet BusinessKulgeet TanyaNo ratings yet

- Bike Premsons Honda: Banker's LienDocument2 pagesBike Premsons Honda: Banker's LienKulgeet TanyaNo ratings yet

- Different Types of Deposit Products: 1. Savings Bank AccountDocument6 pagesDifferent Types of Deposit Products: 1. Savings Bank AccountKulgeet TanyaNo ratings yet

- Methods of Food PurchasingDocument10 pagesMethods of Food Purchasingrizzwan khan100% (1)

- Data Analyst - AssignmentDocument3 pagesData Analyst - AssignmentChandrakant Babar50% (2)

- Sales Contract No. 001/SC-SHP/09/2021Document2 pagesSales Contract No. 001/SC-SHP/09/2021QrenNo ratings yet

- Kuliah Ke-5 #Cost of CapitalDocument45 pagesKuliah Ke-5 #Cost of CapitalHASNA PUTRINo ratings yet

- What Is Test Scenario - Template With ExamplesDocument3 pagesWhat Is Test Scenario - Template With ExamplesFlorin ConduratNo ratings yet

- Marketing - 5-Segmenntation, Targeting and PositioningDocument46 pagesMarketing - 5-Segmenntation, Targeting and PositioningYogendra ShuklaNo ratings yet

- 3 Org Structures To Consider For Experience Led TransformationDocument15 pages3 Org Structures To Consider For Experience Led TransformationYangjin KwonNo ratings yet

- Concept of Salary Under Income Tax ActDocument29 pagesConcept of Salary Under Income Tax ActMaaz Alam100% (2)

- Cement Industry WCMDocument18 pagesCement Industry WCMAzwad ChowdhuryNo ratings yet

- RW2011-15 Toc 183749110917062932Document6 pagesRW2011-15 Toc 183749110917062932Dwi AgungNo ratings yet

- ZoOm Pitch DeckDocument5 pagesZoOm Pitch DeckHakimuddin TinwalaNo ratings yet

- Account Statement: PrakashDocument1 pageAccount Statement: PrakashRny buriaNo ratings yet

- Property and Equity 2Document101 pagesProperty and Equity 2Bc Violá100% (1)

- PDF TDocument2 pagesPDF TahmdkamyabrjmNo ratings yet

- 31jan2019 - PDs CompiledDocument108 pages31jan2019 - PDs CompiledharigroupphilippinesNo ratings yet

- Cad Cam TheoryDocument12 pagesCad Cam TheoryShashank VermaNo ratings yet

- Financing A Car Loan WorksheetDocument3 pagesFinancing A Car Loan WorksheetDestiney GriffinNo ratings yet

- HC/EDUCATION: CVM 44 Tracker - November/22: Edition #548 - December 16, 2022Document4 pagesHC/EDUCATION: CVM 44 Tracker - November/22: Edition #548 - December 16, 2022CAIO HENRIQUE FIORDELIZNo ratings yet

- Economics Slide C5Document41 pagesEconomics Slide C5Tamara Jacobs100% (1)

- Econ CE GDP MCDocument19 pagesEcon CE GDP MCs sNo ratings yet

- Arnolds v. WillitsDocument1 pageArnolds v. WillitsStephanie Erica Louise RicamonteNo ratings yet

- MBA Case Let It Be MeDocument1 pageMBA Case Let It Be MeMichelle AlvarezNo ratings yet

- Kalbe Farma TBK - Billingual - 30 - Sept - 2023 - ReleasedDocument145 pagesKalbe Farma TBK - Billingual - 30 - Sept - 2023 - ReleasedTimothy GracianovNo ratings yet

- Life Cycle Costing Q&ADocument2 pagesLife Cycle Costing Q&AanjNo ratings yet

- Egyptian International Pharmaceutical Industries Company (EIPICO)Document1 pageEgyptian International Pharmaceutical Industries Company (EIPICO)yasser massryNo ratings yet

- Class Exercises - Accounting Errors - AnswersDocument4 pagesClass Exercises - Accounting Errors - Answerseshakaur100% (2)

- Analysis of Marketing of PerfumeDocument10 pagesAnalysis of Marketing of Perfume337 Nandawat KanishkaNo ratings yet

- HMSI Company Profile 2019 - HinoDocument25 pagesHMSI Company Profile 2019 - HinoahmadmubarokharbarindoNo ratings yet

- Assignment1 - Group 8Document8 pagesAssignment1 - Group 8digamber patilNo ratings yet