Professional Documents

Culture Documents

Taxation 1 - Lecture 2

Taxation 1 - Lecture 2

Uploaded by

Justin Pandher0 ratings0% found this document useful (0 votes)

12 views2 pagesThis document summarizes various deductions that can be claimed from employment income under Canadian tax law. It outlines deductions for items like professional dues, supplies, home office expenses, contributions to pension plans, and travel expenses. It notes limitations on deductions for things like automobile costs, leases, and meals and entertainment. The document also discusses deductions related to commissions, and treatment of GST/HST on taxable benefits and employee rebates.

Original Description:

tax 2 notes

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes various deductions that can be claimed from employment income under Canadian tax law. It outlines deductions for items like professional dues, supplies, home office expenses, contributions to pension plans, and travel expenses. It notes limitations on deductions for things like automobile costs, leases, and meals and entertainment. The document also discusses deductions related to commissions, and treatment of GST/HST on taxable benefits and employee rebates.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

12 views2 pagesTaxation 1 - Lecture 2

Taxation 1 - Lecture 2

Uploaded by

Justin PandherThis document summarizes various deductions that can be claimed from employment income under Canadian tax law. It outlines deductions for items like professional dues, supplies, home office expenses, contributions to pension plans, and travel expenses. It notes limitations on deductions for things like automobile costs, leases, and meals and entertainment. The document also discusses deductions related to commissions, and treatment of GST/HST on taxable benefits and employee rebates.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

Taxation 1 – Lecture 2

Week 2

Deductions from Employment Income

o Major items that my be deducted

Professional and union dues [8(1)(i)]

Cost of supplies consumed [8(1)(i)]

Annual dues paid to trade union [8(1)(i)]

Cellphone plan[8(1)(i)]

RPP contributions [8(1)(m)]

Office space or workplace-in-home [8(13)]

Legal expenses –to collect or establish right to salary [8(1)(b)]

Interest & CCA –only on motor vehicles and aircraft [8(1)(j)]

Home office expenses

o Place where employee principally performs duties of employment (more than 50% of the

time), OR

o Space used exclusively for employment AND used on a regular and continuous basis for

meeting clients or other persons in the ordinary course of employment

o Utilities [8(1)(i)]

o Maintenance [8(1)(i)]

o Rent [8(1)(i)]

o Salesperson [8(1)(f)]

House insurance and property tax

Included in expenses subject to limitation

o Employees cannot deduct mortgage interest as a work space in the home expense

Deductions for EI

o Expenses incurred by employees earning commissions from selling or negotiating

contracts [8(1)(f)]

o LIMIT -Deduction cannot exceed commissions

o Deduction is not available if the employee receives a reasonable travel allowance

o Items NOT limited to commission: CCA on an automobile and automobile financing

costs

o Capital expenses, membership fees or dues in a club and payments for the use of a yacht,

camp, lodge or golf course are specifically NOT deductible [18(1)(l)]

o Meals and entertainment –50% [67.1]

Travelling expenses (including car) [8(1)(h), 8(1)(h.1)] )(NOT JUST FOR SALESPERSON)

o Deduction is not available if the employee receives a reasonable allowance for travel or

motor vehicle expenses

o Deduction is not available if a deduction is claimed under 8(1)(f) (see above)

o Meals–must be outside metropolitan area for at least 12 hours to deduct meals as travel

expense [8(4)]

Travel Expenses

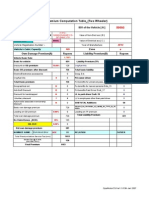

o Limitations to Cars

Maximum cost -$30,000 plus tax [13(7)(g), Reg 7307]

Interest –Monthly maximum -$300 [67.2]

Lease –Monthly maximum -$800 plus tax [67.3] (see next

Lease Limitations

o Refer to slide 16

Employment Income and the GST/HST

o Employer must include the value of the GST/HST when calculating the value of taxable

benefits

o Employee GST/HST rebate

Applicable when employee incurs expenses as part of employment contract

Employees are not registered for GST/HST so they are not eligible to claim

credits

Therefore, employees incurring deductible expenses can claim a GST/HST rebate

on those expenses

Refund is taxable when received

You might also like

- Sample Craft Business PlanDocument24 pagesSample Craft Business PlanJhOsh PErdigon CerOriales63% (8)

- ESAJR - Home Health Care Services - BusinessplanDocument30 pagesESAJR - Home Health Care Services - Businessplangaranzoleonievee50% (2)

- Belle Femme Boutique Business Plan PDFDocument19 pagesBelle Femme Boutique Business Plan PDFapi-26745586290% (21)

- MLM Cleaning Products Business PlanDocument35 pagesMLM Cleaning Products Business PlanJohn Nii Armah100% (1)

- Question SamplesDocument10 pagesQuestion SamplesJinu JosephNo ratings yet

- Buckwold 21e - CH 4 Selected SolutionsDocument18 pagesBuckwold 21e - CH 4 Selected SolutionsLucy50% (2)

- Taxation AnswerDocument13 pagesTaxation AnswerkannadhassNo ratings yet

- ITA8-RecordedLectureNotes-FALL2023 9 4433505321735677Document9 pagesITA8-RecordedLectureNotes-FALL2023 9 4433505321735677ronny nyagakaNo ratings yet

- TAX 212 - Fringe Benefits 2023Document31 pagesTAX 212 - Fringe Benefits 2023edwardsyaameenNo ratings yet

- Deductions From Employment: Sections 8 (1) and 8 (2) Section 67 - ReasonablenessDocument15 pagesDeductions From Employment: Sections 8 (1) and 8 (2) Section 67 - ReasonablenessskuuuuuuuuuNo ratings yet

- 9mys 2010 Dec A PDFDocument7 pages9mys 2010 Dec A PDFGabriel SimNo ratings yet

- Akhtar Tax ReturnDocument7 pagesAkhtar Tax Returnsyedfaisal_sNo ratings yet

- Chapter 3 Income or Loss From EmploymentDocument12 pagesChapter 3 Income or Loss From EmploymentDonna SoNo ratings yet

- Capital AllowancesDocument11 pagesCapital AllowancesnovetanNo ratings yet

- Tax ReturnDocument7 pagesTax Returnsyedfaisal_sNo ratings yet

- Taxation 1 - Lecture 1Document5 pagesTaxation 1 - Lecture 1Justin PandherNo ratings yet

- ACCT604 Week 7 Lecture SlidesDocument29 pagesACCT604 Week 7 Lecture SlidesBuddika PrasannaNo ratings yet

- F6PKN 2013 Jun Ans PDFDocument14 pagesF6PKN 2013 Jun Ans PDFabby bendarasNo ratings yet

- Fringe Benefits: Paragraph 6 (1) (A)Document11 pagesFringe Benefits: Paragraph 6 (1) (A)takundaNo ratings yet

- F6PKN 2012 Dec A PDFDocument13 pagesF6PKN 2012 Dec A PDFabby bendarasNo ratings yet

- Taxation 2013 NovDocument25 pagesTaxation 2013 NovAshok 'Maelk' RajpurohitNo ratings yet

- TAX 327 Employment Benefits Part 1 2021 - 1Document22 pagesTAX 327 Employment Benefits Part 1 2021 - 1mamitjasNo ratings yet

- Solution To P3-5: Chapter 8) - When The Shares Are Sold in 2021, When Landry Is A Non-Resident, TheDocument23 pagesSolution To P3-5: Chapter 8) - When The Shares Are Sold in 2021, When Landry Is A Non-Resident, TheLucyNo ratings yet

- S 8 Allowances 2022Document11 pagesS 8 Allowances 2022v8ysqzd9pbNo ratings yet

- Rsm324 Week 1Document18 pagesRsm324 Week 1Rudy GuNo ratings yet

- Profits and Gains of Business or Profession-2Document15 pagesProfits and Gains of Business or Profession-2Dr. Mustafa KozhikkalNo ratings yet

- Lecture Slides For Mod B WK 3Document23 pagesLecture Slides For Mod B WK 3hcjycjNo ratings yet

- Withholding Tax - Bureau of Internal Revenue161116Document20 pagesWithholding Tax - Bureau of Internal Revenue161116SandyNo ratings yet

- Employment Income: 1 The ScopeDocument24 pagesEmployment Income: 1 The ScopeAnB InternationalNo ratings yet

- Withholding TaxDocument21 pagesWithholding TaxTres SanicamNo ratings yet

- Normal TaxDocument5 pagesNormal Taxrah.mitha786No ratings yet

- Format of IHC - Listed & UnlistedDocument11 pagesFormat of IHC - Listed & UnlistedTengku Kamilia00No ratings yet

- ATX Revision Notes: Income TaxDocument127 pagesATX Revision Notes: Income TaxIvaylo TsvetanovNo ratings yet

- Examples Salary 2015Document44 pagesExamples Salary 2015Farhan JanNo ratings yet

- I. VAT: Zero Rated ExemptDocument6 pagesI. VAT: Zero Rated ExemptHiền nguyễn thuNo ratings yet

- Tax SemiDocument18 pagesTax Seminodnel salonNo ratings yet

- Chapter 5 NotesDocument3 pagesChapter 5 NotesFarah KhattabNo ratings yet

- NDTV Ethnic Retail Limited: Standalone Statement of Profit & Loss For Period 01/04/2013 To 31/03/2014Document24 pagesNDTV Ethnic Retail Limited: Standalone Statement of Profit & Loss For Period 01/04/2013 To 31/03/2014junkyNo ratings yet

- Lecture16le - Accleases and Off-Balance Sheet Financing PDFDocument8 pagesLecture16le - Accleases and Off-Balance Sheet Financing PDFjasminetsoNo ratings yet

- Chapter 4Document16 pagesChapter 4lijijiw23No ratings yet

- Advanced Taxation and Strategic Tax Planning PDFDocument11 pagesAdvanced Taxation and Strategic Tax Planning PDFAnuk PereraNo ratings yet

- 04 LectureDocument23 pages04 Lecturehsmalik777No ratings yet

- Depreciation and Income Taxes: Semester July 2010 1Document30 pagesDepreciation and Income Taxes: Semester July 2010 1screenscreamerNo ratings yet

- Suggested Answers Intermediate Examinations - Autumn 2011: Financial AccountingDocument6 pagesSuggested Answers Intermediate Examinations - Autumn 2011: Financial AccountingUssama AbbasNo ratings yet

- f6pkn 2011 Dec ADocument12 pagesf6pkn 2011 Dec Aabby bendarasNo ratings yet

- Week 3 Discussion NotesDocument32 pagesWeek 3 Discussion NotesJonNo ratings yet

- CH - 4 Public Finace@2015 Part 1Document32 pagesCH - 4 Public Finace@2015 Part 1firaolmosisabonkeNo ratings yet

- Malaysian Taxation Lecture 2 Employment Income 1Document35 pagesMalaysian Taxation Lecture 2 Employment Income 1Hafizah Mat NawiNo ratings yet

- It 2Document44 pagesIt 2Business RecoveryNo ratings yet

- CH 01 Review and Discussion Problems SolutionsDocument11 pagesCH 01 Review and Discussion Problems SolutionsArman BeiramiNo ratings yet

- Note 8 - Tax Planning For CompaniesDocument9 pagesNote 8 - Tax Planning For CompaniesNur Dina AbsbNo ratings yet

- Income From SalaryDocument18 pagesIncome From SalaryKejal JainNo ratings yet

- Employee Tax Benefits: - A Ready ReckonerDocument9 pagesEmployee Tax Benefits: - A Ready ReckonerPRKLN .RNo ratings yet

- TA U2 Property1 PDFDocument5 pagesTA U2 Property1 PDFRafaelKwongNo ratings yet

- Tax Cheat Sheet AY1415 Semester 2 V2Document3 pagesTax Cheat Sheet AY1415 Semester 2 V2Krithika NaiduNo ratings yet

- Proforma Profits Tax ComputationDocument2 pagesProforma Profits Tax Computation余日中No ratings yet

- Proforma Profits Tax ComputationDocument2 pagesProforma Profits Tax ComputationVintonius Raffaele PRIMUSNo ratings yet

- Income From Business 23Document27 pagesIncome From Business 23kalyani baviskarNo ratings yet

- Quick Tax Guide-2012Document9 pagesQuick Tax Guide-2012Paul MaposaNo ratings yet

- TaxAudit Final 29.09.07Document52 pagesTaxAudit Final 29.09.07bsrahulNo ratings yet

- Public CHAPTER 4Document15 pagesPublic CHAPTER 4embiale ayaluNo ratings yet

- Brief Note On Car Hiring of CarDocument2 pagesBrief Note On Car Hiring of CarDilip AgrawalNo ratings yet

- Motor Premium Computation Table - (Two Wheeler) : IDV of The Vehicle (A)Document26 pagesMotor Premium Computation Table - (Two Wheeler) : IDV of The Vehicle (A)Karan JoshiNo ratings yet

- Practice Test 1Document8 pagesPractice Test 1Justin PandherNo ratings yet

- Multiple ChoiceDocument3 pagesMultiple ChoiceJustin PandherNo ratings yet

- Managerial Accounting 2 - Lecture 2Document3 pagesManagerial Accounting 2 - Lecture 2Justin PandherNo ratings yet

- Taxation 2 - Lecture 5Document2 pagesTaxation 2 - Lecture 5Justin PandherNo ratings yet

- Taxation 1 - Lecture 1Document5 pagesTaxation 1 - Lecture 1Justin PandherNo ratings yet

- HRM NotesDocument21 pagesHRM NotesJustin PandherNo ratings yet

- Maple Ridge Pitt Meadows News - October 27, 2010 Online EditionDocument39 pagesMaple Ridge Pitt Meadows News - October 27, 2010 Online EditionmapleridgenewsNo ratings yet

- Taxi ServiceDocument25 pagesTaxi ServiceAmitsinh ViholNo ratings yet

- Goods and Services Tax/harmonized Sales Tax Credit (GST/HSTC) NoticeDocument3 pagesGoods and Services Tax/harmonized Sales Tax Credit (GST/HSTC) NoticeSam StormeNo ratings yet

- Bakery Business Plan Planul de Afaceri de PanificatieDocument34 pagesBakery Business Plan Planul de Afaceri de PanificatieCioloca AdrianaNo ratings yet

- Business Plan of An E-Commerce Based CompanyDocument68 pagesBusiness Plan of An E-Commerce Based CompanyZahirul Islam67% (3)

- Tax Setup DocumentDocument26 pagesTax Setup DocumentManish BhansaliNo ratings yet

- Tax Setup Document PDFDocument26 pagesTax Setup Document PDFhariyhnNo ratings yet

- rc1 Fill 23eDocument14 pagesrc1 Fill 23eHakar Qadir GardiNo ratings yet

- Sunshine BakeryDocument48 pagesSunshine Bakeryለህዳሴአችን እንተባበርNo ratings yet

- Name of The Business-Rainbow Blooms LLC. Executive SummaryDocument17 pagesName of The Business-Rainbow Blooms LLC. Executive SummaryAhamed AliNo ratings yet

- Day CareDocument21 pagesDay CareSarfraz AliNo ratings yet

- Start-Up Real Estate Business PlanDocument32 pagesStart-Up Real Estate Business PlanKush Bairoliya100% (1)

- The Following Selected Transactions Were Completed by Gutters Co During PDFDocument1 pageThe Following Selected Transactions Were Completed by Gutters Co During PDFTaimur TechnologistNo ratings yet

- Wednesday June 16, 2010 LeaderDocument41 pagesWednesday June 16, 2010 LeaderSurrey/North Delta LeaderNo ratings yet

- Maple Ridge Pitt Meadows News - November 5, 2010 Online EditionDocument49 pagesMaple Ridge Pitt Meadows News - November 5, 2010 Online EditionmapleridgenewsNo ratings yet

- LBA Auditing Financial PlanDocument24 pagesLBA Auditing Financial PlanwillieNo ratings yet

- Hotel Bussiness PlanDocument56 pagesHotel Bussiness PlansuryakantshrotriyaNo ratings yet

- CFCM Sept 2010 PDFDocument40 pagesCFCM Sept 2010 PDFAPEX SONNo ratings yet

- Martini Astrology TarotDocument29 pagesMartini Astrology TarotchompaNo ratings yet

- ISACDocument179 pagesISACStewart BellNo ratings yet

- 14 - Chapter 5Document32 pages14 - Chapter 5Sukanya DuttaNo ratings yet

- Receipts GasDocument21 pagesReceipts Gasbijan8261No ratings yet

- Jason Simon, CPA, CA BDO Canada LLP, Senior Manager, TaxDocument22 pagesJason Simon, CPA, CA BDO Canada LLP, Senior Manager, TaxTaichi ChenNo ratings yet

- The Honourable Diane Lebouthillier LetterDocument3 pagesThe Honourable Diane Lebouthillier Letterapi-348726621No ratings yet

- Review Test Questions: Show DetailsDocument4 pagesReview Test Questions: Show DetailsHiwa Khan SalamNo ratings yet

- Your Phone Bill: Summary of Your AccountDocument6 pagesYour Phone Bill: Summary of Your AccountJagpreet Singh RandhawaNo ratings yet