Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

12 views"Capital Decisions As Part of Strategic Scheduling Process": Eduardo Coloma - Maptek Christie Myburgh - Atomorphis

"Capital Decisions As Part of Strategic Scheduling Process": Eduardo Coloma - Maptek Christie Myburgh - Atomorphis

Uploaded by

Luis David RenteriaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Connector Datasheet - JK03M & JK03M2 Connector Datasheet - ENDocument2 pagesConnector Datasheet - JK03M & JK03M2 Connector Datasheet - ENDiogoNo ratings yet

- Lab Expansion Proposal: Kwabena Osei & Tim TolinDocument27 pagesLab Expansion Proposal: Kwabena Osei & Tim Tolinttolin03No ratings yet

- Production Planning and ControlDocument25 pagesProduction Planning and ControlSharad Bharadwaj100% (1)

- INDE8900-30 Lecture 1 S23Document35 pagesINDE8900-30 Lecture 1 S23sohila reddyNo ratings yet

- Apresentação Jorge WMC 2016 19 October 2016Document42 pagesApresentação Jorge WMC 2016 19 October 2016JorgrNo ratings yet

- Capacity PlanningDocument40 pagesCapacity PlanningNguyen LinhNo ratings yet

- Capacity PlanningDocument47 pagesCapacity Planningcharles makasabiNo ratings yet

- 19 Project FeasibilityDocument23 pages19 Project FeasibilityAzwar Mehdi Qasim AghaNo ratings yet

- Lean VSM CaseDocument26 pagesLean VSM CasePANKAJNo ratings yet

- Open Pit OptimizationDocument6 pagesOpen Pit Optimizationdeim0No ratings yet

- CPCHP 6Document30 pagesCPCHP 6Darwiza Figueroa GuimocNo ratings yet

- Comet TheoryDocument5 pagesComet TheoryCatalina Andrea Badilla QuiñonesNo ratings yet

- Chapter 6 - Strategic Capacity PlanningDocument16 pagesChapter 6 - Strategic Capacity PlanningJahirul Islam ShovonNo ratings yet

- Capacity Planning Chapter 4Document33 pagesCapacity Planning Chapter 4Mustafa MangalNo ratings yet

- Capacity Planning Chapter 4Document33 pagesCapacity Planning Chapter 4Mustafa MangalNo ratings yet

- Determination of A Mining Cutoff Grade Strategy Based On An Iterative Factor PDFDocument5 pagesDetermination of A Mining Cutoff Grade Strategy Based On An Iterative Factor PDFRenzo MurilloNo ratings yet

- Capacity Planning, Facility Location & LayoutDocument56 pagesCapacity Planning, Facility Location & LayoutFekadu100% (1)

- ABC Target Costing - NotesDocument11 pagesABC Target Costing - NotesSebastian JaramilloNo ratings yet

- Capacity Planning and ControlpptDocument37 pagesCapacity Planning and ControlpptAditya SinghNo ratings yet

- System (Totals) M L L L: Product Quality Service QualityDocument1 pageSystem (Totals) M L L L: Product Quality Service QualityChad FreemanNo ratings yet

- Crompton Blue Chip Case Study.Document11 pagesCrompton Blue Chip Case Study.KinjalBhadreshwara0% (2)

- Slimhole vs. MicroholeDocument27 pagesSlimhole vs. Microholekeke VuNo ratings yet

- Decision Making ProcessDocument36 pagesDecision Making ProcessSherif AL-KammashNo ratings yet

- WINSEM2012-13 CP1147 02-Jan-2013 RM01 ORandInfoSysDocument30 pagesWINSEM2012-13 CP1147 02-Jan-2013 RM01 ORandInfoSysAmna NashitNo ratings yet

- Lecture Three: Capacity PlanningDocument26 pagesLecture Three: Capacity PlanningmahmoudNo ratings yet

- Surpac Whittle InterfaceDocument4 pagesSurpac Whittle InterfaceDelfidelfi SatuNo ratings yet

- Chapter 05 FinalDocument24 pagesChapter 05 Finalsubeyr963No ratings yet

- DagdelenDocument4 pagesDagdelenWashington BobadillaNo ratings yet

- Capacity PlanningDocument21 pagesCapacity PlanningGraceson Binu SebastianNo ratings yet

- Robust, Flexible and Operational Mine Design Strategies: B. Groeneveld, E. Topal and B. LeendersDocument10 pagesRobust, Flexible and Operational Mine Design Strategies: B. Groeneveld, E. Topal and B. LeendersBeatriceWasongaNo ratings yet

- Integrated Strategy Optimsation For Complex OperationsDocument8 pagesIntegrated Strategy Optimsation For Complex OperationsCarlos A. Espinoza MNo ratings yet

- A3.P33 The Costing of Handling and Storage in Warehouses - 2.high-Bay WarehousesDocument106 pagesA3.P33 The Costing of Handling and Storage in Warehouses - 2.high-Bay Warehousesdenny suci kurniaNo ratings yet

- Operations Management IMTDocument32 pagesOperations Management IMTrishabhproptigerNo ratings yet

- Block Cave Production Scheduling Using PCBC: Typical Project WorkflowDocument17 pagesBlock Cave Production Scheduling Using PCBC: Typical Project WorkflowBranimir DelevicNo ratings yet

- Supply Chain Management: Strategy, Planning, and Operation: Seventh EditionDocument34 pagesSupply Chain Management: Strategy, Planning, and Operation: Seventh Editionsandeep pradhanNo ratings yet

- Strategic OpenPit Mine PlanningDocument4 pagesStrategic OpenPit Mine PlanningLehlabile MorenaNo ratings yet

- 2 ND Part of PDPEDocument43 pages2 ND Part of PDPEIndresh BharadwajNo ratings yet

- CA Inter Costing Theory Book by Tabish Hassan Sirca InterDocument84 pagesCA Inter Costing Theory Book by Tabish Hassan Sirca InterRevathy MohanNo ratings yet

- Omps Mim 4Document18 pagesOmps Mim 4Nicos AntoniadesNo ratings yet

- InventorymanagementDocument6 pagesInventorymanagementkhang.nguyengenikouNo ratings yet

- Simultaneous Destination and Schedule Optimization With Minemax Scheduling Technology at NewmontDocument44 pagesSimultaneous Destination and Schedule Optimization With Minemax Scheduling Technology at Newmontraymond.jyl6807No ratings yet

- Operations Strategy: Session 5Document23 pagesOperations Strategy: Session 5Venkatesh NenavathNo ratings yet

- Flexible Supply Chain StrategiesDocument39 pagesFlexible Supply Chain Strategiesn0kkiesNo ratings yet

- Robust Versus Flexible Open Pit Mine Design: B Groeneveld, E Topal and B LeendersDocument14 pagesRobust Versus Flexible Open Pit Mine Design: B Groeneveld, E Topal and B LeendersUriel Placido Jacho PachaNo ratings yet

- Session 6 Capacity PlanningDocument26 pagesSession 6 Capacity PlanningArka BandyopadhyayNo ratings yet

- 5 Capacity PlanningDocument53 pages5 Capacity PlanningBekir589No ratings yet

- Holtec Consultancy - Limestone Mining Cost ReductionDocument6 pagesHoltec Consultancy - Limestone Mining Cost ReductionTvs SarmaNo ratings yet

- Cost EstimationDocument29 pagesCost EstimationLyka TanNo ratings yet

- SHillDocument24 pagesSHillsrivasthu100% (1)

- Long Range Intermediate Range: ManufacturingDocument59 pagesLong Range Intermediate Range: ManufacturingManal VermaNo ratings yet

- W3-Network OptimizationDocument21 pagesW3-Network OptimizationEva RosaNo ratings yet

- Lec 14 - Capacity PlanningDocument29 pagesLec 14 - Capacity PlanningAhsan AnikNo ratings yet

- 6 - Cost Estimation & DepreciationDocument78 pages6 - Cost Estimation & Depreciationعبدالله الرايقيNo ratings yet

- B04 - Throughput AccountingDocument24 pagesB04 - Throughput AccountingAcca Books100% (1)

- 06-Project Management For Construction-Cost EstimationDocument46 pages06-Project Management For Construction-Cost EstimationRAGHAVENDRA PKNo ratings yet

- 4901 Ccs Roadmap Innovation and RDDocument9 pages4901 Ccs Roadmap Innovation and RDRashidNo ratings yet

- World Class ManufacturingDocument23 pagesWorld Class ManufacturingAnand BhargavaNo ratings yet

- Long Range Intermediate Range: ManufacturingDocument59 pagesLong Range Intermediate Range: Manufacturingprateekgenext9754No ratings yet

- Critical Chain Project Management: A Concept Used By The Great Military and Aerospace Companies of The World.From EverandCritical Chain Project Management: A Concept Used By The Great Military and Aerospace Companies of The World.No ratings yet

- IT Success!: Towards a New Model for Information TechnologyFrom EverandIT Success!: Towards a New Model for Information TechnologyRating: 3 out of 5 stars3/5 (1)

- Cobalto Stgo 20 11 INDocument19 pagesCobalto Stgo 20 11 INLuis David RenteriaNo ratings yet

- Starbucks 2022 Global Environmental and Social Impact ReportDocument82 pagesStarbucks 2022 Global Environmental and Social Impact ReportLuis David RenteriaNo ratings yet

- Programa DigitalDocument7 pagesPrograma DigitalLuis David RenteriaNo ratings yet

- S1 11 - 10 Artur SaldanhaDocument15 pagesS1 11 - 10 Artur SaldanhaLuis David RenteriaNo ratings yet

- Short Term Planning For High-Risk Zones Prone To Mud-Water Entry at El Teniente MineDocument12 pagesShort Term Planning For High-Risk Zones Prone To Mud-Water Entry at El Teniente MineLuis David RenteriaNo ratings yet

- S6 16 - 40 Aline LacerdaDocument22 pagesS6 16 - 40 Aline LacerdaLuis David RenteriaNo ratings yet

- P2 09 - 00 Craig MorleyDocument12 pagesP2 09 - 00 Craig MorleyLuis David RenteriaNo ratings yet

- A Dark Age Era SourcebookDocument122 pagesA Dark Age Era SourcebookLcarowan100% (6)

- Operation Manual: EpsolarDocument64 pagesOperation Manual: EpsolarZoki JevtićNo ratings yet

- 140706DPRB14303 Exde03 79 PDFDocument80 pages140706DPRB14303 Exde03 79 PDFBassem BalghouthiNo ratings yet

- Information Analyzer Data Quality Rules Implementations Standard Practices - 01052012Document94 pagesInformation Analyzer Data Quality Rules Implementations Standard Practices - 01052012abreddy2003No ratings yet

- User Manual: Geforce Gtx10 Series MXM Graphics Board Aetina M3N1050-LN Aetina M3N1050TI-LNDocument29 pagesUser Manual: Geforce Gtx10 Series MXM Graphics Board Aetina M3N1050-LN Aetina M3N1050TI-LNJovino Junior Jr.No ratings yet

- PE 4210 Lab #1 Wellbore SchematicsDocument5 pagesPE 4210 Lab #1 Wellbore SchematicsRichard OwusuNo ratings yet

- Hsu 7 9 12 14 18 22 PDFDocument93 pagesHsu 7 9 12 14 18 22 PDFBvm BvmmNo ratings yet

- Review of Wellsharp Test Question: Instructor Submitting The RequestDocument2 pagesReview of Wellsharp Test Question: Instructor Submitting The RequestBarbare RenNo ratings yet

- 10 Michelle Nael Fio q4 Gantt ChartDocument4 pages10 Michelle Nael Fio q4 Gantt Chartapi-286447179No ratings yet

- Doors - Legit CheatsDocument2 pagesDoors - Legit CheatsPhat TruongNo ratings yet

- Design Manual (Cansat)Document208 pagesDesign Manual (Cansat)Juan Julian Jesus Huaroto Sevilla50% (2)

- 2020 June ICTDocument20 pages2020 June ICTPramila BandaraNo ratings yet

- cp3800 GCDocument75 pagescp3800 GCMuhammad TalhaNo ratings yet

- B 9781509963379Document379 pagesB 9781509963379enazifiNo ratings yet

- Diesel Fuel Oil System Commissioing ProcedureDocument34 pagesDiesel Fuel Oil System Commissioing ProcedureAdelNo ratings yet

- Data Security Best PracticesDocument20 pagesData Security Best Practiceshim2000himNo ratings yet

- Book 1Document3 pagesBook 1Mj KousalyaNo ratings yet

- Professional Regulation Commission: Id Claim SlipDocument1 pageProfessional Regulation Commission: Id Claim SlipRheivinn RoselloNo ratings yet

- FFP 3000 5000Document10 pagesFFP 3000 5000potoculNo ratings yet

- Mba Report SampleDocument78 pagesMba Report Samplesayaliofficial05No ratings yet

- s71500 CM PTP Function Manual en-US en-USDocument88 pagess71500 CM PTP Function Manual en-US en-USArunagiri MurugesanNo ratings yet

- What Are Batch Processing System and Real Time Processing System and The Difference Between ThemDocument6 pagesWhat Are Batch Processing System and Real Time Processing System and The Difference Between ThemfikaduNo ratings yet

- 16 Marks Questions With AnswersDocument3 pages16 Marks Questions With AnswersJyothi PNo ratings yet

- BSP-AA-201609 - Leaks On BOP Control SystemDocument2 pagesBSP-AA-201609 - Leaks On BOP Control Systemvikrant911No ratings yet

- Steps in Installing FusionComputeDocument1 pageSteps in Installing FusionComputeanniNo ratings yet

- Contoh Soal Perpindahan Panas TransienDocument3 pagesContoh Soal Perpindahan Panas TransienprosedurNo ratings yet

- CSE AI - 4 1 SEM CS Syllabus - UG - R20Document50 pagesCSE AI - 4 1 SEM CS Syllabus - UG - R20saitirumula541No ratings yet

- ProjectReport (FitnessCenterManagementWebsite)Document16 pagesProjectReport (FitnessCenterManagementWebsite)Arjun NainNo ratings yet

- Spatial Data Science MOOC Section 4 Exercise 1 - Detect PatternsDocument11 pagesSpatial Data Science MOOC Section 4 Exercise 1 - Detect PatternsChaoubi YoussefNo ratings yet

"Capital Decisions As Part of Strategic Scheduling Process": Eduardo Coloma - Maptek Christie Myburgh - Atomorphis

"Capital Decisions As Part of Strategic Scheduling Process": Eduardo Coloma - Maptek Christie Myburgh - Atomorphis

Uploaded by

Luis David Renteria0 ratings0% found this document useful (0 votes)

12 views15 pagesOriginal Title

Untitled

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

12 views15 pages"Capital Decisions As Part of Strategic Scheduling Process": Eduardo Coloma - Maptek Christie Myburgh - Atomorphis

"Capital Decisions As Part of Strategic Scheduling Process": Eduardo Coloma - Maptek Christie Myburgh - Atomorphis

Uploaded by

Luis David RenteriaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 15

“Capital Decisions as part of

Strategic Scheduling Process”

Eduardo Coloma – Maptek

Christie Myburgh - Atomorphis

Agenda

• Context

• Problem

• Solution

• Case Studies

• Conclusions

• Future Research

Context (1/2)

• Mining businesses work by looking at long term

opportunities to make an economic gain from a

resource.

• An investment decision in a mine is based upon a

timeframe of generally 10 or more years.

• A mining operation is an extremely complex

environment and the impact of a very large

number of variables combine to cause those

investment assumptions to look less and less

accurate over time as mining proceeds.

Context (2/2)

• The ability to simultaneously optimise

strategic capital decisions as well as multiple

mining policies (cutoff grade, mill capacities,

trucks, stockpiles, etc) across multiple mine

sites greatly reduces the iterative process

involved in optimising a business and unlocks

robust value.

Mining industry greenfield capex

• Source: S&P Market intelligence, Deloitte analysis

Problem

• Simultaneous

optimization of extraction

sequence and cut-off

grade for single/multiple

elements in the face of

multiple processing

streams and multiples

mines under some capital

decisions which can make

the project

feasible/infeasible.

Solution – Evolution Strategy

• Maptek Evolution Strategy

– Strategical scenarios based on

cutoff grade optimization and

sequence to maximize net

present value (NPV) and

blending.

– Provides the ability to use the

block model directly, reducing

the amount of data preparation

and minimizing the risk

associated with data

manipulation.

– Flexible to model multi-

process/multi-element

operations with the ability to

add as many user controls as

are required.

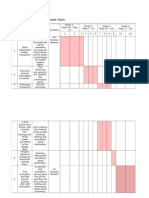

Solution - Strategy Engine

Scenario 1:

Analyzing Purchase truck policy

Trucks Type Purchase Cost ($) Life (years) Capacity (tonnes)

Truck A $5,500,000 5 300

Truck B $3,500,000 4 90

Scenario 2:

Analyzing Processing Capacity

Processing Type Incremental Purchase Processing Cost Processing

Cost ($) Escalation ($/ton) Capacity

(t/y)

Processing A 20,000,000 1.5 2,000,000

Processing B 10,000,000 1.0 3,000,000

Processing C 15,000,000 0.5 4,500,000

Scenario 3:

Evaluate the best infrastructure

• Pit B to Port B online in

period 1.

• Pit C to Port B online in

period 1.

• Pit A to Pit B online in

period 18.

Conclusions

• The memetic algorithm

allows for the efficient

global optimization of

multiple policies such as:

– Extraction sequence.

– Multiple cutoff-grade

policies.

– Stockpile policies.

– Various capital decision

policies such as equipment,

plant capacity and

infrastructure.

Conclusions

• The use of evolutionary algorithms

provides a flexible and powerful

framework to solve complex, non-

linear problems in an efficient way

without make any assumptions of the

fitness landscape. This approach has

many advantages, particularly around

ease of implementation, easily

incorporating surrogate models and

other optimisation techniques.

• Finally, as always, the result from any

technique is only as good as the model

on which it is operating.

Future Research

• Given the duration of some projects (i.e. more

than 20 years), the effect of NPV as a mechanism

to decide investment needs to be carefully

considered

• The use of “new” evaluations techniques can

improve the decision-making process.

“Capital Decisions as part of

Strategic Scheduling Process”

Eduardo Coloma – Maptek

Christie Myburgh - Atomorphis

You might also like

- Connector Datasheet - JK03M & JK03M2 Connector Datasheet - ENDocument2 pagesConnector Datasheet - JK03M & JK03M2 Connector Datasheet - ENDiogoNo ratings yet

- Lab Expansion Proposal: Kwabena Osei & Tim TolinDocument27 pagesLab Expansion Proposal: Kwabena Osei & Tim Tolinttolin03No ratings yet

- Production Planning and ControlDocument25 pagesProduction Planning and ControlSharad Bharadwaj100% (1)

- INDE8900-30 Lecture 1 S23Document35 pagesINDE8900-30 Lecture 1 S23sohila reddyNo ratings yet

- Apresentação Jorge WMC 2016 19 October 2016Document42 pagesApresentação Jorge WMC 2016 19 October 2016JorgrNo ratings yet

- Capacity PlanningDocument40 pagesCapacity PlanningNguyen LinhNo ratings yet

- Capacity PlanningDocument47 pagesCapacity Planningcharles makasabiNo ratings yet

- 19 Project FeasibilityDocument23 pages19 Project FeasibilityAzwar Mehdi Qasim AghaNo ratings yet

- Lean VSM CaseDocument26 pagesLean VSM CasePANKAJNo ratings yet

- Open Pit OptimizationDocument6 pagesOpen Pit Optimizationdeim0No ratings yet

- CPCHP 6Document30 pagesCPCHP 6Darwiza Figueroa GuimocNo ratings yet

- Comet TheoryDocument5 pagesComet TheoryCatalina Andrea Badilla QuiñonesNo ratings yet

- Chapter 6 - Strategic Capacity PlanningDocument16 pagesChapter 6 - Strategic Capacity PlanningJahirul Islam ShovonNo ratings yet

- Capacity Planning Chapter 4Document33 pagesCapacity Planning Chapter 4Mustafa MangalNo ratings yet

- Capacity Planning Chapter 4Document33 pagesCapacity Planning Chapter 4Mustafa MangalNo ratings yet

- Determination of A Mining Cutoff Grade Strategy Based On An Iterative Factor PDFDocument5 pagesDetermination of A Mining Cutoff Grade Strategy Based On An Iterative Factor PDFRenzo MurilloNo ratings yet

- Capacity Planning, Facility Location & LayoutDocument56 pagesCapacity Planning, Facility Location & LayoutFekadu100% (1)

- ABC Target Costing - NotesDocument11 pagesABC Target Costing - NotesSebastian JaramilloNo ratings yet

- Capacity Planning and ControlpptDocument37 pagesCapacity Planning and ControlpptAditya SinghNo ratings yet

- System (Totals) M L L L: Product Quality Service QualityDocument1 pageSystem (Totals) M L L L: Product Quality Service QualityChad FreemanNo ratings yet

- Crompton Blue Chip Case Study.Document11 pagesCrompton Blue Chip Case Study.KinjalBhadreshwara0% (2)

- Slimhole vs. MicroholeDocument27 pagesSlimhole vs. Microholekeke VuNo ratings yet

- Decision Making ProcessDocument36 pagesDecision Making ProcessSherif AL-KammashNo ratings yet

- WINSEM2012-13 CP1147 02-Jan-2013 RM01 ORandInfoSysDocument30 pagesWINSEM2012-13 CP1147 02-Jan-2013 RM01 ORandInfoSysAmna NashitNo ratings yet

- Lecture Three: Capacity PlanningDocument26 pagesLecture Three: Capacity PlanningmahmoudNo ratings yet

- Surpac Whittle InterfaceDocument4 pagesSurpac Whittle InterfaceDelfidelfi SatuNo ratings yet

- Chapter 05 FinalDocument24 pagesChapter 05 Finalsubeyr963No ratings yet

- DagdelenDocument4 pagesDagdelenWashington BobadillaNo ratings yet

- Capacity PlanningDocument21 pagesCapacity PlanningGraceson Binu SebastianNo ratings yet

- Robust, Flexible and Operational Mine Design Strategies: B. Groeneveld, E. Topal and B. LeendersDocument10 pagesRobust, Flexible and Operational Mine Design Strategies: B. Groeneveld, E. Topal and B. LeendersBeatriceWasongaNo ratings yet

- Integrated Strategy Optimsation For Complex OperationsDocument8 pagesIntegrated Strategy Optimsation For Complex OperationsCarlos A. Espinoza MNo ratings yet

- A3.P33 The Costing of Handling and Storage in Warehouses - 2.high-Bay WarehousesDocument106 pagesA3.P33 The Costing of Handling and Storage in Warehouses - 2.high-Bay Warehousesdenny suci kurniaNo ratings yet

- Operations Management IMTDocument32 pagesOperations Management IMTrishabhproptigerNo ratings yet

- Block Cave Production Scheduling Using PCBC: Typical Project WorkflowDocument17 pagesBlock Cave Production Scheduling Using PCBC: Typical Project WorkflowBranimir DelevicNo ratings yet

- Supply Chain Management: Strategy, Planning, and Operation: Seventh EditionDocument34 pagesSupply Chain Management: Strategy, Planning, and Operation: Seventh Editionsandeep pradhanNo ratings yet

- Strategic OpenPit Mine PlanningDocument4 pagesStrategic OpenPit Mine PlanningLehlabile MorenaNo ratings yet

- 2 ND Part of PDPEDocument43 pages2 ND Part of PDPEIndresh BharadwajNo ratings yet

- CA Inter Costing Theory Book by Tabish Hassan Sirca InterDocument84 pagesCA Inter Costing Theory Book by Tabish Hassan Sirca InterRevathy MohanNo ratings yet

- Omps Mim 4Document18 pagesOmps Mim 4Nicos AntoniadesNo ratings yet

- InventorymanagementDocument6 pagesInventorymanagementkhang.nguyengenikouNo ratings yet

- Simultaneous Destination and Schedule Optimization With Minemax Scheduling Technology at NewmontDocument44 pagesSimultaneous Destination and Schedule Optimization With Minemax Scheduling Technology at Newmontraymond.jyl6807No ratings yet

- Operations Strategy: Session 5Document23 pagesOperations Strategy: Session 5Venkatesh NenavathNo ratings yet

- Flexible Supply Chain StrategiesDocument39 pagesFlexible Supply Chain Strategiesn0kkiesNo ratings yet

- Robust Versus Flexible Open Pit Mine Design: B Groeneveld, E Topal and B LeendersDocument14 pagesRobust Versus Flexible Open Pit Mine Design: B Groeneveld, E Topal and B LeendersUriel Placido Jacho PachaNo ratings yet

- Session 6 Capacity PlanningDocument26 pagesSession 6 Capacity PlanningArka BandyopadhyayNo ratings yet

- 5 Capacity PlanningDocument53 pages5 Capacity PlanningBekir589No ratings yet

- Holtec Consultancy - Limestone Mining Cost ReductionDocument6 pagesHoltec Consultancy - Limestone Mining Cost ReductionTvs SarmaNo ratings yet

- Cost EstimationDocument29 pagesCost EstimationLyka TanNo ratings yet

- SHillDocument24 pagesSHillsrivasthu100% (1)

- Long Range Intermediate Range: ManufacturingDocument59 pagesLong Range Intermediate Range: ManufacturingManal VermaNo ratings yet

- W3-Network OptimizationDocument21 pagesW3-Network OptimizationEva RosaNo ratings yet

- Lec 14 - Capacity PlanningDocument29 pagesLec 14 - Capacity PlanningAhsan AnikNo ratings yet

- 6 - Cost Estimation & DepreciationDocument78 pages6 - Cost Estimation & Depreciationعبدالله الرايقيNo ratings yet

- B04 - Throughput AccountingDocument24 pagesB04 - Throughput AccountingAcca Books100% (1)

- 06-Project Management For Construction-Cost EstimationDocument46 pages06-Project Management For Construction-Cost EstimationRAGHAVENDRA PKNo ratings yet

- 4901 Ccs Roadmap Innovation and RDDocument9 pages4901 Ccs Roadmap Innovation and RDRashidNo ratings yet

- World Class ManufacturingDocument23 pagesWorld Class ManufacturingAnand BhargavaNo ratings yet

- Long Range Intermediate Range: ManufacturingDocument59 pagesLong Range Intermediate Range: Manufacturingprateekgenext9754No ratings yet

- Critical Chain Project Management: A Concept Used By The Great Military and Aerospace Companies of The World.From EverandCritical Chain Project Management: A Concept Used By The Great Military and Aerospace Companies of The World.No ratings yet

- IT Success!: Towards a New Model for Information TechnologyFrom EverandIT Success!: Towards a New Model for Information TechnologyRating: 3 out of 5 stars3/5 (1)

- Cobalto Stgo 20 11 INDocument19 pagesCobalto Stgo 20 11 INLuis David RenteriaNo ratings yet

- Starbucks 2022 Global Environmental and Social Impact ReportDocument82 pagesStarbucks 2022 Global Environmental and Social Impact ReportLuis David RenteriaNo ratings yet

- Programa DigitalDocument7 pagesPrograma DigitalLuis David RenteriaNo ratings yet

- S1 11 - 10 Artur SaldanhaDocument15 pagesS1 11 - 10 Artur SaldanhaLuis David RenteriaNo ratings yet

- Short Term Planning For High-Risk Zones Prone To Mud-Water Entry at El Teniente MineDocument12 pagesShort Term Planning For High-Risk Zones Prone To Mud-Water Entry at El Teniente MineLuis David RenteriaNo ratings yet

- S6 16 - 40 Aline LacerdaDocument22 pagesS6 16 - 40 Aline LacerdaLuis David RenteriaNo ratings yet

- P2 09 - 00 Craig MorleyDocument12 pagesP2 09 - 00 Craig MorleyLuis David RenteriaNo ratings yet

- A Dark Age Era SourcebookDocument122 pagesA Dark Age Era SourcebookLcarowan100% (6)

- Operation Manual: EpsolarDocument64 pagesOperation Manual: EpsolarZoki JevtićNo ratings yet

- 140706DPRB14303 Exde03 79 PDFDocument80 pages140706DPRB14303 Exde03 79 PDFBassem BalghouthiNo ratings yet

- Information Analyzer Data Quality Rules Implementations Standard Practices - 01052012Document94 pagesInformation Analyzer Data Quality Rules Implementations Standard Practices - 01052012abreddy2003No ratings yet

- User Manual: Geforce Gtx10 Series MXM Graphics Board Aetina M3N1050-LN Aetina M3N1050TI-LNDocument29 pagesUser Manual: Geforce Gtx10 Series MXM Graphics Board Aetina M3N1050-LN Aetina M3N1050TI-LNJovino Junior Jr.No ratings yet

- PE 4210 Lab #1 Wellbore SchematicsDocument5 pagesPE 4210 Lab #1 Wellbore SchematicsRichard OwusuNo ratings yet

- Hsu 7 9 12 14 18 22 PDFDocument93 pagesHsu 7 9 12 14 18 22 PDFBvm BvmmNo ratings yet

- Review of Wellsharp Test Question: Instructor Submitting The RequestDocument2 pagesReview of Wellsharp Test Question: Instructor Submitting The RequestBarbare RenNo ratings yet

- 10 Michelle Nael Fio q4 Gantt ChartDocument4 pages10 Michelle Nael Fio q4 Gantt Chartapi-286447179No ratings yet

- Doors - Legit CheatsDocument2 pagesDoors - Legit CheatsPhat TruongNo ratings yet

- Design Manual (Cansat)Document208 pagesDesign Manual (Cansat)Juan Julian Jesus Huaroto Sevilla50% (2)

- 2020 June ICTDocument20 pages2020 June ICTPramila BandaraNo ratings yet

- cp3800 GCDocument75 pagescp3800 GCMuhammad TalhaNo ratings yet

- B 9781509963379Document379 pagesB 9781509963379enazifiNo ratings yet

- Diesel Fuel Oil System Commissioing ProcedureDocument34 pagesDiesel Fuel Oil System Commissioing ProcedureAdelNo ratings yet

- Data Security Best PracticesDocument20 pagesData Security Best Practiceshim2000himNo ratings yet

- Book 1Document3 pagesBook 1Mj KousalyaNo ratings yet

- Professional Regulation Commission: Id Claim SlipDocument1 pageProfessional Regulation Commission: Id Claim SlipRheivinn RoselloNo ratings yet

- FFP 3000 5000Document10 pagesFFP 3000 5000potoculNo ratings yet

- Mba Report SampleDocument78 pagesMba Report Samplesayaliofficial05No ratings yet

- s71500 CM PTP Function Manual en-US en-USDocument88 pagess71500 CM PTP Function Manual en-US en-USArunagiri MurugesanNo ratings yet

- What Are Batch Processing System and Real Time Processing System and The Difference Between ThemDocument6 pagesWhat Are Batch Processing System and Real Time Processing System and The Difference Between ThemfikaduNo ratings yet

- 16 Marks Questions With AnswersDocument3 pages16 Marks Questions With AnswersJyothi PNo ratings yet

- BSP-AA-201609 - Leaks On BOP Control SystemDocument2 pagesBSP-AA-201609 - Leaks On BOP Control Systemvikrant911No ratings yet

- Steps in Installing FusionComputeDocument1 pageSteps in Installing FusionComputeanniNo ratings yet

- Contoh Soal Perpindahan Panas TransienDocument3 pagesContoh Soal Perpindahan Panas TransienprosedurNo ratings yet

- CSE AI - 4 1 SEM CS Syllabus - UG - R20Document50 pagesCSE AI - 4 1 SEM CS Syllabus - UG - R20saitirumula541No ratings yet

- ProjectReport (FitnessCenterManagementWebsite)Document16 pagesProjectReport (FitnessCenterManagementWebsite)Arjun NainNo ratings yet

- Spatial Data Science MOOC Section 4 Exercise 1 - Detect PatternsDocument11 pagesSpatial Data Science MOOC Section 4 Exercise 1 - Detect PatternsChaoubi YoussefNo ratings yet